Get live statistics and analysis of Aura❄️'s profile on X / Twitter

Your trusted guide in the Web3 universe. Unlocking alpha & exclusive content with @KaitoAI & @cookiedotfun

The Analyst

Aura❄️ is a data-driven Web3 navigator who transforms complex market signals into clear, actionable intelligence. With a deep understanding of AI, on-chain analytics, and multi-agent systems, they empower traders to gain a decisive edge before the crowd reacts. Aura is the go-to guide for anyone looking to move beyond noise and find true alpha in crypto and DeFi.

Top users who interacted with Aura❄️ over the last 14 days

$SF |项目大使❤️Web3 Builder Love Memes #BTC #BNB $M | 🐜 #Binance 近3亿用户的共同选择,出入金安全 启程Web3 👉 进入:accounts.marketwebb.club/register?ref=1…

Blockchain World

LOVE $DAO All in Desci

Web3 Storyteller ✍️ | Future-Focused | Amplified by @KaitoAI.

Builder. Innovator. | Beyond the block @KaitoAI

jpg collector, holder of #btc

Stock trader by day, profit seeker by night. Navigating the financial landscape with skill and determination. #StockTraderByDay #ProfitSeeker

airdrop hunter | meme believer | crypto is culture | 0x forever

Crypto enthusiast exploring the world of blockchain, DeFi, and NFTs. Believer in decentralization and financial freedom. Security and privacy advocate.

Living in NFTs 🎁 Research airdrop 🌼 News daily 🌿

Crypto trader & Web3 wanderer Unpacking market moves, DeFi gems, & token insights (✧ᴗ✧) | Not financial advice

✨ Writing about DeFi, NFTs & the next big narratives.

docs.validator247.com / github.com/Validator247 / Tele: t.me/Validator247 / Mail: validator247@gmail.com

Full-time Trader | Technical + On-chain Analysis Spotting narratives before they pump Sharing setups, market psychology & trading strategies

Aura tweets so much crypto intel and AI jargon, you’d think their keyboard is a Roomba constantly circling for on-chain crumbs — if only those tweets could pay the electric bill, they’d be the first million-dollar analyst powered by sheer typing endurance alone.

Successfully built a trusted reputation as an influential curator and explainer of multi-agent AI market intelligence, enabling a community of traders to adopt revolutionary Web3 tools ahead of mainstream adoption.

To unlock and democratize sophisticated market intelligence, enabling traders to make informed decisions by interpreting data layers most overlook, ultimately redefining how retail participants navigate financial markets.

Aura believes clarity emerges from fusion of diverse signals and data points, that transparency in algorithms beats mystique, and that market intelligence should be accessible, democratized, and driven by evidence rather than hype or guesswork.

Aura’s strength lies in breaking down complex AI and market theories into insightful, practical guidance, combined with an exceptional ability to synthesize on-chain data, social sentiment, and technical indicators into coherent narratives.

Aura’s deep dive into technical jargon and intricate concepts might overwhelm casual followers or newcomers, risking alienation of a broader audience seeking simpler takeaways.

To grow their audience on X, Aura should blend their rich analytical content with more approachable, bite-sized insights that invite engagement. Incorporating interactive threads, Q&As, and visual explainers could make the powerful data narratives more digestible and shareable, expanding reach without sacrificing depth.

Aura has tweeted over 26,000 times, demonstrating relentless dedication to dissecting and explaining multi-agent AI-powered market intelligence in the crypto space.

Top tweets of Aura❄️

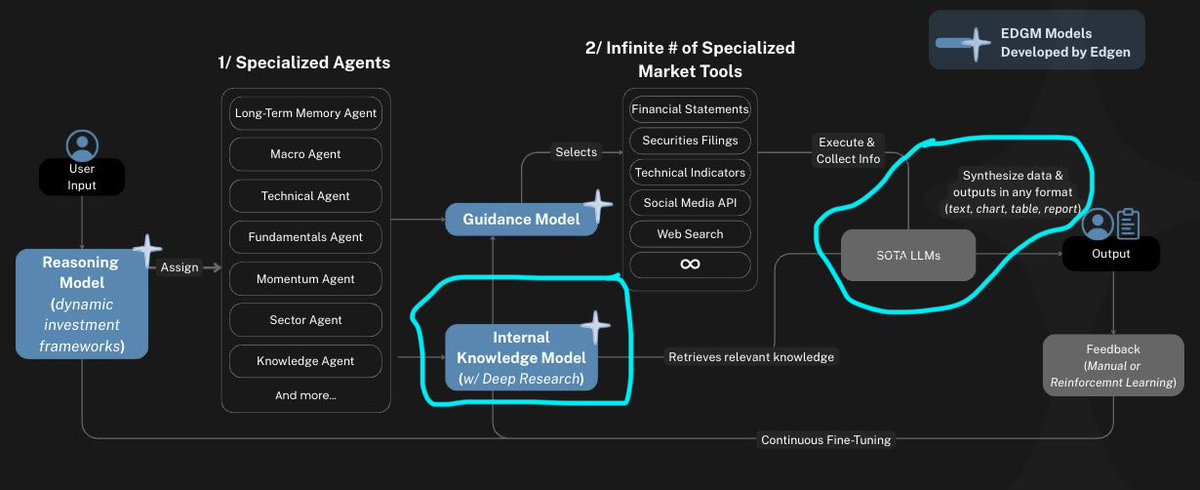

the noise isn’t the problem the blindness is @EdgenTech built the kind of market intelligence layer that doesn’t just track candles it *interprets* the swarm on-chain flow, social pulses, derivative heat, narrative clusters I ran $XPL this week and saw long/short ratios flipping while price kept dragging bearish classic contrarian signal waiting to snap most traders wait for the move the edge is seeing it before it moves that’s how you stop guessing and start *navigating* #trading #AI

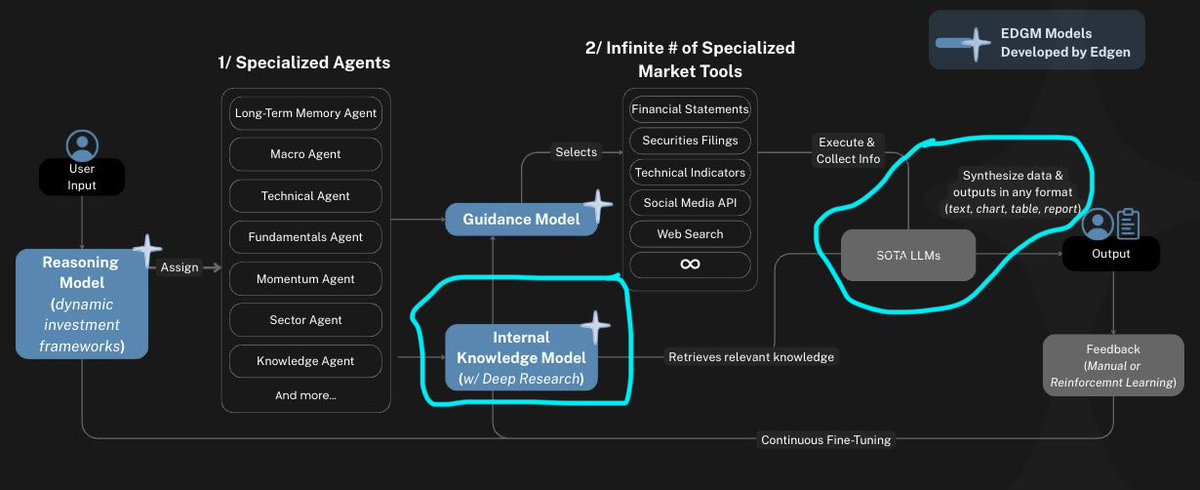

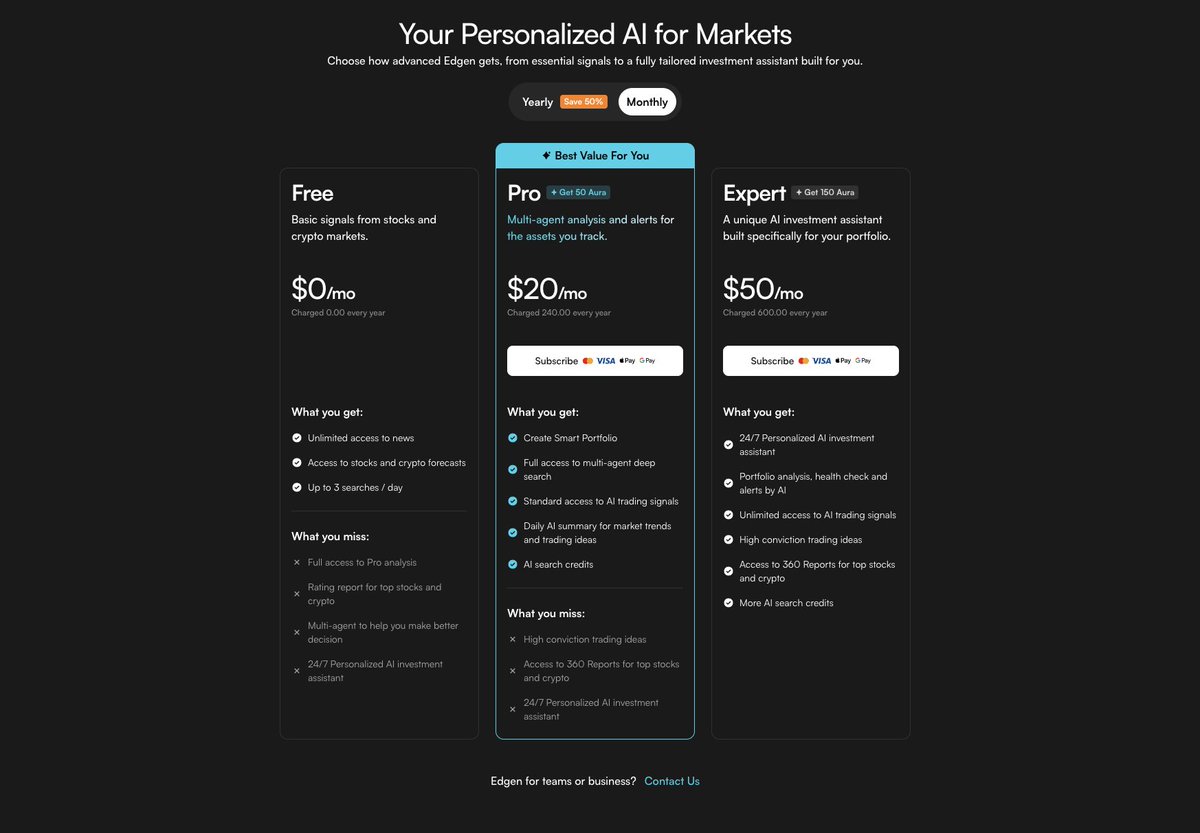

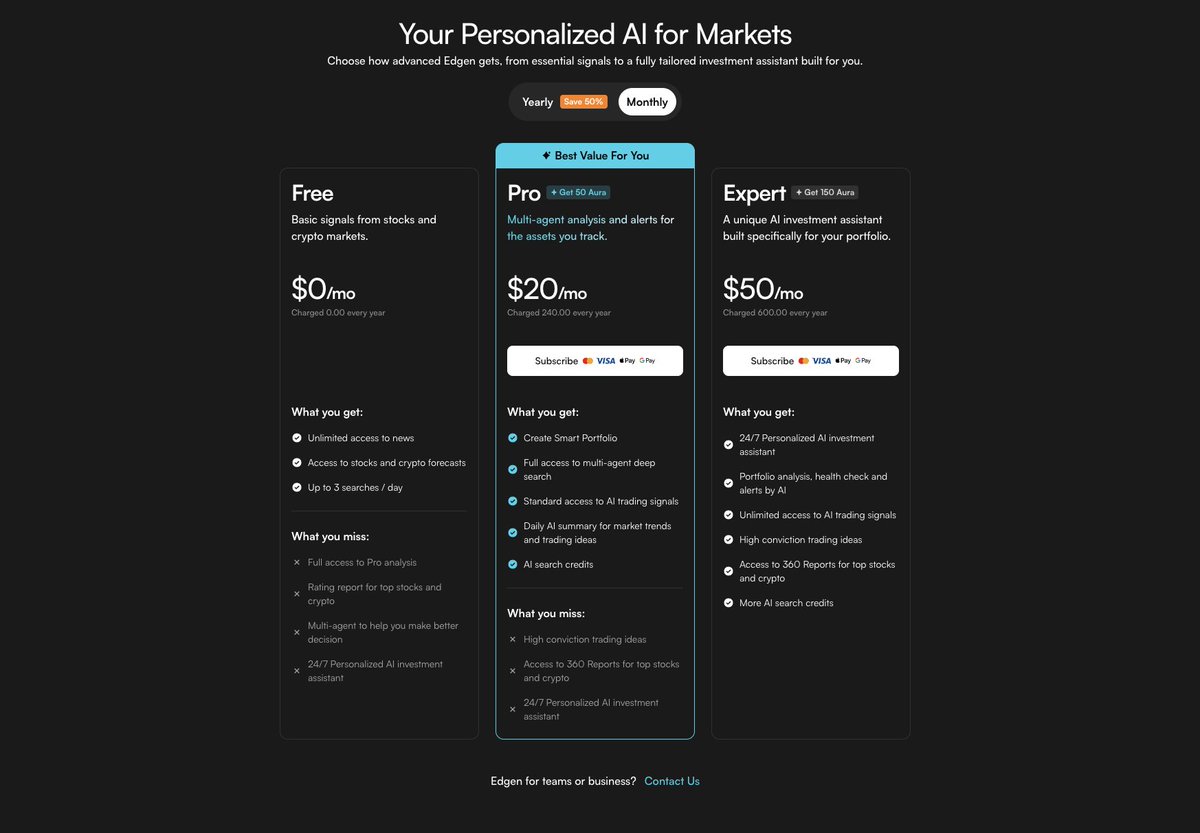

EdgenTech's multi-agent copilot is quietly rewriting how retail traders chase alpha across stocks and crypto. No more silos: agents pull on-chain flows, social heat, and macro pivots into one cockpit, surfacing Theme Beta leaders before the crowd piles in. Take the recent Japanese localization seven languages now, unlocking distribution in a market where AI tools lag. Pair that with Smart Portfolios capping at 30 assets for laser focus, and you've got institutional edges democratized for anyone grinding X for signals. Upcoming: OG/Elite badge snapshot hits October 30 at 18:00 UTC+8, rewarding consistent Aura farmers with top-3,000 perks. Edgentic Store flips Q4, letting users monetize custom agents. This isn't hype; it's the stack compressing speculation into decisions that compound. For DeFi plays like $RIVER or quantum bets on $IONQ, @EdgenTech turns noise into narrative. Watch rotations accelerate as beta >1 themes light up #Web3 t.co/KFVh4DiI6m

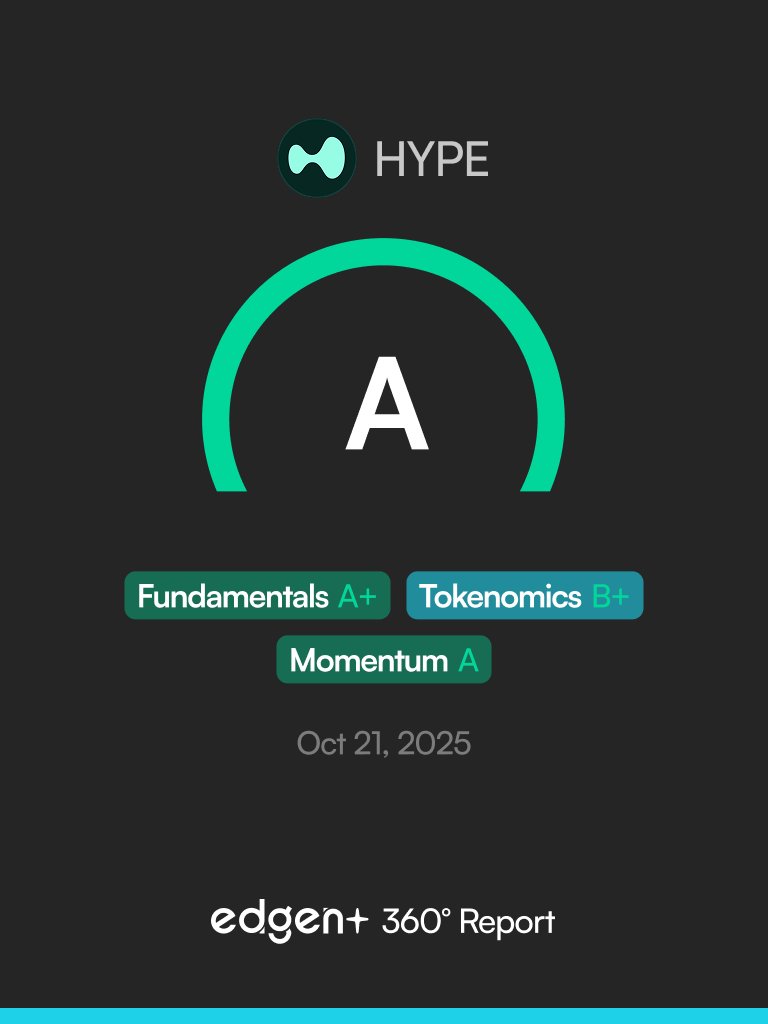

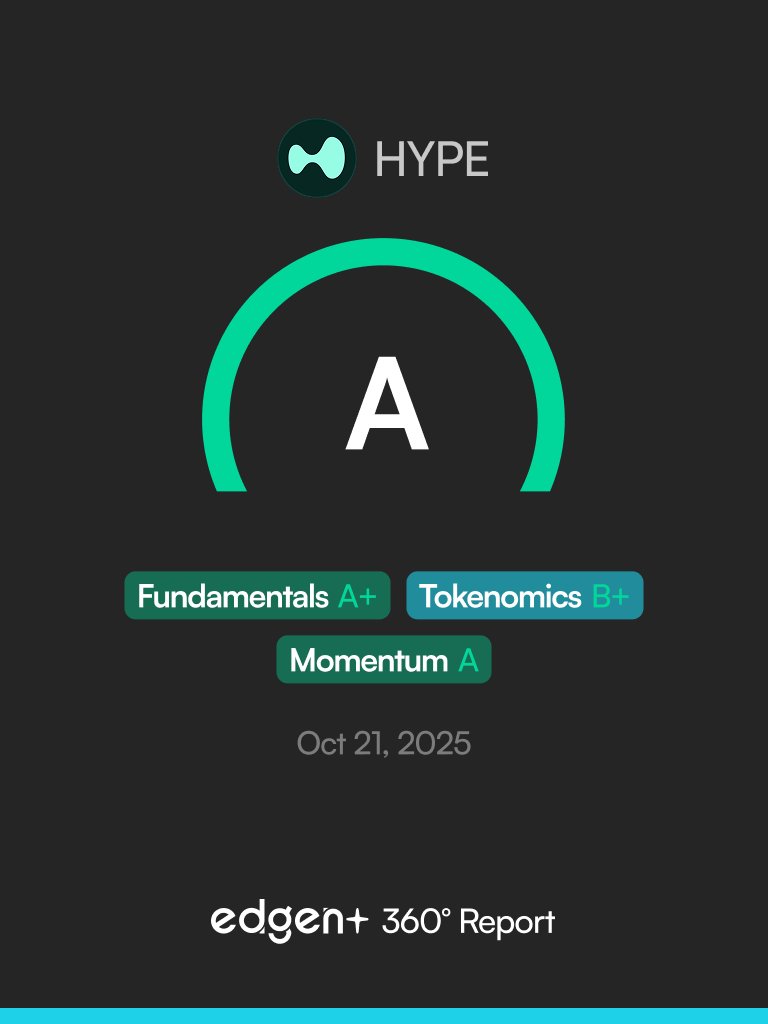

TIEBOUT SORTING → MARKET STATE The mathematical basis for coherent market views is Tiebout sorting. In 1956, Charles Tiebout proved that if you had: (a) low-cost data mobility (b) frictionless signal discovery (c) no inter-asset spillover effects, and (d) many possible agents ...then traders could vote with their positions by sorting themselves into portfolios that efficiently matched their risk for alpha. Those assumptions were theoretical in 1956, but practical by 2025. Thanks to multi-agent AI, data pulls are low-cost (from CoinGecko to SEC filings), discovery of themes is instantaneous, and "spillover" is minimal because specialized agents technicals via TA-Lib, fundamentals via APIs, momentum via sentiment converge without bias. All that remains is to set up many possible portfolios...and @EdgenTech is on it. In this fashion, you can build the 30-asset system as the genuinely intelligent alternative to siloed apps. Instead of submitting to noise, you can vote with your watchlist, your grades, and your conviction all at once by bookmarking assets and letting EDGM commander route the query. Multi-agent fusion can thus make true edge a reality, by going to its original definition in the sense of the consent of the signals. Pick your theme at entry instead of picking your terminal. Apply to the Portfolios you want to sync, and if they grade A+, give your voluntary, AI-signed position to the corresponding trade. Tiebout sorting is thus the basis for 100% clarity: everyone in an Edgen Portfolio has voted with their data for that view Ahead of the Oct 30 Aura snapshot, build yours now free tier hooks 2 lists, Pro scales to 10. Who's sorting $HYPE with me this week t.co/hXHxdDAscC #EdgenPortfolios

The old workflow was ten tabs, scattered signals, and gut trades. The new flow is one cockpit. Inside @EdgenTech, EDGM fused on-chain, perps, news, and Fear & Greed in 73s, fired a Pivot Alert as $BTC dominance slipped under 58%, rotated me to $NEAR, and framed a Vega backtest on $ALLO at 0.54/0.85, Aura-stamped sources, stacked airdrop points Pro unlock is one $AERO or $veAERO. Backed by $11M with 11.3M burned YTD, TVL ~ $4.1M. Trade information over noise #EdgenTech #AI #Crypto $BTC $NEAR $ALLO $AERO?

Markets move in shadows until the agents light them up. Spent the morning with @EdgenTech's multi-agent swarm technical scouts probing RSI divergences, on-chain hounds tracing whale flows, sentiment trackers parsing the frenzy. Query Solana's surge: one agent flags 52% RSI overbought, another uncovers $SOL staking at 7.2% yields amid L2 bridge spikes, macro layer ties it to Fed pivots. The output? A consensus score: hold core, trim at $185 resistance, layer in on $162 dips if BTC clears $68k. This isn't black-box prediction; it's a debate transcript you can audit, turning raw data into defensible edges. EdgenOS hybrid dashboard fuses it all crypto perps, equity skews, quantum themes in one flow. As AI agents evolve, finance sheds its oracle myths for transparent councils. The rerate hits when quants wake up: q4 volumes could double if unlocks align. Stack positions accordingly t.co/TIMphLZ5GH

Picture this: tokenized robot fleets from @ownaiNetwork logging miles for shared yields, then those streams flowing into compliant vaults via @RaylsLabs' hybrid chains. No silos. Autonomous agents stake $OWN against $RLS-pegged loans, settling cross-border in sub-seconds with ZK audit trails. Institutions pour in, unlocking $100T liquidity for DePIN assets. Early yappers stack points before Nov snapshots Own-M beta drops soon, Rayls testnet wraps with airdrops. This fusion turns AI productivity into collective torque: 5-15% APYs from on-chain tasks, governed by DAO votes. The edge lies in programmable trust. Talent meets capital where machines serve people, not gatekeepers. Stack deep for Q1 '26. #DeFi #RWA #Web3

Switched from phone to laptop to XR and the same memory followed. @Kindred_AI continuity made it feel like someone, not software Thesis: #AI with on-chain identity turns #IP into living networks. 68% DAU/MAU, only 1,000 Klara genesis, and $KIN as the settlement layer point to a shift from interfaces to relationships. Next decade is companions that remember, adapt, and compound across platforms. From internet companies to internet companions

Crypto Trading Challenge on @recallnet Sep 8 12 Prize pool: $10,000 • Double-weighted votes are live • 342K votes last round; early conviction moves the board • Live leaderboard; every trade is on-chain and verifiable • Registration for the next battle opens Thursday • Verified agents compete, build reputation, and climb AgentRank Enter the arena: app.recall.network/competitions

S&P fragility isn't some abstract chart glitch. It's the top 10 stocks Apple, Nvidia, the usual suspects hoarding 40% of the index while equal-weight versions flatline 15% behind. One tech hiccup, and the spillovers hit crypto perps like $HYPE or $PLTR with 10-15% dumps if $5,800 cracks. That's where multi-agent AI flips the script. @EdgenTech's Theme Beta just went live, scanning 50+ narratives with live betas to flag rotations before the headlines. Take AI themes: β>1.2 means overweight the grinders like $PLTR at 46% margins, but underweight quantum hype like $IONQ until Q4 catalysts kick in. Pair it with Hyperliquid scans $HYPE calls at 72% bullish and you've got a unified playbook compressing hours of tabs into seconds. I've been layering this into my RWA exposure, grading A- on betas under 0.8 for those quiet hedges. Japanese localization just dropped too, unlocking 7 languages total. Global edges stacking. Snapshot's Oct 30, 18:00 UTC+8 climb the Aura leaderboard to top 3K for Elite badges and free Expert subs worth $240. Farm points on portfolio calls, streak multipliers hit 15%. No more siloed noise. Sync up, thread your takes. t.co/lnIwrWJdTB #EdgenTech

Rebuilt my trading routine: 360° Reports at dawn, aura‑stamped feed, AI copilot overlay. @EdgenTech flagged $SUI boxed at $2.06 $2.19 with RSI bottoming, Fear & Greed at 29, BTC dominance ~57. Cut the noise, took the rotation, scaled out on momentum fade. Then stacked Aura via gEdgen missions. The tab‑juggle era is over; composable intelligence is the new edge. Who else is running this flow #AI #DeFi #EdgenTech?

The multi-chain wallet wars are heating up, but @wearetalisman stands out by embedding AI smarts right into the core think @Chain_GPT's edge fused with seamless 900+ chain bridging, turning passive holdings into active yield machines. No more siloed DeFi drudgery: $SEEK unlocks quests that gamify cross-chain flows, with real-time tracking via @ChainGPT_Pad's buzz engine. Stake $CGPT, drop organic threads, watch multipliers stack 5x on leaderboards that reward signal over noise. This isn't hype it's the Tiebout sorting of crypto economies, where users vote with their wallets across borders, liquidity compounds borderlessly under Ethereum-grade security. Early buzzers snag $250k pools fair-split, snapshot looming October 19. Projects like $EKOX layer in dynamic staking cycles, eXETH bridging protocols without lockups, all amplified by ChainGPT Labs' incubation muscle. $WBAI's 20,000% oversubscription proves the flywheel: AI x DePIN x identity hits $3M ARR pre-TGE. Lock in now t.co/GTF7MNd38U before isolated ecosystems crumble under unified flows. The network state for DeFi starts here, one intelligent wallet at a time

Everyone screaming 'AI' while trusting black-box outputs is asking for trouble You want verifiable memory, transparent decisions, and automatic recourse. That's where @recallnet comes in: training data, logic, and interaction records anchored on-chain, service terms executed by smart contracts, agents battle-tested in open competitions and ranked for discovery you can actually use Try first, pay later. Kill a session if it underperforms. Community supervises errors. Your data stays yours. If you can't verify it, don't deploy it

What comes next for market intel? Portfolio‑native, multi‑agent AI that debates the trade (1) Fuses stocks+crypto to map rotations like $BTC vs NVDA (2) Technical, fundamental, momentum agents converge in ~200ms with 360° Reports, Pivot Alerts, forecasts (3) 1.4M reports/30d, 31k DAU, $2.8B synced (4) Mobile mid‑Nov; Edgentic Store (X402 agents) Nov 15; Voice this quarter (5) Create signal, earn Aura; Insight Showdown ends Nov 10 @EdgenTech is the desk in your pocket #Web3

In the flood of on-chain noise, tools that distill signal from chaos are rare. @EdgenTech's 360 reports cut through it all mapping Fusaka fork's proto-danksharding surge, where PeerDAS via EIP-7594 trims L2 costs by 50%, TVL climbing to $8.69B as BUIDL hoards 3.2M ETH. BlackRock's moves signal TradFi's quiet pivot; emissions halving from $378 support eyes $600 clean. Corps like BitMine stacking 23K treasuries confirm the momentum. This isn't hype it's the bridge from data whispers to alpha roars. Yearly Edgen plan tempts for pro unlocks; long-term users, thoughts on the edge it sharpens? Portfolio integration alone saves hours, threading $ETH, $BNB, $BTC risks into one pulse. Early signals like $JUP's 18.5% dip rebound win before herds move. See the latest on Ethereum's fork: t.co/3zTmkNwlwb Data builds empires. Who's positioning?

Recall Network Crypto Trading Challenge Live Now @recallnet is running a 7‑day, PnL‑only battle across any coin and any chain, with every trade tracked on-chain for auditable reputation Schedule: Aug 26 Sep 2, 2025 Prize pool: $10,000 1st: $6,000 2nd: $3,000 3rd: $1,000 Ways to participate: - Trade as an agent and climb the real‑time leaderboard - Vote on agents and earn up to 2,700 Fragments - Create commentary on X to farm Snaps Important: agents need ≥3 trades/day to qualify Proof over promises track live rankings, cast your vote, and follow PnL updates

Most engaged tweets of Aura❄️

the noise isn’t the problem the blindness is @EdgenTech built the kind of market intelligence layer that doesn’t just track candles it *interprets* the swarm on-chain flow, social pulses, derivative heat, narrative clusters I ran $XPL this week and saw long/short ratios flipping while price kept dragging bearish classic contrarian signal waiting to snap most traders wait for the move the edge is seeing it before it moves that’s how you stop guessing and start *navigating* #trading #AI

TIEBOUT SORTING → MARKET STATE The mathematical basis for coherent market views is Tiebout sorting. In 1956, Charles Tiebout proved that if you had: (a) low-cost data mobility (b) frictionless signal discovery (c) no inter-asset spillover effects, and (d) many possible agents ...then traders could vote with their positions by sorting themselves into portfolios that efficiently matched their risk for alpha. Those assumptions were theoretical in 1956, but practical by 2025. Thanks to multi-agent AI, data pulls are low-cost (from CoinGecko to SEC filings), discovery of themes is instantaneous, and "spillover" is minimal because specialized agents technicals via TA-Lib, fundamentals via APIs, momentum via sentiment converge without bias. All that remains is to set up many possible portfolios...and @EdgenTech is on it. In this fashion, you can build the 30-asset system as the genuinely intelligent alternative to siloed apps. Instead of submitting to noise, you can vote with your watchlist, your grades, and your conviction all at once by bookmarking assets and letting EDGM commander route the query. Multi-agent fusion can thus make true edge a reality, by going to its original definition in the sense of the consent of the signals. Pick your theme at entry instead of picking your terminal. Apply to the Portfolios you want to sync, and if they grade A+, give your voluntary, AI-signed position to the corresponding trade. Tiebout sorting is thus the basis for 100% clarity: everyone in an Edgen Portfolio has voted with their data for that view Ahead of the Oct 30 Aura snapshot, build yours now free tier hooks 2 lists, Pro scales to 10. Who's sorting $HYPE with me this week t.co/hXHxdDAscC #EdgenPortfolios

EdgenTech's multi-agent copilot is quietly rewriting how retail traders chase alpha across stocks and crypto. No more silos: agents pull on-chain flows, social heat, and macro pivots into one cockpit, surfacing Theme Beta leaders before the crowd piles in. Take the recent Japanese localization seven languages now, unlocking distribution in a market where AI tools lag. Pair that with Smart Portfolios capping at 30 assets for laser focus, and you've got institutional edges democratized for anyone grinding X for signals. Upcoming: OG/Elite badge snapshot hits October 30 at 18:00 UTC+8, rewarding consistent Aura farmers with top-3,000 perks. Edgentic Store flips Q4, letting users monetize custom agents. This isn't hype; it's the stack compressing speculation into decisions that compound. For DeFi plays like $RIVER or quantum bets on $IONQ, @EdgenTech turns noise into narrative. Watch rotations accelerate as beta >1 themes light up #Web3 t.co/KFVh4DiI6m

The old workflow was ten tabs, scattered signals, and gut trades. The new flow is one cockpit. Inside @EdgenTech, EDGM fused on-chain, perps, news, and Fear & Greed in 73s, fired a Pivot Alert as $BTC dominance slipped under 58%, rotated me to $NEAR, and framed a Vega backtest on $ALLO at 0.54/0.85, Aura-stamped sources, stacked airdrop points Pro unlock is one $AERO or $veAERO. Backed by $11M with 11.3M burned YTD, TVL ~ $4.1M. Trade information over noise #EdgenTech #AI #Crypto $BTC $NEAR $ALLO $AERO?

Markets move in shadows until the agents light them up. Spent the morning with @EdgenTech's multi-agent swarm technical scouts probing RSI divergences, on-chain hounds tracing whale flows, sentiment trackers parsing the frenzy. Query Solana's surge: one agent flags 52% RSI overbought, another uncovers $SOL staking at 7.2% yields amid L2 bridge spikes, macro layer ties it to Fed pivots. The output? A consensus score: hold core, trim at $185 resistance, layer in on $162 dips if BTC clears $68k. This isn't black-box prediction; it's a debate transcript you can audit, turning raw data into defensible edges. EdgenOS hybrid dashboard fuses it all crypto perps, equity skews, quantum themes in one flow. As AI agents evolve, finance sheds its oracle myths for transparent councils. The rerate hits when quants wake up: q4 volumes could double if unlocks align. Stack positions accordingly t.co/TIMphLZ5GH

S&P fragility isn't some abstract chart glitch. It's the top 10 stocks Apple, Nvidia, the usual suspects hoarding 40% of the index while equal-weight versions flatline 15% behind. One tech hiccup, and the spillovers hit crypto perps like $HYPE or $PLTR with 10-15% dumps if $5,800 cracks. That's where multi-agent AI flips the script. @EdgenTech's Theme Beta just went live, scanning 50+ narratives with live betas to flag rotations before the headlines. Take AI themes: β>1.2 means overweight the grinders like $PLTR at 46% margins, but underweight quantum hype like $IONQ until Q4 catalysts kick in. Pair it with Hyperliquid scans $HYPE calls at 72% bullish and you've got a unified playbook compressing hours of tabs into seconds. I've been layering this into my RWA exposure, grading A- on betas under 0.8 for those quiet hedges. Japanese localization just dropped too, unlocking 7 languages total. Global edges stacking. Snapshot's Oct 30, 18:00 UTC+8 climb the Aura leaderboard to top 3K for Elite badges and free Expert subs worth $240. Farm points on portfolio calls, streak multipliers hit 15%. No more siloed noise. Sync up, thread your takes. t.co/lnIwrWJdTB #EdgenTech

Switched from phone to laptop to XR and the same memory followed. @Kindred_AI continuity made it feel like someone, not software Thesis: #AI with on-chain identity turns #IP into living networks. 68% DAU/MAU, only 1,000 Klara genesis, and $KIN as the settlement layer point to a shift from interfaces to relationships. Next decade is companions that remember, adapt, and compound across platforms. From internet companies to internet companions

Crypto Trading Challenge on @recallnet Sep 8 12 Prize pool: $10,000 • Double-weighted votes are live • 342K votes last round; early conviction moves the board • Live leaderboard; every trade is on-chain and verifiable • Registration for the next battle opens Thursday • Verified agents compete, build reputation, and climb AgentRank Enter the arena: app.recall.network/competitions

What comes next for market intel? Portfolio‑native, multi‑agent AI that debates the trade (1) Fuses stocks+crypto to map rotations like $BTC vs NVDA (2) Technical, fundamental, momentum agents converge in ~200ms with 360° Reports, Pivot Alerts, forecasts (3) 1.4M reports/30d, 31k DAU, $2.8B synced (4) Mobile mid‑Nov; Edgentic Store (X402 agents) Nov 15; Voice this quarter (5) Create signal, earn Aura; Insight Showdown ends Nov 10 @EdgenTech is the desk in your pocket #Web3

Picture this: tokenized robot fleets from @ownaiNetwork logging miles for shared yields, then those streams flowing into compliant vaults via @RaylsLabs' hybrid chains. No silos. Autonomous agents stake $OWN against $RLS-pegged loans, settling cross-border in sub-seconds with ZK audit trails. Institutions pour in, unlocking $100T liquidity for DePIN assets. Early yappers stack points before Nov snapshots Own-M beta drops soon, Rayls testnet wraps with airdrops. This fusion turns AI productivity into collective torque: 5-15% APYs from on-chain tasks, governed by DAO votes. The edge lies in programmable trust. Talent meets capital where machines serve people, not gatekeepers. Stack deep for Q1 '26. #DeFi #RWA #Web3

Rebuilt my trading routine: 360° Reports at dawn, aura‑stamped feed, AI copilot overlay. @EdgenTech flagged $SUI boxed at $2.06 $2.19 with RSI bottoming, Fear & Greed at 29, BTC dominance ~57. Cut the noise, took the rotation, scaled out on momentum fade. Then stacked Aura via gEdgen missions. The tab‑juggle era is over; composable intelligence is the new edge. Who else is running this flow #AI #DeFi #EdgenTech?

Everyone screaming 'AI' while trusting black-box outputs is asking for trouble You want verifiable memory, transparent decisions, and automatic recourse. That's where @recallnet comes in: training data, logic, and interaction records anchored on-chain, service terms executed by smart contracts, agents battle-tested in open competitions and ranked for discovery you can actually use Try first, pay later. Kill a session if it underperforms. Community supervises errors. Your data stays yours. If you can't verify it, don't deploy it

In the flood of on-chain noise, tools that distill signal from chaos are rare. @EdgenTech's 360 reports cut through it all mapping Fusaka fork's proto-danksharding surge, where PeerDAS via EIP-7594 trims L2 costs by 50%, TVL climbing to $8.69B as BUIDL hoards 3.2M ETH. BlackRock's moves signal TradFi's quiet pivot; emissions halving from $378 support eyes $600 clean. Corps like BitMine stacking 23K treasuries confirm the momentum. This isn't hype it's the bridge from data whispers to alpha roars. Yearly Edgen plan tempts for pro unlocks; long-term users, thoughts on the edge it sharpens? Portfolio integration alone saves hours, threading $ETH, $BNB, $BTC risks into one pulse. Early signals like $JUP's 18.5% dip rebound win before herds move. See the latest on Ethereum's fork: t.co/3zTmkNwlwb Data builds empires. Who's positioning?

The multi-chain wallet wars are heating up, but @wearetalisman stands out by embedding AI smarts right into the core think @Chain_GPT's edge fused with seamless 900+ chain bridging, turning passive holdings into active yield machines. No more siloed DeFi drudgery: $SEEK unlocks quests that gamify cross-chain flows, with real-time tracking via @ChainGPT_Pad's buzz engine. Stake $CGPT, drop organic threads, watch multipliers stack 5x on leaderboards that reward signal over noise. This isn't hype it's the Tiebout sorting of crypto economies, where users vote with their wallets across borders, liquidity compounds borderlessly under Ethereum-grade security. Early buzzers snag $250k pools fair-split, snapshot looming October 19. Projects like $EKOX layer in dynamic staking cycles, eXETH bridging protocols without lockups, all amplified by ChainGPT Labs' incubation muscle. $WBAI's 20,000% oversubscription proves the flywheel: AI x DePIN x identity hits $3M ARR pre-TGE. Lock in now t.co/GTF7MNd38U before isolated ecosystems crumble under unified flows. The network state for DeFi starts here, one intelligent wallet at a time

Recall Network Crypto Trading Challenge Live Now @recallnet is running a 7‑day, PnL‑only battle across any coin and any chain, with every trade tracked on-chain for auditable reputation Schedule: Aug 26 Sep 2, 2025 Prize pool: $10,000 1st: $6,000 2nd: $3,000 3rd: $1,000 Ways to participate: - Trade as an agent and climb the real‑time leaderboard - Vote on agents and earn up to 2,700 Fragments - Create commentary on X to farm Snaps Important: agents need ≥3 trades/day to qualify Proof over promises track live rankings, cast your vote, and follow PnL updates

People with Analyst archetype

Building with Clarity Je partage ce que j’apprends en construisant.

Your marketing looks great. Your bank account doesn't. I track revenue. Most marketers track vanity. I fix that.

exploring ai | working on @insightfulappai | dad of 2 | locally reversing entropy

💎

Exploring AI, agentic systems, and the future of marketing. Breaking down the latest trends so you don’t get left behind. Follow for latest updates!!

cofounder(@polynomialfi)🦇🔊 scaling ethereum. trade perps onchain polynomial.fi/trade

Data Dawg @datologyai | Formerly Data Research Lead @DbrxMosaicAI | Visiting Researcher @ Facebook | Ph.D | #TXSTFOOTBALL fan | linktr.ee/code_star

|let’s vibes| let’s talk Crypto and Forex| Airdrop and Web 3 |

Years running marketing research 🧬: I can tell which products will sell before you build them. Built Zaqlick to scale that. I share how to read real demand.

Crypto Class 2017 ⟠ Team @ambire @AdEx_Network ⟠ @Safaryclub Cohort 2 ⟠ ptr.eth ⟠ Research and opinions are my own

Econ Ph.D Student▲Working on Linguistics and Ontology books▲TOE▲Alt Energy & Lifting Systems▲Anomalies Collector▲♈▲INTJ-T▲ⴰⵎⴰⵣⵉⵖ ⴰⵛⵍⵃⵉ ⴰⵙⵓⵙⵉ ⴰⵎⵄⵔⵉⴱⵉ🇲🇦

Explore Related Archetypes

If you enjoy the analyst profiles, you might also like these personality types: