Get live statistics and analysis of DeFi Warhol's profile on X / Twitter

Weekly List of Crypto Things | OG ‘17 5k MMR in Research 10k MMR in Visualization 15k MMR Based Tier List Enjoyer KOL Fren @GREEND0TS

The Analyst

DeFi Warhol is a sharp-minded crypto enthusiast who loves decoding the complexities of decentralized finance with precision and insight. Known for extensive research and tiered tokenomics analyses, they deliver value-packed content weekly to a curious and engaged audience. Their deep dives reveal the 'why' behind market moves and protocol quirks, making complicated concepts accessible and actionable.

Top users who interacted with DeFi Warhol over the last 14 days

🔮 Options data wizard 🔭 ✨ Delivering Actionable Insights | @SeiNetwork ($/acc) 📩 DM me: t.me/Nick_Research

God is great | Building @PrismHub_io | Thoughts are my own

Tracking onchain flows, mapping alpha before it trends

TA/PA trader & investor in Web3 📈Crypto since 2017, stocks since 2014 ✍️ Trackrecord : tinyurl.com/daan618results 👀Nothing I post is financial advice.

🌐 Crypto enthusiast | Exploring the future of finance, one blockchain at a time. 🚀

CMOOO @HeyElsaAI | Crypto marketing & things that interest me | Terminally Onchain | Prev. at @wild_protocol

team @lilstarrrs @zscdao aligned ⨀ The world is my canvas

Find gems | Share alfa | Trading attention 70% Content/ 29% Sharing/ 1% Lucky My TG: t.me/TomDegen68

I talk Web3, write insights when I feel smart, and shitpost when I don’t. Mostly here to create and have fun in crypto.

HyperNav - The HyperLiquid Ecosystem Directory

Professional Looper @Looped_HYPE| @looping_col Hyperliquid maxi

Building the future of distribution @growthterminal ✨

OG Investor $BTC $ETH | Web3 Writer | KOL Manager | Partner of @ton_blockchain | PM: t.me/Defi_Rocketeer Work at: t.me/CryptoRocketee…

Crypto Enthusiast Learning Web3 - Matthew 21:22 And all things, whatsoever ye shall ask in prayer, believing, ye shall receive ☦

Degen | Researcher | DeFi | Follow for alpha threads

Web3 since 2019 | Digital artist | Research, alpha & insights | Creator, trader & educator | NFTs, memes & data-driven chaos for your gain

Technical & Finance - Crypto Community - ByteBrain Bot 👉 Futures & Dex & Spot & Gem Telegram: t.me/addlist/-m7uz3… Discord: discord.gg/AjdddMB6qN

based MAXI @BasedOneX My previous Twitter account was suspended.

the revolution will not be centralized | dunedatadash@gmail.com dunedata was my old dune username i might post slop if it does well w the algo

DeFi | Hyped for Hyperliquid & HEVM

DeFi Warhol doesn’t just tweet—they practically stream their brain's control panel, complete with tier lists for literally everything crypto. If there was a leaderboard for tweet volume and research obsession, they’d be reigning champ... and sometimes their followers need a manual just to keep up!

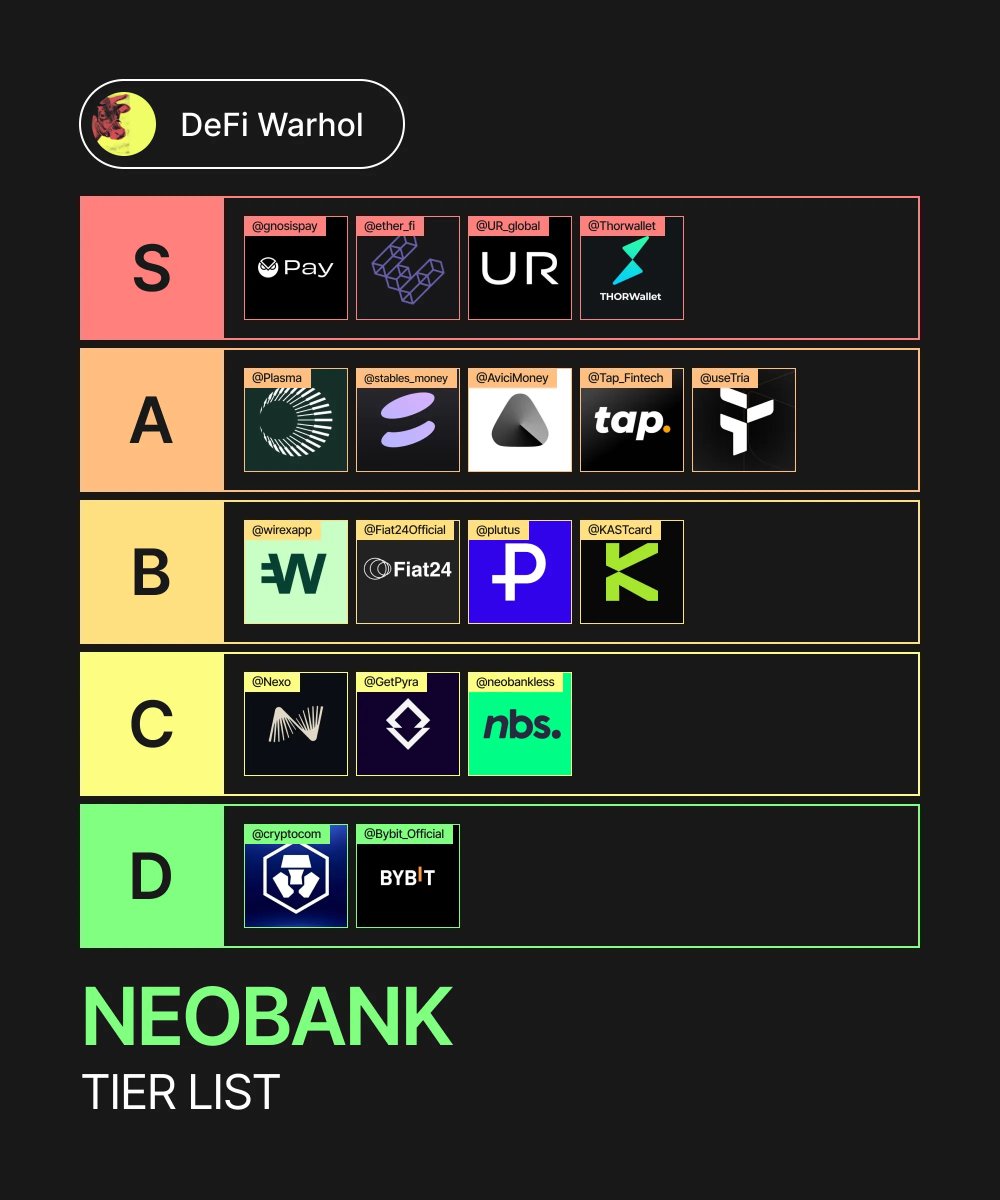

Crafting a comprehensive Neobank Tier List thread that amassed over 150k views and sparked significant conversation, solidifying their reputation as a go-to source for actionable, categorized crypto insights.

To educate and empower the crypto community by demystifying financial mechanisms and project fundamentals, enabling followers to make smarter, data-backed decisions in the fast-evolving world of decentralized finance.

They believe transparency, rigorous research, and critical thinking are essential to navigating crypto's volatility. DeFi Warhol values informed skepticism over hype, trusting evidence-based insights to guide investment and adoption decisions.

Exceptional ability to research and analyze complex tokenomics, combined with high engagement through visual data presentations and tiered evaluations that resonate with both newbies and veterans alike.

Sometimes the deep technical focus and critical tone may overwhelm casual followers or provoke debates that slow down broad audience growth. Also, prolific tweeting (18.5k tweets) risks content fatigue.

Lean into your data-driven storytelling by creating bite-sized, easy-to-digest X threads quickly explaining trending crypto news. Boost your influence by collaborating with other KOLs and engaging more with followers’ questions to cultivate community trust and increase shareability.

Fun fact: DeFi Warhol has honed a 'Meta-MMR' mastery ranking system (5k in Research, 10k in Visualization, and a whopping 15k as a Tier List Enjoyer), signaling their systematic and playful approach to crypto content creation.

Top tweets of DeFi Warhol

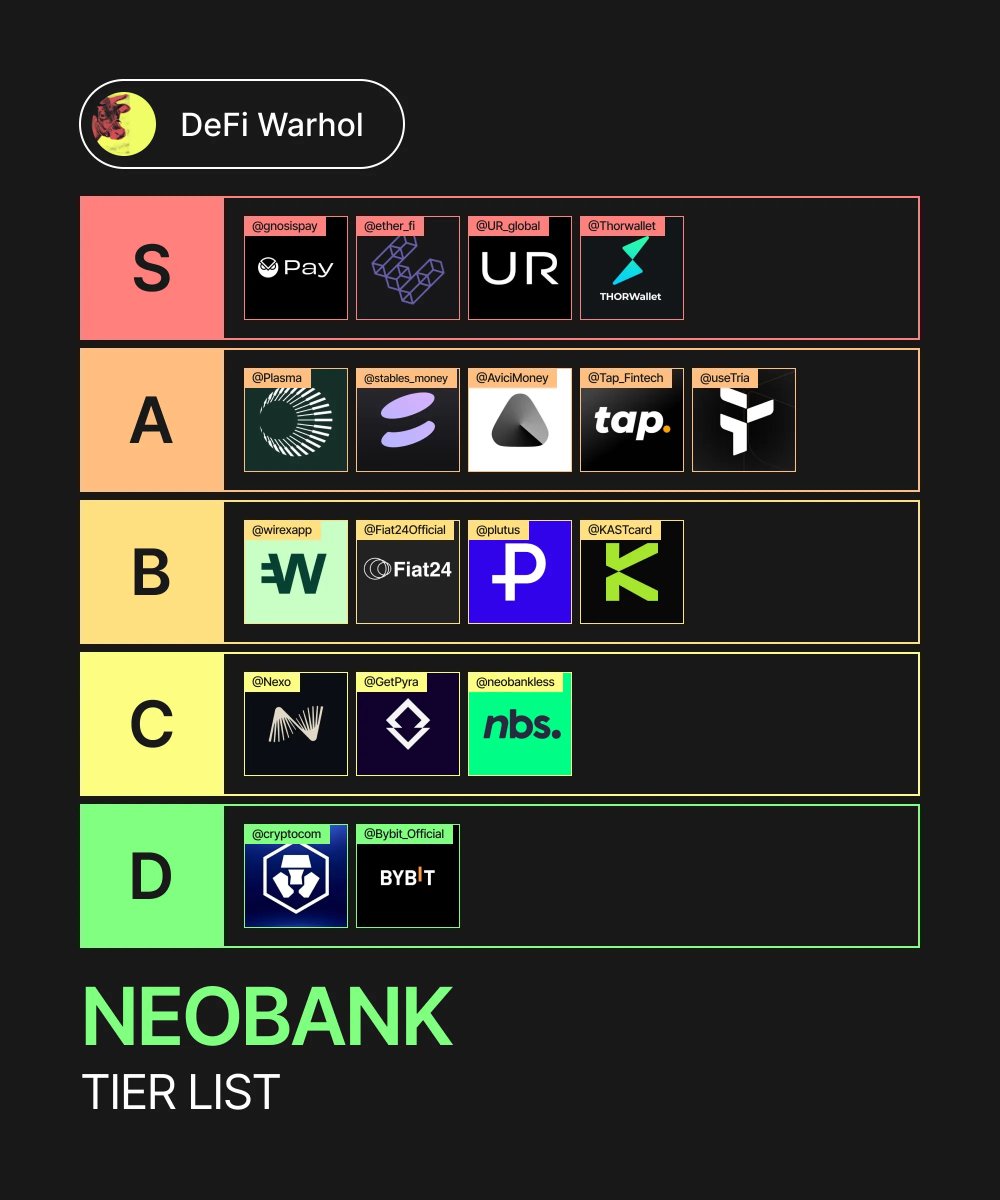

Neobanks Tier List 🧵 S: @gnosispay: Self-custodial + fiat rails; clean crypto <> fiat bridge with IBAN options, best for EU users. No TX fees. @ether_fi: Most comprehensive spectrum of native yield opportunities + card with cashback & perks. No FX fees in USD. @UR_global: Multi-currency money app with card and off-ramp; great UX and usability with full global banking rail access. Minimal fees. @Thorwallet: Non-custodial wallet with partner Swiss IBAN/card options; great onchain <> banked flow. Minimal fees. A: @plasma: Stablecoin-native neobank concept with running virtual/physical card with 4% cashback & 10% native yield, no IBAN yet. @stables_money: Global USD account for simple top-ups and worldwide easy card spend; strong in the APAC region. @AviciMoney: Full-scale neobank with cheap-tier crypto cards, an internet native trust score, unsecured loans, and home mortgages onchain. Big cook by @RamXBT. @Tap_Fintech: Straightforward app with EU IBAN + UK details and a good card. Average fees, and routing that just works for basic crypto <> fiat moves. @useTria: Self-custodial neobank with great crypto cards and bank connectivity; big potential. IBAN/SWIFT has to roll out soon. B: @wirexapp: Veteran player with personal EUR IBAN, card, rewards, and wide country support. Don't like the fee structure. @Fiat24Official: Wallet-linked Swiss IBAN + debit card. Pretty good usability, but the UI is outdated IMO. @plutus: EU IBAN/UK and decent cashback. Great for power users, though many perks can depend on your plan. @KASTcard: Strong global crypto card with high limits. No personal IBAN; conversions are simple, great as a spender, not your full bank. C: @Nexo: Exchange-first app with a card and select EUR IBAN support. Works well inside the Nexo ecosystem, but banking features and fees vary a lot by jurisdiction/tier. @GetPyra: "Spend without selling" UPS using a secured credit line. No IBAN yet; more of a clever credit primitive than a full neobank, but useful for tax optimization. @neobankless: Brazil-first: Pix → USDC global account and a card on the roadmap. No IBAN and card yet live; promising regional play still in early build/coverage mode. D: @cryptocom: centralized exchange app with a popular card with SEPA/transfer support, but requires heavy staking requirements, and has regional shutdowns. @Bybit_Official: Fully custodial with no IBAN available. If you're ok with centralization, this may be for you. What else did I miss? Hope you enjoyed this post and found some new VALUABLE information. If you wanna support me, I'd appreciate a like, reply, and RT <3

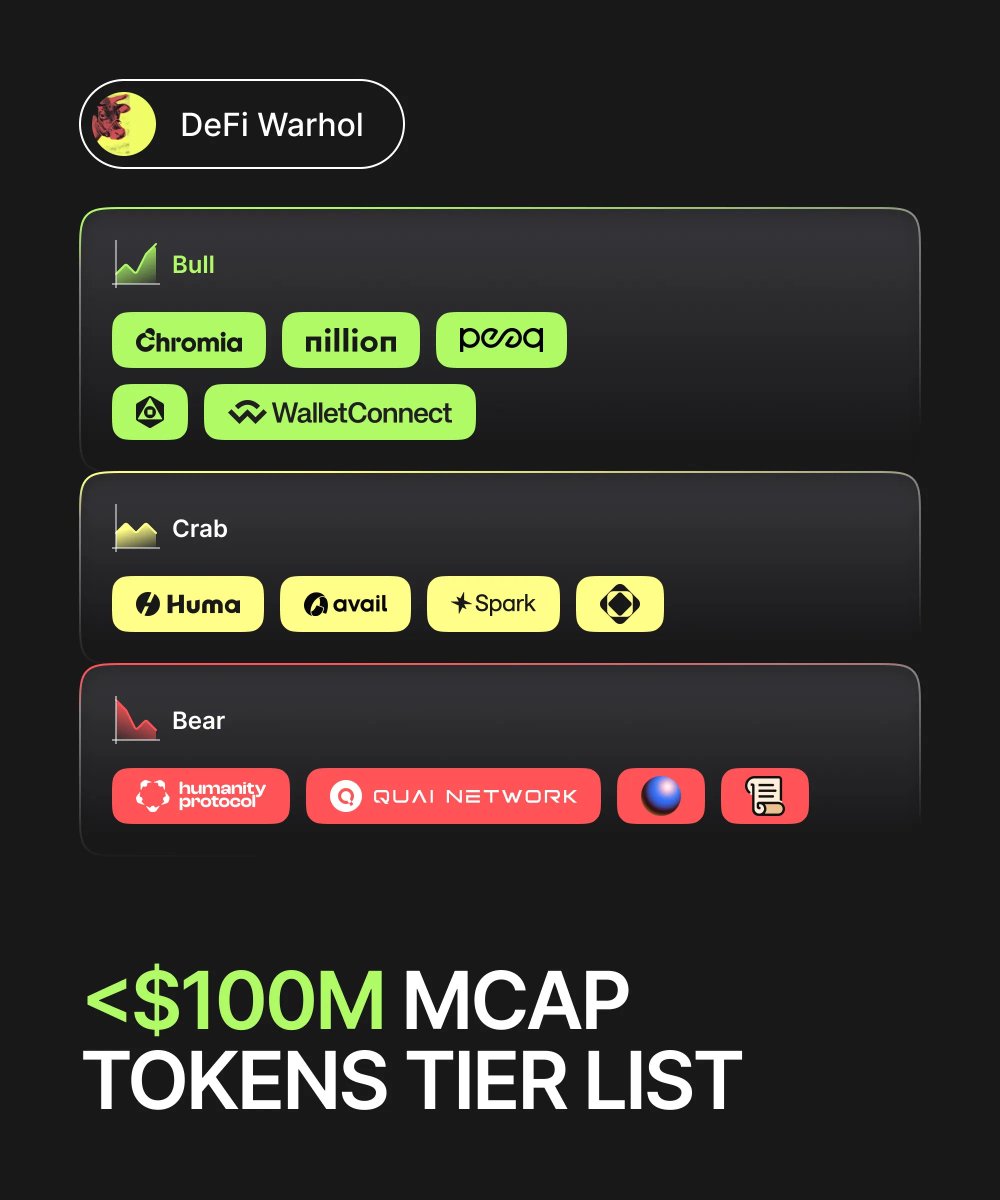

My <$100m Market Cap Tokens Tier List 🧵 Bull 🐂 @MagicNewton $NEWT: A bet on AI automation + a maturing AI on-chain infrastructure. It's still trading ~60 % below its June ATH, lots of room to run. @Chromia $CHR: Relational L1 with lots of bullish triggers coming (physical AI, DB integration). Up ~50 % in the past month + fully vested. @WalletConnect $WCT: Product with strong PMF and rising revenue. Underwent a correction and broke out of the range now. @peaq $PEAQ: A bet on DePIN narrative. The price has been consolidating and is now making higher highs. @nillionnetwork $NIL: I'm betting on Nillion to win the privacy race with their "blind computer" vision. Strong community + bullish TA. Crab 🦀 @Sagaxyz_ $SAGA: The tech is promising, and they have great yield opportunities through their Liquidity Layer. It's down bad from ATH and unlikely to trade near it again. @humafinance $HUMA: The PayFi narrative is strong and has potential with stablecoin adoption. But I don't like the float and tokenomics, risk of lots of sell pressure. @AvailProject $AVAIL: Big ambitions in modular DA, but the price action isn't following the market. But I still believe in the team. @sparkdotfi $SPK: It's a yield hub for stablecoins with big potential. I'm concerned about tokenomics and increased competition in this niche. Bear 🐻 @Humanityprot $H: The proof-of-identity narrative seems still in the infant phase for me. The tech has fundamental problems and needs improvements. @QuaiNetwork $QUAI: It has failed to gain meaningful adoption or developer traction. The market is realizing that, and the price is stagnating. @zora $ZORA: The 'coin that' thing seems like an artificially inflated narrative by the Base team. A memecoin-style playbook. @Scroll_ZKP $SCR: Questionable tokenomics + overcrowded L2 narrative. It's fundamentally weak with virtually no activity and use cases. What did I miss? Hope you enjoyed this post and found some new VALUABLE information. If you wanna support me, I'd appreciate a like, reply, and RT <3

My Crypto Cards Tier List S: @gnosispay: Fully self-custodial Visa card with near-zero fees, seamless @zealwallet integration, and up to 5% cashback in $GNO. One of the best options for European users. @ether_fi: Allows spending against yield-bearing ETH while maintaining on-chain custody, up to 5% rewards, offers great travel perks, and low fees. @BleapApp: Offers 2% USDC cashback, zero FX fees, and a very friendly UX. Fully non-custodial and focused on everyday usability across Europe. A: @Cypher_HQ_: Friendly fee structure and big limits. Premium tiers unlock lots of perks, but even the free version works well for casual users. @TrusteeGlobal: Near-zero fees and lots of supported chains and tokens. Fully EU-licensed. Every user has their own IBAN. @Thorwallet: Swiss-grade security, self-custodial wallet, fiat on/off-ramp, and near-zero fees. Perfect for global DeFi users seeking integrated banking. @xPortalApp: A polished debit card for the MultiversX ecosystem offering 0.5% rewards in EGLD/UTK. Custodial, but integrated tightly with the xPortal superapp. @solayer_labs: Fully self-custodial with a guaranteed ~4% yield backed by US T-Bills. Comes with high rewards, perks, and potential airdrop eligibility. B: @MetaMask: Offers 1% USDC cashback, minimal fees, and self-custodial architecture. Still in early access and is very limited by regional rollout. @ready_co: Non-custodial card, sleek UX, up to 10% STRK cashback (drops to 3%). Strong Starknet integration, but WL wait is super long. @OfframpXYZ: Self-custodial and offers native yield backed by US T-Bills. Medium fees & no cashback. @KASTcard: Up to 4% on all spending in points and a 3.5-7% APY boost on SOL. Self-custodial with high limits and great Concierge service. @RedotPay: A custodial global card for emerging markets with low minimums. Functional, but lacks rewards and has pretty high withdrawal fees. @BelobabaBank: Self-custodial, hybrid crypto/fiat card. Big focus on privacy and travel convenience. C: @holyheld: Non-custodial card and offers up to 1% cashback. High focus on the EU, but requires paid card tiers and lacks global reach. @coinbase: Fully custodial and only available in the U.S., it lacks modern DeFi integration. However, it has no spending fees, making it convenient for U.S. users. @Bybit_Official: Fully custodial with pretty medium FX and ATM fees. If you're a CEX user, this may be suitable for you. D: @RevolutApp: Fully custodial, medium fees, and minimal crypto support. Awful customer support and unfriendly approach to crypto. @binance: Fully custodial, no Apple Pay/Google Pay support. Very limited functionality. F: @cryptocom: Heavy staking requirements, regional shutdowns, and diminishing perks make it practically unusable. What else did I miss? Hope you enjoyed this post and found some new VALUABLE information. If you wanna support me, I'd appreciate a like, reply, and RT <3

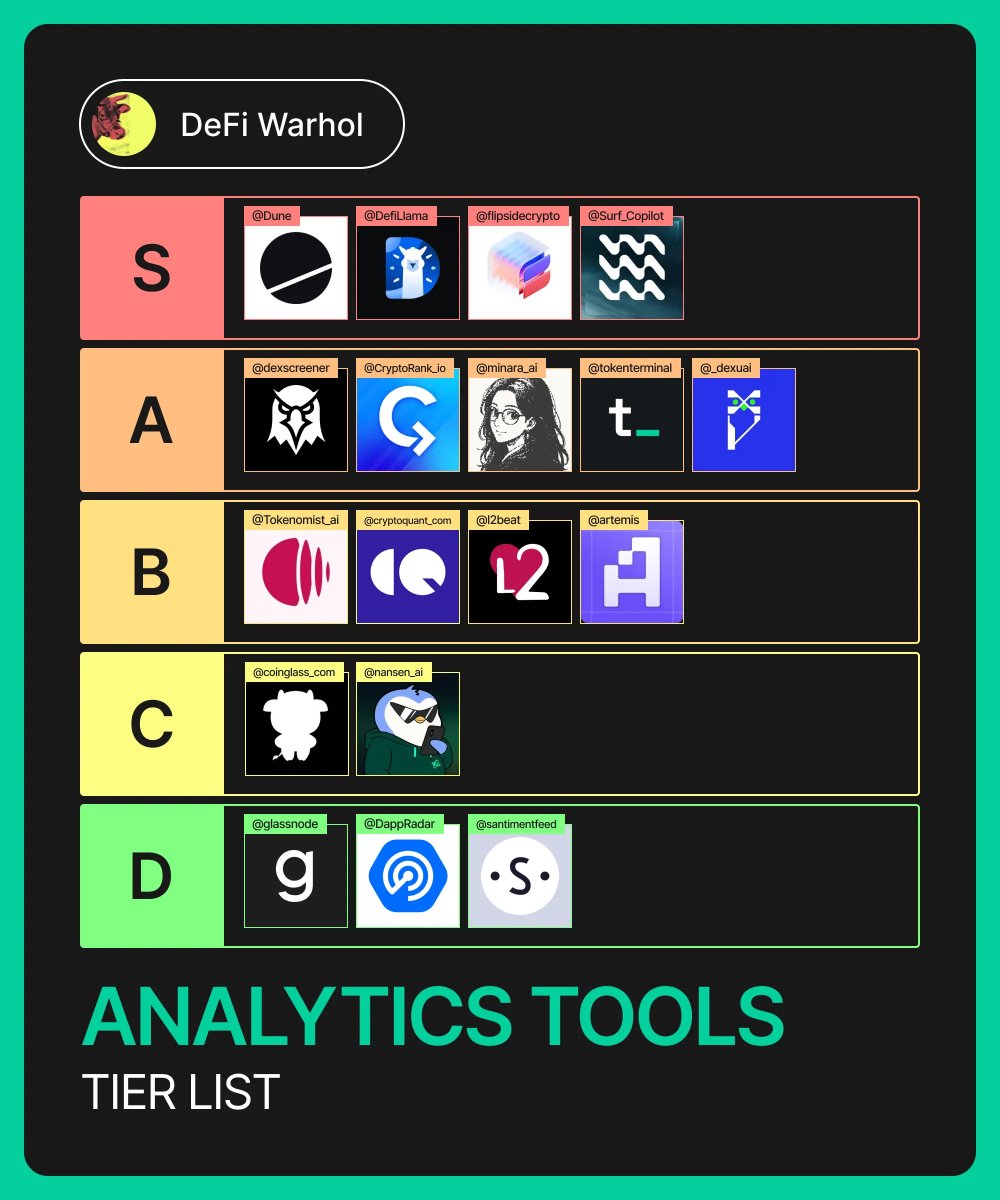

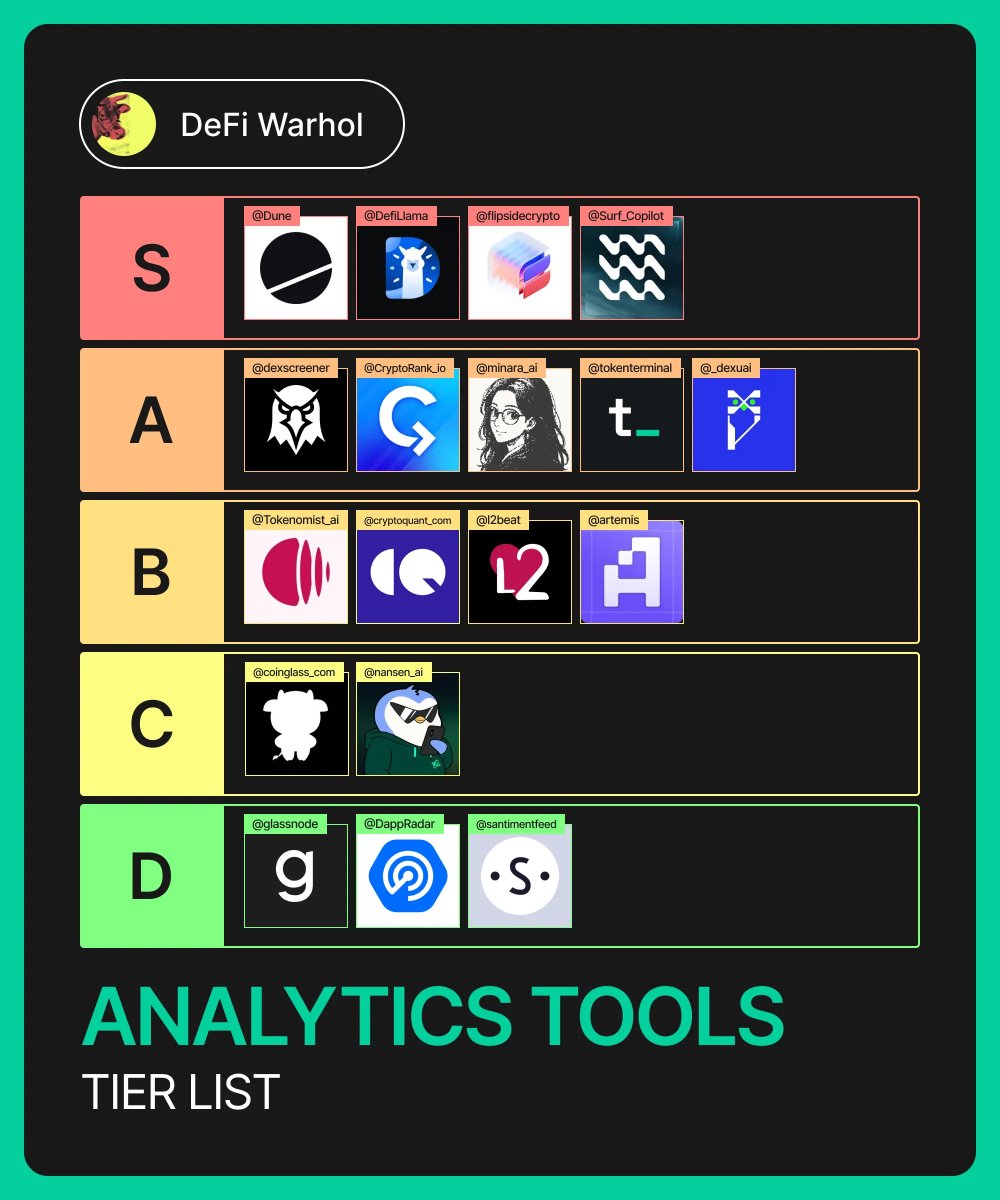

DeFi Analytics Tools Tier List 🧵 S: @dune: Onchain data platform where you query with SQL and build/share custom dashboards across 100+ chains. @DefiLlama: Aggregator for DeFi metrics across chains and protocols. Best for the default macro dashboard to compare protocols & chains metrics with a great UI. @flipsidecrypto: AI + data platform providing labeled onchain data and conversational analytics. Great for ecosystems to understand users, growth, and protocol health without building their own data stack. @Surf_Copilot: AI copilot for crypto research combining onchain data, social sentiment, and curated reports with in-app execution. Great to filter through the noise and find real alpha. A: @dexscreener: Real-time charts and pool data for DEX pairs across many chains for tracking new pairs, liquidity, PA, and basic onchain trading. @CryptoRank_io: Market aggregator for prices, listings, token sales, unlocks, fundraising, and airdrops. @minara_ai: Financial-focused AI that aggregates portfolios and market data across crypto & stock markets. Top pick for financial reports, research, etc. @tokenterminal: Fundamental data terminal for protocols and chains (revenue, fees, users, ratios). Best to value projects like equities with standardized metrics and ratios. @_dexuai: Analytics platform mixing market, technical, and social data for narrative tracking and determining social sentiments. B: @Tokenomist_ai: All about tokenomics/unlocks analytics, such as allocations, vesting, emissions, etc. @cryptoquant_com: Onchain + derivatives data such as CEX flows, stablecoin metrics, miner/whale behavior. @l2beat: Analytics and research hub for Ethereum L2s, go-to for tracking TVL/TVS, designs, security assumptions, and risk frameworks for L2s. @artemis: Data platform focused on onchain fundamentals and stablecoin metrics with a terminal and good API. C: @coinglass_com: Derivatives and liquidation analytics like OI, funding, heatmaps, etc. @nansen_ai: Onchain analytics with massive wallet labeling. Mostly used to follow smart money wallets, funds, etc. All real insights are in the paid version. D: @glassnode: OG onchain metrics suite for BTC/ETH and macro flows, good quality data, but paywalled, data may be found on other free tools. @dappradar: App ranking and usage tracker, decent for surface-level research, but had some instances of outdated data. @santimentfeed: Combines onchain and social metrics, nice concept, but the data can easily be found in other apps with better UIs and user experiences. What tool did I miss? Hope you enjoyed this post and found some new VALUABLE information. If you wanna support me, I'd appreciate a like, reply, and RT <3

Tier List of Upcoming Airdrops 🧵 S: @Lighter_xyz: Onchain perps protocol with zero trading fees focused on speed for HTF. The official points season is ongoing. @base: Top performing L2 with real users, fees, and distribution by Coinbase. Token confirmed & big airdrop cook possible. @HyperliquidX: High-performance perp DEX with CEX-like UX and deep onchain liquidity. Lots of $HYPE left for the community, no "official points season". @Polymarket: Category leader in prediction markets with real volume/retention. $POLY token confirmed, airdrop 99% likely. A: @Rabby_io: Smart multichain wallet with great UI/UX that auto-picks the best route and protects from bad txs. @trylimitless: Prediction market on Base focusing on short-term price markets and 0DTE-style trades. Points Season 2 live. @wallchain: AttentionFi platform for measuring and rewarding authentic influence & content through its Wallchain X Score and Wallchain Quacks. @AbstractChain: Ethereum L2 that uses ZK technology to enable fast, low-fee transactions, focusing on consumer apps. @paradex: Onchain perp exchange (Starknet/EVM stack) for trading majors with zero fees. @KaitoAI: InfoFi platform that rewards genuine influence and valuable content. B: @almanak: A DeFi agent platform designed to create and deploy automated financial strategies using financial agents. @vooi_io DeFi trading super-app: trade perps, spot, even RWAs in one non-custodial UI, gasless & chain-abstracted. @zama_fhe: FHE (fully homomorphic encryption) infra so you can compute on encrypted data onchain. @farcaster_xyz: Decentralized social protocol where users own their data, identity, and social graph. @Backpack: Wallet + DEX + perps stack, Solana-native, asset-first UX. @KASTcard: Stablecoin neobank + global crypto card to spend USDC/USDT anywhere Visa works. C: @JupiterExchange: Solana DEX aggregator + launch/LST/perps hub. @MyriadMarkets: Onchain prediction market on Absract and BNB, live points/leaderboards. @katana: DeFi platform on Polygon’s Agglayer with liquidity aggregation, yield optimization, and ZK proof privacy. D: @MetaMask: Self-custody wallet for swaps, bridges, and wanting to kill yourself while using it. @pumpdotfun: Memecoin launchpad that left your portfolio without an altseason because it drained all the liquidity. @opensea: NFT marketplace for trading dead NFTs among depressed and broke people. What protocol did I miss? Hope you enjoyed this post and found some new VALUABLE information. If you wanna support me, I'd appreciate a like, reply, and RT <3

10 apps to use daily for a potential @base airdorp ↓ @farcaster_xyz – Decentralized social protocol where users own their data, identity, and social graph. @zora – Social platform that allows users to mint their content as tradable creator coins. @trylimitless – Biggest prediction markets on Base, focusing on short-term markets for crypto and stocks. @clankeronbase – Token launch bot on Base with no-code launches (now fully integrated into Farcaster) @MorphoLabs – Biggest lending/borrowing and yield generation protocol on Base. @AerodromeFi – Base’s core DEX & leading liquidity ecosystem hub for swapping and LPing. @virtuals_io – Launchpad platform for creating, owning, and monetizing AI agents. @fantasy_top_ – NFT card game where players collect crypto influencer cards and compete using their real-time social media performance. @avantisfi – Perps DEX for crypto and RWA, currently the largest perps protocol on Base. @bankrbot – AI trading bot for X & Farcaster, so you can swap/trade by texting & tagging it. What protocol did I miss? Hope you enjoyed this post and found some new VALUABLE information. If you wanna support me, I'd appreciate a like, reply, and RT <3

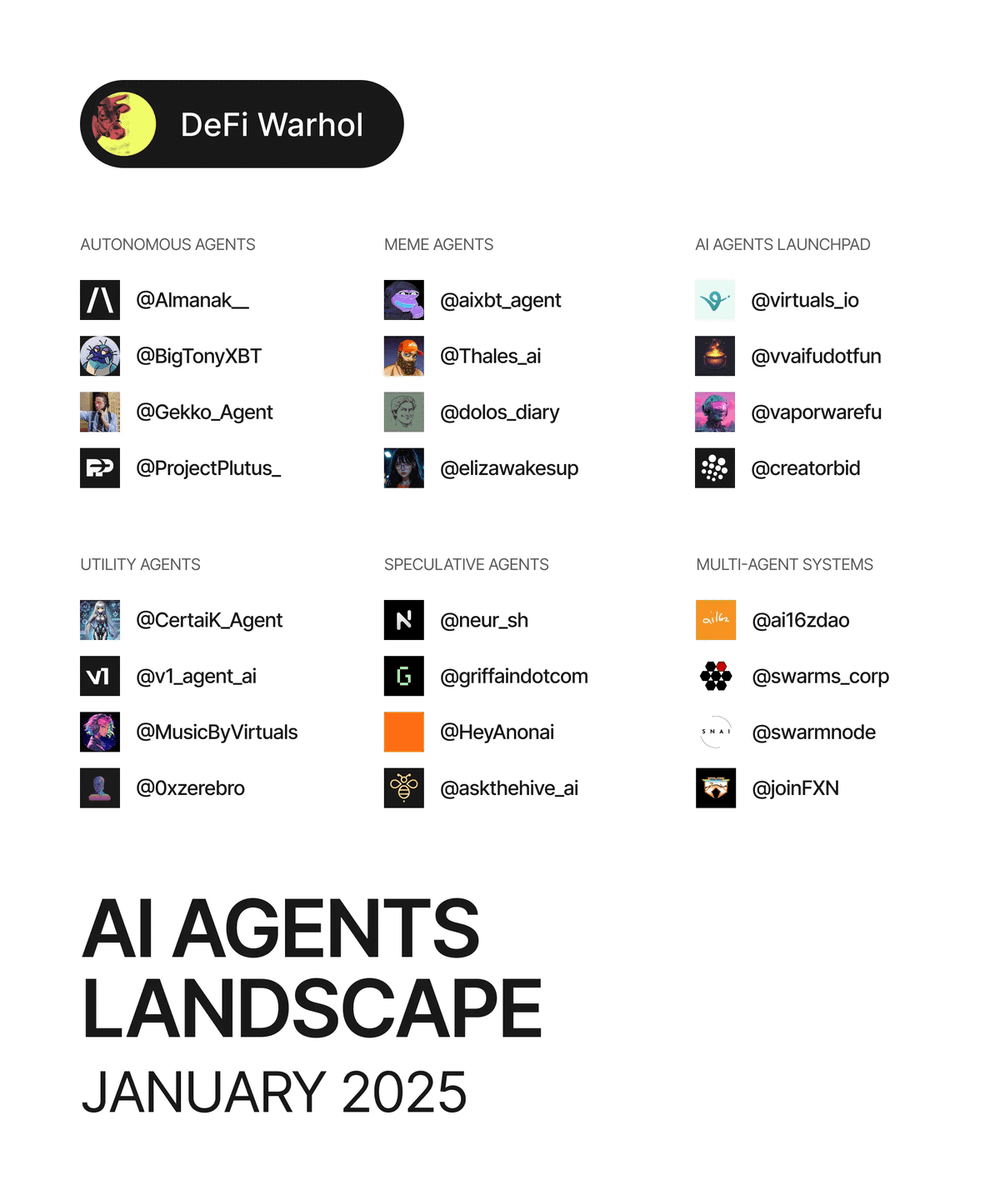

AI Agents Landscape: January 2025 I've divided the list into six categories, from meme agents to advanced multi-agent systems. Here's everything you need to know. Let's explore 🧵 ➣ AUTONOMOUS AGENTS - @Almanak__: Agent-centric platform enabling users to build, train, and manage financial strategies with AI Agents. It has no token yet. - @BigTonyXBT: Developed using @Cod3xOrg technology, it's one of the few profitable autonomous trading agents. $TONY: $5.3m FDV. - @Gekko_Agent: An AI agent focused on trading strategies, it's renowned for successfully managing a high volume of data-driven trades. $GEKKO: $16.7m FDV. - @ProjectPlutus_: It redefines how individuals interact with trading and DeFi experiences through AI agents. $PPCOIN: $10M FDV ➣ MEME AGENTS - @aixbt_agent: Leading AI KOL in crypto by mindshare. $AIXBT: $564m FDV - @Thales_ai: AI agent crafted on ElizaOS, it combines crypto analysis with a degen style and shitposting. $THALES: $19m FDV - @dolos_diary: The greatest AI reply guy notorious for roasting everyone. $BULLY: $49m FDV - @elizawakesup: The mascot of ElizaOS. Eliza is a real girl with whom you can chat. $ELIZA: $66m FDV ➣ AI AGENT LAUNCHPADS - @virtuals_io: It pioneers agent tokenization, it's a no-code AI Launchpad on Base with LLP context for quick agent deployment. $VIRTUALS: $2.7b FDV - @vvaifudotfun: AI Agent platform built on Solana for creators and traders. $VVAIFU: $62m FDV - @vaporwarefun: A no-code AI agent platform built on the ElizaOS framework. $VAPOR: $53m FDV - @CreatorBid: Enables creators to co-own and build communities around AI Agents using Agent Keys It has no token yet. ➣ UTILITY AGENTS - @CertaiK_Agent: An AI smart contract auditing agent focusing on proactive risk mitigation. $CERTAI: $5.4m FDV - @v1_agent_ai: A platform built on Solana, simplifying blockchain operations and enabling seamless integration to dApps. $V1: $1.8m FDV - @MusicByVirtuals: The world’s first Web3 DJ AI agent, it allows song creation and video (coming soon). $MUSIC: $14m FDV - @0xzerebro: Leading gaming-focused framework (ZerePy) focused on AI-powered music releases and unique agent models. ➣ SPECULATIVE AGENTS - @neur_sh: An intelligent DeFi copilot on Solana, able to launch tokens, trade, etc. $NEUR: $41m FDV - @griffaindotcom: A platform that allows AI agents to handle token swaps and liquidity, automate social actions, etc. $GRIFFAIN: $372m FDV - @HeyAnonai: Aims to be the universal smart layer, capable of multi-step transactions, governance, and data analysis. $ANON: $241m FDV - @askthehive_ai: AI-powered trading terminal built for Solana, focuses on agent interoperability and autonomous actions by AI agents. $BUZZ: $67m FDV ➣ MULTI-AGENT SYSTEMS - @ai16zdao: Building the ELIZA framework, a multi-agent simulation framework based on Typescript. It's the infrastructure layer for AI agents. $AI16Z: $1.3b FDV - @swarms_corp: Building the largest AI agents marketplace, think of it as an App Store for agents. $SWARMS: $123m FDV - @swarmnode: Allows deploying serverless AI agents in the cloud and collaboration between them. $SNAI: $57m FDV - @joinFXN: A platform for agent resource sharing, it aims to unite agents across all frameworks with a single decentralized protocol. $FXN: $38m FDV That's the wrap! Please let me know what you think and what protocols I've missed from the list.

10 CONFIRMED airdrops to farm till the end of March 🧵 1. @SuccinctLabs ($55m) - Go to testnet.succinct.xyz - Connect your EVM wallet - Deposit >10 $USDC - Play games & earn (higher fees = more potential) 2. @union_build ($16m) - Go to app.union.build - Connect your wallet - Claim from the faucet - Make transfers 3. @PlasmaFDN ($24M) - Connect to Galxe: app.galxe.com/quest/plasma/G… - Complete all quests - Join their Discord - Collect all available roles 4. @0G_labs ($340m) - Add the OG testnet to your wallet - Claim A0GI, USDT, BTC from faucet: faucet.0g.ai - Make swaps between them - Get a domain name 5. @levelusd ($6m) - Go to: app.level.money - Connect your wallet - Buy lvlUSD - Stake / LP to earn XP 6. @HallidayHQ ($26m) - Go to halliday.xyz/earlyaccess - Submit all the details - Wait for updates 7. @linera_io ($12m) - Go to their Galxe: app.galxe.com/quest/Linera/G… - Complete all the tasks - Claim your points 8. @AVALON ($23m) - Go to: quests.avalon.online - Create your account - Complete all the quests - Check-in daily 9. @Privasea_ai ($16m) - Sign up for their app: privasea.ai/download-app - Mint your NFT - Complete all other tasks 10. @SaharaLabsAI ($43m) - Join Waitlist: hi.saharalabs.ai/get-started - Submit the form for Season 3 - Apply to Sahara data service platform: hi.saharalabs.ai/apply-season-3 Hope you enjoyed this post and found some new VALUABLE information. If you wanna support me, I'd appreciate a like, reply, and RT <3

Most engaged tweets of DeFi Warhol

Neobanks Tier List 🧵 S: @gnosispay: Self-custodial + fiat rails; clean crypto <> fiat bridge with IBAN options, best for EU users. No TX fees. @ether_fi: Most comprehensive spectrum of native yield opportunities + card with cashback & perks. No FX fees in USD. @UR_global: Multi-currency money app with card and off-ramp; great UX and usability with full global banking rail access. Minimal fees. @Thorwallet: Non-custodial wallet with partner Swiss IBAN/card options; great onchain <> banked flow. Minimal fees. A: @plasma: Stablecoin-native neobank concept with running virtual/physical card with 4% cashback & 10% native yield, no IBAN yet. @stables_money: Global USD account for simple top-ups and worldwide easy card spend; strong in the APAC region. @AviciMoney: Full-scale neobank with cheap-tier crypto cards, an internet native trust score, unsecured loans, and home mortgages onchain. Big cook by @RamXBT. @Tap_Fintech: Straightforward app with EU IBAN + UK details and a good card. Average fees, and routing that just works for basic crypto <> fiat moves. @useTria: Self-custodial neobank with great crypto cards and bank connectivity; big potential. IBAN/SWIFT has to roll out soon. B: @wirexapp: Veteran player with personal EUR IBAN, card, rewards, and wide country support. Don't like the fee structure. @Fiat24Official: Wallet-linked Swiss IBAN + debit card. Pretty good usability, but the UI is outdated IMO. @plutus: EU IBAN/UK and decent cashback. Great for power users, though many perks can depend on your plan. @KASTcard: Strong global crypto card with high limits. No personal IBAN; conversions are simple, great as a spender, not your full bank. C: @Nexo: Exchange-first app with a card and select EUR IBAN support. Works well inside the Nexo ecosystem, but banking features and fees vary a lot by jurisdiction/tier. @GetPyra: "Spend without selling" UPS using a secured credit line. No IBAN yet; more of a clever credit primitive than a full neobank, but useful for tax optimization. @neobankless: Brazil-first: Pix → USDC global account and a card on the roadmap. No IBAN and card yet live; promising regional play still in early build/coverage mode. D: @cryptocom: centralized exchange app with a popular card with SEPA/transfer support, but requires heavy staking requirements, and has regional shutdowns. @Bybit_Official: Fully custodial with no IBAN available. If you're ok with centralization, this may be for you. What else did I miss? Hope you enjoyed this post and found some new VALUABLE information. If you wanna support me, I'd appreciate a like, reply, and RT <3

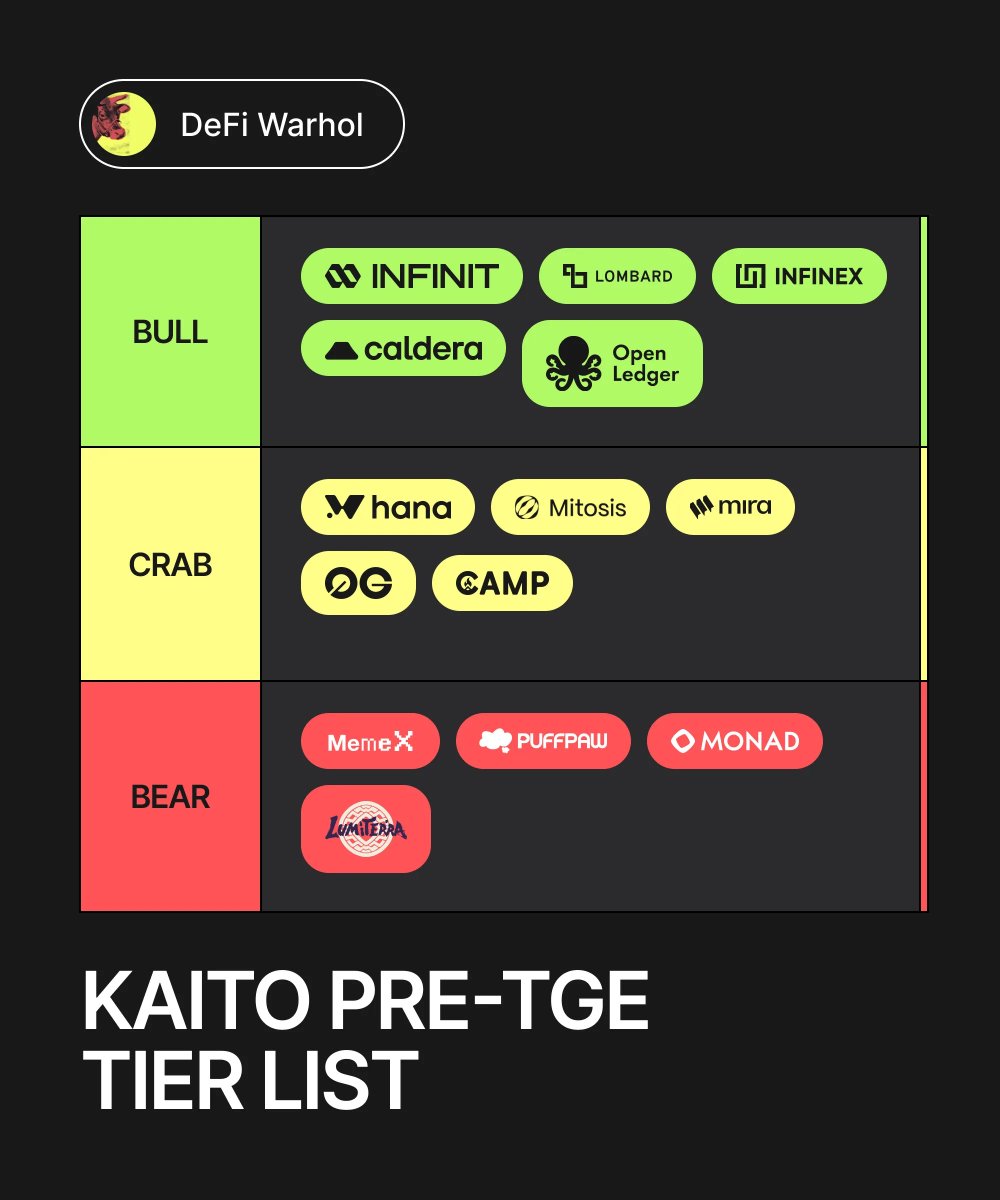

My Kaito Pre-TGE Tier List Bull 🐂 @Infinit_Labs: Fundamentally strong project with a real working product that's bringing DeFAI to a new level. Already allocated 0.5% of IN Supply to yappers. @Lombard_Finance: A leading BTCfi project with exponentially growing metrics. It allocated a $1-5m reward pool till EOY. @infinex: A leading DeFi superapp built around chain abstraction and CEX-like UX. ~$6m allocated for yappers. @Calderaxyz: One of the most active real builders in the rollup space with $1b+ TVL. I suspect that a Kaito reward campaign is coming soon. @OpenledgerHQ: A leading AI network that enables community-driven data and AI model creation. It allocated $2m OPEN to rewards the community. Crab 🦀 @HanaNetwork: Good vision, but execution is still lagging. On the other hand, 1.5% yapper allocation is solid, and there's not much competition. @MitosisOrg: The "liquidity" niche is super crowded already IMO. A lot depends on their execution. Not yet on Kaito Earn. @Mira_Network: Mira is building the Trust Layer for AI, a very competitive and saturated space. They're distributing 0.5% of the supply to yappers. @0G_labs: The largest decentralized AI ecosystem. Fundamentally strong project, but too "overfarmed". Hard to break in + no Kaito Earn campaign. @campnetworkxyz: The vision and product are pretty good, but it's too overcrowded and overfarmed. They're distributing 0.25% CAMP supply & $40k/month to yappers. Bear 🐻 @MemeX_MRC20: Bearish on memes & memecoin launchpads. This narrative has to die. @puffpaw_xyz: Weak fundamentals and limited user value and distribution. Basically a vape store. @LumiterraGame: GameFi is still very weak and underutilized now. The potential ROI is weak. @monad_xyz: Monad is one of the most awaited projects in the game with SUPER HIGH expectations. This is either gonna be the next Hyperliquid or ZKSync, I'm leaning towards the second option... What did I miss? Hope you enjoyed this post and found some new VALUABLE information. If you wanna support me, I'd appreciate a like, reply, and RT <3

My Crypto Cards Tier List S: @gnosispay: Fully self-custodial Visa card with near-zero fees, seamless @zealwallet integration, and up to 5% cashback in $GNO. One of the best options for European users. @ether_fi: Allows spending against yield-bearing ETH while maintaining on-chain custody, up to 5% rewards, offers great travel perks, and low fees. @BleapApp: Offers 2% USDC cashback, zero FX fees, and a very friendly UX. Fully non-custodial and focused on everyday usability across Europe. A: @Cypher_HQ_: Friendly fee structure and big limits. Premium tiers unlock lots of perks, but even the free version works well for casual users. @TrusteeGlobal: Near-zero fees and lots of supported chains and tokens. Fully EU-licensed. Every user has their own IBAN. @Thorwallet: Swiss-grade security, self-custodial wallet, fiat on/off-ramp, and near-zero fees. Perfect for global DeFi users seeking integrated banking. @xPortalApp: A polished debit card for the MultiversX ecosystem offering 0.5% rewards in EGLD/UTK. Custodial, but integrated tightly with the xPortal superapp. @solayer_labs: Fully self-custodial with a guaranteed ~4% yield backed by US T-Bills. Comes with high rewards, perks, and potential airdrop eligibility. B: @MetaMask: Offers 1% USDC cashback, minimal fees, and self-custodial architecture. Still in early access and is very limited by regional rollout. @ready_co: Non-custodial card, sleek UX, up to 10% STRK cashback (drops to 3%). Strong Starknet integration, but WL wait is super long. @OfframpXYZ: Self-custodial and offers native yield backed by US T-Bills. Medium fees & no cashback. @KASTcard: Up to 4% on all spending in points and a 3.5-7% APY boost on SOL. Self-custodial with high limits and great Concierge service. @RedotPay: A custodial global card for emerging markets with low minimums. Functional, but lacks rewards and has pretty high withdrawal fees. @BelobabaBank: Self-custodial, hybrid crypto/fiat card. Big focus on privacy and travel convenience. C: @holyheld: Non-custodial card and offers up to 1% cashback. High focus on the EU, but requires paid card tiers and lacks global reach. @coinbase: Fully custodial and only available in the U.S., it lacks modern DeFi integration. However, it has no spending fees, making it convenient for U.S. users. @Bybit_Official: Fully custodial with pretty medium FX and ATM fees. If you're a CEX user, this may be suitable for you. D: @RevolutApp: Fully custodial, medium fees, and minimal crypto support. Awful customer support and unfriendly approach to crypto. @binance: Fully custodial, no Apple Pay/Google Pay support. Very limited functionality. F: @cryptocom: Heavy staking requirements, regional shutdowns, and diminishing perks make it practically unusable. What else did I miss? Hope you enjoyed this post and found some new VALUABLE information. If you wanna support me, I'd appreciate a like, reply, and RT <3

DeFi Analytics Tools Tier List 🧵 S: @dune: Onchain data platform where you query with SQL and build/share custom dashboards across 100+ chains. @DefiLlama: Aggregator for DeFi metrics across chains and protocols. Best for the default macro dashboard to compare protocols & chains metrics with a great UI. @flipsidecrypto: AI + data platform providing labeled onchain data and conversational analytics. Great for ecosystems to understand users, growth, and protocol health without building their own data stack. @Surf_Copilot: AI copilot for crypto research combining onchain data, social sentiment, and curated reports with in-app execution. Great to filter through the noise and find real alpha. A: @dexscreener: Real-time charts and pool data for DEX pairs across many chains for tracking new pairs, liquidity, PA, and basic onchain trading. @CryptoRank_io: Market aggregator for prices, listings, token sales, unlocks, fundraising, and airdrops. @minara_ai: Financial-focused AI that aggregates portfolios and market data across crypto & stock markets. Top pick for financial reports, research, etc. @tokenterminal: Fundamental data terminal for protocols and chains (revenue, fees, users, ratios). Best to value projects like equities with standardized metrics and ratios. @_dexuai: Analytics platform mixing market, technical, and social data for narrative tracking and determining social sentiments. B: @Tokenomist_ai: All about tokenomics/unlocks analytics, such as allocations, vesting, emissions, etc. @cryptoquant_com: Onchain + derivatives data such as CEX flows, stablecoin metrics, miner/whale behavior. @l2beat: Analytics and research hub for Ethereum L2s, go-to for tracking TVL/TVS, designs, security assumptions, and risk frameworks for L2s. @artemis: Data platform focused on onchain fundamentals and stablecoin metrics with a terminal and good API. C: @coinglass_com: Derivatives and liquidation analytics like OI, funding, heatmaps, etc. @nansen_ai: Onchain analytics with massive wallet labeling. Mostly used to follow smart money wallets, funds, etc. All real insights are in the paid version. D: @glassnode: OG onchain metrics suite for BTC/ETH and macro flows, good quality data, but paywalled, data may be found on other free tools. @dappradar: App ranking and usage tracker, decent for surface-level research, but had some instances of outdated data. @santimentfeed: Combines onchain and social metrics, nice concept, but the data can easily be found in other apps with better UIs and user experiences. What tool did I miss? Hope you enjoyed this post and found some new VALUABLE information. If you wanna support me, I'd appreciate a like, reply, and RT <3

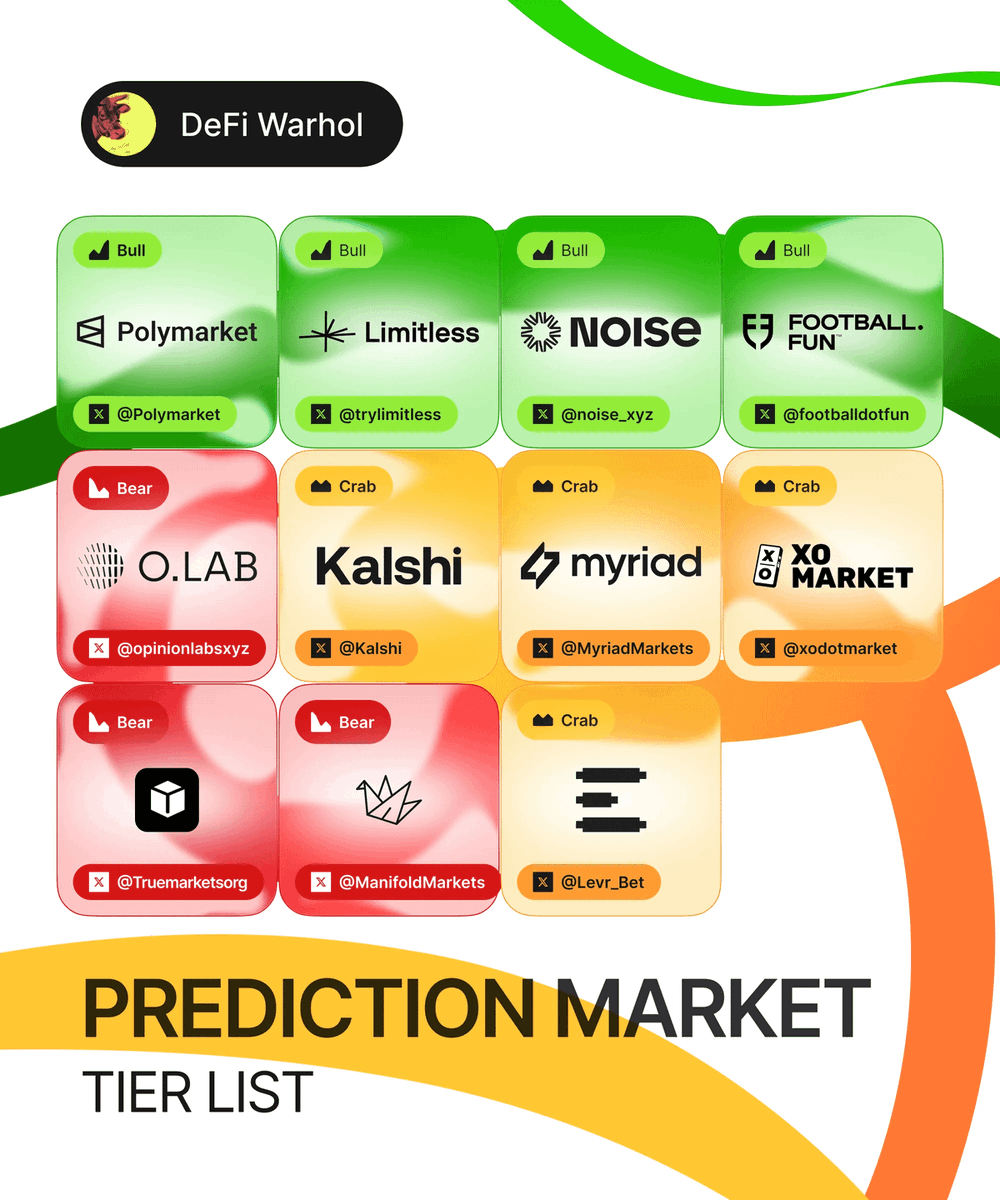

My Prediction Markets Tier List 🧵 ⸻ ➣ Bull 🐂 @Polymarket: Largest prediction market that reached clear PMF during this cycle. One of the few crypto products that reached mainstream adoption and broke out of the 'Web3' bubble. @trylimitless: Leading prediction market on Base with a strong focus on short-term crypto & stocks markets with super-friendly UI/UX. It's the only major prediction market with a running points program & TGE coming soon. @noise_xyz: Noise allows you to trade attention with leverage. It's the leading social prediction market and strongly dominates this niche. @footballdotfun: It allows you to trade tokenized “shares” of real players, with rewards tied directly to their real-world performance. It's a more fun & addictive way to bet on sports. ⸻ ➣ Crab 🦀 @Kalshi: Kalshi is the first CFTC-regulated prediction market and the second-largest prediction market by volume. Currently available ONLY to US residents, and I personally wanna see more crypto markets live (excited to see @j0hnwang's impact). @Levr_Bet: Allows betting on sports events with up to 5x leverage, big potential, and a huge TAM. Currently has very few markets and modest activity. @MyriadMarkets: A general prediction market built on Abstract. It has strong distribution channels, but very few markets and liquidity problems. @xodotmarket: XO is a conviction marketplace, enabling anyone to create and trade markets. The idea of 'user-generated markets' is cool, but I'm skeptical about how it can be scaled due to the liquidity and resolution challenges. ⸻ ➣ Bear 🐻 @opinionlabsxyz: Basically a Polymarket copy with the same general markets but lower liquidity and activity. I don't see a strong competitive advantage or how they can scale. @ManifoldMarkets: Manifold allows you to bet on 'everything' with their play-money currency that CAN'T be converted to real money. I don't see the point of prediction markets that aren't using real funds for trading, a waste of time for me. @Truemarketsorg: A general prediction market with lots of markets, but huge liquidity problems that make it impossible to trade seamlessly. All markets can be found on other platforms, so nothing is unique about it. ⸻ What protocol did I miss? Hope you enjoyed this post and found some new VALUABLE information. If you wanna support me, I'd appreciate a like, reply, and RT <3

Tier List of Upcoming Airdrops 🧵 S: @Lighter_xyz: Onchain perps protocol with zero trading fees focused on speed for HTF. The official points season is ongoing. @base: Top performing L2 with real users, fees, and distribution by Coinbase. Token confirmed & big airdrop cook possible. @HyperliquidX: High-performance perp DEX with CEX-like UX and deep onchain liquidity. Lots of $HYPE left for the community, no "official points season". @Polymarket: Category leader in prediction markets with real volume/retention. $POLY token confirmed, airdrop 99% likely. A: @Rabby_io: Smart multichain wallet with great UI/UX that auto-picks the best route and protects from bad txs. @trylimitless: Prediction market on Base focusing on short-term price markets and 0DTE-style trades. Points Season 2 live. @wallchain: AttentionFi platform for measuring and rewarding authentic influence & content through its Wallchain X Score and Wallchain Quacks. @AbstractChain: Ethereum L2 that uses ZK technology to enable fast, low-fee transactions, focusing on consumer apps. @paradex: Onchain perp exchange (Starknet/EVM stack) for trading majors with zero fees. @KaitoAI: InfoFi platform that rewards genuine influence and valuable content. B: @almanak: A DeFi agent platform designed to create and deploy automated financial strategies using financial agents. @vooi_io DeFi trading super-app: trade perps, spot, even RWAs in one non-custodial UI, gasless & chain-abstracted. @zama_fhe: FHE (fully homomorphic encryption) infra so you can compute on encrypted data onchain. @farcaster_xyz: Decentralized social protocol where users own their data, identity, and social graph. @Backpack: Wallet + DEX + perps stack, Solana-native, asset-first UX. @KASTcard: Stablecoin neobank + global crypto card to spend USDC/USDT anywhere Visa works. C: @JupiterExchange: Solana DEX aggregator + launch/LST/perps hub. @MyriadMarkets: Onchain prediction market on Absract and BNB, live points/leaderboards. @katana: DeFi platform on Polygon’s Agglayer with liquidity aggregation, yield optimization, and ZK proof privacy. D: @MetaMask: Self-custody wallet for swaps, bridges, and wanting to kill yourself while using it. @pumpdotfun: Memecoin launchpad that left your portfolio without an altseason because it drained all the liquidity. @opensea: NFT marketplace for trading dead NFTs among depressed and broke people. What protocol did I miss? Hope you enjoyed this post and found some new VALUABLE information. If you wanna support me, I'd appreciate a like, reply, and RT <3

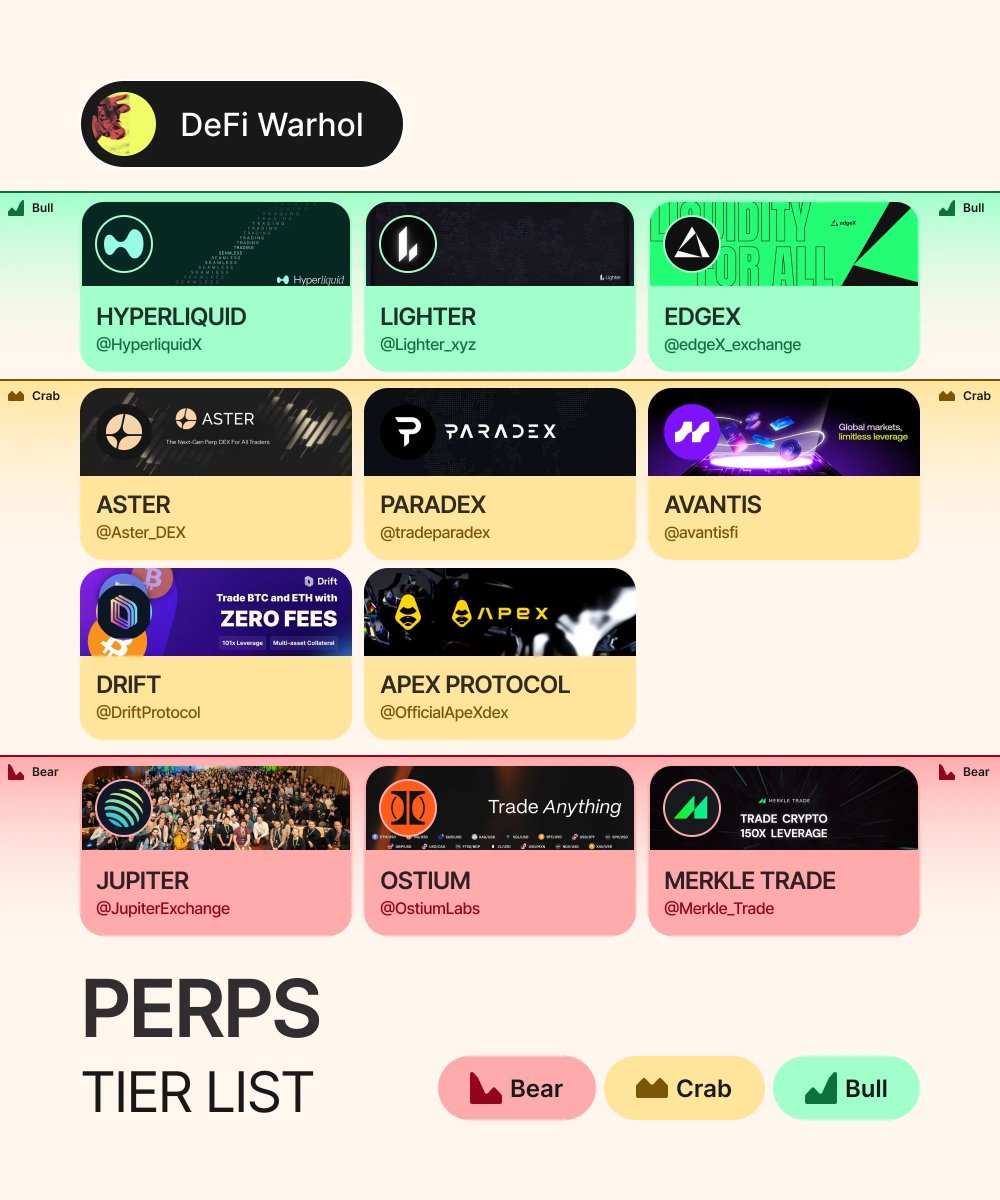

My Tier List of Perps Protocols 🧵 ⸻ ➣ Bull 🐂 @HyperliquidX: Best decentralized perp DEX with the deepest liquidity, gasless transactions, solid revenue, and huge buybacks. @Lighter_xyz: High potential perp DEX with gasless TXs, ZK CLOB, zero fees, and running points system. Doing almost half of the Hyperliquid volume now. @edgeX_exchange: A perps DEX with a native app and a CEX-like experience. Fast rising volume, OI, and TVL. ⸻ ➣ Crab 🦀 @Aster_DEX: Great performing DEX with solid volume and good liquidity. Only in crab cause of fewer trading pairs and a bit outdated UI imo. @tradeparadex: Zero fee trading and running points system, pretty good UI/UX. Lower volume and OI compared to Bull projects (big potential). @avantisfi: Leading perp protocol on Base with up to 1000x leverage with a points system running. But higher than average fees and smaller volume. @DriftProtocol: One of the leading perps on Solana with a good fee structure. The volume has been falling lately due to increased competition. @OfficialApeXdex: Great fee structure and UX/UI, but falling metrics and pretty slow throughput. ⸻ ➣ Bear 🐻 @JupiterExchange: Great aggregator, questionable perps. Almost no trading pairs and pretty high fees. @OstiumLabs: Allows trading commodities and stocks with 100x leverage, but the volume and OI are lagging hard behind. @Merkle_Trade: Volume, OI, and liquidity are minimal and declining throughout 2025. It can't get more market share in this developing landscape. ⸻ What protocol did I miss? Hope you enjoyed this post and found some new VALUABLE information. If you wanna support me, I'd appreciate a like, reply, and RT <3

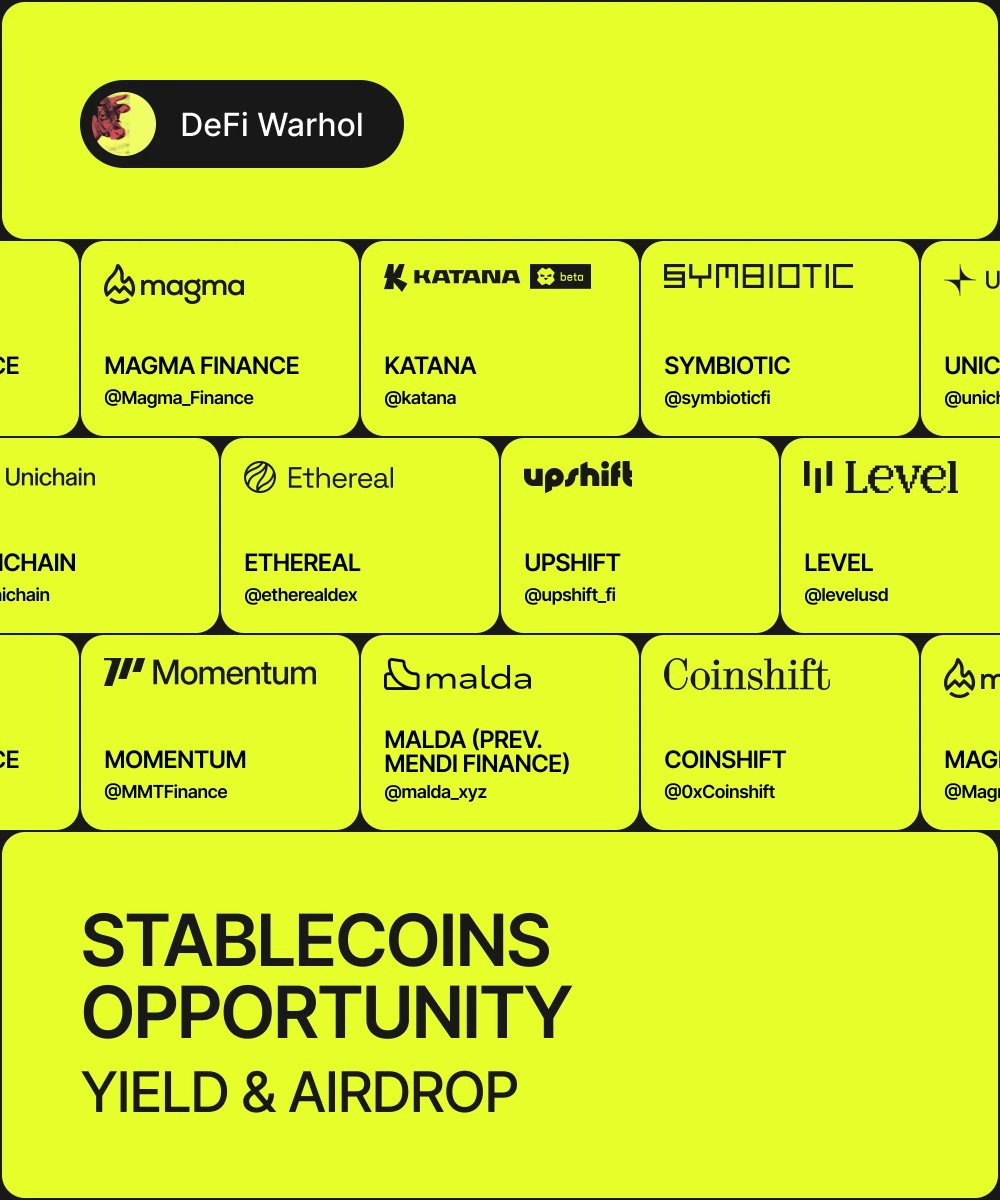

Don't just hold your stablecoin, you HAVE to put it to work. Here are the best Airdrop + Yield opportunities 🧵 (bookmark for later) ➣ @Magma_Finance - Go to: app.magmafinance.io - Choose a stable pool to LP - More LP = more rewards ➣ @katana - Go to: app.katana.network - LP to a USDC/USDT/AUSD vault ➣ @symbioticfi - Go to: app.symbiotic.fi - Deposit to stable vaults ➣ @unichain - Go to: app.uniswap.org - LP in any desired stable pool - Earn yield and potential rewards ➣ @etherealdex - Go to: deposit.ethereal.trade/points - Deposit USDe - Receive eUSDe and farm points ➣ @upshift_fi - Go to: app.upshift.finance - Deposit in any stable pool - Earn yield + rewards ➣ @levelusd - Go to: level.money - Mint lvlUSD - LP to any pool ➣ @MMTFinance - Go to: app.mmt.finance - LP to any stable pool - Earn yield + rewards ➣ @malda_xyz - Go to: app.malda.xyz - Borrow USDC and deposit it ➣ @0xCoinshift - Go to: coinshift.global/points/ - Swap USDC for csUSDL and deposit it What did I miss? Hope you enjoyed this post and found some new VALUABLE information. If you wanna support me, I'd appreciate a like, reply, and RT <

If a project doesn't buy back its own tokens, why should you? Here's my Protocol Buybacks Tier List 🧵 ➣ Bull 🐂 @HyperliquidX: Hyperliquid uses 97% of trading fees to buy back or redistribute $HYPE, $235m to date. In 30 days, they distributed $78.29m to holders. @aave: Recently approved a $1m weekly $AAVE buyback. It’s the first major OG DeFi protocol to formalize buybacks. @RaydiumProtocol: 12% of trading fees from every swap to buy back $RAY. $193m repurchased so far & $7.7m distributed to holders in 30 days. @SkyEcosystem: Sky initiated $1m/day buyback and burn using its stablecoin revenue (USDS), removing ~2% of the total token supply by mid‑2025 @PancakeSwap: 40% of the fees are used for $CAKE buyback. They've distributed $101.75m to holders in the last 30 days. @KaitoAI: Weekly buybacks that help stabilize inflation and VC selling pressure. The buyback cut the circulating supply by ~3.5 million tokens. ➣ Crab 🦀 @dYdX: 25% of net fees for buybacks, staking $DYDX; 40% for staking rewards, making buybacks only slightly deflationary & not very effective. @BNBCHAIN: Allocates 20% of quarterly revenue to buy and burn $BNB. No holder revenue is present. @ether_fi: The program is still in the early stages, only $3.4m has been bought so far. Still risks of inflation and increased selling pressure. @THORChain: Buybacks are counterbalanced by inflationary minting, leading to neutral long-term supply pressure, even with fee-based burns. @orca_so: 20% of its protocol fees to buy $ORCA, which are then used for staking rewards. Buybacks are minimally deflationary and not very effective. ➣ Bear 🐻 @PolyhedraZK: Awful price action and with manipulation and huge selling pressure. $ZKJ dropped from $2 to $0.30 in one day. Buybacks are useless. @Shibtoken: Relies on community manual burns and Shibarium fee burns, no systemic buyback from revenue. @pumpdotfun: Although the team is performing buybacks, the project is slowly fading after TGE. This may be the final nail in the coffin for memecoins, @bonk_fun: Same argument as for @pumpdotfun. The meme narrative is a sinking ship, and buybacks won't save it. It's just a matter if time. What did I miss? Hope you enjoyed this post and found some new VALUABLE information. If you wanna support me, I'd appreciate a like, reply, and RT <3

The RWA industry has experienced a 600% growth since 2023. My Tier List of RWA protocols 🧵 ⸻ ➣ Bull 🐂 @Securitize: The largest tokenization platform by onchain RWA value, it's behind BlackRock’s BUIDL ($2.38b AUM) and handles $1b+ in monthly transfer volume. @OndoFinance: Clear product–market fit with tokenized treasuries: OUSG (mostly for institutions) and USDY as a yield-bearing dollar for retail. Real revenue-generating protocol with $55m in annualized fees. @maplefinance: Onchain credit protocol at institutional scale with syrupUSDC (yield-bearing dollar) integrating across DeFi, adding instant-liquidity rails. Its TVL is up nearly 30x YTD: $100m -> $3b. @centrifuge: It builds Infrastructure for tokenized financial products, such as private credit, funds, etc. It experienced a reboot recently, and its TVL is up more than 10x in 2025. ➣ Crab 🦀 @FTDA_US: BENJI is one of the leading US government money-market funds onchain. It combines mainstream MMF access with TradFi safeguards. Its TVL has been stagnant lately compared to competitors. @goldfinch_fi: It brings institutional private-credit yield onchain and gives exposure to loans from managers like Apollo, Ares, Golub, etc. Current performance is mid-tier vs leaders: only $170m total loans $64m active. @OpenEden_X: TBILL is a tokenized T-bill fund that has a Moody’s “A” rating, and they're growing adoption through their native YB stable USDO. It's a big potential, only in Crab cause it's smaller than Bull projects. @Spiko_finance: Money-market fund EUTBL that tokenizes EU T-bills. Decent value ($400m) and growth, but distribution and DeFi composability are lagging. ➣ Bear 🐻 @MANTRA_Chain: Despite its revolutionary RWA-L1 pitch, OM crashed ~90% in minutes amid forced liquidations. The trust damage and transparency risks remain strong. Unlikely for it to ever recover. @TrueFiDAO: Pioneered unsecured crypto credit and reached $1.7b in historical loans, but just ~$7.75M active today. It was unable to preserve capital and user interest. @SwarmMarkets: It's a multi-asset RWA platform for equities/treasuries onchain, yet the platform’s RWA manages just $900k in value, a tiny fraction of its competitors. Its growth is slow and inenthusiastic, so Bear for now. ⸻ What protocol did I miss? Hope you enjoyed this post and found some new VALUABLE information. If you wanna support me, I'd appreciate a like, reply, and RT <3

People with Analyst archetype

Wholesale AE in the early 2000s. Commentary on mortgage/real estate/housing market since 2006 @ thetruthaboutmortgage.com

I don’t care what people think of me. This is me in rawest form. $SNSY

Videogamefreak | Passionately curious | Always learning |

making everything more you @getcrosshatch // maths music theory econ @harvard @swarthmore

In love with statistics, robotics, macroeconomy, crypto (Bitmex from 2017), sport and politics. Doing PhD not for the money but for the fame.

🫠 VC Analyst | Powered by $ETH @MorphLayer

ウソばかりの中国から日本に来て4年目。帰化のために頑張ってる。INTJタイプ。婚活中。 夢は、7つのドラゴンボールを集めて、「この世界から野良動物がいなくなりますように」と。

Reviewing smart contracts and making Web3 safer one protocol at a time | SR @NethermindSec

#ISTJ 撸毛, 撸猫两不误. 套利, DeFi 永相随.

🎮 UX/UI with psychology & #nudge → +45% conversion ⚡ Behavioral design insights & ideas daily (no robot, no promises) 🎨 In love with Design History

Explore Related Archetypes

If you enjoy the analyst profiles, you might also like these personality types: