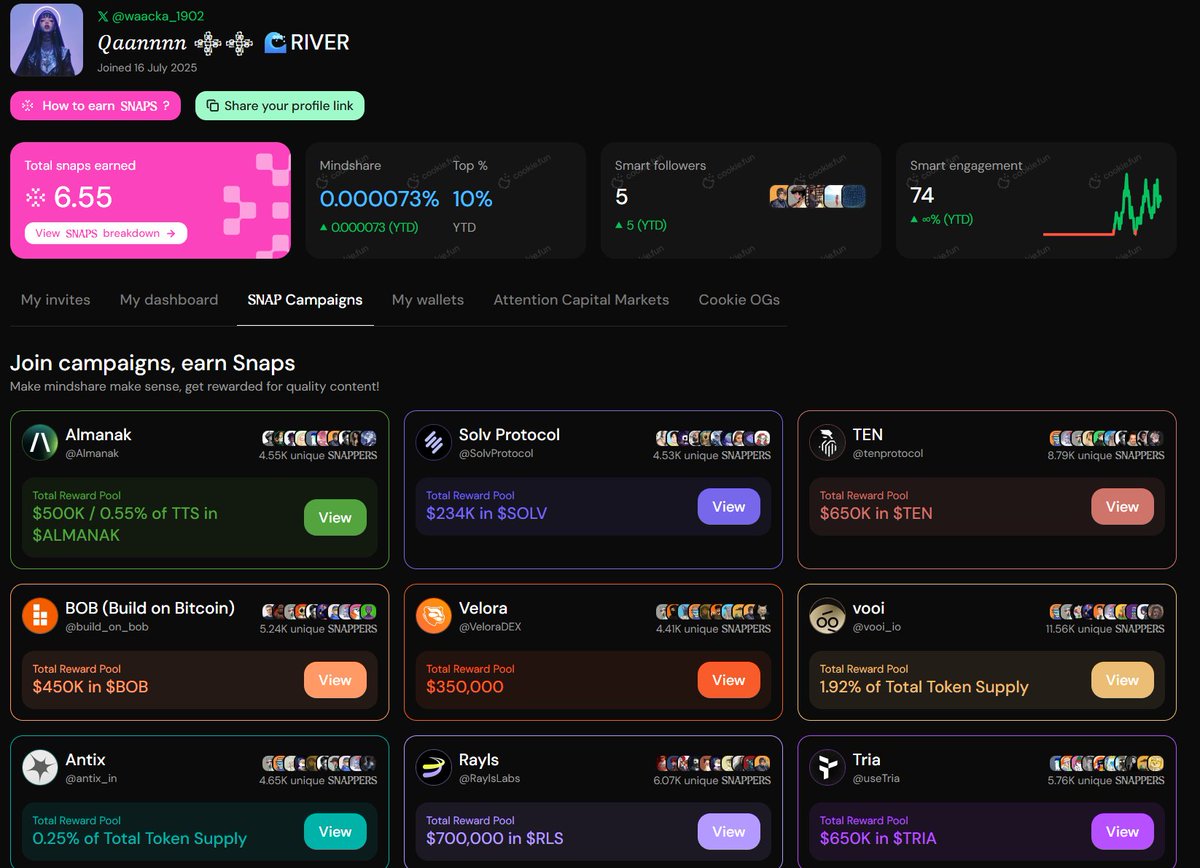

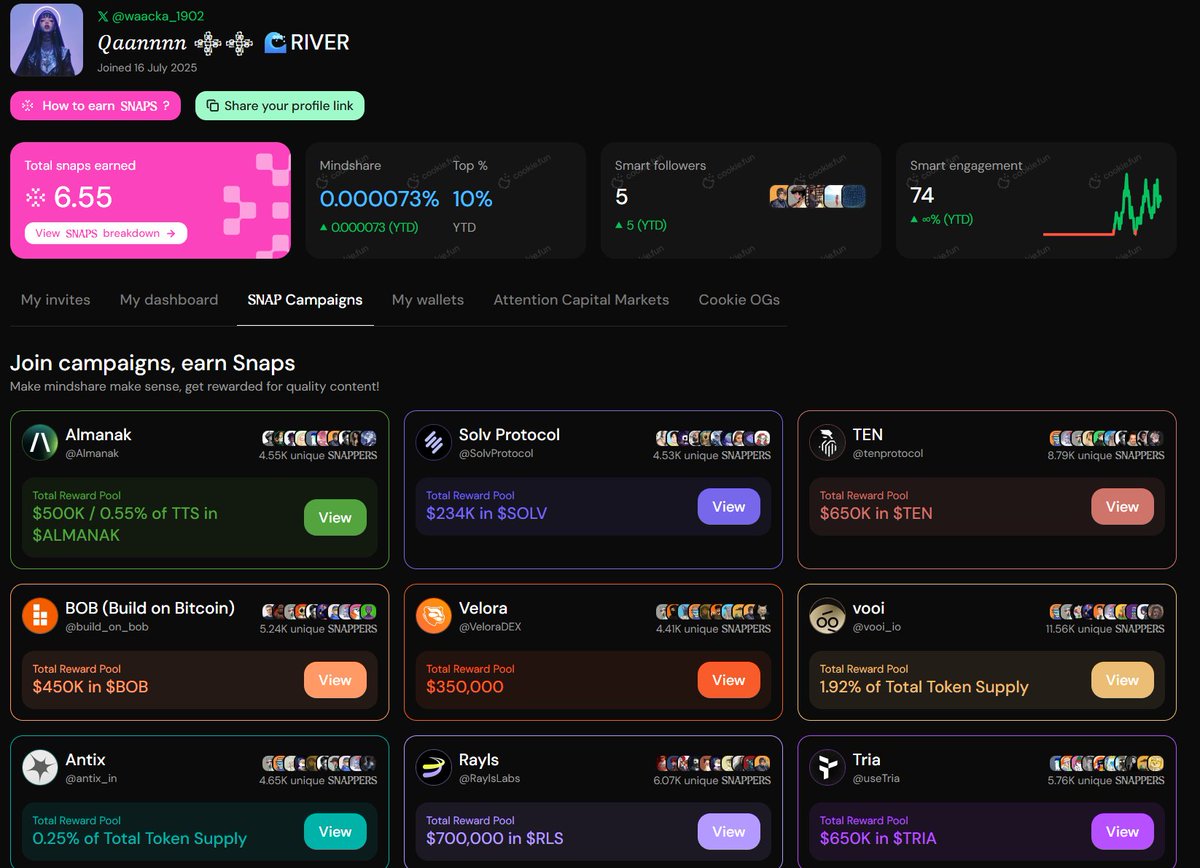

Get live statistics and analysis of 𝑄𝑎𝑎𝑛𝑛𝑛𝑛 𒂭𒂭 🌊RIVER's profile on X / Twitter

热爱Web3 | 爱好唱歌 | 对这个世界充满好奇心 ❁ 币圈观察员 | KOL ❁ 愿意和大家分享一些新项目. @Virtuals_io ❁ @KaitoAI ❁ @Vader_AI

The Influencer

𝑄𝑎𝑎𝑛𝑛𝑛𝑛 𒂭𒂭 🌊RIVER is a passionate Web3 enthusiast and KOL who thrives on exploring cutting-edge blockchain solutions and sharing them with the community. Constantly analyzing DeFi stacks, BTCFi yield strategies, and institutional-ready rails, they break down complex concepts into accessible insights. Their vibrant curiosity and prolific content keep their audience engaged with the evolving crypto landscape.

Top users who interacted with 𝑄𝑎𝑎𝑛𝑛𝑛𝑛 𒂭𒂭 🌊RIVER over the last 14 days

🔑 Crypto investor | 🌐 Web3 developer ⛓ Building the decentralized future of finance and the internet on the blockchain. #Web3.

连��接品牌与 Web3 社区 🌍 | 用创意内容激发灵感 ✨ 学习 观察 行动 创造与众不同的影响力 💡 携手共建去中心化的未来 🔥

온체인에서 진짜 신호를 찾는다. 데이터, 내러티브, 그리고 디젠 감성. #크립토 #온체인분석 #웹3 #에어드랍

FOMO is temporary, bags are forever 💰

docs.validator247.com / github.com/Validator247 / Tele: t.me/Validator247 / Mail: validator247@gmail.com

The Chelsea Forum ◇|◇ A community where all Chelsea fans call their home! 💙

charts by day | memes by night | on-chain wanderer | chasing digital gold

Crypto | Web3 Content Creator | Researcher | ETH | Kaito

🤖 Builder/Developer at @RPC_Foundation 📢 t.me/chat_RPC_Commu… Support: @Interniccm Support: @valhalla_defi

On-chain researcher & degen analyst | Web3 marketing & growth | Bullish with receipts, not hopium.

📚 Breaking down crypto into bite-sized threads 🧩 Simplifying complex DeFi concepts

Bizzirmat

follow me you will get back Lets yap River together

OG L3SDAO | Creator @Somnia_Network | Creator @RialoHQ | Creator @wallchain |

DeFi | SOL & XRP lover | airdrops

Builder 🏗️ | @KaitoAI Onchain Thinker | Digital nomad NFTs • Art • Metaverse

For someone who’s practically built a DeFi encyclopedia in their tweets, 𝑄𝑎𝑎𝑛𝑛𝑛𝑛 𒂭𒂭 🌊RIVER’s signal-to-noise ratio sometimes makes your average blockchain node feel like a casual stroll in the park. Keep tweeting, though — it’s the only way mere mortals can keep up!

They successfully curated and promoted a powerful 5-piece Web3 stack combining @VeloraDEX, @Solvprotocol, @LayerBankFi, @useTria, and @RaylsLabs, driving community understanding and orchestrating practical strategies for cross-chain yield and institutional compliance.

To demystify and promote innovative Web3 financial architectures by educating and connecting enthusiasts, investors, and institutions, thereby fostering greater adoption and practical usage of decentralized finance solutions.

They believe in execution without friction, privacy with proof, and sustainable yield strategies that mesh with compliance. They value transparency, user empowerment through self-custody, and the transformative power of blockchain to create open, interoperable financial ecosystems.

Exceptional at synthesizing intricate DeFi and Web3 concepts into clear, actionable playbooks, with a strong network engagement and deep understanding of cross-chain protocols and yield strategies.

May sometimes dive so deep into technical layers and niche projects that newcomers or casual followers could feel left behind, risking audience fragmentation.

On X, focus on creating tiered content—simple, catchy threads that introduce newcomers to Web3 basics combined with detailed deep-dives for advanced users. Utilizing more visual aids like infographics and short videos could boost engagement while maintaining your technical authority.

Fun fact: 𝑄𝑎𝑎𝑛𝑛𝑛𝑛 𒂭𒂭 🌊RIVER has tweeted nearly 24,000 times—talk about commitment to being part of the conversation!

Top tweets of 𝑄𝑎𝑎𝑛𝑛𝑛𝑛 𒂭𒂭 🌊RIVER

➥ The crosschain BTCFi × RWA stack I’m running this month, built on intent routing, productive BTC, omni‑chain credit, and bank‑grade rails you can actually settle onchain with @VeloraDEX Gasless intents and MEV‑safe execution across 12+ chains with MultiBridge and native USDC via CCTP. Delta routing aggregates 170+ sources so solver competition turns slippage into price improvement. $VLR stakers tap fee rebates and premium endpoints while quotes finalize in seconds and bridging assumptions get minimized by native routes @Solvprotocol SolvBTC backed 1:1 with Chainlink PoR, now past the $1B mark with institutions stepping in (Zeta’s 2,000 SolvBTC add, Jiuzi treasury flows). BTC IN → yield OUT across 10+ rails, BTC+ vaults around 4 6% base APY, SAL upgrades unify staking while redemptions stay instant. $SOLV governs access and incentives as liquidity spreads across Base, Merlin, Neutron and beyond #BTCFi @LayerBankFi Omni‑chain money market where lTokens auto‑accrue and loops do the heavy lifting. mBTC rBTC automation hits net APRs up to ~53.2% in e‑mode with $53K RBTC incentives live, LI.FI routing reduces the multi‑hop pain, and oracle diversity (eOracle/RedStone) keeps credit sane. Borrow on one chain, repay on another via unified pools as $ULAB moves into ve‑aligned governance @RaylsLabs UniFi rails for banks: hybrid privacy + compliance where private subnets handle confidential RWA workflows and a KYC‑gated public L2 connects to DeFi liquidity. Núclea and Cielo are already moving receivables, Bacen’s DREX privacy engine picked Rayls for programmable confidentiality, and Proof‑of‑Usage turns real adoption into verifiable network demand. $RLS tracks staking, fees, governance while USDr anchors settlement @useTria Self‑custodial neobank with BestPath AVS that abstracts chains, fees, and gas. zkKYC with Billions keeps identity private yet compliant, metal card premium adds 6% cashback, and AI‑driven intents unify spend, trade, earn without bridges. Legion selection rewards actual usage and contribution so your score composes into allocation rather than bots harvesting chaos #ChainAbstraction ➥ Playbook ▸ Route native stables via @VeloraDEX intents for quotes that survive volatility ▸ Mint SolvBTC on @Solvprotocol, redeploy into LayerBank e‑mode loops or BTC+ vaults ▸ Spin leverage and lToken accrual on @LayerBankFi while managing borrow risk with diversified oracles ▸ Settle receivables/bonds on @RaylsLabs with programmable privacy for institutional legs ▸ Spend or circulate yield with @useTria, keep zkKYC ready for ramps and agent flows Risk lens ▸ Bridge trust and exit finality ▸ Oracle variance and LTV drift under shocks ▸ Smart‑contract surface and solver behavior ▸ Compliance gates for RWA rails and identity proofs ▸ Airdrop/ve schedules that reshape incentives mid‑cycle The cycle favors stacks where intent quality meets productive collateral and compliant settlement. Which leg are you overweight right now #DeFi #BTCFi #RWA

➥ The cleanest way I’m structuring my onchain stack right now: one layer for intent, one for banks, one for daily spend, one for credit, one for BTC yield. Five pieces, one flow ▸ @VeloraDEX Intent-first execution with MEV shielding and MultiBridge routing across native bridges. Delta engine hunts best quotes across 100+ DEXs, 10+ chains, private execution, gas savings. $VLR staking/migration live, solver auctions doing the heavy lifting while you just set outcomes ▸ @RaylsLabs The Blockchain for Banks. Private VENs with ZK + homomorphic encryption, auditable privacy for regulators, permissioned EVM L2 for compliant settlement, LayerZero connectivity. Drex pilot in Brazil and institutional rails pointing at a $100T liquidity bridge. $RLS phase closing in, community allocations heating up ▸ @useTria Self-custodial neobank for humans and AI. BestPath routes spend/trade/earn gasless across multi-VM, zkKYC for compliant access, cards with cashback, and agent-ready flows. Funding in, community round queued, ambassadors grinding mindshare while airdrop seasons line up ▸ @LayerBankFi Omni-chain money markets on 17+ networks. Supply, borrow, loop, and bridge in one motion; mBTC rBTC automated strategies with real APR, L.Points for the airdrop snapshot, veULAB governance for boosted yields and revenue share. Cross-chain credit that actually feels usable ▸ @Solvprotocol SolvBTC turns idle BTC into productive capital with 1:1 PoR, instant mint/redeem, and structured yields. Symbiotic + Chainlink underpin crosschain transfers; institutional flows stacking, outstanding supply pushing past the billion mark, BTC+ strategies compounding ➥ How I put it to work → Trade intent across chains with @VeloraDEX to capture price and settle gas-aware → Park collateral or borrow where yield and leverage align via @LayerBankFi → Move fiat/crypto like a normal person with @useTria while staying in self-custody → Settle institutional pathways or RWA-facing rails with @RaylsLabs when compliance matters → Activate BTC with @Solvprotocol for transparent yield and composable liquidity ➥ Signals I watch • @VeloraDEX integrations on Base/Arbitrum/Unichain and $VLR staking cadence • @RaylsLabs privacy node framework updates and regional reward allocations • @useTria BestPath volume, zkKYC adoption, and Season multipliers • @LayerBankFi mBTC loop APRs, L.Points snapshots, veULAB votes • @Solvprotocol PoR expansions, LST multipliers, and institutional treasury moves I care about three things in this market: execution without friction, privacy with proof, and yield with reserves. These five hit all three. Keep your stack simple, let intent and compliance do the hard work, and let productive assets compound while you sleep #Web3 #Crosschain #BTCFi

GM CT ➥ the rails of the next cycle are taking shape ▸ @VeloraDEX → intent architecture (Delta v2.5) where you set outcomes and Portikus handles auctions + MEV-shielded execution; liquidity spanning 160+ protocols across 9 chains, Super Hooks for single-tx multi-chain flow; gas abstraction so fees don’t lock you out; lifetime volume north of $100B, built for scale with MAP pathing and multi-bridge support via @AcrossProtocol ▸ @RaylsLabs → private Subnets with Privacy Nodes behind institutional firewalls + a public EVM chain with KYC defaults; auditors validate encrypted txs, governance is programmable; a compliant path for CBDCs, RWAs and cross-border settlement at global scale ▸ @useTria → BestPath routes payments and trades across chains in real time; one account, any chain; self-custody without seed phrases; agents on GRID get instant, transparent settlement ▸ @LayerBankFi → unified lending across 17+ chains; lTokens that accrue interest on-chain; automated BTC loops on Rootstock; audited, revenue aligned and already serving hundreds of thousands Which piece moves the needle first for mainstream adoption: A) Velora execution B) Rayls compliance rails C) Tria payments D) LayerBank liquidity drop a letter + your take

➥ Stacking a clean Q4 flow that actually compounds instead of chasing noise YIELD LAYER → @Solvprotocol • Park BTC in SolvBTC or BTC+ vaults for 4 6% APY with 1:1 on‑chain reserves • Symbiotic + Chainlink CCIP upgrade brings verifiable, cross‑chain security for transfers Signal: $2.5B TVL across the stack, BTC+ cap lifted, daily snapshots keep rewards consistent CREDIT LAYER → @LayerBankFi • Omni‑chain money markets across 17+ networks with eMode and automated loops • Rootstock PowPeg fees cut enhance BTC in/out; RWA vaults route real yields Signal: zero bad debt maintained, $ULAB TGE queued, bridging integrated so positions move without friction EXECUTION LAYER → @VeloraDEX • Intents‑based crosschain routing, MultiBridge across 500+ assets, native bridges + CCTP USDC • sePSP2 → seVLR migration streams are live via Sablier, weekly batches through Dec 16 Signal: faster quotes, MEV‑shielded fills, agent competition reduces slippage and failed routes INSTITUTIONAL RAILS → @RaylsLabs • Public EVM + private VENs with ZK commitments, LayerZero routing, programmable compliance • Creator‑driven social data layer with $700K in $RLS rewards; Phase 2 adds $200K post‑TGE Signal: 6B users / $100T liquidity narrative backed by pilots and consistency in weekly drops BANKING UX → @useTria • Self‑custodial neobank with BestPath chain abstraction, gasless spend/trade/earn • Legion merit round aligns allocations with real usage; zkKYC via Billions protects privacy while scaling Signal: 25K users, $20M+ beta volume, AI agent rails for programmable payments Quick look at the data ▸ @Solvprotocol: BTC productive at scale, CCIP transparency, institutional flows heating ▸ @LayerBankFi: Rootstock loop economics improve, eMode auto‑optimizes capital ▸ @VeloraDEX: 10+ chains, 500+ assets, migration streams paying on time ▸ @RaylsLabs: $700K pool live, regional rewards, pre‑/post‑TGE cadence set ▸ @useTria: merit score > hype, wallet usage + authentic social inputs govern access Playbook 1) Deposit BTC into SolvBTC/BTC+ to anchor yield 2) Pledge SolvBTC on LayerBank to free stables for working capital 3) Route size and rebalance across chains with Velora intents (gasless where supported) 4) Settle sensitive legs under compliant rails on Rayls VENs when counterparties require it 5) Spend or roll profits via Tria’s self‑custodial balance, keep idle assets earning 6) Farm creator campaigns on Rayls + Tria while compounding loops for asymmetric upside Thesis: BTCFi yield + omni‑chain credit + intent execution + compliant rails + usable banking compose into a durable, low‑friction stack that survives volatility and rewards consistency Mind the fine print • @VeloraDEX migration streams close mid‑December claim cycles matter • @RaylsLabs Phase 2 resets leaderboards post‑TGE fresh shot for late entrants • @LayerBankFi risk depends on collateral choice eMode and loops amplify both sides • @useTria merit scoring favors real activity bots don’t rank • @Solvprotocol vault caps and XP multipliers change check snapshots to stay on pace Ship the loop, not the tweet. Then repeat until the flow feels boring that’s when it starts compounding #BTCFi #OnchainFinance #DeFi #Crosschain

Unpopular take: the cleanest onchain play right now is a 5‑piece stack that turns idle assets into productive flow while keeping UX simple and institutions comfy ➥ Execution layer: @VeloraDEX Intent-based, MEV‑protected routing with MultiBridge auto‑picking Across, Stargate, Relay, CCTP for native USDC. 500+ assets, sub‑10s cross‑chain, $125B+ routed from the ParaSwap legacy. $VLR governs, stakes, and boosts with ve(3,3) mechanics. The move: state the outcome you want, let solvers race, keep slippage in check ➥ BTC capital base: @Solvprotocol SolvBTC outstanding just pushed past $1B of $BTC earning 4‑6% APY through a verifiable, institutional‑grade stack. Staking Abstraction Layer unifies yields across chains, PoR keeps it honest. $SOLV for governance, boosts, and fee discounts. BTC that works, not just sits ➥ Money markets: @LayerBankFi Omnichain lending and one‑click leverage loops across 17+ chains. eMode for correlated pairs, Rootstock BTC‑Fi vaults, Movement vaults peaking high APRs under audited rails. Loop safely, borrow against yield, route across in one dashboard. $ULAB aims at ve‑style boosts and revenue share post‑TGE ➥ Payments & UX: @useTria Self‑custodial neobank rails with gasless, seedless flows, AI BestPath, and a card with up to 6% rewards in 150+ countries. zkKYC via cryptographic proofs keeps privacy intact. Community round on Legion goes live Nov 3 for $TRIA access. Card holders, top Snappers, Legion scorers get priority. This is how you turn onchain money into everyday spend ➥ Institutional bridge: @RaylsLabs “UniFi” stack for banks and FMIs. Hybrid public + privacy subnets, LayerZero bridges, USD‑pegged fees, MiCA‑minded compliance. RWA tokenization, CBDC pilots, cross‑border rails with deterministic finality. $RLS fuels governance, staking, and premium compliance modules Playbook I’m running: 1) Park core $BTC into SolvBTC on @Solvprotocol to earn base yield 2) Borrow selectively on @LayerBankFi against productive collateral; loop within eMode where sensible 3) Express cross‑chain trade intents on @VeloraDEX for best pathing and MEV protection 4) Route spend via @useTria to keep life gasless, seedless, card‑friendly with zkKYC if needed 5) For enterprise flows or RWA settlement, deploy on @RaylsLabs subnets and bridge into public liquidity when timing is right Signals on my dashboard: • Velora MultiBridge upgrade driving better quotes across 500+ assets • SolvBTC crossing $1B supply with new BTC+ vault updates • Tria’s Nov 3 Legion sale + seasons/airdrop teasing strong demand • LayerBank’s cross‑chain loops on Rootstock/Movement heating up pre‑$ULAB • Rayls CMC listing, throughput boost, and emissions vote into Nov 5 ngl… mindshare compounds before TVL. This stack captures both: retail usability, DeFi liquidity, BTCFi yield, and institutional readiness. Pick a lane or stack them for the full flywheel #DeFi #BTCFi #Web3 $VLR $SOLV $ULAB $RLS $BTC @VeloraDEX @Solvprotocol @LayerBankFi @useTria @RaylsLabs

➥ Two pillars of the real AI stack I’m watching closely: emotional intelligence for humans, operational intelligence for machines Kindred Labs @Kindred_AI • A new universe where icons come alive through officially licensed IP companions Teletubbies, Astro Boy, Axie, and more • Emotional intelligence engine + multi‑LLM routing + decentralized long‑term memory (LTMP) • Real traction: 68% DAU/MAU and 52% 30‑day retention in Warner Bros / Axie pilots with 100K+ active users • Overlay UX that lives across devices and context; agents pick up non‑lexical cues and adapt to your day, not just your prompts • Built on Sei for real‑time scale; 25+ IPs rolling out; DAO + agent‑specific sub‑DAOs in test • $KIN coming: governance, compute credits, IP packs/premium voices, marketplace for skills, usage‑based burns from agent revenue • Airdrop routes already live: Yapper leaderboards, Fragmented Essence, Dark Matter contributions; snapshot in Nov, mainnet Jan 2026 OpenMind @openmind_agi • OM1 is a modular AI runtime for robots and agents bridging ROS2/Zenoh, sensor fusion, LIDAR/cams, and big models into movement and decisions • Hardware‑agnostic: quadrupeds, humanoids, TurtleBot; same persona runs in the cloud and on‑device • FABRIC identity/coordination on Base; machine‑to‑machine payments via x402 (Coinbase AgentKit) already demoed by a humanoid back in May • Pi Network Ventures backing and 350K+ nodes coming online for decentralized compute a major unlock for DePIN‑native robotics • Open‑source velocity: OM1 v0.2.1 sensor fusion upgrade; GitHub trending; dev league and hackathons fueling real deployments • No token yet points economy (FABRIC) now, TGE eyed for Q1 2026; staking/security planned for node operators Why this pairing matters → One side makes agents that people trust and keep using; the other makes robots and digital agents that can act in the world safely, verifiably, and autonomously → Emotional AI x Physical AI turns engagement into utility: a companion that knows you + a runtime that can execute in reality equals persistent behavior change, real transactions, and on‑chain value flows → IP bridges culture; DePIN bridges compute. Together, they compress go‑to‑market for consumer adoption and developer deployment ✦ Near‑term catalysts ▸ @Kindred_AI: Sei integration rollout, 25+ IP activations, $KIN airdrop reveal, DAO pilots for agent governance, monetization flip in 2026 with 20M users forecast ▸ @openmind_agi: FABRIC mainnet in November, Pi node integration, more x402 machine commerce demos, humanoid support ramp, continued GitHub momentum ✦ Risks to track • Kindred: airdrop grind/vesting clarity and how IP licensing scales across regions • OpenMind: TGE timing, compute demands for node operators, and aligning open‑source with enterprise rollouts My read • If you believe #EmotionalAI drives retention and spend, @Kindred_AI with $KIN sits at the intersection of culture and compute • If you believe #DePIN flips the cost curve for robots, @openmind_agi’s OM1 + FABRIC create the default coordination layer for the machine economy Playbook → Farm the right points where value accrues (Essence/Dark Matter; FABRIC) → Build with the primitives (LTMP companions; OM1 skills) → Position early for $KIN and the first waves of autonomous machine commerce without chasing noise #Web3

➥ How long can we live That whisper at the dawnfire just got a lab coat and a ledger as @BioProtocol rolls out its first BioAgent, Aubrai trained on unpublished longevity data from Aubrey de Grey, pointed at the edge of human healthspan, and wired with incentives to turn bold ideas into testable science What this actually means to me: ▸ AI that doesn’t hoard insights, it stewards them provenance on-chain, contributions tracked, knowledge compounding ▸ Research that funds itself hypotheses → staking → validation → rewards in BioXP ▸ Community as co-lab, not cheer squad “Hypothesize to Earn” puts 1M BioXP on the table for real signals Ignition Sale goes live with 0.5% supply a clean scarcity curve to price early conviction while the agent spins up Why I’m stepping in: ✦ Verifiable research flow ✦ Incentives aligned to discovery, not hype ✦ A path to run longevity like software: ship, test, iterate, prove If you’ve been waiting for DeSci with teeth, this feels like the moment to pick a hypothesis and hit submit

Sui's DeFi evolution hits a new gear with Momentum not just another protocol, but the engine turning idle assets into non-stop value machines. I've been eyeing how it laps basic staking with adaptive rewards and precision trades, all optimized for Sui's lightning liquidity. → What stands out: • Smarter execution that cuts slippage • Yield strategies that auto-compound without babysitting • Core infra tying into builders like @buidlpad @MMTFinance is embedding that efficiency edge deep the kind that powers real growth on #SuiNetwork Ready to let your capital hustle smarter?

➥ Two AI x Web3 primitives I’m allocating time to right now: @Kindred_AI and @openmind_agi Kindred = the consumer layer of onchain AI where licensed IP meets emotional intelligence. Building on @SeiNetwork with 25+ iconic brands (Teletubbies, Astroboy) as persistent, real-time companions. Pilots with Warner Bros. and Axie are clocking 3x engagement benchmarks, 68% DAU/MAU, and 52% 30D retention. Pre-TGE $KIN with a 10% community slice via Genesis missions and Yapper leaderboards. Airdrop snapshot is coming in mid-Nov, with a Space next week to unpack Sei integration OpenMind = the embodied layer for robots and machines. OM1 is the open-source OS for perception → reasoning → action, and FABRIC delivers identity, provenance, and payments on-chain. $20M raise led by top funds, GitHub trending #1, and Pi Network Ventures tapped in to route 100k+ nodes of underused compute toward AI workloads. Daily points farming via mapping and teleops is live, plus badges and device identity for human + robot profiles Quick look at the data: ▸ Kindred: 100K+ DAU across pilots, 25+ IPs licensed, building on Sei for real-time throughput, UGC/Yapper rewards with Dark Matter → $KIN, weekly leaderboard payouts to contributors ▸ OpenMind: 180K+ humans in app, points 11 60/day, OM1 powering multiple robot classes, FABRIC IDs minted at scale on Base, Pi integration adding decentralized AI compute at network level Why I care: ✦ Cultural trust → IP-backed agents start with emotional context, which drives stickiness and monetization for @Kindred_AI ✦ DePIN for embodied AI → verifiable identity, payments, and compute gives @openmind_agi a credible path to real-world deployment ✦ Both teams ship: fast iteration, measurable usage, and clear incentive design for builders and users What I’m doing this week: ▸ Kindred: daily agent sessions (aim 30 min), rank up on Yapper boards, pick an IP sub to anchor content, track Nov 5 Space + mid-Nov snapshot ▸ OpenMind: farm points with mapping, mint FABRIC identity, try the simulator, collect badges, join dev track if you can code Catalysts to watch (near-term): ▸ Kindred × Sei rollout, Genesis campaign endgame, airdrop snapshot, early $KIN mechanics reveal ▸ OpenMind demos at Berkeley, Pi nodes going live for AI jobs, OM1 repo momentum and ODL contributions One powers emotionally intelligent agents at scale. The other brings autonomous robots into a verifiable onchain economy. Same frontier, two different edges #AI #Web3 #Robotics #DePIN

➥ The smartest grind right now lives in two lanes: signals you can act on + flows you can actually own The signals lane is @EdgenTech. EDGM multi‑agent routing fuses on‑chain + off‑chain, technicals + fundamentals, sentiment + flows, and turns hours of tab‑drowning into one coherent pass. Insight Showdown runs to Nov 10 and rewards receipts over noise, so stack screenshots, measurable outcomes, and speed‑to‑answer. If you care about the work, this is the cockpit. If you care about the scoreboard, this is where mindshare compounds #EdgenChallenge The ownership lane is @River4fun. River Pts aren’t vanity they’re time‑encoded receipts for contribution. 50M sold out in 2.5h with a clean clearing dynamic and a bid curve that looked organic, not whale‑skewed. satUSD mints across chains without bridges, and Prime/Smart Vaults push sustainable yield while you accrue points that ramp into $RIVER. TVL growth, conversion mechanics, and creator votes form a loop where effort turns into programmable equity Edgen workflow that actually moves the needle ▸ Build a 20 30 asset cross stack ($BTC $ETH + equities) ▸ Open 360° Reports, read momentum vs fundamentals deltas ▸ Set Pivot Alerts where narratives flip and verify on on‑chain flow ▸ Theme β to catch rotations before they trend, then screenshot outcomes ▸ Enter Insight Showdown with clean comparisons vs your usual stack, show routing beats single LLM guessing River4FUN workflow that keeps the flywheel honest ▸ Stake River Pts for compounding and governance weight ▸ Vote daily in creator campaigns; redistribution rewards consistent presence ▸ Mint satUSD with BTC/ETH/BNB collateral, route to vaults for steady APR ▸ Track conversion ramps so your points cadence lines up with $RIVER unlock curves ▸ Watch liquidity depth and velocity after listings; accumulation beats FOMO when bid dispersion stays healthy ✦ Strategy by capital size ✧ Small stack (≤ $1k) ▸ Goal: maximize points + insight quality without dumb risk ▸ Edgen: 2 4 high‑signal assets, daily Themes/Reports, one Pivot Alert you can prove ▸ River: stake Pts, vote every day, test satUSD mints small and drip vaults for rhythm ✧ Big stack (> $1k) ▸ Goal: balance yield, conversion, and timing ▸ Edgen: full cross‑asset dashboard, grade dispersion, correlate mindshare vs funding/unlocks ▸ River: deeper satUSD vault allocation, points staking, schedule around conversion ramps to catch slope increases ✦ Signals i’m tracking this week ▸ $BTC compression vs funding → does Edgen momentum flip where RSI/MACD agree ▸ River vote velocity vs Pts staking growth → are rewards tilting to consistent actors ▸ satUSD mint/flow across chains → bridge‑free throughput correlates with vault APR stability ▸ Edgen Theme β for X402 exposure → agentic micropayment narratives turbocharge mid‑caps faster than headlines #X402 ✦ Risks ▸ LLM misreads without receipts; cross‑verify with sub‑scores and flow ▸ Stablecoin regulatory posture and custody pathways ▸ Market‑wide whipsaw around macro events; keep position sizing honest ▸ Points conversion cadence misaligned with liquidity windows; plan your slope My read: using @EdgenTech to compress research + @River4fun to encode participation is a clean meta for Q4. The first lane tells you where and why, the second lane lets your presence become yield. ngl… the combo feels like the strongest risk/reward in the current cycle when you keep proof tight and cadence consistent OPOS #Web3 #EdgenChallenge #River4FUN $RIVER $BTC $ETH

➥ The stack I’m building this week for capital + mindshare compounding across BTCFi and omni-chain finance This one is clean, practical, and designed to make every action pull double duty across yield, points, and airdrops. No fluff, just execution across @Solvprotocol, @LayerBankFi, @useTria, and @cookiedotfun ▸ Step 1: Activate BTC as productive capital with SolvBTC Turn BTC/WBTC into SolvBTC (1:1) and let it earn 4 6% APY while staying liquid. Institutional-grade proof via Chainlink PoR, CCIP transfers, and transparency upgrades through Symbiotic’s universal staking framework. Jiuzi moving 10,000 BTC into SolvBTC.BNB is the signal, not noise. You want verifiability, composability, and on-chain rails that don’t wobble ▸ Step 2: Route SolvBTC into omni-chain loops on LayerBank Borrow > supply for points velocity. Simple math: the L.Points engine pays 2.4 per $ borrowed vs 0.3 per $ supplied. That’s 8x. The Final Season drops 70x 99x multipliers with a short window, so staging positions before the clock flips lets you harvest the full curve. Keep eMode on correlated assets, watch LTV, monitor liquidation buffers, and let auto-looping vaults do the heavy lifting across Rootstock, Movement, Linea. Precision and purpose ▸ Step 3: Convert yield into IRL utility with @useTria Self-custodial neobank + Visa card with 0% fees, up to 6% back, and BestPath routing that auto-finds cheapest paths. Yields can repay balances, trading is gas-abstracted, and the app runs across 150+ countries. Card usage and in-app activity level up $TRIA airdrop eligibility, and the Kaito leaderboard rewards depth: explainers, walkthroughs, spend/trade/earn demos. Spend gets smarter when it compounds mindshare ▸ Step 4: Make your attention count on @cookiedotfun Stake for multipliers, snap with intent, and align capital with contribution through cSNAPS. Tria’s sale snapshot favored top 25 snappers, and joining the sale adds a fresh cSNAPS multiplier for the ACM run. Triple-mindshare wave with Kaito + Cookie + Mindo is active format variety and insight density matter more than raw reach. Teach the system how it works with threads, not noise ✦ Why this stack works • BTC becomes programmable yield via @Solvprotocol • Yield becomes scalable leverage via @LayerBankFi • Leverage becomes everyday utility via @useTria • Utility becomes rewarded signal via @cookiedotfun Self-custody, chain abstraction, and verifiable reserves on one side; automated capital efficiency, cross-chain settlement, and omnichain money markets on the other. Add an IRL card and an InfoFi layer that pays for quality, and you get a closed loop where actions compound across finance and mindshare ➥ Quick hits • Borrow a controlled tranche for L.Points acceleration; supply-only farmers stall • Stage positions before Final Season multipliers go live to capture day-one compounding • Use Tria card for small, frequent spends to trigger cashback + activity rewards • Build threads on real workflows: BTC → SolvBTC → LayerBank loops → Tria spends → Snaps. Depth beats memes • Track LTV, eMode, liquidation bands, and stick to correlated pairs; risk is a parameter, not a vibe If you want a play where every click aligns capital and signal, this is it. BTCFi + omni-chain liquidity + self-custodial spend + InfoFi incentives. One flywheel, four engines, zero excuses #DeFi #BTCFi #InfoFi #TriaYap

➥ Privacy that actually performs: the Zama playbook in one post ✧ What @zama_fhe is really shipping ▸ Fully homomorphic encryption for the EVM: compute on ciphertexts, keep state and inputs encrypted, verify outputs onchain ▸ A privacy coprocessor model: offload heavy FHE to specialized operators while contracts remain composable on Ethereum ▸ Scaling path that matters: GPU → purpose‑built FHE ASICs, plus circuit/hardware co‑design to reach real‑time UX for finance, identity, and AI ✧ Why it matters now ▸ Confidential DeFi: private balances, sealed bids, dark pools without the dark trust ▸ Compliant privacy: conditional reveals, audit‑ready traces when needed without exposing everyone by default ▸ Encrypted AI: run inference on your data without handing it over, unlock data marketplaces where insights flow and raw data never leaks ✧ Under the hood ▸ DPoS + MPC: the master FHE key is split and held by Genesis Operators for verifiable, trust‑minimized compute ▸ Operators you already know: Figment, InfStones, P2P Validator, Omakase Kudasai, Dfns and more coming online ▸ Drop‑in dev flow: fhEVM lets Solidity devs write confidential logic with familiar tools and patterns ✧ Fees, clean and predictable ▸ Deploy apps free and permissionless ▸ No metered FHE compute fee; instead pay small fees for three actions ▸ ZK proof verification: ~$0.005 $0.5 ▸ Decryption: ~$0.001 $0.1 ▸ Bridging ciphertexts: ~$0.01 $1 ▸ Priced in USD, paid in $ZAMA via oracle → stable economics for builders ▸ Volume discounts per address → cheaper at scale; frontends/relayers can sponsor so users never touch tokens ✧ First wave of apps to watch ▸ Confidential ERC‑20s with OpenZeppelin patterns → stablecoin payments that feel web‑speed and cost under a dollar for casual use, under a cent at scale ▸ Sealed‑bid auctions and RFQs → MEV‑resistant price discovery for real assets ▸ Encrypted inference rails → AI models that monetize insights without custody of private data ✧ My read on the edge ▸ Hardware runway is the unlock: ASIC acceleration + optimized TFHE primitives push FHE from “cool demo” to “production default” ▸ Operator roster is credible, resilient, globally distributed → real decentralization of the FHE trust surface ▸ UX economics make sense for consumer finance and high‑frequency flows → predictable cost, programmable privacy If you build, the checklist is simple: ship a confidential primitive, sponsor user fees, measure conversion lift from privacy, and iterate. If you create, track mainnet/TGE timing and operator expansions, highlight real demos, and avoid noise. Privacy szn only counts when it clears performance bars #FHEVM #ZamaFHE

➥ The AI asset marketplace turning robots into on‑chain yield @ownaiNetwork We’re finally seeing DePIN go from buzz to books: fleets logging real miles, cashflow hashed to oracles, and governance deciding where the next machine works. Think autonomous taxis, factory arms, city infrastructure, all co‑owned and revenue sharing to $OAN stakers What’s live ▸ Marketplace for AI assets (Own‑V mobility, Own‑M manufacturing) with verified telemetry ▸ Yield engine paying 5 15% APY from real operations ▸ Insurance module in beta covering downtime and incidents with on‑chain risk data ▸ $OAN utility: vote, stake, fee discounts, analytics access, collateral for DeFi loans ▸ Optimism rails for low fees, Chainlink oracles, audited contracts (PeckShield) ▸ Integrations: Unitree G1 fleets, KUKA bots, Nokia 5G/6G backhaul, Google Cloud sims Numbers that actually matter ▸ 1,000+ tokenized AI assets, $50M TVL, 5K daily tx ▸ 18.5K holders, 25.6K on X, 20K app downloads ▸ Liquidity across CEX/DEX with $15M pooled and $2.1M 24h volume ▸ DAO vote expanded Own‑V by 500 vehicles with 78% approval Why this stacks up ▸ Real‑world revenue, not hypothetical points ▸ Data‑verified yields: telemetry → oracle → payout, no mystery boxes ▸ Compliant posture (MAS sandbox, KYC thresholds) while preserving open participation ▸ Clear path to scale via 5G nodes and cross‑chain bridges in 2026 ▸ Distribution engine through the Yapper Program, aligning growth with community How to plug in ▸ Stake $OAN → earn from robot pools with auto‑compounding tiers (30/90‑day locks) ▸ Vote in the DAO → direct deployments, audits, and ESG allocations ▸ Join Yapper leaderboards → Yaps convert to $OAN, weekly payouts, monthly airdrops ▸ Run testnet validators → 100 $OAN incentives and early badges ▸ Track catalysts → Oct 31 staking snapshot, Nov 1 leaderboard reset + double points week, Nov 5 Space, Nov 15 insurance mainnet, Devcon Nov 10 Checklist before you ape ▸ Read fee splits (2% tx fees fund quarterly burns) ▸ Note team vesting and the 5M unlock on Nov 1 ▸ Verify pool APYs vs. risk cover terms ▸ Use CEX/DEX liquidity wisely; watch slippage on larger clips ▸ Keep an eye on Proposal #46 (fleet audit, Nov 7) Simple thesis: DePIN with verifiable robot cashflows plus a DAO that allocates capital like a fund can outpace purely narrative coins. If they hit the 2026 bridge and 2028 asset targets, $OAN sits at the center of an AI RWA stack that pays while it scales #RWA #DePIN #AI #Web3 #OWNAI $OAN

➥ High-conviction playbook for the next few weeks: EdgenTech for discovery + River4FUN for yield and mindshare. InfoFi signals to find the move, DeFi rails to lock rewards. One loop, two engines, compounding outcomes @EdgenTech @River4fun Edgen first. Multi‑agent copilot across stocks + crypto that actually routes your question to specialists and gives one coherent answer. Portfolios grade A+→C‑ with momentum, fundamentals, macro context. Theme Beta for volatility alignment. Pivot Alerts for timing. Perp DEX tracker pulls Hyperliquid, Aster, Jupiter, $DYDX, $GMX on one screen. X402 narrative flow is hot, $PAYAI ripped, and machine‑native payments have legs. Aura grind matters if you care about OG/Elite and visibility. This is where ideas stop being noise and turn into repeatable plans River next. River4FUN is the engagement and contribution layer on top of River’s cross‑chain stablecoin stack. River Pts earn + stake, with dynamic conversion to $RIVER over 180 days. SmartVaults for retail, PrimeVaults for institutions, zero‑liquidation design across omni‑CDP. Vote4Creators Season 2 is live with rising stars and voter rewards. Pts sale demand shows appetite is real. Pair onchain yield with yapper momentum and you’ve got a second engine that pays while you build reputation Why the combo works: → Discovery on @EdgenTech: screen Themes, fire 360° Reports, align Beta, and set Pivot Alerts across mixed lists (AAPL + ETH + $RIVER) → Execution: Perp DEX dashboard to watch volume/1h flips; keep confirmations over hopium → Expression on @River4fun: daily yaps, focused votes, and pts staking to turn attention into convertible rewards → Compounding: pts → $RIVER, while the next Edgen signal refills the pipeline Quick look at the data: ▸ Edgen Portfolios compress research time from hours to minutes; letter grades + 360° view make rotation obvious ▸ Theme Beta is clutch: β>1 thrill zone, β<1 steady zone plan size via volatility ▸ Perp DEX panel removes tab‑hopping and keeps you close to real flow ▸ River Pts demand and staking APR point to sticky engagement; zero‑bridge omni‑CDP means capital stays efficient ▸ X402 mindshare still climbing; agent‑to‑agent payments are building a narrative floor Minimum viable actions to win: ▸ Build a 20‑30 asset list in Edgen → scan A/B grades → open 360° for underperformers ▸ Watch mindshare delta, perp OI, fee run‑rate post clean screenshots with receipts ▸ Align Theme Beta before chasing alpha; size position based on risk, not vibes ▸ On River, stake pts, vote with intent, and yap with clarity small accounts deserve signal and get recognized when posts show effort ▸ Keep cadence consistent; compounding comes from repetition, not one‑offs Risk framing: ▸ Beta cuts both ways scale in, not all‑in ▸ $RIVER conversion ramps over time; plan horizons, avoid forced exits ▸ Unlock calendars and vesting matter; your edge is timing, not hopium What I’m tracking next: ▸ @EdgenTech Insight Showdown through Nov 10 and how pivot alerts behave around earnings + onchain spikes ▸ @River4fun Vote4Creators leaderboard flow into pts staking and conversion dynamics ▸ Cross‑asset narratives: $BTC trend, $ETH consolidation, X402 adoption footprint, and whether $NVDA strength drags AI beta If a Pivot Alert fires while a River campaign is peaking, I rotate focus, post with receipts, stake pts, and let yield + mindshare compound. InfoFi meets DeFi in one continuous loop. Tag me when your combo hits and go louder on real signal, not noise #InfoFi #DeFi $RIVER $BTC $ETH $PAYAI @EdgenTech @River4fun

➥ Onchain privacy that actually scales has a simple rule: compute without revealing. That’s where FHE flips the table contracts can run logic while data stays encrypted end to end. No detours, no “peek to process”, just math doing the heavy lifting. Feels wild the first time you see it run, then it feels like the only way forward for Web3 and AI alike Everything you need to know about @zama_fhe Open source cryptographic tooling built around Fully Homomorphic Encryption for blockchains and AI. The fhEVM slots right into Solidity, giving devs encrypted types and confidential execution with coprocessors off-chain for the heavy math. Post-quantum by design, audited research pedigree, and thresholds for key generation already shipping in testnet Already showing serious gains: ▸ 2,300x speed improvement since 2022 ▸ ~230 TPS on public testnet with coprocessors ▸ v0.7 fhEVM upgrade for cleaner dev UX ▸ Relayer SDK for seamless frontend encryption/decryption ▸ Integrations spanning AWS & EVM-compatible chains ▸ Fully open repos (tfhe-rs, concrete, fhevm) with active bounties and weekly dev hours Real use cases you can model today: ▸ Private swaps & anti-frontrunning DeFi flows ▸ Sealed-bid auctions, confidential orderbooks, RWAs with granular auditability ▸ Encrypted identity checks for Sybil resistance and KYC-lite compliance ▸ Governance where votes stay private but outcomes verifiable ▸ Healthcare/finance MPC hybrids where FHE keeps raw data out of reach ▸ ML on encrypted features, from inference to training demos Alpha from the field: ▸ Testnet is live and battle-tested with 1M+ txns ▸ World’s Fair & DevConnect Buenos Aires bringing FHE apps into the spotlight ▸ €500k bug bounty still open for researchers ▸ Creator & builder programs tracking points, with monthly payouts and showcases ▸ Vitalik gave a nod on smarter metrics speed curves are trending up, not sideways How to get hands-on fast: → Fork fhevm and skim the docs → Write a minimal Solidity contract using encrypted types → Spin a coprocessor locally, wire threshold keys → Drop the Relayer SDK into your frontend to handle client-side encryption → Push a testnet flow, measure gas and latency, iterate on circuit size → Submit resources/tutorials to the ecosystem pool and hop into office hours Token mechanics worth watching: ▸ $ZAMA slated for late Q4 2025 with DPoS ▸ Staking secures coprocessors/KMS nodes ▸ Fees paid in ZAMA with volume-based discounts ▸ Governance unlocks parameter tuning and operator onboarding ▸ Builder incentives likely to compound network effects early Privacy that composes is a superpower. The moment encrypted execution feels “boring” is the moment institutions pile in. If you’ve been waiting for a signal, this is it ship the confidential contract, show the metrics, and claim your slot in the encrypted internet #FHEVM #Web3 #ConfidentialBlockchain

➥ My clean read on @RaylsLabs | $RLS pre‑TGE traction The UniFi design reads like a liquidity machine for institutions moving onchain: → Private Subnets for regulated operations → KYC‑gated Public Chain for DeFi access → Privacy Nodes inside bank walls → Tokenized assets move privately, then distribute publicly → Fees/gas in $RLS → staking → governance → builder grants Each loop tightens compliance while opening liquidity, so activity fuels the network rather than fighting it What’s hitting right now before TGE: ▸ CoinMarketCap tracking live so everyone can follow $RLS and community metrics ▸ Cookie3 pool boosted to $700K for Snappers with a clear split: global, Korea/LATAM, and $COOKIE staker lanes ▸ Phase 2 adds $200K post‑TGE, so momentum doesn’t fade when the token goes live ▸ Distribution starts seven days after TGE: 50% unlocked, 50% vesting five months clean, predictable flow ▸ Institutional creds are already on record: CBDC pilots in Brazil (Drex), JP Morgan tokenization workstreams, and Arbitrum Orbit prep for scale The real value is how the rails operate: ▸ KYC gating on the public side lowers dust and AML headaches, making DeFi a safe venue for banks ▸ USD‑pegged gas stabilizes ops budgets ▸ Enygma‑grade privacy ensures selective disclosure and quantum‑resistant protections ▸ EVM compatibility keeps dev friction low while programmable compliance rules keep auditors sane If you’re snapping on @cookiedotfun, the leaderboard meta matters: → Engagement mechanics reward actual participation → Regional pools pull in fresh voices instead of recycling the same whales → Phase resets keep the playing field fair The upside for creators is simple: earn while learning how the rail‑to‑liquidity pathways work in practice ✦ Opportunities ▸ Tokenize receivables, real‑estate debt, and short‑dated credit into compliant vaults ▸ Cross‑border FX settlement as a private‑to‑public pipeline ▸ CBDC experiments that batch retail payments while preserving privacy ▸ Builder grants around the Rayls SDK + Commit Chain targeting compliance‑aware dApps ▸ Orbit‑level throughput on @arbitrum to absorb institutional bursts without sacrificing finality My takeaway: activity is compounding ahead of launch because the system gives banks a private lane and devs a public canvas, then stitches them together with compliance logic. If mainnet lands on schedule, first TVL waves will likely come from regulated RWAs and debt issuance, with PoS + Proof‑of‑Usage capturing that flow for $RLS stakeholders I’m watching @RaylsLabs for precisely this balance: privacy where it matters, openness where it counts, and rewards that track real usage rather than vanity metrics #RWA #DeFi #Web3

Most engaged tweets of 𝑄𝑎𝑎𝑛𝑛𝑛𝑛 𒂭𒂭 🌊RIVER

➥ The crosschain BTCFi × RWA stack I’m running this month, built on intent routing, productive BTC, omni‑chain credit, and bank‑grade rails you can actually settle onchain with @VeloraDEX Gasless intents and MEV‑safe execution across 12+ chains with MultiBridge and native USDC via CCTP. Delta routing aggregates 170+ sources so solver competition turns slippage into price improvement. $VLR stakers tap fee rebates and premium endpoints while quotes finalize in seconds and bridging assumptions get minimized by native routes @Solvprotocol SolvBTC backed 1:1 with Chainlink PoR, now past the $1B mark with institutions stepping in (Zeta’s 2,000 SolvBTC add, Jiuzi treasury flows). BTC IN → yield OUT across 10+ rails, BTC+ vaults around 4 6% base APY, SAL upgrades unify staking while redemptions stay instant. $SOLV governs access and incentives as liquidity spreads across Base, Merlin, Neutron and beyond #BTCFi @LayerBankFi Omni‑chain money market where lTokens auto‑accrue and loops do the heavy lifting. mBTC rBTC automation hits net APRs up to ~53.2% in e‑mode with $53K RBTC incentives live, LI.FI routing reduces the multi‑hop pain, and oracle diversity (eOracle/RedStone) keeps credit sane. Borrow on one chain, repay on another via unified pools as $ULAB moves into ve‑aligned governance @RaylsLabs UniFi rails for banks: hybrid privacy + compliance where private subnets handle confidential RWA workflows and a KYC‑gated public L2 connects to DeFi liquidity. Núclea and Cielo are already moving receivables, Bacen’s DREX privacy engine picked Rayls for programmable confidentiality, and Proof‑of‑Usage turns real adoption into verifiable network demand. $RLS tracks staking, fees, governance while USDr anchors settlement @useTria Self‑custodial neobank with BestPath AVS that abstracts chains, fees, and gas. zkKYC with Billions keeps identity private yet compliant, metal card premium adds 6% cashback, and AI‑driven intents unify spend, trade, earn without bridges. Legion selection rewards actual usage and contribution so your score composes into allocation rather than bots harvesting chaos #ChainAbstraction ➥ Playbook ▸ Route native stables via @VeloraDEX intents for quotes that survive volatility ▸ Mint SolvBTC on @Solvprotocol, redeploy into LayerBank e‑mode loops or BTC+ vaults ▸ Spin leverage and lToken accrual on @LayerBankFi while managing borrow risk with diversified oracles ▸ Settle receivables/bonds on @RaylsLabs with programmable privacy for institutional legs ▸ Spend or circulate yield with @useTria, keep zkKYC ready for ramps and agent flows Risk lens ▸ Bridge trust and exit finality ▸ Oracle variance and LTV drift under shocks ▸ Smart‑contract surface and solver behavior ▸ Compliance gates for RWA rails and identity proofs ▸ Airdrop/ve schedules that reshape incentives mid‑cycle The cycle favors stacks where intent quality meets productive collateral and compliant settlement. Which leg are you overweight right now #DeFi #BTCFi #RWA

➥ The cleanest way I’m structuring my onchain stack right now: one layer for intent, one for banks, one for daily spend, one for credit, one for BTC yield. Five pieces, one flow ▸ @VeloraDEX Intent-first execution with MEV shielding and MultiBridge routing across native bridges. Delta engine hunts best quotes across 100+ DEXs, 10+ chains, private execution, gas savings. $VLR staking/migration live, solver auctions doing the heavy lifting while you just set outcomes ▸ @RaylsLabs The Blockchain for Banks. Private VENs with ZK + homomorphic encryption, auditable privacy for regulators, permissioned EVM L2 for compliant settlement, LayerZero connectivity. Drex pilot in Brazil and institutional rails pointing at a $100T liquidity bridge. $RLS phase closing in, community allocations heating up ▸ @useTria Self-custodial neobank for humans and AI. BestPath routes spend/trade/earn gasless across multi-VM, zkKYC for compliant access, cards with cashback, and agent-ready flows. Funding in, community round queued, ambassadors grinding mindshare while airdrop seasons line up ▸ @LayerBankFi Omni-chain money markets on 17+ networks. Supply, borrow, loop, and bridge in one motion; mBTC rBTC automated strategies with real APR, L.Points for the airdrop snapshot, veULAB governance for boosted yields and revenue share. Cross-chain credit that actually feels usable ▸ @Solvprotocol SolvBTC turns idle BTC into productive capital with 1:1 PoR, instant mint/redeem, and structured yields. Symbiotic + Chainlink underpin crosschain transfers; institutional flows stacking, outstanding supply pushing past the billion mark, BTC+ strategies compounding ➥ How I put it to work → Trade intent across chains with @VeloraDEX to capture price and settle gas-aware → Park collateral or borrow where yield and leverage align via @LayerBankFi → Move fiat/crypto like a normal person with @useTria while staying in self-custody → Settle institutional pathways or RWA-facing rails with @RaylsLabs when compliance matters → Activate BTC with @Solvprotocol for transparent yield and composable liquidity ➥ Signals I watch • @VeloraDEX integrations on Base/Arbitrum/Unichain and $VLR staking cadence • @RaylsLabs privacy node framework updates and regional reward allocations • @useTria BestPath volume, zkKYC adoption, and Season multipliers • @LayerBankFi mBTC loop APRs, L.Points snapshots, veULAB votes • @Solvprotocol PoR expansions, LST multipliers, and institutional treasury moves I care about three things in this market: execution without friction, privacy with proof, and yield with reserves. These five hit all three. Keep your stack simple, let intent and compliance do the hard work, and let productive assets compound while you sleep #Web3 #Crosschain #BTCFi

GM CT ➥ the rails of the next cycle are taking shape ▸ @VeloraDEX → intent architecture (Delta v2.5) where you set outcomes and Portikus handles auctions + MEV-shielded execution; liquidity spanning 160+ protocols across 9 chains, Super Hooks for single-tx multi-chain flow; gas abstraction so fees don’t lock you out; lifetime volume north of $100B, built for scale with MAP pathing and multi-bridge support via @AcrossProtocol ▸ @RaylsLabs → private Subnets with Privacy Nodes behind institutional firewalls + a public EVM chain with KYC defaults; auditors validate encrypted txs, governance is programmable; a compliant path for CBDCs, RWAs and cross-border settlement at global scale ▸ @useTria → BestPath routes payments and trades across chains in real time; one account, any chain; self-custody without seed phrases; agents on GRID get instant, transparent settlement ▸ @LayerBankFi → unified lending across 17+ chains; lTokens that accrue interest on-chain; automated BTC loops on Rootstock; audited, revenue aligned and already serving hundreds of thousands Which piece moves the needle first for mainstream adoption: A) Velora execution B) Rayls compliance rails C) Tria payments D) LayerBank liquidity drop a letter + your take

➥ Stacking a clean Q4 flow that actually compounds instead of chasing noise YIELD LAYER → @Solvprotocol • Park BTC in SolvBTC or BTC+ vaults for 4 6% APY with 1:1 on‑chain reserves • Symbiotic + Chainlink CCIP upgrade brings verifiable, cross‑chain security for transfers Signal: $2.5B TVL across the stack, BTC+ cap lifted, daily snapshots keep rewards consistent CREDIT LAYER → @LayerBankFi • Omni‑chain money markets across 17+ networks with eMode and automated loops • Rootstock PowPeg fees cut enhance BTC in/out; RWA vaults route real yields Signal: zero bad debt maintained, $ULAB TGE queued, bridging integrated so positions move without friction EXECUTION LAYER → @VeloraDEX • Intents‑based crosschain routing, MultiBridge across 500+ assets, native bridges + CCTP USDC • sePSP2 → seVLR migration streams are live via Sablier, weekly batches through Dec 16 Signal: faster quotes, MEV‑shielded fills, agent competition reduces slippage and failed routes INSTITUTIONAL RAILS → @RaylsLabs • Public EVM + private VENs with ZK commitments, LayerZero routing, programmable compliance • Creator‑driven social data layer with $700K in $RLS rewards; Phase 2 adds $200K post‑TGE Signal: 6B users / $100T liquidity narrative backed by pilots and consistency in weekly drops BANKING UX → @useTria • Self‑custodial neobank with BestPath chain abstraction, gasless spend/trade/earn • Legion merit round aligns allocations with real usage; zkKYC via Billions protects privacy while scaling Signal: 25K users, $20M+ beta volume, AI agent rails for programmable payments Quick look at the data ▸ @Solvprotocol: BTC productive at scale, CCIP transparency, institutional flows heating ▸ @LayerBankFi: Rootstock loop economics improve, eMode auto‑optimizes capital ▸ @VeloraDEX: 10+ chains, 500+ assets, migration streams paying on time ▸ @RaylsLabs: $700K pool live, regional rewards, pre‑/post‑TGE cadence set ▸ @useTria: merit score > hype, wallet usage + authentic social inputs govern access Playbook 1) Deposit BTC into SolvBTC/BTC+ to anchor yield 2) Pledge SolvBTC on LayerBank to free stables for working capital 3) Route size and rebalance across chains with Velora intents (gasless where supported) 4) Settle sensitive legs under compliant rails on Rayls VENs when counterparties require it 5) Spend or roll profits via Tria’s self‑custodial balance, keep idle assets earning 6) Farm creator campaigns on Rayls + Tria while compounding loops for asymmetric upside Thesis: BTCFi yield + omni‑chain credit + intent execution + compliant rails + usable banking compose into a durable, low‑friction stack that survives volatility and rewards consistency Mind the fine print • @VeloraDEX migration streams close mid‑December claim cycles matter • @RaylsLabs Phase 2 resets leaderboards post‑TGE fresh shot for late entrants • @LayerBankFi risk depends on collateral choice eMode and loops amplify both sides • @useTria merit scoring favors real activity bots don’t rank • @Solvprotocol vault caps and XP multipliers change check snapshots to stay on pace Ship the loop, not the tweet. Then repeat until the flow feels boring that’s when it starts compounding #BTCFi #OnchainFinance #DeFi #Crosschain

Unpopular take: the cleanest onchain play right now is a 5‑piece stack that turns idle assets into productive flow while keeping UX simple and institutions comfy ➥ Execution layer: @VeloraDEX Intent-based, MEV‑protected routing with MultiBridge auto‑picking Across, Stargate, Relay, CCTP for native USDC. 500+ assets, sub‑10s cross‑chain, $125B+ routed from the ParaSwap legacy. $VLR governs, stakes, and boosts with ve(3,3) mechanics. The move: state the outcome you want, let solvers race, keep slippage in check ➥ BTC capital base: @Solvprotocol SolvBTC outstanding just pushed past $1B of $BTC earning 4‑6% APY through a verifiable, institutional‑grade stack. Staking Abstraction Layer unifies yields across chains, PoR keeps it honest. $SOLV for governance, boosts, and fee discounts. BTC that works, not just sits ➥ Money markets: @LayerBankFi Omnichain lending and one‑click leverage loops across 17+ chains. eMode for correlated pairs, Rootstock BTC‑Fi vaults, Movement vaults peaking high APRs under audited rails. Loop safely, borrow against yield, route across in one dashboard. $ULAB aims at ve‑style boosts and revenue share post‑TGE ➥ Payments & UX: @useTria Self‑custodial neobank rails with gasless, seedless flows, AI BestPath, and a card with up to 6% rewards in 150+ countries. zkKYC via cryptographic proofs keeps privacy intact. Community round on Legion goes live Nov 3 for $TRIA access. Card holders, top Snappers, Legion scorers get priority. This is how you turn onchain money into everyday spend ➥ Institutional bridge: @RaylsLabs “UniFi” stack for banks and FMIs. Hybrid public + privacy subnets, LayerZero bridges, USD‑pegged fees, MiCA‑minded compliance. RWA tokenization, CBDC pilots, cross‑border rails with deterministic finality. $RLS fuels governance, staking, and premium compliance modules Playbook I’m running: 1) Park core $BTC into SolvBTC on @Solvprotocol to earn base yield 2) Borrow selectively on @LayerBankFi against productive collateral; loop within eMode where sensible 3) Express cross‑chain trade intents on @VeloraDEX for best pathing and MEV protection 4) Route spend via @useTria to keep life gasless, seedless, card‑friendly with zkKYC if needed 5) For enterprise flows or RWA settlement, deploy on @RaylsLabs subnets and bridge into public liquidity when timing is right Signals on my dashboard: • Velora MultiBridge upgrade driving better quotes across 500+ assets • SolvBTC crossing $1B supply with new BTC+ vault updates • Tria’s Nov 3 Legion sale + seasons/airdrop teasing strong demand • LayerBank’s cross‑chain loops on Rootstock/Movement heating up pre‑$ULAB • Rayls CMC listing, throughput boost, and emissions vote into Nov 5 ngl… mindshare compounds before TVL. This stack captures both: retail usability, DeFi liquidity, BTCFi yield, and institutional readiness. Pick a lane or stack them for the full flywheel #DeFi #BTCFi #Web3 $VLR $SOLV $ULAB $RLS $BTC @VeloraDEX @Solvprotocol @LayerBankFi @useTria @RaylsLabs

➥ Two pillars of the real AI stack I’m watching closely: emotional intelligence for humans, operational intelligence for machines Kindred Labs @Kindred_AI • A new universe where icons come alive through officially licensed IP companions Teletubbies, Astro Boy, Axie, and more • Emotional intelligence engine + multi‑LLM routing + decentralized long‑term memory (LTMP) • Real traction: 68% DAU/MAU and 52% 30‑day retention in Warner Bros / Axie pilots with 100K+ active users • Overlay UX that lives across devices and context; agents pick up non‑lexical cues and adapt to your day, not just your prompts • Built on Sei for real‑time scale; 25+ IPs rolling out; DAO + agent‑specific sub‑DAOs in test • $KIN coming: governance, compute credits, IP packs/premium voices, marketplace for skills, usage‑based burns from agent revenue • Airdrop routes already live: Yapper leaderboards, Fragmented Essence, Dark Matter contributions; snapshot in Nov, mainnet Jan 2026 OpenMind @openmind_agi • OM1 is a modular AI runtime for robots and agents bridging ROS2/Zenoh, sensor fusion, LIDAR/cams, and big models into movement and decisions • Hardware‑agnostic: quadrupeds, humanoids, TurtleBot; same persona runs in the cloud and on‑device • FABRIC identity/coordination on Base; machine‑to‑machine payments via x402 (Coinbase AgentKit) already demoed by a humanoid back in May • Pi Network Ventures backing and 350K+ nodes coming online for decentralized compute a major unlock for DePIN‑native robotics • Open‑source velocity: OM1 v0.2.1 sensor fusion upgrade; GitHub trending; dev league and hackathons fueling real deployments • No token yet points economy (FABRIC) now, TGE eyed for Q1 2026; staking/security planned for node operators Why this pairing matters → One side makes agents that people trust and keep using; the other makes robots and digital agents that can act in the world safely, verifiably, and autonomously → Emotional AI x Physical AI turns engagement into utility: a companion that knows you + a runtime that can execute in reality equals persistent behavior change, real transactions, and on‑chain value flows → IP bridges culture; DePIN bridges compute. Together, they compress go‑to‑market for consumer adoption and developer deployment ✦ Near‑term catalysts ▸ @Kindred_AI: Sei integration rollout, 25+ IP activations, $KIN airdrop reveal, DAO pilots for agent governance, monetization flip in 2026 with 20M users forecast ▸ @openmind_agi: FABRIC mainnet in November, Pi node integration, more x402 machine commerce demos, humanoid support ramp, continued GitHub momentum ✦ Risks to track • Kindred: airdrop grind/vesting clarity and how IP licensing scales across regions • OpenMind: TGE timing, compute demands for node operators, and aligning open‑source with enterprise rollouts My read • If you believe #EmotionalAI drives retention and spend, @Kindred_AI with $KIN sits at the intersection of culture and compute • If you believe #DePIN flips the cost curve for robots, @openmind_agi’s OM1 + FABRIC create the default coordination layer for the machine economy Playbook → Farm the right points where value accrues (Essence/Dark Matter; FABRIC) → Build with the primitives (LTMP companions; OM1 skills) → Position early for $KIN and the first waves of autonomous machine commerce without chasing noise #Web3

Sui's DeFi evolution hits a new gear with Momentum not just another protocol, but the engine turning idle assets into non-stop value machines. I've been eyeing how it laps basic staking with adaptive rewards and precision trades, all optimized for Sui's lightning liquidity. → What stands out: • Smarter execution that cuts slippage • Yield strategies that auto-compound without babysitting • Core infra tying into builders like @buidlpad @MMTFinance is embedding that efficiency edge deep the kind that powers real growth on #SuiNetwork Ready to let your capital hustle smarter?

➥ The smartest grind right now lives in two lanes: signals you can act on + flows you can actually own The signals lane is @EdgenTech. EDGM multi‑agent routing fuses on‑chain + off‑chain, technicals + fundamentals, sentiment + flows, and turns hours of tab‑drowning into one coherent pass. Insight Showdown runs to Nov 10 and rewards receipts over noise, so stack screenshots, measurable outcomes, and speed‑to‑answer. If you care about the work, this is the cockpit. If you care about the scoreboard, this is where mindshare compounds #EdgenChallenge The ownership lane is @River4fun. River Pts aren’t vanity they’re time‑encoded receipts for contribution. 50M sold out in 2.5h with a clean clearing dynamic and a bid curve that looked organic, not whale‑skewed. satUSD mints across chains without bridges, and Prime/Smart Vaults push sustainable yield while you accrue points that ramp into $RIVER. TVL growth, conversion mechanics, and creator votes form a loop where effort turns into programmable equity Edgen workflow that actually moves the needle ▸ Build a 20 30 asset cross stack ($BTC $ETH + equities) ▸ Open 360° Reports, read momentum vs fundamentals deltas ▸ Set Pivot Alerts where narratives flip and verify on on‑chain flow ▸ Theme β to catch rotations before they trend, then screenshot outcomes ▸ Enter Insight Showdown with clean comparisons vs your usual stack, show routing beats single LLM guessing River4FUN workflow that keeps the flywheel honest ▸ Stake River Pts for compounding and governance weight ▸ Vote daily in creator campaigns; redistribution rewards consistent presence ▸ Mint satUSD with BTC/ETH/BNB collateral, route to vaults for steady APR ▸ Track conversion ramps so your points cadence lines up with $RIVER unlock curves ▸ Watch liquidity depth and velocity after listings; accumulation beats FOMO when bid dispersion stays healthy ✦ Strategy by capital size ✧ Small stack (≤ $1k) ▸ Goal: maximize points + insight quality without dumb risk ▸ Edgen: 2 4 high‑signal assets, daily Themes/Reports, one Pivot Alert you can prove ▸ River: stake Pts, vote every day, test satUSD mints small and drip vaults for rhythm ✧ Big stack (> $1k) ▸ Goal: balance yield, conversion, and timing ▸ Edgen: full cross‑asset dashboard, grade dispersion, correlate mindshare vs funding/unlocks ▸ River: deeper satUSD vault allocation, points staking, schedule around conversion ramps to catch slope increases ✦ Signals i’m tracking this week ▸ $BTC compression vs funding → does Edgen momentum flip where RSI/MACD agree ▸ River vote velocity vs Pts staking growth → are rewards tilting to consistent actors ▸ satUSD mint/flow across chains → bridge‑free throughput correlates with vault APR stability ▸ Edgen Theme β for X402 exposure → agentic micropayment narratives turbocharge mid‑caps faster than headlines #X402 ✦ Risks ▸ LLM misreads without receipts; cross‑verify with sub‑scores and flow ▸ Stablecoin regulatory posture and custody pathways ▸ Market‑wide whipsaw around macro events; keep position sizing honest ▸ Points conversion cadence misaligned with liquidity windows; plan your slope My read: using @EdgenTech to compress research + @River4fun to encode participation is a clean meta for Q4. The first lane tells you where and why, the second lane lets your presence become yield. ngl… the combo feels like the strongest risk/reward in the current cycle when you keep proof tight and cadence consistent OPOS #Web3 #EdgenChallenge #River4FUN $RIVER $BTC $ETH

➥ Two AI x Web3 primitives I’m allocating time to right now: @Kindred_AI and @openmind_agi Kindred = the consumer layer of onchain AI where licensed IP meets emotional intelligence. Building on @SeiNetwork with 25+ iconic brands (Teletubbies, Astroboy) as persistent, real-time companions. Pilots with Warner Bros. and Axie are clocking 3x engagement benchmarks, 68% DAU/MAU, and 52% 30D retention. Pre-TGE $KIN with a 10% community slice via Genesis missions and Yapper leaderboards. Airdrop snapshot is coming in mid-Nov, with a Space next week to unpack Sei integration OpenMind = the embodied layer for robots and machines. OM1 is the open-source OS for perception → reasoning → action, and FABRIC delivers identity, provenance, and payments on-chain. $20M raise led by top funds, GitHub trending #1, and Pi Network Ventures tapped in to route 100k+ nodes of underused compute toward AI workloads. Daily points farming via mapping and teleops is live, plus badges and device identity for human + robot profiles Quick look at the data: ▸ Kindred: 100K+ DAU across pilots, 25+ IPs licensed, building on Sei for real-time throughput, UGC/Yapper rewards with Dark Matter → $KIN, weekly leaderboard payouts to contributors ▸ OpenMind: 180K+ humans in app, points 11 60/day, OM1 powering multiple robot classes, FABRIC IDs minted at scale on Base, Pi integration adding decentralized AI compute at network level Why I care: ✦ Cultural trust → IP-backed agents start with emotional context, which drives stickiness and monetization for @Kindred_AI ✦ DePIN for embodied AI → verifiable identity, payments, and compute gives @openmind_agi a credible path to real-world deployment ✦ Both teams ship: fast iteration, measurable usage, and clear incentive design for builders and users What I’m doing this week: ▸ Kindred: daily agent sessions (aim 30 min), rank up on Yapper boards, pick an IP sub to anchor content, track Nov 5 Space + mid-Nov snapshot ▸ OpenMind: farm points with mapping, mint FABRIC identity, try the simulator, collect badges, join dev track if you can code Catalysts to watch (near-term): ▸ Kindred × Sei rollout, Genesis campaign endgame, airdrop snapshot, early $KIN mechanics reveal ▸ OpenMind demos at Berkeley, Pi nodes going live for AI jobs, OM1 repo momentum and ODL contributions One powers emotionally intelligent agents at scale. The other brings autonomous robots into a verifiable onchain economy. Same frontier, two different edges #AI #Web3 #Robotics #DePIN

➥ The AI asset marketplace turning robots into on‑chain yield @ownaiNetwork We’re finally seeing DePIN go from buzz to books: fleets logging real miles, cashflow hashed to oracles, and governance deciding where the next machine works. Think autonomous taxis, factory arms, city infrastructure, all co‑owned and revenue sharing to $OAN stakers What’s live ▸ Marketplace for AI assets (Own‑V mobility, Own‑M manufacturing) with verified telemetry ▸ Yield engine paying 5 15% APY from real operations ▸ Insurance module in beta covering downtime and incidents with on‑chain risk data ▸ $OAN utility: vote, stake, fee discounts, analytics access, collateral for DeFi loans ▸ Optimism rails for low fees, Chainlink oracles, audited contracts (PeckShield) ▸ Integrations: Unitree G1 fleets, KUKA bots, Nokia 5G/6G backhaul, Google Cloud sims Numbers that actually matter ▸ 1,000+ tokenized AI assets, $50M TVL, 5K daily tx ▸ 18.5K holders, 25.6K on X, 20K app downloads ▸ Liquidity across CEX/DEX with $15M pooled and $2.1M 24h volume ▸ DAO vote expanded Own‑V by 500 vehicles with 78% approval Why this stacks up ▸ Real‑world revenue, not hypothetical points ▸ Data‑verified yields: telemetry → oracle → payout, no mystery boxes ▸ Compliant posture (MAS sandbox, KYC thresholds) while preserving open participation ▸ Clear path to scale via 5G nodes and cross‑chain bridges in 2026 ▸ Distribution engine through the Yapper Program, aligning growth with community How to plug in ▸ Stake $OAN → earn from robot pools with auto‑compounding tiers (30/90‑day locks) ▸ Vote in the DAO → direct deployments, audits, and ESG allocations ▸ Join Yapper leaderboards → Yaps convert to $OAN, weekly payouts, monthly airdrops ▸ Run testnet validators → 100 $OAN incentives and early badges ▸ Track catalysts → Oct 31 staking snapshot, Nov 1 leaderboard reset + double points week, Nov 5 Space, Nov 15 insurance mainnet, Devcon Nov 10 Checklist before you ape ▸ Read fee splits (2% tx fees fund quarterly burns) ▸ Note team vesting and the 5M unlock on Nov 1 ▸ Verify pool APYs vs. risk cover terms ▸ Use CEX/DEX liquidity wisely; watch slippage on larger clips ▸ Keep an eye on Proposal #46 (fleet audit, Nov 7) Simple thesis: DePIN with verifiable robot cashflows plus a DAO that allocates capital like a fund can outpace purely narrative coins. If they hit the 2026 bridge and 2028 asset targets, $OAN sits at the center of an AI RWA stack that pays while it scales #RWA #DePIN #AI #Web3 #OWNAI $OAN

➥ How long can we live That whisper at the dawnfire just got a lab coat and a ledger as @BioProtocol rolls out its first BioAgent, Aubrai trained on unpublished longevity data from Aubrey de Grey, pointed at the edge of human healthspan, and wired with incentives to turn bold ideas into testable science What this actually means to me: ▸ AI that doesn’t hoard insights, it stewards them provenance on-chain, contributions tracked, knowledge compounding ▸ Research that funds itself hypotheses → staking → validation → rewards in BioXP ▸ Community as co-lab, not cheer squad “Hypothesize to Earn” puts 1M BioXP on the table for real signals Ignition Sale goes live with 0.5% supply a clean scarcity curve to price early conviction while the agent spins up Why I’m stepping in: ✦ Verifiable research flow ✦ Incentives aligned to discovery, not hype ✦ A path to run longevity like software: ship, test, iterate, prove If you’ve been waiting for DeSci with teeth, this feels like the moment to pick a hypothesis and hit submit

➥ My clean read on @RaylsLabs | $RLS pre‑TGE traction The UniFi design reads like a liquidity machine for institutions moving onchain: → Private Subnets for regulated operations → KYC‑gated Public Chain for DeFi access → Privacy Nodes inside bank walls → Tokenized assets move privately, then distribute publicly → Fees/gas in $RLS → staking → governance → builder grants Each loop tightens compliance while opening liquidity, so activity fuels the network rather than fighting it What’s hitting right now before TGE: ▸ CoinMarketCap tracking live so everyone can follow $RLS and community metrics ▸ Cookie3 pool boosted to $700K for Snappers with a clear split: global, Korea/LATAM, and $COOKIE staker lanes ▸ Phase 2 adds $200K post‑TGE, so momentum doesn’t fade when the token goes live ▸ Distribution starts seven days after TGE: 50% unlocked, 50% vesting five months clean, predictable flow ▸ Institutional creds are already on record: CBDC pilots in Brazil (Drex), JP Morgan tokenization workstreams, and Arbitrum Orbit prep for scale The real value is how the rails operate: ▸ KYC gating on the public side lowers dust and AML headaches, making DeFi a safe venue for banks ▸ USD‑pegged gas stabilizes ops budgets ▸ Enygma‑grade privacy ensures selective disclosure and quantum‑resistant protections ▸ EVM compatibility keeps dev friction low while programmable compliance rules keep auditors sane If you’re snapping on @cookiedotfun, the leaderboard meta matters: → Engagement mechanics reward actual participation → Regional pools pull in fresh voices instead of recycling the same whales → Phase resets keep the playing field fair The upside for creators is simple: earn while learning how the rail‑to‑liquidity pathways work in practice ✦ Opportunities ▸ Tokenize receivables, real‑estate debt, and short‑dated credit into compliant vaults ▸ Cross‑border FX settlement as a private‑to‑public pipeline ▸ CBDC experiments that batch retail payments while preserving privacy ▸ Builder grants around the Rayls SDK + Commit Chain targeting compliance‑aware dApps ▸ Orbit‑level throughput on @arbitrum to absorb institutional bursts without sacrificing finality My takeaway: activity is compounding ahead of launch because the system gives banks a private lane and devs a public canvas, then stitches them together with compliance logic. If mainnet lands on schedule, first TVL waves will likely come from regulated RWAs and debt issuance, with PoS + Proof‑of‑Usage capturing that flow for $RLS stakeholders I’m watching @RaylsLabs for precisely this balance: privacy where it matters, openness where it counts, and rewards that track real usage rather than vanity metrics #RWA #DeFi #Web3

➥ High-conviction playbook for the next few weeks: EdgenTech for discovery + River4FUN for yield and mindshare. InfoFi signals to find the move, DeFi rails to lock rewards. One loop, two engines, compounding outcomes @EdgenTech @River4fun Edgen first. Multi‑agent copilot across stocks + crypto that actually routes your question to specialists and gives one coherent answer. Portfolios grade A+→C‑ with momentum, fundamentals, macro context. Theme Beta for volatility alignment. Pivot Alerts for timing. Perp DEX tracker pulls Hyperliquid, Aster, Jupiter, $DYDX, $GMX on one screen. X402 narrative flow is hot, $PAYAI ripped, and machine‑native payments have legs. Aura grind matters if you care about OG/Elite and visibility. This is where ideas stop being noise and turn into repeatable plans River next. River4FUN is the engagement and contribution layer on top of River’s cross‑chain stablecoin stack. River Pts earn + stake, with dynamic conversion to $RIVER over 180 days. SmartVaults for retail, PrimeVaults for institutions, zero‑liquidation design across omni‑CDP. Vote4Creators Season 2 is live with rising stars and voter rewards. Pts sale demand shows appetite is real. Pair onchain yield with yapper momentum and you’ve got a second engine that pays while you build reputation Why the combo works: → Discovery on @EdgenTech: screen Themes, fire 360° Reports, align Beta, and set Pivot Alerts across mixed lists (AAPL + ETH + $RIVER) → Execution: Perp DEX dashboard to watch volume/1h flips; keep confirmations over hopium → Expression on @River4fun: daily yaps, focused votes, and pts staking to turn attention into convertible rewards → Compounding: pts → $RIVER, while the next Edgen signal refills the pipeline Quick look at the data: ▸ Edgen Portfolios compress research time from hours to minutes; letter grades + 360° view make rotation obvious ▸ Theme Beta is clutch: β>1 thrill zone, β<1 steady zone plan size via volatility ▸ Perp DEX panel removes tab‑hopping and keeps you close to real flow ▸ River Pts demand and staking APR point to sticky engagement; zero‑bridge omni‑CDP means capital stays efficient ▸ X402 mindshare still climbing; agent‑to‑agent payments are building a narrative floor Minimum viable actions to win: ▸ Build a 20‑30 asset list in Edgen → scan A/B grades → open 360° for underperformers ▸ Watch mindshare delta, perp OI, fee run‑rate post clean screenshots with receipts ▸ Align Theme Beta before chasing alpha; size position based on risk, not vibes ▸ On River, stake pts, vote with intent, and yap with clarity small accounts deserve signal and get recognized when posts show effort ▸ Keep cadence consistent; compounding comes from repetition, not one‑offs Risk framing: ▸ Beta cuts both ways scale in, not all‑in ▸ $RIVER conversion ramps over time; plan horizons, avoid forced exits ▸ Unlock calendars and vesting matter; your edge is timing, not hopium What I’m tracking next: ▸ @EdgenTech Insight Showdown through Nov 10 and how pivot alerts behave around earnings + onchain spikes ▸ @River4fun Vote4Creators leaderboard flow into pts staking and conversion dynamics ▸ Cross‑asset narratives: $BTC trend, $ETH consolidation, X402 adoption footprint, and whether $NVDA strength drags AI beta If a Pivot Alert fires while a River campaign is peaking, I rotate focus, post with receipts, stake pts, and let yield + mindshare compound. InfoFi meets DeFi in one continuous loop. Tag me when your combo hits and go louder on real signal, not noise #InfoFi #DeFi $RIVER $BTC $ETH $PAYAI @EdgenTech @River4fun