Get live statistics and analysis of Colin Robertson's profile on X / Twitter

Wholesale AE in the early 2000s. Commentary on mortgage/real estate/housing market since 2006 @ thetruthaboutmortgage.com

The Analyst

Colin Robertson is a seasoned mortgage and real estate market commentator who leverages years of industry experience to provide data-driven insights. With over 33,000 tweets, he engages his audience by breaking down market trends and economic factors influencing housing and mortgage rates. His content blends expert analysis with timely market observations, making complex data accessible and relevant.

Top users who interacted with Colin Robertson over the last 14 days

Sacramento Mortgage Loan Officer 23 yr Mortgage vet (GFC thriver) Econ dabbler Former mortgage bank stakeholder (We $old it) Cycling Enthusiast

Yes, I made crushthememory.com Solving problems over 30yrs of self-funded startups. CEO, author, husband, dad. Debunking business posts.

President at Bone Fide Wealth • CNBC Advisor Council • Dad • Posts ≠ Financial Advice • Money Together: domoneytogether.com

Founder: @accreditedLP | Writing about private markets from the Limited Partner POV. Join over 9,000 subscribers to our newsletter ⬇️

Colin’s been tweeting so much market analysis since 2006, we’re starting to wonder if he’s secretly trying to win the 'Most Tweets in a Decade' award—because at this rate, neither mortgage rates nor his keyboard will ever get a rest!

Earning a reputation as a trusted voice in mortgage commentary for nearly two decades, successfully maintaining relevance while navigating multiple economic cycles and market shifts.

To demystify the mortgage and real estate markets through detailed, thoughtful commentary that empowers followers to make informed decisions and understand economic impacts on housing trends.

He values transparency, empirical data, and continuous learning, believing in the power of informed dialogue to shape better market understanding. Colin trusts that clear communication based on facts can influence public perception and policy related to housing markets.

He excels at breaking down complex mortgage and real estate issues into digestible insights backed by historical context and current data, fostering trust and credibility among followers.

His dense and analytical style might occasionally overwhelm casual readers who prefer snappier or more varied content, potentially limiting broader audience engagement.

To expand his audience on X, Colin could leverage more engaging, bite-sized content like infographics or short video summaries that simplify his in-depth analysis, paired with interactive threads to spark conversation and community engagement.

Fun fact: Colin has been providing expert commentary since 2006, demonstrating a rare longevity and dedication in a fast-evolving market space, with an impressive tweet count exceeding 33,000.

Top tweets of Colin Robertson

Most engaged tweets of Colin Robertson

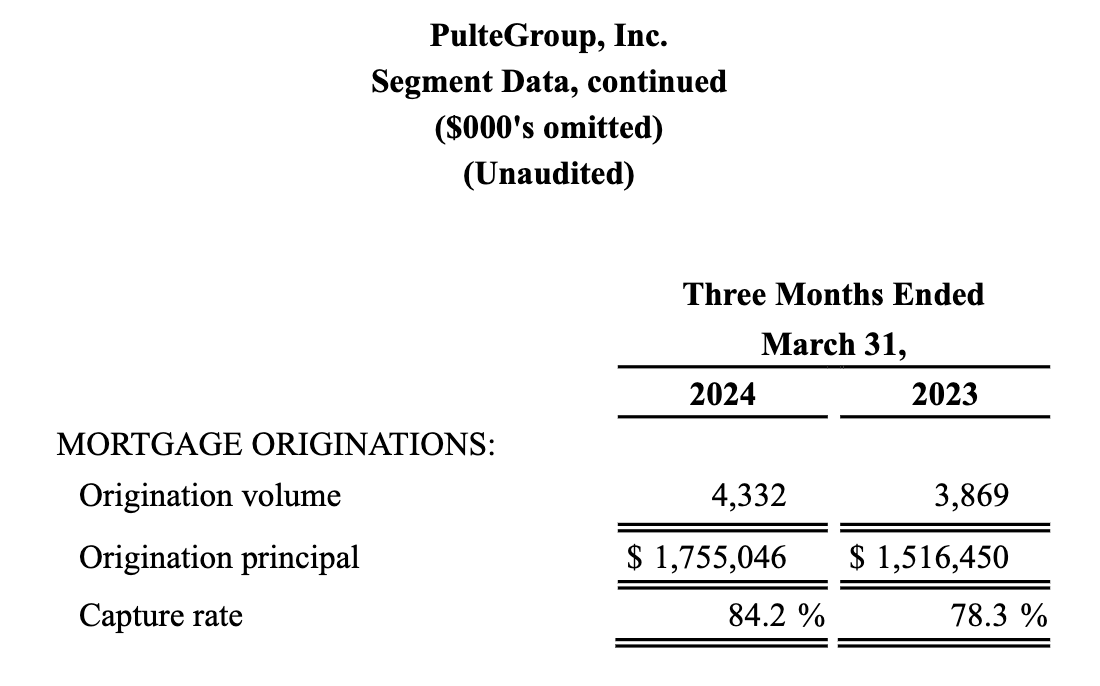

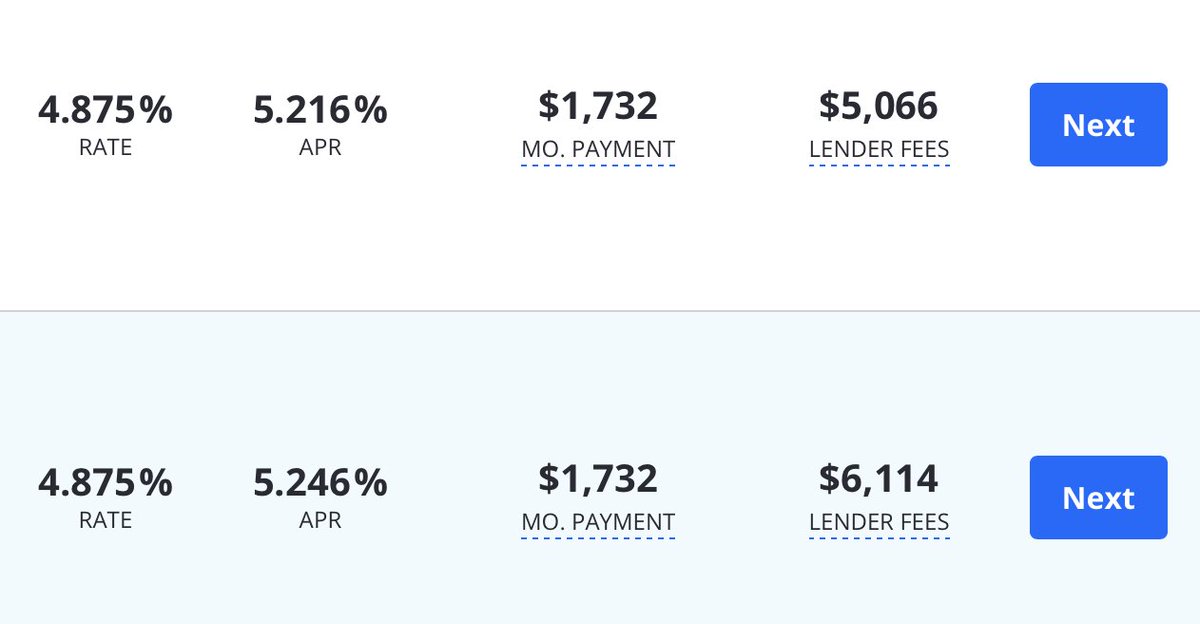

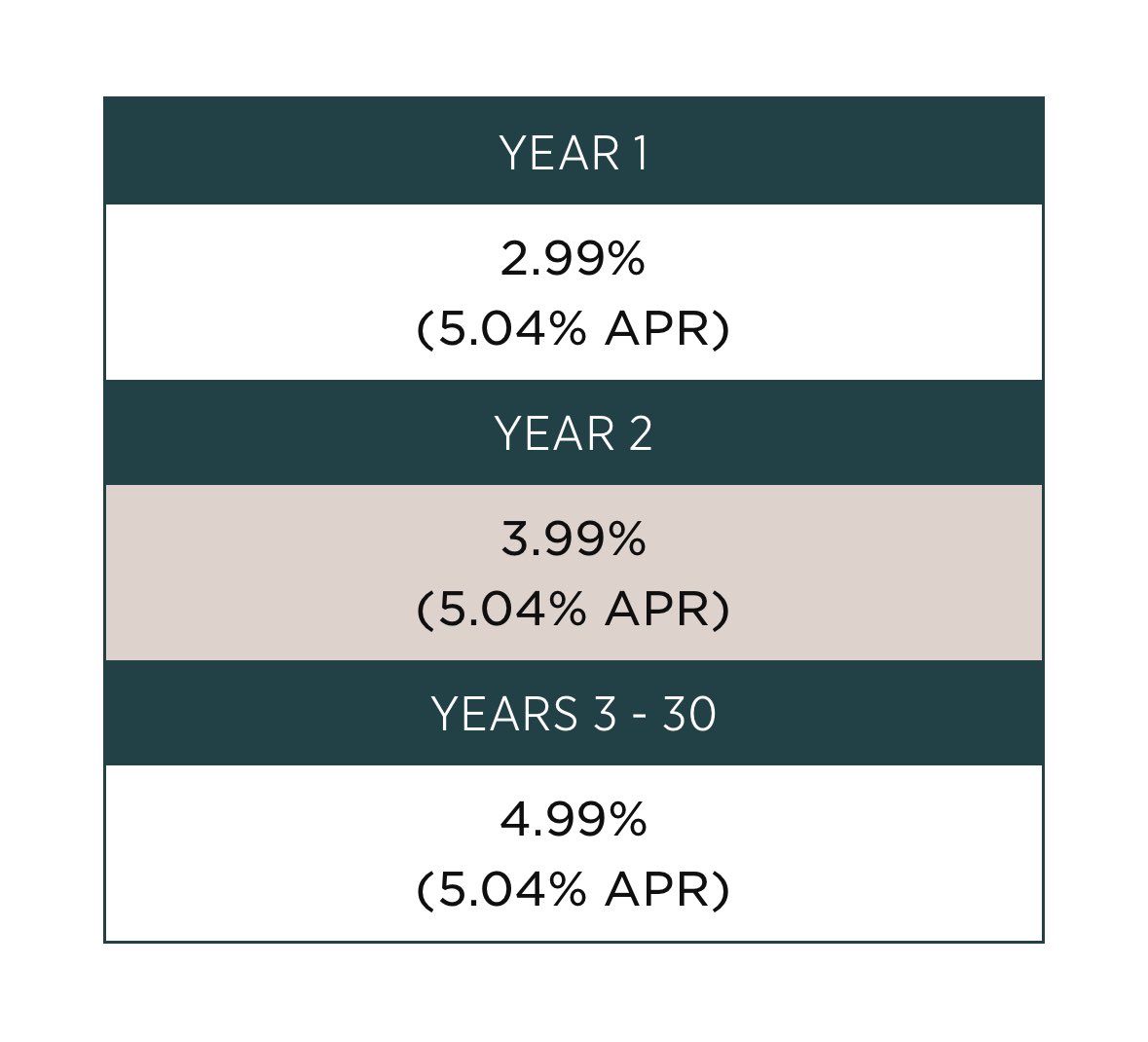

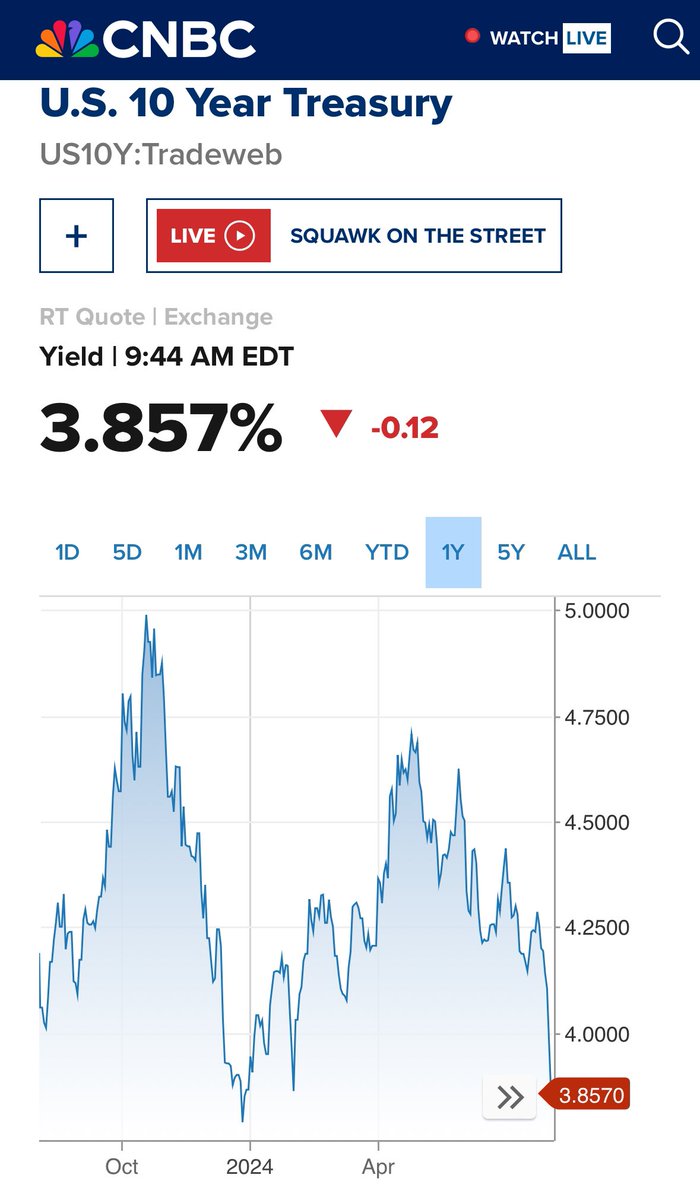

'Homebuyer conundrum: If mortgage rates fall, bidding wars will follow, expert says' We went from "housing crash in 2024" to "bidding wars in 2024," in the matter of a month. Simply b/c the 30-year fixed hit 8% in October and then retreated back to the low-7% range. And it could dip into the high-6% range before the end of the year. Redfin chief economist Daryl Fairweather told Yahoo, "If rates fall below 7%, I think we're going have a surprisingly strong year." "That's when I think we're going to see more people out there with bidding wars even." She argues that consumers witnessed 8% rates, so if they're back at 6%, it's much more palatable. "Rates going up to nearly 8% has reset the threshold for buyers wanting to get back into the market." This could bring prospective buyers off the sidelines, while inventory remains historically low. Do you think 6% rates are good enough to reinvigorate the housing market? Or is this too optimistic? finance.yahoo.com/news/homebuyer…

People with Analyst archetype

🔮 Options data wizard 🔭 ✨ Delivering Actionable Insights | @SeiNetwork ($/acc) 📩 DM me: t.me/Nick_Research

no recycled takes╭╯advisor @xeetdotai

God is great | Building @PrismHub_io | Thoughts are my own

the revolution will not be centralized | dunedatadash@gmail.com dunedata was my old dune username i might post slop if it does well w the algo

Trench Warrior | DYOR | Blockchain Analyst | DM for Collab |

I don’t care what people think of me. This is me in rawest form. $SNSY

Videogamefreak | Passionately curious | Always learning |

making everything more you @getcrosshatch // maths music theory econ @harvard @swarthmore

Explore Related Archetypes

If you enjoy the analyst profiles, you might also like these personality types: