Get live statistics and analysis of frog.eth's profile on X / Twitter

The Analyst

frog.eth is a data-driven thinker who thrives on decoding complex DeFi ecosystems and bringing clarity to crypto project metrics. With a prolific tweet history and a sharp eye for protocol innovations, they are the go-to source for nuanced industry insights and pragmatic narratives. Engaging their audience through informed discussions, frog.eth cultivates thoughtful discourse around trading strategies and decentralized finance infrastructure.

Top users who interacted with frog.eth over the last 14 days

Crypto Trader / Researcher / Airdrop Hunter Channel : t.me/VictorVenture $BTC, $ETH, $PEPE, $ATOM, $RON, TrumpNFT, Runestone 🧙♂️,🧙♂️

KOL Manager TG:@michael_0000000 纯分享不是投资建议 理财、合约、币币选 #OKX 方便、安全 入口:okx.com/join/2205021 Bybit为专业交易者而生:partner.bybit.com/b/1095 🎰顶级游戏体验尽在 @bcgame

Web3 Enthusiast | NFT Collector | DAO Contributor

每一笔交易,都值得被尊重。 爱冲土狗 ,撸毛 合作DM:TG @linda6666666 所有推文均无投资建议

Researcher | DeFi Explorer | Angel Investor | Web3 Advocate

𖠁 𝑊𝑒𝑏𝟹 𝑃𝑟𝑜𝑚𝑜𝑡𝑒𝑟 & 𝐾𝑂𝐿 𝑀𝑎𝑟𝑘𝑒𝑡𝑖𝑛𝑔 𖠁 $𝑆𝑂𝐿 𝑀𝑎𝑥𝑖 @𝐾𝑎𝑖𝑡𝑜 𖠁 @𝑣𝑖𝑟𝑡𝑢𝑎𝑙 𖠁

$QANX holder | Azcoinvest

创新不止,娱乐常在,链上自由永远不妥协 Web3爱好者丨爱好打铭文丨 本账号推文信息不做为投资建议。 #BTC #BNB TG:@ziyou2020

⚡ Crypto KOL | Turning signals into conviction

frog.eth tweets so much crypto alpha that their notifications probably need their own DeFi protocol to manage the gas fees—guess they’re trading quantity for clarity like it's an NFT drop.

Successfully positioned themselves as a highly credible thought-leader within niche DeFi circles, consistently driving meaningful discussions about cutting-edge projects backed by major investors like Pantera and Sequoia.

To illuminate the ever-evolving decentralized finance landscape by providing detailed evaluations and context-rich commentary that empower followers to make informed decisions.

frog.eth holds the conviction that transparency, data integrity, and technical innovation are the pillars driving the next wave of crypto adoption and ecosystem growth. They value accuracy and context over hype, pushing for smart, educated engagement rather than surface-level speculation.

Exceptional ability to synthesize complex blockchain concepts into digestible, actionable insights while fostering interactive discussions that invite community input and critical thinking.

May sometimes dive too deep into technicalities that can intimidate casual followers, and the high tweet volume could overwhelm audiences not accustomed to intensive crypto discourse.

Focus on threading key insights into more bite-sized, relatable tweet series to broaden appeal. Incorporate occasional engaging polls or simplified explainer threads to convert technical depth into accessible education, helping to steadily grow a diverse and loyal following on X.

frog.eth has tweeted over 21,500 times, demonstrating a relentless commitment to sharing intricate, high-value crypto analysis with their followers.

Top tweets of frog.eth

watching @wallchain_xyz push attentionfi without the MEV tax anti-MEV cashback on every swap, ~$1.5B+ secured monthly, fewer sandwiches and a rebate loop that recycles flow @idOS_network proofs turn quests into authenticated actions; mobile zk tightened the stack IWO sorts by vest length, calmer books, stronger holders which metric decides 2025? A) net MEV saved per user B) % quests with onchain ID C) IWO participation vs supply reply A/B/C + one sentence or drop a counter-thesis

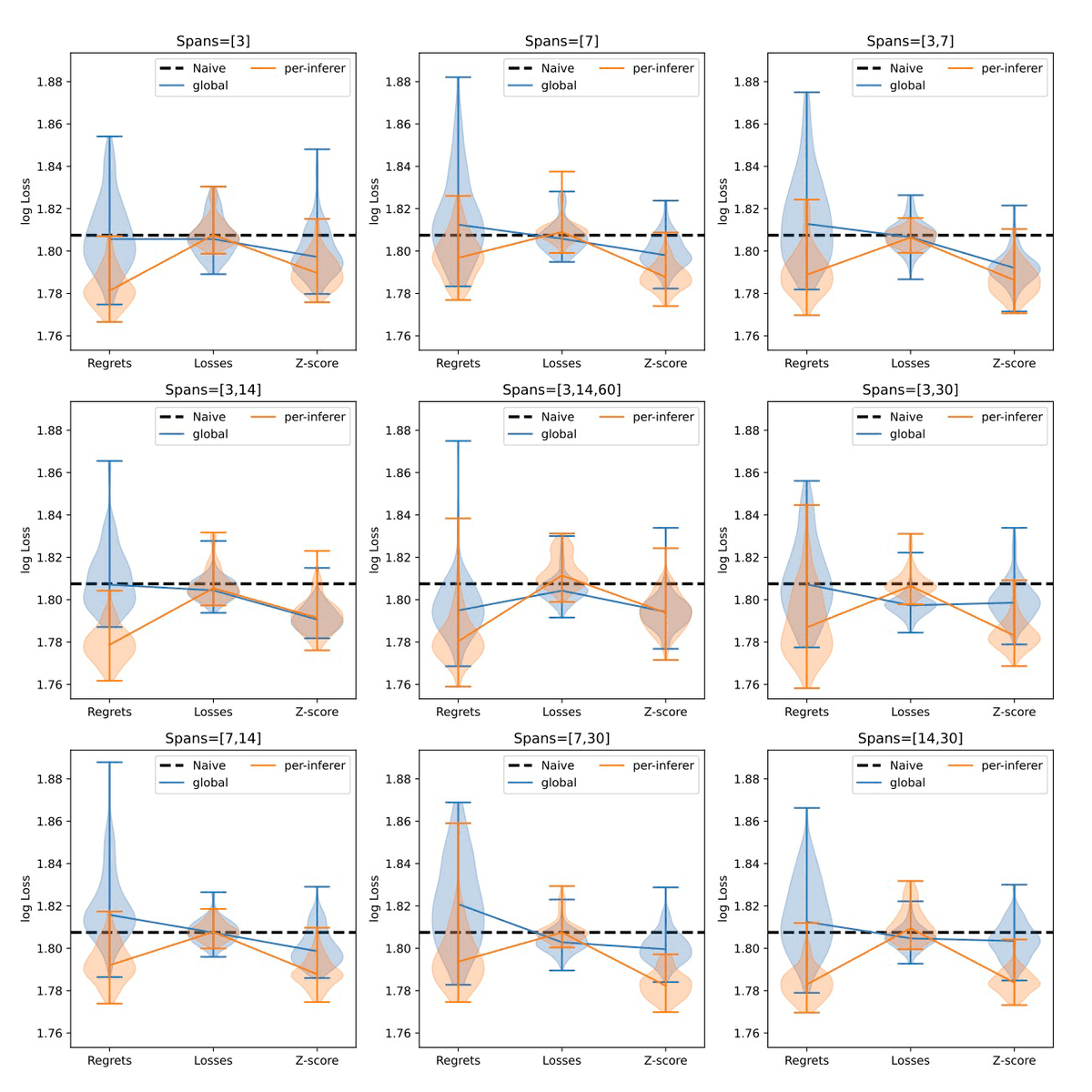

tough szn anons bags feel heavy, mindshare swings, leaderboards flex and yet the quiet stuff compunds @multiplifi… - ~6%+ on native BTC, double-digs on stables, no lock - vault design dodges leverage/liqs while rotating across market inefs - RWA pipes for tokenized gold + insto strats, DeFi skin on top - infra for teams: plug yield, risk, compliance without rebuilding - BNB Chain growth that went parabolic to ~95m TVL in weeks - backed by Pantera + Sequoia, $21.5m retooled to ship want cute narratives or working rails that pay while you sleep choose your fighter

gmsor to all ten believers | ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄| TEE ENDGAME |____________| \ (•◡•) / \ / | | |_ |_ r3 → TEN new name same path encryption forever encrypted L2 on ethereum mev protection on by default faster txs and private compute poker battleship strategy onchain no more perfect-info only devs plug in with the tools u already know transparent where it matters private where it counts values stay tech iterates we keep shipping which TEN article taught you the most drop it i’ll read it then yap more i’m a simple man, i see @tenprotocol build real encrypted infra i interact zkgm ten fam 0______0

alpha that learns context > alpha that guesses @AlloraNetwork is wiring up a decentralized intelligence layer where humans and models co-predict, get scored on accuracy, and route capital toward what consistently works 10,000+ BTC predictions already logged with ~53% directional hit rate small on a spreadsheet, deadly when you compound sizing and filter by context the sleeper feature forecasters don’t just guess price, they rank which models fit which regime the network learns who to trust per market state and blends signals on-chain no hand waving, just measurable predictive lift achieved before $ALLO incentives even start devs plug in like an API get real-time probabilities for DeFi risk, autonomous trading, DAO vote outcomes, in-game economies verifiable signals, transparent scoring, payouts tied to contribution quality flip the script on “analytics” let intelligence earn yield, let markets adapt in real time and yes, this pairs cleanly with prediction markets like @moremarketsxyz study the rails now, front-run the cycle later when $ALLO turns on, quality and coverage accelerate sleep if you want the network keeps learning while you do

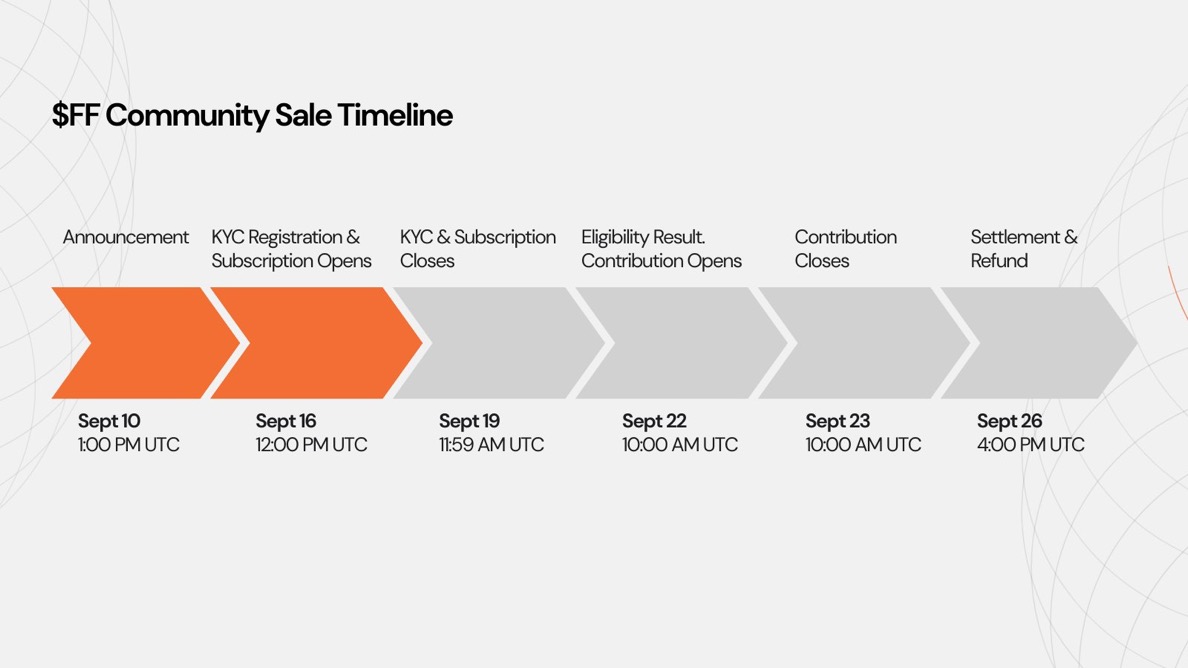

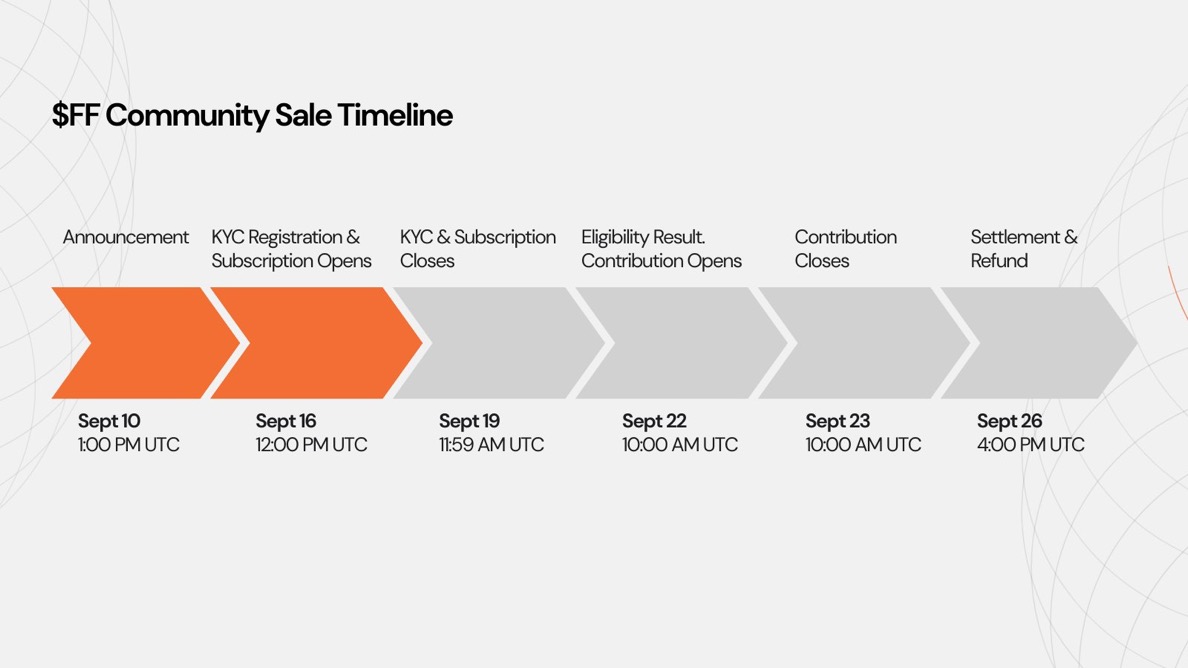

8 days. $20,000,000 in $USDf staked via BUIDLpad and TVL cruising past $1.8B… mindshare #1 on kaito, supply at $1.75B edging for $2B, and @FalconStable just dialed Pendle Miles to 72x while Base farming heats up on Aerodrome LPs. That combo screams reflexive flywheel rn Here’s my read: - Liquidity compounds as USDf supply expands, yield routes deepen, and TVL chases safer carry - $FF pre-TGE momentum + DWF Labs backing + BUIDLpad’s track record (3x avg) creates a clean setup for price discovery - Tier 1 $FF at $350M FDV is gated by $3k USDf/sUSDf staked in Falcon Boosted Yield, extra juice if you lock via BUIDLpad HODL - There’s also a $450M FDV track but early birds typically win on unit cost, so timing matters Registration + wallet checks for the $FF airdrop are live, and subs close fast. If you’ve stacked miles/badges, don’t sleep. gFalcon keeps shipping, the flock keeps flying. My bet: $USDf tags $2B supply before $FF unlocks and TVL tags a fresh ATH after What’s your move before the window snaps shut on this run-up to TGE

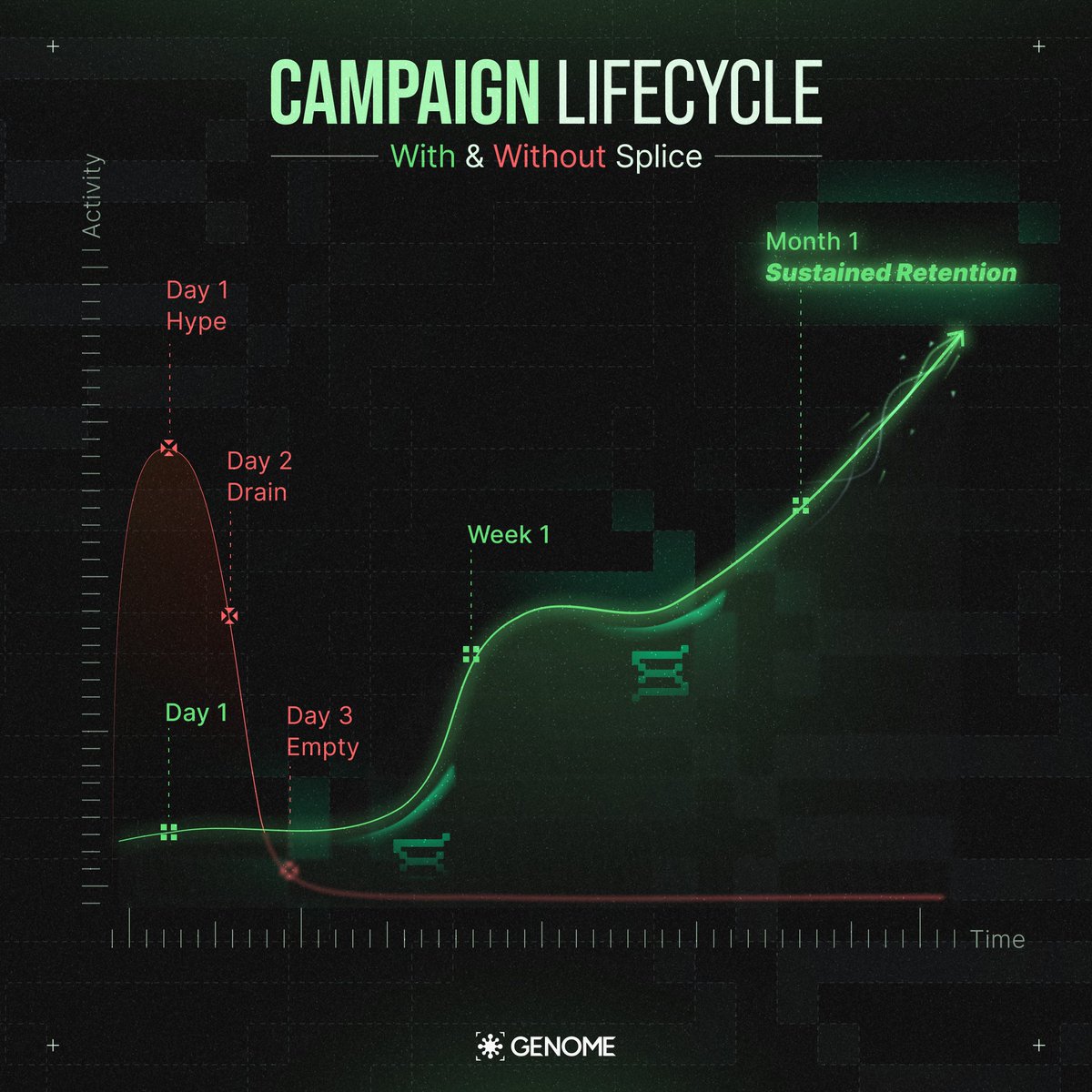

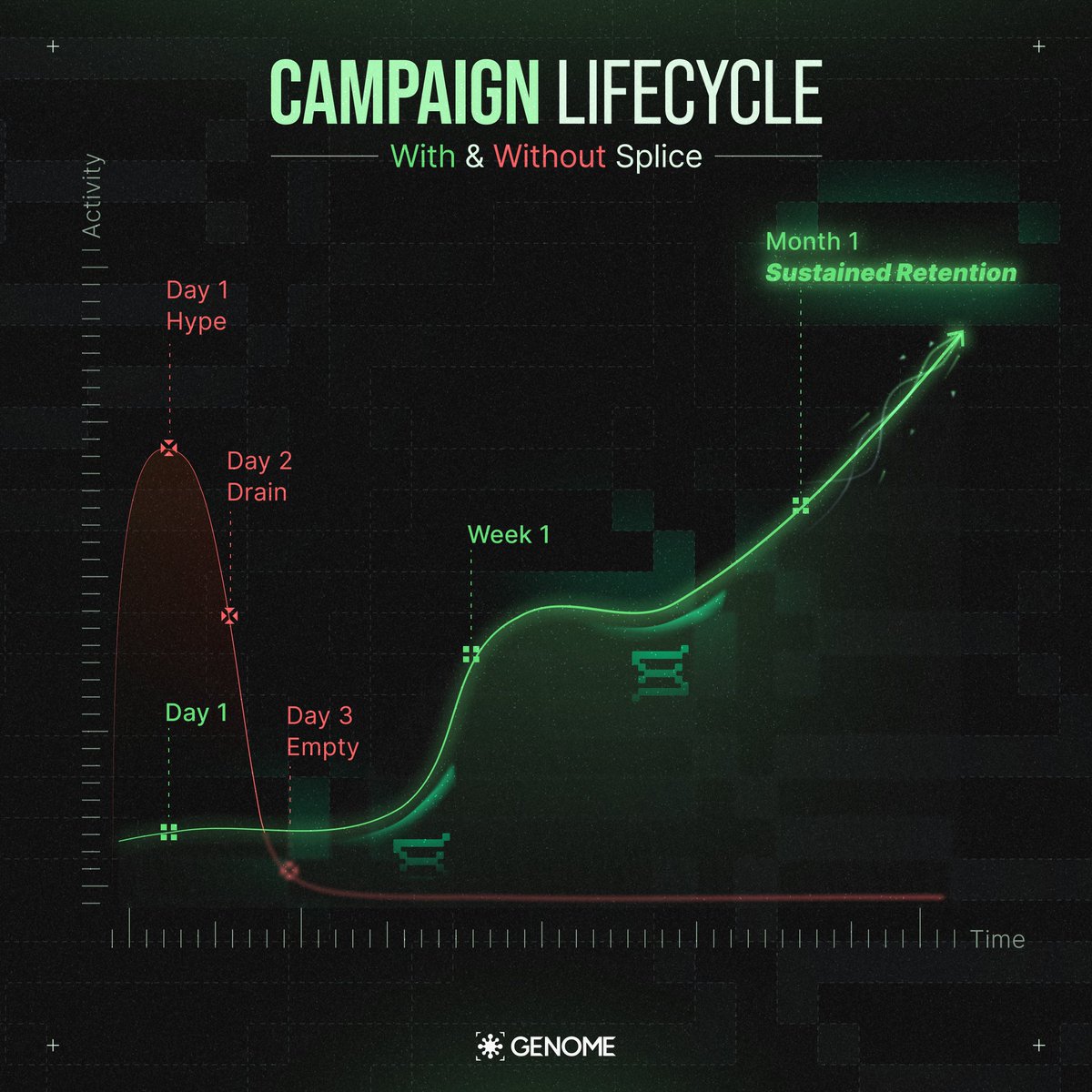

Web3 retention isn't a buzzword, it's the quiet killer of most protocols. Too many projects chase clicks that vanish overnight, leaving empty wallets and ghosted communities. But @genome_protocol sees through the noise. They're rolling out the Retention Economy right now, where every verified interaction compounds into real stakes. Think about it: on-chain quests that track your depth, not just your dip in. Splice layers on top, blending off-chain vibes like consistent yaps with on-chain proofs from Edge badges and token flows. It scores your behavioral cred, filters out the fakes, and turns fleeting attention into ownable data you control. No more bot farms gaming leaderboards. This is PoE in action, proof of engagement that rewards the grinders who stick around, build teams, and shape the ecosystem. Recent drop: +20% active users last month, 17K weekly txns from real players, not scripts. That's momentum you feel before you see it. And with $NOME gearing up for TGE, staking here means voting on what grows next, unlocking adaptive AI strategies that evolve with your playstyle. I've been watching the Yapper leaderboards heat up, top quackers like @TMA_420 pulling in tranches that prove consistency pays. If you're building or just grinding games, Genome's superchain isn't waiting for permission. It's forking the future where your moves in Astra Nova or PlayEFAS feed a unified economy, royalties flowing back to creators who earn them. Join the Discord reset, hit those Galxe quests, and watch your footprint turn into equity. This isn't hype dropping. It's the loop that sticks. #GameFAI

been tracking $WLFI moves like a hawk lately @worldlibertyfi rails are basically humming now USD1 stablecoin flowing on ETH / BSC / TRON BTC + ETH stacks growing while fiat<>crypto swaps hit no choke points billions in WLFI sliding thru Gnosis + BitGo cross‑border pay, capital lending, issuance all loading tradfi‑grade infra but open rails anyone can plug into Justin Sun threw $75M and grabbed an advisor seat Aqua fund slid $100M in public co pulling $1.5B to scoop 7.5% at 0.20/token heavyweight roster, listings from Binance to Uniswap lining up 30B coin airdrop proposal in the wild snapshot live, claims starting to ping wallets Eric Trump backstop, Zach Witkoff hinting weeks not months feels like one of those “quiet grind then vertical” plays #WLFI #worldlibertyfi

这个playbook太实用了,day1就该塞兜里 低倍练手先,precision timing flips the script,尤其drift rounds里微调hedge,treat like timed option,稳着来细水长流才是暴击 $LMTS 季2那$2M池子叠wallchain quests,双倍upside,flow real但size small DYOR 谁在跑1.6x-1.8x edge,今天Base上低倍捡cents compounding,timing block cadence log rounds scale confirmed 精确王道,#Base预测venue #1 @trylimitless

3分钟搞懂 idOS:Web3 身份的操作系统 “身份不应是静态的,它应该随你而动。自托管是关键。” @idOS_network 让这成为现实 一个开源、链中立的去中心化身份层,用户存储、管理并选择性分享加密个人数据,跨越生态系统保持主权。 想想看,你的 KYC 数据散布在钱包、平台和链上。idOS 解决痛点:验证一次,到处复用,减少应用入门的摩擦。端到端加密确保隐私,监管服务如 DeFi 和稳定币也能合规访问。 核心价值: 1️⃣ 一身份,全链 无需重复 KYC 或钱包链接 2️⃣ 隐私优先 数据跟你走,不在中心化服务器 3️⃣ 即时接入 应用秒级验证用户,推动真实采用 从 Fractal ID 演化而来,2020 年创立,2023 年协议上线。协作 NEAR、Gnosis 等生态,目标成为互联网默认身份层,推动“更好金融系统” 用户永久拥有数据,生态无缝互操作,OpenFi 规模化至万亿价值。 最近动态:10 月 25 日 Epoch 2 启动,引入验证层级、idOS NotABank(隐私导向新银行)、周任务和贡献积分。75K+ 独特用户加入,测试组满员。10 月 28 日 Outlier Ventures Twitter Space 聊“数字身份经济学”,创始人 Lluis Bardet 现身。 代币 IDOS 总供应 10 亿,TGE 预计 2025 年底 Arbitrum Orbit L2,社区激励 13.8%(任务、早期采用者)。质押节点运营存储网络,赚取数据交易费。固定供应,无通胀,稀缺性内置。 对稳定币经济(2000 亿+ 市场)来说,idOS 是基础设施金矿。MiCA 法规下,合规 DID 需求爆棚,它定位 OpenFi 基石 加密贷款、DAO 投票、跨链凭证,一键撤销访问。 多年后回望,早布局 idOS,你会发现收获远超等待。Web3 信任从控制转向拥有,社区更强,空投更准。 加入 app.idos.network,连接 X 赚积分。#idOSnetwork #Web3 t.co/OYXtRlH484

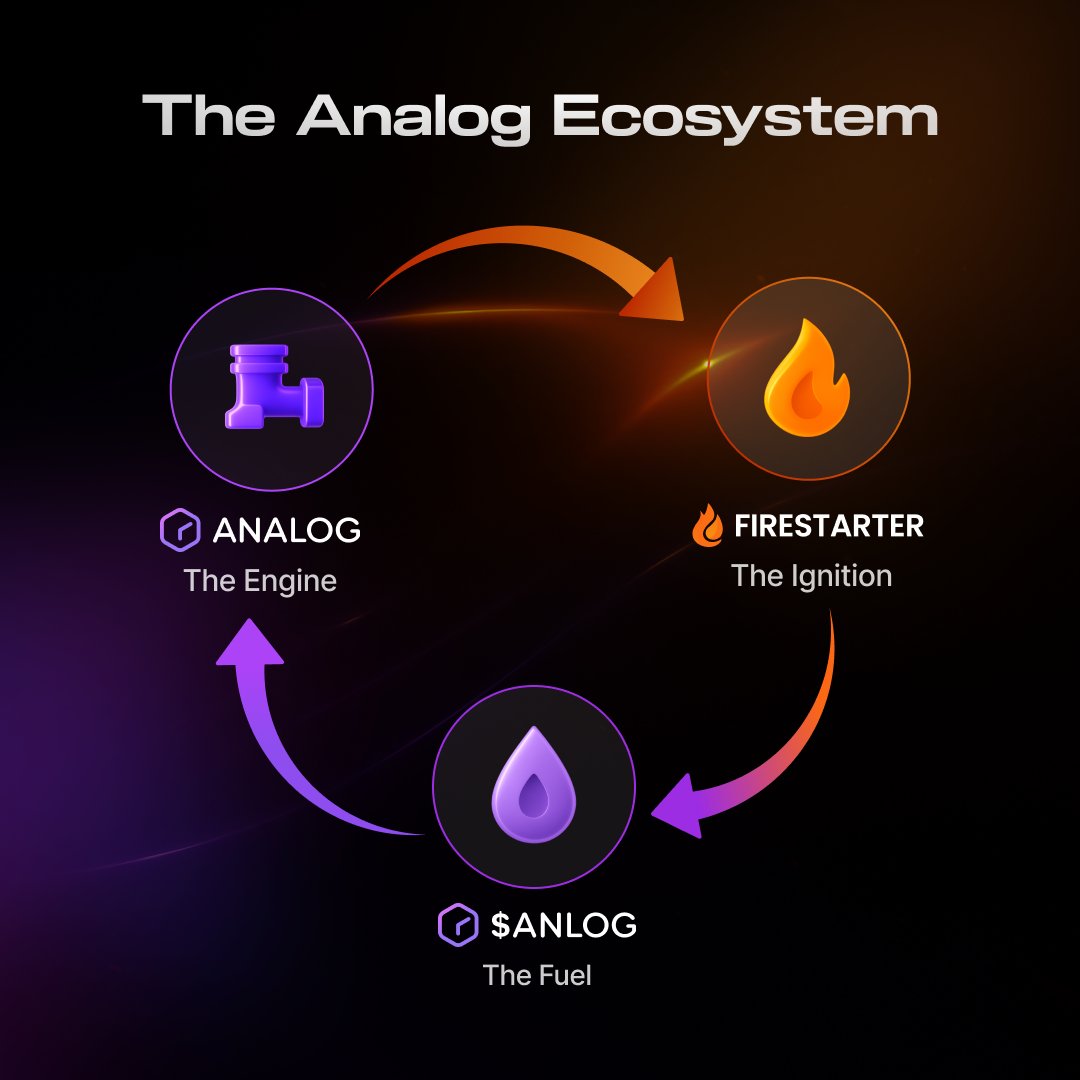

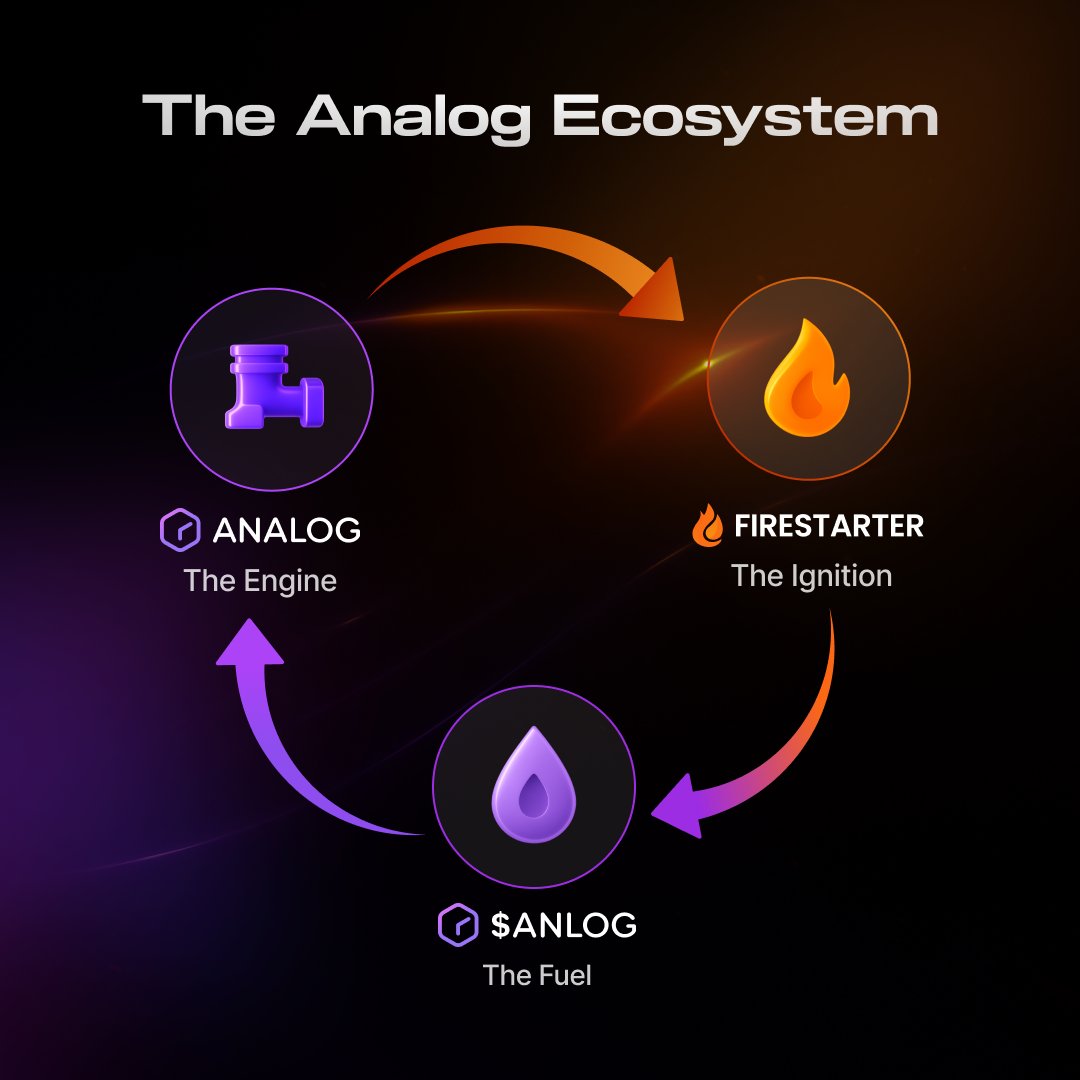

analog processed 500k gmp messages on testnet last month with zero disputes. that's 100% verifiable time-stamps across 20+ chains using threshold crypto. layerzero hit 15% failure rates on high-volume days last quarter. every other bridge charges 0.1-0.5% per hop killing small de-fi flows. analog's proof-of-time settles free for sub-second data sync. frax locked $50m liquidity there first because the economics finally scale for real multi-chain commerce. developers spent 6 months onboarding to cairo on starknet. analog's watch sdk deploys cross-chain dapps in one api call. no wrappers. no oracles. just unified memory where ethereum and solana read the same event ledger. firestarter already launched 10 ai liquidity pools pulling from both ecosystems. zenswap routes $5m testnet volume weekly without fragmentation drag. builders who stick around build empires. $anlog staking hit 7% apy after the october upgrade. 240m circulating at tge with 40% community allocation. tribe led the $16m round pricing it at $150m fully diluted before mainnet drops q4. balaji advising on the threshold proofs that make ai agents trustless across chains. wallchain's mindshare campaign distributed $50k last snapshot to top yappers like @victoryoungme. 23 days left for batch 2. infrastructure this tight at pre-launch valuation captures the omni-chain meta before it prints $1b tvl. @oneanalog

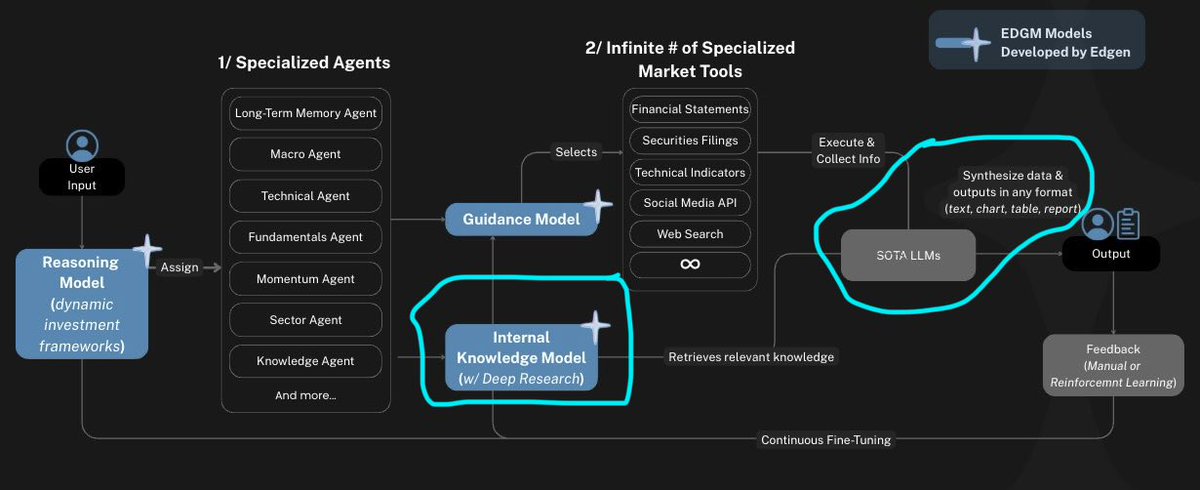

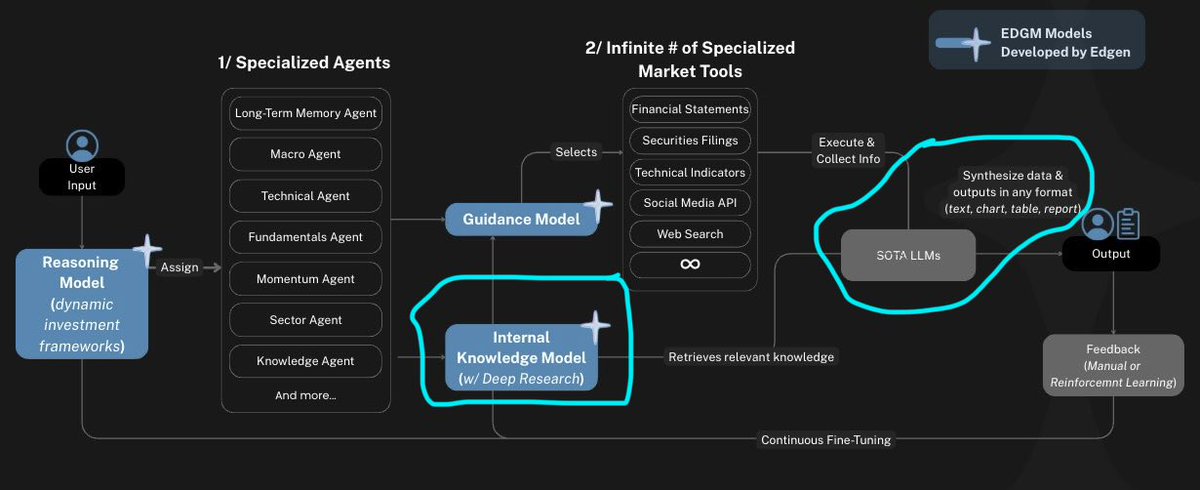

撸毛训练营今天的盘面工具分享:EdgenTech实操指南 为什么选@EdgenTech:多市场统一看板(股票+加密),AI信号+实时情报+可操作的报告,背后有EVG HQ、hiFramework、NorthIslandVC支持,信息流干净且高效 核心打法: - 建立主题清单:AI、RWA、Meme、监管、衍生品,关联你跟踪的ticker - 将新闻、链上、期权/永续数据纳入同一条警报,触发后直接看到“事件全貌+可能受影响资产” - 交易纪律:追上下文,不追标题党 示例复盘($DOGE): - Edgen报价:价位~0.259411、流通~151.2B、成交~2.7B、总市值~39.1B - 叙事:从“meme”向“流动性/文化”偏移,支撑0.24-0.25,阻力0.28-0.32 - 驱动:DOJE ETF落地、CleanCore Solutions新增500M DOGE(175M PIPE)、九月资金回流meme赛道 - 风险:未稳上0.30有回撤到0.22-0.20的可能,情绪波动大 上手步骤: 1、注册并选主题 2、为每个主题绑定新闻源+链上+衍生品指标 3、设定阈值与跨市场警报 4、盘前用Crypto Reports做日内计划,盘中用智能提醒执行 链接:t.co/BHOkjKkW2z 实战场景: - 芯片短缺预警出现→自动联动AI/机器人股 - DeFi监管动向→同步你的代币观察清单 PS:有需要我发个人警报模板,评论区见。市场不睡,但我们要用对工具,信息要快、准、连贯。今天把EdgenTech接入你的策略栈,提升一个维度

벨벳 캐피탈 @Velvet_Capital 의 DeFAI 여정, 솔직히 이게 왜 지금 $0.21에서 아직도 저평가된 느낌이 드는지 이야기해볼까 해요. 2019년 뉴욕에서 시작된 이 프로젝트는, 팀이 7자리 포트폴리오를 직접 굴리다 보니 DeFi의 파편화에 지쳤대요. 체인마다 흩어진 자산 관리, 수동 리밸런싱의 피로... 그로부터 태어난 게 바로 '벨벳 유니콘' AI 시스템이죠. 자연어로 명령 내리면 멀티 에이전트가 시장 분석부터 크로스체인 스왑까지 알아서 처리하는 거예요. - 핵심은 non-custodial 볼트예요. 사용자 자산은 스마트 컨트랙트에 갇혀서 팀 손도 못 대고, $VELVET 스테이킹으로 veVELVET 되면 거버넌스 투표권에 50% 수수료 할인, 심지어 2~6배 젬 멀티플라이어까지 쌓여요. 최근 에폭 4(11월 10일)에서 100만 $VELVET(약 $21만) 드롭 예정이고, 월간 월체인 쵸크스 리더보드에선 $44K씩 100명 + 랜덤 20명 뽑아요. 성장 지표 보니 TVL $3.57M(월 30%↑), 누적 볼륨 $100M+, 사용자 10만 돌파(5월). 비트겟 상장 후 검색량 SOL/BTC 앞지른 게 증거죠. OKX DEX 통합으로 20+ 체인 리퀴디티도 풀렸고, Aethir랑 손잡아 AI 컴퓨트 스케일링 중이에요. - 개인적으로 @Velvet_Capital 앱에서 공공 볼트 하나 띄워봤는데, 에셋 픽부터 수수료 세팅, 화이트리스트까지 10분 만에 온체인 헤지펀드 완성. 다른 사람들이 따라 투자할 수 있게 투명하게 트래킹되니, DeFi랑 펀드 매니지먼트의 브릿지 역할이 딱 느껴지더라고요. 매일 트레이드/스테이크로 젬 쌓다 월말 $VELVET 변환되는 구조가 참여를 강제하는 재미예요. AI가 타이밍 잡아주니, 그냥 꾸준히 플로우 쌓기만 하면 돼요. 이게 바로 DeFAI의 미래: 자동화된 알파 발견, 인텐트 기반 실행으로 슬리피지 50% 줄이고. 아직 $19M 마켓캡에서 $300B 기관 DeFi 노릴 준비 중이니, 어얼리 포지션 잡는 게 현명할 거 같아요. 월체인 쵸크 캠페인(1월 끝) 타고 커뮤니티 빌드업 보니, 채택이 폭발할 분위기. 벨벳의 조용한 컴파운딩, 놓치지 마세요 #DeFAI

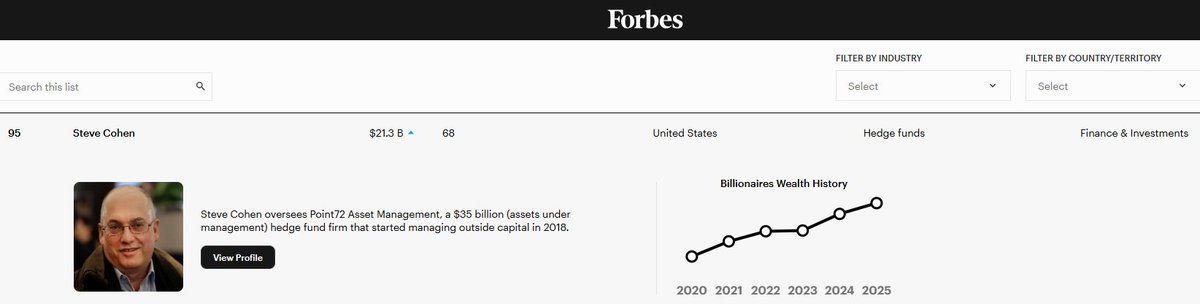

Signal over noise today, fam $WLFI finally stepping into price discovery and the tape looks spicy zero-fee pre-market live, early prints tagged 14 a pop and size actually went through. Not a single micro order, real bids met real asks Thesis in one breath: @worldlibertyfi pushing an everything-DeFi token as the bridge between Web3 rails and Web2 distribution, with USD1 as the onramp. Infra-first, liquidity-minded, institution-ready And yeah, the TradFi tells are loud a Wall Street whale just filed that they’ve got exposure that maps to a nine-figure look‑through on WLFI’s stack. That’s not retail yapping, that’s suits putting skin in Float tight, treasury mechanics matter, first candles will lie, second wave decides trend. I’m watching order book imbalance, depth at round numbers, and how fast sellers get recycled What’s your first real print for $WLFI when the spot gates swing wide? Fade the open or smack the green button

starting my day by quacking harder on @wallchain_xyz with Epoch 2 winding down in just a few days, all eyes on @genome_protocol for that $NOME slice you feel it right the buzz around Splice isn't hype it's the shift to real retention where your onchain grind actually compounds no more fading into the noise Splice layers in multi-chain signals from your Hex Hunt runs and Vee Formation plays turning scattered actions into verified loyalty scores that's the edge protocols get cleaner data users get owned footprints they can stake or monetize and on Wallchain it all feeds the leaderboard fire top quackers like @beijingdou stacking 500+ points show how it's done consistent yaps quests and game sessions multiply your shot at that 1.34% $NOME pool I've been diving deep into Edge quests myself unlocked a few multipliers just by chaining Vee drops with daily threads feels like building actual skin in the game not chasing ghosts Genome flips the script on emission leaks circulates value back into ecosystems through PoE verification every quack every hunt every formation strengthens the network long term that's the superchain sauce games spawning mutating forking under DAO eyes with $NOME fueling the retention pools projected to hit $10B by 2028 if the pilots hold and with Splice POC dropping early November you want in on the beta wave grab those Galxe tasks now Edge Runner campaign closes mid-month with NFT airdrops for 50+ pointers Yappers get the nod too spin up threads on Retention Economy snag Yap Points via Kaito redeem at 100:1 for $NOME alpha it's not about volume it's about showing up real @genome_protocol built this for the maxis the ones who stick so if you're locked in gNome say it back pass the quack to your squad let's build that living attention net together

早,@OneAnalog 的Mindshare Campaign 还在火热进行中,上周Wallchain leaderboard 更新了,top10 里好几个老哥冲得飞起,总奖励池200K+ $ANLOG,月结一次,11月21号截止 简单说说怎么玩才能多薅点羊毛:别光发帖,得带点干货,解释下Timechain怎么让跨链数据同步,或者x402支付怎么让AI agents 瞬间收钱,内容越有料越容易上分 我上周试了下,发了篇关于Proof of Time 避开桥和oracle的分析,yaps 分直接翻倍,感觉这波比纯刷量靠谱多了,早加入的还能叠加ATP加成,testnet老用户优先 代币侧看,总量10亿,流通24%,staking APY 现在稳在40%左右,锁仓还能投PoT节点,收益曲线挺健康的,最近x402集成后,交易量蹭蹭上,$ANLOG 0.45刀位有支撑 有兴趣的小伙伴去app.wallchain.xyz/analog 绑推特开始yap,指南在teamanalog.notion.site,积少成多,月底前多冲几天,奖励随机抽也香 一起建生态,gAnalog fam #MindshareCampaign

Most engaged tweets of frog.eth

watching @wallchain_xyz push attentionfi without the MEV tax anti-MEV cashback on every swap, ~$1.5B+ secured monthly, fewer sandwiches and a rebate loop that recycles flow @idOS_network proofs turn quests into authenticated actions; mobile zk tightened the stack IWO sorts by vest length, calmer books, stronger holders which metric decides 2025? A) net MEV saved per user B) % quests with onchain ID C) IWO participation vs supply reply A/B/C + one sentence or drop a counter-thesis

tough szn anons bags feel heavy, mindshare swings, leaderboards flex and yet the quiet stuff compunds @multiplifi… - ~6%+ on native BTC, double-digs on stables, no lock - vault design dodges leverage/liqs while rotating across market inefs - RWA pipes for tokenized gold + insto strats, DeFi skin on top - infra for teams: plug yield, risk, compliance without rebuilding - BNB Chain growth that went parabolic to ~95m TVL in weeks - backed by Pantera + Sequoia, $21.5m retooled to ship want cute narratives or working rails that pay while you sleep choose your fighter

gmsor to all ten believers | ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄ ̄| TEE ENDGAME |____________| \ (•◡•) / \ / | | |_ |_ r3 → TEN new name same path encryption forever encrypted L2 on ethereum mev protection on by default faster txs and private compute poker battleship strategy onchain no more perfect-info only devs plug in with the tools u already know transparent where it matters private where it counts values stay tech iterates we keep shipping which TEN article taught you the most drop it i’ll read it then yap more i’m a simple man, i see @tenprotocol build real encrypted infra i interact zkgm ten fam 0______0

alpha that learns context > alpha that guesses @AlloraNetwork is wiring up a decentralized intelligence layer where humans and models co-predict, get scored on accuracy, and route capital toward what consistently works 10,000+ BTC predictions already logged with ~53% directional hit rate small on a spreadsheet, deadly when you compound sizing and filter by context the sleeper feature forecasters don’t just guess price, they rank which models fit which regime the network learns who to trust per market state and blends signals on-chain no hand waving, just measurable predictive lift achieved before $ALLO incentives even start devs plug in like an API get real-time probabilities for DeFi risk, autonomous trading, DAO vote outcomes, in-game economies verifiable signals, transparent scoring, payouts tied to contribution quality flip the script on “analytics” let intelligence earn yield, let markets adapt in real time and yes, this pairs cleanly with prediction markets like @moremarketsxyz study the rails now, front-run the cycle later when $ALLO turns on, quality and coverage accelerate sleep if you want the network keeps learning while you do

8 days. $20,000,000 in $USDf staked via BUIDLpad and TVL cruising past $1.8B… mindshare #1 on kaito, supply at $1.75B edging for $2B, and @FalconStable just dialed Pendle Miles to 72x while Base farming heats up on Aerodrome LPs. That combo screams reflexive flywheel rn Here’s my read: - Liquidity compounds as USDf supply expands, yield routes deepen, and TVL chases safer carry - $FF pre-TGE momentum + DWF Labs backing + BUIDLpad’s track record (3x avg) creates a clean setup for price discovery - Tier 1 $FF at $350M FDV is gated by $3k USDf/sUSDf staked in Falcon Boosted Yield, extra juice if you lock via BUIDLpad HODL - There’s also a $450M FDV track but early birds typically win on unit cost, so timing matters Registration + wallet checks for the $FF airdrop are live, and subs close fast. If you’ve stacked miles/badges, don’t sleep. gFalcon keeps shipping, the flock keeps flying. My bet: $USDf tags $2B supply before $FF unlocks and TVL tags a fresh ATH after What’s your move before the window snaps shut on this run-up to TGE

been tracking $WLFI moves like a hawk lately @worldlibertyfi rails are basically humming now USD1 stablecoin flowing on ETH / BSC / TRON BTC + ETH stacks growing while fiat<>crypto swaps hit no choke points billions in WLFI sliding thru Gnosis + BitGo cross‑border pay, capital lending, issuance all loading tradfi‑grade infra but open rails anyone can plug into Justin Sun threw $75M and grabbed an advisor seat Aqua fund slid $100M in public co pulling $1.5B to scoop 7.5% at 0.20/token heavyweight roster, listings from Binance to Uniswap lining up 30B coin airdrop proposal in the wild snapshot live, claims starting to ping wallets Eric Trump backstop, Zach Witkoff hinting weeks not months feels like one of those “quiet grind then vertical” plays #WLFI #worldlibertyfi

Web3 retention isn't a buzzword, it's the quiet killer of most protocols. Too many projects chase clicks that vanish overnight, leaving empty wallets and ghosted communities. But @genome_protocol sees through the noise. They're rolling out the Retention Economy right now, where every verified interaction compounds into real stakes. Think about it: on-chain quests that track your depth, not just your dip in. Splice layers on top, blending off-chain vibes like consistent yaps with on-chain proofs from Edge badges and token flows. It scores your behavioral cred, filters out the fakes, and turns fleeting attention into ownable data you control. No more bot farms gaming leaderboards. This is PoE in action, proof of engagement that rewards the grinders who stick around, build teams, and shape the ecosystem. Recent drop: +20% active users last month, 17K weekly txns from real players, not scripts. That's momentum you feel before you see it. And with $NOME gearing up for TGE, staking here means voting on what grows next, unlocking adaptive AI strategies that evolve with your playstyle. I've been watching the Yapper leaderboards heat up, top quackers like @TMA_420 pulling in tranches that prove consistency pays. If you're building or just grinding games, Genome's superchain isn't waiting for permission. It's forking the future where your moves in Astra Nova or PlayEFAS feed a unified economy, royalties flowing back to creators who earn them. Join the Discord reset, hit those Galxe quests, and watch your footprint turn into equity. This isn't hype dropping. It's the loop that sticks. #GameFAI

3分钟搞懂 idOS:Web3 身份的操作系统 “身份不应是静态的,它应该随你而动。自托管是关键。” @idOS_network 让这成为现实 一个开源、链中立的去中心化身份层,用户存储、管理并选择性分享加密个人数据,跨越生态系统保持主权。 想想看,你的 KYC 数据散布在钱包、平台和链上。idOS 解决痛点:验证一次,到处复用,减少应用入门的摩擦。端到端加密确保隐私,监管服务如 DeFi 和稳定币也能合规访问。 核心价值: 1️⃣ 一身份,全链 无需重复 KYC 或钱包链接 2️⃣ 隐私优先 数据跟你走,不在中心化服务器 3️⃣ 即时接入 应用秒级验证用户,推动真实采用 从 Fractal ID 演化而来,2020 年创立,2023 年协议上线。协作 NEAR、Gnosis 等生态,目标成为互联网默认身份层,推动“更好金融系统” 用户永久拥有数据,生态无缝互操作,OpenFi 规模化至万亿价值。 最近动态:10 月 25 日 Epoch 2 启动,引入验证层级、idOS NotABank(隐私导向新银行)、周任务和贡献积分。75K+ 独特用户加入,测试组满员。10 月 28 日 Outlier Ventures Twitter Space 聊“数字身份经济学”,创始人 Lluis Bardet 现身。 代币 IDOS 总供应 10 亿,TGE 预计 2025 年底 Arbitrum Orbit L2,社区激励 13.8%(任务、早期采用者)。质押节点运营存储网络,赚取数据交易费。固定供应,无通胀,稀缺性内置。 对稳定币经济(2000 亿+ 市场)来说,idOS 是基础设施金矿。MiCA 法规下,合规 DID 需求爆棚,它定位 OpenFi 基石 加密贷款、DAO 投票、跨链凭证,一键撤销访问。 多年后回望,早布局 idOS,你会发现收获远超等待。Web3 信任从控制转向拥有,社区更强,空投更准。 加入 app.idos.network,连接 X 赚积分。#idOSnetwork #Web3 t.co/OYXtRlH484

Signal over noise today, fam $WLFI finally stepping into price discovery and the tape looks spicy zero-fee pre-market live, early prints tagged 14 a pop and size actually went through. Not a single micro order, real bids met real asks Thesis in one breath: @worldlibertyfi pushing an everything-DeFi token as the bridge between Web3 rails and Web2 distribution, with USD1 as the onramp. Infra-first, liquidity-minded, institution-ready And yeah, the TradFi tells are loud a Wall Street whale just filed that they’ve got exposure that maps to a nine-figure look‑through on WLFI’s stack. That’s not retail yapping, that’s suits putting skin in Float tight, treasury mechanics matter, first candles will lie, second wave decides trend. I’m watching order book imbalance, depth at round numbers, and how fast sellers get recycled What’s your first real print for $WLFI when the spot gates swing wide? Fade the open or smack the green button

早,@OneAnalog 的Mindshare Campaign 还在火热进行中,上周Wallchain leaderboard 更新了,top10 里好几个老哥冲得飞起,总奖励池200K+ $ANLOG,月结一次,11月21号截止 简单说说怎么玩才能多薅点羊毛:别光发帖,得带点干货,解释下Timechain怎么让跨链数据同步,或者x402支付怎么让AI agents 瞬间收钱,内容越有料越容易上分 我上周试了下,发了篇关于Proof of Time 避开桥和oracle的分析,yaps 分直接翻倍,感觉这波比纯刷量靠谱多了,早加入的还能叠加ATP加成,testnet老用户优先 代币侧看,总量10亿,流通24%,staking APY 现在稳在40%左右,锁仓还能投PoT节点,收益曲线挺健康的,最近x402集成后,交易量蹭蹭上,$ANLOG 0.45刀位有支撑 有兴趣的小伙伴去app.wallchain.xyz/analog 绑推特开始yap,指南在teamanalog.notion.site,积少成多,月底前多冲几天,奖励随机抽也香 一起建生态,gAnalog fam #MindshareCampaign

这个playbook太实用了,day1就该塞兜里 低倍练手先,precision timing flips the script,尤其drift rounds里微调hedge,treat like timed option,稳着来细水长流才是暴击 $LMTS 季2那$2M池子叠wallchain quests,双倍upside,flow real但size small DYOR 谁在跑1.6x-1.8x edge,今天Base上低倍捡cents compounding,timing block cadence log rounds scale confirmed 精确王道,#Base预测venue #1 @trylimitless

撸毛训练营今天的盘面工具分享:EdgenTech实操指南 为什么选@EdgenTech:多市场统一看板(股票+加密),AI信号+实时情报+可操作的报告,背后有EVG HQ、hiFramework、NorthIslandVC支持,信息流干净且高效 核心打法: - 建立主题清单:AI、RWA、Meme、监管、衍生品,关联你跟踪的ticker - 将新闻、链上、期权/永续数据纳入同一条警报,触发后直接看到“事件全貌+可能受影响资产” - 交易纪律:追上下文,不追标题党 示例复盘($DOGE): - Edgen报价:价位~0.259411、流通~151.2B、成交~2.7B、总市值~39.1B - 叙事:从“meme”向“流动性/文化”偏移,支撑0.24-0.25,阻力0.28-0.32 - 驱动:DOJE ETF落地、CleanCore Solutions新增500M DOGE(175M PIPE)、九月资金回流meme赛道 - 风险:未稳上0.30有回撤到0.22-0.20的可能,情绪波动大 上手步骤: 1、注册并选主题 2、为每个主题绑定新闻源+链上+衍生品指标 3、设定阈值与跨市场警报 4、盘前用Crypto Reports做日内计划,盘中用智能提醒执行 链接:t.co/BHOkjKkW2z 实战场景: - 芯片短缺预警出现→自动联动AI/机器人股 - DeFi监管动向→同步你的代币观察清单 PS:有需要我发个人警报模板,评论区见。市场不睡,但我们要用对工具,信息要快、准、连贯。今天把EdgenTech接入你的策略栈,提升一个维度

analog processed 500k gmp messages on testnet last month with zero disputes. that's 100% verifiable time-stamps across 20+ chains using threshold crypto. layerzero hit 15% failure rates on high-volume days last quarter. every other bridge charges 0.1-0.5% per hop killing small de-fi flows. analog's proof-of-time settles free for sub-second data sync. frax locked $50m liquidity there first because the economics finally scale for real multi-chain commerce. developers spent 6 months onboarding to cairo on starknet. analog's watch sdk deploys cross-chain dapps in one api call. no wrappers. no oracles. just unified memory where ethereum and solana read the same event ledger. firestarter already launched 10 ai liquidity pools pulling from both ecosystems. zenswap routes $5m testnet volume weekly without fragmentation drag. builders who stick around build empires. $anlog staking hit 7% apy after the october upgrade. 240m circulating at tge with 40% community allocation. tribe led the $16m round pricing it at $150m fully diluted before mainnet drops q4. balaji advising on the threshold proofs that make ai agents trustless across chains. wallchain's mindshare campaign distributed $50k last snapshot to top yappers like @victoryoungme. 23 days left for batch 2. infrastructure this tight at pre-launch valuation captures the omni-chain meta before it prints $1b tvl. @oneanalog

昨晚的@kloutgg alpha又整了个通宵,哥们们谁顶得住这种节奏啊 我从上周就开始刷shouts,起初就发了个趋势预测的破帖,意外进了前500,领了点quacks积分,现在积分面板看着还行,够换个common NFT了 关键是这玩意儿不光是刷存在感,里面有merge机制,3个common砸一起能升uncommon,power直接翻倍,下轮leaderboard我打算全押K-pop和crypto两条线,早鸟bonus能吃10x,稳了 TGE还有22天,shouts截止11月1号,赶紧去wallchain dashboard瞅瞅自己的排名,别像我上次一样错过vultisig giveaway,那5个WL spots飞了心疼 现在NFT floor稳在0.3 SOL左右,mint后一周卷了900k刀,meteora的流动性一上,估计TGE开盘就拉,社区10k TG日活2k,牛逼哄哄 我这种小散户就爱这种attention economy的活儿,平时doomscrolling X,现在直接变现,预测个#BINANCE热搜都能分pot,爽歪歪 谁还没quack两声?去klout.gg注册,tag@kloutgg发帖,积分来得飞起,gKloutio从今天开始 别等TGE再后悔,alpha testers里前100有500 $KLOUT空投,哥们我昨晚模拟trade,抓了个假趋势,赚了虚拟50刀,真实上线得癫 #KloutGG #gKloutio

벨벳 캐피탈 @Velvet_Capital 의 DeFAI 여정, 솔직히 이게 왜 지금 $0.21에서 아직도 저평가된 느낌이 드는지 이야기해볼까 해요. 2019년 뉴욕에서 시작된 이 프로젝트는, 팀이 7자리 포트폴리오를 직접 굴리다 보니 DeFi의 파편화에 지쳤대요. 체인마다 흩어진 자산 관리, 수동 리밸런싱의 피로... 그로부터 태어난 게 바로 '벨벳 유니콘' AI 시스템이죠. 자연어로 명령 내리면 멀티 에이전트가 시장 분석부터 크로스체인 스왑까지 알아서 처리하는 거예요. - 핵심은 non-custodial 볼트예요. 사용자 자산은 스마트 컨트랙트에 갇혀서 팀 손도 못 대고, $VELVET 스테이킹으로 veVELVET 되면 거버넌스 투표권에 50% 수수료 할인, 심지어 2~6배 젬 멀티플라이어까지 쌓여요. 최근 에폭 4(11월 10일)에서 100만 $VELVET(약 $21만) 드롭 예정이고, 월간 월체인 쵸크스 리더보드에선 $44K씩 100명 + 랜덤 20명 뽑아요. 성장 지표 보니 TVL $3.57M(월 30%↑), 누적 볼륨 $100M+, 사용자 10만 돌파(5월). 비트겟 상장 후 검색량 SOL/BTC 앞지른 게 증거죠. OKX DEX 통합으로 20+ 체인 리퀴디티도 풀렸고, Aethir랑 손잡아 AI 컴퓨트 스케일링 중이에요. - 개인적으로 @Velvet_Capital 앱에서 공공 볼트 하나 띄워봤는데, 에셋 픽부터 수수료 세팅, 화이트리스트까지 10분 만에 온체인 헤지펀드 완성. 다른 사람들이 따라 투자할 수 있게 투명하게 트래킹되니, DeFi랑 펀드 매니지먼트의 브릿지 역할이 딱 느껴지더라고요. 매일 트레이드/스테이크로 젬 쌓다 월말 $VELVET 변환되는 구조가 참여를 강제하는 재미예요. AI가 타이밍 잡아주니, 그냥 꾸준히 플로우 쌓기만 하면 돼요. 이게 바로 DeFAI의 미래: 자동화된 알파 발견, 인텐트 기반 실행으로 슬리피지 50% 줄이고. 아직 $19M 마켓캡에서 $300B 기관 DeFi 노릴 준비 중이니, 어얼리 포지션 잡는 게 현명할 거 같아요. 월체인 쵸크 캠페인(1월 끝) 타고 커뮤니티 빌드업 보니, 채택이 폭발할 분위기. 벨벳의 조용한 컴파운딩, 놓치지 마세요 #DeFAI

starting my day by quacking harder on @wallchain_xyz with Epoch 2 winding down in just a few days, all eyes on @genome_protocol for that $NOME slice you feel it right the buzz around Splice isn't hype it's the shift to real retention where your onchain grind actually compounds no more fading into the noise Splice layers in multi-chain signals from your Hex Hunt runs and Vee Formation plays turning scattered actions into verified loyalty scores that's the edge protocols get cleaner data users get owned footprints they can stake or monetize and on Wallchain it all feeds the leaderboard fire top quackers like @beijingdou stacking 500+ points show how it's done consistent yaps quests and game sessions multiply your shot at that 1.34% $NOME pool I've been diving deep into Edge quests myself unlocked a few multipliers just by chaining Vee drops with daily threads feels like building actual skin in the game not chasing ghosts Genome flips the script on emission leaks circulates value back into ecosystems through PoE verification every quack every hunt every formation strengthens the network long term that's the superchain sauce games spawning mutating forking under DAO eyes with $NOME fueling the retention pools projected to hit $10B by 2028 if the pilots hold and with Splice POC dropping early November you want in on the beta wave grab those Galxe tasks now Edge Runner campaign closes mid-month with NFT airdrops for 50+ pointers Yappers get the nod too spin up threads on Retention Economy snag Yap Points via Kaito redeem at 100:1 for $NOME alpha it's not about volume it's about showing up real @genome_protocol built this for the maxis the ones who stick so if you're locked in gNome say it back pass the quack to your squad let's build that living attention net together

People with Analyst archetype

Dev | Researcher | Web3 | Certified Biochemist | Football ⚽ Lover | Basketball 🏀 Admirer | GRINDING, GOD & GROWTH 📈 |

X CCTV | Engineer & Analyst | E-Commerce Strategist | Passion for Aviation, Current Affairs & Digital Media | Photographer at heart

Diary of quotidian musings about the humanoid botanical garden

Shitposter ||| Researcher ||| Growth ||| Having fun w/ @keypro

Building in Web3 ⚙️ | Smart contract tinkerer | Code, coffee, crypto ☕

🧩 Crypto KOL | DeFi | Narratives | Adoption

#Earn #Binance #Base @guildxyz @KaitoAI @cookiedotfun @BioProtocol

Defi research writer Living with crypto, chasing airdrops daily, using Infofi & Kaito for alpha, farming Cookie, vibing on Yapper – always early to gems 🚀

docs.validator247.com / github.com/Validator247 / Tele: t.me/Validator247 / Mail: validator247@gmail.com

Positional/ Intraday Trader in Nifty50📈Making Charts Very Simple to Read. Saving Many from Tops & Bottoms.📈📊Follow up for Guidance on Financial Literacy.

Explore Related Archetypes

If you enjoy the analyst profiles, you might also like these personality types: