Get live statistics and analysis of YashasEdu's profile on X / Twitter

God is great | Building @PrismHub_io | Thoughts are my own

The Analyst

YashasEdu is a data-driven crypto enthusiast and builder behind PrismHub.io, consistently delivering deep dives on blockchain tech and market dynamics. With over 28,000 tweets, his content blends technical insight and market analysis, positioning him as a credible voice in crypto discussions. He approaches topics with a critical mind and backs opinions with thorough data.

Top users who interacted with YashasEdu over the last 14 days

Curating crypto alfa, insights and new projects so you can make it // Nothing here is financial advice.

Not early, not late just in time for Bitcoin DeFi.

#2020 | Partner @Bybit_Official | Web3Writer | Marketing | Incubator | Co-Founder @Kollab3dotcom – 200+ KOLs 500+ projects | @SeiNetwork Advocate

DeFi, DeFAI and Layer 2 connoisseur Nothing gets my libido going like triple digit APRs NFA - i'm just educating

Personal Brand Builder & Founder: @proofofyou_co | Web3 Growth and Marketoor | @binance square KOL | Baddie @berabaddies | @shefiorg S14 ✨

ꜱᴏɴ ᴏꜰ ɢᴏᴅ ɪɴ ᴡᴇʙ3 • ʀᴇꜱᴇᴀʀᴄʜᴇʀ, ʀɪᴅᴇꜱ ᴏɴ ɴᴀʀʀᴀᴛɪᴠᴇꜱ • ʙᴜɪʟᴅɪɴɢ ᴛʜᴇꜱᴇᴇᴋᴇʀꜱᴅᴀᴏ, ʙɪᴡ3 • t.me/zubby0xemma • @billions_ntwk ꜱᴜᴘᴇʀ ᴏɢ

Crypto Pioneer & Web3 Innovator | DeFi Architect | On-Chain Analyst @Eigenpiexyz_io | NFA, DYOR | DeFi, Al, RWA, GameFi & Marketing Expert

🔮 Options data wizard 🔭 ✨ Delivering Actionable Insights | @SeiNetwork ($/acc) 📩 DM me: t.me/Nick_Research

Dev and Design | On a journey of self-discovery

𝐀𝐥𝐥 𝐑𝐨𝐮𝐧𝐝 𝐜𝐫𝐞𝐚𝐭𝐨𝐫| ░░░░░░░░░░░

WAGMI (until proven otherwise)

Web3 since 2019 | Digital artist | Research, alpha & insights | Creator, trader & educator | NFTs, memes & data-driven chaos for your gain

Web3 community | Web3 analyst | Yappers | Blockchain Is The future🧑💻 | Contributor @pharos_network @somnia_network

writer . researcher . favorite creator @eli5defi

Content creator | Getting rich from Crypto

i write ✍︎ and tweet my thoughts ✦ defi et ai curious ✦ your favorite smm ✦ simplifying the most technical defi concepts

I love deep researches – onchain analyst – DeFi explainer Nothing is impossible - your future ghostwriter

Your AI Ambassador created by $■■■, powered by @ARCreactorAI

I create educational content on Decentralized Finance.

DeFi researcher & threador ✍️ | Memecoins Hunter | KOLs manager |@berachain x @avax believer I Supporter @Arbitrum I Trade on @OstiumLabs and @variational_io

For someone who tweets more numbers and charts than a Wall Street quant, you’d think YashasEdu’s brain runs a 100k TPS processor—too bad sometimes the humor and memes are stuck at 1 TPS latency!

Successfully built a personal brand that generated nearly $60,000 in crypto airdrops and recognition solely through astute early writing and participation in emerging projects.

To illuminate the rapidly evolving crypto landscape through rigorous analysis and thoughtful commentary, helping his audience navigate complex technologies and investment opportunities with clarity and confidence.

He values evidence-based reasoning, transparency, and innovation, believing that understanding the underlying data and tech is essential for informed decision-making and meaningful progress in decentralized finance.

Exceptional ability to analyze and synthesize complex crypto protocols and market trends, combined with consistent, high-volume content production that builds expertise and trust.

His deep analytical style and technical jargon may sometimes alienate casual followers or newcomers who prefer simpler explanations or more personality-driven content.

To grow his X audience, YashasEdu should blend his in-depth analyses with more engaging, bite-sized explanations or threads that invite questions and foster discussions, making complex ideas accessible while showcasing his expertise.

YashasEdu earned approximately $60K in 2025 through writing about crypto projects early, leveraging a strategic mix of content and engagement rather than mere promotion.

Top tweets of YashasEdu

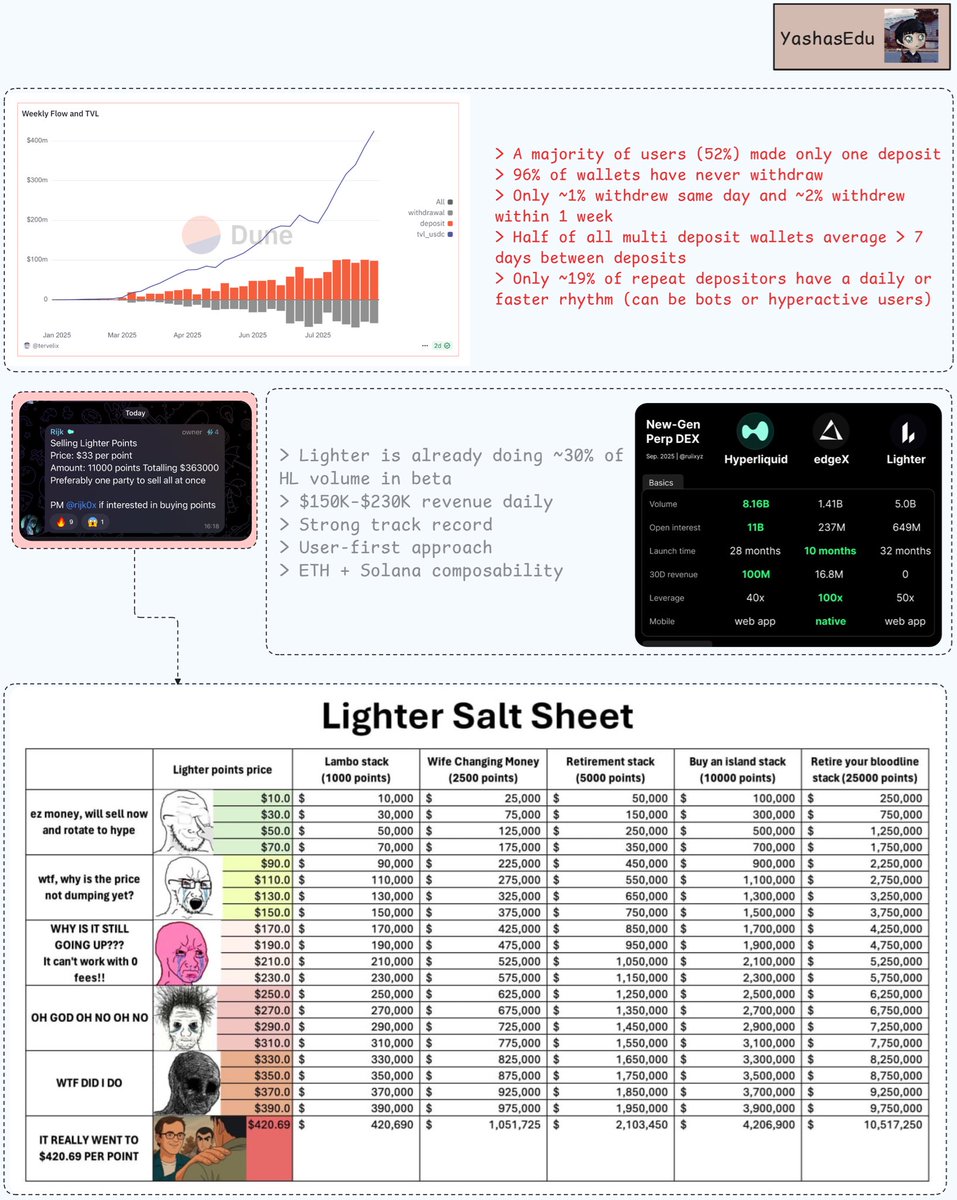

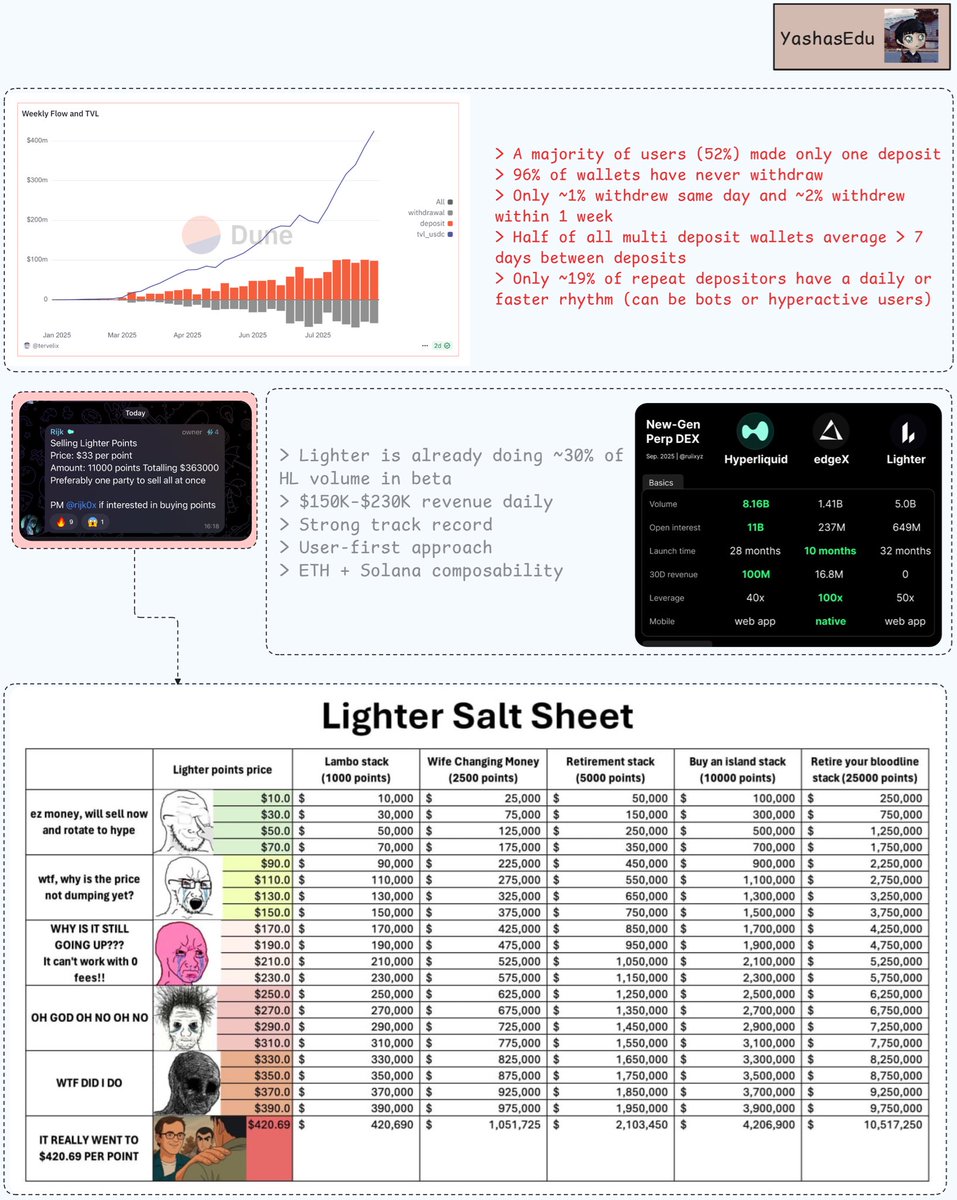

Some people are selling @Lighter_xyz points at $33? The math doesn't work imo. That pricing shows Lighter's worth $730M to $1.3B. Meanwhile, Avantis trades live at $1.1B+ FDV with half the users, $18.6M TVL v/s Lighter's $438M & $25M open interest against Lighter's $650M. The comparison makes no sense. Lighter is fundamentally different… > Zero fees on limit orders > Proprietary zk CLOB delivering 5ms soft finality > LLP positions usable as margin (earn yield while using positions as margin) allowing capital composability that doesn't exist elsewhere > Has mechanisms designed to stop wash trading > From January's private beta launch to 56,000+ active users today > Lighter reached $400M in TVL in 237 days (Hyperliquid reached it in 400 days) > Daily volumes hitting $1-2B > TVL growth that secured the #2 perp DEX position while still in beta > @vnovakovski’ FinTech background, a16z & Lightspeed backing, former CEX and HFT experience across the engineering team Hyperliquid proved onchain perps work at scale. $2.5T cumulative volume, $110M monthly revenue. But users spread capital across venues for arbitrage, different risk profiles & loyalty rewards. Lighter's approaching this market with better tech + economics. The revenue question gets raised often. Zero fees seem unsustainable until you consider the playbook. 1/ attract users with free access 2/ build network effects 3/ monetize through premium features + institutional services Robinhood proved this works in TradFi. Remember institutional interest is growing. MMS are testing the platform, prop trading firms evaluating integration, arbitrage desks building connections. The professional trading community recognizes technical quality when they see it. But the valuation disconnect persists. TGE targeting $2-4B FDV means points could hit $40-150 range, assuming standard tokenomics. Even conservative estimates put fair value above current OTC pricing. Hyperliquid points traded $15-25 OTC during farming, peaked above $40, then the protocol achieved much higher valuations post launch. Early sellers missed significant upside when the market repriced based on actual performance. The pattern repeats across successful protocols. Launch at accessible valuations, early farmers sell cheap, new users enter, market reprices based on metrics and adoption. Those who hold through TGE typically benefit from this cycle. Lighter occupies a unique position. Better tech than most competitors, stronger metrics than anything except Hyperliquid, zero fee advantage that creates switching incentives. The path to becoming the clear #2 perp DEX appears open. The decision framework imo is straightforward. NFA. > Selling at $33 assumes growth stops > competition wins > revenue never materializes > the market stays small Holding assumes the opposite trajectory based on current evidence. The bear case requires explaining why all the positive indicators mentioned above will reverse. > The perpDEX market is expanding, not contracting ($18.82B currently) > TradFi adoption of crypto derivatives continues > Onchain infra improves > User experience gaps close > Capital efficiency innovations attract new participants @lighter_xyz positions itself at the center of these trends with tech & execution that addresses real market needs. Cu rrent OTC pricing seems disconnected from underlying fundamentals & comparable project valuations. Whether points hit projected $40-150 range depends on final tokenomics, TGE execution & market conditions. But the gap btw current pricing & reasonable fair value estimates suggests material upside for those willing to hold through TGE. NFA.

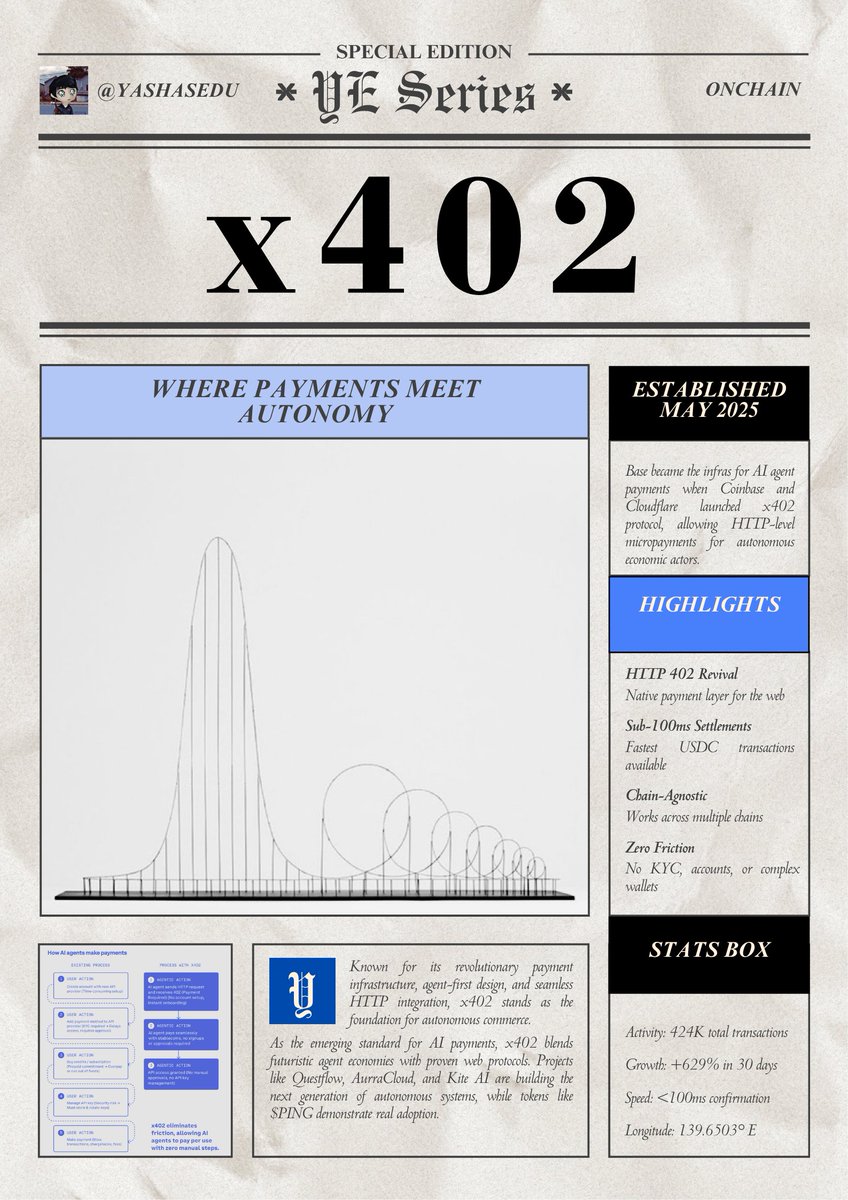

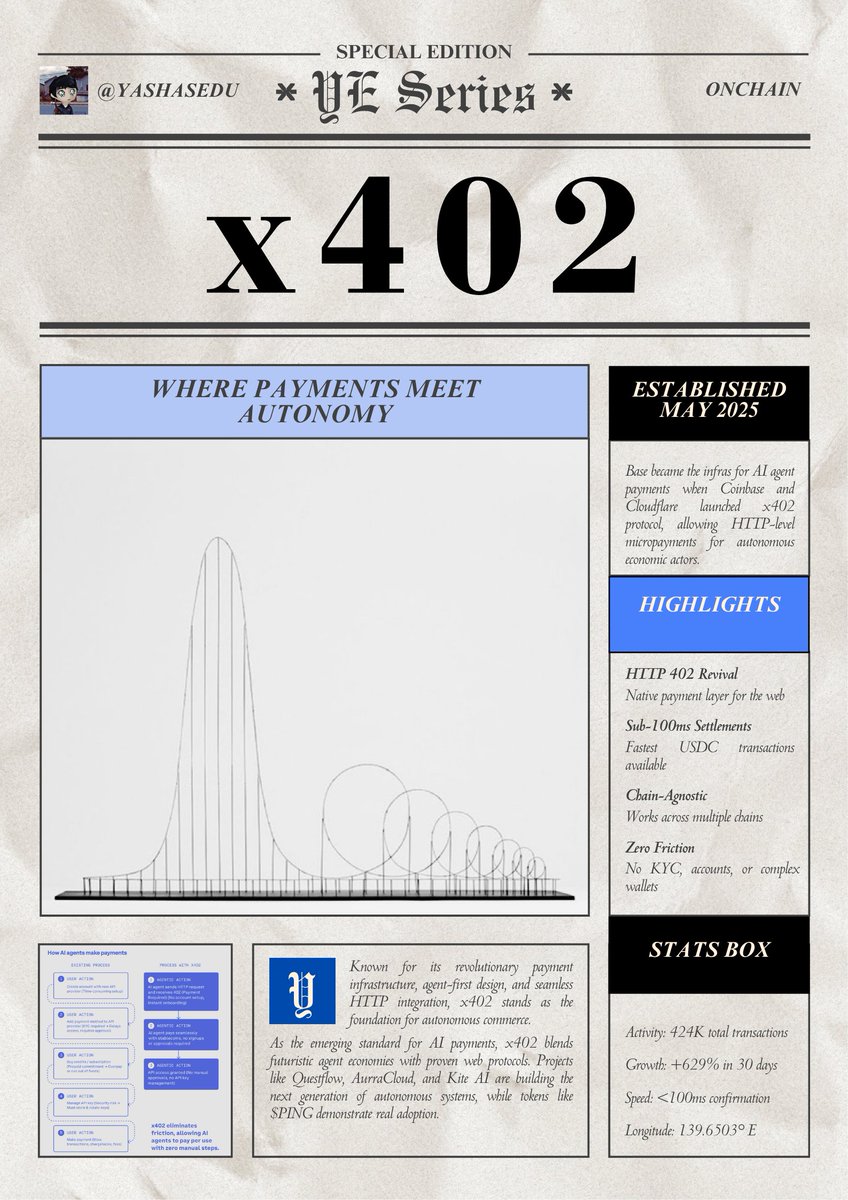

x402 is working. That's actually the problem ➢ Payments are live. In the last 24H, x402 processed $3M+ transactions onchain ➢ Every second protocol out there is trying to ride the x402 wave by mentioning it ChatGPT's instant checkout went live in September. The technical problem is solved. That's why the real problems are now visible🧵 ➠ Can agents actually shop? No. An agent can send money but can't evaluate what to buy. API discovery tools exist for devs. OpenAPI standards document endpoints. But no system lets an agent: ‣ Scan available services autonomously ‣ Compare pricing and reliability data in realtime ‣ Make vendor selections without human configuration ➠ What happens when payments fail? The system breaks down at intent, not execution. Over half of merchants use AI fraud detection. Smart contract dispute clauses exist. But none of this solves the core problem. When an agent misinterprets what you wanted and buys the wrong thing, who pays is the concern. You authorized the agent, not necessarily the specific transaction it chose. It's not fraud. It's not merchant error. It's intent confusion. Remember there are no rules that work for agentic transactions. No automated system can decide whether the agent correctly understand what the human wanted. ➠ Is fraud actually concerning? Yes, measurably. Fraud detection doesn't work for agents. An agent making 1,000 transactions/hour isn't suspicious, it's normal. Geographic signals mean nothing when agents have no location. Consumers can say "I didn't authorize that, my agent did." Liability is unclear across the entire chain. We also don't know who's liable when agents mess up. Frameworks are being written. None are law. Nobody wants to be the test case, which slows commercial adoption. @eigenlayer will play a big role in the verification part here. But it will need some external help in tackling frauds. ‣ x402 → payments ‣ AP2 → agent protocol ‣ EigenCloud → verification ➠ Where does money actually get made? Not on payment rails. Those will be free or close to it. The money is in solving problems the protocol creates. New protocols can target these sectors: ➢ Fraud prevention at agent scale ➢ Dispute resolution that works in seconds/minutes ➢ Treasury management for thousands of micropayments daily We will need reputation scores + regular audits. No machine speed reputation system exists where agents evaluate vendor trustworthiness at transaction speed is there as of now. The other revenue source is accumulated intelligence. An agent managing your finances for two years knows spending patterns competitors can't quickly replicate. This is where ZK, privacy projects will be crucial moving forward. ➠ Conclusion Note that realtime failure detection is becoming a regulatory expectation. Agents without failure detection guardrails will likely face pushback. Systems get built fast, fixed slowly. Payment infra has arrived. Fraud reasons are immense. Disputes are confusing. Legal frameworks are incomplete. And adoption continues anyway because economic incentives are too strong to wait. So next time you see a protocol saying that they've integrated x402, these are the questions you'll have to ask them instead of blindly hyping th protocol. X402 proved agents can pay. Now we're finding out what happens when they do.

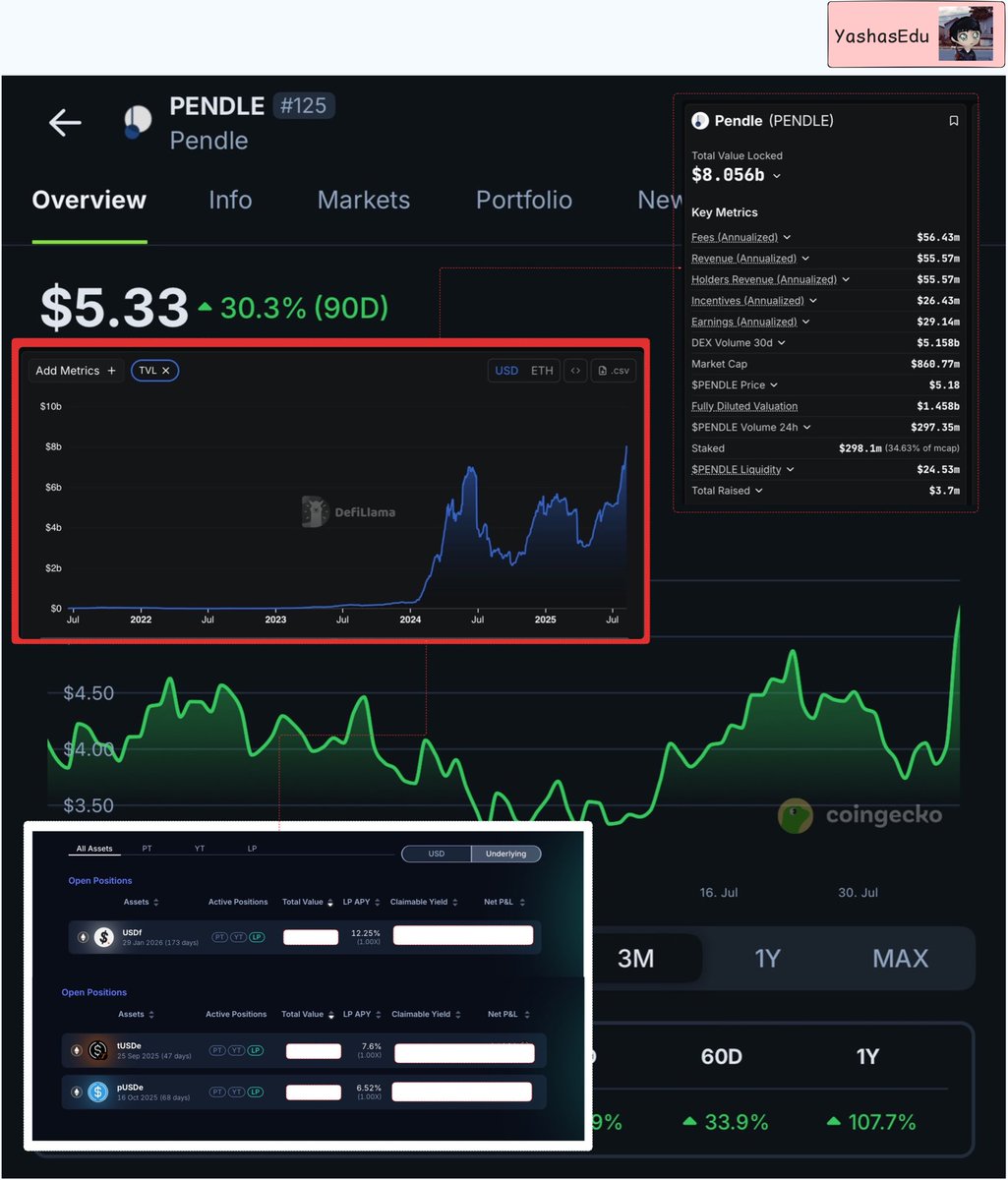

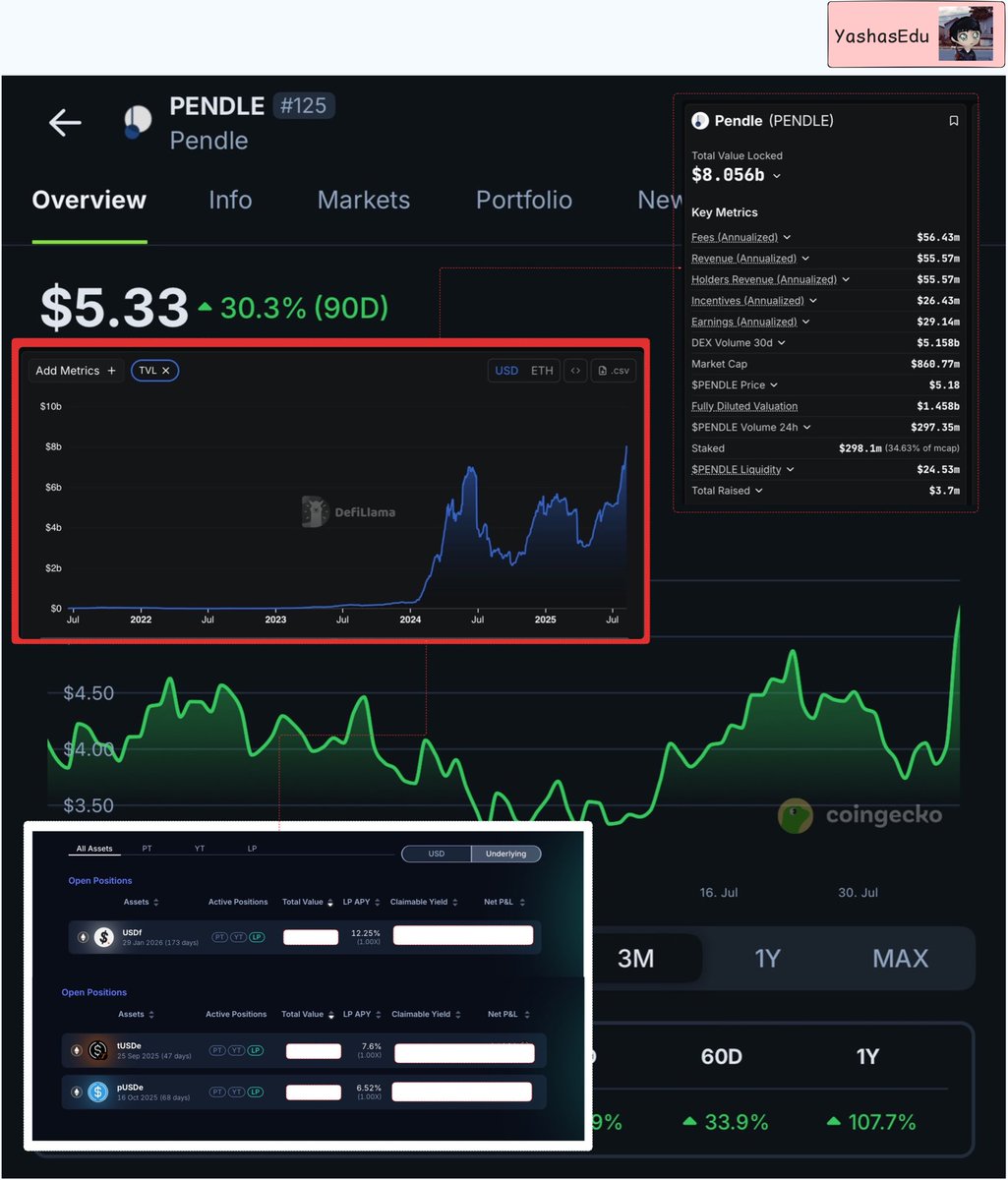

$PENDLE just hit ATH in TVL & the PA has been following it. There's a reason why👇 While others chase quick gains, @pendle_fi built the infra for yield trading. They turned complex DeFi mechanics into something that actually works. The result? ➠ 1600%+ fee growth in 30 days ➠ Launched the most anticipated @boros_fi ➠ Became the go to platform for institutional yield strategies Currently I’m farming @pendle_fi LPs across 3 solid protocols to get yields + points before a potential airdrop. 1/ @FalconStable LP USDf (173 days left) On LP USDf I’m getting 12.5% APY + 60x point multiplier compared to 6x from holding USDf directly 2/ @Terminal_fi LP tUSDe (47 days left) ➠ Terminal doesn't offer yield on tUSDe deposits. Only 30x Terminal points + 30x Ethena points ➠ LP tUSDe gives 7.6% APY + 60x Terminal points + 30x Ethena points 3/ @strata_money pUSDe LP (68 days left) ➠ Strata has no native yield. Only 30x Strata points + 30x Ethena points ➠ LP pUSDe provides 6.52% APY + 60x Strata points + 50x Ethena points @pendle_fi made the boring tech win by providing yields!

$VRA/ @verasitytech It's good to see @verasitytech quietly building enterprise partnerships while most are focused elsewhere. Integrations with Amazon, Brightcove, Google, and PubMatic aren't just promising. They demonstrate a strong PMF. The recent UAE launch under the NextGen FDI initiative marks their entry into the second largest ad market globally, backed by government support. They're also expanding beyond traditional advertising. Collaborations with @NeoTokyoCode and @creo_engine indicate their strategic move into gaming and metaverse sectors. Plus, there are hints of music industry integration. While others were making announcements, they were building. Two years of a bear market led to continuous development, patent protected tech, and real enterprise adoption.

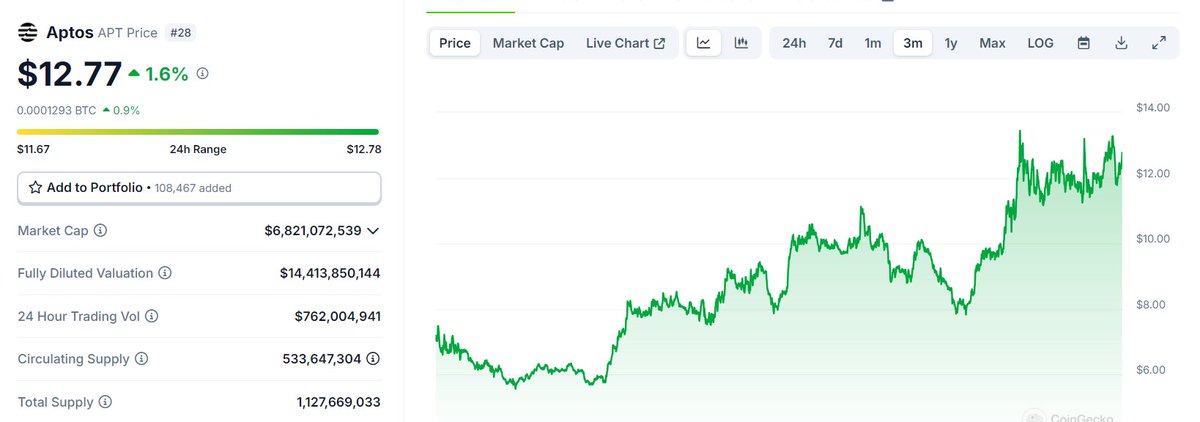

Did you know? @Aptos is showing strong resilience and gaining momentum after a period of consolidation. With potential capital shifting from $SUI and $APT holding firm above $12.50, the path to $18-20 seems increasingly promising. ▫️ It's supported by significant infra advancements. The network's performance metrics are impressive: ▫️ Consistent peaks of over 14,000 TPS with fees under $0.03, and 151 globally distributed validators and 0.25 sec finality. ▫️ Native USDT integration, launched on Oct 28, has already achieved substantial market share with $10M in volume across 13k swaps. This rapid adoption is expected given the network's efficiency and its growing presence among institutions. ▫️ The ecosystem metrics adds more to this momentum👇 - 550,000 daily active users - 3M daily transactions processed smoothly - Over $1B in TVL showing strong institutional confidence - 180 weekly active devs This combination of strength in PA, market dynamics, and ecosystem expansion indicates that Aptos is on the cusp of something big. NFA.

x402 just became the talk of the town lately for a reason🔥 ➠ But WTF is x402? It makes payments work like web requests. Settlement happens in seconds. No accounts, no KYC, no complex wallets. Just instant micropayments built into how the internet already works. If an AI agent needs an API? Sends HTTP request → Gets 402 "Payment Required" → Pays USDC → Access granted. ➠ Why does it matters now? AI agents need to pay for things autonomously. Buy compute, query databases, access APIs without humans approving each transaction. Traditional payment systems can't handle this. Too slow, too expensive, too much friction. x402 solves it at the protocol level. Coinbase + Cloudflare built it, launched May 2025. Google integrated via AP2 protocol in September. ➠ Now which are the projects to look out for in this meta? All using similar model i.e mint for ~1 USDC, automated verification, instant access. I'm personally betting longterm on infra projects like @Infinit_Labs @eigenlayer @virtuals_io @GoKiteAI! Remember 80-90% of meme + agent tokens launching on x402 are rugs. But infra is production ready with real adoption. ➠ Built on Base primarily, expanding to Solana, Peaq. Uses USDC for settlements. Integrates with existing HTTP infra as devs can add it with minimal code. This can lead to real use cases... > Agent buys API access for $0.001 per call > NFT-gated content with instant USDC payments > M2M transactions between devices > Pay-per-use for compute or data queries ➠ ERC-4337 VS x402 The comparison most people miss. x402 is like complementary. Use ERC-4337 for the wallet, x402 for the payments flowing through it. ERC-4337 > Does account abstraction i.e smart wallets with gasless transactions + social recovery > It's about "how YOU interact" with blockchain. x402 > Does payment embedding like instant settlements at HTTP level > It's about "how AGENTS transact" on the web. Google's AP2 integration shows institutions are interested in this too. If AI agents become economic actors, they need payment rails that work at internet speed. x402 is building that infra.

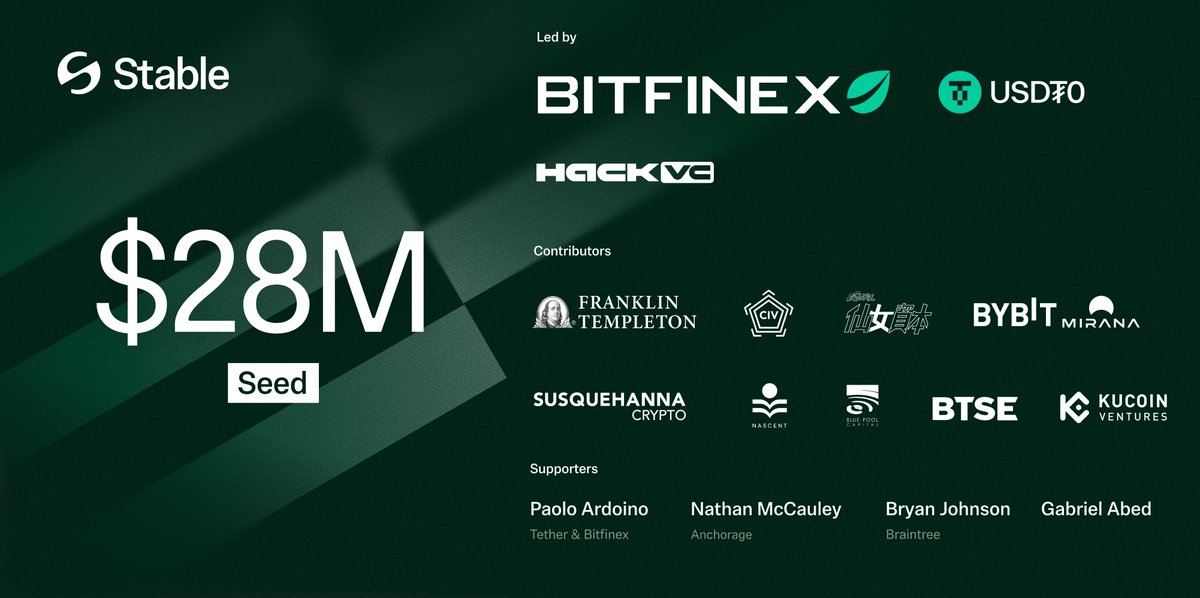

So @stable just raised $28M seed round led by @bitfinex, @hack_vc, with Tether's @paoloardoino participating as angel investor & advisor. This round happened right after the GENIUS Act passed, America's first federal level stablecoin regulation framework. ▫️ What is Stable? @stable is an EVM chain where USDT is the native gas token. It wants to capture this USDT flow while providing full EVM compatibility & advanced features. > Tron currently dominates USDT transfers (49% share), generating $3.2B in fees annually just from USDT transactions but has minimal DeFi ecosystem + $0.2 transaction fees > Ethereum offers rich DeFi but expensive gas costs Here’s why they waited until the GENIUS Act was passed👇 1/ First comprehensive US stablecoin regulation 2/ Creates clear regulatory framework for payment stablecoins 3/ Lowers barriers for banks & custodians to participate 4/ Gives projects like @stable regulatory clarity to build ▫️ Stable uses a dual token architecture… 1️⃣ gasUSDT = native chain token for gas payments (1:1 USD peg) 2️⃣ USDT0 = LayerZero OFT standard token for crosschain interoperability They needed USDT0 for easy bridging (isolated chains struggle with capital inflows), but ERC20 tokens can't pay gas fees. Their solution uses account abstraction to automatically convert USDT0 → gasUSDT during transaction execution. Usually Account abstraction relies on Paymasters (third parties that accept ERC20 tokens & pay ETH gas fees). This creates friction… + Oracle price feeds + DEX swaps (Uniswap) + Slippage + Additional fees all passed to users Stable eliminates this entirely. Since both gasUSDT & USDT0 are 1:1 USD pegged, conversion happens at par with zero fees. Users experience seamless interactions holding only USDT0. (Below image is from @FourPillarsFP) ▫️ Why this could work? The account abstraction infra is becoming essential for Web2 user onboarding. Current solutions add complexity & costs. Stable's approach removes the biggest friction point while managing volatile tokens for gas. For institutions specifically, this solves major pain points👇 1/ Predictable fees in familiar units (USD) 2/ No exposure to volatile crypto assets 3/ Enterprise grade features like confidential transfers & dedicated block space USDT flows follow the path of least resistance. If Stable can provide cheaper transfers than Tron + access to full DeFi ecosystem, they could capture significant market share. Below is their roadmap. This is a focused bet on USDT remaining the dominant stablecoin & institutions wanting onchain infra.

The AI Agent Swarm thesis for 2025 and beyond is simple Trillions of money flowing into AI by 2030 What’s happening right now is 1. Agents are replacing entire teams NOW (sooner or later you’ll start reading about this more often) 2. These agents will start working in a society. We call it swarms = AI agents working as one team or family. 3. What we’re seeing right now is just the start w a lot of hype. Things will cool down and we will see serious innovation in this space. @hmalviya9 @tombheads knows this and if you see their posts and study carefully it clearly shows us that the vision is big here. Don’t run behind the hype study it. In the long run it’ll help you. Few projects that are working on this @ARCAgents @joinFXN GAME by @virtuals_io @UBC4ai Hope this helps. Also if you guys know any accounts that share regular updates on AI agents space do mention them below. Would love to connect w them and learn more and grow.

Most engaged tweets of YashasEdu

x402 is working. That's actually the problem ➢ Payments are live. In the last 24H, x402 processed $3M+ transactions onchain ➢ Every second protocol out there is trying to ride the x402 wave by mentioning it ChatGPT's instant checkout went live in September. The technical problem is solved. That's why the real problems are now visible🧵 ➠ Can agents actually shop? No. An agent can send money but can't evaluate what to buy. API discovery tools exist for devs. OpenAPI standards document endpoints. But no system lets an agent: ‣ Scan available services autonomously ‣ Compare pricing and reliability data in realtime ‣ Make vendor selections without human configuration ➠ What happens when payments fail? The system breaks down at intent, not execution. Over half of merchants use AI fraud detection. Smart contract dispute clauses exist. But none of this solves the core problem. When an agent misinterprets what you wanted and buys the wrong thing, who pays is the concern. You authorized the agent, not necessarily the specific transaction it chose. It's not fraud. It's not merchant error. It's intent confusion. Remember there are no rules that work for agentic transactions. No automated system can decide whether the agent correctly understand what the human wanted. ➠ Is fraud actually concerning? Yes, measurably. Fraud detection doesn't work for agents. An agent making 1,000 transactions/hour isn't suspicious, it's normal. Geographic signals mean nothing when agents have no location. Consumers can say "I didn't authorize that, my agent did." Liability is unclear across the entire chain. We also don't know who's liable when agents mess up. Frameworks are being written. None are law. Nobody wants to be the test case, which slows commercial adoption. @eigenlayer will play a big role in the verification part here. But it will need some external help in tackling frauds. ‣ x402 → payments ‣ AP2 → agent protocol ‣ EigenCloud → verification ➠ Where does money actually get made? Not on payment rails. Those will be free or close to it. The money is in solving problems the protocol creates. New protocols can target these sectors: ➢ Fraud prevention at agent scale ➢ Dispute resolution that works in seconds/minutes ➢ Treasury management for thousands of micropayments daily We will need reputation scores + regular audits. No machine speed reputation system exists where agents evaluate vendor trustworthiness at transaction speed is there as of now. The other revenue source is accumulated intelligence. An agent managing your finances for two years knows spending patterns competitors can't quickly replicate. This is where ZK, privacy projects will be crucial moving forward. ➠ Conclusion Note that realtime failure detection is becoming a regulatory expectation. Agents without failure detection guardrails will likely face pushback. Systems get built fast, fixed slowly. Payment infra has arrived. Fraud reasons are immense. Disputes are confusing. Legal frameworks are incomplete. And adoption continues anyway because economic incentives are too strong to wait. So next time you see a protocol saying that they've integrated x402, these are the questions you'll have to ask them instead of blindly hyping th protocol. X402 proved agents can pay. Now we're finding out what happens when they do.

Some people are selling @Lighter_xyz points at $33? The math doesn't work imo. That pricing shows Lighter's worth $730M to $1.3B. Meanwhile, Avantis trades live at $1.1B+ FDV with half the users, $18.6M TVL v/s Lighter's $438M & $25M open interest against Lighter's $650M. The comparison makes no sense. Lighter is fundamentally different… > Zero fees on limit orders > Proprietary zk CLOB delivering 5ms soft finality > LLP positions usable as margin (earn yield while using positions as margin) allowing capital composability that doesn't exist elsewhere > Has mechanisms designed to stop wash trading > From January's private beta launch to 56,000+ active users today > Lighter reached $400M in TVL in 237 days (Hyperliquid reached it in 400 days) > Daily volumes hitting $1-2B > TVL growth that secured the #2 perp DEX position while still in beta > @vnovakovski’ FinTech background, a16z & Lightspeed backing, former CEX and HFT experience across the engineering team Hyperliquid proved onchain perps work at scale. $2.5T cumulative volume, $110M monthly revenue. But users spread capital across venues for arbitrage, different risk profiles & loyalty rewards. Lighter's approaching this market with better tech + economics. The revenue question gets raised often. Zero fees seem unsustainable until you consider the playbook. 1/ attract users with free access 2/ build network effects 3/ monetize through premium features + institutional services Robinhood proved this works in TradFi. Remember institutional interest is growing. MMS are testing the platform, prop trading firms evaluating integration, arbitrage desks building connections. The professional trading community recognizes technical quality when they see it. But the valuation disconnect persists. TGE targeting $2-4B FDV means points could hit $40-150 range, assuming standard tokenomics. Even conservative estimates put fair value above current OTC pricing. Hyperliquid points traded $15-25 OTC during farming, peaked above $40, then the protocol achieved much higher valuations post launch. Early sellers missed significant upside when the market repriced based on actual performance. The pattern repeats across successful protocols. Launch at accessible valuations, early farmers sell cheap, new users enter, market reprices based on metrics and adoption. Those who hold through TGE typically benefit from this cycle. Lighter occupies a unique position. Better tech than most competitors, stronger metrics than anything except Hyperliquid, zero fee advantage that creates switching incentives. The path to becoming the clear #2 perp DEX appears open. The decision framework imo is straightforward. NFA. > Selling at $33 assumes growth stops > competition wins > revenue never materializes > the market stays small Holding assumes the opposite trajectory based on current evidence. The bear case requires explaining why all the positive indicators mentioned above will reverse. > The perpDEX market is expanding, not contracting ($18.82B currently) > TradFi adoption of crypto derivatives continues > Onchain infra improves > User experience gaps close > Capital efficiency innovations attract new participants @lighter_xyz positions itself at the center of these trends with tech & execution that addresses real market needs. Cu rrent OTC pricing seems disconnected from underlying fundamentals & comparable project valuations. Whether points hit projected $40-150 range depends on final tokenomics, TGE execution & market conditions. But the gap btw current pricing & reasonable fair value estimates suggests material upside for those willing to hold through TGE. NFA.

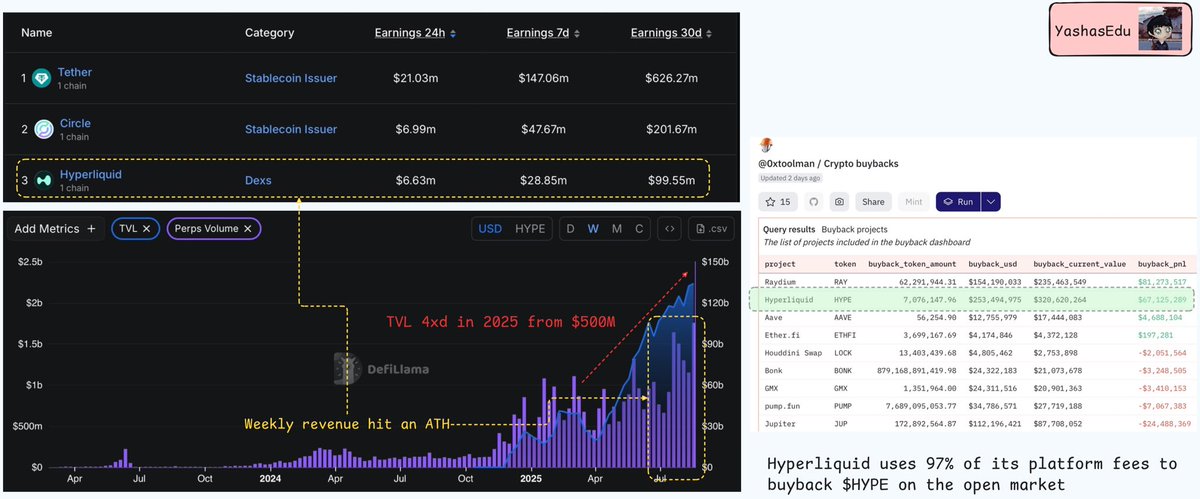

People should learn from @HyperliquidX on how to build a sustainable business models in crypto. > In the last 24H, volume of ($27B in perp + $770M in spot) > $7.4M in daily fees > $HYPE making a new ATH Their dual chain strategy is working… 1/ HyperCore handles perp trading with CEX level performance 2/ HyperEVM provides DeFi composability ➠ HyperEVM's TVL grew from $500M to $2B this year ➠ More TVL drives more trading volume, generating more fees for buybacks ➠ Hyperliquid generates more daily fees ($6.63M) than most established protocols, ranking third behind only Tether & Circle ➠ The difference is their 97% profit margin (almost all revenue flows to token holders through buybacks) ➠ Looking at protocols with active buyback programs, Hyperliquid's $67M gain ranks second ➠ Most other major protocols are showing losses on their buyback strategies, showing buyback doesn’t mean success I’d like to compare $HYPE move to that of 2021’ $BNB Both tokens capture value from platform growth. $BNB proved this model works at scale. $HYPE is applying it to onchain infra @HyperliquidX is building something rare in crypto i.e profitable infra that shares value with its closest working community.

The BTCFi market is currently dominated by Babylon with approximately ~$6B in TVL, holding ~80% market share. @SolvProtocol sits with $1.5B locked across 12+ chains, capturing around 10% of the liquid BTCFi market. Their TVL is heavily concentrated on Bitcoin ($1.3B), Merlin Chain ($116M) and Ethereum ($98M) SolvBTC is their core product w Chainlink PoR verification which ensures full transparency & 1:1 redemption capability at all times. But why does Solv holds this position? ➥ Exclusive BTC fund manager for Binance Earn ➥ Integrated with BlackRock's BUIDL fund for U.S. Treasury-backed RWA yields ➥ Zeta(Nasdaq-listed) raised $231M in BTC through Solv & formed a joint steering committee to expand SolvBTC across Solana, Base and TON ➥ The BTC+ vault delivers ~4-6% base APY through structured strategies. ➥ Built SolvBTC.CORE, which is a Shariah compliant yield product, targeting the $5T+ Islamic finance market Solv has generated approximately ~$27M in cumulative fees with annualized projections around $31-32M. During recent Bitcoin volatility (early October when BTC dipped to $102K and the broader market saw $19B in liquidations), Solv reported zero liquidations across their platform. @SolvProtocol has built credible infra for making Bitcoin productive in DeFi. With verified institutional partnerships, consistent yield generation & expanding crosschain presence. They're positioned really well!

Prediction markets are having their moments here🔥 Polymarket raised at $9-15B valuation. Kalshi hit $5B valuation. Total weekly volume across all platforms hit $3.15B (record) Now BNB Chain has its contender. @opinionlabsxyz just launched and claimed 3rd globally with $198M in week one. Here's what makes it different from the rest🧵 ‣ Launched mainnet on BNB Chain mid October 2025 ‣ 100K+ registrations in hours (invite-only) ‣ ~$750M in trading volume this week ‣ 23.7% global prediction market share ‣ Currently sitting behind Polymarket ($1.1B) and Kalshi ($1.2B) ➠ What Makes It Different? Opinion's is building infra, not just an exchange. Permissionless market creation + AI powered oracles + composability with DeFi. The vision is to turn prediction markets from entertainment into actual financial instruments for hedging, arbitrage and macro insights. Opinion is built on Opinion Stack, which is a 4 layer architecture. 1. Trading layer with offchain orders + onchain settlement 2. AI oracle that parses complex data automatically 3. Meta Pool for cross market liquidity 4. Universal protocol for interoperability So it's less of "will X do Y?" and more "what's the probability of event Z?" ➠ What's the reason behind such rapid growth? 24K users generated $33.3M TVL in 2 weeks. That's intense. For context, Polymarket has 1.5M users with $255M TVL. Opinion has 0.12M transactions vs Polymarket's 3.8M this week. This means higher volume per transaction = whales and serious traders YZi Labs led a $5M seed round + it was part of Binance's MVB accelerator program in 2024. On BNB Chain, this positioning matters. So it was supposed to do well! ➠ How can one get more points? Still invite only beta. Registration opens and closes randomly. To participate you've to do 200 USDT weekly volume minimum. Whales are farming hard, points per small user are low. You earn more through: ‣ Limit orders closer to market price ‣ Holding positions longer ‣ Larger transaction sizes (nonlinear rewards) ‣ Special markets with multipliers ➠ Conclusion The Binance ecosystem angle + macro focus + infrastructure approach separates it from other prediction markets. @opinionlabsxyz launched fast and captured meaningful volume quickly. Every major chain needs prediction market infras. Opinion could become THE layer for this on BNB, similar to what Polymarket is for Ethereum or Kalshi for TradFi.

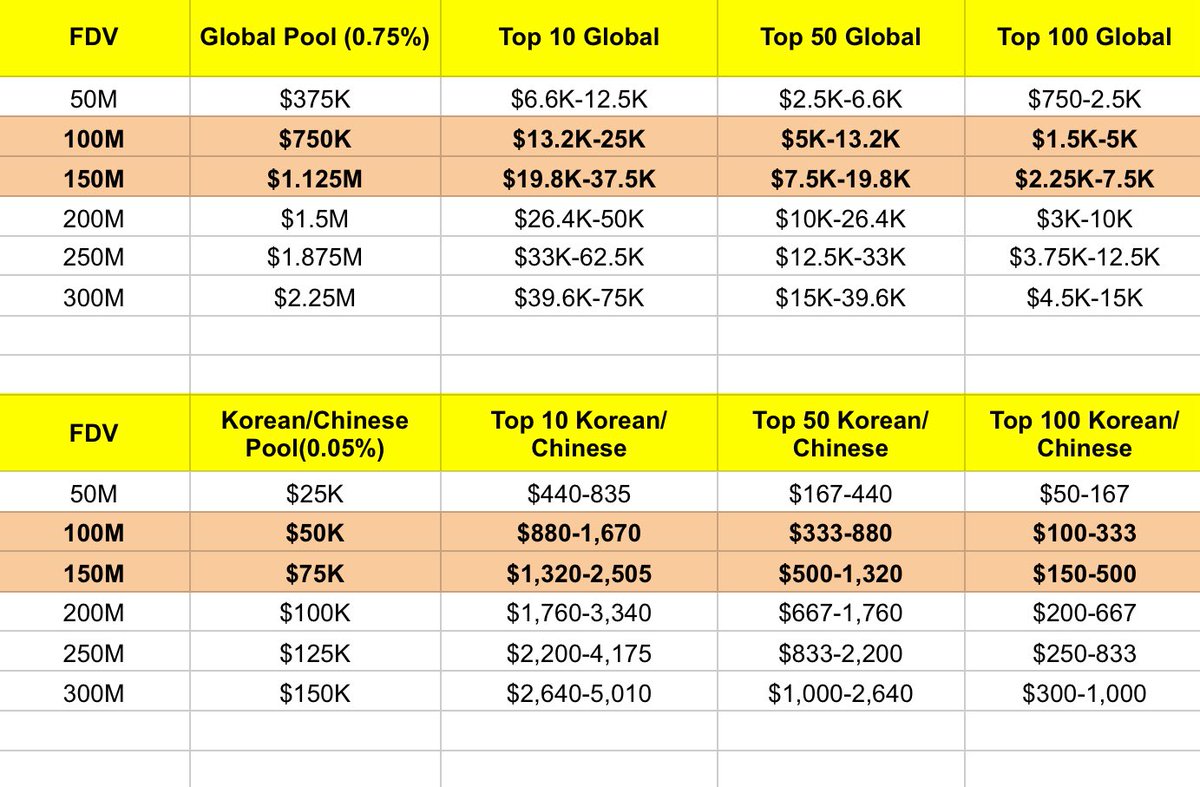

Congratulations to the $NEWT yappers in advance. Here’s why I say this👇 @MagicNewton’ reward structure is worth understanding if you're participating (They’ve raised 83M) Newton is getting attention for trying to solve AI agent verification through ZKP instead of TEE approaches. It is an automated crosschain DCA for AI agents. While transaction logic automation isn't necessarily "real AI," the verification problem they're tackling is legitimate. The total pool is 0.75% of tokens + 0.05% for Korean/Chinese participants. At a conservative 100-150M FDV, that's $750K-1.1M globally with $50K-75K for Korea/China With TGE expected this month… (My conservative expectations) - Top 10: $15K-25K avg - Top 50: $5K-15K avg - Top 100: $2K-5K avg The rewards scale based on ranking rather than equal distribution, so consistent performance matters more than one time efforts. Think it’ll be listing around 100-150M FDV, though can go higher given the AI agent narrative momentum. Recent updates include @virtuals_io integration & multichain USDC support (Base, Arbitrum, Optimism) The community hit 0.75% of the $NEWT reward target. In just 4 weeks, @MagicNewton reached👇 ✅ 862K subscribers ✅ 300K agent transactions ✅ 183K+ active agents Portal quest has ended but @KaitoAI rewards remain open for all participants.

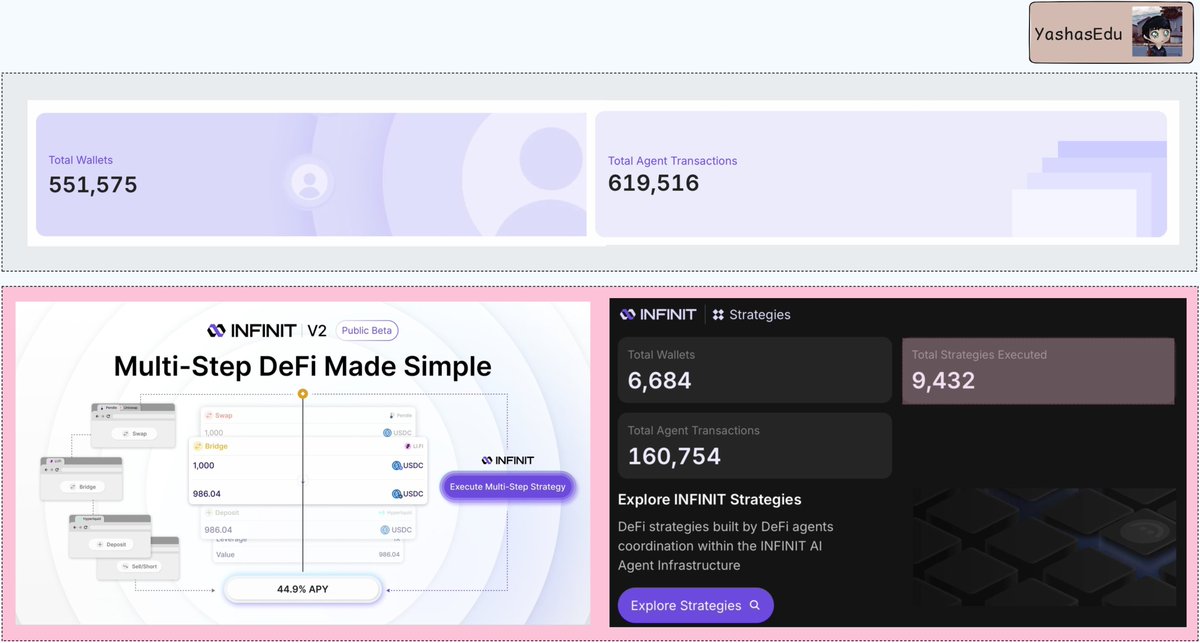

So last week Infinit launched their Strategies product after processing ~600K transactions🔥 See running a simple leveraged yield position in DeFi means usually having 15-20 transactions across different platforms. ➥ Bridging assets ➥ Swapping collateral ➥ Supplying to lending protocols ➥ Borrowing ➥ Looping leverage ➥ Monitoring liquidation risk @Infinit_Labs compresses this into one click using coordinated AI agents. Your assets stay in your wallet the entire time. Everything happens non-custodially. You sign once. > They reached ~550K users & ~600K transactions organically > Nearly ~9400 times the strategies have been executed so far Three major types of strategies available... 1. Delta-Neutral ➠ Farm yields while hedging price exposure ➠ Options include Ethena, BNBChain, Hyperliquid & Kaito 2. Leverage Looping ➠ Maple's SyrupUSDC, PT-kHYPE, mETH, Sky ecosystem, EtherFi ➠ Ethena liquid leverage through Aave 3. Airdrop & Multi-LP ➠ Split capital across AI infra tokens (50% into Gaib AI and USD AI), Midas multi-LP (25% split between Pendle and Terminal) ➠ Exposure to Ethena ecosystem & HyperEVM airdrops Each strategy automates 50+ steps down to a single click. So to test it I asked Infinit which strategy would work best for my risk profile & capital. Looking for 10-15% APY with moderate risk using $10K USDC. It recommended the Delta-Neutral KAITO strategy on Base & Arbitrum. Current APY is 13.94%. Here's what it does automatically👇 > Deposits USDC on Base > Swaps 50% to PT-sKAITO-29JAN2026 on Pendle > Bridges remaining 50% to Arbitrum > Deposits bridged USDC to Hyperliquid > Opens 1x short position on KAITO The strategy is delta-neutral. Long PT-sKAITO on Base, short KAITO on Hyperliquid. This offsets market direction & reduces exposure to price swings. All capital stays in USDC. Without Infinit, this would be at least 10-15 separate transactions across multiple platforms. With it, one click. $IN recently got listed on Upbit. Currently live on 10+ chains. 16-18 strategies available with yields ranging 10-40% APY. Most protocols announce features with 0 usage. If complexity keeps people out of DeFi, removing that friction matters. That is what @Infinit_Labs is doing! Roadmap includes prompt-to-DeFi where you design strategies using natural language & Infinit Intelligence where AI develops strategies tailored to your specific wallet. (Take this piece as an informational update & not an investment thesis)

x402 just became the talk of the town lately for a reason🔥 ➠ But WTF is x402? It makes payments work like web requests. Settlement happens in seconds. No accounts, no KYC, no complex wallets. Just instant micropayments built into how the internet already works. If an AI agent needs an API? Sends HTTP request → Gets 402 "Payment Required" → Pays USDC → Access granted. ➠ Why does it matters now? AI agents need to pay for things autonomously. Buy compute, query databases, access APIs without humans approving each transaction. Traditional payment systems can't handle this. Too slow, too expensive, too much friction. x402 solves it at the protocol level. Coinbase + Cloudflare built it, launched May 2025. Google integrated via AP2 protocol in September. ➠ Now which are the projects to look out for in this meta? All using similar model i.e mint for ~1 USDC, automated verification, instant access. I'm personally betting longterm on infra projects like @Infinit_Labs @eigenlayer @virtuals_io @GoKiteAI! Remember 80-90% of meme + agent tokens launching on x402 are rugs. But infra is production ready with real adoption. ➠ Built on Base primarily, expanding to Solana, Peaq. Uses USDC for settlements. Integrates with existing HTTP infra as devs can add it with minimal code. This can lead to real use cases... > Agent buys API access for $0.001 per call > NFT-gated content with instant USDC payments > M2M transactions between devices > Pay-per-use for compute or data queries ➠ ERC-4337 VS x402 The comparison most people miss. x402 is like complementary. Use ERC-4337 for the wallet, x402 for the payments flowing through it. ERC-4337 > Does account abstraction i.e smart wallets with gasless transactions + social recovery > It's about "how YOU interact" with blockchain. x402 > Does payment embedding like instant settlements at HTTP level > It's about "how AGENTS transact" on the web. Google's AP2 integration shows institutions are interested in this too. If AI agents become economic actors, they need payment rails that work at internet speed. x402 is building that infra.

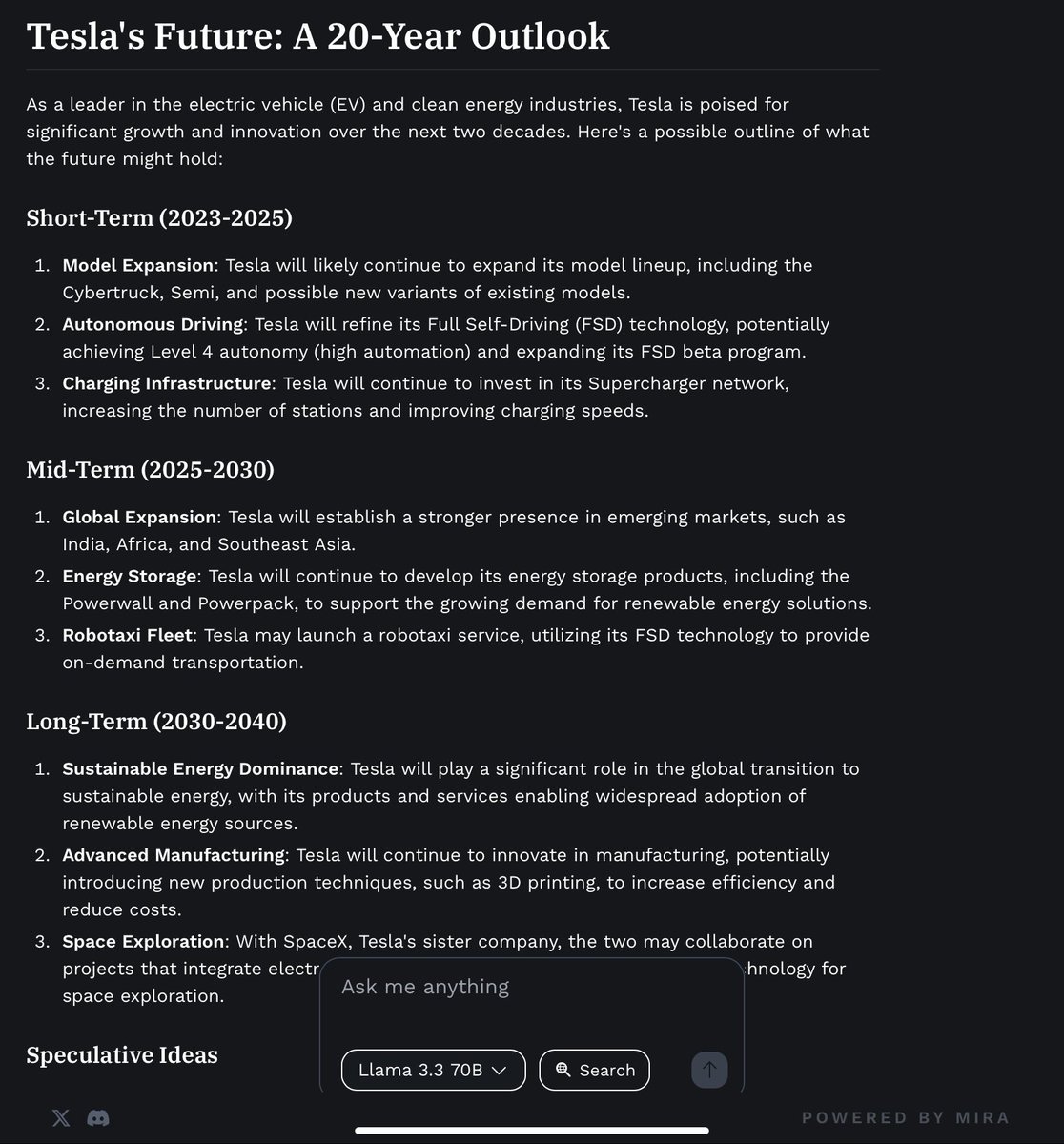

I asked the same question to @grok & @klok_app I.e What will Tesla look like in 20 years? Grok gave me a detailed long prediction with exact numbers… + $10T valuation + $1T robotaxi revenue + Level 5 autonomy by 2030 + Optimus robots dominating manufacturing by 2045 It read like a confident business forecast despite being pure speculation. Klok took a different approach + It outlined realistic possibilities across short, mid & longterm periods + Model expansion, energy storage growth, potential robotaxi services + But then it included something Grok didn't (a clear disclaimer acknowledging uncertainty & that actual events may differ from projections) The difference matters👇 - One AI system presented speculation as fact - The other marked its predictions as uncertain & based on current trends - One could mislead someone making investment decisions - The other provides useful analysis while being honest about limitations This is exactly why @Mira_Network exists. Their protocol verifies AI outputs using Proof-of-Context & collective consensus. The @klok_app shows what verified AI reasoning looks like (measured, grounded & transparent about uncertainty) Most AI projects focus on making models faster or cheaper. @Mira_Network focuses on making them trustworthy. In a world where AI influences real decisions, verification infra matters more than performance benchmarks. @Mira_Network represents the shift from confident AI to verified AI.

$PENDLE just hit ATH in TVL & the PA has been following it. There's a reason why👇 While others chase quick gains, @pendle_fi built the infra for yield trading. They turned complex DeFi mechanics into something that actually works. The result? ➠ 1600%+ fee growth in 30 days ➠ Launched the most anticipated @boros_fi ➠ Became the go to platform for institutional yield strategies Currently I’m farming @pendle_fi LPs across 3 solid protocols to get yields + points before a potential airdrop. 1/ @FalconStable LP USDf (173 days left) On LP USDf I’m getting 12.5% APY + 60x point multiplier compared to 6x from holding USDf directly 2/ @Terminal_fi LP tUSDe (47 days left) ➠ Terminal doesn't offer yield on tUSDe deposits. Only 30x Terminal points + 30x Ethena points ➠ LP tUSDe gives 7.6% APY + 60x Terminal points + 30x Ethena points 3/ @strata_money pUSDe LP (68 days left) ➠ Strata has no native yield. Only 30x Strata points + 30x Ethena points ➠ LP pUSDe provides 6.52% APY + 60x Strata points + 50x Ethena points @pendle_fi made the boring tech win by providing yields!

Most crypto fundraising is a mess. Teams raise millions, dump tokens on retail, insiders get sweetheart deals and holders watch their bags slowly bleed🧵 @MetaDAOProject is fixing exactly all of that. Instead of letting teams control everything, MetaDAO locks all raised funds in a DAO-controlled treasury. The team can't just take the money and run. Team tokens unlock based on price performance. So if there is no price growth, team gets nothing. ‣ 2x from ICO price = first unlock ‣ 4x = second unlock ‣ 8x, 16x, 32x = remaining stages ➠ Governance actually works on Futarchy Most DAOs use token-weighted voting. Whales decide everything. MetaDAO uses prediction markets instead. So people bet real money on the outcome. ➢ Someone submits a proposal (allocate $500K to build a new X protocol) ➢ The system creates two prediction markets: 1. Market A: What will $META price be if this passes? 2. Market B: What will $META price be if this fails? If Market A shows $15 and Market B shows $5, the market is saying "this proposal adds value" The proposal passes automatically. ➠ MetaDAO vs PumpFun Both are on Solana. Both launch tokens. That's where similarities end. PumpFun dominates volume (80% market share) while MetaDAO dominates sustainability. 1. PumpFun ‣ 10M+ tokens launched since January 2024 ‣ One click creation for under $2 ‣ 71% of all Solana tokens in October ‣ ~$1M daily revenue ‣ Only 0.7-0.8% of tokens move to real DEXs ‣ 99%+ failure rate 2. MetaDAO ‣ Application required ‣ 4-day commitment period ‣ Vetted projects only ‣ ~100 proposals, 5+ completed ICOs ‣ Average 12x ROI at ATHs ➠ How does it stand out? Major spending needs governance approval through prediction markets. This makes sense cuz otherwise whales control outcomes, low participation, emotional decisions, no accountability. MetaDAO controls everything from Minting rights + Treasury access + Smart contract permissions + Budget approval If it is oversubscribed, you get proportional allocation + refund. If it doesn't hit minimum you get full automatic refund. ➢ Once funding succeeds, all USDC moves to DAO treasury (not team wallet) ➢ 20% USDC + 5M tokens seed liquidity ➢ Team limited to 1/6 of minimum raise/month ➢ @paradigm just committed to buying more tokens ➢ 6th Man Ventures bought $1.5M worth at $6.35 ➢ If founders disappear, community can continue or restart ➠ Performance of the projects launched 1. Umbra: Raised $3M with 1,160% oversubscription 2. Omnipair: Raised $1.1M, 3.6x oversubscribed 3. Avici: ICO $0.35, did a 3x in terms of PA 4. Recent ones like ZKSOL & Loyal are 5% down from launch $META is up 450% last month, currently trading at $8.75 with a mcap of $200M. ➠ How can one participate? ‣ Go to Metadao site ‣ Connect wallet (need USDC + gas) ‣ Browse active fundraises ‣ Read disclosure, commit funds ➠ Conclusion 100+ projects applied. Five passed threshold. Seven tokens trading. Platform launched mid-2025. All on Solana is exposed to ecosystem volatility imo. If someone is building something lasting on Solana. Performance unlocks + DAO treasury +prediction markets signals shows's @MetaDAOProject' model makes sense.

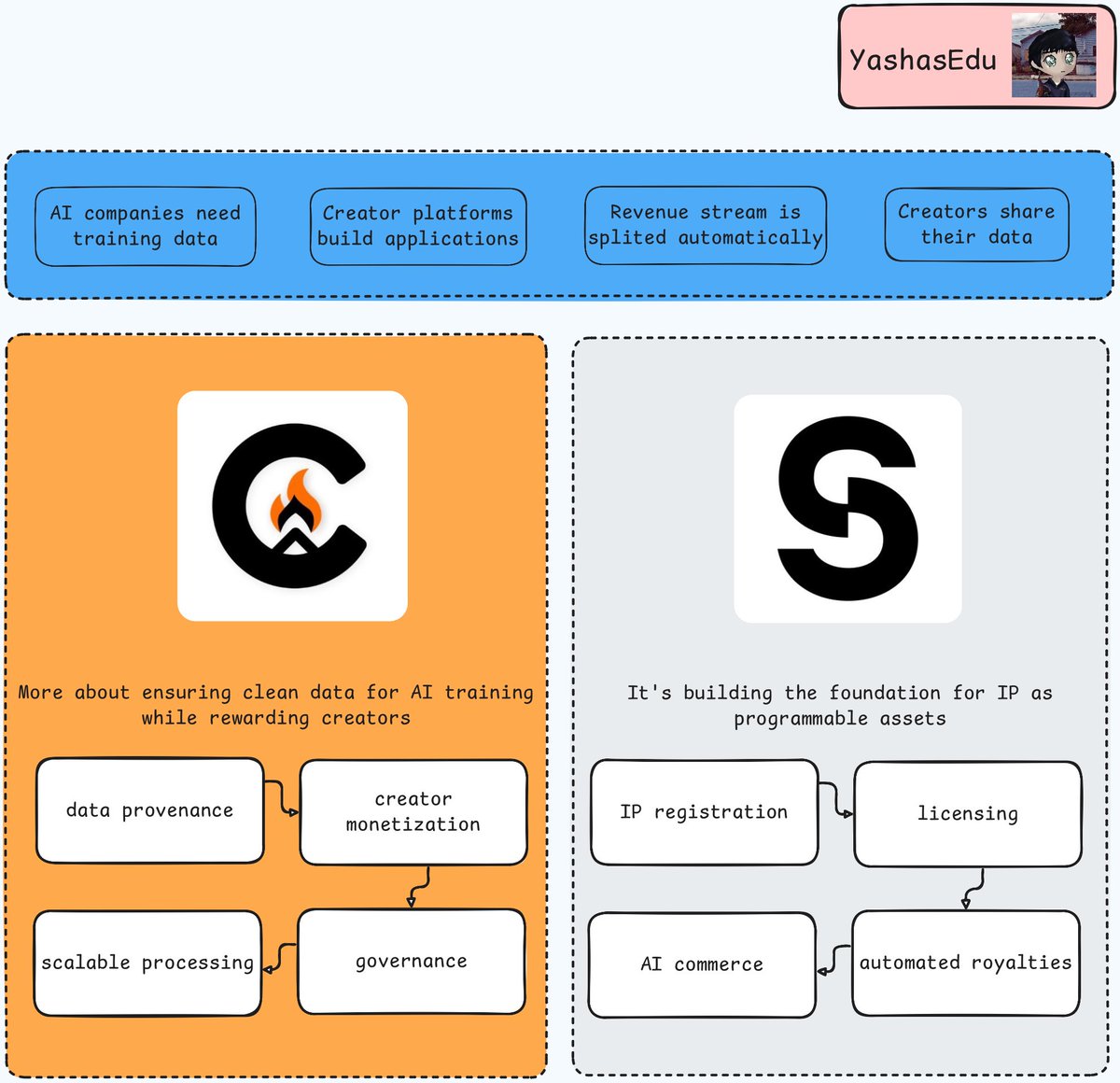

Remember @StoryProtocol with its $6B valuation for bringing IP onchain? Heritage Distilling recently made a $360M bet on them. Here’s what actually happened… ➠ Heritage invested $82M into $IP through PIPE (Private Investment in Public Equity) at $3.4 fixed price ➠ Story Foundation gets the cash, sells $IP at $3.4 ➠ Foundation commits to buy back $IP on open market within 90 days using 100% of that cash ➠ $IP dropped from $6.80 to $5.72 because investors saw the $3.4 sale as selling pressure If Heritage holds their tokens (longterm lockup) + Foundation uses all $82M for open market buybacks, it's actually net positive buying pressure. It's the first time a public company this small (around $13M mcap) has done a DAT play. On the other side there’s @campnetworkxyz, doing something similar & raised $30M instead. The core issue remains the same. AI scrapes millions of content pieces, trains models, & creators get nothing. Original ownership gets lost in the process. This is where a chain powered platform to publish IP onchain makes sense because it ensures clear proof of origin & transparent ownership. ➠ Contributors define terms, remix rights & royalty splits ➠ Consumers & agents license IP for reuse, AI training or content generation ➠ All activity is transparently tracked, allowing better attribution & discovery By implementing IP ownership & value flows at the protocol level, @campnetworkxyz is building a more composable, equitable & creator aligned digital economy. Here’s how it is different from @StoryProtocol 👇

So @MMTFinance is quietly becoming an infra on Sui. While everyone is talking about PM, PerpDEXs & BNB eco, Momentum just crossed $430M in TVL & became the 3rd largest DeFi protocol on Sui. Sui's DeFi ecosystem grew 1,200% in 13 months. Total TVL across the chain is around $2.4B. Momentum launched as a ve(3,3) DEX & liquidy hub right in the middle of this growth phase & captured ~18% of the entire Sui DeFi market in less than a year. They're running critical infra here... → Concentrated liquidity pools (CLMM) for better capital efficiency → ve(3,3) tokenomics model which means emissions + governance votes → Crosschain integration through Wormhole → Liquid staking with xSUI for dual yields → TVL doubled in 7 days because of a points campaign w @buidlpad → Handles serious institutional flow. Backed by OKX Ventures, Coinbase Ventures, Circle too Compared to other @SuiNetwork protocols, Momentum is 3rd now (up from ninth in August). Suilend leads at ~$760M TVL (lending) followed by NAVI at ~$700M (also lending). In the last 7 days... > NAVI grew 32% > Suilend 14% > Momentum grew 95% in the same period It also generated $7.33M in fees during Q3, up 76% from Q2. That's a 5.7% annualized fee to TVL ratio (normal range for a DEX) 1/ About 60-70% of the recent TVL spike is from people farming points who'll likely leave after the campaign 2/ The ve(3,3) suggests only 25% stays longterm for fee sharing (veMMT holders capture ~20% of protocol fees) 3/ Protocols usually see 40-60% TVL drops when campaigns end (Aerodrome on Base followed this pattern) If Momentum's TVL drops 50% but keeps volume stable (possible if SUI stays volatile), it still generates ~$1M monthly in fees. At 20% revenue share, that's $200K monthly to veMMT token lockers. Regarding their campaign on Buidlpad, all you've to do is provide liquidity on Momentum & connect it to Buidlpad. You earn normal LP yield + Bricks that determine your allocation in the upcoming token sale. More Bricks = better tier = larger allocation Campaign ends October 19. We all know how well Buidlpad launches have been in the recent times. So if that excites you to enter, you may choose... > suiUSDT/USDC = no IL risk, predictable farming > SUI/USDC or SUI/xSUI = higher yield with price exposure > BTC pairs = middle option if you already hold the asset Take this piece as an informational update & not an investment thesis.

People with Analyst archetype

DLG_Crypto Ⓜ️Ⓜ️T

DhCrypto🌊 RIVER|.edge🦭

🔮 Options data wizard 🔭 ✨ Delivering Actionable Insights | @SeiNetwork ($/acc) 📩 DM me: t.me/Nick_Research

no recycled takes╭╯advisor @xeetdotai

the revolution will not be centralized | dunedatadash@gmail.com dunedata was my old dune username i might post slop if it does well w the algo

Trench Warrior | DYOR | Blockchain Analyst | DM for Collab |

Wholesale AE in the early 2000s. Commentary on mortgage/real estate/housing market since 2006 @ thetruthaboutmortgage.com

I don’t care what people think of me. This is me in rawest form. $SNSY

Videogamefreak | Passionately curious | Always learning |

Explore Related Archetypes

If you enjoy the analyst profiles, you might also like these personality types: