Get live statistics and analysis of 0xMukesh.BNB's profile on X / Twitter

🧩 Crypto KOL | DeFi | Narratives | Adoption

The Analyst

0xMukesh.BNB is a sharp crypto commentator who dives deep into DeFi mechanics and emerging blockchain tech with precision and clarity. Known for breaking down complex narratives into actionable insights, Mukesh educates and influences a savvy audience hungry for the latest in crypto adoption and innovation. His prolific tweeting showcases a relentless pursuit of understanding the moving parts behind lasting liquidity and sustainable yield.

Top users who interacted with 0xMukesh.BNB over the last 14 days

Builder 🏗️ | @KaitoAI Onchain Thinker | Digital nomad NFTs • Art • Metaverse

yêu mèo , thích mỹ nữ , đam mê huyền học #BTC

🎣 Be cool, stay cool, don't get lost. If you are lost, stay cool.

ValidatorVN delivers high-performance, security-focused validator services with a strong commitment to supporting proof-of-stake networks.

✨ Writing about DeFi, NFTs & the next big narratives.

Web3猎手 | Deifi和RWA代币化狂热份子| 分享最新Web3撸毛趋势与教程,带你轻松入门 | $BTC $ETH Hodler

Projects Construction Warrior|Digital Artist & Content Strategist @megaeth

Crafting stories in Web3 & AI. Driven by a Steel Mind, guided by Steel Moves.

BD at @Nimo_Web3 🐟 ✨ 🇻🇳 Creator at @Econstellation_ @Ronin_Network

专门猎捕空投| Yapper Kaito | 持有以太坊和比特币

Quacker @wallchain #kaitoAi #wallchain #RIVER #yap

Love MMO and sharing information about crypto

Challenge yourself and conquer the world of cryptocurrencies Take control of the world of cryptocurrencies!

Mukesh tweets so much crypto geekery that half his followers probably need a dictionary app just to keep up—bring a translator or you’re just swimming in a sea of ve(3,3) and TP/SL markers with no life raft in sight.

Successfully dissected and popularized the nuanced benefits of ve(3,3) protocol design on the $SUI network, helping rally a community around more sustainable liquidity models that resist typical DeFi churn.

Mukesh’s life purpose is to demystify decentralized finance and on-chain innovation, empowering his community to make smarter, data-driven decisions in the evolving crypto landscape. By bridging technical knowledge with accessible storytelling, he fosters adoption and contributes to the growth of Web3 ecosystems.

He values transparency, precision, and long-term sustainability within the crypto space. Mukesh believes in leveraging technology to reduce friction, increase accessibility, and champion innovation through collaborative and informed participation rather than hype.

His deep analytical skills and ability to translate on-chain metrics into digestible insights make him a trusted voice in the crypto community. His engagement with advanced concepts such as ve(3,3) mechanics and real-time liquidations positions him as a go-to expert for nuanced crypto narratives.

Mukesh’s high tweet volume combined with technical jargon might overwhelm casual followers or new entrants to crypto who crave simplicity and broader context. Sometimes, his content favors depth at the expense of wider audience accessibility.

To grow his audience on X, Mukesh should sprinkle in more beginner-friendly content that introduces core concepts alongside his expert-level tweets. Creating engaging threads that tell simple stories about complex DeFi innovations can attract a broader follower base while retaining his knowledgeable core audience.

Fun fact: Mukesh doesn’t just talk DeFi, he tracks and analyzes real-time protocol data, like batch swaps and staking flows, breaking new ground on how durable liquidity is built and maintained on chains like SUI and BNB.

Top tweets of 0xMukesh.BNB

Think of a co‑op vs a flash sale: one aligns members, the other churns On $SUI, @MMTFinance tackles short‑term farming with ve(3,3): lock, vote, earn fees and bribes while protocols bid for liquidity @buidlpad fixes access: KYC, anti‑Sybil, participation‑ratio allocations, 100% TGE in SUI/BNB/USD1 for $MMT Overlooked detail: Sui PTBs batch swaps, staking, and LP into one flow, cutting friction for newcomers and squads This is how durable liquidity gets built

Rainbow just flipped the script on perp visuals with real-time liq price overlays and TP/SL markers that actually make sense mid-trade. @rainbowdotme's Oct 20 drop turns those chaotic Hyperliquid charts into something you can glance at without squinting. I dug into the release notes + tested on $MEGA (3x leverage live now): the color-coded zones flag exact liquidation bands pulled from on-chain oracles, so you spot overleverage before it bites. ❯ What changed: Legacy perps hid liq in fine print; Rainbow surfaces it natively with auto-zoom on your position. ❯ Proof it's sticky: 40x leverage feels safer when the app whispers "you're good" via green gradients. ❯ Edge case win: Works cross-chain (Base/Optimism) without lag spikes. My take: This nudges more degens toward mobile perps over desktop drudgery stack points while you trade, airdrop snapshot looms Q4. If you're not rainbowmaxxing yet, tomorrow's Chonks icon mint closes the loop on custom vibes. $RNBW season incoming

The @Theo_Network x @KaitoAI leaderboard dropped today, channeling onchain capital straight into real-world assets with a creator twist. Theo bridges global markets to blockchain, but this setup layers in mindshare metrics that reward actual influence over volume alone. Key factors for the 0.05% THEO supply pot: ❯ Usage points from platform interactions ❯ Social engagement on Theo content ❯ Your follower growth tied to yaps ❯ 5% KAITO stake multiplier for edge Plus 50K $THBILL monthly to top 100 across regions global, CN, KR splits keep it inclusive. For creators, stake early and track your Theo-specific yaps; the algo favors consistent builders over one-offs. RWAs need voices like this to scale beyond treasuries. Climb in before the pool deepens

Real-time awareness wins markets ❯ If you're building HFT: simulate 100 txns/day, instrument latency dashboards, tie alerts to on-chain triggers ❯ If you trade: use testnet fills, monitor dynamic risk feeds, pre-position size where alerts fire sub-40ms Snapshot Nov 1 for Flames join @FogoChain #Web3

ai onchain just found a home mainnet parallel exec at ~10k tps rewrites throughput playbooks deifi reprice incoming vaults re-lever, pockets of 30 45% APR show up as liquidity chases real yield airdrop signals active, leaderboard noise hides the silent builders track tx graphs, vouch rings, infra commits and agent infra if you’re farming, pivot to builder signals and long-term APY sustainability on @monad

gm ct Agents that learn your moods, remember your moves, and make you money @Kindred_AI builds tokenized AI companions for games, shopping, XR owned, tradable, monetizable • Emotion Engine + Memory Core + AI Runner • 2M+ waitlist, onboarding via @thirdweb, strong on-chain traction on @SeiNetwork This is the $KIN agent economy. Position accordingly

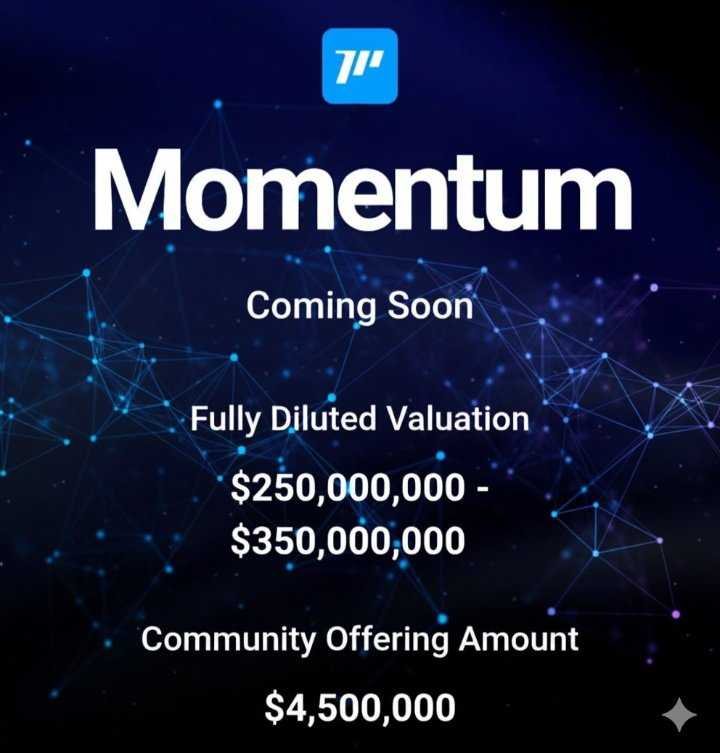

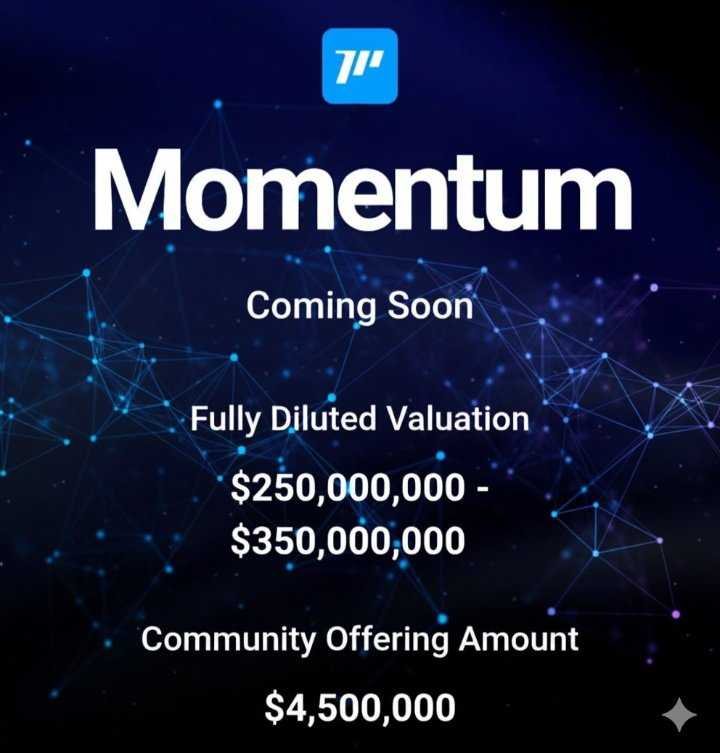

➥ watching @MMTFinance x @buidlpad because coordination > hype ▸ $MMT runs Sui’s money flow: CLMM depth, PTBs, vaults, veMMT, xSUI + MSafe for institutional‑grade ops ▸ BuidlPad handles fair access: KYC, anti‑Sybil, ratio‑based allocation, priority slots for UGC squads launch → list → liquidity in one loop. claim/TGE next week, snapshot window closing fast. builders list on BuidlPad, traders park size on Momentum. pick your lane, own the flow #Sui #DeFi #Buidlpad

Tiebout sorting hits crypto like a stealth upgrade folks self-selecting into alpha zones via prefs, no more forced-fit noise. @EdgenTech ports that '56 econ hack straight to 2025 chains: cheap feeds from CoinGecko thru SEC filings, agents slicing themes without bleedover TA-Lib signals + API liquidity + sentiment waves fusing seamless in multi-agent stacks. Traders ballot their bags into risk-tuned portfolios, shedding solo silos for collective edge Spin up 30-asset beasts: tag watchlists, conviction-score holds, EDGM paths laser A+ entries on AI-vetted nods. Full transparency each Edgen stack mirrors voted market truth, no fog Aura snap pre-Oct 30? Free tier grabs 2 pods, Pro unleashes 10. $HYPE sharpening blades this run #EdgenPortfolios t.co/s2IFx6rF77

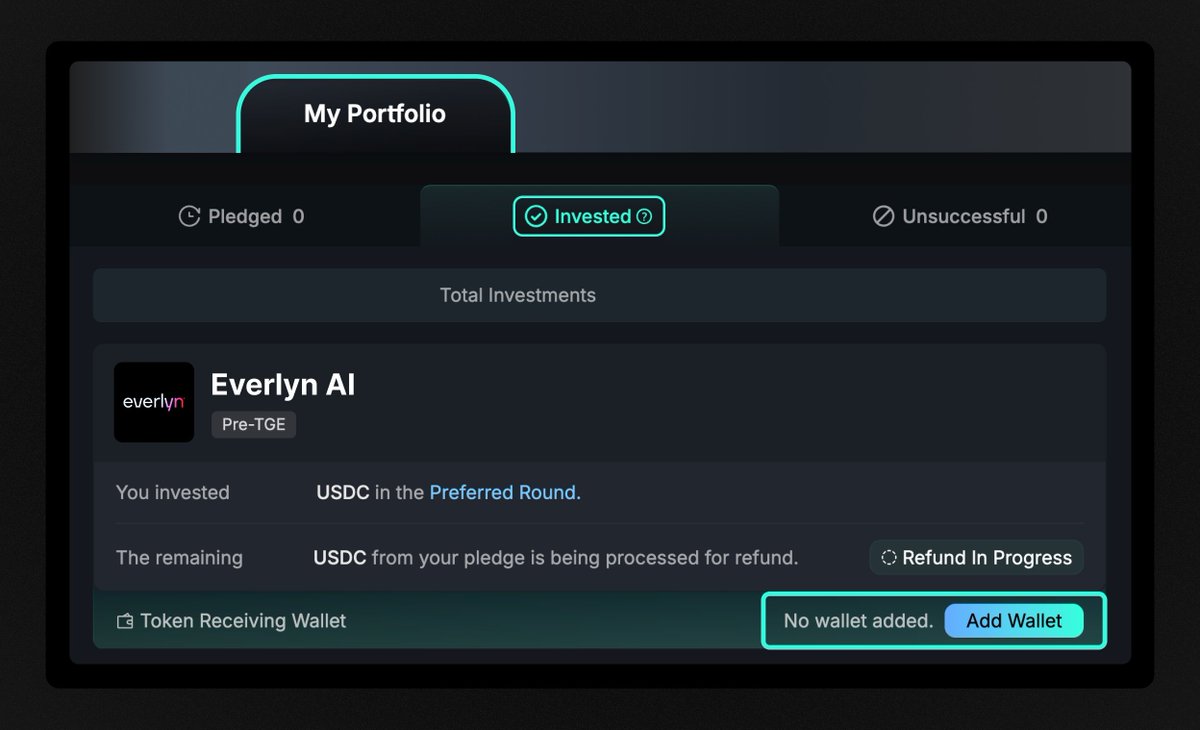

Liquidity uptime just flipped the DeFi script for real yields @multiplifi routes idle rewards straight into active pools, turning protocol survival into compounding edge over volatile APYs. ❯ Receipts: CEO shaaran’s reward poll wraps in ~10h, tallying votes on channeling emissions to high-motion liquidity live on snapshot, 70%+ leaning toward phased rollout. ❯ Proof it compounds: leaderboard S2 ties $TURTLE vesting (70% TGE unlock above 1700) to consistent deposits, rotating funds across Katana/@solsticefi for diversified uptime plays. ❯ Under the hood: every cycle endured stacks credibility, verifier-gated rebalances keep slippage low while guardian rails cap downside. --- My read after scanning the poll + mechanics: edge lives in motion, not mints @multiplifi’s design survives resets where others flash-crash, baking trust into TVL flywheels. Quick play: stake early post-poll, target 12-wk vest for alpha, then hedge via @Infinit_Labs S3 yaps for $IN boosts. If uptime holds through Q4 volatility, this becomes the quiet TVL magnet no one sees coming.

Seedless MPC/TSS vaults = custody 2.0 Shards keys across devices phishing‑resistant UX without seed phrases Hot‑wallet speed with institutional guarantees Plugin marketplace to power AI agents automating DCA, swaps, treasury routing ops on autopilot Launch week: WL Oct 27 (12:00 UTC), public + Kraken Oct 28, surprise Oct 29 Token: 80% community/LP, staking from protocol fees, up to 70% discounts; $3M FDV WL vs $70M prior alignment > hype Leaderboard top500 connect your vault & climb before snapshot @vultisig #Web3 DYOR

<10 seconds to $15M hardcap. That's not a raise that's a conviction tsunami hitting the pad. OP captured the exact degen nightmare: double alarms, phone + PC primed, hand on confirm... brain glitch, one video + two messages, back to red screen, full, refreshed five times thinking lag. Reality: evaporated. Tail-end crumbs only, missed tier + NFT. Pure pain. But zoom out this is the loudest demand signal we've seen on Kaito all cycle. @bitdealernet didn't just launch a pledge phase. They detonated one. Why every metric screams structural alpha: ❯ Hardcap locked at $15M no greedy upsizes, no dilution surprises. ❯ <10s fill on strategic = whales moving faster than bots, zero hesitation. ❯ Oversubscribed 15x in <24h, pushing individual allocations lower = cleaner distribution, explosive launch convexity. ❯ 7-day refund window kills dump fear dead participants hold or exit clean, no forced paper hands. ❯ Retail-first pricing: public matches strategic at $0.035 / 35M FDV, seed pays double with cliffs. ❯ Revenue engine already live 1,700+ casinos spinning, 100% profits buying back graduated tokens + $BIT. This isn't meme hype. It's the first launchpad where every spin compounds the floor. Bonding curves → instant liquidity → game dev funded → real players → perpetual buy pressure. Meteora/Jupiter backing means day-1 routing everywhere. Team shipped transparency while others hide behind NDAs. Net take: pledge window still open, 6 days left, but momentum says tomorrow it's done. If you believe asset-backed memes are the next meta, this is ground zero. Who's locking final allocation before the door slams? @bitdealernet building the casino that pays holders forever

Not just another DePIN tease this is an actual allocation that moves wallets 0.6% to yappers is not DIY marketing math; with ~10.8K active yaps that’s meaningful per head, and weighted 7D/12M + leaderboard tilts turn casual into outsized winners 52x ZK ASIC accel, 10x energy wins, 7M+ proofs, dual-token stack ($CYS utility, $CGT governance) = compute yields that flip idle silicon into recurring value If you build or run nodes, stack before Dec TGE Rare node alpha #ComputeFi Bullish $CYS @cysic_xyz

AlphaVault from @TheoriqAI flips the script on volatility: AI agents spot regime shifts hours ahead, slam the brakes on leverage, and reroute to safer yields before the storm hits. Zero liquidations in sims, ETH-positive through crashes Guardian's circuit breaker enforces that edge without the guesswork. Stake $THQ to back top performers; 26x oversubscribed on Kaito screams demand. Q4 drops full vaults and TGE, layering DeFAI with @mellowprotocol for custody-kept gains. --- ❯ Scan your LP exposure: if it's >20% vol, test a mini-delegation to an Alpha agent ❯ Track via dashboard every tweak logs transparent, no black box ❯ Expo cred at Veloza? That's the signal retail's leveling up Net take: Theoriq standardizes AI discipline for onchain flows, turning "hope for the best" into engineered resilience. I'm eyeing how TGE liquidity plays out, but the agent swarm's already rewriting risk.

this is the leap from pattern matching to social minds mindgames + determinism = auditable agency fixed seeds, transparent logs verifiable choices, not TPS LiveCodeBench Pro forces real-time, tight-memory reasoning with deterministic judges GRID + Sentient Chat + OML fingerprints = loyal, verifiable open AGI watch them reason, negotiate, adapt imagine millions of on-chain agents with receipts @SentientAGI #Web3Community gSenti frens

Most engaged tweets of 0xMukesh.BNB

Think of a co‑op vs a flash sale: one aligns members, the other churns On $SUI, @MMTFinance tackles short‑term farming with ve(3,3): lock, vote, earn fees and bribes while protocols bid for liquidity @buidlpad fixes access: KYC, anti‑Sybil, participation‑ratio allocations, 100% TGE in SUI/BNB/USD1 for $MMT Overlooked detail: Sui PTBs batch swaps, staking, and LP into one flow, cutting friction for newcomers and squads This is how durable liquidity gets built

Rainbow just flipped the script on perp visuals with real-time liq price overlays and TP/SL markers that actually make sense mid-trade. @rainbowdotme's Oct 20 drop turns those chaotic Hyperliquid charts into something you can glance at without squinting. I dug into the release notes + tested on $MEGA (3x leverage live now): the color-coded zones flag exact liquidation bands pulled from on-chain oracles, so you spot overleverage before it bites. ❯ What changed: Legacy perps hid liq in fine print; Rainbow surfaces it natively with auto-zoom on your position. ❯ Proof it's sticky: 40x leverage feels safer when the app whispers "you're good" via green gradients. ❯ Edge case win: Works cross-chain (Base/Optimism) without lag spikes. My take: This nudges more degens toward mobile perps over desktop drudgery stack points while you trade, airdrop snapshot looms Q4. If you're not rainbowmaxxing yet, tomorrow's Chonks icon mint closes the loop on custom vibes. $RNBW season incoming

The @Theo_Network x @KaitoAI leaderboard dropped today, channeling onchain capital straight into real-world assets with a creator twist. Theo bridges global markets to blockchain, but this setup layers in mindshare metrics that reward actual influence over volume alone. Key factors for the 0.05% THEO supply pot: ❯ Usage points from platform interactions ❯ Social engagement on Theo content ❯ Your follower growth tied to yaps ❯ 5% KAITO stake multiplier for edge Plus 50K $THBILL monthly to top 100 across regions global, CN, KR splits keep it inclusive. For creators, stake early and track your Theo-specific yaps; the algo favors consistent builders over one-offs. RWAs need voices like this to scale beyond treasuries. Climb in before the pool deepens

Tiebout sorting hits crypto like a stealth upgrade folks self-selecting into alpha zones via prefs, no more forced-fit noise. @EdgenTech ports that '56 econ hack straight to 2025 chains: cheap feeds from CoinGecko thru SEC filings, agents slicing themes without bleedover TA-Lib signals + API liquidity + sentiment waves fusing seamless in multi-agent stacks. Traders ballot their bags into risk-tuned portfolios, shedding solo silos for collective edge Spin up 30-asset beasts: tag watchlists, conviction-score holds, EDGM paths laser A+ entries on AI-vetted nods. Full transparency each Edgen stack mirrors voted market truth, no fog Aura snap pre-Oct 30? Free tier grabs 2 pods, Pro unleashes 10. $HYPE sharpening blades this run #EdgenPortfolios t.co/s2IFx6rF77

Seedless MPC/TSS vaults = custody 2.0 Shards keys across devices phishing‑resistant UX without seed phrases Hot‑wallet speed with institutional guarantees Plugin marketplace to power AI agents automating DCA, swaps, treasury routing ops on autopilot Launch week: WL Oct 27 (12:00 UTC), public + Kraken Oct 28, surprise Oct 29 Token: 80% community/LP, staking from protocol fees, up to 70% discounts; $3M FDV WL vs $70M prior alignment > hype Leaderboard top500 connect your vault & climb before snapshot @vultisig #Web3 DYOR

<10 seconds to $15M hardcap. That's not a raise that's a conviction tsunami hitting the pad. OP captured the exact degen nightmare: double alarms, phone + PC primed, hand on confirm... brain glitch, one video + two messages, back to red screen, full, refreshed five times thinking lag. Reality: evaporated. Tail-end crumbs only, missed tier + NFT. Pure pain. But zoom out this is the loudest demand signal we've seen on Kaito all cycle. @bitdealernet didn't just launch a pledge phase. They detonated one. Why every metric screams structural alpha: ❯ Hardcap locked at $15M no greedy upsizes, no dilution surprises. ❯ <10s fill on strategic = whales moving faster than bots, zero hesitation. ❯ Oversubscribed 15x in <24h, pushing individual allocations lower = cleaner distribution, explosive launch convexity. ❯ 7-day refund window kills dump fear dead participants hold or exit clean, no forced paper hands. ❯ Retail-first pricing: public matches strategic at $0.035 / 35M FDV, seed pays double with cliffs. ❯ Revenue engine already live 1,700+ casinos spinning, 100% profits buying back graduated tokens + $BIT. This isn't meme hype. It's the first launchpad where every spin compounds the floor. Bonding curves → instant liquidity → game dev funded → real players → perpetual buy pressure. Meteora/Jupiter backing means day-1 routing everywhere. Team shipped transparency while others hide behind NDAs. Net take: pledge window still open, 6 days left, but momentum says tomorrow it's done. If you believe asset-backed memes are the next meta, this is ground zero. Who's locking final allocation before the door slams? @bitdealernet building the casino that pays holders forever

gm ct Agents that learn your moods, remember your moves, and make you money @Kindred_AI builds tokenized AI companions for games, shopping, XR owned, tradable, monetizable • Emotion Engine + Memory Core + AI Runner • 2M+ waitlist, onboarding via @thirdweb, strong on-chain traction on @SeiNetwork This is the $KIN agent economy. Position accordingly

➥ watching @MMTFinance x @buidlpad because coordination > hype ▸ $MMT runs Sui’s money flow: CLMM depth, PTBs, vaults, veMMT, xSUI + MSafe for institutional‑grade ops ▸ BuidlPad handles fair access: KYC, anti‑Sybil, ratio‑based allocation, priority slots for UGC squads launch → list → liquidity in one loop. claim/TGE next week, snapshot window closing fast. builders list on BuidlPad, traders park size on Momentum. pick your lane, own the flow #Sui #DeFi #Buidlpad

Real-time awareness wins markets ❯ If you're building HFT: simulate 100 txns/day, instrument latency dashboards, tie alerts to on-chain triggers ❯ If you trade: use testnet fills, monitor dynamic risk feeds, pre-position size where alerts fire sub-40ms Snapshot Nov 1 for Flames join @FogoChain #Web3

ai onchain just found a home mainnet parallel exec at ~10k tps rewrites throughput playbooks deifi reprice incoming vaults re-lever, pockets of 30 45% APR show up as liquidity chases real yield airdrop signals active, leaderboard noise hides the silent builders track tx graphs, vouch rings, infra commits and agent infra if you’re farming, pivot to builder signals and long-term APY sustainability on @monad

this is the leap from pattern matching to social minds mindgames + determinism = auditable agency fixed seeds, transparent logs verifiable choices, not TPS LiveCodeBench Pro forces real-time, tight-memory reasoning with deterministic judges GRID + Sentient Chat + OML fingerprints = loyal, verifiable open AGI watch them reason, negotiate, adapt imagine millions of on-chain agents with receipts @SentientAGI #Web3Community gSenti frens

Liquidity uptime just flipped the DeFi script for real yields @multiplifi routes idle rewards straight into active pools, turning protocol survival into compounding edge over volatile APYs. ❯ Receipts: CEO shaaran’s reward poll wraps in ~10h, tallying votes on channeling emissions to high-motion liquidity live on snapshot, 70%+ leaning toward phased rollout. ❯ Proof it compounds: leaderboard S2 ties $TURTLE vesting (70% TGE unlock above 1700) to consistent deposits, rotating funds across Katana/@solsticefi for diversified uptime plays. ❯ Under the hood: every cycle endured stacks credibility, verifier-gated rebalances keep slippage low while guardian rails cap downside. --- My read after scanning the poll + mechanics: edge lives in motion, not mints @multiplifi’s design survives resets where others flash-crash, baking trust into TVL flywheels. Quick play: stake early post-poll, target 12-wk vest for alpha, then hedge via @Infinit_Labs S3 yaps for $IN boosts. If uptime holds through Q4 volatility, this becomes the quiet TVL magnet no one sees coming.

low-key truth: nostalgia + agentic ai is the product edge few teams can actually ship how @Kindred_AI is doing it • early distribution + real mindshare gains (top 50 momentum) • infra-first play keeps builders from rage-quitting • engagement loops that compound momentum = moat expect allocation tools, surprise drops and partnerships; time it right and mindshare could 3x frens, this feels like a new era

AlphaVault from @TheoriqAI flips the script on volatility: AI agents spot regime shifts hours ahead, slam the brakes on leverage, and reroute to safer yields before the storm hits. Zero liquidations in sims, ETH-positive through crashes Guardian's circuit breaker enforces that edge without the guesswork. Stake $THQ to back top performers; 26x oversubscribed on Kaito screams demand. Q4 drops full vaults and TGE, layering DeFAI with @mellowprotocol for custody-kept gains. --- ❯ Scan your LP exposure: if it's >20% vol, test a mini-delegation to an Alpha agent ❯ Track via dashboard every tweak logs transparent, no black box ❯ Expo cred at Veloza? That's the signal retail's leveling up Net take: Theoriq standardizes AI discipline for onchain flows, turning "hope for the best" into engineered resilience. I'm eyeing how TGE liquidity plays out, but the agent swarm's already rewriting risk.

People with Analyst archetype

Tracking smart money & market rotations since 2021. DeFi analyst | Market psychology enthusiast.

Dev | Researcher | Web3 | Certified Biochemist | Football ⚽ Lover | Basketball 🏀 Admirer | GRINDING, GOD & GROWTH 📈 |

X CCTV | Engineer & Analyst | E-Commerce Strategist | Passion for Aviation, Current Affairs & Digital Media | Photographer at heart

Diary of quotidian musings about the humanoid botanical garden

Shitposter ||| Researcher ||| Growth ||| Having fun w/ @keypro

Building in Web3 ⚙️ | Smart contract tinkerer | Code, coffee, crypto ☕

#Earn #Binance #Base @guildxyz @KaitoAI @cookiedotfun @BioProtocol

Defi research writer Living with crypto, chasing airdrops daily, using Infofi & Kaito for alpha, farming Cookie, vibing on Yapper – always early to gems 🚀

docs.validator247.com / github.com/Validator247 / Tele: t.me/Validator247 / Mail: validator247@gmail.com

Explore Related Archetypes

If you enjoy the analyst profiles, you might also like these personality types: