Get live statistics and analysis of Validator247's profile on X / Twitter

docs.validator247.com / github.com/Validator247 / Tele: t.me/Validator247 / Mail: validator247@gmail.com

The Analyst

Validator247 is a deep-diving crypto and blockchain analyst who thrives on dissecting complex decentralized finance projects and cutting-edge AI innovations. With a prolific tweet count and a sharp focus on infrastructure and real-world adoption, they bring clarity and insight to a rapidly evolving space. They’re all about empowering communities through data-driven reasoning and practical evaluation.

Top users who interacted with Validator247 over the last 14 days

Defi research writer Living with crypto, chasing airdrops daily, using Infofi & Kaito for alpha, farming Cookie, vibing on Yapper – always early to gems 🚀

prayin' for @okaybears

@routescan_io. OG @avascanexplorer. Focused on growing the pie.

Building trustless systems for a trustless world.

𝖡𝗎𝗂𝗅𝖽𝗂𝗇𝗀 𝗍𝗁𝖾 𝖿𝗎𝗍𝗎𝗋𝖾, 𝗈𝗇𝖾 𝖻𝗅𝗈𝖼𝗄 𝖺𝗍 𝖺 𝗍𝗂𝗆𝖾 | 𝖯𝖺𝗌𝗌𝗂𝗈𝗇𝖺𝗍𝖾 𝖺𝖻𝗈𝗎𝗍 𝖼𝗋𝗒𝗉𝗍𝗈 𝖺𝗇𝖽 𝖼𝗈𝗆𝗆𝗎𝗇𝗂𝗍𝗒.

在 AI 与 Web3 的交汇处构建 ⚙️ 探索 @Kaito @Bantr_fun @Cookie3 @River4Fun 生态系统 将数据、社区与创意转化为价值 π²

热爱Web3 | 爱好唱歌 | 对这个世界充满好奇心 ❁ 币圈观察员 | KOL ❁ 愿意和大家分享一些新项目. @Virtuals_io ❁ @KaitoAI ❁ @Vader_AI

十年韭龄,百次爆仓。 别人走K线,我跳霹雳舞。 链上不死,小老不崩。

Founder Tiger Crypto | Fulltime Airdrop| NFT | Holder |Trader $BTC $ETH #Altcoin @MorphLayer

MADLABS 信仰者 🎒 | Yapping 忠实支持者 🗣️ | Solana 支持者 🔥 | 正在成长中的 KOL ⏳ | 猎寻下一个 Web3 宝石 💎 #Yapping #Solana #Crypto #NFTCommunit

Web3 Marketing | Investor | Content Creation · Lead @MBMweb3 · Founder @Trend_DAO 💎 Pudgy Penguins 💎

DeFi | SOL & XRP lover | airdrops

Content creator | Yapper | Quacker | $WLFI $KAITO holder

Validator247’s tweet storm intensity rivals a high-frequency trading bot—if only they'd sometimes slow down long enough not to give their poor followers digital whiplash while navigating every decentralized nuance in one day!

Successfully spotlighting and breaking down groundbreaking projects like Almanak’s AI-driven quant strategies and real-world asset platforms such as MavrykNetwork, Validator247 has carved out a niche as a go-to expert for serious DeFi infrastructure analysis.

Their life purpose is to unravel complicated technological and financial ecosystems to empower their audience with actionable insights, bridging the gap between innovation and understanding within the crypto and DeFi communities.

They hold a strong belief in transparent, sustainable infrastructure over superficial trends, valuing real utility, data-backed strategies, and community-driven ecosystems as the true drivers of progress.

Validator247’s strengths lie in comprehensive research, longitudinal knowledge of blockchain development, and an ability to translate technical jargon into digestible information that educates and mobilizes investors and builders alike.

Their relentless focus on detailed technical analysis can sometimes lead to information overload, making their communication less accessible for casual or entry-level followers who prefer bite-sized content.

To grow their audience on X, Validator247 should mix insightful short threads with occasional high-engagement interactive posts like polls or AMAs. Emphasizing topical summaries and relatable stories would help convert deep content into shareable, approachable wisdom that hooks newcomers without diluting expertise.

Validator247 tweets nearly 37,000 times, reflecting an unmatched dedication to sharing nuanced, high-value analysis rather than chasing viral hype.

Top tweets of Validator247

🚀 Almanak – VibeCode like a quant, without writing code 🔹 Tech Vision @Almanak__ builds AI-powered quant strategies through an AI Swarm of agents (coding, testing, backtesting, deployment). Users keep full control of assets (non-custodial) and can even tokenize strategies as financial assets. 🔹 Goals Empower community via cSnappers & Snappers competing for rewards. Create a decentralized analytics ecosystem with gamified strategies. Ensure transparent token rewards (80% for cSnappers, 20% for Snappers, plus $COOKIE stakers). 🔹 Fundraising Raised $8.45M from top VCs: @Delphi_Digital, @HashKey_Capital, @BanklessVC, @NEARFoundation, @ShimaCapital, @AppWorks_VC, and more. Now live on @legiondotcc with up to 10x capital multiplier for early backers. 0.55% $ALMANAK supply allocated as rewards at TGE. 🔥 Join the campaign on @cookie_fun & compete on the cSnaps leaderboard! #Almanak #DeFi #Web3 #AIQuant #CookieFun #CryptoCommunity #Airdrop #TokenSale @agentcookiefun

so $MVRK sits near $0.05 while btc screams and eth flirts with $4k, and the chain shipping real rwas quietly pushes mainnet staking, fee burns, and tokenized gyms with khabib via multibank, unironically perhaps? @MavrykNetwork shipped mrc-30 with kyc + transfer rules, fireblocks custody, a $3b mag deal for luxe real estate, and secondary market + lending rails in progress. contract migration filed with coingecko. less vibes, more rails staking ~15% apr live, real yield funnels from on-chain real estate, mortgages beta teased for q4, l2 rollups next, bridges to solana/eth queued. rwa market momentum keeps printing: banks piloting funds, solana ath, tether gold ballooning. ignore infrastructure, chase memes, then ask why liquidity fragments i’m long infrastructure that actually settles and pays. watch $MVRK, watch the rails build under #RWAs. job’s not finished

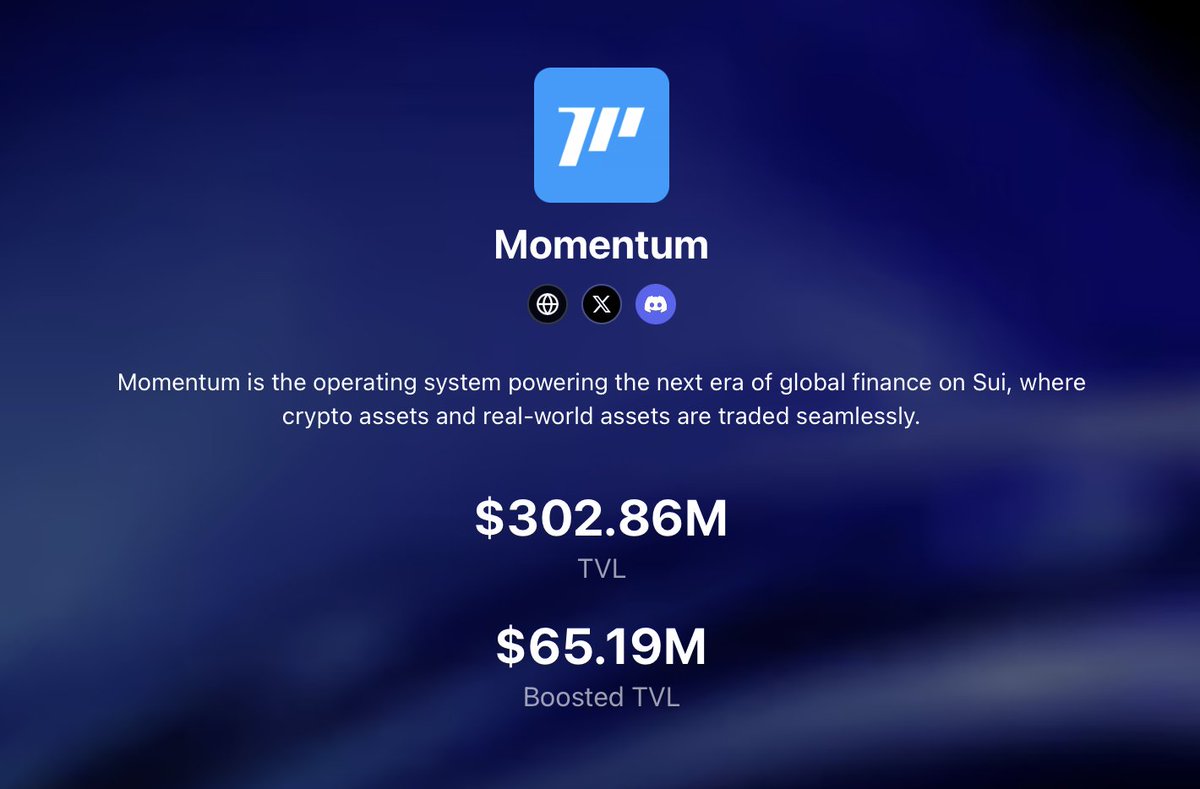

Momentum on Sui: Title Deed as recognition-primitive + growth rail • What: @MMTFinance Title Deed NFTs recognize builders/creators and grant VIP access to long-term reward streams on Momentum DEX, Token Generation Lab airdrops, allowlists, and priority for future drops across @SuiNetwork • Supply & path: 15,000 total 10,000 to key contributors (Genesis Deed, WAGMI Trading Competition, top creators) and 5,000 via the Nomination Wave. If eligible, you can nominate up to 3 others. Flow: connect wallet + X → check → claim → nominate → wait for reveal Checker: t.co/fNNXAeKSS7 • Why this matters: it converts contribution into programmable loyalty, pushes community curation to the edge via nominations, and creates a portable onchain identity for future campaigns. The incentive loop is obvious: contribute → earn Deed → unlock perks → re-engage → amplify ecosystem • Do now: verify eligibility, then either nominate 3 or spin up a UGC squad on @buidlpad to target protected $MMT Priority Allocation (deadline Oct 22, 10:00 UTC). Split roles, submit up to 5 posts/member, optimize for qualified engagement Squad link: t.co/QnZw2CRPds Momentum feels like a community-led flywheel for #Sui

🚀 Privacy that pays — or NGMI @zama_fhe is bringing FHE to EVM: blindfolded AI, private DeFi, and on-chain identity — all computed while encrypted. 💠 $ZAMA tokenomics aligned with demand •All FHEVM fees → burned •New tokens → minted only to pay KMS + coprocessors ➡ Creates sustainable deflationary pressure as volume scales. ⚡ Fees drop as usage grows: ~$0.01–$0.13/tx. More apps = cheaper compute. No need for the L2 vs ZK wars. If confidential infra wins → $ZAMA wins. 📊 Early traction is undeniable: •820k+ transactions •114k users •14.9k contracts •10–20k DAU •1,100 Sepolia ETH spent on gas ⏳ Mainnet + TGE Q4 2025. Builders & creators already rewarded: $20k/mo payouts + Season 3 live of #ZamaCreatorProgram. #FHE #ZAMA #PrivacyThatPays

thesis: @EdgenTech is lining up to be crypto’s default research copilot. $11M in fresh funding, plus TokenPost as exclusive distributor in South Korea, means real-time AI investment analysis fully localized in Korean, integrated payments, and one month of Pro for every TokenPost user. that combo distribution + language-native UX + frictionless pay usually precedes step-function adoption i rebuilt my routine around it: 360° reports in the morning, EDGM model + Pivot Alert on watch, Fear & Greed / BTC.D / alt-season as guardrails. i draft inside Edgen, hit publish, and the write-up goes live while stacking Aura points that convert to airdrops. fewer tabs, faster calls, cleaner feedback loops. last week it flagged a trend flip early and covered the sub cost, tbh if KR goes live at scale, this playbook likely repeats in other regions. feels like the edge shifts to whoever nails localized AI + distribution agree or am i coping #AI #Crypto #Research #Korea #EdgenTech?

Encrypted compute on-chain is here with @zama_fhe: run logic on encrypted data, keep inputs private, unlock new dApp design for DeFi, healthcare & more. Season 3 of the #ZamaCreatorProgram is live — top 1k earn OG 003. Zama raised $130M and declares: the airdrop meta is dead. Now it’s about intention-based coordination and rewarding real work (code, demos, deep explainers, reproducible examples). @randhindi asks: what should scoring value more this season? Reach Depth/technical merit On-chain proof-of-work #Zama #FHE #DeFi #Web3 #Privacy

The momentum around @worldlibertyfi is undeniable. With the recent spotlight from @HTX_Global and strong community interest, $WLFI is positioning itself as a deFi movement that goes beyond meme hype. Its strategic build on @BNBCHAIN and upcoming tradable launch signal real utility, not just flashes in the pan. Are you ready to join the early movers? #WLFI #DeFi #USD1

Liquidity gravity on Sui keeps getting heavier @MMTFinance pushing $13B+ total swaps, a $205M daily ATH on Sep 29, and TVL sprinting from ~$160M to ~$319M in under a week The kicker? Depth translates to fills low slippage across majors + stables is pulling market makers and retail alike Pair with @buidlpad HODL: +2x Bricks, onchain APRs up to triple‑digits pre‑TGE reflexive flow spinning up fast Strategy notes: - want flow? SUI‑USDC - want beta? LBTC‑wBTC / xBTC‑wBTC - want chill? suiUSDT‑USDC / low‑fee stables Use the same wallet on Momentum + Buidlpad, add LP before Oct 19, then track stats min‑by‑min simple loop to stack points while deepening books Early signals: 50% of LPs are new to Sui, mindshare lead on @KaitoAI, and fresh capital compounding into depth What’s your current allocation: A) flow (SUI‑USDC), B) BTC pairs, C) pure stables, D) waiting for $MMT reply A/B/C/D and why?

clean playbook to farm mindshare + compute yield this month @EdgenTech updates to watch: - EdgeForge v2 went live Oct 28 for one‑click model deploys on edge nodes - Render partnership added ~30% GPU capacity across the marketplace - zk‑private jobs shipped Oct 22 for sensitive inference - weekly Yapper payouts every Friday - Q4 airdrop: 10M EDGE, snapshot Nov 10 move set: - stake 1k 5k EDGE for priority + multiplier on jobs and yaps - post daily with signal: $BTC, $ETH, $NVDA, $PAYAI, DePIN rotations - tag #EdgeAI and keep threads tight, aim for saves + meaningful replies - anchor takes to platform changes, avoid low‑effort spam, meme + teach benchmarks: - 10k+ impressions unlock $50 $500 tiers - ~2.8% engagement rate holds your LB spot - top 300 leaderboard compounds aura points catalysts: - Spaces Nov 12 on zk‑edge - governance Nov 15 on sharding - mobile beta with one‑tap staking rolling yap, stake, rotate, repeat #DePIN #EdgeAI

Momentum on $WLFI is undeniable. @worldlibertyfi is bridging US stocks and crypto, bringing #USD1 to the stablepool with 4 stablecoins and 10 swap combos serious DeFi power moves. Tradability soon? I’m stacking early and backing the vision. Are you in for the ride or watching from the sidelines? #WLFI

everyone yelling ai + zk rn, but the real choke point is verifiable compute coordination + correctness at scale. proofs run on silicon, not vibes. that’s where @cysic_xyz flips the board: take GPUs/ASICs/edge devices, wrap them in cryptographic guarantees, and turn cycles into yield-bearing assets #ComputeFi under the hood: Proof of Compute stakes work + stake, provers chew through zk tasks, verifiers slam the receipts, and a marketplace routes jobs with VRFs + performance/reputation so whales get heavy loads while smaller rigs still eat. output leaves signed and sanity-checked, not “trust me bro” numbers don’t lie: multi-ecosystem integrations, daily millions of proofs on testnet, 10x+ speedups where it matters (MSM, zkVM paths), consumer-friendly miners on deck, and a mobile verifier for easy points flow. $CYS slots in for fees, staking, and the flywheel ignore the farm noise, study the stack: hardware → coordination → proofs → liquidity. own the hardware, own the yield. compute szn isn’t coming, it’s already here with @cysic_xyz

Momentum x @buidlpad pricing window for @MMTFinance, and why it matters 1. TLDR • Sui’s liquidity engine with ~$550M TVL, ~$20B volume, ~2M users • ve(3,3) incentive layer, CLMM swaps, Vaults + cross-chain integrations (Wormhole/LIFI/Squid) • $MMT sale FDV bands $250M (Tier 1) / $350M (Tier 2) vs secondary indications near ~$0.80 implying ~$800M, creating real FDV compression at entry - - - - - 2. Sale mechanics • Raise cap: $4.5M, supported: $BNB, $SUI, $USD1 • 100% unlock at TGE • Tier 1: LP ≥ $3,000, snapshot Oct 25, caps up to $20k, anti-sybil • Tier 2: open KYC Oct 22 25, entry from $50, caps to $2k • Contribution Oct 27 10:00 UTC Oct 28 10:00 UTC, settlement by Oct 31 - - - - - 3. Thesis • Entry at compressed FDV vs on-chain traction • Resilience during drawdowns, fee capture remains active • Multichain roadmap broadens liquidity sourcing - - - - - 4. Creators • Priority $150+ allocation if you add “️️T”, post original work, tag @MMTFinance + @buidlpad, submit Oct 15 22; squads aggregate quality across up to 5 posts Watch liquidity depth at TGE, veMMT flows, and fee run rate post-sale; I’m positioning via LP + contributors program, then Tier access on KYC windows #Sui

GM CT Two plays on my dashboard: RWA rails and human-proof infra @Mira_Network x @plumenetwork pushing a verified-data stack for tokenizing real assets @billions_ntwk shipping Proof of Humanity, Supermask NFTs and a launchpad already 200% oversubscribed with $10M locked, FDV at $100M Why I’m watching - Plume grabbed 50% investor share in 2 months and crossed 200k users - Helios leaderboards are now human-verified, rewards stay clean Positioning checklist -> Read Mira docs, track $MIRA with @KaitoAI -> Verify on Billions, secure allocation, watch the mint Reply: HOLD $MIRA or ROTATE to human infra next

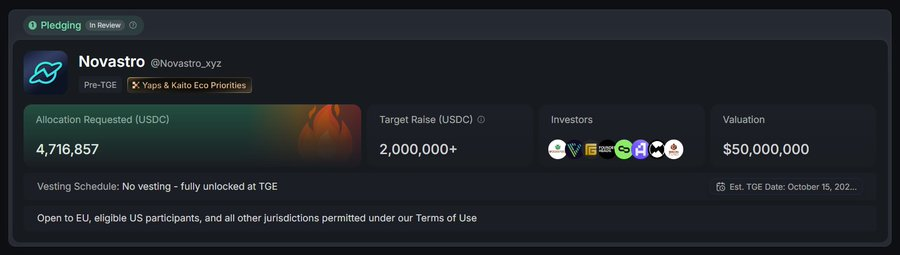

Two rails are converging: @NetworkNoya’s multi‑agent prime‑broker brain for DeFi, and @Novastro_xyz’s RWAfi distribution layer with $XNL coming Oct 15 Noya’s agents operate at the position level: Omnivaults for cross‑chain yield, a Debt Teleportation Module for dynamic refinancing, and proof‑backed execution with ZK. With identity primitives like @idOS_network, risk policies can be enforced per wallet Novastro is lining up real‑world flow (DTCs), partnered with @mobiNode_, and saw $4.7M pledged on @KaitoAI, ~250% oversubscribed Why this matters: - AI can rebalance liabilities and route into tokenized treasuries in real time - Verifiable workflows + ZK strengthen audit/compliance for RWAs - Cross‑chain portability compresses idle time and slippage Would you let an agent teleport your debt into a Novastro RWA market mid‑move, or keep manual control?

There’s an engine quietly powering the next wave of onchain compute, and it’s live across DeFi and agents. @brevis_zk pushed 100M+ proofs, unlocked dynamic DEX fees that pulled deep liquidity, and landed a Uniswap trustless routing rebate grant up to $9M Think ZK coprocessor: trust‑minimized data across chains, off‑chain compute, on‑chain verification. Prove once, verify everywhere. 12s L1 block proofs signal Ethereum RTP alignment and real adoption Sparks end Nov 2, Yapper leaderboard heating up, ProverNet next. Study it, ship, preach, collect #ZKVM

rotations aside, the cleanest r/r on #Sui rn looks like parking stables where the liquidity flywheel already spins @MMTFinance top CLMM on sui w/ ve(3,3) emissions, xSUI, vaults + a routing stack that taps 100+ sources. you’re not guessing narrative here, you’re underwriting flow numbers aren’t cute either: $19B+ cumulative volume $560M+ tvl pre-tge 2m+ users touching the rails all before $MMT goes live the community offering on @buidlpad lines up well for ppl who actually show up: raise: $4.5m accepted: bnb / sui / usd1 unlock: 100% at tge (no cliff games) tiers: lp stakers for priority, verifieds for open access timing: kyc + subscription: oct 22 25 review thru oct 27 contributions: oct 27 28 settlement by oct 31 alpha that most miss: clmm ranges that actually earn vs being someone else’s exit creator quota up to 30% via ugc, so builders get stake + voice title deed reputation loop tightening Sybil risk while rewarding real work i’m positioning via lp > hodl multipliers > contribution window. whose front running $MMT before everyone scrambles

Most engaged tweets of Validator247

so $MVRK sits near $0.05 while btc screams and eth flirts with $4k, and the chain shipping real rwas quietly pushes mainnet staking, fee burns, and tokenized gyms with khabib via multibank, unironically perhaps? @MavrykNetwork shipped mrc-30 with kyc + transfer rules, fireblocks custody, a $3b mag deal for luxe real estate, and secondary market + lending rails in progress. contract migration filed with coingecko. less vibes, more rails staking ~15% apr live, real yield funnels from on-chain real estate, mortgages beta teased for q4, l2 rollups next, bridges to solana/eth queued. rwa market momentum keeps printing: banks piloting funds, solana ath, tether gold ballooning. ignore infrastructure, chase memes, then ask why liquidity fragments i’m long infrastructure that actually settles and pays. watch $MVRK, watch the rails build under #RWAs. job’s not finished

Momentum on Sui: Title Deed as recognition-primitive + growth rail • What: @MMTFinance Title Deed NFTs recognize builders/creators and grant VIP access to long-term reward streams on Momentum DEX, Token Generation Lab airdrops, allowlists, and priority for future drops across @SuiNetwork • Supply & path: 15,000 total 10,000 to key contributors (Genesis Deed, WAGMI Trading Competition, top creators) and 5,000 via the Nomination Wave. If eligible, you can nominate up to 3 others. Flow: connect wallet + X → check → claim → nominate → wait for reveal Checker: t.co/fNNXAeKSS7 • Why this matters: it converts contribution into programmable loyalty, pushes community curation to the edge via nominations, and creates a portable onchain identity for future campaigns. The incentive loop is obvious: contribute → earn Deed → unlock perks → re-engage → amplify ecosystem • Do now: verify eligibility, then either nominate 3 or spin up a UGC squad on @buidlpad to target protected $MMT Priority Allocation (deadline Oct 22, 10:00 UTC). Split roles, submit up to 5 posts/member, optimize for qualified engagement Squad link: t.co/QnZw2CRPds Momentum feels like a community-led flywheel for #Sui

🚀 Almanak – VibeCode like a quant, without writing code 🔹 Tech Vision @Almanak__ builds AI-powered quant strategies through an AI Swarm of agents (coding, testing, backtesting, deployment). Users keep full control of assets (non-custodial) and can even tokenize strategies as financial assets. 🔹 Goals Empower community via cSnappers & Snappers competing for rewards. Create a decentralized analytics ecosystem with gamified strategies. Ensure transparent token rewards (80% for cSnappers, 20% for Snappers, plus $COOKIE stakers). 🔹 Fundraising Raised $8.45M from top VCs: @Delphi_Digital, @HashKey_Capital, @BanklessVC, @NEARFoundation, @ShimaCapital, @AppWorks_VC, and more. Now live on @legiondotcc with up to 10x capital multiplier for early backers. 0.55% $ALMANAK supply allocated as rewards at TGE. 🔥 Join the campaign on @cookie_fun & compete on the cSnaps leaderboard! #Almanak #DeFi #Web3 #AIQuant #CookieFun #CryptoCommunity #Airdrop #TokenSale @agentcookiefun

thesis: @EdgenTech is lining up to be crypto’s default research copilot. $11M in fresh funding, plus TokenPost as exclusive distributor in South Korea, means real-time AI investment analysis fully localized in Korean, integrated payments, and one month of Pro for every TokenPost user. that combo distribution + language-native UX + frictionless pay usually precedes step-function adoption i rebuilt my routine around it: 360° reports in the morning, EDGM model + Pivot Alert on watch, Fear & Greed / BTC.D / alt-season as guardrails. i draft inside Edgen, hit publish, and the write-up goes live while stacking Aura points that convert to airdrops. fewer tabs, faster calls, cleaner feedback loops. last week it flagged a trend flip early and covered the sub cost, tbh if KR goes live at scale, this playbook likely repeats in other regions. feels like the edge shifts to whoever nails localized AI + distribution agree or am i coping #AI #Crypto #Research #Korea #EdgenTech?

🚀 Privacy that pays — or NGMI @zama_fhe is bringing FHE to EVM: blindfolded AI, private DeFi, and on-chain identity — all computed while encrypted. 💠 $ZAMA tokenomics aligned with demand •All FHEVM fees → burned •New tokens → minted only to pay KMS + coprocessors ➡ Creates sustainable deflationary pressure as volume scales. ⚡ Fees drop as usage grows: ~$0.01–$0.13/tx. More apps = cheaper compute. No need for the L2 vs ZK wars. If confidential infra wins → $ZAMA wins. 📊 Early traction is undeniable: •820k+ transactions •114k users •14.9k contracts •10–20k DAU •1,100 Sepolia ETH spent on gas ⏳ Mainnet + TGE Q4 2025. Builders & creators already rewarded: $20k/mo payouts + Season 3 live of #ZamaCreatorProgram. #FHE #ZAMA #PrivacyThatPays

Encrypted compute on-chain is here with @zama_fhe: run logic on encrypted data, keep inputs private, unlock new dApp design for DeFi, healthcare & more. Season 3 of the #ZamaCreatorProgram is live — top 1k earn OG 003. Zama raised $130M and declares: the airdrop meta is dead. Now it’s about intention-based coordination and rewarding real work (code, demos, deep explainers, reproducible examples). @randhindi asks: what should scoring value more this season? Reach Depth/technical merit On-chain proof-of-work #Zama #FHE #DeFi #Web3 #Privacy

clean playbook to farm mindshare + compute yield this month @EdgenTech updates to watch: - EdgeForge v2 went live Oct 28 for one‑click model deploys on edge nodes - Render partnership added ~30% GPU capacity across the marketplace - zk‑private jobs shipped Oct 22 for sensitive inference - weekly Yapper payouts every Friday - Q4 airdrop: 10M EDGE, snapshot Nov 10 move set: - stake 1k 5k EDGE for priority + multiplier on jobs and yaps - post daily with signal: $BTC, $ETH, $NVDA, $PAYAI, DePIN rotations - tag #EdgeAI and keep threads tight, aim for saves + meaningful replies - anchor takes to platform changes, avoid low‑effort spam, meme + teach benchmarks: - 10k+ impressions unlock $50 $500 tiers - ~2.8% engagement rate holds your LB spot - top 300 leaderboard compounds aura points catalysts: - Spaces Nov 12 on zk‑edge - governance Nov 15 on sharding - mobile beta with one‑tap staking rolling yap, stake, rotate, repeat #DePIN #EdgeAI

Momentum x @buidlpad pricing window for @MMTFinance, and why it matters 1. TLDR • Sui’s liquidity engine with ~$550M TVL, ~$20B volume, ~2M users • ve(3,3) incentive layer, CLMM swaps, Vaults + cross-chain integrations (Wormhole/LIFI/Squid) • $MMT sale FDV bands $250M (Tier 1) / $350M (Tier 2) vs secondary indications near ~$0.80 implying ~$800M, creating real FDV compression at entry - - - - - 2. Sale mechanics • Raise cap: $4.5M, supported: $BNB, $SUI, $USD1 • 100% unlock at TGE • Tier 1: LP ≥ $3,000, snapshot Oct 25, caps up to $20k, anti-sybil • Tier 2: open KYC Oct 22 25, entry from $50, caps to $2k • Contribution Oct 27 10:00 UTC Oct 28 10:00 UTC, settlement by Oct 31 - - - - - 3. Thesis • Entry at compressed FDV vs on-chain traction • Resilience during drawdowns, fee capture remains active • Multichain roadmap broadens liquidity sourcing - - - - - 4. Creators • Priority $150+ allocation if you add “️️T”, post original work, tag @MMTFinance + @buidlpad, submit Oct 15 22; squads aggregate quality across up to 5 posts Watch liquidity depth at TGE, veMMT flows, and fee run rate post-sale; I’m positioning via LP + contributors program, then Tier access on KYC windows #Sui

Liquidity gravity on Sui keeps getting heavier @MMTFinance pushing $13B+ total swaps, a $205M daily ATH on Sep 29, and TVL sprinting from ~$160M to ~$319M in under a week The kicker? Depth translates to fills low slippage across majors + stables is pulling market makers and retail alike Pair with @buidlpad HODL: +2x Bricks, onchain APRs up to triple‑digits pre‑TGE reflexive flow spinning up fast Strategy notes: - want flow? SUI‑USDC - want beta? LBTC‑wBTC / xBTC‑wBTC - want chill? suiUSDT‑USDC / low‑fee stables Use the same wallet on Momentum + Buidlpad, add LP before Oct 19, then track stats min‑by‑min simple loop to stack points while deepening books Early signals: 50% of LPs are new to Sui, mindshare lead on @KaitoAI, and fresh capital compounding into depth What’s your current allocation: A) flow (SUI‑USDC), B) BTC pairs, C) pure stables, D) waiting for $MMT reply A/B/C/D and why?

GM CT Two plays on my dashboard: RWA rails and human-proof infra @Mira_Network x @plumenetwork pushing a verified-data stack for tokenizing real assets @billions_ntwk shipping Proof of Humanity, Supermask NFTs and a launchpad already 200% oversubscribed with $10M locked, FDV at $100M Why I’m watching - Plume grabbed 50% investor share in 2 months and crossed 200k users - Helios leaderboards are now human-verified, rewards stay clean Positioning checklist -> Read Mira docs, track $MIRA with @KaitoAI -> Verify on Billions, secure allocation, watch the mint Reply: HOLD $MIRA or ROTATE to human infra next

everyone yelling ai + zk rn, but the real choke point is verifiable compute coordination + correctness at scale. proofs run on silicon, not vibes. that’s where @cysic_xyz flips the board: take GPUs/ASICs/edge devices, wrap them in cryptographic guarantees, and turn cycles into yield-bearing assets #ComputeFi under the hood: Proof of Compute stakes work + stake, provers chew through zk tasks, verifiers slam the receipts, and a marketplace routes jobs with VRFs + performance/reputation so whales get heavy loads while smaller rigs still eat. output leaves signed and sanity-checked, not “trust me bro” numbers don’t lie: multi-ecosystem integrations, daily millions of proofs on testnet, 10x+ speedups where it matters (MSM, zkVM paths), consumer-friendly miners on deck, and a mobile verifier for easy points flow. $CYS slots in for fees, staking, and the flywheel ignore the farm noise, study the stack: hardware → coordination → proofs → liquidity. own the hardware, own the yield. compute szn isn’t coming, it’s already here with @cysic_xyz

[A quick take on Pico Prism RTP] Pico updates are everywhere, but here’s what matters. Current stats: 96.8% sub-10s proofs, ~6.9s avg on 64 GPUs, ~2.2% from EF’s 99% target. Combine EigenLayer AVS with propose‑challenge and you get lightweight verification, opening the door to phone‑tier validators and cheaper L1 security Back-of-the-envelope: - scaling looks close to log base ~2 (doubling GPUs ≈ −~1s) - 16 GPU target suggests ~8 9s median with a 3.2% heavy‑block tail - real win is omnichain ZK data for CPI, zkML, InfoFi If @brevis_zk ships sub‑10s on smaller clusters, #ZK meets low‑cost, high‑security validation for #Ethereum and devs get trustless cross‑chain compute. Wdyt

lots of bullish things happening around in the @ownaiNetwork ecosystem and you're not paying attention! - AI automated asset marketplace for robots & autonomous vehicles - $OAN lets you co-own machines and share real revenue - verifiable data via ZK proofs with @brevis_zk automation runs 24/7; with OWNAI you stream performance on-chain, track efficiency per unit, and get paid for the intelligence you contribute the play: acquire capacity stake $OAN permission data earn fees + insights physical reliability meeting digital scalability in a single flywheel #OWNAI

There’s an engine quietly powering the next wave of onchain compute, and it’s live across DeFi and agents. @brevis_zk pushed 100M+ proofs, unlocked dynamic DEX fees that pulled deep liquidity, and landed a Uniswap trustless routing rebate grant up to $9M Think ZK coprocessor: trust‑minimized data across chains, off‑chain compute, on‑chain verification. Prove once, verify everywhere. 12s L1 block proofs signal Ethereum RTP alignment and real adoption Sparks end Nov 2, Yapper leaderboard heating up, ProverNet next. Study it, ship, preach, collect #ZKVM

Do not fade @trylimitless Pinned-price rounds = replayable tape Anchor the level, pick the hourly, ride volatility not vibes $100m pledged, CT + LB compounding; @wallchain_xyz pulled $104m on $1m target liquidity makes the meta, not the meme 160m isn’t the ceiling if API open, backtests live, depth view baked-in, sizing presets onboard quants + casuals Flow: set anchor - map microstructure - flip on breach - Kelly-lite Sizing discipline matters #predictionmarkets @limitless

rotations aside, the cleanest r/r on #Sui rn looks like parking stables where the liquidity flywheel already spins @MMTFinance top CLMM on sui w/ ve(3,3) emissions, xSUI, vaults + a routing stack that taps 100+ sources. you’re not guessing narrative here, you’re underwriting flow numbers aren’t cute either: $19B+ cumulative volume $560M+ tvl pre-tge 2m+ users touching the rails all before $MMT goes live the community offering on @buidlpad lines up well for ppl who actually show up: raise: $4.5m accepted: bnb / sui / usd1 unlock: 100% at tge (no cliff games) tiers: lp stakers for priority, verifieds for open access timing: kyc + subscription: oct 22 25 review thru oct 27 contributions: oct 27 28 settlement by oct 31 alpha that most miss: clmm ranges that actually earn vs being someone else’s exit creator quota up to 30% via ugc, so builders get stake + voice title deed reputation loop tightening Sybil risk while rewarding real work i’m positioning via lp > hodl multipliers > contribution window. whose front running $MMT before everyone scrambles

People with Analyst archetype

Building in Web3 ⚙️ | Smart contract tinkerer | Code, coffee, crypto ☕

🧩 Crypto KOL | DeFi | Narratives | Adoption

#Earn #Binance #Base @guildxyz @KaitoAI @cookiedotfun @BioProtocol

Defi research writer Living with crypto, chasing airdrops daily, using Infofi & Kaito for alpha, farming Cookie, vibing on Yapper – always early to gems 🚀

Positional/ Intraday Trader in Nifty50📈Making Charts Very Simple to Read. Saving Many from Tops & Bottoms.📈📊Follow up for Guidance on Financial Literacy.

世界是精彩的,无聊的只有你自己

Exploring how AI learns and how humans forget- Stitched together by questions, mistakes and a strange sense of humor.

AI | ML | Data

💪Superdan要努力变强 @Arbitrum @wardenprotocol @SonicLabs @burnt_xion ambassador ❤️ #okx OKX足够:https://t.co/1dAowld #binance 选择币安:https://t.co/ton5sbmQ11

Explore Related Archetypes

If you enjoy the analyst profiles, you might also like these personality types: