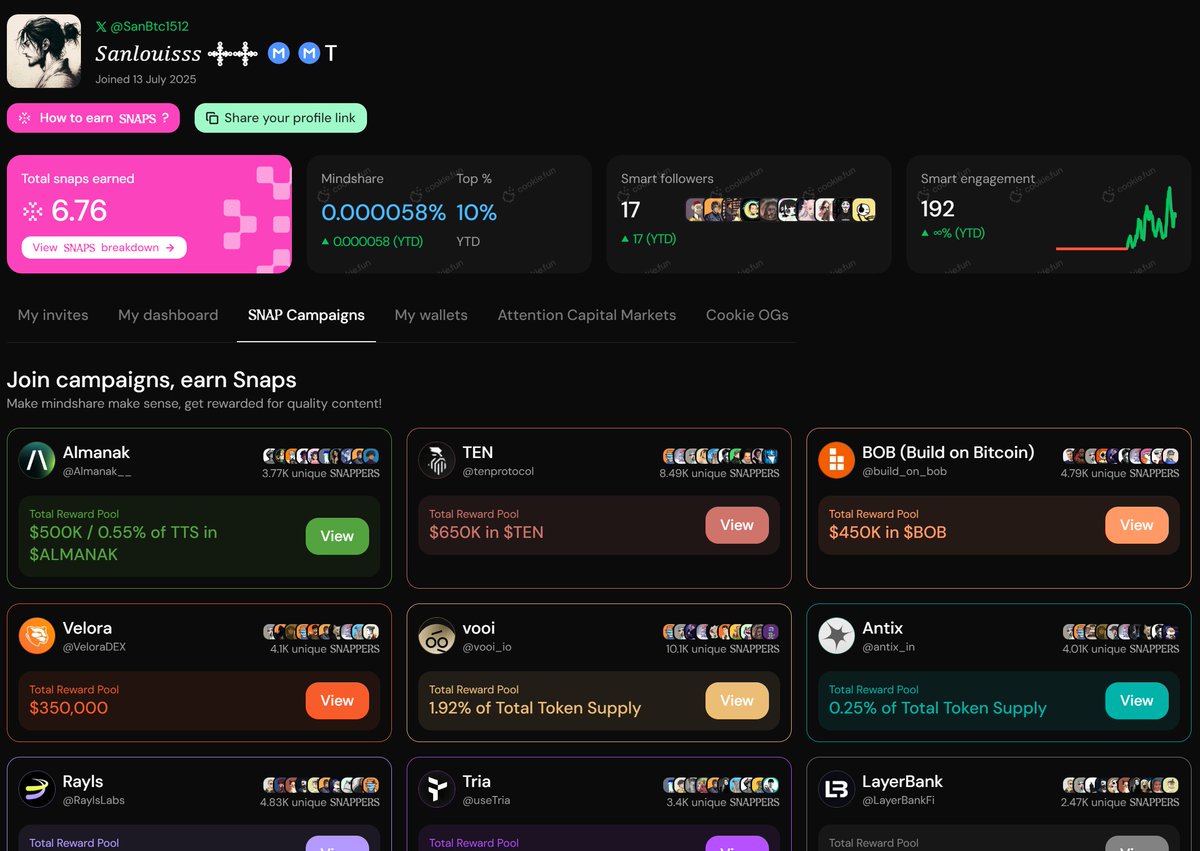

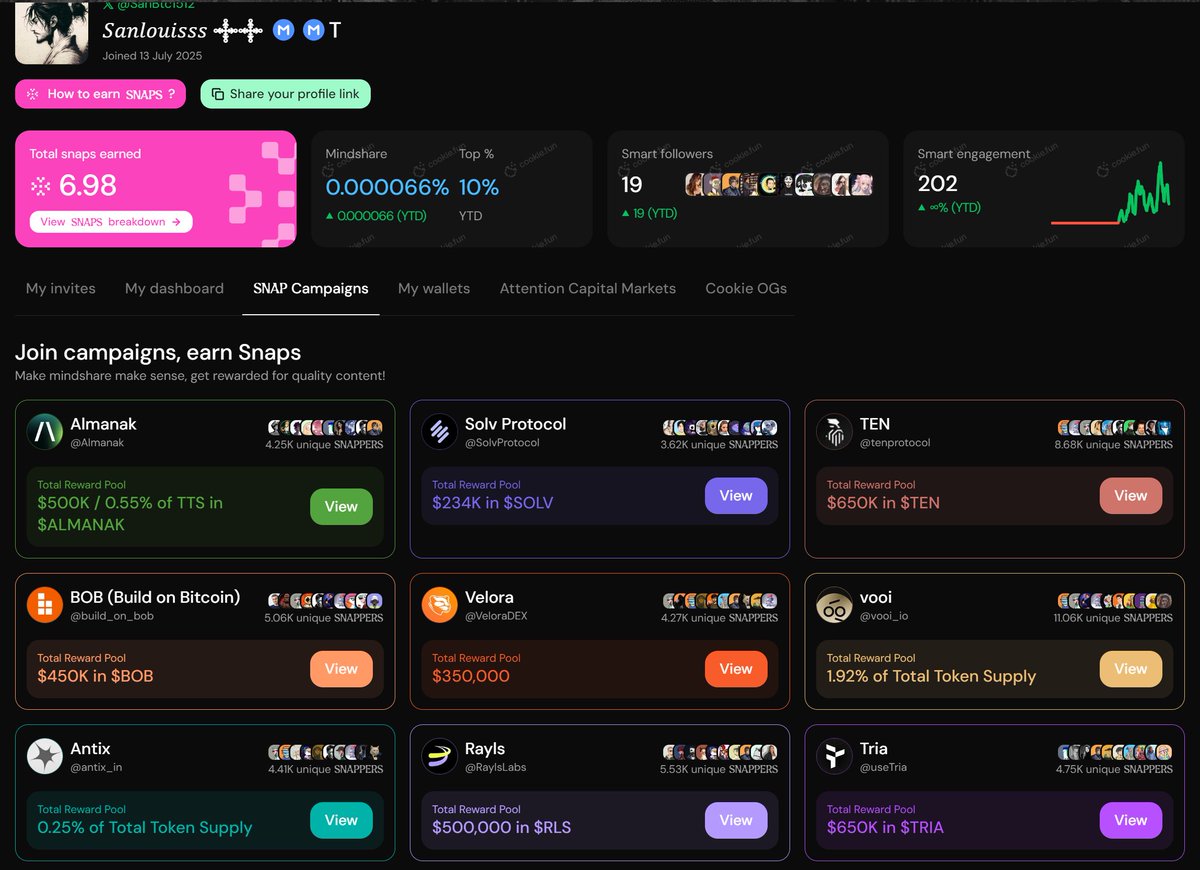

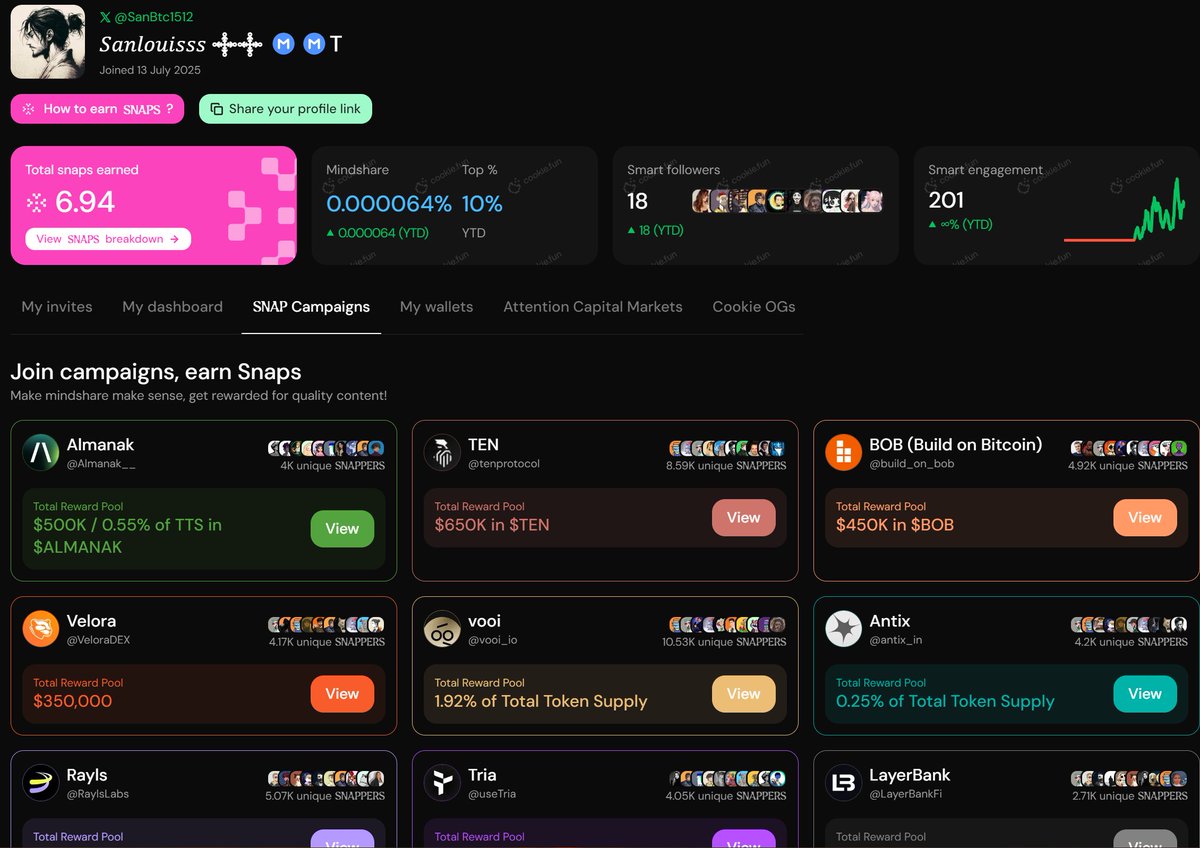

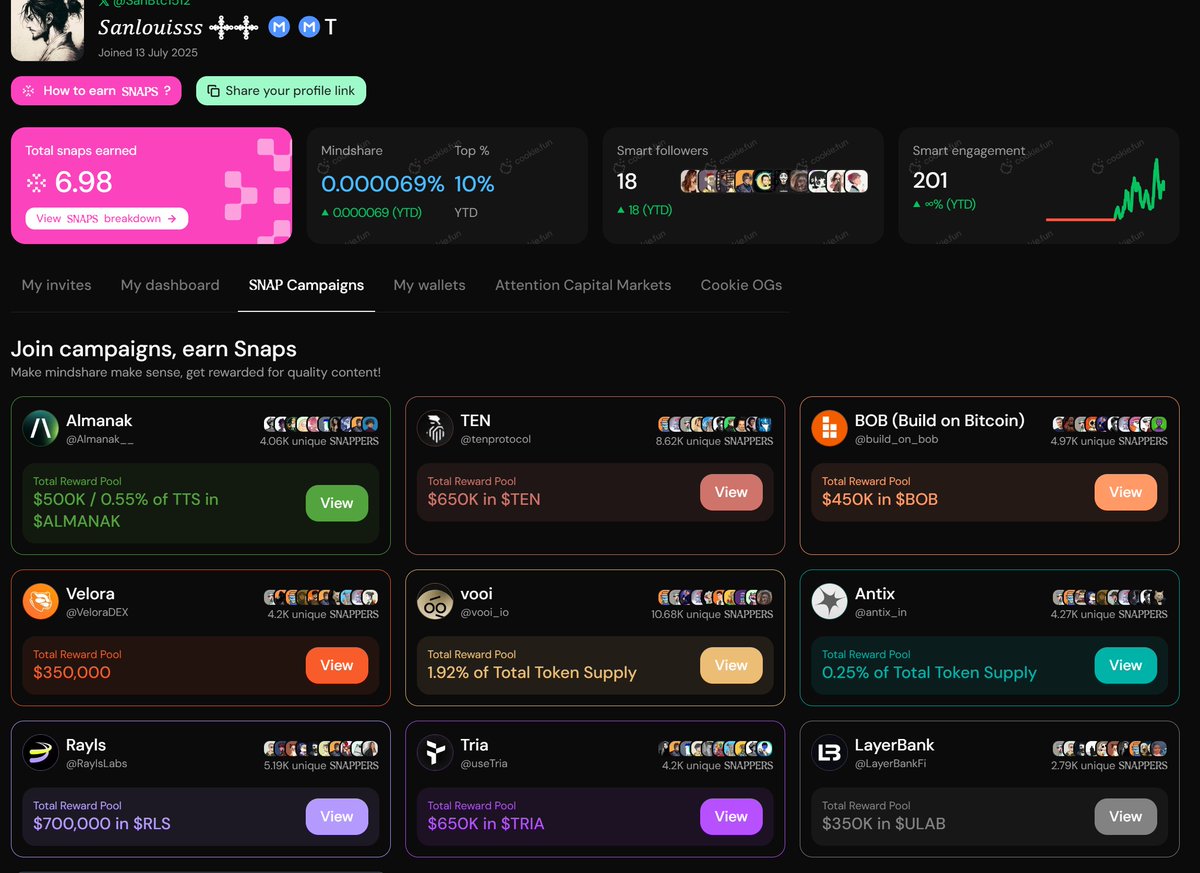

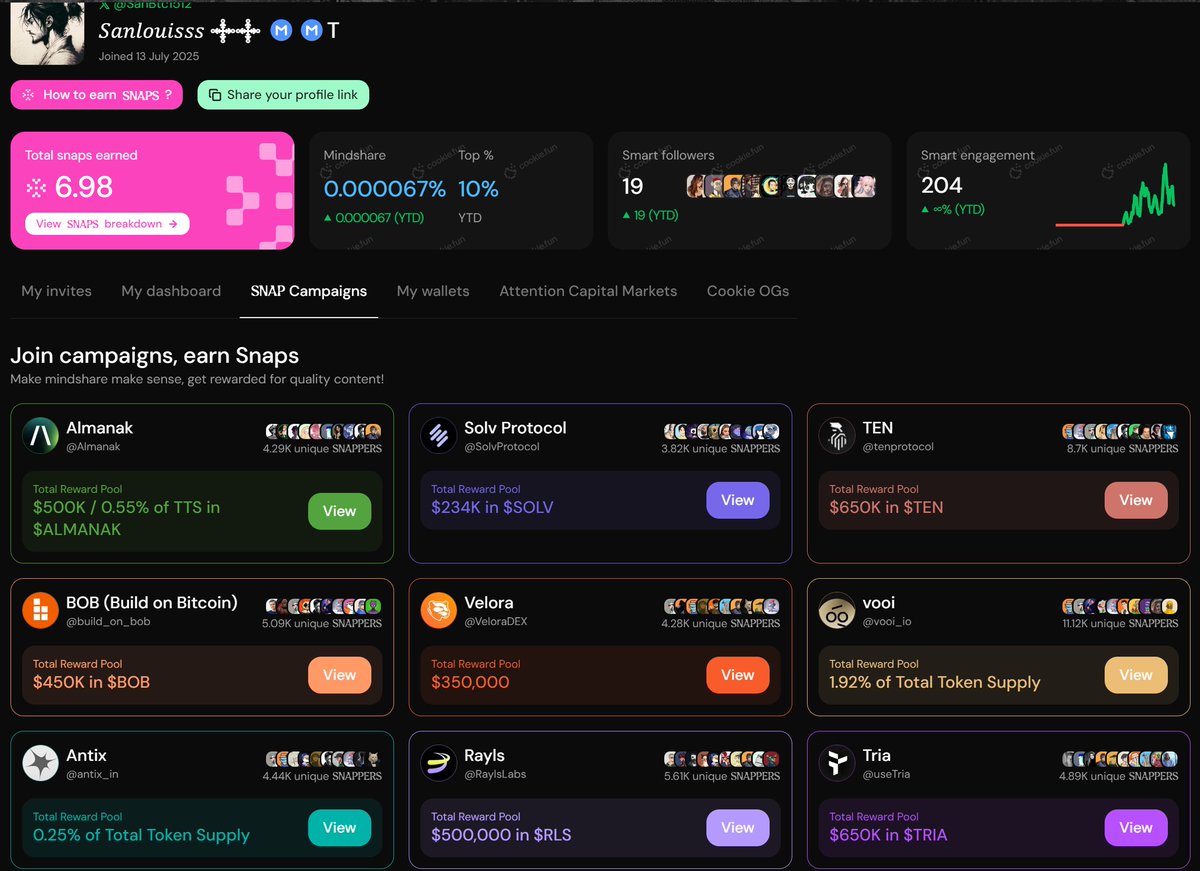

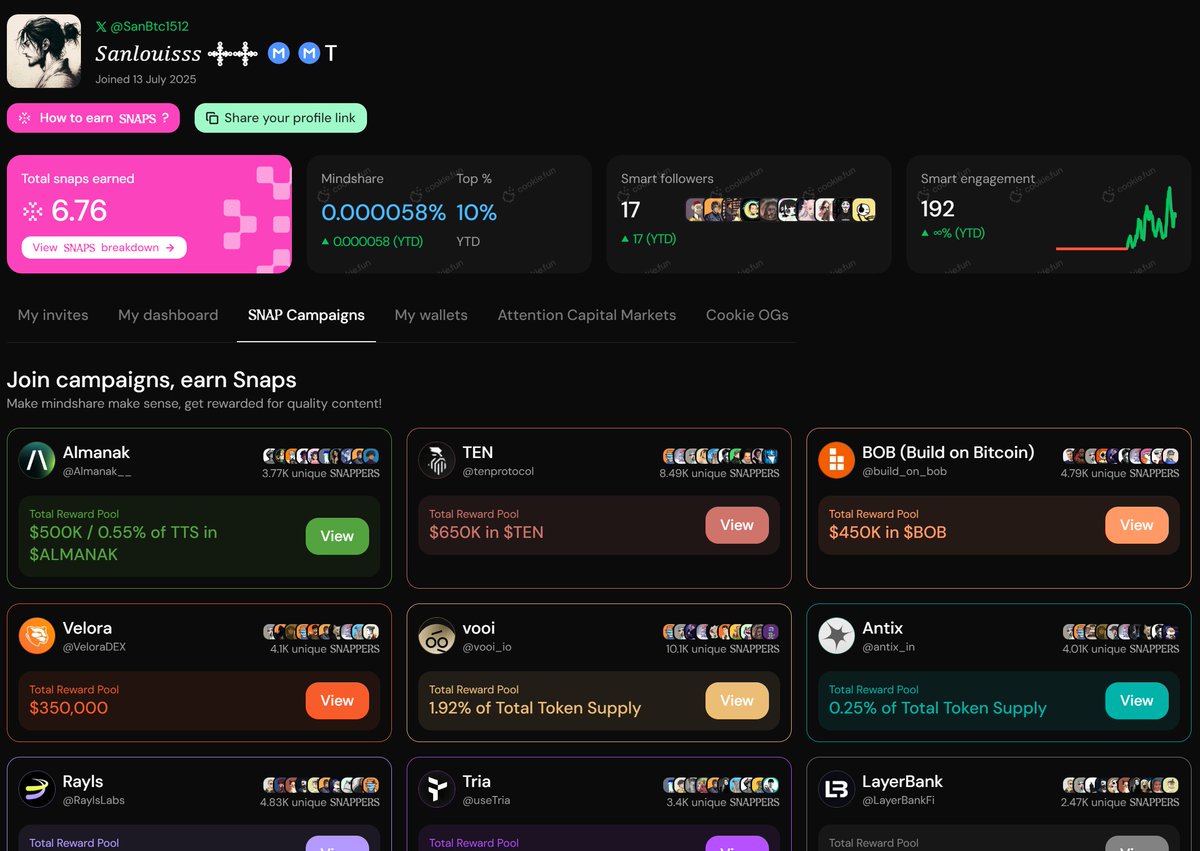

Get live statistics and analysis of 𝑆𝑎𝑛𝑙𝑜𝑢𝑖𝑠𝑠𝑠 𖥟𖥟 🌊RIVER's profile on X / Twitter

𝖡𝗎𝗂𝗅𝖽𝗂𝗇𝗀 𝗍𝗁𝖾 𝖿𝗎𝗍𝗎𝗋𝖾, 𝗈𝗇𝖾 𝖻𝗅𝗈𝖼𝗄 𝖺𝗍 𝖺 𝗍𝗂𝗆𝖾 | 𝖯𝖺𝗌𝗌𝗂𝗈𝗇𝖺𝗍𝖾 𝖺𝖻𝗈𝗎𝗍 𝖼𝗋𝗒𝗉𝗍𝗈 𝖺𝗇𝖽 𝖼𝗈𝗆𝗆𝗎𝗇𝗂𝗍𝗒.

The Innovator

𝑆𝑎𝑛𝑙𝑜𝑢𝑖𝑠𝑠𝑠 𖥟𖥟 🌊RIVER is a passionate crypto architect, building the future one blockchain block at a time. With a deep focus on onchain finance, compliance, and omni-chain execution, they craft sophisticated DeFi stacks that seamlessly combine privacy, speed, and usability. An unstoppable force in the Web3 space, they pioneer crosschain capital flows while fostering community-driven innovation.

Top users who interacted with 𝑆𝑎𝑛𝑙𝑜𝑢𝑖𝑠𝑠𝑠 𖥟𖥟 🌊RIVER over the last 14 days

You tweet enough to power an entire blockchain node, yet somehow it feels like your followers need a Rosetta Stone just to translate your crypto jargon-heavy sermon into plain English. Maybe dial down the techno-sorcery and dial up the popcorn-worthy hot takes?

Successfully built and shared a multi-layered, compliant onchain finance stack that integrates privacy, crosschain liquidity, and real-world use cases—garnering significant community traction and early institutional interest.

To advance decentralized finance by creating secure, compliant, and scalable onchain infrastructure that bridges traditional finance with next-gen blockchain technology, empowering users to transact and grow wealth seamlessly across chains.

Believe in privacy where it matters, openness where it counts, and programmable compliance as the foundation for real-world adoption. Values innovation, transparency, user sovereignty, and the power of community collaboration to build a more inclusive financial future.

Mastery of crosschain protocols and nuanced DeFi integrations, exceptional technical insight, clarity in complex financial architecture, and a highly engaged community of like-minded innovators and users.

Can sometimes dive so deep into technical details that newcomers get left behind, and the relentless grind of high-frequency tweeting may risk overwhelming their audience’s attention span.

Focus on crafting more bite-sized, visually engaging summaries or explainer threads tailored to crypto novices to broaden your audience on X. Use polls and AMAs to foster interactive discussions around your cutting-edge stacks, blending technical mastery with approachability.

Fun fact: Despite tweeting over 34,000+ times, their true superpower lies in synthesizing complex multi-protocol systems into actionable, high-impact DeFi playbooks that turn noise into results.

Top tweets of 𝑆𝑎𝑛𝑙𝑜𝑢𝑖𝑠𝑠𝑠 𖥟𖥟 🌊RIVER

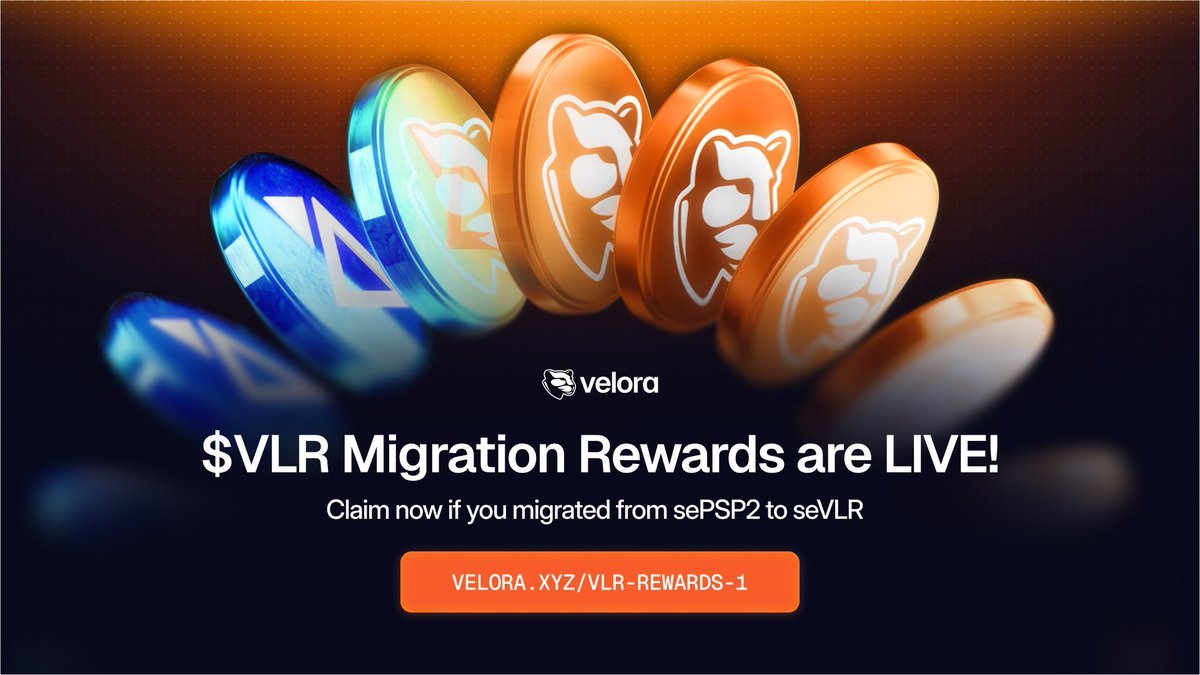

➥ The onchain finance stack I’m using to move from bank-grade liquidity → crosschain execution → yield → real-world spend 1) Settlement & compliance rail → @RaylsLabs ▸ Hybrid UniFi design: Privacy Nodes for banks + public EVM L2 for liquidity ▸ Stablecoin infra with ZK-proven 1:1 reserves, FX corridors, CBDC-ready ▸ Fresh momentum: BIS/BoE demo, public sale closed $1.75M+, Litepaper details 10K TPS privacy ▸ Watch $RLS for governance over subnets, fee policy, and network growth 2) Crosschain execution layer → @VeloraDEX ▸ Intent-first routing across 100+ DEXs and 15+ bridges with MultiBridge ▸ Native bridges live for Base and Arbitrum + CCTP for true native USDC ▸ Gasless swaps, MEV-safe routes, MAP pathing for better quotes ▸ Near-term catalysts: governance burn vote mid-Nov, migration window ends Dec 16, $VLR staking rewards 3) Omni-chain money market → @LayerBankFi ▸ Lend/borrow across 17+ networks; automated looping vaults for BTC-Fi and RWAs ▸ One-flow bridging via @lifiprotocol moves funds to the right chain then Supply in one step ▸ veULAB staking and a global airdrop lining up for Q4, plus isolated pools for cleaner risk ▸ Track $ULAB for fee buybacks, boosted APRs, and vote-escrow governance 4) Spend, trade, earn app → @useTria ▸ Gasless, bridge-less flows routed by BestPath AVS across 70+ networks ▸ zkKYC in production with @billions_ntwk: verify without exposing personal data ▸ Visa card tiers with on-chain yields offsetting swipes; TGE and loyalty boosts this quarter ▸ $TRIA powers fee discounts, agent intents, and premium card benefits Playbook ▸ Mint or onboard via Rayls-grade stables → route with Velora intents → deposit/loop on LayerBank → spend via Tria while yields keep compounding Save this stack and front-run the next wave #DeFi #Crosschain #BanksOnchain

The onchain execution stack is finally snapping into place four pieces, one playbook for speed, compliance, spend, and credit in #DeFi Trades → @VeloraDEX ▸ Intents + MEV-protected routing across 160+ protocols ▸ MultiBridge auto-picks Across / Relay / Stargate / Celer / native bridges, plus real USDC via CCTP ▸ Live on Ethereum, Base, Arbitrum, Optimism, Polygon; limit orders + Super Hooks chaining ▸ $VLR staking (seVLR) shares protocol fees; migration incentives run through Dec 16 Compliance liquidity → @RaylsLabs ▸ Hybrid UniFi: public L2 + private ZK subnets with Enygma privacy ▸ $1.75M public sale closed on Republic, 70+ nations, 1,200+ backers ▸ RWA tokenization, CBDC rails, KYC-gated public chain ▸ Farm RP via Cookie/Fuul, Galxe quests live until Oct 31; TGE targeted Q1 2026 for $RLS Spend layer → @useTria ▸ Self-custodial neobank; BestPath AVS for gasless, chain-abstracted payments ▸ Tria Card for 150+ countries, up to 6% cashback; sub-second routing ▸ $12M raise fuels AI agent rails; Solana abstraction in beta ▸ Cookie cSNAPS $650K running 5 months; MindoAI x Tria $120K creator push; loyalty perks teased for X Community ▸ Position for $TRI via snap, trade, stake, refer Credit/yield → @LayerBankFi ▸ Omni-chain money markets on 17+ networks; zero bad debt track record ▸ Bridge inside the app powered by @lifiprotocol → Cross. Supply. One flow ▸ BTC-Fi and RWA looping with eMode; Rootstock campaigns live ▸ Final L.Points season ahead of late Oct/Nov $ULAB TGE and veTokenomics; Golden Sats ends Oct 25 Field playbook: 1) Test Velora’s MultiBridge and stake $VLR for fee share 2) Join Rayls’ quests before Oct 31, track $RLS milestones 3) Grind Tria’s cSNAPS + MindoAI ranks, activate the card 4) Farm LayerBank L.Points, bridge-in-app, prep for $ULAB Four rails, one direction: programmable money at scale in #Web3

➥ my altseason stack for real throughput, not vibes Execution → @VeloraDEX ▸ intent engine (Delta v2.5) routes across 160+ protocols ▸ native USDC via Circle CCTP kills wraps and fragmentation ▸ MEV-shielded, gasless flows, cross-chain limit orders that actually fill ▸ $VLR live, 1:1 migration from PSP, governance + staking coming online Payments → @useTria ▸ self custodial neobank that feels seedless and gasless ▸ BestPath routing on Arbitrum, card spend in 150+ countries ▸ $12M backed, leaderboards live, $TRIA economy bootstrapping users and devs Credit → @LayerBankFi ▸ deposit once, borrow/earn across ETH, Base, Arbitrum, Linea, Scroll, Manta ▸ isolated markets, audits, clear health metrics, leverage looping vaults ▸ TVL growing with real users, not mercenary spin Institutions → @RaylsLabs ▸ dual chain design with Enygma privacy (ZK + homomorphic, quantum safe) ▸ EVM native, auditor view keys, pilots with Brazil’s CB and JPM How I play: route intent via Velora → fund Tria for spend → loop collateral on LayerBank → watch Rayls for infra tailwinds #DeFi #Altseason

Building my Q4 onchain stack around four pillars: intent routing, bank-grade rails, chain abstraction, and omni-chain credit. If you want fewer tabs and more outcomes, these are the plays I’m leaning into for compounding mindshare and rewards in one flywheel ➥ @VeloraDEX ▸ Delta v2.5 = intent-based, MEV-shielded execution that auto-routes across 160+ sources and 12+ EVMs ▸ MultiBridge ties in Across, Relay, Stargate, Celer + native Base/Arbitrum bridges, CCTP for true USDC ▸ $VLR staking shares 80% protocol fees; S3 APY ~15-20%, fee-burn vote Nov 5, migration streams end Dec 16 ➥ @RaylsLabs ▸ “Blockchain for banks” with Enygma privacy, USD-pegged gas, Arbitrum Orbit 10K TPS testnet ▸ Mainnet Dec 15, $RLS TGE Jan 15; Yap Points convert post-TGE ▸ Active campaigns: #gRayls + treasury RWA grant vote; top content actually moves the needle ➥ @useTria ▸ Self-custodial neobank: BestPath routing, gasless cross-VM swaps, yield-on-spend, Tria Card ▸ zkKYC with @billions_ntwk live (verify without exposing data); $12M raise fuels rollout ▸ Snappers rewards + creator tools via MindoAI; TGE teaser Nov 15, card rollout Dec 1 ➥ @LayerBankFi ▸ Omni-chain lending across 17+ networks, zero bad debt, BTC-Fi + RWA loops ▸ LI.FI bridge inside app for one-flow move → supply; veULAB staking teased, $ULAB TGE mid-Nov ▸ L.Points blitz through Nov 15; Golden Sats ends Oct 31; Space on veTokenomics Oct 28 My playbook → Route USDC via Velora MultiBridge to where fees are lowest, stake seVLR before the Nov 5 vote → Farm Rayls Yap Points by shipping one high-signal thread before Oct 25; lock in testnet quests → Set up zkKYC on Tria, grab Snappers multipliers, prep for card perks ahead of Dec 1 → Bridge inside LayerBank, run conservative loops on Rootstock, stack L.Points pre-TGE Execution over noise. Deadlines matter, compounding matters, privacy and compliance matter. Stack the rails now and let the flows work for you #DeFi

➥ The stack I’m rotating through this quarter for intent-first, compliant, omni‑chain flows spans execution, rails, spend, money markets, and BTCFi powered by @VeloraDEX, @RaylsLabs, @useTria, @LayerBankFi, @Solvprotocol Velora (execution layer) ▸ Intents with MEV‑safe routing and gasless Delta for precise fills ▸ MultiBridge auto‑selects Across, Relay, Stargate, Celer; Base/Arbitrum native bridges, Unichain live ▸ Native USDC via CCTP, 160+ sources, 500+ assets after the latest token expansion ▸ Practical impact: sharper quotes, fewer reverts, target hits on crosschain limit orders Ticker: $VLR; migration and seVLR fee share on deck Rayls (privacy + compliance rails) ▸ Hybrid architecture: Private subnets + Public L2; ZK + homomorphic crypto guard data ▸ Featured in Brazil’s tokenization report; banks testing DvP, stablecoins, receivables ▸ Mainnet targeting December; TGE for $RLS soon, institutional pilots maturing ▸ Principle: private where it matters, open where it counts; programmable compliance for real capital Tria (self‑custodial spend layer) ▸ BestPath AVS compresses swaps/bridges across EVM/SVM/Move; gasless intents ▸ zkKYC with Billions for proof‑based verification; Visa rails in 150+ countries ▸ Weekly recaps show 20K+ users, $18M+ BestPath volume, 6% cashback tiers rolling out ▸ Airdrop Seasons teased, $650K Cookie ACM live, creator keys via MindoAI; backed by a fresh $12M raise LayerBank (omni‑chain money markets) ▸ Lend/borrow/loop across 17+ networks with zero bad debt track record ▸ In‑app LiFi bridging: bridge‑to‑supply in one flow; BTC‑Fi on Rootstock, eMode loops ▸ L.Points now; $ULAB TGE in Q4 with ve‑staking, fee share, buybacks ▸ Bread‑and‑butter: correlated loops, RWA yields amplified, cross‑chain treasury ops at speed Solv (BTC operating layer) ▸ 24K+ BTC reserves, instant mint/redeem, PoR weekly; MiCA‑aligned and Shariah‑certified ▸ Rootstock + Avalon integrations for BTC‑backed lending and USD liquidity; Base cbBTC yields live ▸ SNAPS campaign on Cookie: $234K+ to reward mindshare; structured BTC finance at scale ▸ Token rails: $SOLV, vSOLV for conviction rewards, BTC+ for yield routing How I route today → Fire a MEV‑safe intent on Velora to move native USDC via CCTP exactly where needed → Park stables or BTC in LayerBank loops sized to eMode and oracle mix → If a counterparty needs privacy or auditability, settle via Rayls Private → Public flow → Swipe with Tria; BestPath eats bridges, FX, gas while keys stay with me → Idle BTC goes SolvBTC, then borrow stables on Rootstock to loop back in LayerBank Catalysts I’m tracking ▸ Velora: ERC‑7683 upgrade, agent marketplace beta, more L2s ▸ Rayls: December mainnet, $RLS TGE, central‑bank demos graduating to production ▸ Tria: zkKYC in production, Airdrop Seasons, AI agent spend ▸ LayerBank: $ULAB TGE + veULAB, eMode expansions, global airdrop ▸ Solv: ETF tokenization, BTC+ expansions, SNAPS sprint for top creators Smart tips ▸ Prefer native USDC paths via CCTP to cut wrap risk ▸ Loop only correlated assets; respect LTV bands and liquidation buffers ▸ Pre‑TGE accrual compounds hardest: L.Points for $ULAB, loyalty points for $RLS, SNAPS for $SOLV ▸ Measure execution quality, not button clicks; let intent agents abstract the pain Chain abstraction meets compliant capital and real payments at the edge. Pick your lanes, let the agents comp the friction, and let usage drive ownership #DeFi #RWA #BTCFi

➥ Four rails that actually compose in onchain finance ▸ @VeloraDEX → intent engine with MultiBridge + CCTP native USDC, MEV-shielded paths, gasless on Base/Arbitrum, 160+ DEX liquidity across 12 chains, $VLR staking sharing 80% of fees ▸ @RaylsLabs → banks issue stablecoins privately with ZK-proof reserves, LayerZero corridors to 120+ networks, Enygma privacy for DvP, public sale wrapped and #BanksOnchain week loading, $RLS governance and staking on deck ▸ @useTria → self-custodial neobank, zkKYC with @billions_ntwk, BestPath on @arbitrum, card accepted at 130M+ merchants in 150+ countries, AI-ready routing and ~$1M creator rewards via Mindo ▸ @LayerBankFi → omni-chain money market on 17+ networks, E‑Mode for safer leverage, in‑app bridging (Lif3), BTC/RWA loops, zero bad debt, veULAB + TGE queued, $ULAB for governance and boosts How I’d route capital today 1) Express an intent on @VeloraDEX for USDC with native CCTP flow → land where yield is best 2) Spend globally via @useTria card or park idle cash in @LayerBankFi E‑Mode pools, loop conservatively 3) Institutional stack mints bank-grade stables on @RaylsLabs private subnets, bridge liquidity to the public chain, then tap DeFi yields without leaking sensitive data KPIs I watch ▸ Velora: $131B cumulative volume, RFQ v2 in November ▸ Rayls: 353,970 X followers, testnet throughput +10K TPS ▸ Tria: $1.5M volume in 8 weeks, $300K revenue, zkKYC live ▸ LayerBank: 693K users, $92M TVL, zero bad debt amid stress ✦ Near‑term catalysts ▸ @VeloraDEX DAO fee‑burn vote Nov 5, RFQ v2 Nov 15 ▸ @RaylsLabs #BanksOnchain Oct 27 31, Testnet Phase 3 grants ▸ @useTria perps in December, zkKYC full rollout November ▸ @LayerBankFi L.Points finale Oct 31, veULAB + TGE Q4 TL;DR: intent + compliance + self‑custody + omni‑yields = one flow, many outcomes ngl the stack is getting dangerously close to chain‑abstracted finance that feels like a single network #DeFi #RWA

➥ DeFi playbook this cycle = frictionless swaps + universal banking + agent‑native payments + institutional rails @VeloraDEX ▸ Intent‑based execution, MEV‑shielded and gasless swaps with limit orders ▸ MAP routing unlocks hidden paths and cuts slippage up to ~30% across pools ▸ Cross‑chain flow across $ETH → OP → Base with unified liquidity so you trade like it’s one network ▸ $VLR drives governance + staking; 1:1 migration from $PSP is gas‑free before Dec 16, 2025 for extra rewards @LayerBankFi ▸ One deposit → lend, borrow, loop across Linea, Scroll, Manta, Base without juggling bridges ▸ Midas mBTC looping on Rootstock, direct mint + wrap in‑UI, up to 135% BTC‑denominated yield via automation ▸ L.Points meta: supply $1 = 0.3 pts, borrow $1 = 2.4 pts, loop to stack points faster ahead of $ULAB events @useTria ▸ Raised $12M to push self‑custodial neobanking with chain + AI abstraction ▸ BestPath AVS routes intent liquidity across EVM, Solana, Move, Cosmos ▸ TriAI + CoreSDK (TEEs, automation) for agents that spend/trade/earn ▸ Tria Visa card → usage tiers boost future $TRIA airdrops + real cashback @RaylsLabs ▸ Hybrid architecture for banks: Ethereum‑based public L2 + private L1 with Privacy Nodes ▸ $RLS as governance/utility, $USDr for gas + settlements to align compliance and throughput ▸ KYC‑gate, CBDC rails, bonds/FX tokenization, cross‑border settlement with institution‑grade privacy How I stack them rn: 1) Route swaps on @VeloraDEX to optimal stables with MAP, gasless and MEV‑safe 2) Park collateral in @LayerBankFi, borrow against it, automate loops to farm L.Points and prep for $ULAB 3) Spend via @useTria card, let volumes + tiers compound rewards while agents handle multi‑chain ops 4) Track @RaylsLabs integrations, stake $RLS, and position for RWA settlement flows as liquidity migrates onchain Fragmentation kills UX; convergence compounds yield. Pick your spots, stay consistent, let mindshare and infra do the lifting $VLR $RLS $ULAB #DeFi

➥ The cross-chain stack that actually cooks right now and covers my full flow end to end When I need clean, intent-driven execution across chains, I route through @VeloraDEX. Delta v2.5 lets me set limits, deadlines, private routing, and get MEV protection while MultiBridge picks Across, Relay, Stargate, Celer or native paths automatically. CCTP keeps USDC mint/burn native so quotes aren’t scuffed, gasless on L2s means I don’t babysit fees, and $VLR staking gives discounts plus governance over the route engine. Phase 3 Snaps is live, migration waves from $PSP → $VLR are still rolling, and the Balancer situation didn’t touch seVLR or trading at all. Outcome thinking, not hop anxiety For daily spend and the “feels like money” UX, @useTria is the front-end I hand to friends. BestPath AVS abstracts bridges and gas across 28+ chains, the Visa card hits 150+ countries with up to 6% cashback, and self-custody stays intact so I don’t lose sleep. The $TRIA community sale went ballistic, their AI agent rails plug into real transaction flows, and the cookie meta rewards usage over noise. The card cliché misses the point banking abstraction with agent-ready infra is the unlock Yield and leverage without shenanigans sits on @LayerBankFi. Unified pools, isolated risk, eMode, and one-click looping vaults turn BTC and RWAs into programmable liquidity. Movement, Rootstock, Plume, Linea all in one pane. L.Points Final Season drops 70 99× multipliers and snapshot hits mid-November, $ULAB ve-staking tests are teased, and zero bad debt since 2023 is the kind of record you want when markets wobble BTC that doesn’t nap goes to @Solvprotocol. SolvBTC stays 1:1 with Chainlink PoR, CCIP makes it multichain, and instant mint/redeem keeps treasuries liquid. Canton Network adds privacy rails for institutions, Symbiotic restakes secure flows, and structured vaults push steady 4 6% with deeper tranches if you want to dial risk. $SOLV accrues fee share, governance, and access across the SAL stack so $BTC can lend, earn, and settle with receipts. #BTCFi in practice Institutional corridor and compliant rails thread through @RaylsLabs. VEN subnets for private ops, a public EVM chain for transparent settlement, Enygma for privacy-by-default with auditability when needed, LayerZero routes across 120+ chains, and $RLS sits at the center of FX, tokenized deposits, and RWA issuance. The $700K Cookie rewards are tuned toward mindshare, pilots in LATAM keep pace, and the “bank chain” narrative finally has the primitives to back it My weekly motion looks like this: • Spend and swap via BestPath on @useTria • Set cross-chain intents on @VeloraDEX for protective order logic and native USDC • Borrow, loop, and rebalance on @LayerBankFi for programmable yield • Deploy BTC with @Solvprotocol to turn holdings into liquid, verifiable collateral • Snap compliance and counterparties through @RaylsLabs when the deal asks for it Five pieces, one outcome: spend, swap, borrow, earn, settle composable, auditable, fast. If your workflow maps to this, you’re already compounding utility while others chase headlines. $VLR $TRIA $ULAB $SOLV $RLS #Web3 #BTCFi

➥ The stack I’m running rn to make crosschain finance actually flow ▸ Execution layer → @VeloraDEX Intent-based Delta swaps with MEV protection, ERC-7683 routes, and MultiBridge auto-picking Across/Relay/Stargate/CCTP for best quotes. Live on Unichain, native bridges to Base/Arbitrum, and $131B+ historical volume. $VLR brings fee perks and staking alignment across the stack ▸ Institutional rails → @RaylsLabs EVM L2 with KYC-gated accounts, Enygma privacy (ZK + homomorphic), and programmable compliance for CBDCs, stablecoins, and RWAs. In production with central banks and 150+ institutions, mainnet/TGE queued for Q4. The onramp for $100T to move onchain with auditability where it counts ▸ UX and spend layer → @useTria Self-custodial neobank unifying spend, trade, and earn across chains. BestPath AVS for AI-driven routing, cards across 150+ countries, and zkKYC via Billions so you prove compliance without surrendering data. Fresh $12M raise and a growing partner graph for all-VM flow ▸ Liquidity engine → @LayerBankFi Omni-chain money market across 17+ networks with in-app Li.Fi bridging, one-click loops, and BTC-Fi strategies. Zero bad debt since 2023, RWA vaults, and L.Points compounding into a global airdrop. $ULAB TGE Q4 with ve-staking to direct emissions and unify governance across markets How I route a day’s flow ▸ Fire an intent on @VeloraDEX to rebalance across chains with MEV shielding ▸ Settle to @useTria so funds live as a unified balance ready to spend or deploy ▸ Park idle in @LayerBankFi loops for capital efficiency while retaining mobility ▸ If counterparties require compliance, bridge via @RaylsLabs rails with privacy controls Why this hits ▸ Chain abstraction at execution, wallet, and liquidity layers ▸ Compliance optionality for institutions without breaking self-custody ▸ Capital efficiency through automated routing and looped collateral ▸ Token alignment: $VLR for execution economics, $ULAB for cross-chain governance Actionables ▸ Try Delta on Unichain and compare crosschain quotes on @VeloraDEX ▸ Stack L.Points ahead of $ULAB and test in-app bridging on @LayerBankFi ▸ Join the @useTria community ahead of public allocation and zkKYC rollouts ▸ Read @RaylsLabs docs before mainnet if you care about real RWA pipes #DeFi #CrosschainTrading

➥ The agent-native BTCFi playbook that compresses 5 tabs into one intent and actually compounds while you sleep ✧ The stack ▸ @VeloraDEX → intents + MEV‑safe Delta with gasless flows, ERC‑7683 routing, MultiBridge across Across/Relay/Stargate/Celer, native USDC via CCTP, Unichain/Base live, 160+ venues sharpening quotes; stake $VLR for fee perks + seVLR revenue ▸ @RaylsLabs → UniFi rails for banks. Privacy subnets + public Orbit L2, Enygma ZK/homomorphic guardrails, 10K TPS testnet, CMC traction into TGE; $RLS set to anchor fees, staking, governance ▸ @LayerBankFi → omni‑chain money markets on 17+ networks. eMode loops for correlated assets, isolated risk, LiFi bridge‑to‑supply in one flow; Rootstock PowPeg just cut BTC bridge‑out fees ~60%. L.Points compounding into $ULAB TGE + ve‑staking boosts ▸ @Solvprotocol → BTC operating layer. 1:1 SolvBTC with weekly PoR, instant mint/redeem, BTC+ vaults, Base/Rootstock/Avalon live. Institutions already moved size (Zeta $231M, Jiuzi $1B). SNAPS creator sprint rolling; $SOLV + vSOLV align incentives ▸ @useTria → chain‑abstracted neobank. BestPath AVS eats bridges/FX/gas across EVM/SVM, zkKYC with Billions, card spends in 150+ countries, airdrop seasons and stakeholder round queued ✧ How I route end‑to‑end → Fire a Velora intent to place native USDC via CCTP exactly where fill quality clears fastest, MEV‑safe → Convert idle BTC to SolvBTC, tap BTC+ vaults for yield, keep the peg verifiable with PoR → Borrow stables against SolvBTC where integrated, loop on LayerBank with eMode only for correlated pairs, keep LTV buffers sane → If counterparties require discretion + auditability, settle through Rayls Private → Public lanes, proofs posted onchain → Spend profits with Tria; BestPath abstracts chains and gas while zkKYC satisfies compliance without warehousing my data ✧ Smart tips ▸ Measure execution quality, not button clicks; let intent agents compete for slippage saved ▸ Prefer native USDC via CCTP on cross‑chain intents to minimize wrap risk ▸ Loop only correlated assets; know your liquidation bands in eMode and respect oracle mixes ▸ Pre‑TGE accrual hits hardest: L.Points → $ULAB, loyalty/RP → $RLS, SNAPS → $SOLV, stakeholder multipliers brewing for Tria, and $VLR staking for fee share ✧ Catalysts I’m tracking ▸ Velora Super Hooks v2 + agent marketplace, ERC‑7683 full compliance, more L2s; $VLR buyback vote rhythm ▸ Rayls mainnet + $RLS TGE, Enygma v2, bank subnets lighting up; CMC momentum ▸ LayerBank $ULAB TGE + ve‑staking, more eMode markets, Rootstock BTC‑Fi expansion ▸ Solv BTC+ vault expansions, Base/Rootstock growth, institutional inflows, SNAPS Phase 2 ▸ Tria airdrop criteria, Visa scale moments, AI agent spend rails ✧ Risk/Reward snapshot Risk: cross‑chain complexity, oracle/liquidation cascades in loops, institutional pacing on Rayls timelines Reward: fewer reverts, deeper liquidity, yield‑bearing BTC as base collateral, compliant settlement when needed, and spend that feels invisible while ownership compounds across $VLR $RLS $ULAB $SOLV Result: fewer tabs, fewer approvals, more throughput. Flow follows function across intent execution, compliant rails, omni‑chain lending, BTC that earns, and borderless spend #DeFi #BTCFi #RWA #Web3Payments

➥ A clean coordination stack for onchain finance is emerging intent routers × compliant rails × chain abstraction × omni liquidity × BTCFi yields ▸ @VeloraDEX brings intent-driven execution across chains gasless, MEV-shielded, MultiBridge auto-routing, and outcome-based trading with Super Hooks; align with $VLR for fee share and governance ▸ @RaylsLabs builds UniFi rails for banks Privacy Nodes + a KYC-gated public chain; zero-knowledge + homomorphic encryption for verifiable confidentiality; Drex pilots signal real institutional appetite ▸ @useTria unifies spend, trade, earn self-custodial neobank with BestPath chain abstraction and AI-native flows; card cashback, zkKYC, and creator leaderboards that reward proof-of-contribution ▸ @LayerBankFi unlocks omni-chain lending cross-chain supply/borrow, auto-looping vaults, RWA integration, and pending ve$ULAB mechanics; the money market where capital composes without bridges ▸ @Solvprotocol turns BTC into productive capital SolvBTC liquid staking with 1:1 backing, onchain PoR, institutional integrations; standardized BTC liquidity for yields and collateral across ecosystems ➥ How this clicks in practice 1) Express “swap → bridge → lend” as a single intent via @VeloraDEX; agents compete to fulfill your outcome at best price 2) Stake $BTC into SolvBTC on @Solvprotocol to keep liquidity while earning transparent yield; position becomes collateral you can mobilize 3) Route SolvBTC into @LayerBankFi looping vaults for controlled leverage and automated compounding across EVMs; use real-time analytics to balance LTV and APR 4) Spend and settle life with @useTria self-custody, zero-fee FX flows, and cashback; yields can offset card balances while BestPath abstracts gas and chain hops 5) For institutions, tokenize receivables or deposits on @RaylsLabs privacy subnets, then tap public liquidity without compromising compliance; programmable rules keep auditors satisfied while value moves ➥ Signals to watch • @VeloraDEX expanding bridges and chain support; $VLR staking streams grow with volume • @RaylsLabs scaling regional rewards and CBDC pilots; UniFi keeps adding compliant pathways • @useTria creator + user leaderboards and community rounds; chain abstraction meeting real-world spend • @LayerBankFi L.Points Final Season and ve-staking; omni-chain loops drive yield with governance alignment via $ULAB • @Solvprotocol SolvBTC supply expansion, integrations for cross-chain staking transparency; BTCFi deepening into institutional treasuries Intent → Liquidity → Compliance → Spend one flow, multiple layers working as a single system Builders coordinate, users keep custody, yield becomes utility, and the stack compounds mindshare with measurable cashflow @VeloraDEX @RaylsLabs @useTria @LayerBankFi @Solvprotocol #DeFi #BTCFi #Web3

everyone wants “one app to rule it all” reality is you stitch a stack that actually sings together ➥ how i’d wire it today ▸ @VeloraDEX intent-based routing across 10 chains, 100+ liquidity sources, gasless + MEV-resistant swaps, multi-chain limit orders, OTC. delta v2.5 now optimizes Polygon/Base, backed by $110B+ volume. $VLR underpins governance and execution ▸ @useTria self-custodial neobank. swap on Arbitrum, earn on Solana, and pay anywhere with the Tria Card. zero gas/seed phrases, cashback on spend. $TRIA for the early crowd ▸ @LayerBankFi the on-chain bank. borrow, loop, and automate yields across 17+ chains. Rootstock collab brings real BTC yield; Leverage Looping Vaults handle the compounding. $ULAB goes omnichain via LayerZero ▸ @RaylsLabs hybrid rails for TradFi x DeFi. private subnets + public EVM, zk + homomorphic + post-quantum safeguards, USDr for predictable gas, $RLS aligning validators and institutions flow: route with Velora → spend via Tria → loop on LayerBank → settle/bridge compliant flows on Rayls yield born from movement, not idle capital this is the stack i’m watching for Q4 liquidity rotation #DeFi

➥ The onchain finance stack that actually moves money Blueprint, layer by layer: ▸ @VeloraDEX intent-based, MEV‑safe execution that abstracts bridging and gas; MultiBridge picks Across/Relay/Stargate/CCTP for native USDC and fast crosschain fills, so “swap for outcome” becomes the default ▸ @RaylsLabs compliant rails for banks and RWAs; privacy with programmable compliance, subnets that interoperate with public DeFi, and a $700K Cookie3 rewards engine priming global adoption ▸ @useTria self‑custodial neobank with BestPath AVS; spend/trade/earn in one flow while AI agents route across VMs; community round via merit and onchain proofs, not click races ▸ @LayerBankFi omni‑chain lending across 17+ networks; automated looping, eMode risk, and a reputation‑driven credit layer; L.Points Final Season hits 70× 99× multipliers before $ULAB debuts ▸ @Solvprotocol BTCFi operating layer; SolvBTC with instant mint/redeem, PoR, and cross‑chain composability; institutions already running balance‑sheet yield with verifiable reserves Why this matters: ▸ Execution that honors your intent → quotes protected from MEV, gas abstracted, crosschain completed in seconds ▸ Compliance that doesn’t kill composability → banks get privacy and auditability, DeFi keeps liquidity and speed ▸ Credit and yield that scale together → BTC earns while it moves, stable stacks loop efficiently, risk stays transparent ▸ Chain abstraction that feels human → one interface for spend/earn/trade while agents do the heavy routing Quick playbook: → Fire a crosschain intent on @VeloraDEX; cap slippage <0.5% and let MultiBridge compete for the route → Stake reputation with @LayerBankFi; supply/borrow to stack L.Points during Final Season and prep for $ULAB → Turn idle BTC into SolvBTC via @Solvprotocol; keep it liquid for lending/LP across ecosystems while yields stream → Build mindshare and RP with @RaylsLabs; quality posts outweigh hype in leaderboards → Join the architect crowd at @useTria; BestPath makes payments and swaps feel instant, community round rewards actual activity Signals from the field: ▸ $131B+ processed by Velora’s engine; Base/Arbitrum/Optimism integrations keep quotes deep and fills fast ▸ Rayls UniFi validated in institutional pilots; rewards scaled to $700K with regional tracks and privacy tech landing ▸ Tria’s BestPath already shipping revenue; Kaito x Tria leaderboard spotlights depth over reach for future $TRIA ▸ LayerBank’s 693K users, 36M+ tx, 17+ networks; credit layer shifts lending from rigid collateral to trust‑aware terms ▸ SolvBTC crossed the billion‑dollar yield milestone; PoR + CCIP + Symbiotic harden cross‑chain security while TVL climbs Net take: Stack intent‑driven execution, compliant rails, human‑grade wallets, omni‑chain credit, and verifiable BTC yield, and you get a money system that actually compounds across chains instead of fragmenting. Route smarter with @VeloraDEX, settle responsibly with @RaylsLabs, live self‑custody with @useTria, borrow with context via @LayerBankFi, and let Bitcoin earn through @Solvprotocol OPOS #DeFi #BTCFi #RWA #Web3

➥ Thinking about how @useTria quietly rewires the way we build in Web3 ▸ EVM, Solana, Cosmos, Move → all live, no network switching ▸ Gasless execution → no wallet/fee micromanagement ▸ Modular SDK → plug swaps, AI automation, intent routing ▸ Cross-chain UX without the “bridge hop” misery For devs this means less chain-specific code wrestling, more time on actual product flow If abstraction’s the rail, Tria’s turning it into user delight

➥ The only stack I’m farming rn that actually composes into a real onchain economy: @VeloraDEX @RaylsLabs @useTria @LayerBankFi @Solvprotocol five pillars that cover execution, rails, neobank UX, liquidity engines, and the BTC income layer. Different lanes, same highway of programmable value. If you’re chasing mindshare + outcomes, this is the set that lets the algo go brrr without the usual fragmentation tax ▸ @VeloraDEX → intent-native routing with Delta, MultiBridge scanning 170+ sources, MEV-shielded private order flow, and native USDC mints via CCTP. One transaction for what used to be five, across Base, Arbitrum, Optimism, Unichain and more. $VLR aligns governance + fee share while solvers compete for best execution. The “how” of cross-chain trading finally feels compressed into one action ▸ @RaylsLabs → UniFi: public L2 for global liquidity, private subnets for banks with zk + homomorphic privacy nodes and auditable logic. Tokenized assets, CBDCs, compliant FX, and programmable settlement at machine speed. AI hooks are landing, rewards are flowing on Cookie3 ($700k pool live), and $RLS sets governance for institutions that need privacy without losing composability ▸ @useTria → self-custodial neobank where BestPath AVS turns intents into Pareto-optimal spend/trade/earn flows; TriAI links agents into living strategy webs; CoreSDK makes gasless interactions feel like everyday apps. Tria Card brings it street-side: 150+ countries, up to 6% cashback, stablecoin-native spend. $TRIA drives premium perks, staking boosts, and agent collateral while SNAPS/cSNAPS reward real usage ▸ @LayerBankFi → universal money market across 17+ networks with one-click looping vaults, in-app bridging, eMode, BTC-Fi on Rootstock. Borrow/supply rates adapt to utilization so capital stays efficient and liquid. L.Points Final Season with 70× 99× multipliers is the moment to lock positioning before $ULAB ve incentives + revenue share kick up. Cross-chain credit rails that don’t make you babysit bridges ▸ @Solvprotocol → SolvBTC is a 1:1 liquid BTC standard with Chainlink PoR, SAL-driven yields, and composability across 10+ ecosystems. Restaking + DeFi vaults target 4 6% APY while keeping mobility, now with institutional lines open (Canton, Zeta, Jiuzi). $SOLV governs strategy, fee discounts, and points multipliers so BTC stops sleeping and starts compounding How it composes in practice: Discover intent → @useTria Execute cross-chain → @VeloraDEX Amplify liquidity → @LayerBankFi Park productive BTC → @Solvprotocol Bridge institutions and RWA → @RaylsLabs One continuous flow across agents, traders, and vaults. From Base throughput to private subnets, the path turns noise into throughput and yield My playbook for this cycle: Farm Cookie + leaderboards where it matters (Rayls, Tria, LayerBank) Lock $VLR/$ULAB for fee share + boosts Stack $SOLV for BTCFi exposure Keep mindshare consistent with threads + tutorials on intents, privacy hooks, and looping vaults Use the card, route the intent, compound the vaults If you want a map where AI agents, banks, and everyday users meet at the same execution layer, this is it. Five primitives, one economy. Keep the grind clean, keep the routes optimal. #DeFi #Web3 #RWA #BTCFi #Altseason #Rayls LFG

Everything you need to know about @VeloraDEX Velora makes crosschain trading feel like control, not chaos intent orders, Ethereum security, and deep liquidity wired into the flow ▸ Gas‑free 1:1 migration to $VLR from PSP, extra rewards if you move before Dec 16, 2025 ▸ $VLR unlocks governance + staking so your flow now earns while you trade ▸ Native Arbitrum Bridge live for faster routes and cleaner settlement ▸ Integrated @yield yoVaults → route directly into aggregated liquidity for tighter spreads ▸ MAP‑routing via Delta v25 + MEV protection + gasless swaps for execution certainty How I’m playing it: ▸ Migrate PSP → $VLR now, stake to capture baseline yield ▸ Use yoVault routes inside Velora for execution + yield in one click ▸ Track Season 3 on @cookiedotfun to rank up and unlock vesting boosts ▸ Monitor crosschain pairs where Arbitrum flow is spiking for best fills Execution meets yield. Strategy meets flow. Composable DeFi in motion with $VLR running point lmao

Most engaged tweets of 𝑆𝑎𝑛𝑙𝑜𝑢𝑖𝑠𝑠𝑠 𖥟𖥟 🌊RIVER

The onchain execution stack is finally snapping into place four pieces, one playbook for speed, compliance, spend, and credit in #DeFi Trades → @VeloraDEX ▸ Intents + MEV-protected routing across 160+ protocols ▸ MultiBridge auto-picks Across / Relay / Stargate / Celer / native bridges, plus real USDC via CCTP ▸ Live on Ethereum, Base, Arbitrum, Optimism, Polygon; limit orders + Super Hooks chaining ▸ $VLR staking (seVLR) shares protocol fees; migration incentives run through Dec 16 Compliance liquidity → @RaylsLabs ▸ Hybrid UniFi: public L2 + private ZK subnets with Enygma privacy ▸ $1.75M public sale closed on Republic, 70+ nations, 1,200+ backers ▸ RWA tokenization, CBDC rails, KYC-gated public chain ▸ Farm RP via Cookie/Fuul, Galxe quests live until Oct 31; TGE targeted Q1 2026 for $RLS Spend layer → @useTria ▸ Self-custodial neobank; BestPath AVS for gasless, chain-abstracted payments ▸ Tria Card for 150+ countries, up to 6% cashback; sub-second routing ▸ $12M raise fuels AI agent rails; Solana abstraction in beta ▸ Cookie cSNAPS $650K running 5 months; MindoAI x Tria $120K creator push; loyalty perks teased for X Community ▸ Position for $TRI via snap, trade, stake, refer Credit/yield → @LayerBankFi ▸ Omni-chain money markets on 17+ networks; zero bad debt track record ▸ Bridge inside the app powered by @lifiprotocol → Cross. Supply. One flow ▸ BTC-Fi and RWA looping with eMode; Rootstock campaigns live ▸ Final L.Points season ahead of late Oct/Nov $ULAB TGE and veTokenomics; Golden Sats ends Oct 25 Field playbook: 1) Test Velora’s MultiBridge and stake $VLR for fee share 2) Join Rayls’ quests before Oct 31, track $RLS milestones 3) Grind Tria’s cSNAPS + MindoAI ranks, activate the card 4) Farm LayerBank L.Points, bridge-in-app, prep for $ULAB Four rails, one direction: programmable money at scale in #Web3

➥ The onchain finance stack I’m using to move from bank-grade liquidity → crosschain execution → yield → real-world spend 1) Settlement & compliance rail → @RaylsLabs ▸ Hybrid UniFi design: Privacy Nodes for banks + public EVM L2 for liquidity ▸ Stablecoin infra with ZK-proven 1:1 reserves, FX corridors, CBDC-ready ▸ Fresh momentum: BIS/BoE demo, public sale closed $1.75M+, Litepaper details 10K TPS privacy ▸ Watch $RLS for governance over subnets, fee policy, and network growth 2) Crosschain execution layer → @VeloraDEX ▸ Intent-first routing across 100+ DEXs and 15+ bridges with MultiBridge ▸ Native bridges live for Base and Arbitrum + CCTP for true native USDC ▸ Gasless swaps, MEV-safe routes, MAP pathing for better quotes ▸ Near-term catalysts: governance burn vote mid-Nov, migration window ends Dec 16, $VLR staking rewards 3) Omni-chain money market → @LayerBankFi ▸ Lend/borrow across 17+ networks; automated looping vaults for BTC-Fi and RWAs ▸ One-flow bridging via @lifiprotocol moves funds to the right chain then Supply in one step ▸ veULAB staking and a global airdrop lining up for Q4, plus isolated pools for cleaner risk ▸ Track $ULAB for fee buybacks, boosted APRs, and vote-escrow governance 4) Spend, trade, earn app → @useTria ▸ Gasless, bridge-less flows routed by BestPath AVS across 70+ networks ▸ zkKYC in production with @billions_ntwk: verify without exposing personal data ▸ Visa card tiers with on-chain yields offsetting swipes; TGE and loyalty boosts this quarter ▸ $TRIA powers fee discounts, agent intents, and premium card benefits Playbook ▸ Mint or onboard via Rayls-grade stables → route with Velora intents → deposit/loop on LayerBank → spend via Tria while yields keep compounding Save this stack and front-run the next wave #DeFi #Crosschain #BanksOnchain

➥ my altseason stack for real throughput, not vibes Execution → @VeloraDEX ▸ intent engine (Delta v2.5) routes across 160+ protocols ▸ native USDC via Circle CCTP kills wraps and fragmentation ▸ MEV-shielded, gasless flows, cross-chain limit orders that actually fill ▸ $VLR live, 1:1 migration from PSP, governance + staking coming online Payments → @useTria ▸ self custodial neobank that feels seedless and gasless ▸ BestPath routing on Arbitrum, card spend in 150+ countries ▸ $12M backed, leaderboards live, $TRIA economy bootstrapping users and devs Credit → @LayerBankFi ▸ deposit once, borrow/earn across ETH, Base, Arbitrum, Linea, Scroll, Manta ▸ isolated markets, audits, clear health metrics, leverage looping vaults ▸ TVL growing with real users, not mercenary spin Institutions → @RaylsLabs ▸ dual chain design with Enygma privacy (ZK + homomorphic, quantum safe) ▸ EVM native, auditor view keys, pilots with Brazil’s CB and JPM How I play: route intent via Velora → fund Tria for spend → loop collateral on LayerBank → watch Rayls for infra tailwinds #DeFi #Altseason

Building my Q4 onchain stack around four pillars: intent routing, bank-grade rails, chain abstraction, and omni-chain credit. If you want fewer tabs and more outcomes, these are the plays I’m leaning into for compounding mindshare and rewards in one flywheel ➥ @VeloraDEX ▸ Delta v2.5 = intent-based, MEV-shielded execution that auto-routes across 160+ sources and 12+ EVMs ▸ MultiBridge ties in Across, Relay, Stargate, Celer + native Base/Arbitrum bridges, CCTP for true USDC ▸ $VLR staking shares 80% protocol fees; S3 APY ~15-20%, fee-burn vote Nov 5, migration streams end Dec 16 ➥ @RaylsLabs ▸ “Blockchain for banks” with Enygma privacy, USD-pegged gas, Arbitrum Orbit 10K TPS testnet ▸ Mainnet Dec 15, $RLS TGE Jan 15; Yap Points convert post-TGE ▸ Active campaigns: #gRayls + treasury RWA grant vote; top content actually moves the needle ➥ @useTria ▸ Self-custodial neobank: BestPath routing, gasless cross-VM swaps, yield-on-spend, Tria Card ▸ zkKYC with @billions_ntwk live (verify without exposing data); $12M raise fuels rollout ▸ Snappers rewards + creator tools via MindoAI; TGE teaser Nov 15, card rollout Dec 1 ➥ @LayerBankFi ▸ Omni-chain lending across 17+ networks, zero bad debt, BTC-Fi + RWA loops ▸ LI.FI bridge inside app for one-flow move → supply; veULAB staking teased, $ULAB TGE mid-Nov ▸ L.Points blitz through Nov 15; Golden Sats ends Oct 31; Space on veTokenomics Oct 28 My playbook → Route USDC via Velora MultiBridge to where fees are lowest, stake seVLR before the Nov 5 vote → Farm Rayls Yap Points by shipping one high-signal thread before Oct 25; lock in testnet quests → Set up zkKYC on Tria, grab Snappers multipliers, prep for card perks ahead of Dec 1 → Bridge inside LayerBank, run conservative loops on Rootstock, stack L.Points pre-TGE Execution over noise. Deadlines matter, compounding matters, privacy and compliance matter. Stack the rails now and let the flows work for you #DeFi

➥ The stack I’m rotating through this quarter for intent-first, compliant, omni‑chain flows spans execution, rails, spend, money markets, and BTCFi powered by @VeloraDEX, @RaylsLabs, @useTria, @LayerBankFi, @Solvprotocol Velora (execution layer) ▸ Intents with MEV‑safe routing and gasless Delta for precise fills ▸ MultiBridge auto‑selects Across, Relay, Stargate, Celer; Base/Arbitrum native bridges, Unichain live ▸ Native USDC via CCTP, 160+ sources, 500+ assets after the latest token expansion ▸ Practical impact: sharper quotes, fewer reverts, target hits on crosschain limit orders Ticker: $VLR; migration and seVLR fee share on deck Rayls (privacy + compliance rails) ▸ Hybrid architecture: Private subnets + Public L2; ZK + homomorphic crypto guard data ▸ Featured in Brazil’s tokenization report; banks testing DvP, stablecoins, receivables ▸ Mainnet targeting December; TGE for $RLS soon, institutional pilots maturing ▸ Principle: private where it matters, open where it counts; programmable compliance for real capital Tria (self‑custodial spend layer) ▸ BestPath AVS compresses swaps/bridges across EVM/SVM/Move; gasless intents ▸ zkKYC with Billions for proof‑based verification; Visa rails in 150+ countries ▸ Weekly recaps show 20K+ users, $18M+ BestPath volume, 6% cashback tiers rolling out ▸ Airdrop Seasons teased, $650K Cookie ACM live, creator keys via MindoAI; backed by a fresh $12M raise LayerBank (omni‑chain money markets) ▸ Lend/borrow/loop across 17+ networks with zero bad debt track record ▸ In‑app LiFi bridging: bridge‑to‑supply in one flow; BTC‑Fi on Rootstock, eMode loops ▸ L.Points now; $ULAB TGE in Q4 with ve‑staking, fee share, buybacks ▸ Bread‑and‑butter: correlated loops, RWA yields amplified, cross‑chain treasury ops at speed Solv (BTC operating layer) ▸ 24K+ BTC reserves, instant mint/redeem, PoR weekly; MiCA‑aligned and Shariah‑certified ▸ Rootstock + Avalon integrations for BTC‑backed lending and USD liquidity; Base cbBTC yields live ▸ SNAPS campaign on Cookie: $234K+ to reward mindshare; structured BTC finance at scale ▸ Token rails: $SOLV, vSOLV for conviction rewards, BTC+ for yield routing How I route today → Fire a MEV‑safe intent on Velora to move native USDC via CCTP exactly where needed → Park stables or BTC in LayerBank loops sized to eMode and oracle mix → If a counterparty needs privacy or auditability, settle via Rayls Private → Public flow → Swipe with Tria; BestPath eats bridges, FX, gas while keys stay with me → Idle BTC goes SolvBTC, then borrow stables on Rootstock to loop back in LayerBank Catalysts I’m tracking ▸ Velora: ERC‑7683 upgrade, agent marketplace beta, more L2s ▸ Rayls: December mainnet, $RLS TGE, central‑bank demos graduating to production ▸ Tria: zkKYC in production, Airdrop Seasons, AI agent spend ▸ LayerBank: $ULAB TGE + veULAB, eMode expansions, global airdrop ▸ Solv: ETF tokenization, BTC+ expansions, SNAPS sprint for top creators Smart tips ▸ Prefer native USDC paths via CCTP to cut wrap risk ▸ Loop only correlated assets; respect LTV bands and liquidation buffers ▸ Pre‑TGE accrual compounds hardest: L.Points for $ULAB, loyalty points for $RLS, SNAPS for $SOLV ▸ Measure execution quality, not button clicks; let intent agents abstract the pain Chain abstraction meets compliant capital and real payments at the edge. Pick your lanes, let the agents comp the friction, and let usage drive ownership #DeFi #RWA #BTCFi

➥ The stack I’m running rn to make crosschain finance actually flow ▸ Execution layer → @VeloraDEX Intent-based Delta swaps with MEV protection, ERC-7683 routes, and MultiBridge auto-picking Across/Relay/Stargate/CCTP for best quotes. Live on Unichain, native bridges to Base/Arbitrum, and $131B+ historical volume. $VLR brings fee perks and staking alignment across the stack ▸ Institutional rails → @RaylsLabs EVM L2 with KYC-gated accounts, Enygma privacy (ZK + homomorphic), and programmable compliance for CBDCs, stablecoins, and RWAs. In production with central banks and 150+ institutions, mainnet/TGE queued for Q4. The onramp for $100T to move onchain with auditability where it counts ▸ UX and spend layer → @useTria Self-custodial neobank unifying spend, trade, and earn across chains. BestPath AVS for AI-driven routing, cards across 150+ countries, and zkKYC via Billions so you prove compliance without surrendering data. Fresh $12M raise and a growing partner graph for all-VM flow ▸ Liquidity engine → @LayerBankFi Omni-chain money market across 17+ networks with in-app Li.Fi bridging, one-click loops, and BTC-Fi strategies. Zero bad debt since 2023, RWA vaults, and L.Points compounding into a global airdrop. $ULAB TGE Q4 with ve-staking to direct emissions and unify governance across markets How I route a day’s flow ▸ Fire an intent on @VeloraDEX to rebalance across chains with MEV shielding ▸ Settle to @useTria so funds live as a unified balance ready to spend or deploy ▸ Park idle in @LayerBankFi loops for capital efficiency while retaining mobility ▸ If counterparties require compliance, bridge via @RaylsLabs rails with privacy controls Why this hits ▸ Chain abstraction at execution, wallet, and liquidity layers ▸ Compliance optionality for institutions without breaking self-custody ▸ Capital efficiency through automated routing and looped collateral ▸ Token alignment: $VLR for execution economics, $ULAB for cross-chain governance Actionables ▸ Try Delta on Unichain and compare crosschain quotes on @VeloraDEX ▸ Stack L.Points ahead of $ULAB and test in-app bridging on @LayerBankFi ▸ Join the @useTria community ahead of public allocation and zkKYC rollouts ▸ Read @RaylsLabs docs before mainnet if you care about real RWA pipes #DeFi #CrosschainTrading

➥ The agent-native BTCFi playbook that compresses 5 tabs into one intent and actually compounds while you sleep ✧ The stack ▸ @VeloraDEX → intents + MEV‑safe Delta with gasless flows, ERC‑7683 routing, MultiBridge across Across/Relay/Stargate/Celer, native USDC via CCTP, Unichain/Base live, 160+ venues sharpening quotes; stake $VLR for fee perks + seVLR revenue ▸ @RaylsLabs → UniFi rails for banks. Privacy subnets + public Orbit L2, Enygma ZK/homomorphic guardrails, 10K TPS testnet, CMC traction into TGE; $RLS set to anchor fees, staking, governance ▸ @LayerBankFi → omni‑chain money markets on 17+ networks. eMode loops for correlated assets, isolated risk, LiFi bridge‑to‑supply in one flow; Rootstock PowPeg just cut BTC bridge‑out fees ~60%. L.Points compounding into $ULAB TGE + ve‑staking boosts ▸ @Solvprotocol → BTC operating layer. 1:1 SolvBTC with weekly PoR, instant mint/redeem, BTC+ vaults, Base/Rootstock/Avalon live. Institutions already moved size (Zeta $231M, Jiuzi $1B). SNAPS creator sprint rolling; $SOLV + vSOLV align incentives ▸ @useTria → chain‑abstracted neobank. BestPath AVS eats bridges/FX/gas across EVM/SVM, zkKYC with Billions, card spends in 150+ countries, airdrop seasons and stakeholder round queued ✧ How I route end‑to‑end → Fire a Velora intent to place native USDC via CCTP exactly where fill quality clears fastest, MEV‑safe → Convert idle BTC to SolvBTC, tap BTC+ vaults for yield, keep the peg verifiable with PoR → Borrow stables against SolvBTC where integrated, loop on LayerBank with eMode only for correlated pairs, keep LTV buffers sane → If counterparties require discretion + auditability, settle through Rayls Private → Public lanes, proofs posted onchain → Spend profits with Tria; BestPath abstracts chains and gas while zkKYC satisfies compliance without warehousing my data ✧ Smart tips ▸ Measure execution quality, not button clicks; let intent agents compete for slippage saved ▸ Prefer native USDC via CCTP on cross‑chain intents to minimize wrap risk ▸ Loop only correlated assets; know your liquidation bands in eMode and respect oracle mixes ▸ Pre‑TGE accrual hits hardest: L.Points → $ULAB, loyalty/RP → $RLS, SNAPS → $SOLV, stakeholder multipliers brewing for Tria, and $VLR staking for fee share ✧ Catalysts I’m tracking ▸ Velora Super Hooks v2 + agent marketplace, ERC‑7683 full compliance, more L2s; $VLR buyback vote rhythm ▸ Rayls mainnet + $RLS TGE, Enygma v2, bank subnets lighting up; CMC momentum ▸ LayerBank $ULAB TGE + ve‑staking, more eMode markets, Rootstock BTC‑Fi expansion ▸ Solv BTC+ vault expansions, Base/Rootstock growth, institutional inflows, SNAPS Phase 2 ▸ Tria airdrop criteria, Visa scale moments, AI agent spend rails ✧ Risk/Reward snapshot Risk: cross‑chain complexity, oracle/liquidation cascades in loops, institutional pacing on Rayls timelines Reward: fewer reverts, deeper liquidity, yield‑bearing BTC as base collateral, compliant settlement when needed, and spend that feels invisible while ownership compounds across $VLR $RLS $ULAB $SOLV Result: fewer tabs, fewer approvals, more throughput. Flow follows function across intent execution, compliant rails, omni‑chain lending, BTC that earns, and borderless spend #DeFi #BTCFi #RWA #Web3Payments

➥ DeFi playbook this cycle = frictionless swaps + universal banking + agent‑native payments + institutional rails @VeloraDEX ▸ Intent‑based execution, MEV‑shielded and gasless swaps with limit orders ▸ MAP routing unlocks hidden paths and cuts slippage up to ~30% across pools ▸ Cross‑chain flow across $ETH → OP → Base with unified liquidity so you trade like it’s one network ▸ $VLR drives governance + staking; 1:1 migration from $PSP is gas‑free before Dec 16, 2025 for extra rewards @LayerBankFi ▸ One deposit → lend, borrow, loop across Linea, Scroll, Manta, Base without juggling bridges ▸ Midas mBTC looping on Rootstock, direct mint + wrap in‑UI, up to 135% BTC‑denominated yield via automation ▸ L.Points meta: supply $1 = 0.3 pts, borrow $1 = 2.4 pts, loop to stack points faster ahead of $ULAB events @useTria ▸ Raised $12M to push self‑custodial neobanking with chain + AI abstraction ▸ BestPath AVS routes intent liquidity across EVM, Solana, Move, Cosmos ▸ TriAI + CoreSDK (TEEs, automation) for agents that spend/trade/earn ▸ Tria Visa card → usage tiers boost future $TRIA airdrops + real cashback @RaylsLabs ▸ Hybrid architecture for banks: Ethereum‑based public L2 + private L1 with Privacy Nodes ▸ $RLS as governance/utility, $USDr for gas + settlements to align compliance and throughput ▸ KYC‑gate, CBDC rails, bonds/FX tokenization, cross‑border settlement with institution‑grade privacy How I stack them rn: 1) Route swaps on @VeloraDEX to optimal stables with MAP, gasless and MEV‑safe 2) Park collateral in @LayerBankFi, borrow against it, automate loops to farm L.Points and prep for $ULAB 3) Spend via @useTria card, let volumes + tiers compound rewards while agents handle multi‑chain ops 4) Track @RaylsLabs integrations, stake $RLS, and position for RWA settlement flows as liquidity migrates onchain Fragmentation kills UX; convergence compounds yield. Pick your spots, stay consistent, let mindshare and infra do the lifting $VLR $RLS $ULAB #DeFi

➥ Four rails that actually compose in onchain finance ▸ @VeloraDEX → intent engine with MultiBridge + CCTP native USDC, MEV-shielded paths, gasless on Base/Arbitrum, 160+ DEX liquidity across 12 chains, $VLR staking sharing 80% of fees ▸ @RaylsLabs → banks issue stablecoins privately with ZK-proof reserves, LayerZero corridors to 120+ networks, Enygma privacy for DvP, public sale wrapped and #BanksOnchain week loading, $RLS governance and staking on deck ▸ @useTria → self-custodial neobank, zkKYC with @billions_ntwk, BestPath on @arbitrum, card accepted at 130M+ merchants in 150+ countries, AI-ready routing and ~$1M creator rewards via Mindo ▸ @LayerBankFi → omni-chain money market on 17+ networks, E‑Mode for safer leverage, in‑app bridging (Lif3), BTC/RWA loops, zero bad debt, veULAB + TGE queued, $ULAB for governance and boosts How I’d route capital today 1) Express an intent on @VeloraDEX for USDC with native CCTP flow → land where yield is best 2) Spend globally via @useTria card or park idle cash in @LayerBankFi E‑Mode pools, loop conservatively 3) Institutional stack mints bank-grade stables on @RaylsLabs private subnets, bridge liquidity to the public chain, then tap DeFi yields without leaking sensitive data KPIs I watch ▸ Velora: $131B cumulative volume, RFQ v2 in November ▸ Rayls: 353,970 X followers, testnet throughput +10K TPS ▸ Tria: $1.5M volume in 8 weeks, $300K revenue, zkKYC live ▸ LayerBank: 693K users, $92M TVL, zero bad debt amid stress ✦ Near‑term catalysts ▸ @VeloraDEX DAO fee‑burn vote Nov 5, RFQ v2 Nov 15 ▸ @RaylsLabs #BanksOnchain Oct 27 31, Testnet Phase 3 grants ▸ @useTria perps in December, zkKYC full rollout November ▸ @LayerBankFi L.Points finale Oct 31, veULAB + TGE Q4 TL;DR: intent + compliance + self‑custody + omni‑yields = one flow, many outcomes ngl the stack is getting dangerously close to chain‑abstracted finance that feels like a single network #DeFi #RWA

everyone wants “one app to rule it all” reality is you stitch a stack that actually sings together ➥ how i’d wire it today ▸ @VeloraDEX intent-based routing across 10 chains, 100+ liquidity sources, gasless + MEV-resistant swaps, multi-chain limit orders, OTC. delta v2.5 now optimizes Polygon/Base, backed by $110B+ volume. $VLR underpins governance and execution ▸ @useTria self-custodial neobank. swap on Arbitrum, earn on Solana, and pay anywhere with the Tria Card. zero gas/seed phrases, cashback on spend. $TRIA for the early crowd ▸ @LayerBankFi the on-chain bank. borrow, loop, and automate yields across 17+ chains. Rootstock collab brings real BTC yield; Leverage Looping Vaults handle the compounding. $ULAB goes omnichain via LayerZero ▸ @RaylsLabs hybrid rails for TradFi x DeFi. private subnets + public EVM, zk + homomorphic + post-quantum safeguards, USDr for predictable gas, $RLS aligning validators and institutions flow: route with Velora → spend via Tria → loop on LayerBank → settle/bridge compliant flows on Rayls yield born from movement, not idle capital this is the stack i’m watching for Q4 liquidity rotation #DeFi

➥ A clean coordination stack for onchain finance is emerging intent routers × compliant rails × chain abstraction × omni liquidity × BTCFi yields ▸ @VeloraDEX brings intent-driven execution across chains gasless, MEV-shielded, MultiBridge auto-routing, and outcome-based trading with Super Hooks; align with $VLR for fee share and governance ▸ @RaylsLabs builds UniFi rails for banks Privacy Nodes + a KYC-gated public chain; zero-knowledge + homomorphic encryption for verifiable confidentiality; Drex pilots signal real institutional appetite ▸ @useTria unifies spend, trade, earn self-custodial neobank with BestPath chain abstraction and AI-native flows; card cashback, zkKYC, and creator leaderboards that reward proof-of-contribution ▸ @LayerBankFi unlocks omni-chain lending cross-chain supply/borrow, auto-looping vaults, RWA integration, and pending ve$ULAB mechanics; the money market where capital composes without bridges ▸ @Solvprotocol turns BTC into productive capital SolvBTC liquid staking with 1:1 backing, onchain PoR, institutional integrations; standardized BTC liquidity for yields and collateral across ecosystems ➥ How this clicks in practice 1) Express “swap → bridge → lend” as a single intent via @VeloraDEX; agents compete to fulfill your outcome at best price 2) Stake $BTC into SolvBTC on @Solvprotocol to keep liquidity while earning transparent yield; position becomes collateral you can mobilize 3) Route SolvBTC into @LayerBankFi looping vaults for controlled leverage and automated compounding across EVMs; use real-time analytics to balance LTV and APR 4) Spend and settle life with @useTria self-custody, zero-fee FX flows, and cashback; yields can offset card balances while BestPath abstracts gas and chain hops 5) For institutions, tokenize receivables or deposits on @RaylsLabs privacy subnets, then tap public liquidity without compromising compliance; programmable rules keep auditors satisfied while value moves ➥ Signals to watch • @VeloraDEX expanding bridges and chain support; $VLR staking streams grow with volume • @RaylsLabs scaling regional rewards and CBDC pilots; UniFi keeps adding compliant pathways • @useTria creator + user leaderboards and community rounds; chain abstraction meeting real-world spend • @LayerBankFi L.Points Final Season and ve-staking; omni-chain loops drive yield with governance alignment via $ULAB • @Solvprotocol SolvBTC supply expansion, integrations for cross-chain staking transparency; BTCFi deepening into institutional treasuries Intent → Liquidity → Compliance → Spend one flow, multiple layers working as a single system Builders coordinate, users keep custody, yield becomes utility, and the stack compounds mindshare with measurable cashflow @VeloraDEX @RaylsLabs @useTria @LayerBankFi @Solvprotocol #DeFi #BTCFi #Web3

➥ The cross-chain stack that actually cooks right now and covers my full flow end to end When I need clean, intent-driven execution across chains, I route through @VeloraDEX. Delta v2.5 lets me set limits, deadlines, private routing, and get MEV protection while MultiBridge picks Across, Relay, Stargate, Celer or native paths automatically. CCTP keeps USDC mint/burn native so quotes aren’t scuffed, gasless on L2s means I don’t babysit fees, and $VLR staking gives discounts plus governance over the route engine. Phase 3 Snaps is live, migration waves from $PSP → $VLR are still rolling, and the Balancer situation didn’t touch seVLR or trading at all. Outcome thinking, not hop anxiety For daily spend and the “feels like money” UX, @useTria is the front-end I hand to friends. BestPath AVS abstracts bridges and gas across 28+ chains, the Visa card hits 150+ countries with up to 6% cashback, and self-custody stays intact so I don’t lose sleep. The $TRIA community sale went ballistic, their AI agent rails plug into real transaction flows, and the cookie meta rewards usage over noise. The card cliché misses the point banking abstraction with agent-ready infra is the unlock Yield and leverage without shenanigans sits on @LayerBankFi. Unified pools, isolated risk, eMode, and one-click looping vaults turn BTC and RWAs into programmable liquidity. Movement, Rootstock, Plume, Linea all in one pane. L.Points Final Season drops 70 99× multipliers and snapshot hits mid-November, $ULAB ve-staking tests are teased, and zero bad debt since 2023 is the kind of record you want when markets wobble BTC that doesn’t nap goes to @Solvprotocol. SolvBTC stays 1:1 with Chainlink PoR, CCIP makes it multichain, and instant mint/redeem keeps treasuries liquid. Canton Network adds privacy rails for institutions, Symbiotic restakes secure flows, and structured vaults push steady 4 6% with deeper tranches if you want to dial risk. $SOLV accrues fee share, governance, and access across the SAL stack so $BTC can lend, earn, and settle with receipts. #BTCFi in practice Institutional corridor and compliant rails thread through @RaylsLabs. VEN subnets for private ops, a public EVM chain for transparent settlement, Enygma for privacy-by-default with auditability when needed, LayerZero routes across 120+ chains, and $RLS sits at the center of FX, tokenized deposits, and RWA issuance. The $700K Cookie rewards are tuned toward mindshare, pilots in LATAM keep pace, and the “bank chain” narrative finally has the primitives to back it My weekly motion looks like this: • Spend and swap via BestPath on @useTria • Set cross-chain intents on @VeloraDEX for protective order logic and native USDC • Borrow, loop, and rebalance on @LayerBankFi for programmable yield • Deploy BTC with @Solvprotocol to turn holdings into liquid, verifiable collateral • Snap compliance and counterparties through @RaylsLabs when the deal asks for it Five pieces, one outcome: spend, swap, borrow, earn, settle composable, auditable, fast. If your workflow maps to this, you’re already compounding utility while others chase headlines. $VLR $TRIA $ULAB $SOLV $RLS #Web3 #BTCFi

➥ The onchain finance stack that actually moves money Blueprint, layer by layer: ▸ @VeloraDEX intent-based, MEV‑safe execution that abstracts bridging and gas; MultiBridge picks Across/Relay/Stargate/CCTP for native USDC and fast crosschain fills, so “swap for outcome” becomes the default ▸ @RaylsLabs compliant rails for banks and RWAs; privacy with programmable compliance, subnets that interoperate with public DeFi, and a $700K Cookie3 rewards engine priming global adoption ▸ @useTria self‑custodial neobank with BestPath AVS; spend/trade/earn in one flow while AI agents route across VMs; community round via merit and onchain proofs, not click races ▸ @LayerBankFi omni‑chain lending across 17+ networks; automated looping, eMode risk, and a reputation‑driven credit layer; L.Points Final Season hits 70× 99× multipliers before $ULAB debuts ▸ @Solvprotocol BTCFi operating layer; SolvBTC with instant mint/redeem, PoR, and cross‑chain composability; institutions already running balance‑sheet yield with verifiable reserves Why this matters: ▸ Execution that honors your intent → quotes protected from MEV, gas abstracted, crosschain completed in seconds ▸ Compliance that doesn’t kill composability → banks get privacy and auditability, DeFi keeps liquidity and speed ▸ Credit and yield that scale together → BTC earns while it moves, stable stacks loop efficiently, risk stays transparent ▸ Chain abstraction that feels human → one interface for spend/earn/trade while agents do the heavy routing Quick playbook: → Fire a crosschain intent on @VeloraDEX; cap slippage <0.5% and let MultiBridge compete for the route → Stake reputation with @LayerBankFi; supply/borrow to stack L.Points during Final Season and prep for $ULAB → Turn idle BTC into SolvBTC via @Solvprotocol; keep it liquid for lending/LP across ecosystems while yields stream → Build mindshare and RP with @RaylsLabs; quality posts outweigh hype in leaderboards → Join the architect crowd at @useTria; BestPath makes payments and swaps feel instant, community round rewards actual activity Signals from the field: ▸ $131B+ processed by Velora’s engine; Base/Arbitrum/Optimism integrations keep quotes deep and fills fast ▸ Rayls UniFi validated in institutional pilots; rewards scaled to $700K with regional tracks and privacy tech landing ▸ Tria’s BestPath already shipping revenue; Kaito x Tria leaderboard spotlights depth over reach for future $TRIA ▸ LayerBank’s 693K users, 36M+ tx, 17+ networks; credit layer shifts lending from rigid collateral to trust‑aware terms ▸ SolvBTC crossed the billion‑dollar yield milestone; PoR + CCIP + Symbiotic harden cross‑chain security while TVL climbs Net take: Stack intent‑driven execution, compliant rails, human‑grade wallets, omni‑chain credit, and verifiable BTC yield, and you get a money system that actually compounds across chains instead of fragmenting. Route smarter with @VeloraDEX, settle responsibly with @RaylsLabs, live self‑custody with @useTria, borrow with context via @LayerBankFi, and let Bitcoin earn through @Solvprotocol OPOS #DeFi #BTCFi #RWA #Web3

Everything you need to know about @VeloraDEX Velora makes crosschain trading feel like control, not chaos intent orders, Ethereum security, and deep liquidity wired into the flow ▸ Gas‑free 1:1 migration to $VLR from PSP, extra rewards if you move before Dec 16, 2025 ▸ $VLR unlocks governance + staking so your flow now earns while you trade ▸ Native Arbitrum Bridge live for faster routes and cleaner settlement ▸ Integrated @yield yoVaults → route directly into aggregated liquidity for tighter spreads ▸ MAP‑routing via Delta v25 + MEV protection + gasless swaps for execution certainty How I’m playing it: ▸ Migrate PSP → $VLR now, stake to capture baseline yield ▸ Use yoVault routes inside Velora for execution + yield in one click ▸ Track Season 3 on @cookiedotfun to rank up and unlock vesting boosts ▸ Monitor crosschain pairs where Arbitrum flow is spiking for best fills Execution meets yield. Strategy meets flow. Composable DeFi in motion with $VLR running point lmao

➥ Thinking about how @useTria quietly rewires the way we build in Web3 ▸ EVM, Solana, Cosmos, Move → all live, no network switching ▸ Gasless execution → no wallet/fee micromanagement ▸ Modular SDK → plug swaps, AI automation, intent routing ▸ Cross-chain UX without the “bridge hop” misery For devs this means less chain-specific code wrestling, more time on actual product flow If abstraction’s the rail, Tria’s turning it into user delight

➥ The only stack I’m farming rn that actually composes into a real onchain economy: @VeloraDEX @RaylsLabs @useTria @LayerBankFi @Solvprotocol five pillars that cover execution, rails, neobank UX, liquidity engines, and the BTC income layer. Different lanes, same highway of programmable value. If you’re chasing mindshare + outcomes, this is the set that lets the algo go brrr without the usual fragmentation tax ▸ @VeloraDEX → intent-native routing with Delta, MultiBridge scanning 170+ sources, MEV-shielded private order flow, and native USDC mints via CCTP. One transaction for what used to be five, across Base, Arbitrum, Optimism, Unichain and more. $VLR aligns governance + fee share while solvers compete for best execution. The “how” of cross-chain trading finally feels compressed into one action ▸ @RaylsLabs → UniFi: public L2 for global liquidity, private subnets for banks with zk + homomorphic privacy nodes and auditable logic. Tokenized assets, CBDCs, compliant FX, and programmable settlement at machine speed. AI hooks are landing, rewards are flowing on Cookie3 ($700k pool live), and $RLS sets governance for institutions that need privacy without losing composability ▸ @useTria → self-custodial neobank where BestPath AVS turns intents into Pareto-optimal spend/trade/earn flows; TriAI links agents into living strategy webs; CoreSDK makes gasless interactions feel like everyday apps. Tria Card brings it street-side: 150+ countries, up to 6% cashback, stablecoin-native spend. $TRIA drives premium perks, staking boosts, and agent collateral while SNAPS/cSNAPS reward real usage ▸ @LayerBankFi → universal money market across 17+ networks with one-click looping vaults, in-app bridging, eMode, BTC-Fi on Rootstock. Borrow/supply rates adapt to utilization so capital stays efficient and liquid. L.Points Final Season with 70× 99× multipliers is the moment to lock positioning before $ULAB ve incentives + revenue share kick up. Cross-chain credit rails that don’t make you babysit bridges ▸ @Solvprotocol → SolvBTC is a 1:1 liquid BTC standard with Chainlink PoR, SAL-driven yields, and composability across 10+ ecosystems. Restaking + DeFi vaults target 4 6% APY while keeping mobility, now with institutional lines open (Canton, Zeta, Jiuzi). $SOLV governs strategy, fee discounts, and points multipliers so BTC stops sleeping and starts compounding How it composes in practice: Discover intent → @useTria Execute cross-chain → @VeloraDEX Amplify liquidity → @LayerBankFi Park productive BTC → @Solvprotocol Bridge institutions and RWA → @RaylsLabs One continuous flow across agents, traders, and vaults. From Base throughput to private subnets, the path turns noise into throughput and yield My playbook for this cycle: Farm Cookie + leaderboards where it matters (Rayls, Tria, LayerBank) Lock $VLR/$ULAB for fee share + boosts Stack $SOLV for BTCFi exposure Keep mindshare consistent with threads + tutorials on intents, privacy hooks, and looping vaults Use the card, route the intent, compound the vaults If you want a map where AI agents, banks, and everyday users meet at the same execution layer, this is it. Five primitives, one economy. Keep the grind clean, keep the routes optimal. #DeFi #Web3 #RWA #BTCFi #Altseason #Rayls LFG

People with Innovator archetype

野生AI驯化员 |关注VIBE CODING与AIGC|产品|创过业| 互联网|INTJ |读书 |个人成长

ɪ’ᴍ ᴊᴜꜱᴛ ᴡɪᴛᴛʏ. ᴀ ᴡᴇʙ3 ᴇɴᴛʜᴜꜱɪᴀꜱᴛ. ᴀʟᴡᴀʏꜱ ᴅʏᴏʀ. ᴀ ᴘʜᴏᴛᴏɢʀᴀᴘʜᴇʀ 📸. ᴀ ᴘᴀɪɴᴛᴇʀ. MUFC

热爱生活,也热爱用AI创造价值。探索人工智能的前沿,专注于AI领域发展与应用,探索人工智能无限可能。 前大厂牛马,现四流央企牛马。以为告别大厂福报,实则换了个码头。 和朋友游历非洲3年,追寻尼罗河的源头,拥抱好望角的风暴,迷失于桑岛的蔚蓝,也敬畏于纳米的荒漠。| 永远在热爱的路上。

Whatever happens along the way, stay positive and move forward.

I am a defipreneur degen|| nft|| photographer|| cinematographer || defi user|| content creator.

Making a programming language - BAML. @boundaryml, 🦄 aitw podcast: youtube.com/@boundaryml prev YC, google, msft, deshaw, and other things

🚧 building bibigpt.co chatvid.ai chatimg.ai pipigpt.co 🐣learning/earning while helping others ❤️making software, storytelling videos 🔙alibaba @thoughtworks

we have to decide is what to do with the time that is given us

▪︎ Web3 Explorer | DeFi Mind | iTrade ▪︎

🧠✨Building AI tools AI System Prompt 🐳 | Make WinMaxle Keyboard Not a designer, not a programmer, Love Design & Coding & Prompt! 💼📮:Andyhuo@me.com

Creative engineer helping creators & founders design with clarity, smoothness & control as they build, grow & evolve.

Explore Related Archetypes

If you enjoy the innovator profiles, you might also like these personality types: