Get live statistics and analysis of Mphoza83.edge 🦭🥊's profile on X / Twitter

LOVE $DAO All in Desci

The Activist

Mphoza83.edge is a passionately vocal advocate for decentralized science (DeSci) and cutting-edge blockchain technologies, leveraging deep market insights to energize their community. They thrive on sharing groundbreaking projects and data-driven analysis that push the boundaries of financial and scientific innovation. Always on the frontline of crypto and Web3, they turn complex trends into actionable intelligence with an infectious enthusiasm.

Top users who interacted with Mphoza83.edge 🦭🥊 over the last 14 days

Mphoza83.edge tweets so fast and dense with DeFi acronyms that even their own browser tabs must be filing a union complaint. If only their follower count grew as quickly as their tab chaos, they'd have the whole crypto universe retweeting by now!

Successfully sparked meaningful conversation and hype around emerging DeFi projects like @MMTFinance and @BioProtocol, catalyzing community interest and positioning themselves as a go-to source for insightful crypto market intelligence.

To drive awareness and adoption of decentralized technologies and transparent financial ecosystems, empowering communities to bypass traditional gatekeepers and unlock fair, equitable opportunities.

Believes in the power of open, community-driven innovation where collaboration and transparency outpace centralized control. Advocates for data-backed decision-making and values progress that disrupts legacy systems for the betterment of all.

Impressive ability to merge technical crypto knowledge with engaging storytelling, creating high-value content that educates and motivates diverse audiences. Their detailed market insights and project deep-dives establish credibility and foster trust.

Sometimes their fast-paced, jargon-rich style might overwhelm or alienate newcomers not yet fluent in blockchain lingo, potentially limiting early audience growth outside niche circles.

To grow their audience on X, Mphoza83.edge should consider blending their deep dives with more relatable, beginner-friendly content and interactive polls or AMAs to widen their reach and engagement. Amplifying community highlights and featuring accessible explainer threads could convert casual followers into loyal advocates.

Fun fact: Mphoza83.edge tweets like a crypto oracle, mixing high-velocity data synthesis with passionate campaign-style messaging—kind of like if a blockchain enthusiast and a rally MC merged into one tweetstorming machine.

Top tweets of Mphoza83.edge 🦭🥊

🚀 @MMTFinance x @buidlpad : Powering the Next Wave of Sui DeFi @MMTFinance stands as Sui’s flagship DEX, driving over $20B+ in swap volume, $560M+ TVL, and 2.2M users — backed by OKX Ventures, Coinbase, Circle, and Jump Crypto. It’s fast becoming the core liquidity engine for tokenized assets and RWAs on Sui’s high-speed infrastructure. At its core, $MMT utilizes CLMM technology for ultra-efficient liquidity concentration — cutting fees by up to 80% while empowering LPs to earn 4× rewards through ve(3,3) governance, where emissions are vote-directed for sustainable DeFi growth. Expect instant transactions, low slippage, and dynamic vaults built for optimized, risk-managed yields. Buidlpad is revolutionizing community-driven launches — no VC favoritism, full KYC transparency, and real fairplay. Past gems crushed it: + Solayer: +870% + Sahara AI: +172% + Lombard: +370% + Falcon: +2200% All listed on Binance at TGE. 🔥 The $MMT sale is now live on Buidlpad, targeting a $4.5M raise at $250M–$350M FDV (100% unlock at TGE). 👉 Stake $3K+ for Tier 1 access (snapshot Oct 25) 👉 Submit UGC squads by Oct 22 tagging @MMTFinance & @ for guaranteed $150+ allocs 👉 Complete Galxe quests + HODL campaigns to boost your Bricks multiplier 💡 Pro tip: Momentum’s evolution from DEX → full Financial OS (liquid staking, bridges, AI vaults) + Buidlpad’s flawless track record = massive asymmetric upside. Stack Bricks via swaps, LPs, referrals, and chatter on Kaito for potential airdrops. Sui’s DeFi momentum is real — heading toward a $1B+ ecosystem. DYOR, but this is the play to watch. ⚡

Ditched the endless tab shuffle for a real test run on @EdgenTech yesterday logged in via X, hit EDGM with a prompt on $BTC dom testing 58, and in 68 seconds it fused on-chain inflows, perp funding flips, and sentiment heat maps into a clean Pivot Alert. Spotted the bid leaking into $NEAR around 4.2, drew Vega bands on $ALTO at 0.52/0.87, and Aura flagged verifiable sources so I could thread the call without second-guessing. Stacked points toward the airdrop on the side, all while Pro sits one $AERO flip away backed by that $11M raise from Animoca and OKX Ventures, with 11.3M burned YTD keeping supply tight and TVL steady at ~$4.1M. This isn't just aggregation; it's the first cockpit that anticipates the rotation instead of chasing it. No more stitching signals from noise @EdgenTech turns the scatter into coordinated edge. Who's still grinding ten feeds when one layer reads the flow ahead #EdgenTech #AI #Crypto $BTC $NEAR $ALTO $AERO

The old crypto grind was a war of attrition: twelve tabs open, Dune queries lagging, DefiLlama refreshes every 90 seconds, and X threads screaming FUD while you second-guess a $SOL entry after that memecoin frenzy. Gut trades on dominance flips, half the signal drowned in noise, the other half chasing yesterday's alpha. Enter @EdgenTech: one cockpit where EDGM fuses perps open interest (+$2.3B SOL longs last cycle), social tilt (62% bullish), and on-chain inflows (-87K ETH net out) in 73 seconds flat. Dropped a thesis on $BTC dom capping at 58%, it fired a Pivot Alert, queued $NEAR rotation, framed $ALLO bids at 0.54/0.85 with Vega resistance, and stamped sources via Aura for clean posting. No more tab tax Aura points stack free toward the airdrop just for logging in via X, Pro unlocks with one $AERO or $veAERO bribe. Backed by $11M from Animoca and OKX Ventures, 11.3M burned YTD, TVL holding ~$4.1M steady. This isn't just faster intel; it's the edge that turns effort into routed flow. What's the fair value of an AI stack that reads markets like Soros read pain, but without the backache? #EdgenTech #AI #Crypto $BTC $NEAR $ALLO $AERO

Most ZK projects promise the moon but deliver proofs that take hours and circuits that feel like quantum physics homework. Then there's @brevis_zk, quietly rewriting the script with its Pico zkVM verifying full Ethereum blocks in under 10 seconds on everyday hardware. No data centers required, just raw efficiency that slashes proving costs by half. What sets it apart isn't the speed alone. It's the trustless bridge to cross-chain data: dApps pulling historical states or receipts from anywhere, proving them onchain without exposing a byte. Developers swap endless math for a simple SDK that handles the heavy ZK lifting, letting them build scalable, private apps that actually ship to users. Mainnet's live, integrations like KaitoAI are stacking privacy on top of DeFi leaderboards, and staking's on deck to lock in the network's edge. $BREVIS isn't chasing hype it's the verifiable compute layer Web3's been starving for, turning ZK from a buzzword into the default for onchain everything. This is the infrastructure that sticks.

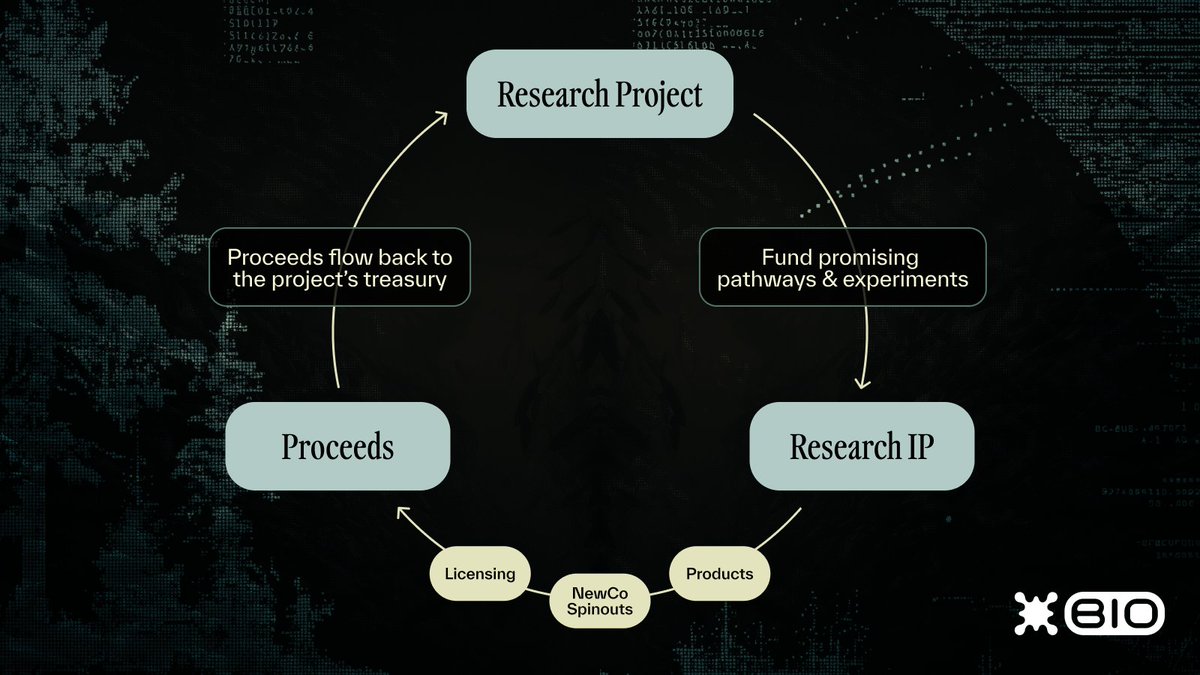

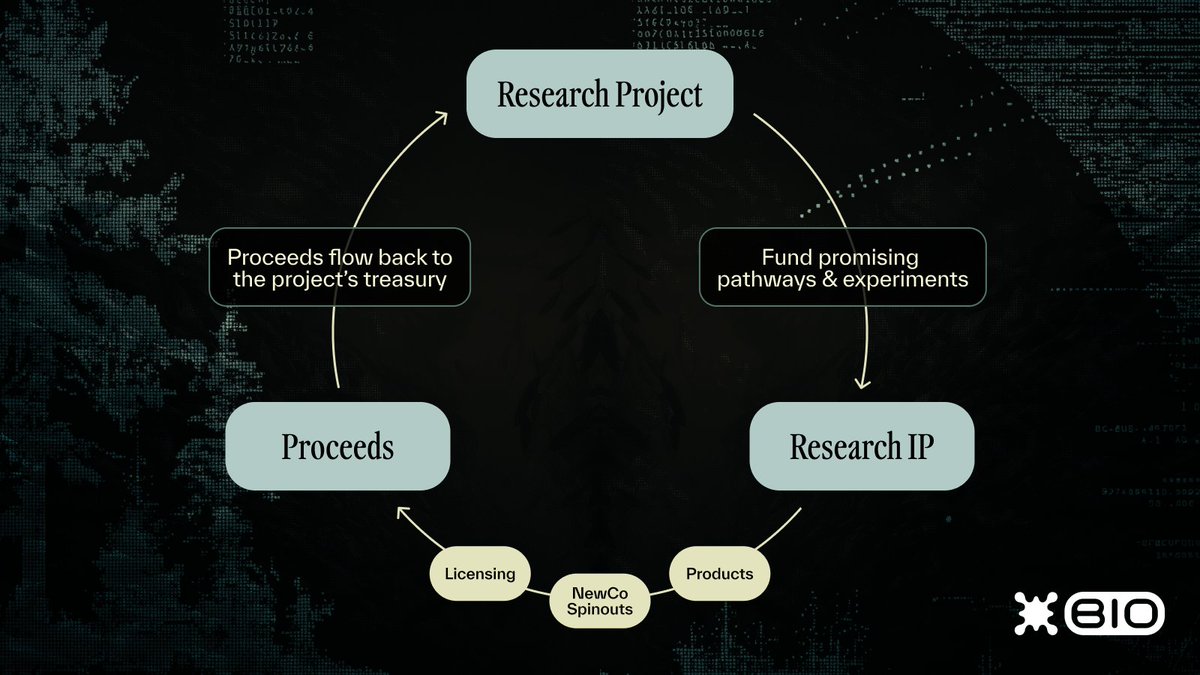

Dug into @BioProtocol's Season 2 after locking $BIO into Ignition for that veBIO drip, and the pattern snaps clear: DeSci's shedding the old grant purgatory for onchain flywheels that actually accelerate biology at data speed. $50M funded since Genesis, TVL cresting $150M with 125M $BIO in pools agents already forking USDC via x402 on Base to spin up wet labs for $GALE's galectin-3 Alzheimer's runs or $DROPS' purity-tuned longevity serums, all before IP-NFT auctions even warm up. No more decade delays or reputation gates; milestones unlock tranches through community votes, BioXP compounds into governance weight, and tokenized assets loop back as yields for holders who backed the hypothesis. Thesis: mid-2026 hits with $500M+ in onchain therapeutics, borderless collabs turning neuroinflammation shields and skin vaults into DAO treasuries that outpace VC silos. Stake early on @BioProtocol, bootstrap the next wave #DeSci $BIO

Dug into the $ETH-$SOL tug-of-war this morning, convinced SOL's on-chain frenzy was overcooked after that 15% pump on memecoin volume. Old me: 12 tabs juggling Dune dashboards, DefiLlama flows, and CT FUD threads, second-guessing every entry. Switched to @EdgenTech cockpit, connected via X in under a minute, dropped a quick thesis on the Aura Leaderboard about dominance flips signaling alt rotations. Prompted EDGM to fuse perps open interest (+$2.3B SOL longs), sentiment tilt (62% bullish on X), and exchange inflows (-87K ETH net out). 73 seconds later: Pivot Alert fires at SOL's 0.58 dominance cap, lines up a trim at $185 with Vega resistance at $192/205, rotates bid to undervalued $ARB layers if ETH holds $3.2K support. Aura stamps my sources clean, points stack free toward the airdrop Pro unlocked with one $veAERO for portfolio-native pings. Before: Gut trades bleeding alpha. After: Routed flow that caught the dip, banked 4.2% on the trim while farming. Backed by $11M with Animoca and OKX Ventures, 11.3M burned YTD, TVL steady at $4.1M. Legacy noise vs AI edge markets don't care about effort, just signal. Who's rebuilding their morning stack around this? #EdgenTech #AI #Crypto $ETH $SOL $ARB $AERO

Most blockchains remember, they struggle to make history useful Enter the zk coprocessor layer that turns raw ledger noise into verifiable inputs developers can build on What @brevis_zk delivers: • Full historical state & events accessible without leaking wallets • Heavy compute off-chain, cheap on-chain verification • Privacy + verifiability: prove user activity without exposing everything • Composable proofs that travel across chains Real outcomes: - smarter DeFi reward curves that pay real contributors - private reputation that follows users across ecosystems - liquidity programs where slippage & behavior are auditable - social apps with provable engagement mechanics Proof points: live integrations (Linea, PancakeSwap, Kwenta), 80x faster ops and major backers in the seed round infra momentum you can measure Strategic thought: pair @brevis_zk with hardware accelerators like @cysic_xyz and you compress proof latency, drop billable costs, and unlock real-time ZK apps Which use-case excites you most? Reply with A) Rewards B) Identity C) Liquidity D) Social proofs let’s debate and build together?

Dug into @ValanniaGame over the weekend and stumbled on something raw: the way guilds aren't just teams, they're these living political machines that actually bend the world around them. Started solo, scraping resources in a green zone, then linked up with a small crew next thing I know, we're haggling tolls on a yellow border trade route, turning scrap iron into a steady gold flow that funds our first dragon tame with the Lerathi faction. That rush when your pathfinding tweaks during an arena skirmish outmaneuver a bigger stack? Pure skill read, no wallet meta. Picked up a Valannium Ring in the blind auction phase went for 4.2 SOL and it unlocked that secret Wonder Shop NPC, dropping hints on unclaimed lore spots. Now my on-chain profile's got that prestige title glowing, and with the 96-unit airdrop, I've got a basic army churning out +20% efficiency on farms. $VALAN launch feels like the real unlock, especially with those creator rewards funneled through @xeetdotai leaderboards stacked my Risen Hero for the 1.2x points boost, watching ranks climb steady. It's not grind for grind's sake; it's building momentum that sticks, where your rep carries weight across sessions. Most web3 games fade after the token pump what's one mechanic that actually hooked you long-term?

Dug into @BioProtocol's BioAgents last night after that DeSciNews space tease hit my feed current date lines up perfect for today's 12PM EST drop with ValleyDAO and the crew. Prompted one to sift through a dusty gut microbiome dataset I'd half-forgotten from a side hustle, tying it to rare disease markers via Nebula streams. In under 40 minutes, it flagged two novel pathways for inflammation blockers, auto-commissioned a $50 USDC validation run through x402 hooks, and spun up a hypothesis marketplace listing for staker bids. The x402 + embedded wallets layer changes everything here: no more clunky subs or grant roulette, just seamless micropays where agents hire human specialists on the fly, remix live datasets, and loop in BioXP yields for $BIO holders pushing $150M TVL. Season 2's Ignition pools are stacking real alpha too USDC frontloads turning into BIO liquidity post-traction, with that 20% TGE vest keeping books clean for launches like $DROPS serum. This isn't hype; it's the quiet shift from siloed labs to onchain flywheels where DeSci compounds without the VC drag. Who's jumping into the space today to probe their own dormant data? #DeSci $BIO

GM spent the week digging into @EdgenTech after getting early access Quick take: real toolset for figuring out "why a market moves" instead of just screaming signals Funding: $11M Free tier = useful Expert = TA Report + 360° deep dives worth testing if you trade size How I use it: - Run the themes feed to spot macro catalysts (AI + IoT + edge compute popping) - Cross-check on‑chain flow + social mood before sizing a position - Use Aura quests to offset cost (daily roll calls add up) - Pull the TA report only for positions I want to hold through news Opportunities - Edge compute + IoT feed removes latency for real‑time infra plays - Useful for traders who want narrated context, not raw alerts Risks - Overfitting to AI signals - Chasing mood without core sizing rules Curious: grind Aura for months or buy Expert for fast alpha which are you choosing? Reply with your pick, tag your take, or RT to poll the room

This morning I logged into @EdgenTech with X and threw EDGM a curveball prompt: if $ETH cracks $3200 on volume, where does the alt bid spill next. Hit enter, and 71 seconds later it drops a Pivot Alert fusing perp flows, onchain whale moves, and sentiment heat from the last 48 hours. Queued $ARB as the clean catch with entry bands at 1.12/1.28, sketched a quick Vega overlay on $IMX holding 1.45 as a guardrail, and Aura auto-stamped three fresh sources so I could screenshot and thread without the usual source hunt. No more juggling Dune tabs, Nansen scraps, and Twitter noise, just one feed that thinks three steps ahead. Stacked points toward the airdrop while I'm at it, Pro gate's still a single $AERO flip or $veAERO park away. Backed by that $11M raise from Animoca and OKX, 11.3M burned YTD keeping supply tight, TVL steady at ~$4.1M. Shifted a small position on the $ARB call and watched it print 8% by lunch. Who's still wiring signals manually when this cockpit routes the flow end-to-end? #EdgenTech #Crypto $ETH $ARB $IMX $AERO

gm alpha pack, edgen's theme beta just flipped the script on narrative hunting crunching cross-asset betas in real-time, flagging ai rotations at 1.2 while quantum dips sub-0.85, all before the tape lights up. pulled s&p fracture signals last week: top 10 stocks hoarding 40% weight, spilling into perps thin spots and alt jitters. multi-agents graded my hybrid bag a- on rwa slices, hedging de pin underweights for 8-12% pops vs flatline benchmarks. layer in the aura snapshot ticking to oct 30, 18:00 utc+8. top 3k lock elite badges + free expert subs for unlimited grinds. i've synced daily themes, overweight $pltr on 46% margins as rotation anchor, fading $ionq till q4 catalysts ranks climbing from 1843, no sweat. japanese rollout pulled fresh asia flows, community past 196k now. yap quality threads on shifts, tag @edgentech for 2x boosts, stack toward edgentic store beta nov 15. pro move: anchor $btc bias while eth etfs claw back from -30k bleed, pivot watches on exchange flips. first green week reclaims above $4k, or volume ghosts to $3.6k base. drop your first theme beta scan below who's threading the edge before badges drop? sync: t.co/ygmkCgfnHS #EdgenTech #InfoFi

Spent the weekend deep-diving into @EdgenTech's EDGM model on a fresh $ZEN setup, and it straight-up uncovered the L3 pivot I missed in the noise Horizen shifting from ghost L1 to Base's privacy engine with ZK-as-a-Service hooks that could snag institutional RWA flows. Layered in the Aura cockpit at 78% alignment, and the signals popped: validator growth syncing with Grayscale's HZEN trust at 5M dev incentives, while inflation risks flagged early at 78k monthly ZEN. No more sifting through fragmented threads; this fuses on-chain velocity with narrative re-ratings into one crisp feed that kept my position sized right through the 8.35 support test. Feels like the upgrade every mid-cap hunter needs for spotting those execution bets before the crowd. What's the wildest infrastructure pivot you've caught early with AI overlays lately? #Crypto #EdgenTech #ZEN

Fogo isn't just another L1 chasing TPS numbers it's engineering the invisible architecture that on-chain trading has been begging for. Imagine a world where execution jitter vanishes, data feeds sync perfectly with state updates, and every perp position clears with the precision of a centralized exchange, but fully decentralized. That's the thesis here: @fogo, paired with Pyron's microstructure mastery, is building latency symmetry at scale. Sub-40ms blocks via Firedancer SVM mean no more watching opportunities evaporate in propagation delays. Traditional traders, skeptical of chains that feel like laggy simulators, will finally cross over not for hype, but because the math checks out. In 12 months, this won't be optional; it'll redefine what "competitive" means in DeFi. Ecosystems that prioritize raw speed over structural integrity? They'll fade. Fogo's proving that true alpha lives in the details most builders overlook.

GM CT Quick thread-level take on two vectors shaping the Companion + Creator economy Kindred brings companions that remember, feel, and transact 25+ IPs, cross-device omnipresence and a commerce loop that converts emotional trust into real transactions. That attention -> utility -> $KIN flow makes engagement behave like economic activity, and their deflationary, transaction-backed tokenomics reduce noise from speculative issuance Everlyn runs on two axes: fast, ownership-first media tooling (images -> videos -> onchain provenance) and a layer that rewards creators and stakers with tangible access (faster APIs, priority compute, perks via $LYN). Staking here is laddered utility, not passive yield Where things get interesting: companions need content and creators need distribution. Imagine a Kindred Companion commissioning short-form scenes from Everlyn, then selling provenance-backed experiences onchain attention becomes collectible, and tradable Poll time: which unlocks more long-term value? 1) Emotional companions that monetize attention ($KIN) 2) Creator-owned media + provenance ($LYN) Also curious who should lead integrations? @brevis_zk for ZK verification or someone else? Reply with your pick, why, and one actionable collab you want to see between @Kindred_AI and @Everlyn_ai

Diving deeper into @BioProtocol's x402 hooks on Base after last week's Ignition workshop, and it's reshaping how I see DeSci scaling from hypothesis to hardware. Right now, with $50M unlocked across seasons and 125M $BIO staked in S2 pools, agents are already forking USDC to commission datasets or spin up validations no more siloed grant waits. But zoom out: by Q3 2026, this wires tokenized pipelines into a $1B+ ecosystem, where longevity serums like $DROPS iterate via community IP-NFTs and neuro shields like $GALE compound yields on hit rates. Labs become composable, stakers earn from every milestone, slashing timelines from years to quarters because science runs on data, not desks. DeSci isn't disrupting biotech it's the only path forward that actually ships. $BIO #DeSci

Most engaged tweets of Mphoza83.edge 🦭🥊

🚀 @MMTFinance x @buidlpad : Powering the Next Wave of Sui DeFi @MMTFinance stands as Sui’s flagship DEX, driving over $20B+ in swap volume, $560M+ TVL, and 2.2M users — backed by OKX Ventures, Coinbase, Circle, and Jump Crypto. It’s fast becoming the core liquidity engine for tokenized assets and RWAs on Sui’s high-speed infrastructure. At its core, $MMT utilizes CLMM technology for ultra-efficient liquidity concentration — cutting fees by up to 80% while empowering LPs to earn 4× rewards through ve(3,3) governance, where emissions are vote-directed for sustainable DeFi growth. Expect instant transactions, low slippage, and dynamic vaults built for optimized, risk-managed yields. Buidlpad is revolutionizing community-driven launches — no VC favoritism, full KYC transparency, and real fairplay. Past gems crushed it: + Solayer: +870% + Sahara AI: +172% + Lombard: +370% + Falcon: +2200% All listed on Binance at TGE. 🔥 The $MMT sale is now live on Buidlpad, targeting a $4.5M raise at $250M–$350M FDV (100% unlock at TGE). 👉 Stake $3K+ for Tier 1 access (snapshot Oct 25) 👉 Submit UGC squads by Oct 22 tagging @MMTFinance & @ for guaranteed $150+ allocs 👉 Complete Galxe quests + HODL campaigns to boost your Bricks multiplier 💡 Pro tip: Momentum’s evolution from DEX → full Financial OS (liquid staking, bridges, AI vaults) + Buidlpad’s flawless track record = massive asymmetric upside. Stack Bricks via swaps, LPs, referrals, and chatter on Kaito for potential airdrops. Sui’s DeFi momentum is real — heading toward a $1B+ ecosystem. DYOR, but this is the play to watch. ⚡

The old crypto grind was a war of attrition: twelve tabs open, Dune queries lagging, DefiLlama refreshes every 90 seconds, and X threads screaming FUD while you second-guess a $SOL entry after that memecoin frenzy. Gut trades on dominance flips, half the signal drowned in noise, the other half chasing yesterday's alpha. Enter @EdgenTech: one cockpit where EDGM fuses perps open interest (+$2.3B SOL longs last cycle), social tilt (62% bullish), and on-chain inflows (-87K ETH net out) in 73 seconds flat. Dropped a thesis on $BTC dom capping at 58%, it fired a Pivot Alert, queued $NEAR rotation, framed $ALLO bids at 0.54/0.85 with Vega resistance, and stamped sources via Aura for clean posting. No more tab tax Aura points stack free toward the airdrop just for logging in via X, Pro unlocks with one $AERO or $veAERO bribe. Backed by $11M from Animoca and OKX Ventures, 11.3M burned YTD, TVL holding ~$4.1M steady. This isn't just faster intel; it's the edge that turns effort into routed flow. What's the fair value of an AI stack that reads markets like Soros read pain, but without the backache? #EdgenTech #AI #Crypto $BTC $NEAR $ALLO $AERO

Dug into the $ETH-$SOL tug-of-war this morning, convinced SOL's on-chain frenzy was overcooked after that 15% pump on memecoin volume. Old me: 12 tabs juggling Dune dashboards, DefiLlama flows, and CT FUD threads, second-guessing every entry. Switched to @EdgenTech cockpit, connected via X in under a minute, dropped a quick thesis on the Aura Leaderboard about dominance flips signaling alt rotations. Prompted EDGM to fuse perps open interest (+$2.3B SOL longs), sentiment tilt (62% bullish on X), and exchange inflows (-87K ETH net out). 73 seconds later: Pivot Alert fires at SOL's 0.58 dominance cap, lines up a trim at $185 with Vega resistance at $192/205, rotates bid to undervalued $ARB layers if ETH holds $3.2K support. Aura stamps my sources clean, points stack free toward the airdrop Pro unlocked with one $veAERO for portfolio-native pings. Before: Gut trades bleeding alpha. After: Routed flow that caught the dip, banked 4.2% on the trim while farming. Backed by $11M with Animoca and OKX Ventures, 11.3M burned YTD, TVL steady at $4.1M. Legacy noise vs AI edge markets don't care about effort, just signal. Who's rebuilding their morning stack around this? #EdgenTech #AI #Crypto $ETH $SOL $ARB $AERO

Ditched the endless tab shuffle for a real test run on @EdgenTech yesterday logged in via X, hit EDGM with a prompt on $BTC dom testing 58, and in 68 seconds it fused on-chain inflows, perp funding flips, and sentiment heat maps into a clean Pivot Alert. Spotted the bid leaking into $NEAR around 4.2, drew Vega bands on $ALTO at 0.52/0.87, and Aura flagged verifiable sources so I could thread the call without second-guessing. Stacked points toward the airdrop on the side, all while Pro sits one $AERO flip away backed by that $11M raise from Animoca and OKX Ventures, with 11.3M burned YTD keeping supply tight and TVL steady at ~$4.1M. This isn't just aggregation; it's the first cockpit that anticipates the rotation instead of chasing it. No more stitching signals from noise @EdgenTech turns the scatter into coordinated edge. Who's still grinding ten feeds when one layer reads the flow ahead #EdgenTech #AI #Crypto $BTC $NEAR $ALTO $AERO

This morning I logged into @EdgenTech with X and threw EDGM a curveball prompt: if $ETH cracks $3200 on volume, where does the alt bid spill next. Hit enter, and 71 seconds later it drops a Pivot Alert fusing perp flows, onchain whale moves, and sentiment heat from the last 48 hours. Queued $ARB as the clean catch with entry bands at 1.12/1.28, sketched a quick Vega overlay on $IMX holding 1.45 as a guardrail, and Aura auto-stamped three fresh sources so I could screenshot and thread without the usual source hunt. No more juggling Dune tabs, Nansen scraps, and Twitter noise, just one feed that thinks three steps ahead. Stacked points toward the airdrop while I'm at it, Pro gate's still a single $AERO flip or $veAERO park away. Backed by that $11M raise from Animoca and OKX, 11.3M burned YTD keeping supply tight, TVL steady at ~$4.1M. Shifted a small position on the $ARB call and watched it print 8% by lunch. Who's still wiring signals manually when this cockpit routes the flow end-to-end? #EdgenTech #Crypto $ETH $ARB $IMX $AERO

Dug into @ValanniaGame over the weekend and stumbled on something raw: the way guilds aren't just teams, they're these living political machines that actually bend the world around them. Started solo, scraping resources in a green zone, then linked up with a small crew next thing I know, we're haggling tolls on a yellow border trade route, turning scrap iron into a steady gold flow that funds our first dragon tame with the Lerathi faction. That rush when your pathfinding tweaks during an arena skirmish outmaneuver a bigger stack? Pure skill read, no wallet meta. Picked up a Valannium Ring in the blind auction phase went for 4.2 SOL and it unlocked that secret Wonder Shop NPC, dropping hints on unclaimed lore spots. Now my on-chain profile's got that prestige title glowing, and with the 96-unit airdrop, I've got a basic army churning out +20% efficiency on farms. $VALAN launch feels like the real unlock, especially with those creator rewards funneled through @xeetdotai leaderboards stacked my Risen Hero for the 1.2x points boost, watching ranks climb steady. It's not grind for grind's sake; it's building momentum that sticks, where your rep carries weight across sessions. Most web3 games fade after the token pump what's one mechanic that actually hooked you long-term?

Most ZK projects promise the moon but deliver proofs that take hours and circuits that feel like quantum physics homework. Then there's @brevis_zk, quietly rewriting the script with its Pico zkVM verifying full Ethereum blocks in under 10 seconds on everyday hardware. No data centers required, just raw efficiency that slashes proving costs by half. What sets it apart isn't the speed alone. It's the trustless bridge to cross-chain data: dApps pulling historical states or receipts from anywhere, proving them onchain without exposing a byte. Developers swap endless math for a simple SDK that handles the heavy ZK lifting, letting them build scalable, private apps that actually ship to users. Mainnet's live, integrations like KaitoAI are stacking privacy on top of DeFi leaderboards, and staking's on deck to lock in the network's edge. $BREVIS isn't chasing hype it's the verifiable compute layer Web3's been starving for, turning ZK from a buzzword into the default for onchain everything. This is the infrastructure that sticks.

Dug into @BioProtocol's Season 2 after locking $BIO into Ignition for that veBIO drip, and the pattern snaps clear: DeSci's shedding the old grant purgatory for onchain flywheels that actually accelerate biology at data speed. $50M funded since Genesis, TVL cresting $150M with 125M $BIO in pools agents already forking USDC via x402 on Base to spin up wet labs for $GALE's galectin-3 Alzheimer's runs or $DROPS' purity-tuned longevity serums, all before IP-NFT auctions even warm up. No more decade delays or reputation gates; milestones unlock tranches through community votes, BioXP compounds into governance weight, and tokenized assets loop back as yields for holders who backed the hypothesis. Thesis: mid-2026 hits with $500M+ in onchain therapeutics, borderless collabs turning neuroinflammation shields and skin vaults into DAO treasuries that outpace VC silos. Stake early on @BioProtocol, bootstrap the next wave #DeSci $BIO

GM CT woke up thinking about how @Kindred_AI is quietly building an economic spine for agentic companions onchain memory that accumulates across sessions. living NFTs that level up. Dark Matter (DM) driving engagement and discovery. $KIN as the coordination primitive for staking, bonding curves, agent payments and buybacks what I like about this blueprint: - data network effect: every interaction increases future agent utility - agent liquidity: a marketplace where supply and demand consolidate value, not fragment it - cross-chain rails: agents that can travel between ecosystems capture compound reach - reputation + token alignment: reliable agents accumulate unforgeable trust and sticky flows what to watch on-chain: active agents, daily quests, DM sinks, $KIN velocity, staking TVL, and agent marketplace depth my prediction: within 12 18 months the product will reveal whether cultural IP + realtime UX becomes the main acquisition channel. if adoption centers around beloved characters, retention multiplies, and so does token value quick poll (reply): which will drive the breakout onchain memory, IP companions, or agent liquidity? explain why?

GM humans Took a deep dive into the hands-on side of web3 video: I’ve been generating reels, trailers, and test clips all week and @Everlyn_ai keeps surprising me Quick hits from my sessions: - 51,000 testnet points from video generation + subscriptions - 30+ videos created per refresh, credits move fast - Avg cost around 0.04 per video with quality that reads cinematic - Latency used to sting, but EfficientARV trimmed inference time noticeably Why this matters: Video drains compute and patience. Everlyn pairs a lean autoregressive pipeline with on-chain incentives so creators can own outputs, earn from agents, and trade contributions via $LYN Real product signals > hype: - daily UX improvements - token mechanics tied to utility - creators actually earning via prompts & datasets Prediction: if throughput keeps scaling and costs hold, Everlyn could capture massive creator spend in next 18 24 months Which use-case should they prioritize next ads, film prototyping, or in-game assets? Reply with your pick and why gEverlyn

Fogo isn't just another L1 chasing TPS numbers it's engineering the invisible architecture that on-chain trading has been begging for. Imagine a world where execution jitter vanishes, data feeds sync perfectly with state updates, and every perp position clears with the precision of a centralized exchange, but fully decentralized. That's the thesis here: @fogo, paired with Pyron's microstructure mastery, is building latency symmetry at scale. Sub-40ms blocks via Firedancer SVM mean no more watching opportunities evaporate in propagation delays. Traditional traders, skeptical of chains that feel like laggy simulators, will finally cross over not for hype, but because the math checks out. In 12 months, this won't be optional; it'll redefine what "competitive" means in DeFi. Ecosystems that prioritize raw speed over structural integrity? They'll fade. Fogo's proving that true alpha lives in the details most builders overlook.

Dug into @BioProtocol's BioAgents last night after that DeSciNews space tease hit my feed current date lines up perfect for today's 12PM EST drop with ValleyDAO and the crew. Prompted one to sift through a dusty gut microbiome dataset I'd half-forgotten from a side hustle, tying it to rare disease markers via Nebula streams. In under 40 minutes, it flagged two novel pathways for inflammation blockers, auto-commissioned a $50 USDC validation run through x402 hooks, and spun up a hypothesis marketplace listing for staker bids. The x402 + embedded wallets layer changes everything here: no more clunky subs or grant roulette, just seamless micropays where agents hire human specialists on the fly, remix live datasets, and loop in BioXP yields for $BIO holders pushing $150M TVL. Season 2's Ignition pools are stacking real alpha too USDC frontloads turning into BIO liquidity post-traction, with that 20% TGE vest keeping books clean for launches like $DROPS serum. This isn't hype; it's the quiet shift from siloed labs to onchain flywheels where DeSci compounds without the VC drag. Who's jumping into the space today to probe their own dormant data? #DeSci $BIO

GM spent the week digging into @EdgenTech after getting early access Quick take: real toolset for figuring out "why a market moves" instead of just screaming signals Funding: $11M Free tier = useful Expert = TA Report + 360° deep dives worth testing if you trade size How I use it: - Run the themes feed to spot macro catalysts (AI + IoT + edge compute popping) - Cross-check on‑chain flow + social mood before sizing a position - Use Aura quests to offset cost (daily roll calls add up) - Pull the TA report only for positions I want to hold through news Opportunities - Edge compute + IoT feed removes latency for real‑time infra plays - Useful for traders who want narrated context, not raw alerts Risks - Overfitting to AI signals - Chasing mood without core sizing rules Curious: grind Aura for months or buy Expert for fast alpha which are you choosing? Reply with your pick, tag your take, or RT to poll the room

Gm CT Today I spent my morning testing a full Everlyn loop and came away convinced: this is the utility play for AI-generated video in Web3 Here’s the breakdown from a user POV: >> Free tier to try ideas fast >> Ultra-fast video generation (minutes, not hours) >> Cheap subscription path to scale content >> Lyn Protocol + Everlyn-1 on Sui for verifiable provenance on-chain >> Reward mechanics you can actually stack 35 points for a single tweeted hyper-realistic clip (costs 2 credits, paste tweet link in User Center → My History) What I’m watching next: - TGE timing (my model says this window) - liquidity & token distribution details - partnerships that unlock creator demand Quick guide: make a short demo, share it, claim points, repeat that compounding rewards curve matters if you want early adopter edge Question for the fam: Which matters more to you for $LYN allocation A) On-chain provenance, B) Speed & UX, C) Rewards & tokenomics? Reply A/B/C and tell me why, let’s build conviction together Also keeping an eye on @AlloraNetwork for ecosystem plays who’s stacking with me

Most blockchains remember, they struggle to make history useful Enter the zk coprocessor layer that turns raw ledger noise into verifiable inputs developers can build on What @brevis_zk delivers: • Full historical state & events accessible without leaking wallets • Heavy compute off-chain, cheap on-chain verification • Privacy + verifiability: prove user activity without exposing everything • Composable proofs that travel across chains Real outcomes: - smarter DeFi reward curves that pay real contributors - private reputation that follows users across ecosystems - liquidity programs where slippage & behavior are auditable - social apps with provable engagement mechanics Proof points: live integrations (Linea, PancakeSwap, Kwenta), 80x faster ops and major backers in the seed round infra momentum you can measure Strategic thought: pair @brevis_zk with hardware accelerators like @cysic_xyz and you compress proof latency, drop billable costs, and unlock real-time ZK apps Which use-case excites you most? Reply with A) Rewards B) Identity C) Liquidity D) Social proofs let’s debate and build together?

gm builders, gm CT another day to stare at infrastructure and actually understand where the next wave of real onchain utility will come from ╭──────────────── \\\\ BREVIS \\\\ ZK \\\\ COPROCESSOR ╰──────────────── BECAUSE ➔ heavy compute moves off‑chain, verifiable proofs land onchain gas drops, complexity rises ➔ smart contracts can now read cross‑chain state & historical data with privacy guarantees ➔ dev UX: Pico zkVM + Rust means teams ship fast, audit slower in a good way ➔ ProverNet scales zk compute so projects stop compromising on logic because of cost ➔ wallet & infra partnerships (looking at you @MetaMask) accelerate real user flows What I’m watching next: 1) onchain proof verifications per day (growth metric) 2) first DeFi program that uses cross‑chain data engine for rewards 3) dev onboarding → tooling adoption rate Question for y’all which product will flip adoption first: verifiable rewards, cross‑chain or AI-friendly zk compute? Reply with your pick and why, or RT to start the convo gBrevis

People with Activist archetype

CEO Pershing Square, Co-trustee @PershingSqFdn

I want to get people into Crypto as safely as possible. Co-Host of Rock the Kaspa. Buy me a coffee if you like my stuff: kas.coffee/chris ☕️🙂

just a squirrel tryna get his nut. if you take me too serious that’s on you but for real, don’t. fulcrom.finance referral code- 2E2OPANM57

Writing it down so it doesn't feel like fiction later

Researcher | Content Creator | Yap on @KaitoAI | @cookiedotfun | Support : @cysic_xyz | @Infinit_Labs | @brevis_zk

Explore the Crypto world with me . Lets grow together.

坦然承受,韧性善争。

🔑 Alpha hunter | DeFi, L2s & narratives

On a quest to unite conservatives from a variety of backgrounds | Midwest | Standing against the tyranny of trends. Standing with the wisdom of tradition. 🇺🇲

@JennyTaylo95768 (此号已掉不要关注)Xdog社区负责人国际社区群:t.me/okbokbokx合约:0x0cc24c51bf89c00c5affbfcf5e856c25ecbdb48e

Christian/British Patriot/Conservatives/中国叛逃公职人员/YT:youtube.com/@woyongdehuawei Discord:discord.gg/GKP2WG7ABx 投稿邮箱:lundunbagong@gmail.com

Explore Related Archetypes

If you enjoy the activist profiles, you might also like these personality types: