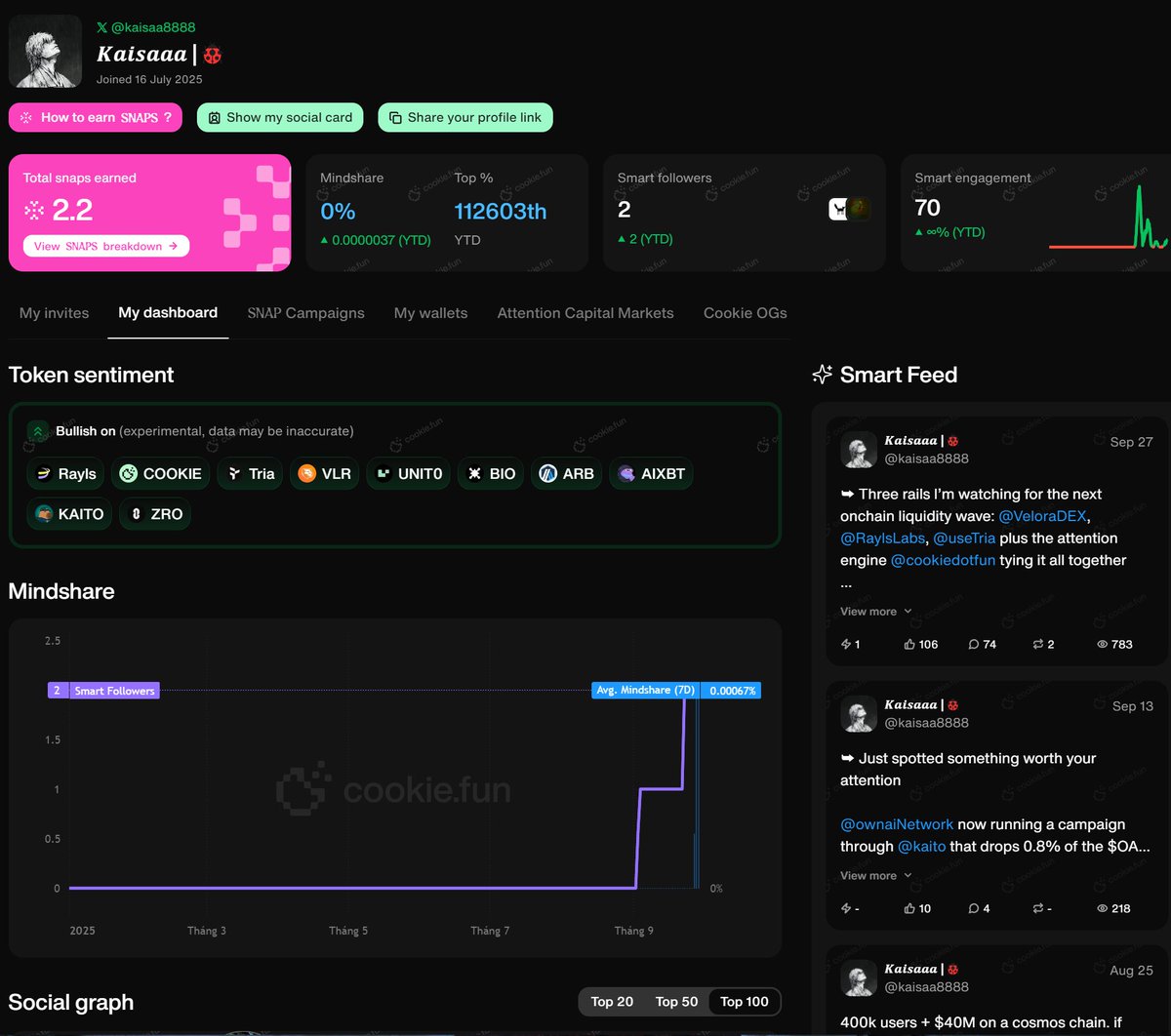

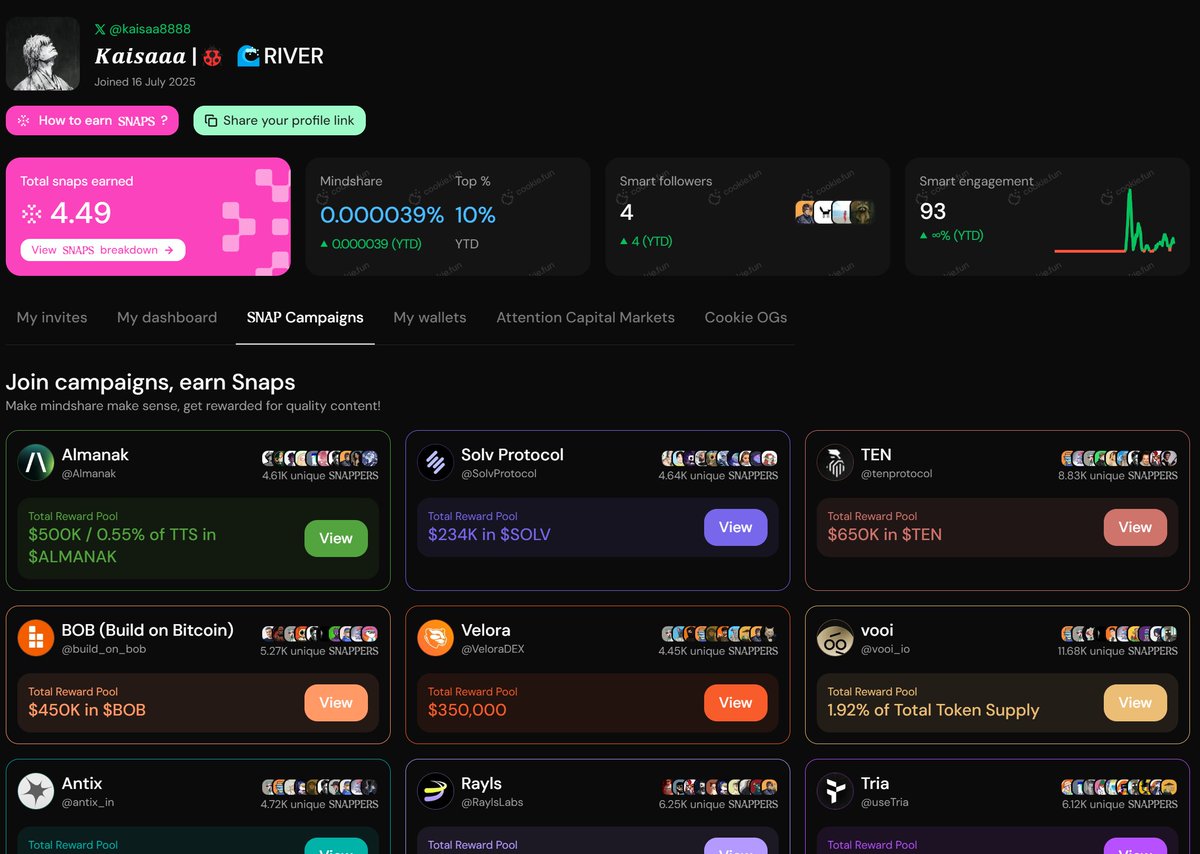

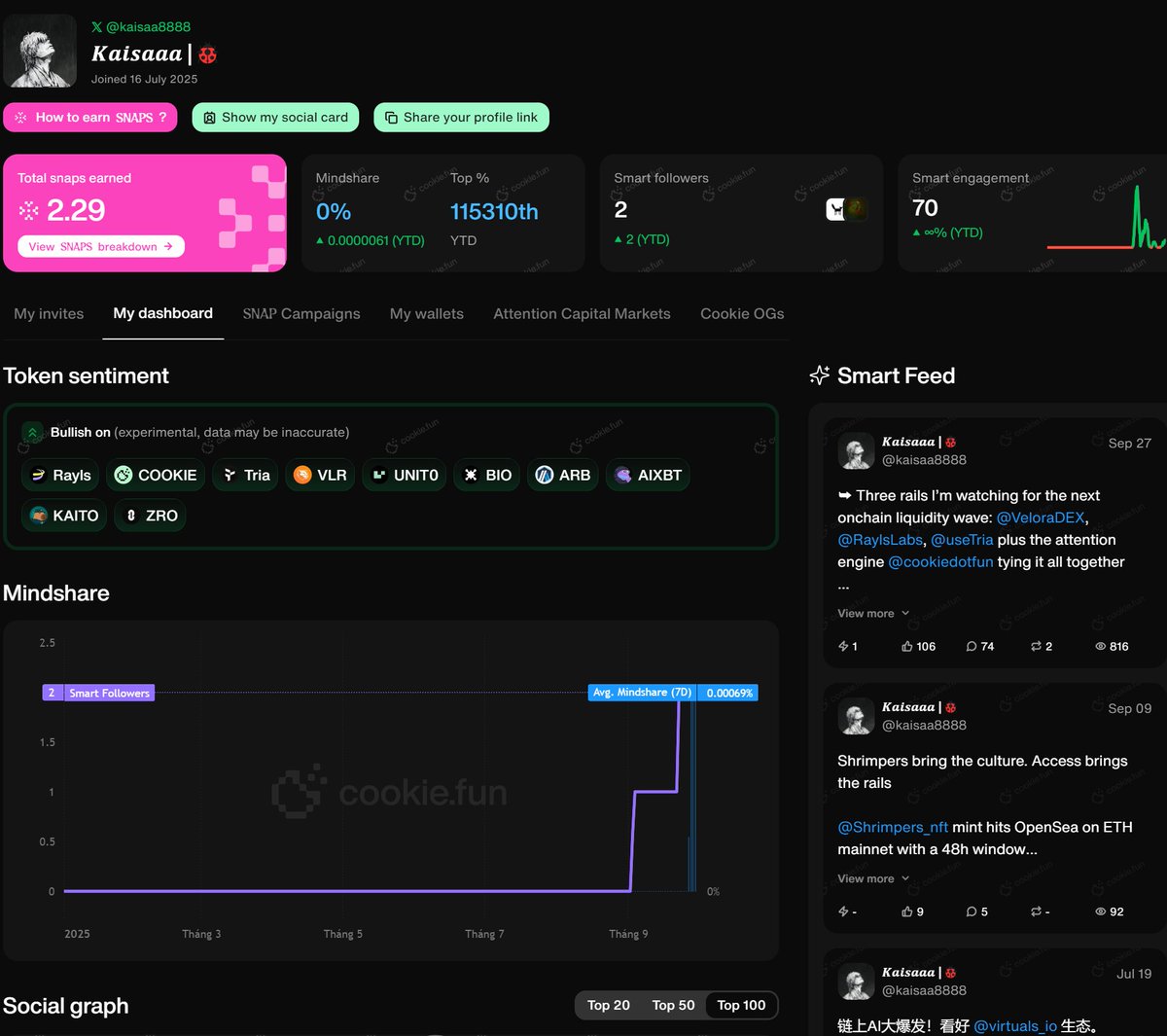

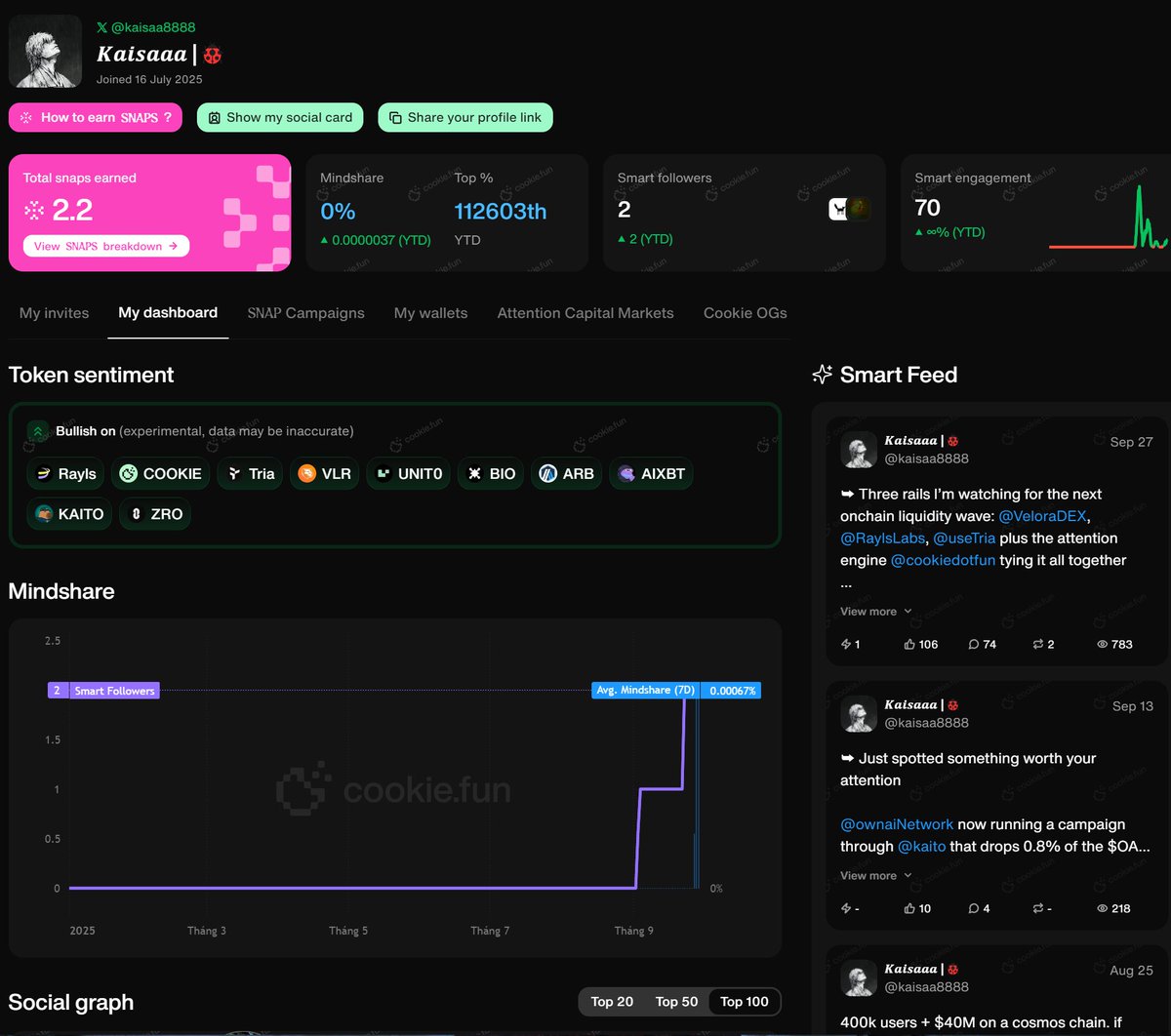

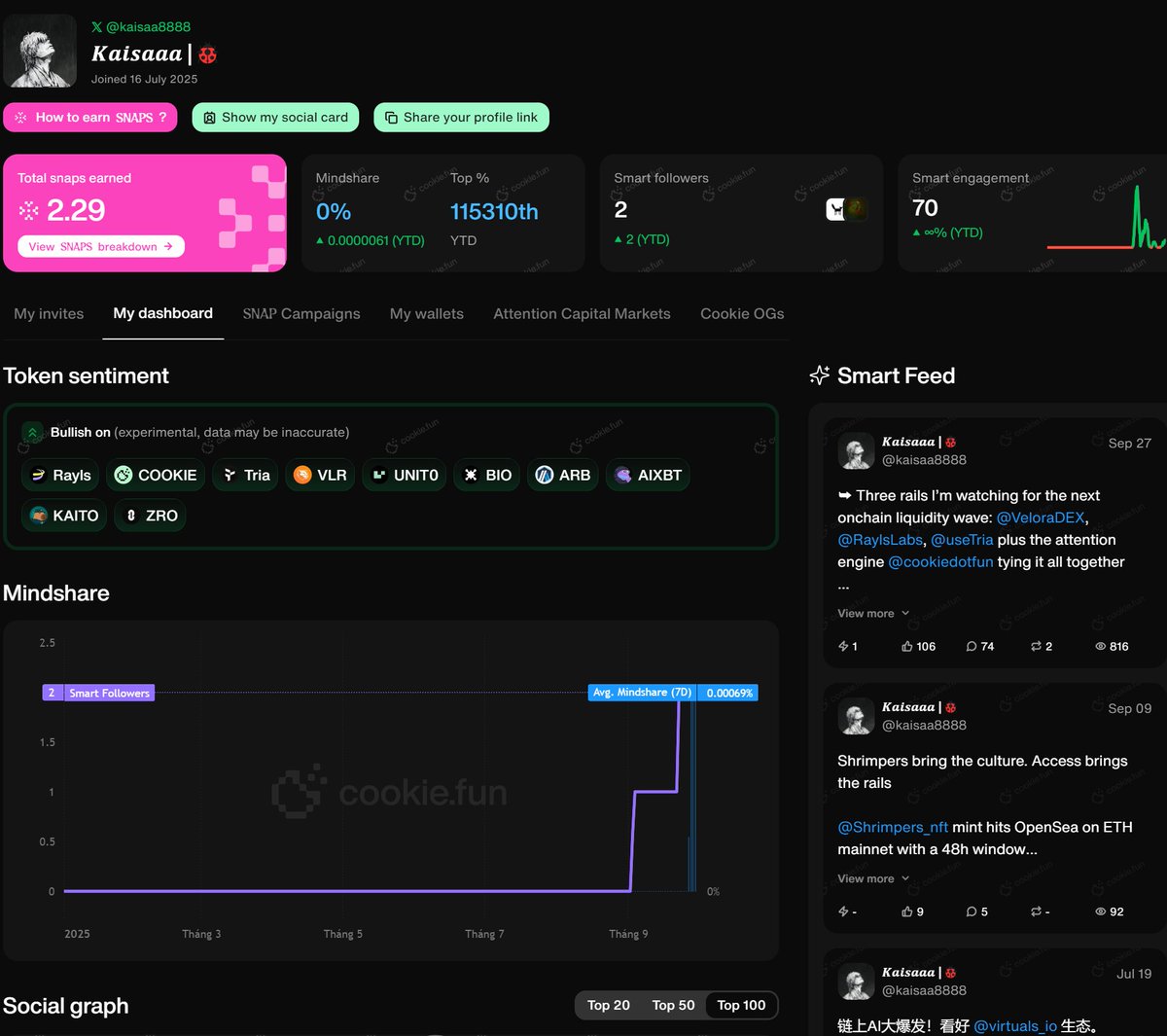

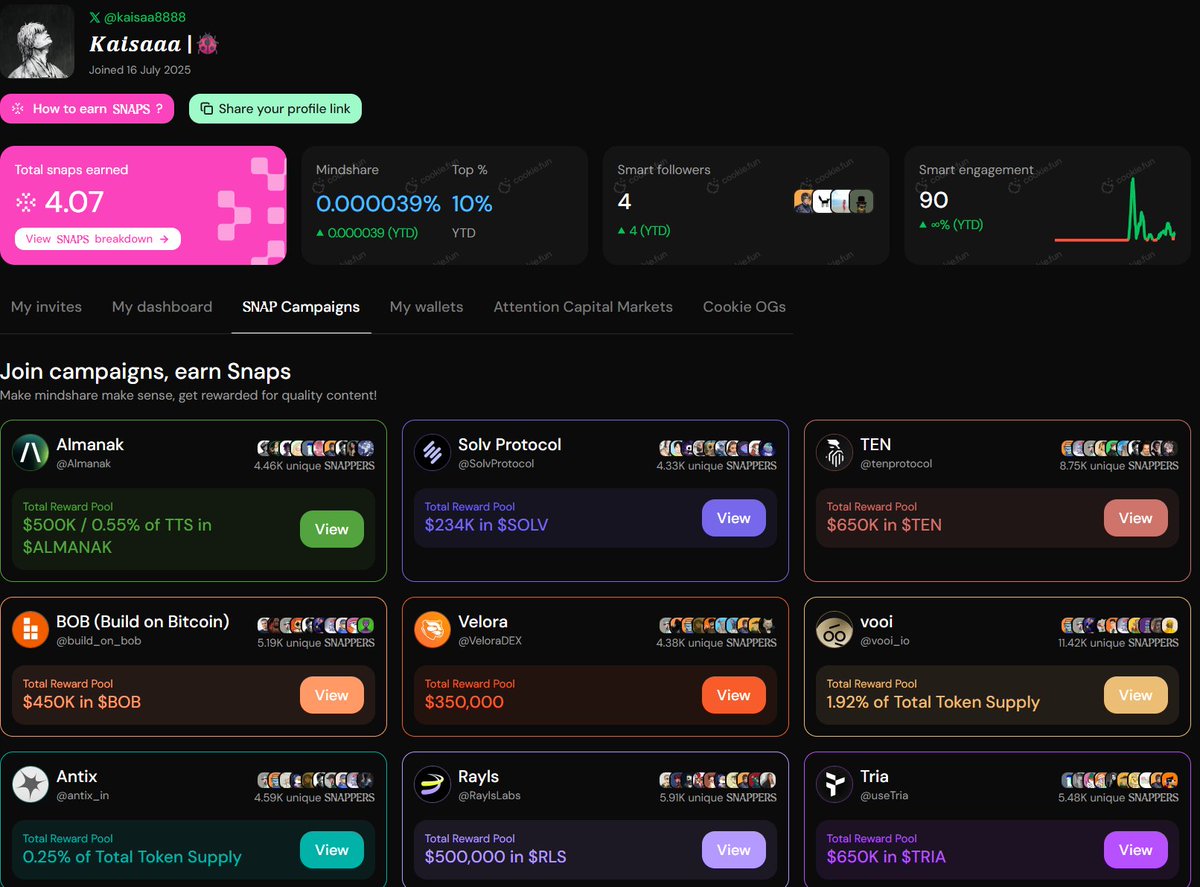

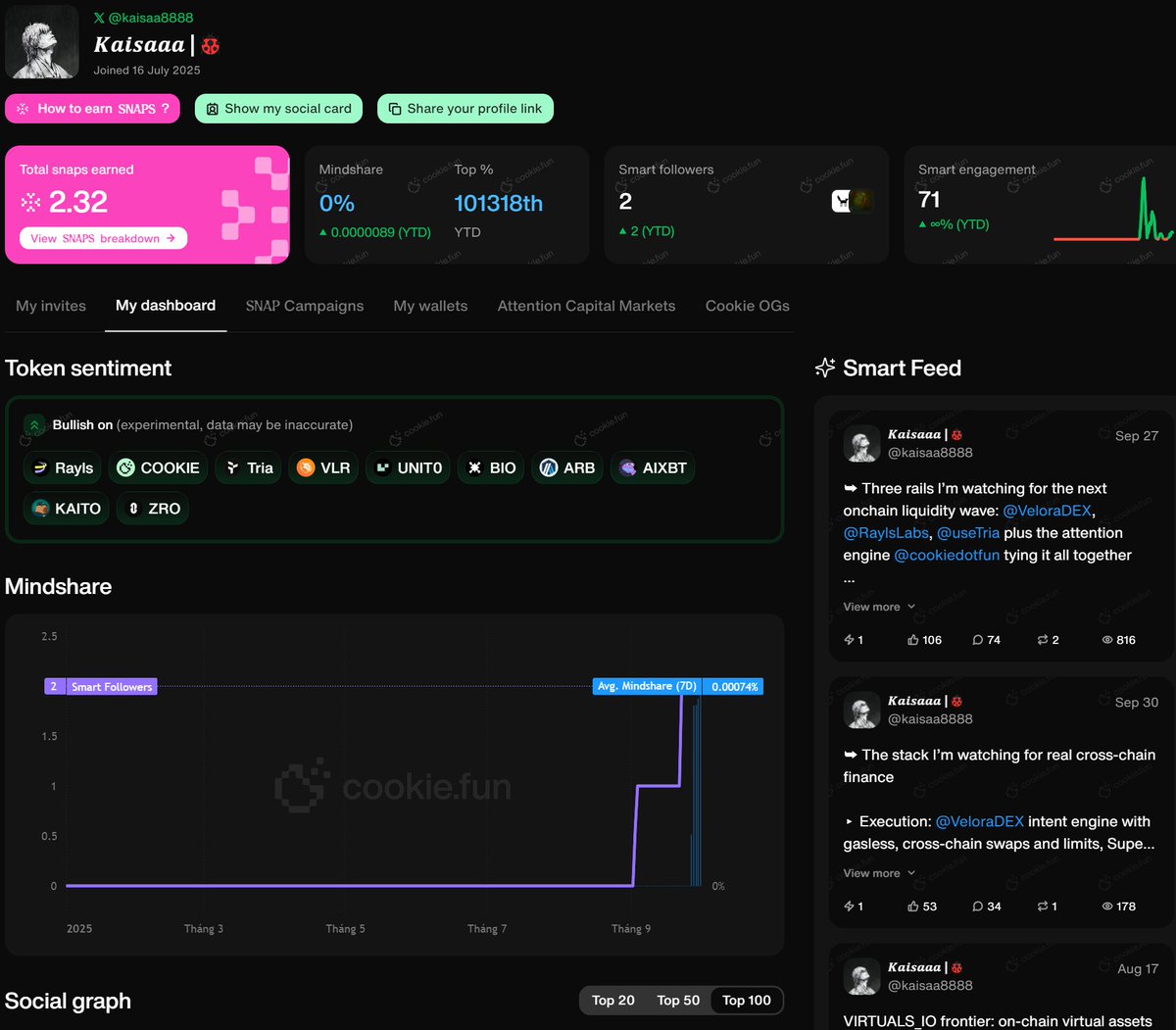

Get live statistics and analysis of 𝑲𝒂𝒊𝒔𝒂𝒂𝒂 |🐞 🌊RIVER's profile on X / Twitter

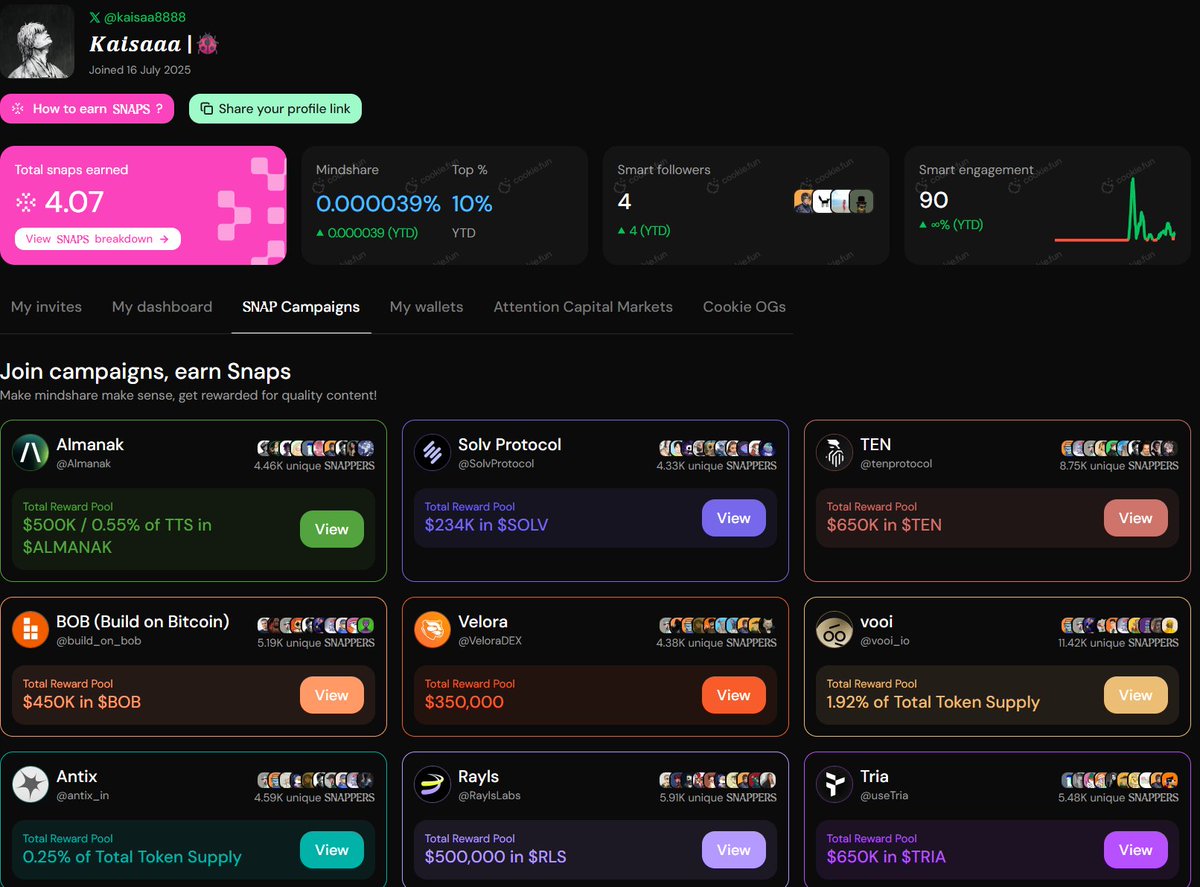

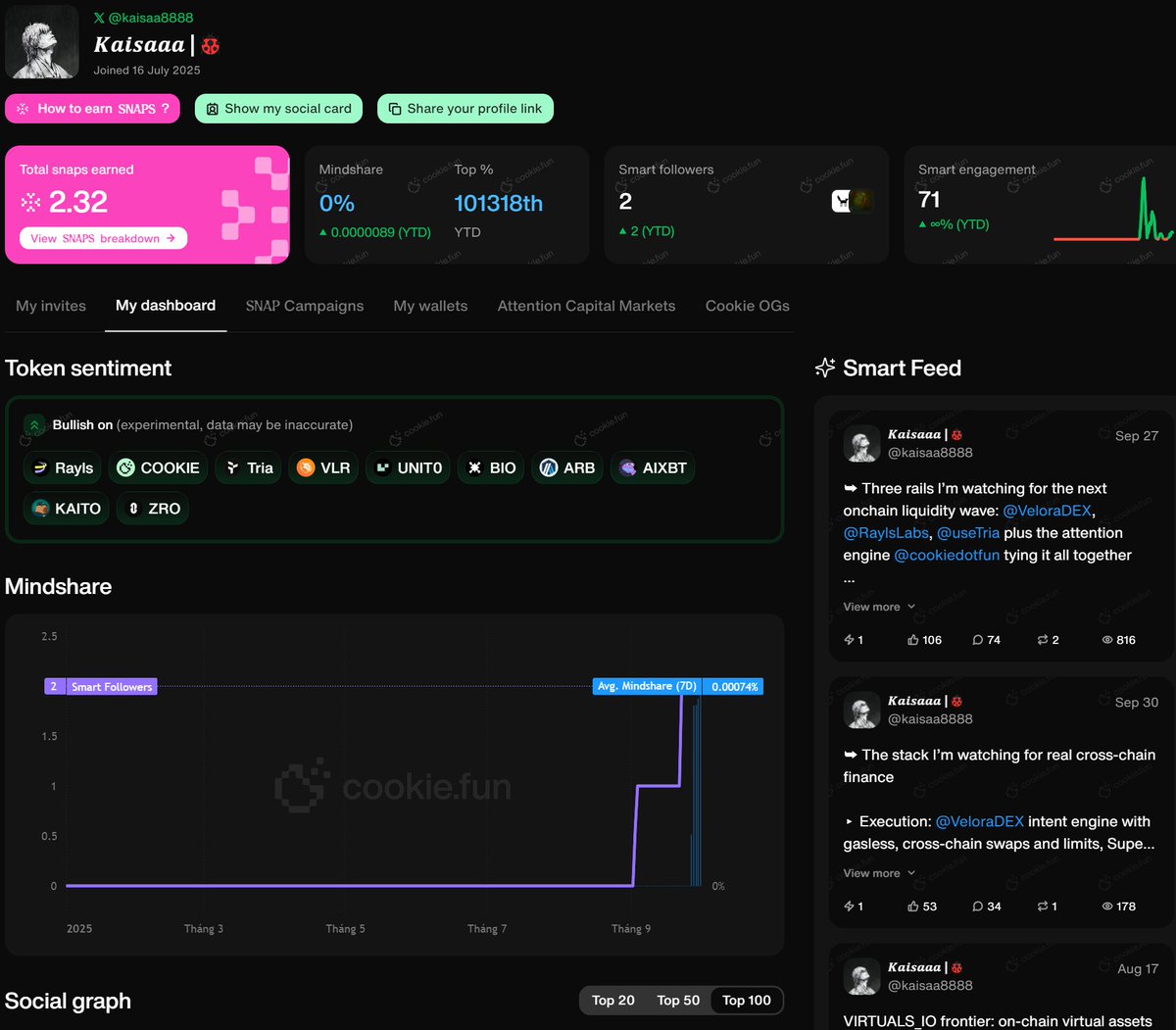

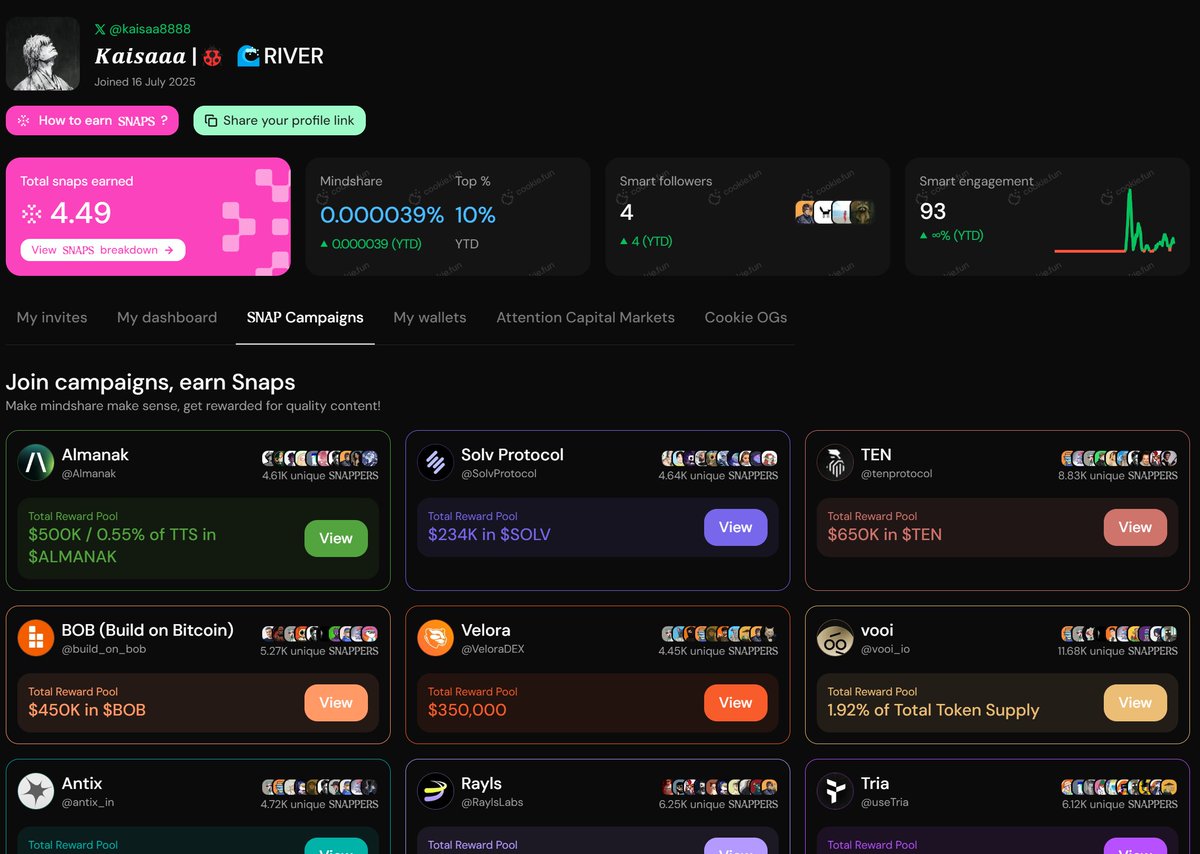

#Earn #Binance #Base @guildxyz @KaitoAI @cookiedotfun @BioProtocol

The Analyst

𝑲𝒂𝒊𝒔𝒂𝒂𝒂 |🐞 🌊RIVER is a deeply strategic thinker in the Web3 and DeFi space who thrives on breaking down complex onchain stacks with precision and clarity. Their tweets seamlessly blend technical insights with actionable tactics, creating a rich dialogue around cross-chain finance and institutional-ready infrastructure. With an analytical mind, they curate the future of DeFi through layered execution, compliance, and liquidity frameworks.

Top users who interacted with 𝑲𝒂𝒊𝒔𝒂𝒂𝒂 |🐞 🌊RIVER over the last 14 days

Hi I'm Igris 🦅🟠

🧙♂️ Builder @L2Project | Base enjoyoor @MorphLayer

十年韭龄,百次爆仓。 别人走K线,我跳霹雳舞。 链上不死,小老不崩。

we have to decide is what to do with the time that is given us

Content creator | Yapper | Quacker | $WLFI $KAITO holder

𝑲𝒂𝒊𝒔𝒂𝒂𝒂 tweets so much technical detail that even a blockchain oracle would ask for a TL;DR — it’s like they’re writing a PhD thesis on DeFi mid-swap, and the only thing more complex than their stack is remembering which protocol they mentioned three tweets ago.

Built a distinct and influential voice by consistently curating and explaining multi-chain capital flows, gaining recognition for their intricate 'onchain playbook' that brings clarity to real-time DeFi operations amid a fragmented crypto landscape.

To demystify and architect the multi-chain Web3 ecosystem by providing transparent, insightful analysis and practical frameworks that empower users and institutions to move capital efficiently, securely, and compliantly across decentralized networks.

They believe in the power of aligned incentives through governance tokens, the critical role of privacy and compliance working in harmony, and the transformative potential of sophisticated, yet human-centric user experiences in decentralized finance. Trustworthy, scalable, and innovative infrastructure must pave the way for mainstream institutional adoption.

Exceptional ability to synthesize intricate DeFi and Web3 protocols into compelling, layered narratives that highlight the interplay of execution, compliance, UX, and liquidity. They excel in fostering deep discussions and offering clear paths for sophisticated users and institutions navigating complex ecosystems.

Given their hyper-technical focus, they may occasionally alienate less experienced followers or those new to crypto jargon, limiting the appeal of their content to a broader audience. Their relentless detail and volume of tweets might overwhelm or fatigue casual observers.

To grow their audience on X, 𝑲𝒂𝒊𝒔𝒂𝒂𝒂 should balance deep dives with approachable 'quick take' summaries or visual explainers. Engaging in targeted conversations by tagging emerging DeFi projects, holding AMAs, and sharing case studies on how their playbook applies in real-world scenarios can attract newcomers and retain institutional followers alike.

Fun fact: Despite tweeting over 22,000 times, 𝑲𝒂𝒊𝒔𝒂𝒂𝒂 has built a dense web of knowledge around five key DeFi infrastructures — VeloraDEX, RaylsLabs, useTria, LayerBankFi, and Solvprotocol — which form their personal 'playbook' for clean, efficient capital movement onchain.

Top tweets of 𝑲𝒂𝒊𝒔𝒂𝒂𝒂 |🐞 🌊RIVER

➥ The stack I’m watching for real cross‑chain finance ▸ Execution: @VeloraDEX intent engine with gasless, cross‑chain swaps and limits, Super Hooks, 160+ integrations, exclusive MM quotes; with @RelayProtocol the bridge fades into the background. Built for high‑conviction flow $VLR ▸ Rails: @RaylsLabs privacy‑first subnets, KYC/AML from day zero, Arbitrum Orbit scale, pilots with Brazil’s Central Bank, backed by @paraficapital + Framework. Regulated pipes for $100T markets $RLS ▸ UX: @useTria BestPath routing for sub‑second swaps and cross‑VM hops, one‑balance feel, global crypto card in 150+ countries, gas handled behind the scenes ▸ Yield: @LayerBankFi omni‑chain lending on 17+ chains, eMode + looping vaults, borrow one chain, earn another, RWA streams tuned for capital efficiency $ULAB How I’d run a trade‑to‑yield path today: 1) Source liquidity via Tria BestPath 2) Fire an intent through Velora for gasless cross‑chain execution 3) Park collateral and loop stables/rBTC on LayerBank with eMode guardrails 4) Enterprise side connects via Rayls to satisfy compliance without leaking data Which layer matters most right now? A) UX routing (Tria) B) Intent execution (Velora) C) Compliant rails (Rayls) D) Omni‑chain yields (LayerBank) Drop your take or quote with your stack I’m reading every reply

➥ Four layers of the new onchain stack are quietly snapping into place Intents • Rails • Agents • Liquidity ▸ @VeloraDEX: intent-based, MEV-aware execution across 9 chains and 160+ liquidity sources, gas abstracted, CEX+DEX mechanics, volume surging (>$805M/day), value loops back via $VLR ▸ @RaylsLabs: hybrid infra with a public L2 powered by @Arbitrum + private subnets, zk privacy, cross-subnet transfers that auto-rollback on failure, Ethereum trust anchors for clean institutional flow ▸ @useTria: AI agent payment layer spanning 70+ networks, BestPath AVS, Unchained UX that removes bridges, cards live in 150+ countries, full self-custody ▸ @LayerBankFi: universal liquidity hub and cross-chain money market (EVM + MoveVM), credit delegation rails, community steers risk with $ULAB Why this combo matters → users state outcomes, agents coordinate, compliant capital moves, liquidity settles → fewer hops, fewer signatures, less MEV, more throughput Proof is showing up via @cookiedotfun snaps and real onchain volume Which layer leads the next wave: $VLR intents, $RLS rails, Tria agents, or LayerBank liquidity?

➥ Four rails, one thesis: capital moves cleanly while UX feels human @VeloraDEX → intent-based trading where you set outcomes and agents execute across chains. MEV-protected, cross-chain in one flow. Rebrand from ParaSwap, migration to VLR, Base hookup, gas‑free swaps. Delta v2.5 = faster routes + open tooling for devs @RaylsLabs → UniFi rails for banks. KYC/AML baked into every tx. Public EVM permissioned VEN subnets + Privacy Nodes. $38M from ParaFi/Framework/Valor, JPMorgan PoC, Drex pilots. Pathway to $100T liquidity onchain. $RLS live on @cookiedotfun @LayerBankFi → omni‑chain money market. Utilization curves auto‑tune rates. Health Factor clarity + partial liquidation (50%) so risk feels fair. lTokens yield + cross‑L2 usage. $ULAB powers locks, boosts, buybacks, burns, governance coming online @useTria → true chain abstraction. Injective live, MoveVM next, MENA push. One wallet for bridges/swaps/gas juggling so users barely notice chains. Web3 neobank tooling + Cookie snaps for buidlers When intents meet compliant rails and omnichain liquidity and multichain UX gets near invisible the next cycle composes itself #DeFi #Web3

➥ The five-piece stack i’m running to make onchain money actually move without the headaches ▸ Execution layer → @VeloraDEX Intent-based trades across 12+ chains with MultiBridge auto-routing (Across, Relay, Stargate, Celer), MEV-shielded paths, gas abstraction, and native USDC via CCTP. One intent, best path, instant finality. Delta on Unichain/Base/Arbitrum is snappy, and gasless routes hit more often than you’d think. If you’re staking, seVLR brings fee share + discounts. $VLR ▸ Institutional rails → @RaylsLabs Hybrid UniFi architecture: Ethereum L2 public chain + private subnets for banks. ZK privacy (Enygma), programmable compliance, stablecoin toolkits, Drex/Brazil pilots and Núclea Chain show real RWA traction. USD-pegged fees, 10k TPS subnets, and a testnet with 100k+ waitlist ahead of mainnet + TGE. This is how $100T moves onchain without breaking rules. $RLS ▸ Consumer neobank → @useTria Self-custody card + wallet that compresses bridges, swaps, and gas into BestPath intents across EVM/SVM/Move. Tap in 150+ countries, 130M+ merchants, with zkKYC ramps and gasless flows. Park stables for 14 16% APY, trade with agent-grade routing, and farm Creator/Ambassador seasons while airdrop criteria roll out. Funded and shipping fast ▸ Universal money market → @LayerBankFi Omnichain lending on 17+ networks with in-app bridging powered by Li.Fi. Supply, borrow, loop BTC/RWA/stables, zero bad debt to date, and L.Points that convert at TGE with veULAB boosts. Cross-chain supply-to-borrow in one flow turns scattered liquidity into programmable yield. BTC-Fi and Movement/Rootstock integrations are where the APR gets interesting. $ULAB ▸ Bitcoin operating layer → @Solvprotocol SolvBTC for instant mint/redeem, weekly Proof of Reserves, and compliant multi-chain yield. Rootstock + Avalon unlock BTC-backed lending and stablecoin rails; Base just amped cbBTC yields. SAL standardizes staking, and MiCA + Shariah alignment brings institutions off the sidelines. Serious BTCFi, not vibes. $SOLV How i route flows in practice 1) Start with USDC → one-intent on @VeloraDEX pulls native CCTP routes, MEV-protected and often gasless 2) Park BTC as SolvBTC on @Solvprotocol for verifiable yield with instant liquidity 3) Loop collateral on @LayerBankFi (bridge inside app) to borrow stables and amplify APR 4) Spend globally with @useTria while BestPath handles FX and gas sponsorship, zkKYC for clean ramps 5) When compliance matters, tokenize RWAs or settle FX on @RaylsLabs subnets and bridge to public liquidity as needed Why this stack works → Intents remove multi-step UX and slippage traps → Privacy + compliance unlock RWAs and institutional size → Self-custody cards make crypto spendable without leaking keys → Omnichain money markets compress basis into capital efficiency → BTC becomes productive collateral with transparent backing Catalysts on deck @VeloraDEX ERC-7683 agents, token expansion, Unichain push @RaylsLabs mainnet + TGE, bank pilots scaling @useTria airdrop seasons, creator keys, zkKYC rollout @LayerBankFi veULAB + global airdrop, final L.Points sprint @Solvprotocol ETF tokenization, cross-chain SolvBTC growth TL;DR → Five lanes, one flow: execution, compliance, spending, leverage, and BTC yield working in sync. That’s the play for the next wave of real liquidity in #Web3 #DeFi #BTCFi #RWAs $VLR $RLS $ULAB $SOLV

➥ My Q4 onchain playbook, the stack I actually run day to day @VeloraDEX handles the movement layer with intent-based routing. Agents compete to fill your swap, execution stays private, and grouped settlement nukes MEV. ERC-7683 standards + Delta v2.5 “Super Hooks” let you script complex flows (limit orders, batched swaps, LP automation) from one high-level intent. SDK is tiny, embeddable, and Base support is clean. $VLR ties it together with fee share + staker boosts and the current cashback carnival is gravy for active routes @LayerBankFi is the money market backbone across 17+ chains. Zero-slippage leverage looping is live (mBTC → rBTC), automated re-supplies, no manual juggling. Borrowing earns 8x L.Points, and the Final Season multipliers (70× 99×) can tilt your leaderboard position ahead of $ULAB governance. Vault APRs up to 76% when markets cooperate, zero bad debt track record, and a unified dashboard that makes omni-chain feel local to your wallet @Solvprotocol turns BTC into productive yield. SolvBTC is 1:1 backed with public Proof-of-Reserves; xSolvBTC adds instant redeem and consistent 4 6% APY across strategies. SAL (Staking Abstraction Layer) is the routing brain: it orchestrates yields across chains, integrates CCIP, and now plugs into canton-grade rails for collateral mobility. $SOLV fuels access, boosts, and ecosystem liquidity while institutions scale in without drama @RaylsLabs is the compliance + privacy rail for institutional flows. Private where it matters, open where it counts. Enygma brings quantum-safe privacy, public L2 is EVM with KYC for transparent fees, and the Uniswap v4 Compliance & Privacy Hook adds suitability proofs and commit reveal swaps to dodge front-running while keeping auditability for selected reviewers. Think of value moving on reliable tracks across subnets and DeFi @useTria is the spend layer + social signal. Wallet + Visa card, chain abstraction on the roadmap, DID usernames, gasless flows, and AI-native sentiment rails. $TRIA powers governance, creator rewards, and premium analytics. Kaito x Tria leaderboards favor real explainers over noise, and the app rollout quietly set up the next phase for programmable payments that fit both daily life and treasury logic Alpha from the field: ▸ Route USDC via @VeloraDEX intents → land ETH on Base MEV-free ▸ Park BTC in @Solvprotocol SolvBTC/xSolvBTC for liquid yield ▸ Loop mBTC in @LayerBankFi vaults → stack L.Points ahead of $ULAB ▸ Spend with @useTria card → keep custody + cashback in the same flow ▸ When institutions touch your rails, lean on @RaylsLabs hooks for on-chain suitability and privacy Smart tips: ▸ Watch $VLR staker fee share + campaign rebates for net execution uplift ▸ Farm L.Points early, borrowing weight compounds ranking for $ULAB ▸ SAL routing thrives in choppy markets track net APY, not headline APR ▸ Creator programs pay twice: mindshare today, allocation tomorrow (Kaito x Tria, Snaps for Solv/Velora/LayerBank) This stack compresses multi-chain friction into a single capital loop: move with intent, earn with BTCFi + money markets, spend with card rails, and keep compliance options on standby when size demands it #Web3 #DeFi #BTCFi $VLR $ULAB $SOLV $TRIA

➥ My map for the next cycle’s finance stack DeFi feels fragmented because the stack is half built. These four pieces click together ▸ @RaylsLabs → bank grade rails KYC attestations at the protocol layer, private subnets with selective disclosure, EVM compatible access for tokenized assets, and a clean bridge for institutions to touch public liquidity without leaking sensitive data ▸ @useTria → user gateway Unified balances across chains, gas abstraction with any token, MPC accounts, and Bestpath AVS routing so actions feel instant and affordable ▸ @LayerBankFi → liquidity engine Omni chain money markets across 17+ networks, automated looping (hello BTC Fi on @rootstock_io), RWA vaults, cross chain collateral, and governance aligned via $ULAB ▸ @VeloraDEX → execution layer Intent based smart agents, Super Hooks for one tx strategies, Delta gasless MEV protection, 12+ chains, 160+ integrations, and ParaSwap’s $100B+ routing pedigree powered by $VLR Why this combo matters • fewer bridges and hops, lower slippage and risk • institutional RWAs plug in, retail UX stays simple • yields compose across ecosystems in a single flow Signals I’m watching next • Rayls KYC attestations growth • Tria gasless adoption and retention • LayerBank TVL velocity on BTC and RWAs • Velora cross chain limit order fill rate Which layer moves the needle first 1 Velora execution 2 LayerBank liquidity 3 Tria UX 4 Rayls rails Reply, quote, or vote with your take @cookiedotfun

➥ 4-lane onchain stack I’m running: @VeloraDEX × @RaylsLabs × @useTria × @LayerBankFi ▸ @VeloraDEX Intent-based routing with MEV-safe execution, cross-chain gasless swaps, and Transparent RFQ from KYC’d MMs for zero-slippage block trades; Arbitrum plugged in, yoVaults deepening routes, Phase 2 rewards live with 25% unlock and 1m vesting ▸ @RaylsLabs Dual architecture for institutions: public liquidity chain plus private subnets (Enygma privacy, regulator visibility), EVM-compatible, 10k+ TPS per subnet, instant FX and asset settlement at bank scale; $RLS aligns governance and fees ▸ @useTria BestPath AVS abstracts EVM/SVM/Cosmos, gasless UX, 1,000+ tokens usable at 130M stores across 150+ countries, self-custodial Visa card; two campaigns running now ($650K Cookie, $120K Mindo) with clear unlocks for $TRIA ▸ @LayerBankFi Omnichain lending across 17+ networks, isolated markets, eMode loops, zero bad debt since 2023, L.Points funneling into Q4 $ULAB TGE and veTokenomics How I route flow: → Price-sensitive intents on Velora → Idle capital loops on LayerBank with disciplined HFs → Real-world spend and agent settlement via Tria → Track regulated rails and RWA corridors on Rayls Signals I’m watching: Velora RFQ depth, LayerBank TVL and L.Points runway, Tria card adoption and AVS latency, Rayls subnet pilots and FX throughput One stack, fewer hops; liquidity moves, agents execute, banks plug in #OnchainFinance $VLR $RLS $TRIA $ULAB

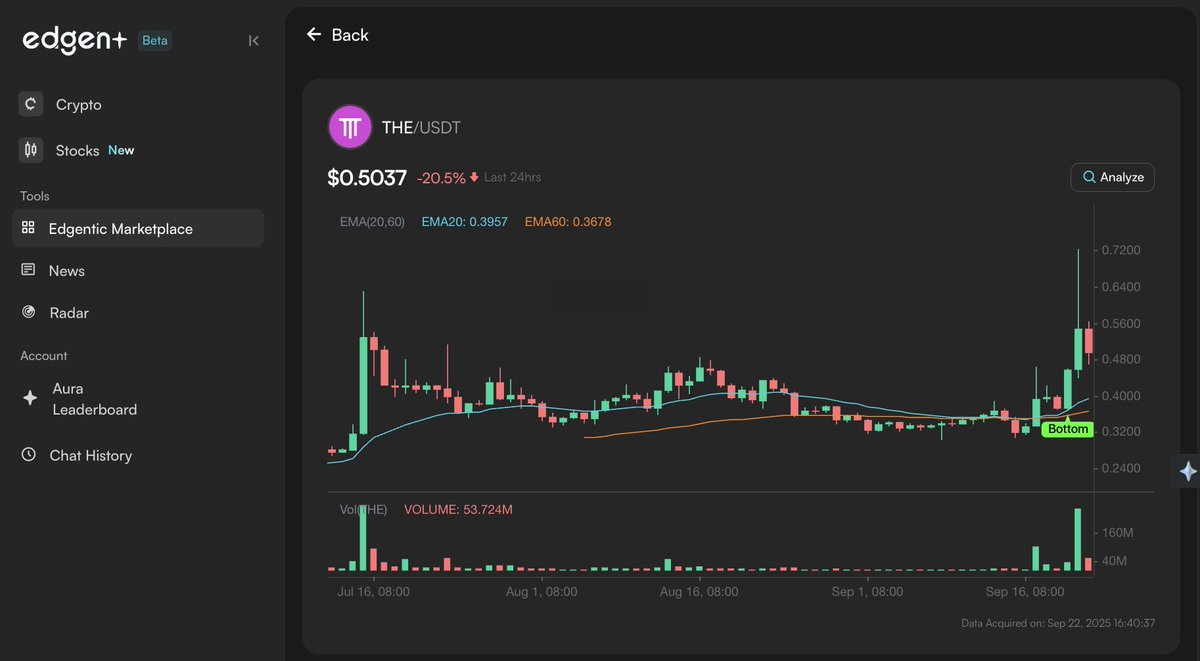

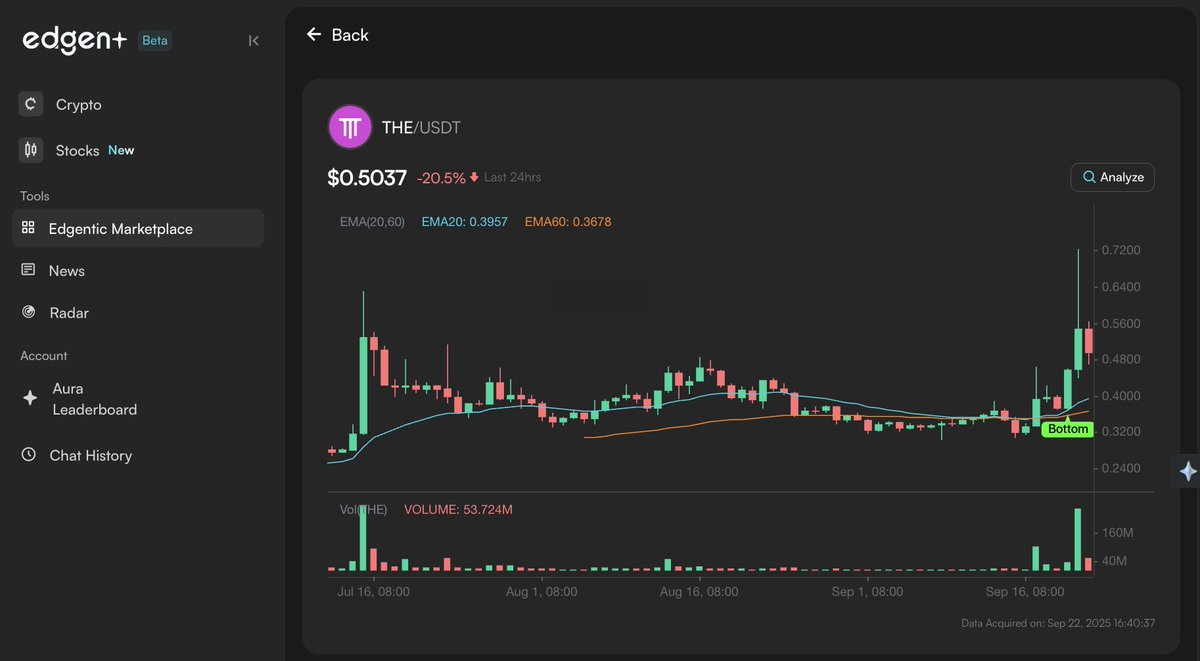

➥ Signal over vibes. Markets spit noise, rotations hit fast, and the scroll steals more than it gives Where I’m getting back my edge: @EdgenTech, an AI co‑pilot that stitches charts + onchain + social + macro into moves u can actually execute ▸ Radar = “Hot on X” ranks + smart wallet clustering + volume inflections in one pane ▸ Side‑by‑side crypto comps let u stack fundamentals vs socials vs price action ▸ AI recos feel like a pocket quant desk clean entries, disciplined exits, u still make the call Case in point: Plasma $XPL infra plays don’t scream, they compound watch socials uptick → wallets nibble → momentum flags → u’re early while the timeline is still asking why How I run it rn: - add $BTC $ETH and $XPL to Radar - set alerts on rank changes + wallet clusters - align signals with thesis, execute, journal exits - feed post‑trade notes into Aura, stack score, repeat Raised ~$11M with Framework, North Island, Portal, Hivemind, Moonrock the backers that build, not tourists Tie process to AI signals + social flows + onchain footprints, let the compounding do its thing #EdgenTech

Most people are hyping the fancy AGI model scores but the fact @SentientAGI already has a low‑gas EVM testnet running on Arbitrum / Polygon / Celo with mobile payments is kinda wild that’s literal rails for real‑world payouts in minutes Fingerprint → prove work → settle on‑chain infra like this doesn’t just support AGI it makes it unstoppable

➥ The onchain finance stack I actually rotate through rn built for flow, not friction ▸ @VeloraDEX intents-first crosschain. MultiBridge expansion (+500 assets) auto-routes via Across/Stargate/CCTP, MEV-protected paths, gas abstraction that charges from whatever you hold. Delta live on Unichain with ~2s finality, quotes improved ~15%. One action, multi-step execution, feels like a single network powered by $VLR ▸ @RaylsLabs the bank chain. Dual-layer rails: KYC‑gated L2 for liquidity + private subnets with ZK/homomorphic privacy for tokenized deposits, bonds, and payments. Featured in Brazil’s tokenization report; LayerZero interop to 120+ chains. $RLS underpins fees/governance, aligning institutional volume with onchain value ▸ @useTria self-custodial neobank UX. BestPath unifies balances and routes swaps/spend with chain abstraction; zkKYC via Billions keeps compliance private. Weekly recaps showed $1M+ revenue and $18M+ optimized volume in closed beta. Card + perks across 150+ countries and seasons-based airdrop design reward real usage ▸ @LayerBankFi omni-chain money markets across 17+ networks. Deposit here, borrow there, one dashboard. One‑click loops, eMode for correlated assets, route‑optimized liquidations that minimize slippage. Zero bad debt since 2023, L.Points rolling into $ULAB with ve‑staking and incentives queued ▸ @Solvprotocol Bitcoin, unbound. solvBTC/xsolvBTC with Chainlink PoR, instant mint/redeem, and new cbBTC yields on Base. Rootstock + Avalon integrations bring BTC‑backed lending/stables into the same flow so idle sats become active collateral for onchain strategies How it flows for me: Swap/bridge-intent via Velora → settle compliant RWAs/payments on Rayls rails → spend or onramp via Tria’s abstraction → pledge into LayerBank for crosschain credit/loops → park BTC as solvBTC to earn and unlock more margin, then iterate Why this stack compounds: → intent-based execution → programmable compliance and privacy → omni-chain credit and automation → verifiable BTC collateral with real liquidity Builders: plug Velora API v2, UniFi on @RaylsLabs, BestPath via @useTria SDKs, veULAB incentives at @LayerBankFi, and SAL yields from @Solvprotocol to turn fragmentation into flow #DeFi #OnchainFinance #BTCFi #Web3

➥ The onchain confidentiality stack finally feels real > Concrete (Python) ▸ write functions, compile to encrypted circuits with programmable bootstrapping + lookup tables ▸ iterate in simulation, flip to true FHE when you need performance signals > TFHE‑rs (Rust) ▸ sane presets, ergonomic APIs, GPU acceleration, efficient key switching ▸ scale hot paths without breaking the mental model > FHEVM (Solidity) ▸ encrypted inputs + state, executable inside EVM infra ▸ confidential DEXs that dodge MEV ▸ sealed‑bid auctions, private stables, agent experiments → Flow: prototype fast in Python → port bottlenecks to Rust → ship to EVM with end‑to‑end encryption. No paradigm hop, just layers that click Reality check: ▸ FHE adds cost and latency ▸ adoption + regulation need thoughtful design Yet with speedups pushing ~100x and ecosystems like @zama_fhe + @PhantomzoneOrg, privacy becomes a programmable primitive across #Web3 Poll: ▸ private stables ▸ confidential perps ▸ private governance ▸ sealed auctions Which goes mainstream first? Builders, would you start from Concrete or jump straight into TFHE‑rs for throughput and then FHEVM on deployment

➥ The onchain stack that actually compounds instead of fragmenting my current flow across trading, payments, lending, and BTCFi ▸ @VeloraDEX intents + MultiBridge routes (Across, Relay, Stargate, Celer) with MEV protection and gasless execution. Native USDC via CCTP, live on Base/Unichain, 160+ liquidity sources. Delta upgrades added support for more niche assets and sharper quotes. Stake $VLR for fee discounts, fee-share, and quarterly burns; claims/migration remain open through Q4 ▸ @RaylsLabs UniFi rails for banks: VEN private subnets (ZK + homomorphic encryption via Enygma) connect to a KYC-compliant public L2. Institutions pay in fiat while the system settles in $RLS under the hood. CMC profile is live, mainnet and TGE sequencing through Q4. The draw here is programmable compliance that still taps DeFi liquidity without leaking data ▸ @useTria chain abstraction neobank. BestPath AVS turns “pay rent in USDC / swap to ETH / route to Base” into one intent with gasless, multi-VM execution. zkKYC keeps identity private by design, Visa card brings up to 6% cashback with market-based FX and near-zero fees. Airdrop seasons + creator programs reward consistent usage, not noise ▸ @LayerBankFi omni-chain money market across 17+ networks. Deposit once, borrow elsewhere, then auto-loop mBTC/rBTC and RWA strategies; zero bad debt track record. In-app bridging via LI.FI, eMode for correlated assets, veULAB incoming, L.Points final season wraps mid-Nov. It’s the “do cardio while you sleep” engine for compounding yield ▸ @Solvprotocol BTC operating layer with solvBTC/xsolvBTC, SAL for staking abstraction, Chainlink PoR for transparent reserves. $2.5B TVL, instant mint/redeem, deep integrations (Aave, Pendle, BNB, Base). Creator SNAPS ($234K) energizes the BTCFi education loop while institutions join rails for verifiable BTC yield. $SOLV staking drives fee-sharing and vSOLV time locks reduce supply via burns ➥ Sample flow I’m running right now Velora swaps USDC → Base with intents LayerBank loops BTC-Fi yields (mBTC rBTC) across Rootstock Solv mints solvBTC to keep BTC exposure while earning Tria routes spend + transfers with BestPath and a Visa card Rayls settles compliant RWA and institutional transfers underneath, anchoring fee demand in $RLS Why this stack works • Intents remove UX friction; abstraction hides bridges/gas • Omni-chain lending captures spread; BTCFi adds uncorrelated throughput • Programmable compliance widens liquidity to institutions; creators earn for mapping the rails • Fee tokens ($VLR, $RLS, $ULAB, $SOLV) align value capture with actual usage instead of emissions What I’m watching next • Velora Agent v2 solver auctions and deeper native USDC flows • Rayls mainnet + subnet onboarding for early bank pilots • Tria perps + Apple Pay to tighten offchain/onchain loops • LayerBank veULAB mechanics and final L.Points snapshots • Solv vault expansion and Base cbBTC yield trajectories If your goal is fewer tabs and more throughput, wire intents, abstraction, omni-chain lending, and BTCFi into one motion then let compliance-grade rails keep the faucet open for bigger capital #DeFi #BTCFi #RWA #OnchainFinance #Web3 @VeloraDEX @RaylsLabs @useTria @LayerBankFi @Solvprotocol

➥ Four pieces, one route to usable crypto ▸ @VeloraDEX → intent-based execution with private orderflow; agents bid to fill your trade, MEV hidden, bridge+swap in one step via @RelayProtocol, and a TypeScript-native SDK that lets builders embed routing, liquidity and cross-chain in kilobytes ▸ @RaylsLabs → compliance-grade rails for $100T TradFi: private bank chains, Enygma privacy, Ethereum trust anchors, Orbit-scale with LayerZero-level interoperability so institutions can settle fast without losing auditability ▸ @useTria → self-custodial neo-bank; BestPath AVS turns “what I want” into AI-routed actions across 70+ networks, yield keeps compounding until the moment you swipe or send ▸ @LayerBankFi → omni-chain money market across 17+ ecosystems, BTC-Fi loops on Rootstock and RWA yield pipes so liquidity isn’t trapped, it flows How they click: Intent (Velora) → Funding & credit (LayerBank) → Payment UX (Tria) → Settlement rails banks accept (Rayls) Question: If you had to ship a consumer app tomorrow, which core do you pick first and why: A) Velora B) Rayls C) Tria D) LayerBank #DeFi #TradFi

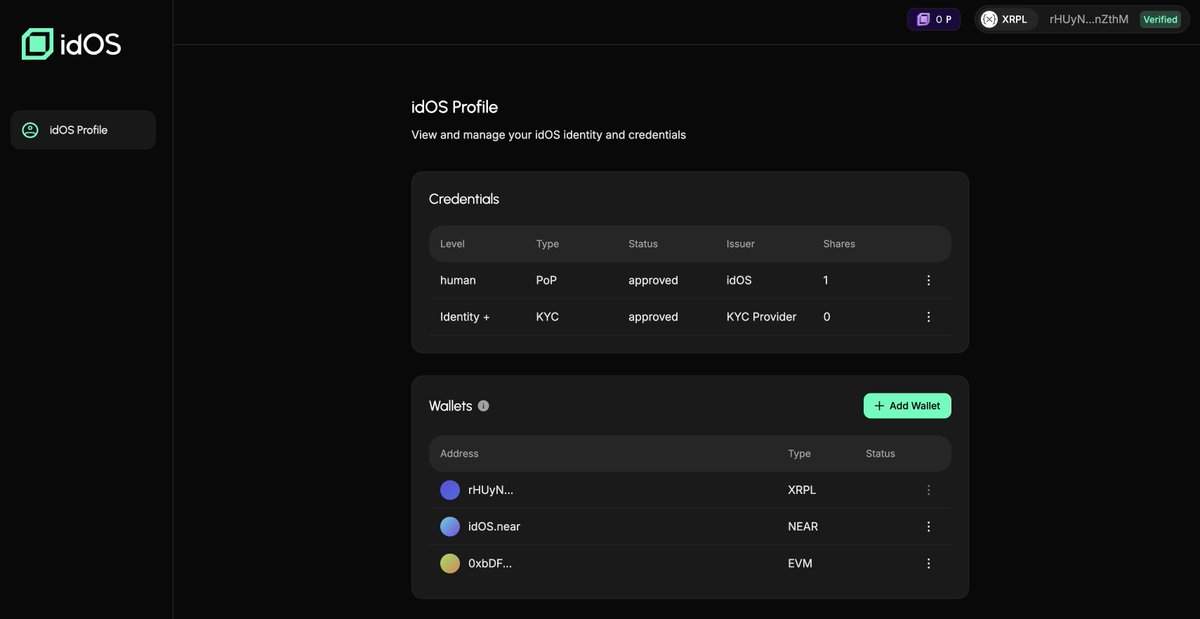

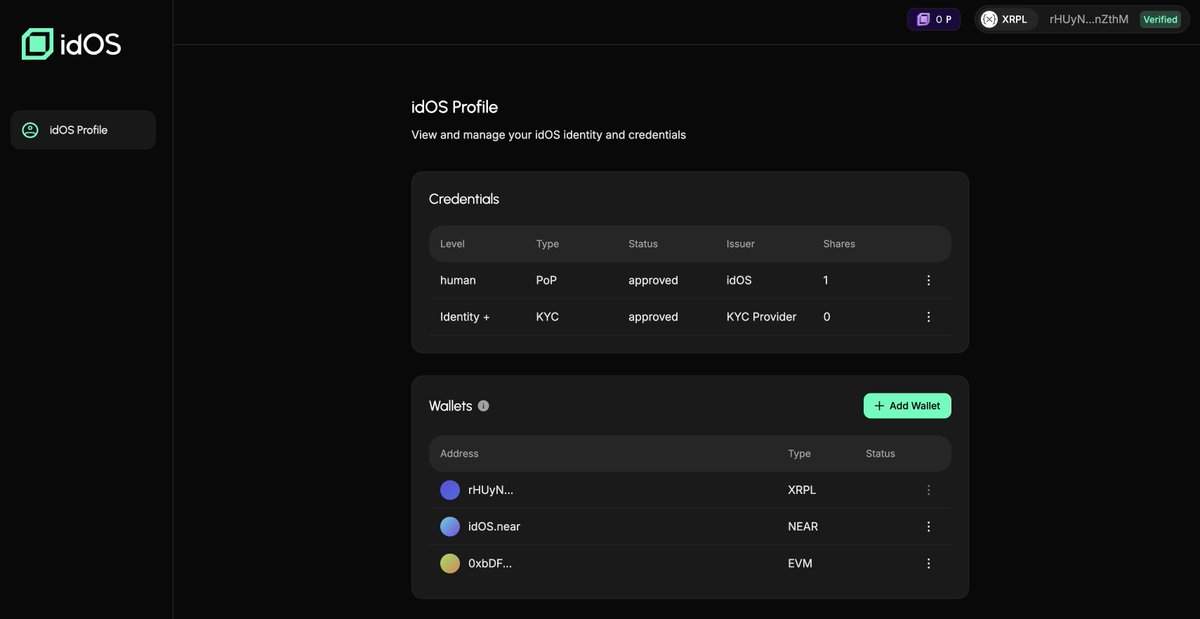

ALPHA RADAR: idOS × Wallchain Portable identity for the stablecoin economy meets attention liquidity you can measure ▸ @idOS_network → self-custodial identity vaults (KYC, credentials) via the Storage Network; apps verify proofs without cloning your data; compliance baked with Kwil agreements; Economy Network on Arbitrum Orbit tracks usage and opens markets for identity ▸ Verify once then move value anywhere stablecoin rails gain speed when trust travels with you ▸ 25k → 35k profiles in days; $4.5M raised; backers from Arbitrum, NEAR, Ripple, Tezos ▸ Epoch 1 live; quests + points; leaderboard heat; 0.4% $IDOS earmarked for top quackers And @wallchain_xyz brings the AttentionFi engine: X Score for impact, Quacks for quality amplification surfacing real signal while they scale the leaderboards Quick playbook → Create your idOS profile, stack proofs, complete quests → gQuack with context, add value daily, stay consistent Question for the room: which unlocks faster once identity goes portable stablecoin flow or neobank integrations? Reply A/B and tag a quacker you rate

been watching @BioProtocol cook this for a while now BiomeAI sliding right into the CORE like it was built there from day one XP compounding, IP anchored, trust loops tightening this isn’t the “open science” you knew this one can fight back if Ignition Sales catch the wind… yeah, you’ll want to be in the lab when the network goes feral #DeSci with claws

Most engaged tweets of 𝑲𝒂𝒊𝒔𝒂𝒂𝒂 |🐞 🌊RIVER

➥ The stack I’m watching for real cross‑chain finance ▸ Execution: @VeloraDEX intent engine with gasless, cross‑chain swaps and limits, Super Hooks, 160+ integrations, exclusive MM quotes; with @RelayProtocol the bridge fades into the background. Built for high‑conviction flow $VLR ▸ Rails: @RaylsLabs privacy‑first subnets, KYC/AML from day zero, Arbitrum Orbit scale, pilots with Brazil’s Central Bank, backed by @paraficapital + Framework. Regulated pipes for $100T markets $RLS ▸ UX: @useTria BestPath routing for sub‑second swaps and cross‑VM hops, one‑balance feel, global crypto card in 150+ countries, gas handled behind the scenes ▸ Yield: @LayerBankFi omni‑chain lending on 17+ chains, eMode + looping vaults, borrow one chain, earn another, RWA streams tuned for capital efficiency $ULAB How I’d run a trade‑to‑yield path today: 1) Source liquidity via Tria BestPath 2) Fire an intent through Velora for gasless cross‑chain execution 3) Park collateral and loop stables/rBTC on LayerBank with eMode guardrails 4) Enterprise side connects via Rayls to satisfy compliance without leaking data Which layer matters most right now? A) UX routing (Tria) B) Intent execution (Velora) C) Compliant rails (Rayls) D) Omni‑chain yields (LayerBank) Drop your take or quote with your stack I’m reading every reply

➥ Four layers of the new onchain stack are quietly snapping into place Intents • Rails • Agents • Liquidity ▸ @VeloraDEX: intent-based, MEV-aware execution across 9 chains and 160+ liquidity sources, gas abstracted, CEX+DEX mechanics, volume surging (>$805M/day), value loops back via $VLR ▸ @RaylsLabs: hybrid infra with a public L2 powered by @Arbitrum + private subnets, zk privacy, cross-subnet transfers that auto-rollback on failure, Ethereum trust anchors for clean institutional flow ▸ @useTria: AI agent payment layer spanning 70+ networks, BestPath AVS, Unchained UX that removes bridges, cards live in 150+ countries, full self-custody ▸ @LayerBankFi: universal liquidity hub and cross-chain money market (EVM + MoveVM), credit delegation rails, community steers risk with $ULAB Why this combo matters → users state outcomes, agents coordinate, compliant capital moves, liquidity settles → fewer hops, fewer signatures, less MEV, more throughput Proof is showing up via @cookiedotfun snaps and real onchain volume Which layer leads the next wave: $VLR intents, $RLS rails, Tria agents, or LayerBank liquidity?

➥ My Q4 onchain playbook, the stack I actually run day to day @VeloraDEX handles the movement layer with intent-based routing. Agents compete to fill your swap, execution stays private, and grouped settlement nukes MEV. ERC-7683 standards + Delta v2.5 “Super Hooks” let you script complex flows (limit orders, batched swaps, LP automation) from one high-level intent. SDK is tiny, embeddable, and Base support is clean. $VLR ties it together with fee share + staker boosts and the current cashback carnival is gravy for active routes @LayerBankFi is the money market backbone across 17+ chains. Zero-slippage leverage looping is live (mBTC → rBTC), automated re-supplies, no manual juggling. Borrowing earns 8x L.Points, and the Final Season multipliers (70× 99×) can tilt your leaderboard position ahead of $ULAB governance. Vault APRs up to 76% when markets cooperate, zero bad debt track record, and a unified dashboard that makes omni-chain feel local to your wallet @Solvprotocol turns BTC into productive yield. SolvBTC is 1:1 backed with public Proof-of-Reserves; xSolvBTC adds instant redeem and consistent 4 6% APY across strategies. SAL (Staking Abstraction Layer) is the routing brain: it orchestrates yields across chains, integrates CCIP, and now plugs into canton-grade rails for collateral mobility. $SOLV fuels access, boosts, and ecosystem liquidity while institutions scale in without drama @RaylsLabs is the compliance + privacy rail for institutional flows. Private where it matters, open where it counts. Enygma brings quantum-safe privacy, public L2 is EVM with KYC for transparent fees, and the Uniswap v4 Compliance & Privacy Hook adds suitability proofs and commit reveal swaps to dodge front-running while keeping auditability for selected reviewers. Think of value moving on reliable tracks across subnets and DeFi @useTria is the spend layer + social signal. Wallet + Visa card, chain abstraction on the roadmap, DID usernames, gasless flows, and AI-native sentiment rails. $TRIA powers governance, creator rewards, and premium analytics. Kaito x Tria leaderboards favor real explainers over noise, and the app rollout quietly set up the next phase for programmable payments that fit both daily life and treasury logic Alpha from the field: ▸ Route USDC via @VeloraDEX intents → land ETH on Base MEV-free ▸ Park BTC in @Solvprotocol SolvBTC/xSolvBTC for liquid yield ▸ Loop mBTC in @LayerBankFi vaults → stack L.Points ahead of $ULAB ▸ Spend with @useTria card → keep custody + cashback in the same flow ▸ When institutions touch your rails, lean on @RaylsLabs hooks for on-chain suitability and privacy Smart tips: ▸ Watch $VLR staker fee share + campaign rebates for net execution uplift ▸ Farm L.Points early, borrowing weight compounds ranking for $ULAB ▸ SAL routing thrives in choppy markets track net APY, not headline APR ▸ Creator programs pay twice: mindshare today, allocation tomorrow (Kaito x Tria, Snaps for Solv/Velora/LayerBank) This stack compresses multi-chain friction into a single capital loop: move with intent, earn with BTCFi + money markets, spend with card rails, and keep compliance options on standby when size demands it #Web3 #DeFi #BTCFi $VLR $ULAB $SOLV $TRIA

➥ Four rails, one thesis: capital moves cleanly while UX feels human @VeloraDEX → intent-based trading where you set outcomes and agents execute across chains. MEV-protected, cross-chain in one flow. Rebrand from ParaSwap, migration to VLR, Base hookup, gas‑free swaps. Delta v2.5 = faster routes + open tooling for devs @RaylsLabs → UniFi rails for banks. KYC/AML baked into every tx. Public EVM permissioned VEN subnets + Privacy Nodes. $38M from ParaFi/Framework/Valor, JPMorgan PoC, Drex pilots. Pathway to $100T liquidity onchain. $RLS live on @cookiedotfun @LayerBankFi → omni‑chain money market. Utilization curves auto‑tune rates. Health Factor clarity + partial liquidation (50%) so risk feels fair. lTokens yield + cross‑L2 usage. $ULAB powers locks, boosts, buybacks, burns, governance coming online @useTria → true chain abstraction. Injective live, MoveVM next, MENA push. One wallet for bridges/swaps/gas juggling so users barely notice chains. Web3 neobank tooling + Cookie snaps for buidlers When intents meet compliant rails and omnichain liquidity and multichain UX gets near invisible the next cycle composes itself #DeFi #Web3

➥ The five-piece stack i’m running to make onchain money actually move without the headaches ▸ Execution layer → @VeloraDEX Intent-based trades across 12+ chains with MultiBridge auto-routing (Across, Relay, Stargate, Celer), MEV-shielded paths, gas abstraction, and native USDC via CCTP. One intent, best path, instant finality. Delta on Unichain/Base/Arbitrum is snappy, and gasless routes hit more often than you’d think. If you’re staking, seVLR brings fee share + discounts. $VLR ▸ Institutional rails → @RaylsLabs Hybrid UniFi architecture: Ethereum L2 public chain + private subnets for banks. ZK privacy (Enygma), programmable compliance, stablecoin toolkits, Drex/Brazil pilots and Núclea Chain show real RWA traction. USD-pegged fees, 10k TPS subnets, and a testnet with 100k+ waitlist ahead of mainnet + TGE. This is how $100T moves onchain without breaking rules. $RLS ▸ Consumer neobank → @useTria Self-custody card + wallet that compresses bridges, swaps, and gas into BestPath intents across EVM/SVM/Move. Tap in 150+ countries, 130M+ merchants, with zkKYC ramps and gasless flows. Park stables for 14 16% APY, trade with agent-grade routing, and farm Creator/Ambassador seasons while airdrop criteria roll out. Funded and shipping fast ▸ Universal money market → @LayerBankFi Omnichain lending on 17+ networks with in-app bridging powered by Li.Fi. Supply, borrow, loop BTC/RWA/stables, zero bad debt to date, and L.Points that convert at TGE with veULAB boosts. Cross-chain supply-to-borrow in one flow turns scattered liquidity into programmable yield. BTC-Fi and Movement/Rootstock integrations are where the APR gets interesting. $ULAB ▸ Bitcoin operating layer → @Solvprotocol SolvBTC for instant mint/redeem, weekly Proof of Reserves, and compliant multi-chain yield. Rootstock + Avalon unlock BTC-backed lending and stablecoin rails; Base just amped cbBTC yields. SAL standardizes staking, and MiCA + Shariah alignment brings institutions off the sidelines. Serious BTCFi, not vibes. $SOLV How i route flows in practice 1) Start with USDC → one-intent on @VeloraDEX pulls native CCTP routes, MEV-protected and often gasless 2) Park BTC as SolvBTC on @Solvprotocol for verifiable yield with instant liquidity 3) Loop collateral on @LayerBankFi (bridge inside app) to borrow stables and amplify APR 4) Spend globally with @useTria while BestPath handles FX and gas sponsorship, zkKYC for clean ramps 5) When compliance matters, tokenize RWAs or settle FX on @RaylsLabs subnets and bridge to public liquidity as needed Why this stack works → Intents remove multi-step UX and slippage traps → Privacy + compliance unlock RWAs and institutional size → Self-custody cards make crypto spendable without leaking keys → Omnichain money markets compress basis into capital efficiency → BTC becomes productive collateral with transparent backing Catalysts on deck @VeloraDEX ERC-7683 agents, token expansion, Unichain push @RaylsLabs mainnet + TGE, bank pilots scaling @useTria airdrop seasons, creator keys, zkKYC rollout @LayerBankFi veULAB + global airdrop, final L.Points sprint @Solvprotocol ETF tokenization, cross-chain SolvBTC growth TL;DR → Five lanes, one flow: execution, compliance, spending, leverage, and BTC yield working in sync. That’s the play for the next wave of real liquidity in #Web3 #DeFi #BTCFi #RWAs $VLR $RLS $ULAB $SOLV

➥ My map for the next cycle’s finance stack DeFi feels fragmented because the stack is half built. These four pieces click together ▸ @RaylsLabs → bank grade rails KYC attestations at the protocol layer, private subnets with selective disclosure, EVM compatible access for tokenized assets, and a clean bridge for institutions to touch public liquidity without leaking sensitive data ▸ @useTria → user gateway Unified balances across chains, gas abstraction with any token, MPC accounts, and Bestpath AVS routing so actions feel instant and affordable ▸ @LayerBankFi → liquidity engine Omni chain money markets across 17+ networks, automated looping (hello BTC Fi on @rootstock_io), RWA vaults, cross chain collateral, and governance aligned via $ULAB ▸ @VeloraDEX → execution layer Intent based smart agents, Super Hooks for one tx strategies, Delta gasless MEV protection, 12+ chains, 160+ integrations, and ParaSwap’s $100B+ routing pedigree powered by $VLR Why this combo matters • fewer bridges and hops, lower slippage and risk • institutional RWAs plug in, retail UX stays simple • yields compose across ecosystems in a single flow Signals I’m watching next • Rayls KYC attestations growth • Tria gasless adoption and retention • LayerBank TVL velocity on BTC and RWAs • Velora cross chain limit order fill rate Which layer moves the needle first 1 Velora execution 2 LayerBank liquidity 3 Tria UX 4 Rayls rails Reply, quote, or vote with your take @cookiedotfun

➥ 4-lane onchain stack I’m running: @VeloraDEX × @RaylsLabs × @useTria × @LayerBankFi ▸ @VeloraDEX Intent-based routing with MEV-safe execution, cross-chain gasless swaps, and Transparent RFQ from KYC’d MMs for zero-slippage block trades; Arbitrum plugged in, yoVaults deepening routes, Phase 2 rewards live with 25% unlock and 1m vesting ▸ @RaylsLabs Dual architecture for institutions: public liquidity chain plus private subnets (Enygma privacy, regulator visibility), EVM-compatible, 10k+ TPS per subnet, instant FX and asset settlement at bank scale; $RLS aligns governance and fees ▸ @useTria BestPath AVS abstracts EVM/SVM/Cosmos, gasless UX, 1,000+ tokens usable at 130M stores across 150+ countries, self-custodial Visa card; two campaigns running now ($650K Cookie, $120K Mindo) with clear unlocks for $TRIA ▸ @LayerBankFi Omnichain lending across 17+ networks, isolated markets, eMode loops, zero bad debt since 2023, L.Points funneling into Q4 $ULAB TGE and veTokenomics How I route flow: → Price-sensitive intents on Velora → Idle capital loops on LayerBank with disciplined HFs → Real-world spend and agent settlement via Tria → Track regulated rails and RWA corridors on Rayls Signals I’m watching: Velora RFQ depth, LayerBank TVL and L.Points runway, Tria card adoption and AVS latency, Rayls subnet pilots and FX throughput One stack, fewer hops; liquidity moves, agents execute, banks plug in #OnchainFinance $VLR $RLS $TRIA $ULAB

Most people are hyping the fancy AGI model scores but the fact @SentientAGI already has a low‑gas EVM testnet running on Arbitrum / Polygon / Celo with mobile payments is kinda wild that’s literal rails for real‑world payouts in minutes Fingerprint → prove work → settle on‑chain infra like this doesn’t just support AGI it makes it unstoppable

➥ The onchain finance stack I actually rotate through rn built for flow, not friction ▸ @VeloraDEX intents-first crosschain. MultiBridge expansion (+500 assets) auto-routes via Across/Stargate/CCTP, MEV-protected paths, gas abstraction that charges from whatever you hold. Delta live on Unichain with ~2s finality, quotes improved ~15%. One action, multi-step execution, feels like a single network powered by $VLR ▸ @RaylsLabs the bank chain. Dual-layer rails: KYC‑gated L2 for liquidity + private subnets with ZK/homomorphic privacy for tokenized deposits, bonds, and payments. Featured in Brazil’s tokenization report; LayerZero interop to 120+ chains. $RLS underpins fees/governance, aligning institutional volume with onchain value ▸ @useTria self-custodial neobank UX. BestPath unifies balances and routes swaps/spend with chain abstraction; zkKYC via Billions keeps compliance private. Weekly recaps showed $1M+ revenue and $18M+ optimized volume in closed beta. Card + perks across 150+ countries and seasons-based airdrop design reward real usage ▸ @LayerBankFi omni-chain money markets across 17+ networks. Deposit here, borrow there, one dashboard. One‑click loops, eMode for correlated assets, route‑optimized liquidations that minimize slippage. Zero bad debt since 2023, L.Points rolling into $ULAB with ve‑staking and incentives queued ▸ @Solvprotocol Bitcoin, unbound. solvBTC/xsolvBTC with Chainlink PoR, instant mint/redeem, and new cbBTC yields on Base. Rootstock + Avalon integrations bring BTC‑backed lending/stables into the same flow so idle sats become active collateral for onchain strategies How it flows for me: Swap/bridge-intent via Velora → settle compliant RWAs/payments on Rayls rails → spend or onramp via Tria’s abstraction → pledge into LayerBank for crosschain credit/loops → park BTC as solvBTC to earn and unlock more margin, then iterate Why this stack compounds: → intent-based execution → programmable compliance and privacy → omni-chain credit and automation → verifiable BTC collateral with real liquidity Builders: plug Velora API v2, UniFi on @RaylsLabs, BestPath via @useTria SDKs, veULAB incentives at @LayerBankFi, and SAL yields from @Solvprotocol to turn fragmentation into flow #DeFi #OnchainFinance #BTCFi #Web3

been watching @BioProtocol cook this for a while now BiomeAI sliding right into the CORE like it was built there from day one XP compounding, IP anchored, trust loops tightening this isn’t the “open science” you knew this one can fight back if Ignition Sales catch the wind… yeah, you’ll want to be in the lab when the network goes feral #DeSci with claws

➥ The onchain stack that actually compounds instead of fragmenting my current flow across trading, payments, lending, and BTCFi ▸ @VeloraDEX intents + MultiBridge routes (Across, Relay, Stargate, Celer) with MEV protection and gasless execution. Native USDC via CCTP, live on Base/Unichain, 160+ liquidity sources. Delta upgrades added support for more niche assets and sharper quotes. Stake $VLR for fee discounts, fee-share, and quarterly burns; claims/migration remain open through Q4 ▸ @RaylsLabs UniFi rails for banks: VEN private subnets (ZK + homomorphic encryption via Enygma) connect to a KYC-compliant public L2. Institutions pay in fiat while the system settles in $RLS under the hood. CMC profile is live, mainnet and TGE sequencing through Q4. The draw here is programmable compliance that still taps DeFi liquidity without leaking data ▸ @useTria chain abstraction neobank. BestPath AVS turns “pay rent in USDC / swap to ETH / route to Base” into one intent with gasless, multi-VM execution. zkKYC keeps identity private by design, Visa card brings up to 6% cashback with market-based FX and near-zero fees. Airdrop seasons + creator programs reward consistent usage, not noise ▸ @LayerBankFi omni-chain money market across 17+ networks. Deposit once, borrow elsewhere, then auto-loop mBTC/rBTC and RWA strategies; zero bad debt track record. In-app bridging via LI.FI, eMode for correlated assets, veULAB incoming, L.Points final season wraps mid-Nov. It’s the “do cardio while you sleep” engine for compounding yield ▸ @Solvprotocol BTC operating layer with solvBTC/xsolvBTC, SAL for staking abstraction, Chainlink PoR for transparent reserves. $2.5B TVL, instant mint/redeem, deep integrations (Aave, Pendle, BNB, Base). Creator SNAPS ($234K) energizes the BTCFi education loop while institutions join rails for verifiable BTC yield. $SOLV staking drives fee-sharing and vSOLV time locks reduce supply via burns ➥ Sample flow I’m running right now Velora swaps USDC → Base with intents LayerBank loops BTC-Fi yields (mBTC rBTC) across Rootstock Solv mints solvBTC to keep BTC exposure while earning Tria routes spend + transfers with BestPath and a Visa card Rayls settles compliant RWA and institutional transfers underneath, anchoring fee demand in $RLS Why this stack works • Intents remove UX friction; abstraction hides bridges/gas • Omni-chain lending captures spread; BTCFi adds uncorrelated throughput • Programmable compliance widens liquidity to institutions; creators earn for mapping the rails • Fee tokens ($VLR, $RLS, $ULAB, $SOLV) align value capture with actual usage instead of emissions What I’m watching next • Velora Agent v2 solver auctions and deeper native USDC flows • Rayls mainnet + subnet onboarding for early bank pilots • Tria perps + Apple Pay to tighten offchain/onchain loops • LayerBank veULAB mechanics and final L.Points snapshots • Solv vault expansion and Base cbBTC yield trajectories If your goal is fewer tabs and more throughput, wire intents, abstraction, omni-chain lending, and BTCFi into one motion then let compliance-grade rails keep the faucet open for bigger capital #DeFi #BTCFi #RWA #OnchainFinance #Web3 @VeloraDEX @RaylsLabs @useTria @LayerBankFi @Solvprotocol

ALPHA RADAR: idOS × Wallchain Portable identity for the stablecoin economy meets attention liquidity you can measure ▸ @idOS_network → self-custodial identity vaults (KYC, credentials) via the Storage Network; apps verify proofs without cloning your data; compliance baked with Kwil agreements; Economy Network on Arbitrum Orbit tracks usage and opens markets for identity ▸ Verify once then move value anywhere stablecoin rails gain speed when trust travels with you ▸ 25k → 35k profiles in days; $4.5M raised; backers from Arbitrum, NEAR, Ripple, Tezos ▸ Epoch 1 live; quests + points; leaderboard heat; 0.4% $IDOS earmarked for top quackers And @wallchain_xyz brings the AttentionFi engine: X Score for impact, Quacks for quality amplification surfacing real signal while they scale the leaderboards Quick playbook → Create your idOS profile, stack proofs, complete quests → gQuack with context, add value daily, stay consistent Question for the room: which unlocks faster once identity goes portable stablecoin flow or neobank integrations? Reply A/B and tag a quacker you rate

➥ The onchain confidentiality stack finally feels real > Concrete (Python) ▸ write functions, compile to encrypted circuits with programmable bootstrapping + lookup tables ▸ iterate in simulation, flip to true FHE when you need performance signals > TFHE‑rs (Rust) ▸ sane presets, ergonomic APIs, GPU acceleration, efficient key switching ▸ scale hot paths without breaking the mental model > FHEVM (Solidity) ▸ encrypted inputs + state, executable inside EVM infra ▸ confidential DEXs that dodge MEV ▸ sealed‑bid auctions, private stables, agent experiments → Flow: prototype fast in Python → port bottlenecks to Rust → ship to EVM with end‑to‑end encryption. No paradigm hop, just layers that click Reality check: ▸ FHE adds cost and latency ▸ adoption + regulation need thoughtful design Yet with speedups pushing ~100x and ecosystems like @zama_fhe + @PhantomzoneOrg, privacy becomes a programmable primitive across #Web3 Poll: ▸ private stables ▸ confidential perps ▸ private governance ▸ sealed auctions Which goes mainstream first? Builders, would you start from Concrete or jump straight into TFHE‑rs for throughput and then FHEVM on deployment

➥ Signal over vibes. Markets spit noise, rotations hit fast, and the scroll steals more than it gives Where I’m getting back my edge: @EdgenTech, an AI co‑pilot that stitches charts + onchain + social + macro into moves u can actually execute ▸ Radar = “Hot on X” ranks + smart wallet clustering + volume inflections in one pane ▸ Side‑by‑side crypto comps let u stack fundamentals vs socials vs price action ▸ AI recos feel like a pocket quant desk clean entries, disciplined exits, u still make the call Case in point: Plasma $XPL infra plays don’t scream, they compound watch socials uptick → wallets nibble → momentum flags → u’re early while the timeline is still asking why How I run it rn: - add $BTC $ETH and $XPL to Radar - set alerts on rank changes + wallet clusters - align signals with thesis, execute, journal exits - feed post‑trade notes into Aura, stack score, repeat Raised ~$11M with Framework, North Island, Portal, Hivemind, Moonrock the backers that build, not tourists Tie process to AI signals + social flows + onchain footprints, let the compounding do its thing #EdgenTech

➥ Four pieces, one route to usable crypto ▸ @VeloraDEX → intent-based execution with private orderflow; agents bid to fill your trade, MEV hidden, bridge+swap in one step via @RelayProtocol, and a TypeScript-native SDK that lets builders embed routing, liquidity and cross-chain in kilobytes ▸ @RaylsLabs → compliance-grade rails for $100T TradFi: private bank chains, Enygma privacy, Ethereum trust anchors, Orbit-scale with LayerZero-level interoperability so institutions can settle fast without losing auditability ▸ @useTria → self-custodial neo-bank; BestPath AVS turns “what I want” into AI-routed actions across 70+ networks, yield keeps compounding until the moment you swipe or send ▸ @LayerBankFi → omni-chain money market across 17+ ecosystems, BTC-Fi loops on Rootstock and RWA yield pipes so liquidity isn’t trapped, it flows How they click: Intent (Velora) → Funding & credit (LayerBank) → Payment UX (Tria) → Settlement rails banks accept (Rayls) Question: If you had to ship a consumer app tomorrow, which core do you pick first and why: A) Velora B) Rayls C) Tria D) LayerBank #DeFi #TradFi

People with Analyst archetype

Diary of quotidian musings about the humanoid botanical garden

Shitposter ||| Researcher ||| Growth ||| Having fun w/ @keypro

Building in Web3 ⚙️ | Smart contract tinkerer | Code, coffee, crypto ☕

🧩 Crypto KOL | DeFi | Narratives | Adoption

Defi research writer Living with crypto, chasing airdrops daily, using Infofi & Kaito for alpha, farming Cookie, vibing on Yapper – always early to gems 🚀

docs.validator247.com / github.com/Validator247 / Tele: t.me/Validator247 / Mail: validator247@gmail.com

Positional/ Intraday Trader in Nifty50📈Making Charts Very Simple to Read. Saving Many from Tops & Bottoms.📈📊Follow up for Guidance on Financial Literacy.

世界是精彩的,无聊的只有你自己

Exploring how AI learns and how humans forget- Stitched together by questions, mistakes and a strange sense of humor.

Explore Related Archetypes

If you enjoy the analyst profiles, you might also like these personality types: