Get live statistics and analysis of Nick Research's profile on X / Twitter

🔮 Options data wizard 🔭 ✨ Delivering Actionable Insights | @SeiNetwork ($/acc) 📩 DM me: t.me/Nick_Research

The Analyst

Nick Research is a data-driven options expert who delivers deep, actionable insights into cryptocurrency markets and blockchain technology. With a sharp eye on macro trends, technological innovation, and market dynamics, he provides his audience with nuanced analyses that cut through the noise. His content is a treasure trove for anyone seeking to understand the complex interplay between economics, geopolitics, and crypto assets.

Top users who interacted with Nick Research over the last 14 days

full time onchain money maxi since 2017 || 🇸🇬 34 years old unc with hair - married to an amazing wife

Sniffing in DeFi 24/7. A Golden Retriever on the path to wealth. I love kibbles with Maple $SYRUP.

Started on Wallstreet, fell in love with the memes | Owner of largest memecoin community on X

Hari with 3 Hypurr bros 🐶+🐱🐱🐱 My dad is an @HyperliquidX MAXI 🤪 $HYPE memes & beginner threads

Data | Content | Community | Views are my own

Love climbing 🧗♂️Sharing my web3 experience on x | @Hustlerslabs | Ambassador @Dexsport • @brickken • @glider_fi

Daily Ape #2017, $HYPE conviction ABS: @SeiNetwork |@TheoriqAI | @Dexsport DailyAPE: t.me/KaffDailyApe DM: t.me/kafka0202

Onchain Analyst | OG since '17 | Running Onchain Intel Hub | Partnered with @nansen_ai @Tokenomist_ai | Cyber Security Director IRL | Previous: EY, Mazars

Researching protocols & ecosystems in Web3. Sharing what matters so you learn early.

Nick tweets so much data, it’s like he’s trying to crash your brain by sending a spreadsheet every 10 minutes – good luck trying to decipher that without your PhD in economics and a double espresso in hand!

Nick’s most notable win is his prescient breakdown of Bitcoin’s mining cost cycle tied to geopolitical tensions and macroeconomic shifts, which positioned him as a trusted voice anticipating BTC rebounds long before they became mainstream talking points.

Nick’s life purpose is to illuminate the hidden patterns and drivers within the often volatile and complex world of cryptocurrency and blockchain, empowering his followers to make smarter, data-backed decisions. By translating technical data into strategic insights, he bridges the gap between raw information and actionable wisdom.

He believes in transparency, the power of rigorous analysis, and the importance of staying ahead of the curve in an ever-evolving market landscape. Nick values objective, evidence-based thinking and holds a core conviction that understanding the macroeconomic and geopolitical undercurrents is key to mastering the crypto space.

His biggest strength is the ability to synthesize vast amounts of technical and economic data into clear, predictive narratives. His analytical rigor and authoritative insights foster credibility and trust among followers craving reliable information.

Sometimes Nick might get too absorbed in complexity, which can make his content dense or overwhelming to newcomers. The occasional deep-dive thread risks losing casual readers who prefer quicker, punchier takes.

To grow his audience on X, Nick should balance his high-level analyses with bite-sized, highly visual summaries (charts, infographics) and timely thread recaps that distill complex ideas into snackable insights. Engaging more in conversation via replies and interactive polls will also amplify his reach and community feel.

Fun fact: Nick’s tweets are sprinkled with detailed math and economic logic, showing he doesn’t just speculate—he builds investment hypotheses from raw data like mining rig prices, hash rates, and token supply allocations!

Top tweets of Nick Research

➥ Marcro & The Bitcoin Minning Cost Correlation ✦ Trade war → rising retaliatory tariffs → rare earth prices ↑ → chip manufacturing cost ↑ → mining rig prices ↑ → mining cost ↑ You know #Bitcoin miners follow upgrade cycles, similar to the halving rhythm. This typically happens every 2-4 years, depending on hardware progress and competitive intensity. It’s now >1 year past the 4th Bitcoin halving (April 20, 2024). → Meaning that most mining rigs are still fresh new > A new wave of hardware investment isn’t due yet. → So any effect from the trade war on mining costs may not be fully priced in for another 6-12 months. ✦ However, in this geopolitical context: ▸ China holds a massive edge in rare soils → the raw materials behind cheap chip production (WTO: China holds 44M tons of rare earth reserves, ranked #1 globally) ▸ Trump isn’t taxing chip exports from China, yet chinese consumers are boycotting U.S. goods, which may dampen exports. → China will look for ways to leverage this resource surplus. If China allows large-scale #Bitcoin mining again: → Cheap domestic chips → competitive rigs → Pressure on U.S.-based miners rises → U.S. must produce domestically at higher cost → upgrades → cost inflation. All paths lead to one conclusion: rising #Bitcoin mining costs. Of course, cost inflation is part of #Bitcoin’s long-term design: ▸ Inflation → halving → new-gen miner competition But in today’s AI-driven, macro-unstable world, the competitive cycle may speed up faster than usual. ✦ Two core metrics reflect this: ➊ Hashrate just hit a new ATH: 1055 EH/s → That’s 1055 million trillion trillion calculations per second to mine BTC. ➋ Mining Difficulty is also at a record high: 121.5B → The market must stay alert to reactions from: • Earnings of China-exposed companies • Inflation spillovers • Geopolitical flare-ups • A potential U.S.-China breakdown • Crypto adoption progress in nations like Singapore, China, U.S… ✦ Zooming in: [1] Bitcoin's divergence from traditional markets: → Correlation with Nasdaq is fading → $BTC volatility is dropping while stocks and bonds grow more volatile → Institutional wallets are quietly accumulating again. [2] Gold has surged ~20% as central banks stockpile it at record pace. → [1][2] hint at a shift: $BTC is transitioning from a high-risk asset → to a strategic macro hedge. Long-term, $BTC won't replace gold, it's becoming a parallel reserve system. In a fragmented global order, capital is chasing neutrality. → That drove the gold rush. → But gold can’t keep surging forever. If #Bitcoin remains resilient under ongoing macro pressure. You may be witnessing the early signals of sovereign/institutional recognition and eventually, public adoption. ✦ TL;DR: ▸ Tech-wise: Bitcoin is engineered for long-term price appreciation ▸ Macro-wise: Geopolitical frictions may ignite an arms race in mining ▸ Sentiment-wise: After the gold rush, Bitcoin might be the only asset that ticks both boxes: liquidity + value refuge ▸ Option insights: Whale aims a big pump in Sept, expecting BTC to hit $140K So from my perspective, a #Bitcoin rebound is likely within the next few months.

➥ Sept 10, 2025 - @LineaBuild Airdrop Claim Date Leaked 👀 But i’ll do a quick math here based on this facts • Total supply = 72,009,990,000 $LINEA • Early-user allocation = 10% of total supply = 7,200,999,000 • Airdrop tranche (leak) = 2,000,000 (possible batch 1) • Eligible wallets ≈ 177,809 (post-Sybil filter) • Total LXP (post-Sybil) ≈ 1,830,000,000 ☒ Case A - the leaked 2,000,000 LINEA pool Token per LXP = 2,000,000 ÷ 1,830,000,000 ≈ 0.001092896 LINEA per LXP So here’re the amounts you’ll receive • 1,000 LXP → 1,000 × 0.001092896 ≈ 1.093 LINEA • 5,000 LXP → ≈ 5.464 LINEA • 6,000 LXP → ≈ 6.557 LINEA • 10,000 LXP → ≈ 10.929 LINEA → the tranche is tiny relative to total supply ☒ Case B - if the airdrop used the full 10% early-user allocation Token per LXP = 7,200,999,000 ÷ 1,830,000,000 ≈ 3.934972 LINEA per LXP • 1,000 LXP → 1,000 × 3.934972 ≈ 3,934.97 LINEA • 5,000 LXP → ≈ 19,674.86 LINEA • 6,000 LXP → ≈ 23,609.83 LINEA • 10,000 LXP → ≈ 39,349.72 LINEA → rewards would be massive per LXP, life-changing for many accounts Voyage NFTs matter as a bonus An Alpha Tier +1,715 LXP is a real multiplier For a 3k LXP account it increases effective LXP by ~57%

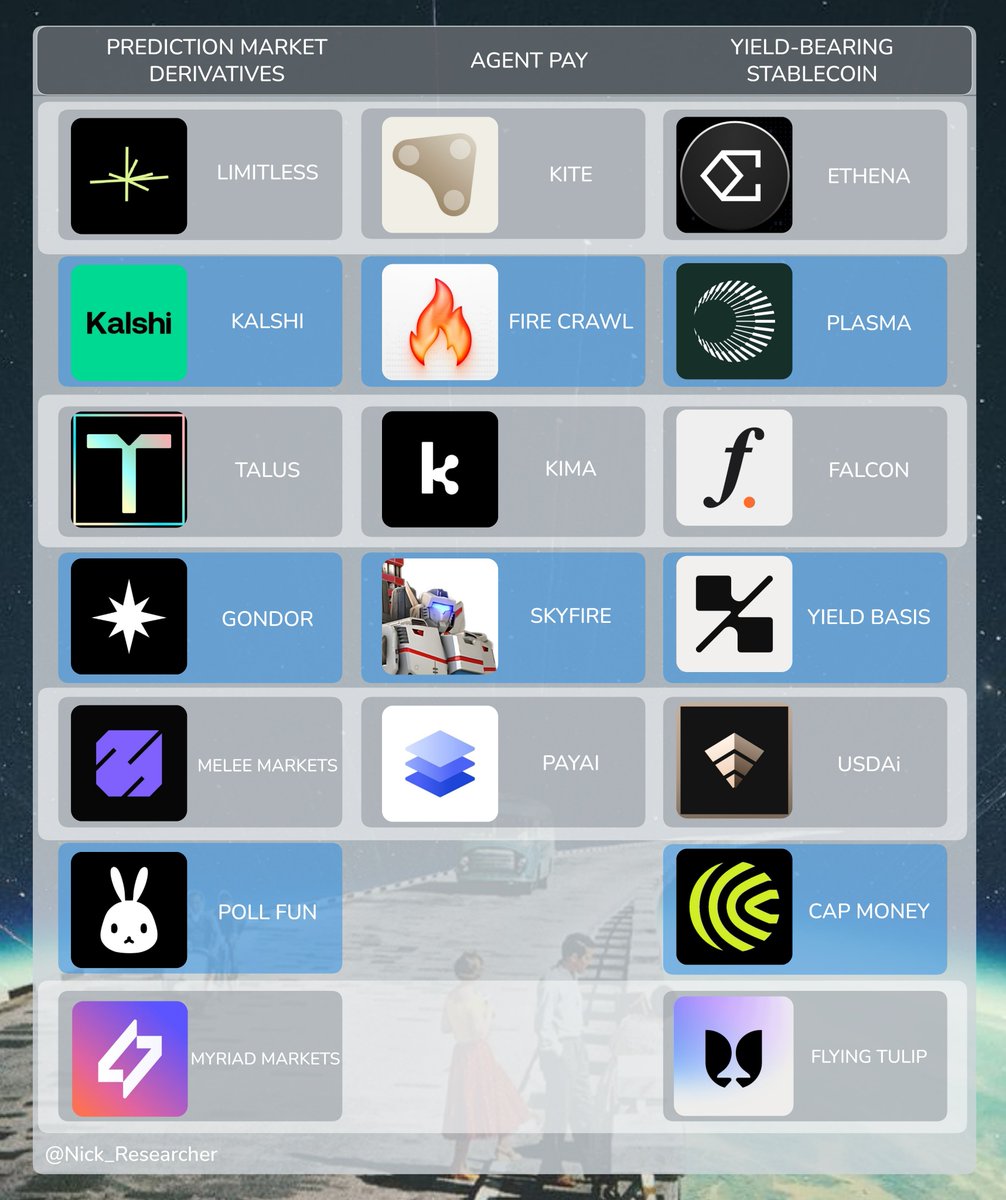

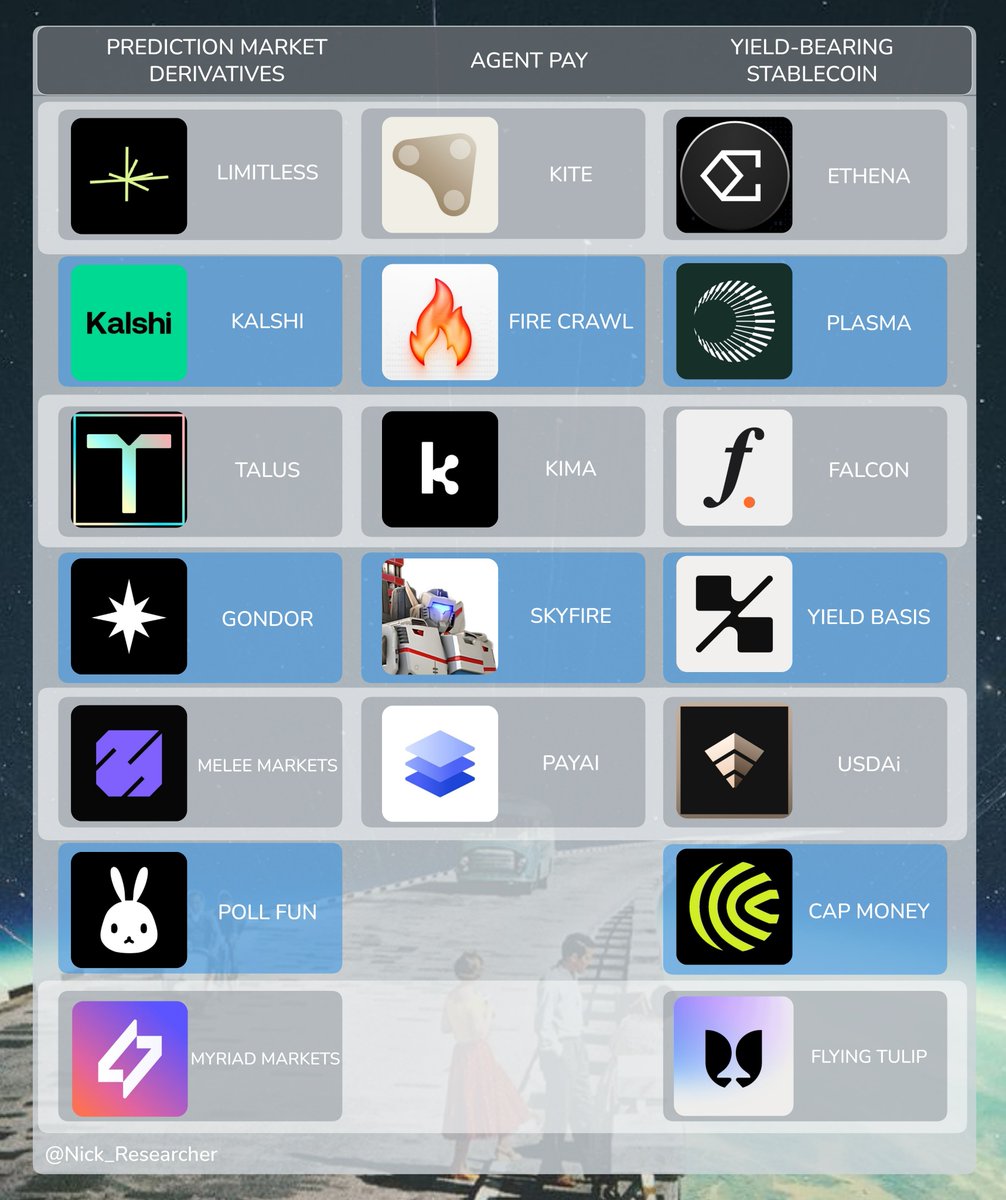

➥ 3 narratives I’m betting on in Q4 Everyone keeps yapping about perp dex, ngl a lot of that is just FOMO rotation For me, real value is brewing somewhere else Here are 3 Narratives I think will matter more ↓↓↓ ➊ Prediction Market Derivatives – @Polymarket touching $10B val, @Kalshi raised $185M, and monthly volume > $1B – But binary yes/no bets are just the start. Derivatives + DeFi integration = where it scales – Think lending, perps, AI x predictions, cross-market AMMs – Big events (macro data, sports, pre-market crypto) will push exposure 10x → Names I’m watching: @trylimitless @TalusNetwork @gondorfi @meleemarkets @polldotfun ➋ Agent Pay – Google, Coinbase, ETH Foundation pushing AP2 + x402 protocols – This is the final mile → agents analyze, execute, and now can pay each other with stablecoins – That unlocks the AgentFi economy for real – I see it like TCP/IP for agents, invisible infra that makes everything else possible → Names I’m watching: @GoKiteAI @KimaNetwork @firecrawl_dev @trySkyfire @PayAINetwork ➌ Yield-bearing Stablecoins – This is the institutional DeFi lane – Ethena, Plasma, Falcon all showed insane traction – Holding USD that yields 4-25% APY, backed by treasuries or RWA, turns stables into wealth engines – If DeFi had a new foundation stone, this is it – No surprise Wall St is sniffing around → Names I’m watching: @yieldbasis @flyingtulip_ @USDai_Official @capmoney_ @Theo_Network These 3 narratives are building real infra + cashflow, I’m positioned here for Q4. Which one do you think will run first?

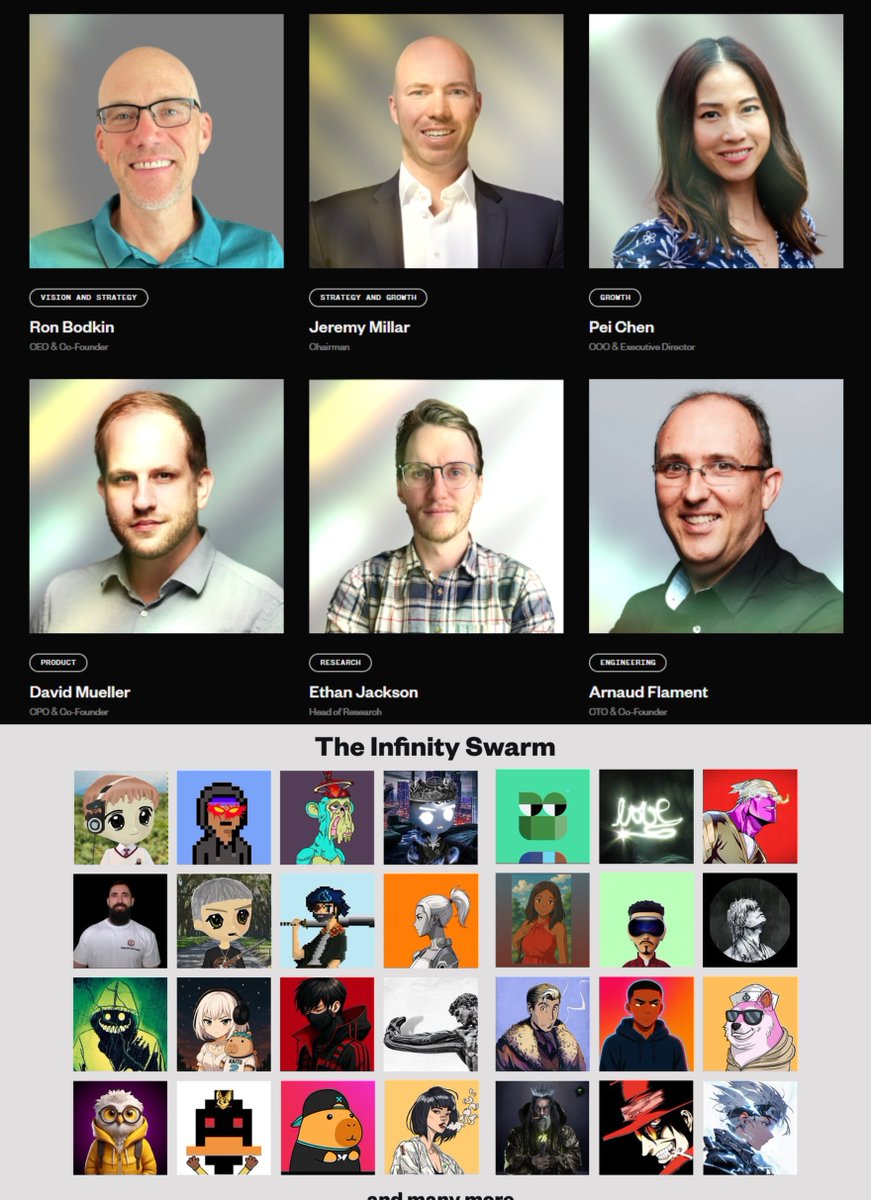

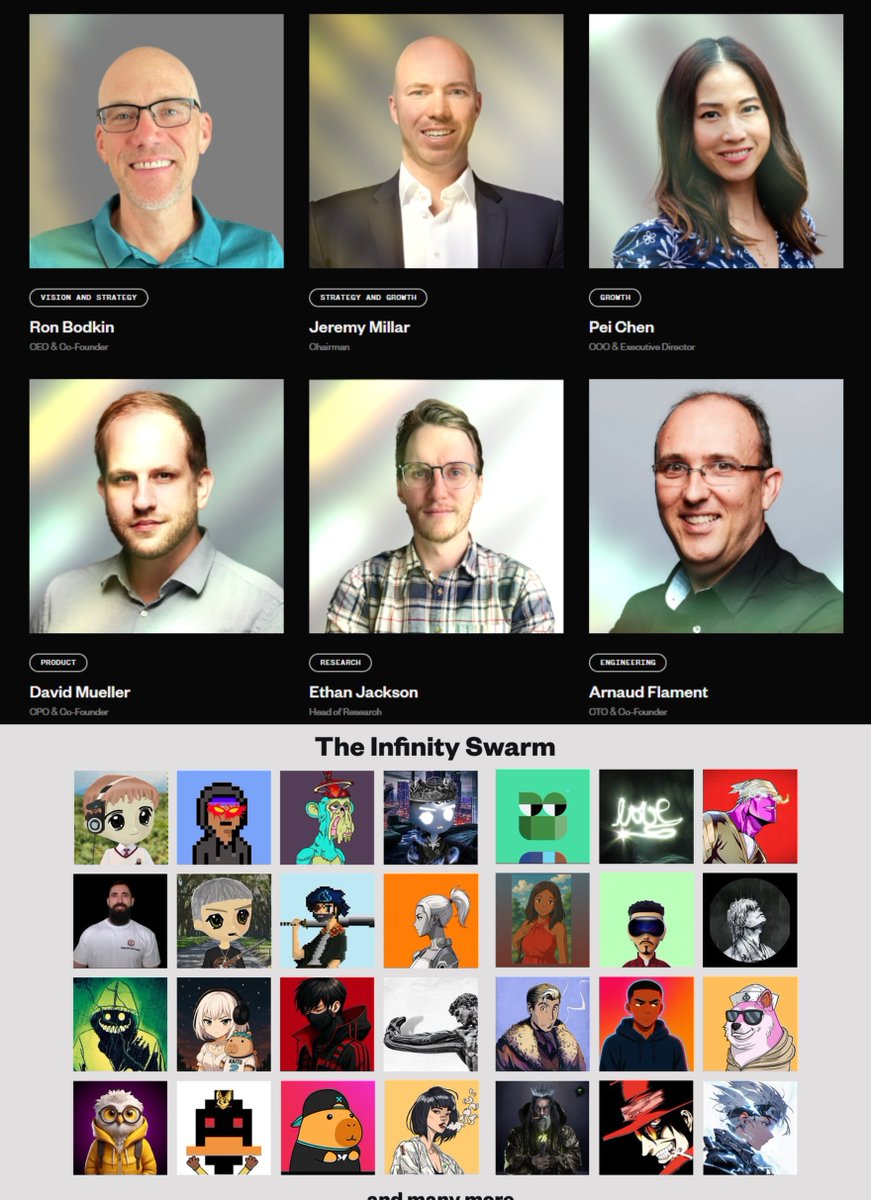

➥ @TheoriqAI’s team structure reflects their vision ▸ @ronbodkin sets the discipline for coordinated autonomy ▸ @davidm_ller translates insight into flow ▸ @PeiChen01 brings DeFi rails into the system ▸ @web3contrail engineers agent-first infra ▸ @TheoRooAI memetically encodes swarm logic but we as the yappers and contributors are right there too yappers, testers, ambassadors, feedback loopers… not on the sidelines, @TheoriqAI counts us as part of the team ngl • Yapping • Testing agents • Sharpening incentives • Evolving UX through actual use • Translating protocol logic into signal Theoriq is not community-led nor team-led, it’s Swarm-led by designed

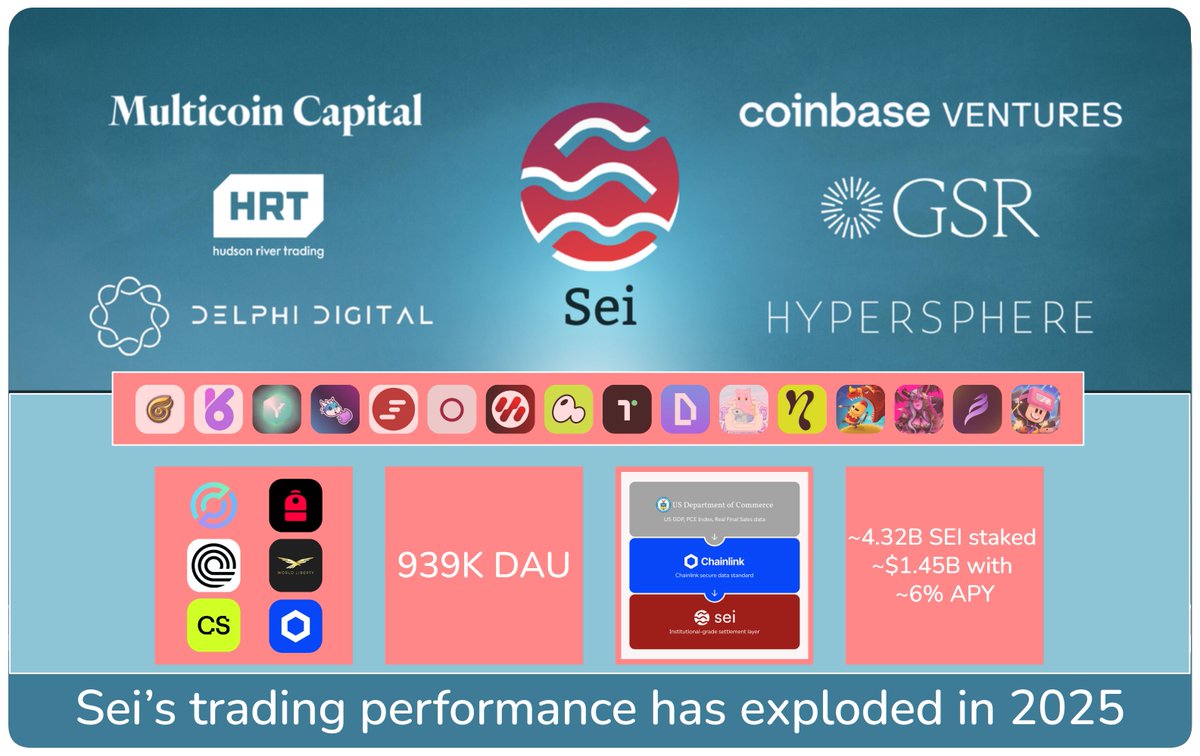

➥ HUGE: $7.6B TVL DeFi giant @MorphoLabs is now live on @SeiNetwork @Featherlend powered by Morpho is bringing seamless lending & borrowing with crazy efficiency on Sei APY speaks for itself ↓ • Feather $SEI vault: 531% APY • Feather $USDC vault: 39.8% APY Plus, $250,000 in $SEI rewards are live from day one DeFi moves faster on Sei ($/acc)

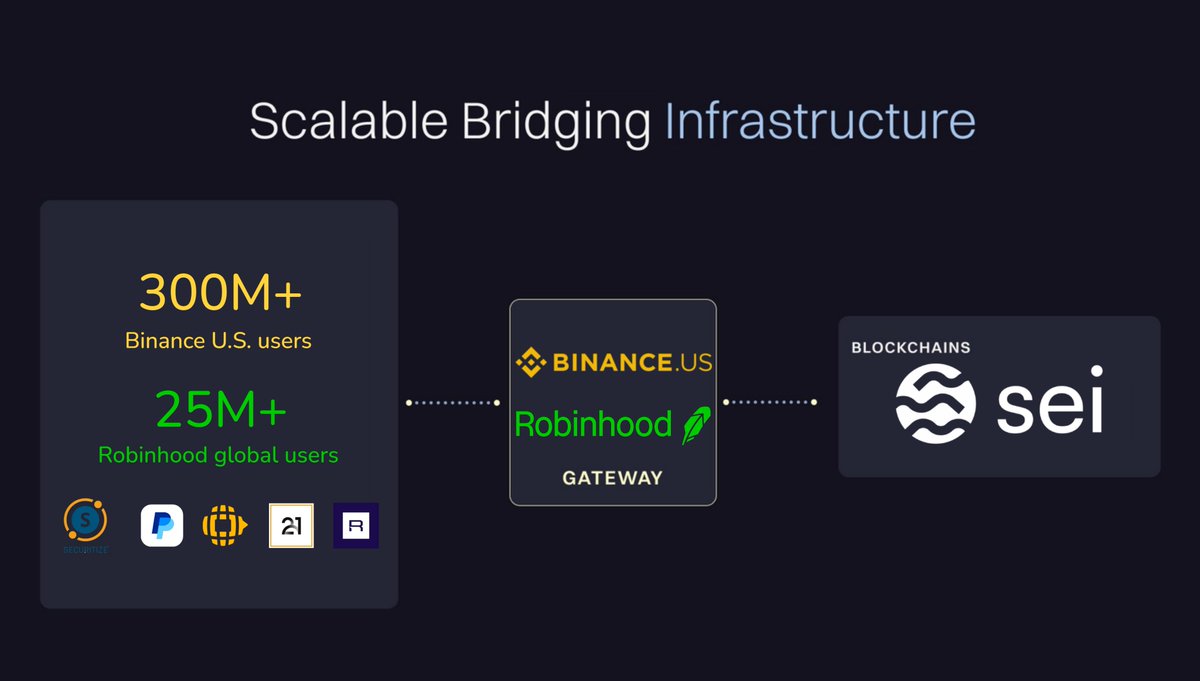

➥ BREAKING: Binance.US has officially listed $SEI The event opens the door for 300M+ U.S. users to trade @SeiNetwork fully compliant and 100% legal 🇺🇸 This comes right after Robinhood and Binance validator added $SEI last week Sei is fast becoming the preferred L1 for institutional and retail markets alike The U.S. market just got a lot more Sei 🌊 ($/acc)

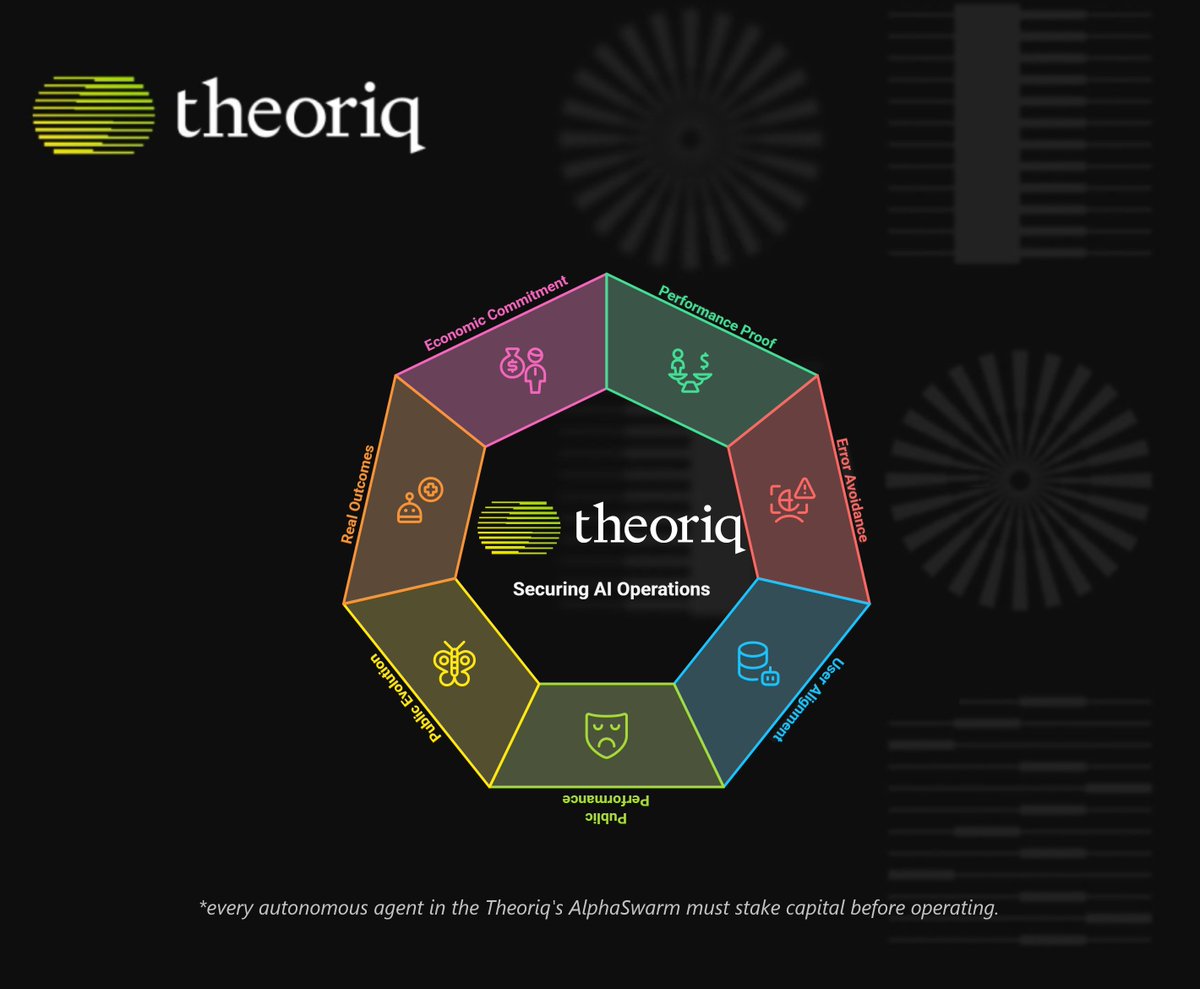

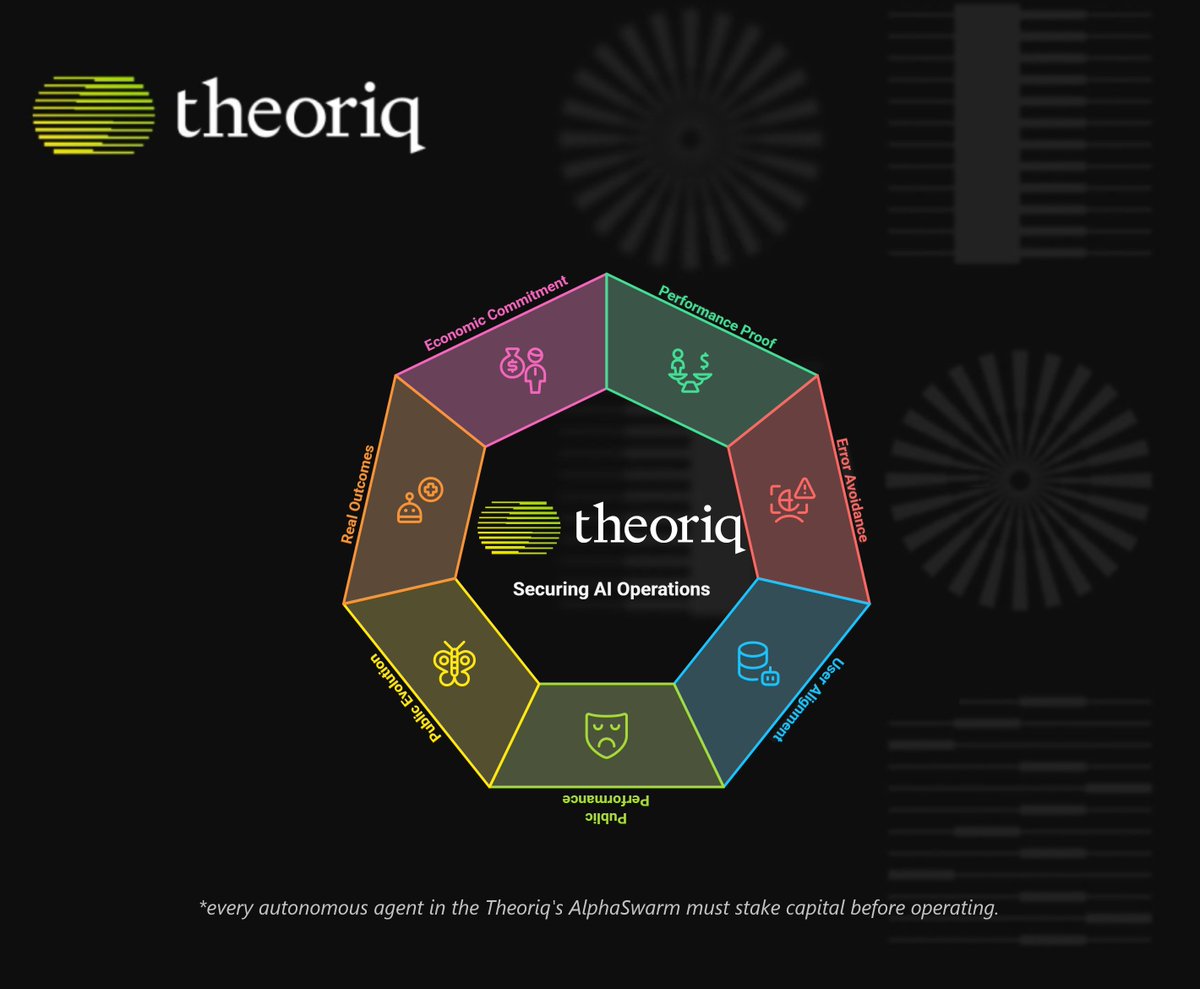

➥ Imagine this: ▸ Lending protocols only whitelisting agents above a trust threshold ▸ Users picking agents based on composable scorecards ▸ Entire swarms coordinated based on real, evolving performance data In @TheoriqAI’s Alpha Protocol, every autonomous agent in the swarm must stake capital before operating. Because agents must prove performance, avoid mistakes, and align with users. ▸ Perform well → Keep stake, earn rewards ▸ Underperform or misbehave → Get slashed, lose credibility It’s the same mechanism that secures PoS networks ➔ now applied to #AI liquidity agents, #DeFi bots, and knowledge workers. So the good agents should look like this: • Make performance public • Evolve in public • Deliver real outcomes • Put economic skin in the game I used to trust agents when I see their outputs & now when they stake to be slashed if they screw up. That’s how @TheoriqAI building a real economy of accountable agents.

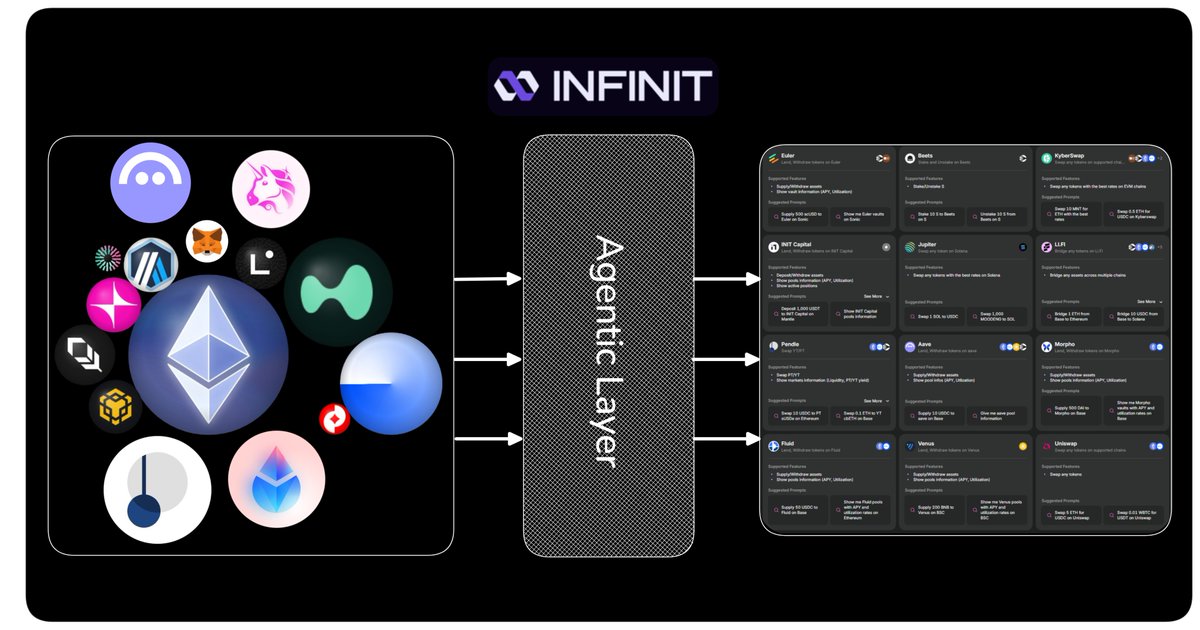

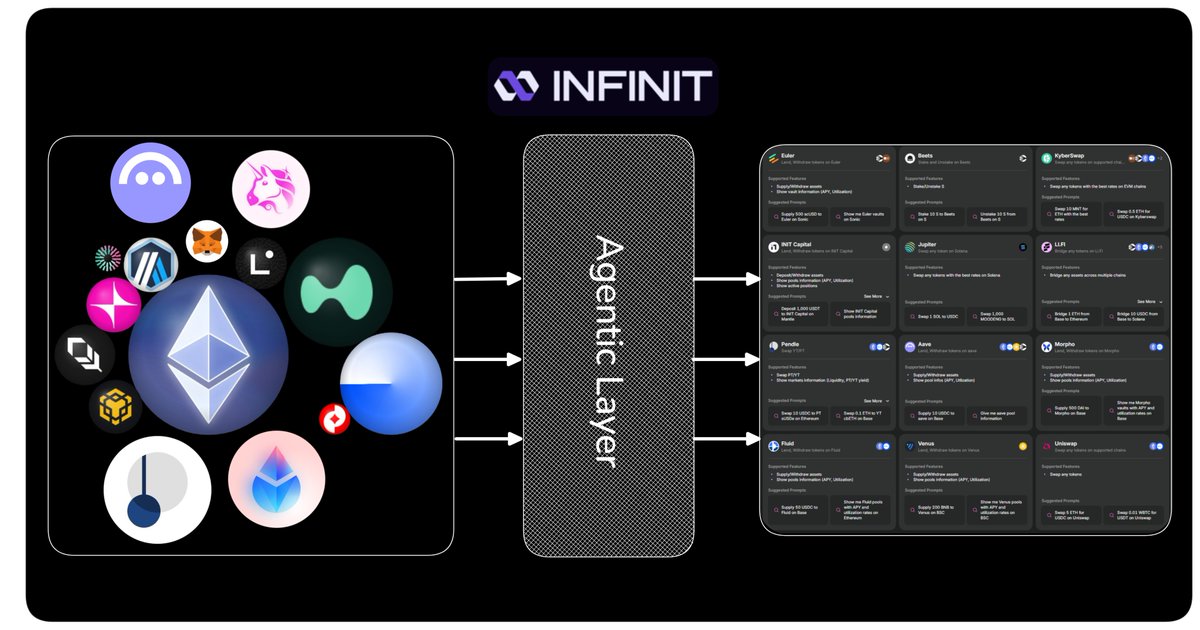

➥ What if every DeFi app had an AI-native UX layer I meant without needing to rebuild from scratch That’s how I’ve come to see @Infinit_Labs as the Agentic dApps Layer You know @Infinit_Labs is already a composable execution layer powered by #AI agents That wrap around 18+ #DeFi protocols like Uniswap, Pendle, Morpho, Stargate, etc. ▸ You want to swap → the Swap agent handles slippage, routing, and approvals in one flow ▸ You want to LP across 3 chains → the Bridge, Zap, and Stake agents coordinate instantly ▸ You want to do basis trades → you describe the logic, the agents execute it deterministically @Infinit_Labs already has 20+ agents deployed and they work You'll have to a chance to use them to do 1-click DeFi in V2 • Auto-bridge to best yield destinations • Loop lending positions without juggling 5 tabs • Simulate complex flows before confirming anything onchain → All in one interface → Fully non-custodial → Bundled into a single verifiable transaction using ERC-4337 / EIP-7702 Why does this matter? ▸ because every time I interact with vanilla DeFi like Uniswap, Aave, Pendle, etc. I feel the friction again ▸ the strategy lives in my head, the execution lives across 5 dApps, wallets, and signatures ▸ and if I mess up one step, I lose yield or get rekt That’s not scalable, not for power users, and efinitely not for the next wave of users What @Infinit_Labs is building is an enabler An Agentic Execution Layer that sits on top of any dApp ▸ Where builders can expose their contracts as agent endpoints ▸ Where users can stack logic like Lego blocks with prompts ▸ Where KOLs and strategists can publish 1-click flows and earn fees It’s like turning every DeFi primitive into an API and letting AI agents compose with them across chains and intents @Infinit_Labs is doing that by upgrading the interface with agentic intelligence And I genuinely believe Agentic UX is what makes modular DeFi usable

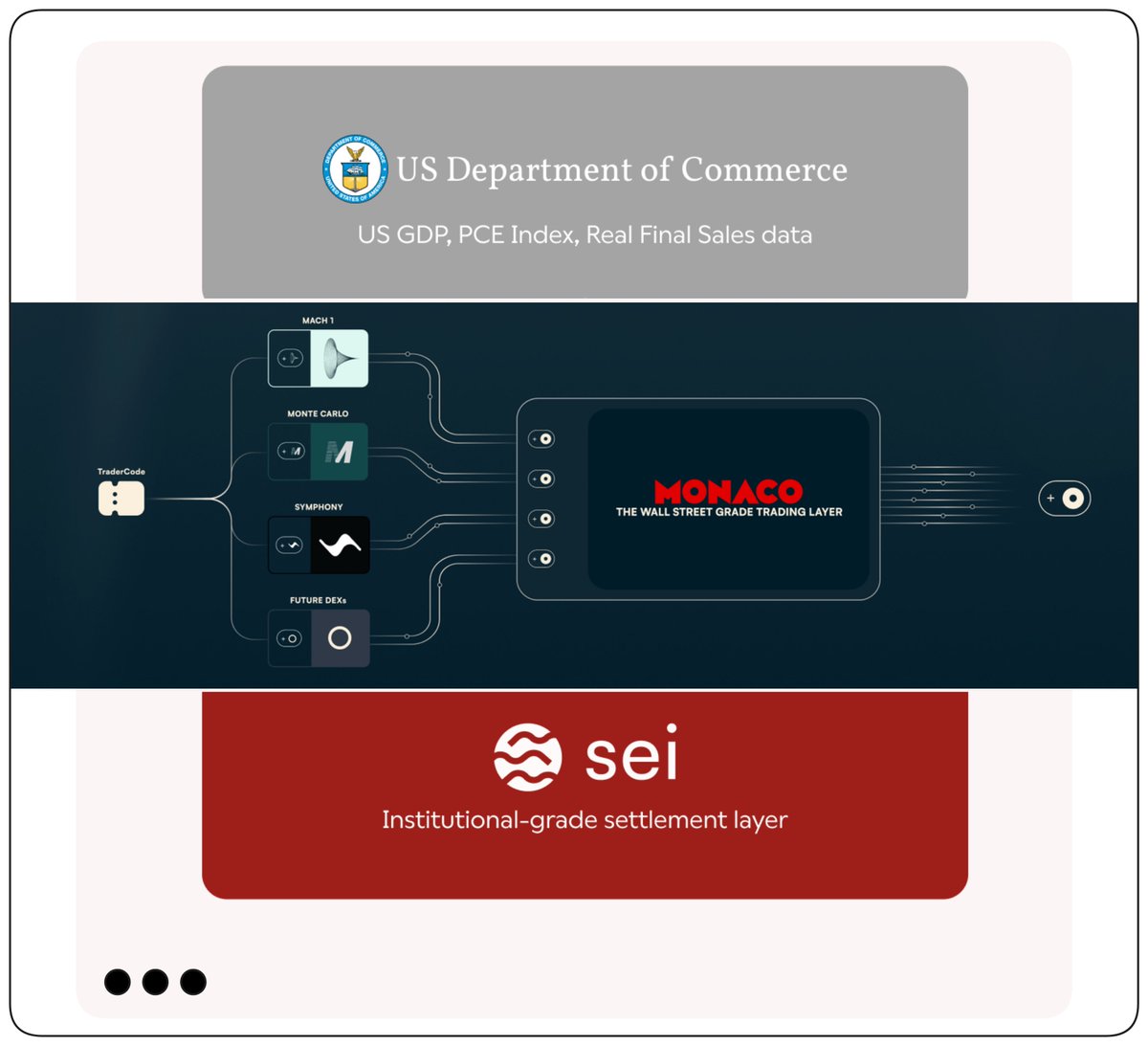

➥ @SeiNetwork’s CLOB Spotlight = @MonacoOnSei Built by @Sei_Labs, a world-class builders from Robinhood, Point72, & Google Monaco is the trading layer that gives DeFi Nasdaq-level execution • Sub-1ms matching • 400ms settlement • Shared liquidity across apps • Builder revenue via PitPass It’s the foundation for institutional-grade DeFi that can support the $30T tokenized asset market The alignment is the real unlock • traders get best execution • builders get paid for volume • $SEI gets compounding liquidity across verticals With Sei’s user base up 7,900% since launch, this is how the eco graduates from fast chain to financial OS Monaco is proof that Sei’s market architecture can actually rival TradFi

➥ Crazy momentum for @trylimitless lately 👀 - $10M Seed Round w 1confirmation, Collider, DCG, Arrington & more - Hit 1M+ monthly trades on @base - $LMTS TGE coming Oct 25 - After all the CZ vs CJ drama… $LMTS still heading to Binance listing - icymi, they broke record w 200x oversub on Kaito Everything is aligning, so I believe $LMTS gonna be one of the most hyped launches

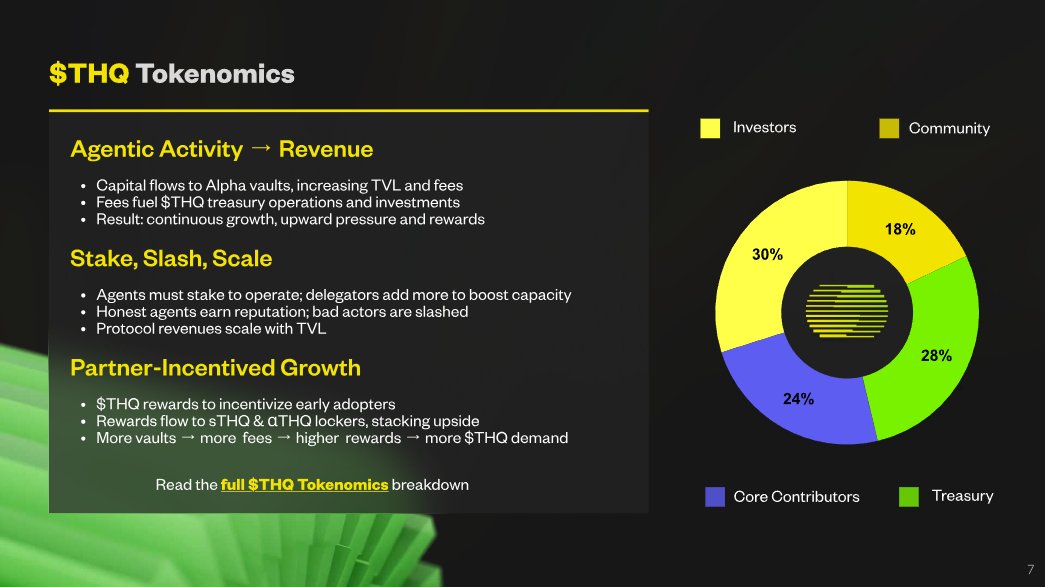

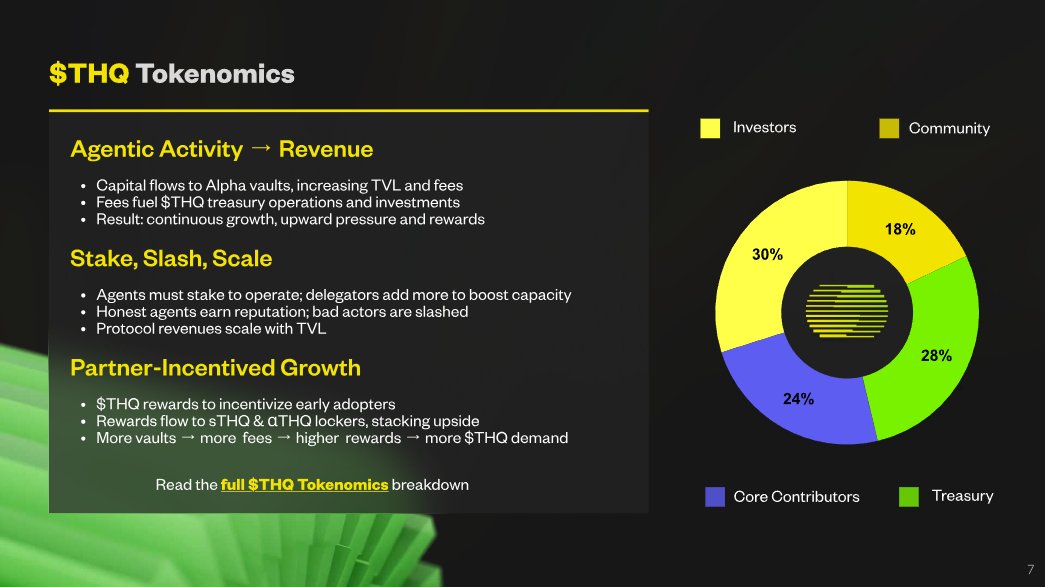

➥ Theoriq is architecting trust for AI agents, like EigenLayer did for AVSs Alright let me explain ↓↓↓ @TheoriqAI's 3-layer design (THQ / sTHQ / αTHQ) is a coordination machine ▸ THQ: protocol access and partner fee layer ▸ sTHQ: staking derivative with real fee + token yield ▸ αTHQ: time-locked collateral for agent slashing & emissions boosts you delegate to agents like you delegate to EigenLayer AVSs except now, you’re securing intelligent, autonomous capital ▸ Partner protocols must buy $THQ to access agent swarms ▸ Agents are modular, reusable infrastructure ▸ αTHQ enables slashing-based trust, agents can be penalized for failure this creates a new kind of asset-backed reputation system that agents earn AND risk capital on-chain You already know @TheoriqAI's traction is real ▸ 60M+ interactions on testnet ▸ 500K+ users onboarded ▸ 14 unique agents, 3 operational swarms ▸ Community sale 40x oversubscribed Because trustless $AI coordination is unsolved, @TheoriqAI might be the first to secure multi-agent autonomy If that happens, $THQ becomes the native trust asset for autonomous DeFi

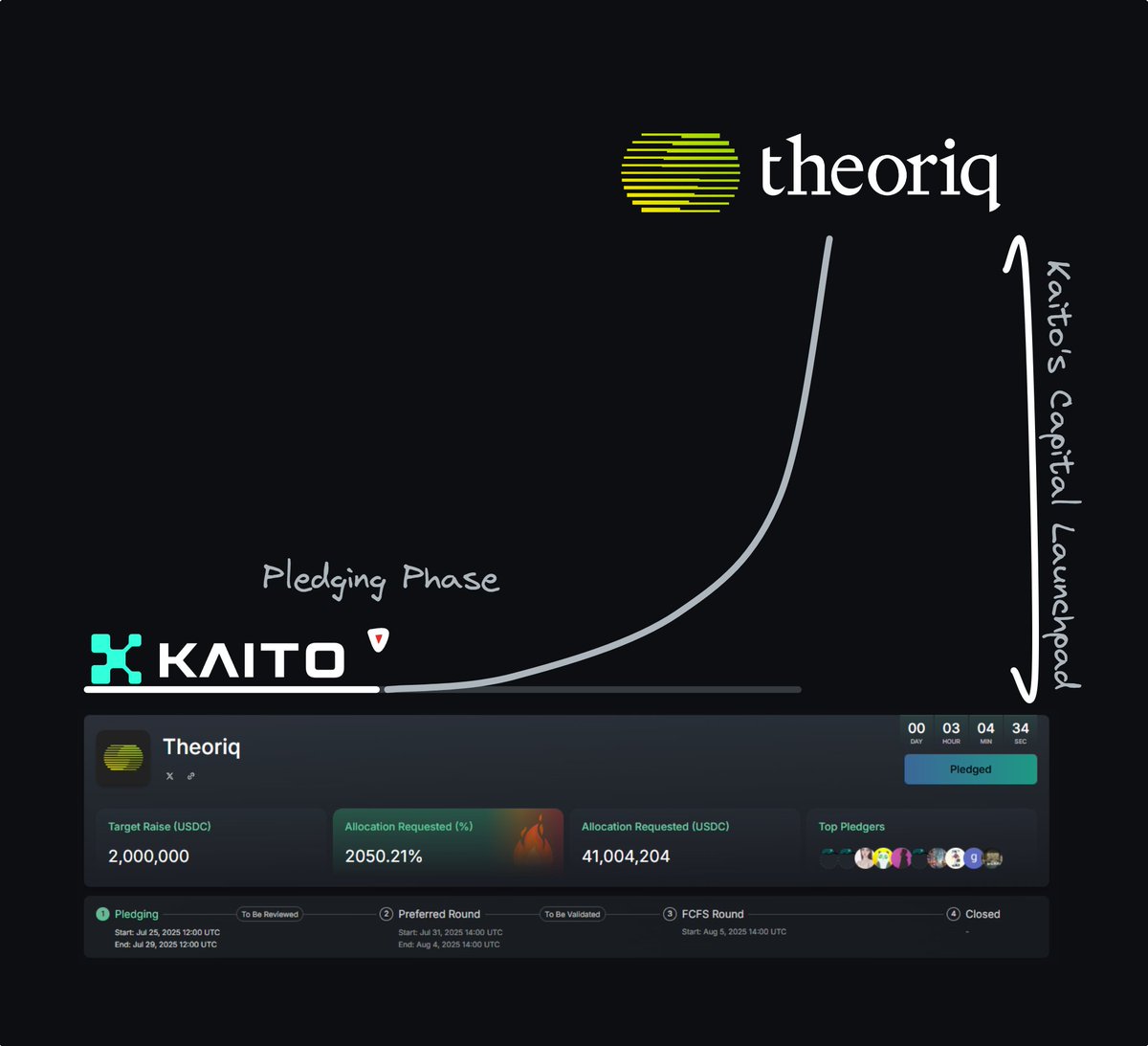

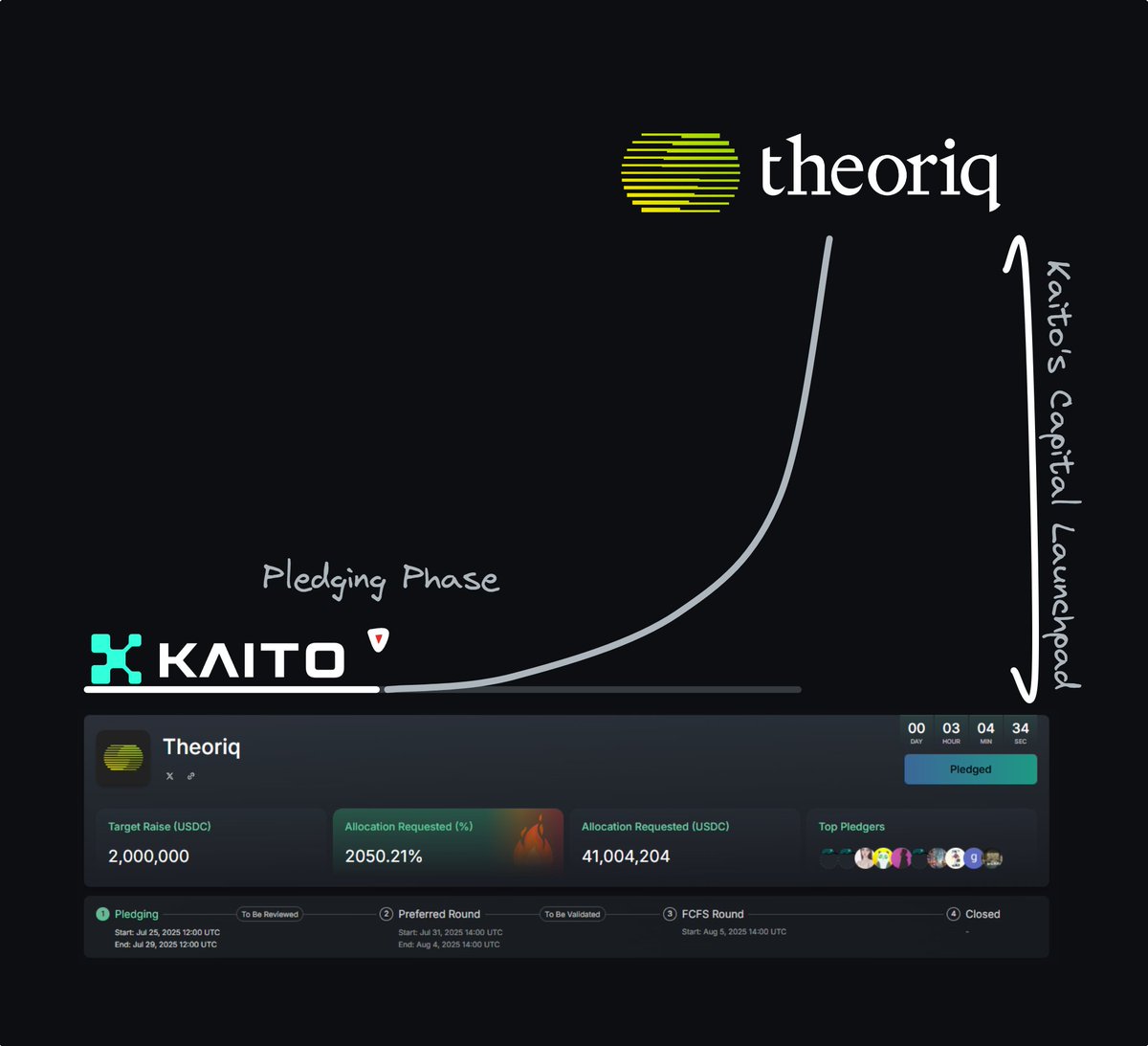

➥ Theoriq Capital Launchpad = Proof of Voluntary Trust at Scale In just 4 days of pledging, @TheoriqAI reached an astonishing 2050% oversub on @KaitoAI → Target: $2M USDC → Total Pledged: $41M USDC → And pledging isn’t even over yet ☒ I can feel the community sentiment @TheoriqAI is a cocktail of (at least this is what i feel rn) ✦ Curiosity - for a radically new model ✦ Respect - for a team that doesn’t control or coerce ✦ Pride - in being part of a trust experiment that respects your choice I already told ya why it matters more than hype ↓↓↓

➥ TOKENS HELD BY TREASURY COMPANIES Believe me or not, but I'll tell you that SMEs = New Retailers The market moves in cycles, you can roughly predict the peak based on overall sentiment • The last buyers in a cycle are usually those with little depth in tech/finance knowledge • They join in during the overheated, unsustainable rally phase Every cycle repeats this pattern, regardless of macroeconomic conditions or policy changes In the past, a bubble signal was when retail investors started buying → Now, the signal might be when a mainstream consumer brand like Amazon, etc. announces they’ve bought #Bitcoin → Meaning the inflow is non-specialist money from businesses completely outside the industry So the peak signal this cycle could be when SME companies publicly announce they’ve bought crypto → that’s the top, time to sell everything From my POV of seeing companies as the new retailers this season, I’d focus on the tokens that big firms are interested in I’ve compiled a list of tokens with dedicated funds from major players like Grayscale, BlackRock, Coinbase, Bitmine… ↓↓↓ [1] Store of Value / Bluechip: $BTC, $ETH, $LTC • widely recognized • easy to buy via major exchanges • digital gold or tech bluechip narrative is easy to market • late-cycle inflows can trigger sharp tops, followed by slow dumps [2] Layer 1 / Ecosystem Growth: $SOL, $SUI, $TON, $TRX, $BNB, $SEI • narrative: Ethereum killer / mobile-first / adoption • attractive to enterprises launching DApps or payment solutions • prone to bubbles when TVL + NFT/gaming explode • L1s often correct 60-80% when the bubble bursts [3] Emerging Narrative / Newcomer: $HYPE, $ENA, $TAO • xx upside potential → very appealing for SMEs seeking diversification • fresh branding, easy to build internal marketing narratives • thinner liquidity, so outflows cause fast dumps [4] Payments / Banking narrative: $XRP • narrative: bridge currency, ties to banks/traditional finance • smaller financial firms are easily drawn into the RippleNet adoption story When corporate treasuries start acting like the late-stage retailers of past cycles, the clock is already ticking Don’t confuse their entry for validation, in crypto it’s often the exit bell in disguise

Most engaged tweets of Nick Research

➥ Marcro & The Bitcoin Minning Cost Correlation ✦ Trade war → rising retaliatory tariffs → rare earth prices ↑ → chip manufacturing cost ↑ → mining rig prices ↑ → mining cost ↑ You know #Bitcoin miners follow upgrade cycles, similar to the halving rhythm. This typically happens every 2-4 years, depending on hardware progress and competitive intensity. It’s now >1 year past the 4th Bitcoin halving (April 20, 2024). → Meaning that most mining rigs are still fresh new > A new wave of hardware investment isn’t due yet. → So any effect from the trade war on mining costs may not be fully priced in for another 6-12 months. ✦ However, in this geopolitical context: ▸ China holds a massive edge in rare soils → the raw materials behind cheap chip production (WTO: China holds 44M tons of rare earth reserves, ranked #1 globally) ▸ Trump isn’t taxing chip exports from China, yet chinese consumers are boycotting U.S. goods, which may dampen exports. → China will look for ways to leverage this resource surplus. If China allows large-scale #Bitcoin mining again: → Cheap domestic chips → competitive rigs → Pressure on U.S.-based miners rises → U.S. must produce domestically at higher cost → upgrades → cost inflation. All paths lead to one conclusion: rising #Bitcoin mining costs. Of course, cost inflation is part of #Bitcoin’s long-term design: ▸ Inflation → halving → new-gen miner competition But in today’s AI-driven, macro-unstable world, the competitive cycle may speed up faster than usual. ✦ Two core metrics reflect this: ➊ Hashrate just hit a new ATH: 1055 EH/s → That’s 1055 million trillion trillion calculations per second to mine BTC. ➋ Mining Difficulty is also at a record high: 121.5B → The market must stay alert to reactions from: • Earnings of China-exposed companies • Inflation spillovers • Geopolitical flare-ups • A potential U.S.-China breakdown • Crypto adoption progress in nations like Singapore, China, U.S… ✦ Zooming in: [1] Bitcoin's divergence from traditional markets: → Correlation with Nasdaq is fading → $BTC volatility is dropping while stocks and bonds grow more volatile → Institutional wallets are quietly accumulating again. [2] Gold has surged ~20% as central banks stockpile it at record pace. → [1][2] hint at a shift: $BTC is transitioning from a high-risk asset → to a strategic macro hedge. Long-term, $BTC won't replace gold, it's becoming a parallel reserve system. In a fragmented global order, capital is chasing neutrality. → That drove the gold rush. → But gold can’t keep surging forever. If #Bitcoin remains resilient under ongoing macro pressure. You may be witnessing the early signals of sovereign/institutional recognition and eventually, public adoption. ✦ TL;DR: ▸ Tech-wise: Bitcoin is engineered for long-term price appreciation ▸ Macro-wise: Geopolitical frictions may ignite an arms race in mining ▸ Sentiment-wise: After the gold rush, Bitcoin might be the only asset that ticks both boxes: liquidity + value refuge ▸ Option insights: Whale aims a big pump in Sept, expecting BTC to hit $140K So from my perspective, a #Bitcoin rebound is likely within the next few months.

➥ What if every DeFi app had an AI-native UX layer I meant without needing to rebuild from scratch That’s how I’ve come to see @Infinit_Labs as the Agentic dApps Layer You know @Infinit_Labs is already a composable execution layer powered by #AI agents That wrap around 18+ #DeFi protocols like Uniswap, Pendle, Morpho, Stargate, etc. ▸ You want to swap → the Swap agent handles slippage, routing, and approvals in one flow ▸ You want to LP across 3 chains → the Bridge, Zap, and Stake agents coordinate instantly ▸ You want to do basis trades → you describe the logic, the agents execute it deterministically @Infinit_Labs already has 20+ agents deployed and they work You'll have to a chance to use them to do 1-click DeFi in V2 • Auto-bridge to best yield destinations • Loop lending positions without juggling 5 tabs • Simulate complex flows before confirming anything onchain → All in one interface → Fully non-custodial → Bundled into a single verifiable transaction using ERC-4337 / EIP-7702 Why does this matter? ▸ because every time I interact with vanilla DeFi like Uniswap, Aave, Pendle, etc. I feel the friction again ▸ the strategy lives in my head, the execution lives across 5 dApps, wallets, and signatures ▸ and if I mess up one step, I lose yield or get rekt That’s not scalable, not for power users, and efinitely not for the next wave of users What @Infinit_Labs is building is an enabler An Agentic Execution Layer that sits on top of any dApp ▸ Where builders can expose their contracts as agent endpoints ▸ Where users can stack logic like Lego blocks with prompts ▸ Where KOLs and strategists can publish 1-click flows and earn fees It’s like turning every DeFi primitive into an API and letting AI agents compose with them across chains and intents @Infinit_Labs is doing that by upgrading the interface with agentic intelligence And I genuinely believe Agentic UX is what makes modular DeFi usable

➥ Theoriq Capital Launchpad = Proof of Voluntary Trust at Scale In just 4 days of pledging, @TheoriqAI reached an astonishing 2050% oversub on @KaitoAI → Target: $2M USDC → Total Pledged: $41M USDC → And pledging isn’t even over yet ☒ I can feel the community sentiment @TheoriqAI is a cocktail of (at least this is what i feel rn) ✦ Curiosity - for a radically new model ✦ Respect - for a team that doesn’t control or coerce ✦ Pride - in being part of a trust experiment that respects your choice I already told ya why it matters more than hype ↓↓↓

➥ Imagine this: ▸ Lending protocols only whitelisting agents above a trust threshold ▸ Users picking agents based on composable scorecards ▸ Entire swarms coordinated based on real, evolving performance data In @TheoriqAI’s Alpha Protocol, every autonomous agent in the swarm must stake capital before operating. Because agents must prove performance, avoid mistakes, and align with users. ▸ Perform well → Keep stake, earn rewards ▸ Underperform or misbehave → Get slashed, lose credibility It’s the same mechanism that secures PoS networks ➔ now applied to #AI liquidity agents, #DeFi bots, and knowledge workers. So the good agents should look like this: • Make performance public • Evolve in public • Deliver real outcomes • Put economic skin in the game I used to trust agents when I see their outputs & now when they stake to be slashed if they screw up. That’s how @TheoriqAI building a real economy of accountable agents.

➥ Theoriq is architecting trust for AI agents, like EigenLayer did for AVSs Alright let me explain ↓↓↓ @TheoriqAI's 3-layer design (THQ / sTHQ / αTHQ) is a coordination machine ▸ THQ: protocol access and partner fee layer ▸ sTHQ: staking derivative with real fee + token yield ▸ αTHQ: time-locked collateral for agent slashing & emissions boosts you delegate to agents like you delegate to EigenLayer AVSs except now, you’re securing intelligent, autonomous capital ▸ Partner protocols must buy $THQ to access agent swarms ▸ Agents are modular, reusable infrastructure ▸ αTHQ enables slashing-based trust, agents can be penalized for failure this creates a new kind of asset-backed reputation system that agents earn AND risk capital on-chain You already know @TheoriqAI's traction is real ▸ 60M+ interactions on testnet ▸ 500K+ users onboarded ▸ 14 unique agents, 3 operational swarms ▸ Community sale 40x oversubscribed Because trustless $AI coordination is unsolved, @TheoriqAI might be the first to secure multi-agent autonomy If that happens, $THQ becomes the native trust asset for autonomous DeFi

➥ @TheoriqAI’s team structure reflects their vision ▸ @ronbodkin sets the discipline for coordinated autonomy ▸ @davidm_ller translates insight into flow ▸ @PeiChen01 brings DeFi rails into the system ▸ @web3contrail engineers agent-first infra ▸ @TheoRooAI memetically encodes swarm logic but we as the yappers and contributors are right there too yappers, testers, ambassadors, feedback loopers… not on the sidelines, @TheoriqAI counts us as part of the team ngl • Yapping • Testing agents • Sharpening incentives • Evolving UX through actual use • Translating protocol logic into signal Theoriq is not community-led nor team-led, it’s Swarm-led by designed

➥ 3 narratives I’m betting on in Q4 Everyone keeps yapping about perp dex, ngl a lot of that is just FOMO rotation For me, real value is brewing somewhere else Here are 3 Narratives I think will matter more ↓↓↓ ➊ Prediction Market Derivatives – @Polymarket touching $10B val, @Kalshi raised $185M, and monthly volume > $1B – But binary yes/no bets are just the start. Derivatives + DeFi integration = where it scales – Think lending, perps, AI x predictions, cross-market AMMs – Big events (macro data, sports, pre-market crypto) will push exposure 10x → Names I’m watching: @trylimitless @TalusNetwork @gondorfi @meleemarkets @polldotfun ➋ Agent Pay – Google, Coinbase, ETH Foundation pushing AP2 + x402 protocols – This is the final mile → agents analyze, execute, and now can pay each other with stablecoins – That unlocks the AgentFi economy for real – I see it like TCP/IP for agents, invisible infra that makes everything else possible → Names I’m watching: @GoKiteAI @KimaNetwork @firecrawl_dev @trySkyfire @PayAINetwork ➌ Yield-bearing Stablecoins – This is the institutional DeFi lane – Ethena, Plasma, Falcon all showed insane traction – Holding USD that yields 4-25% APY, backed by treasuries or RWA, turns stables into wealth engines – If DeFi had a new foundation stone, this is it – No surprise Wall St is sniffing around → Names I’m watching: @yieldbasis @flyingtulip_ @USDai_Official @capmoney_ @Theo_Network These 3 narratives are building real infra + cashflow, I’m positioned here for Q4. Which one do you think will run first?

➥ Sept 10, 2025 - @LineaBuild Airdrop Claim Date Leaked 👀 But i’ll do a quick math here based on this facts • Total supply = 72,009,990,000 $LINEA • Early-user allocation = 10% of total supply = 7,200,999,000 • Airdrop tranche (leak) = 2,000,000 (possible batch 1) • Eligible wallets ≈ 177,809 (post-Sybil filter) • Total LXP (post-Sybil) ≈ 1,830,000,000 ☒ Case A - the leaked 2,000,000 LINEA pool Token per LXP = 2,000,000 ÷ 1,830,000,000 ≈ 0.001092896 LINEA per LXP So here’re the amounts you’ll receive • 1,000 LXP → 1,000 × 0.001092896 ≈ 1.093 LINEA • 5,000 LXP → ≈ 5.464 LINEA • 6,000 LXP → ≈ 6.557 LINEA • 10,000 LXP → ≈ 10.929 LINEA → the tranche is tiny relative to total supply ☒ Case B - if the airdrop used the full 10% early-user allocation Token per LXP = 7,200,999,000 ÷ 1,830,000,000 ≈ 3.934972 LINEA per LXP • 1,000 LXP → 1,000 × 3.934972 ≈ 3,934.97 LINEA • 5,000 LXP → ≈ 19,674.86 LINEA • 6,000 LXP → ≈ 23,609.83 LINEA • 10,000 LXP → ≈ 39,349.72 LINEA → rewards would be massive per LXP, life-changing for many accounts Voyage NFTs matter as a bonus An Alpha Tier +1,715 LXP is a real multiplier For a 3k LXP account it increases effective LXP by ~57%

➥ Crazy momentum for @trylimitless lately 👀 - $10M Seed Round w 1confirmation, Collider, DCG, Arrington & more - Hit 1M+ monthly trades on @base - $LMTS TGE coming Oct 25 - After all the CZ vs CJ drama… $LMTS still heading to Binance listing - icymi, they broke record w 200x oversub on Kaito Everything is aligning, so I believe $LMTS gonna be one of the most hyped launches

➥ TOKENS HELD BY TREASURY COMPANIES Believe me or not, but I'll tell you that SMEs = New Retailers The market moves in cycles, you can roughly predict the peak based on overall sentiment • The last buyers in a cycle are usually those with little depth in tech/finance knowledge • They join in during the overheated, unsustainable rally phase Every cycle repeats this pattern, regardless of macroeconomic conditions or policy changes In the past, a bubble signal was when retail investors started buying → Now, the signal might be when a mainstream consumer brand like Amazon, etc. announces they’ve bought #Bitcoin → Meaning the inflow is non-specialist money from businesses completely outside the industry So the peak signal this cycle could be when SME companies publicly announce they’ve bought crypto → that’s the top, time to sell everything From my POV of seeing companies as the new retailers this season, I’d focus on the tokens that big firms are interested in I’ve compiled a list of tokens with dedicated funds from major players like Grayscale, BlackRock, Coinbase, Bitmine… ↓↓↓ [1] Store of Value / Bluechip: $BTC, $ETH, $LTC • widely recognized • easy to buy via major exchanges • digital gold or tech bluechip narrative is easy to market • late-cycle inflows can trigger sharp tops, followed by slow dumps [2] Layer 1 / Ecosystem Growth: $SOL, $SUI, $TON, $TRX, $BNB, $SEI • narrative: Ethereum killer / mobile-first / adoption • attractive to enterprises launching DApps or payment solutions • prone to bubbles when TVL + NFT/gaming explode • L1s often correct 60-80% when the bubble bursts [3] Emerging Narrative / Newcomer: $HYPE, $ENA, $TAO • xx upside potential → very appealing for SMEs seeking diversification • fresh branding, easy to build internal marketing narratives • thinner liquidity, so outflows cause fast dumps [4] Payments / Banking narrative: $XRP • narrative: bridge currency, ties to banks/traditional finance • smaller financial firms are easily drawn into the RippleNet adoption story When corporate treasuries start acting like the late-stage retailers of past cycles, the clock is already ticking Don’t confuse their entry for validation, in crypto it’s often the exit bell in disguise

➥ @DMZ_Finance’s $QCDT is now live on @Mantle_Official - the world’s first DFSA-approved tokenized money market fund - backed by Qatar National Bank and Standard Chartered Don’t skip, this is bigger than you imagine, RWA just leveled up ICYMI, institutions can now hold yield-bearing assets with $QCDT - use them as exchange collateral via @Bybit_Official - and unlock deeper, compliant liquidity onchain You might ignore this, but it’s part of a bigger RWA vision: - building a foundation for institutional-grade onchain markets where real-world yield meets blockchain efficiency - @Mantle_Official took a big step forward in this vision, they’re working on this The RWA market has already grown to $35B+ onchain, and it’s just the beginning The future of capital markets is being built onchain via @Mantle_Official

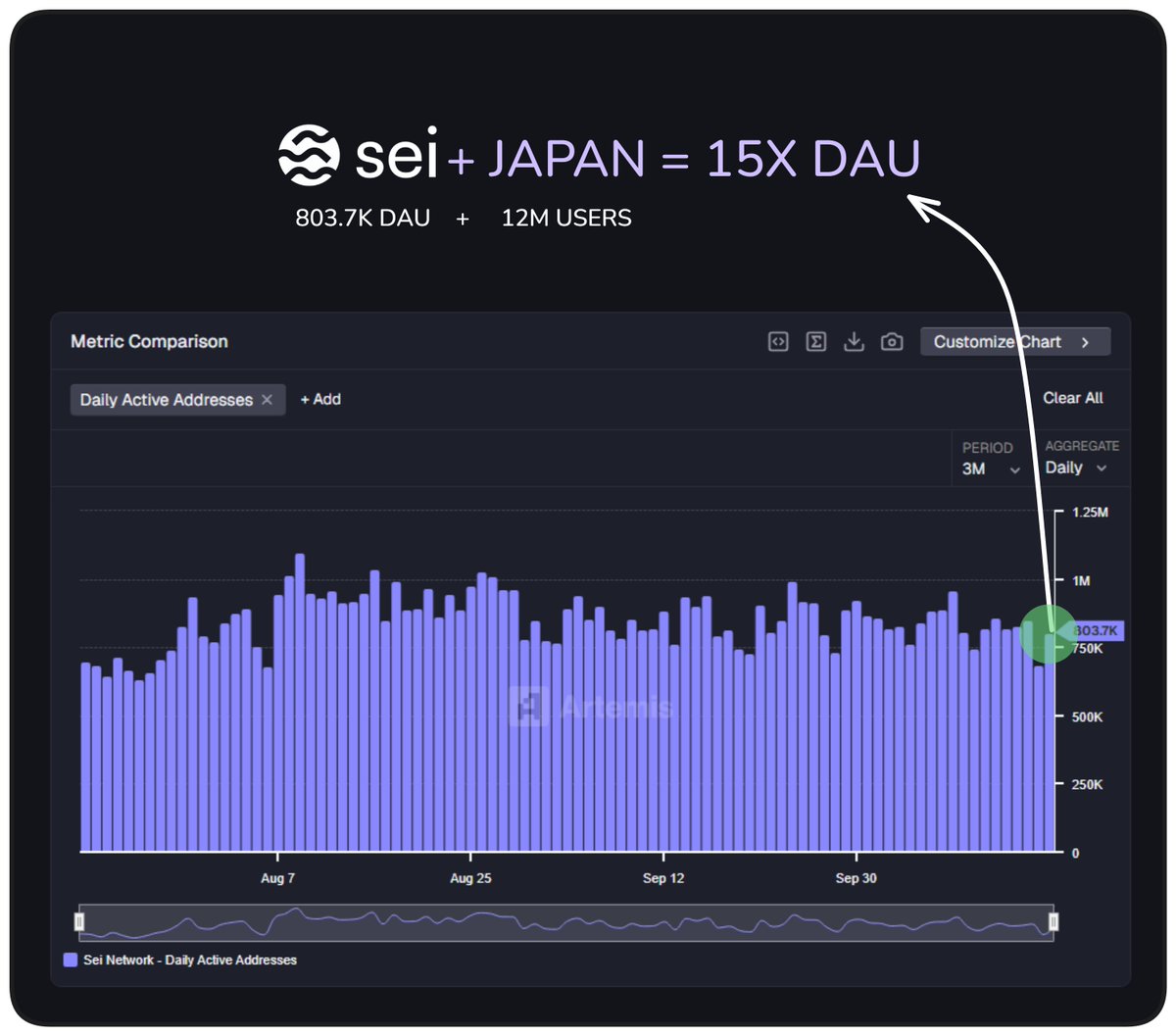

➥ @SeiNetwork got a regulatory edge in Japan Japan’s banking system is opening the crypto gates • Japan has over 12M crypto accounts as of early 2025 • Japan’s FSA is considering reforms to allow banks to acquire and hold digital assets • $SEI has received approval from Japan’s FSA If @SeiNetwork captures even that market, that’s a 15× upside in DAU powered by regulation

➥ $TAO ripping +30% reminds everyone how early DeAI still is so I’d remind you @Mira_Network verifies the truths which is uniquely important to the AI era - onchain consensus for AI outputs → no more hallucinations - backed by Framework, Base-native, already live - and $MIRA sits at 1/65th $TAO’s MC if $TAO is the data layer, $MIRA is the verification layer early means asymmetric, few understand

➥ @Talus_Labs popular facts @Talus_Labs = the first real attempt to give #AI agents an economy of their own Built on Sui’s MoveVM as an entire L1 built for autonomous agents What caught my eye • $19M raised, Polychain led all 3 rounds • Testnet live since Sept, mainnet set for Q1 2026 • Nexus framework lets AI agents battle it out in prediction markets • real Agent vs. Agent games that actually generate onchain value I like that Talus treats incentives as the data layer Because markets reward truth and Talus’ agents learn what matters @Talus_Labs is building the economy they’ll live in, now is your turn to DOYR

People with Analyst archetype

Professor, UC berkeley | Founder @bespokelabsai |

mathematical physicist lost in an extraliminal space of events to take humanity toward the singularity of knowledge 📙 aspiring timelord

Moving away from memes and into UTILITY only projects . DYOR Everything I post is my own opinion and not financial advice!!!

Investor 💵 | /MES Futures Trader 👨💻 | 5+Years of Stock Market Experience 📊 | Business Degree 👨🎓 | Dividend Tracker 💸 | ETF Nerd 🌱 | Spaces Host🎙

DLG_Crypto Ⓜ️Ⓜ️T

DhCrypto🌊 RIVER|.edge🦭

no recycled takes╭╯advisor @xeetdotai

God is great | Building @PrismHub_io | Thoughts are my own

the revolution will not be centralized | dunedatadash@gmail.com dunedata was my old dune username i might post slop if it does well w the algo

Explore Related Archetypes

If you enjoy the analyst profiles, you might also like these personality types: