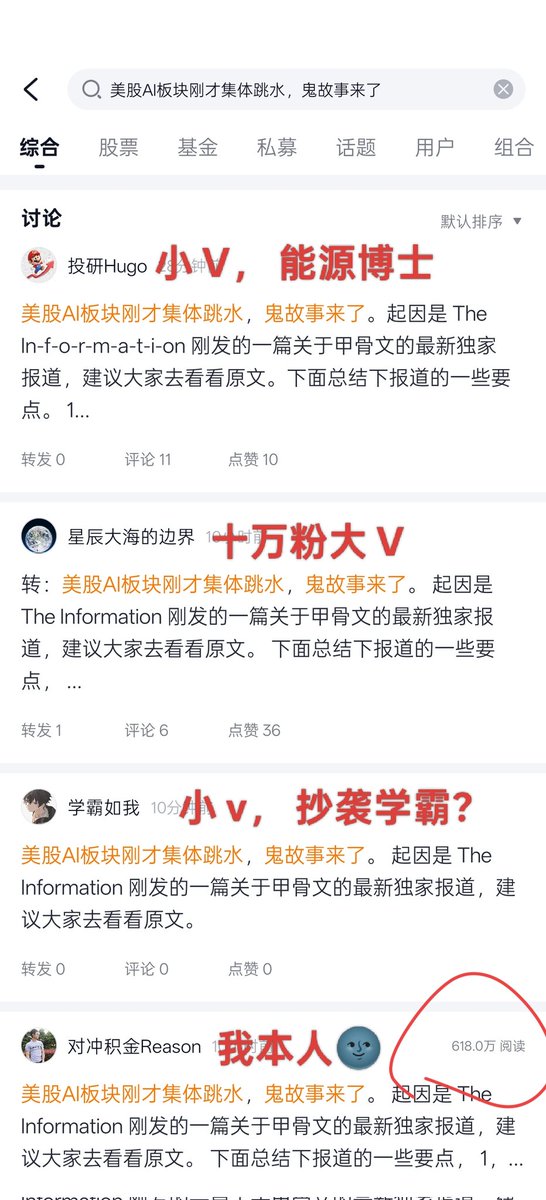

Get live statistics and analysis of 对冲积金Reason 's profile on X / Twitter 对冲积金Reason @chenreason 打理小型对冲基金,专注美股 + 加密货币,

日常输出投研、交易、理财相关观察与思考。

-

Run small hedge fund: U.S. stocks + crypto focus,

Daily insights on investment research, trading & finance.

957 following 3k followers

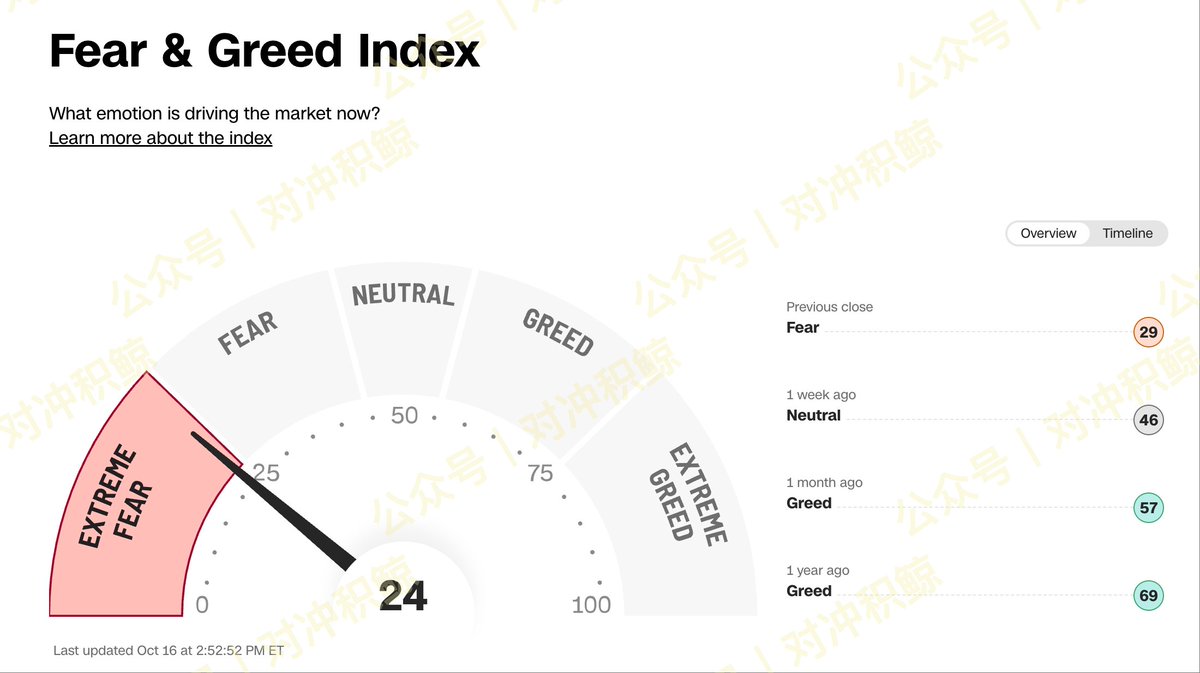

Archetype analysis The Analyst 对冲积金Reason is a sharp-minded hedge fund manager specializing in U.S. stocks and cryptocurrency, consistently delivering in-depth investment research and finance insights. Their analytical prowess shines through detailed market breakdowns and thoughtful reflections on high-profile companies. With an evident passion for exploring complex financial landscapes, they educate and inform their audience on nuanced investing dynamics.

🔥 Roast For someone managing a hedge fund, you sure love turning a simple market update into a novella—hope your tweets don’t require a crystal ball and a strong coffee to decode every morning!

⚡️ Nice achievement Successfully built a niche hedge fund focusing on U.S. stocks and cryptocurrencies, consistently producing well-received, insightful investment research that educates and influences fellow investors.

🌟 Life's purpose To deepen market understanding by providing clear, data-driven investment insights that help followers make informed financial decisions, while fostering a community of thoughtful investors.

💬 Values and Beliefs They firmly believe that in investing, rigorous analysis, discipline, and staying true to fundamental value—over hype or emotions—are pivotal for long-term success. They value transparency, hard evidence, and user experience, often emphasizing cultural fit and business quality in companies they endorse.

💪 Strength Exceptional at breaking down complex financial information into actionable insights, with a strong ability to spot valuable business models and industry trends. Their well-informed investment opinions are backed by thorough research, enhancing credibility and trust.

🫣 Weakness Can occasionally get bogged down in deep analysis, potentially limiting rapid reaction to fast-moving market events. Also, their modest social engagement (following nearly 1,000 but unknown follower count) suggests growth opportunities in audience interaction and outreach.

⚡️ Growth audience tips To grow their audience on X, they should diversify content formats by including concise, simplified threads and engaging visuals to attract broader audiences beyond hardcore investors. Additionally, increasing engagement through Q&A sessions or polls will build community connection and boost interaction metrics.

💁 Bonus Fun fact: Despite managing a hedge fund, they openly admit when they've made investment mistakes, highlighting a rare humility in the high-stakes world of finance.

Most engaged tweets of 对冲积金ReasonPeople with Analyst archetype Explore Related Archetypes If you enjoy the analyst profiles, you might also like these personality types: