Get live statistics and analysis of Emo OG (✧ᴗ✧)'s profile on X / Twitter

Crypto trader & Web3 wanderer Unpacking market moves, DeFi gems, & token insights (✧ᴗ✧) | Not financial advice

The Innovator

Emo OG is a Web3 trailblazer and crypto market explorer who thrives on dissecting complex DeFi projects and sharing cutting-edge token insights. With a high tweet volume and deep dive analyses, they foster a space where the future of decentralized finance is unpacked with enthusiasm and precision. Not one to offer financial advice, Emo OG instead sparks curiosity and empowers the community with actionable knowledge.

Top users who interacted with Emo OG (✧ᴗ✧) over the last 14 days

•Content Creator on @cookiedotfun •Researcher Airdrop| InfoFi Pioneer| Full time on Web3|🐉

Building trustless systems for a trustless world.

🌐 Crypto is more than money — it’s culture & future.

Blockchain Enthusiast | 🚀 Exploring the Decentralized Future | 💡 #Solana Advocate | NFT Collector | 🌐 Crypto Voyager | Passionate about Web3 |@switchboardxyz

Cutest dev in Web3. Deadliest in a DAO

🌍 Tracking macro + crypto intersections 📊 Interest rates, liquidity, Bitcoin cycles

Emo OG tweets so much, even their notifications need a break — at this point, your followers probably have the emoji ✧ᴗ✧ memorized just to keep up with the flood of crypto gems you drop! Slow down, or your timeline might need its own blockchain to handle the throughput.

Successfully cultivated a dynamic platform that bridges high-level DeFi innovations with vibrant community engagement, turning complex tokenomics and protocols into lively conversations and actionable insights.

To demystify the evolving landscape of crypto and DeFi by spotlighting innovative projects, driving informed discussions, and accelerating the adoption of transformative Web3 technologies.

Emo OG values transparency, evidence-based insights, and the power of active participation in crypto economies. They believe that knowledge is the ultimate asset in the decentralized world and that real influence comes from actions and skill rather than mere possession.

Exceptional ability to break down complex Web3 and DeFi innovations into engaging content that sparks community dialogue and educates followers on emerging trends and technologies.

Their fast-paced and densely packed content can sometimes overwhelm newcomers, potentially narrowing their audience to predominantly experienced crypto enthusiasts.

Leverage X threads to create bite-sized explainer series on trending DeFi projects to attract and retain newer audiences. Incorporate regular polls and AMAs to boost follower interaction and community growth.

Emo OG tweets over 11,000 times, making them a relentless source of fresh market intel and interactive discussions in the crypto space.

Top tweets of Emo OG (✧ᴗ✧)

gm builders, men’s sexual health getting a real roadmap @D1ckDAO highlights: • D1ckGPT BioAgent trained on 600+ clinician‑curated studies, routing to evidence and trials • D‑Age metric to quantify performance and aging; track intervention effects over time • Libio pilot (N≈20) + TRIAXIS compare oral vs gel/patch testosterone for safer delivery • IP → commercialization → revenue → $D1CK buybacks to reinforce the treasury New project pages live in the Bio app; GALE (Galectin‑3 inhibitors) added; Launchpad via @BioProtocol Poll: your allocation plan? A) D1ckGPT B) GALE C) wait for more data What would you add to D‑Age HRV, CGM, bloods? Quote with your framework

I thought “points” were the game, then I started using @xeetdotai and the model flipped. On Abstract, verified by them, value is earned by what you do, not what you hold I tested Lute’s action layer and watched social signal become filled orders in ~150ms. Valannia turned my skill and time into assets I can actually own. Gamblr priced my conviction, and DeSci mapped verified research from the $3T R&D world into tradable knowledge This feels like the active stack of #Web3 on #Abstract action, skill, conviction, knowledge. Passive is over. Who’s ready to earn?

only @River4fun season can save your attention stack : - link X, stake $RiverPts (zero entry) - mint $satUSD on Base/BSC, drop it in the general pool for 2x - add LP for satUSD/USDC or satUSD/USDT to hit 25x on Uniswap/Pancake - vault routes go up to 50x, ladder converts across 180 days - time your convert to catch the dynamic rate, late window reaches ~270x into $RIVER at TGE whales moved 38M pts, apr meta shifted outplay size with timing + impressions $20M-backed @RiverdotInc, TVL tracking toward $300M, partner drops refilling demand write, stake, wait, convert t.co/UD5qJIwUqO #DeFi

RT : practical alpha disguised as a to-do list solid flow from @spaace_io → @wallchain → @kloutgg + @reya_xyz InfoFi synergy the common thread? early composability and real user signals not just points farming when $SPAACE gas rebate meets Polygon-backed TVS the volume narrative gets tangible next phase? cross-chain triggers + staking cadence optimization watch the catalysts converge before the snapshot hits this is the layer where conviction compounds

PLAYBOOK FOR THE @DeSciNews run on @xeetdotai - post every other day with real DeSci notes, not filler - reply to strong threads, add one take that helps - track the board daily, aim top 50 first, then press for top 25 - focus on open data, funding models, labs moving on-chain - thank supporters, engage back, xeet points stack faster when the convo is real Signal over noise, consistency wins I’m locked in for #DeSci and #DeSciNews knowledge on-chain or nothing Grinding too on @DeSciNews? What’s one tip that moved you up?

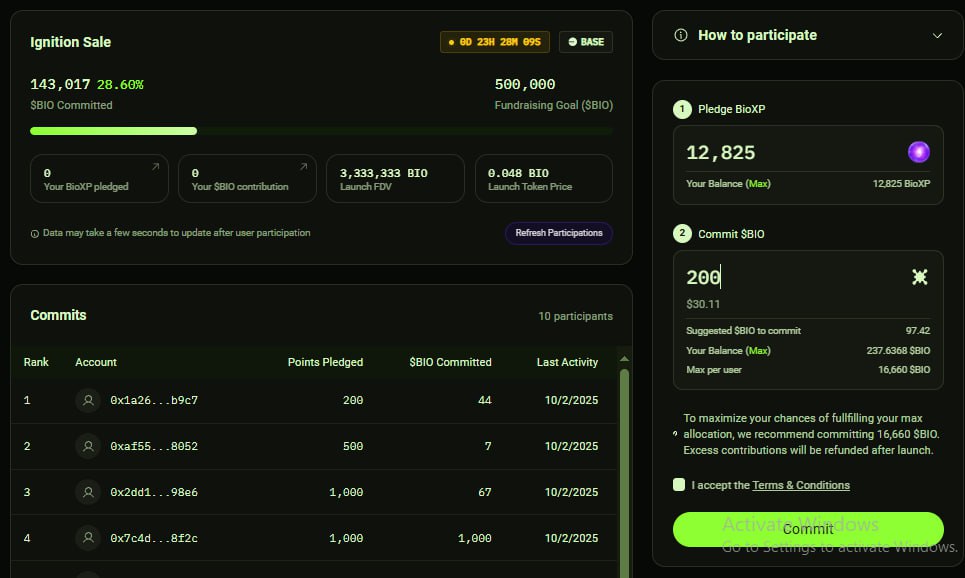

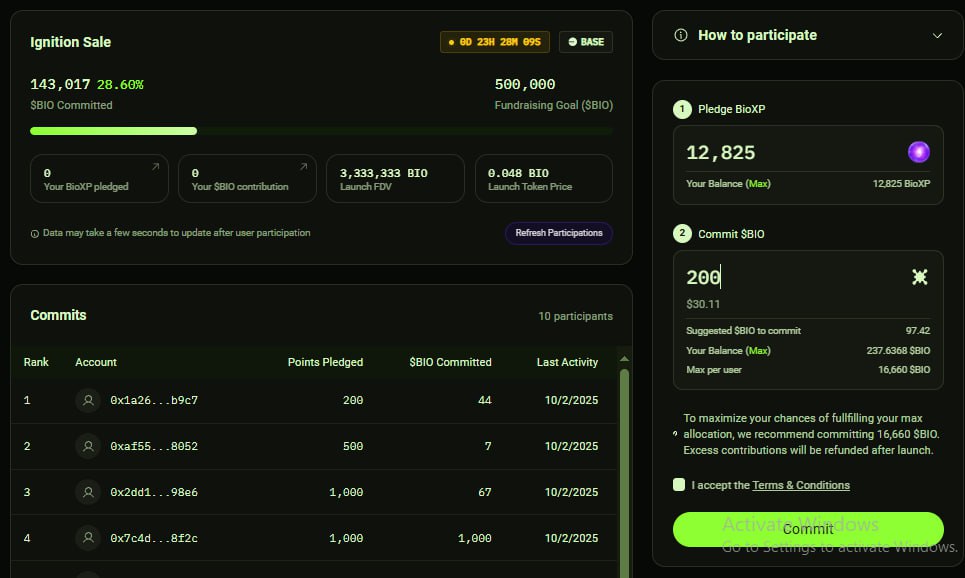

i’m mapping @BioProtocol this week ️ stake $BIO → veBIO weight + BioXP drip; unused xp decays in 14 days so keep it fresh ️ veBIO on Base + eth with a 21d cooldown to keep alignment ️ ignition sales let cohorts form and idle $BIO gets refunded if routes break ️ tokenized IP with on-chain custody, pushing data → discovery ️ a consumer agent like @D1ckGPT taps 600+ studies to track D‑Age and optimize men’s health i locked and i’m routing xp toward hard endpoints which lane should we push now? A) @D1ckGPT B) VitaStem C) NEURONGale

A RIVER WHERE VOTES MINE? I’m here to tell it Follow closely ; There was once a creator who yelled into the void while whales dictated the charts. Engagement scattered, rewards thin Then they found @River4fun by @RiverdotInc a contribution layer where X posts and on-chain votes turn into $RiverPts. Voting equals mining. Tag, vote, stack Stake points for 49%+ APR, wait before converting and you’ll pull more $RIVER. Zero barriers. Redeem anytime. Built on BNB Chain with cross-chain liquidity for heavier yield My ledger today: dip of -500 yesterday, +860 today. 14,000 $RiverPts banked, ~25 $RIVER. Season 3 fires: Top 30 split 3M pts, 1.7B interactions Guide: Link X, stake, vote for creators, let time compound. Creators lead, fans earn. Flow. Earn. Repeat #RiverPts

limitless sale on @KaitoAI was a strong signal > 200x oversub with $46M USDC committed > ~11M $KAITO staked + 576 yapy > KAIO x Kaito ranks quality, not volume my playbook for @KAIO_xyz: > break down the gateway, roadmap, integrations > ship threads, research, memes that teach > track your rank and iterate daily > anchor to real value: KAIO raised $11M to bridge TradFi DeFi and bring real assets onchain goal: compounding distribution before price, mindshare before market what did I miss? who’s grinding this leaderboard with me

watching @BioProtocol tighten signals while @D1ckDAO lines up science you can measure core pieces to track: • D1ckGPT (BioAgent) trained on 600+ clinician‑curated studies, cohort guidance tied to real endpoints • D‑Age metric to benchmark progress over time • Libio pilot (N≈20) for multi‑target ED intervention • TRIAXIS comparing safer testosterone delivery modes • revenue loops earmarked for $D1CK buybacks my move: • stake $BIO → veBIO → farm BioXP before the 14‑day decay • watch adherence >70% and early assay readouts Poll: allocate now? A) D1ckGPT B) TRIAXIS C) longer veBIO locks what metric moves your conviction: D‑Age, pilot data, or veBIO growth

Wallchain’s GTM has been good > incentive design: quacks + leaderboards + epochs drive sticky engagement and reward real value > pipeline: @idOS_network, @kloutgg, @trylimitless, @solsticefi are live to farm pre-TGE momentum on @wallchain_xyz > repeatable loop: reply guy meta → drop insights → gQuack accrual → climb LB > token alignment: $IDOS + $KLOUT tie usage to rewards for creators + identity nodes > clarity on rewards: epoch splits, post-TGE windows, transparent expectations what’s your bets on the TGE window and airdrop allocation, and how are you optimizing the grind

gm timeline about to get flooded with attention markets brodies @kloutgg linking up with @wallchain_xyz to wire quack kinetics into the LB 1% supply for top 300 quackers, 40 day sprint solana rails, 10/10 mint on magiceden, meteora pipes daily playbook: $500 vol swap on elsa bridge to base tap avantis stack quacks via @HeyElsaAI small accounts can climb, just keep yapping and farming signal @Alignerz_ IWO for weighted entries, less dump risk, more discipline own hashtags bet on attention trade trends the internet finally has an order book

reading this makes me think we’ve been staring at chatbots while the rails were being laid under our feet @AlloraNetwork feels more like infra than hype self-learning loops + staking economics + repute penalties… that’s the kind of stuff that survives cycles if governance and cross-chain proof land right… you get actual capital flow not powerpoint decks DeAI mainnet szn might be stupid fun

Diving deeper into @EdgenTech's multi-agent setup it's flipping the script on AI trading tools that spit out blind calls. Picture this: you query a token or stock, and specialized agents break it down fundamentals agent crunches earnings and on-chain flows, technicals agent maps charts and volatility spikes, sentiment agent scans social noise for whale whispers. No black box; you see the full reasoning chain, building conviction layer by layer. Early tests show it nailing BTC's $104k floor amid ETF sinks and hash rate ATHs, projecting 75% upside to $180k by H1 2026 if macro unlocks like Jito's $50M play. Aura rewards amp the grind: tweet for points, climb leaderboards for elite badges, stack multipliers up to 330x on ETH/SOL checks. Oct 31 snapshot incoming position now before volatility compresses. For traders chasing precision over hype, this unifies stocks and crypto intel like a hedge fund dashboard for retail. $EDGEN energy feels primed for TGE momentum, especially with staking pools at 12M+ and post-listing fades turning bullish. Who's stacking Aura first? t.co/DibSTHoh9J

Most engaged tweets of Emo OG (✧ᴗ✧)

only @River4fun season can save your attention stack : - link X, stake $RiverPts (zero entry) - mint $satUSD on Base/BSC, drop it in the general pool for 2x - add LP for satUSD/USDC or satUSD/USDT to hit 25x on Uniswap/Pancake - vault routes go up to 50x, ladder converts across 180 days - time your convert to catch the dynamic rate, late window reaches ~270x into $RIVER at TGE whales moved 38M pts, apr meta shifted outplay size with timing + impressions $20M-backed @RiverdotInc, TVL tracking toward $300M, partner drops refilling demand write, stake, wait, convert t.co/UD5qJIwUqO #DeFi

gm builders, men’s sexual health getting a real roadmap @D1ckDAO highlights: • D1ckGPT BioAgent trained on 600+ clinician‑curated studies, routing to evidence and trials • D‑Age metric to quantify performance and aging; track intervention effects over time • Libio pilot (N≈20) + TRIAXIS compare oral vs gel/patch testosterone for safer delivery • IP → commercialization → revenue → $D1CK buybacks to reinforce the treasury New project pages live in the Bio app; GALE (Galectin‑3 inhibitors) added; Launchpad via @BioProtocol Poll: your allocation plan? A) D1ckGPT B) GALE C) wait for more data What would you add to D‑Age HRV, CGM, bloods? Quote with your framework

I thought “points” were the game, then I started using @xeetdotai and the model flipped. On Abstract, verified by them, value is earned by what you do, not what you hold I tested Lute’s action layer and watched social signal become filled orders in ~150ms. Valannia turned my skill and time into assets I can actually own. Gamblr priced my conviction, and DeSci mapped verified research from the $3T R&D world into tradable knowledge This feels like the active stack of #Web3 on #Abstract action, skill, conviction, knowledge. Passive is over. Who’s ready to earn?

RT : practical alpha disguised as a to-do list solid flow from @spaace_io → @wallchain → @kloutgg + @reya_xyz InfoFi synergy the common thread? early composability and real user signals not just points farming when $SPAACE gas rebate meets Polygon-backed TVS the volume narrative gets tangible next phase? cross-chain triggers + staking cadence optimization watch the catalysts converge before the snapshot hits this is the layer where conviction compounds

limitless sale on @KaitoAI was a strong signal > 200x oversub with $46M USDC committed > ~11M $KAITO staked + 576 yapy > KAIO x Kaito ranks quality, not volume my playbook for @KAIO_xyz: > break down the gateway, roadmap, integrations > ship threads, research, memes that teach > track your rank and iterate daily > anchor to real value: KAIO raised $11M to bridge TradFi DeFi and bring real assets onchain goal: compounding distribution before price, mindshare before market what did I miss? who’s grinding this leaderboard with me

gm timeline about to get flooded with attention markets brodies @kloutgg linking up with @wallchain_xyz to wire quack kinetics into the LB 1% supply for top 300 quackers, 40 day sprint solana rails, 10/10 mint on magiceden, meteora pipes daily playbook: $500 vol swap on elsa bridge to base tap avantis stack quacks via @HeyElsaAI small accounts can climb, just keep yapping and farming signal @Alignerz_ IWO for weighted entries, less dump risk, more discipline own hashtags bet on attention trade trends the internet finally has an order book

i’m mapping @BioProtocol this week ️ stake $BIO → veBIO weight + BioXP drip; unused xp decays in 14 days so keep it fresh ️ veBIO on Base + eth with a 21d cooldown to keep alignment ️ ignition sales let cohorts form and idle $BIO gets refunded if routes break ️ tokenized IP with on-chain custody, pushing data → discovery ️ a consumer agent like @D1ckGPT taps 600+ studies to track D‑Age and optimize men’s health i locked and i’m routing xp toward hard endpoints which lane should we push now? A) @D1ckGPT B) VitaStem C) NEURONGale

A RIVER WHERE VOTES MINE? I’m here to tell it Follow closely ; There was once a creator who yelled into the void while whales dictated the charts. Engagement scattered, rewards thin Then they found @River4fun by @RiverdotInc a contribution layer where X posts and on-chain votes turn into $RiverPts. Voting equals mining. Tag, vote, stack Stake points for 49%+ APR, wait before converting and you’ll pull more $RIVER. Zero barriers. Redeem anytime. Built on BNB Chain with cross-chain liquidity for heavier yield My ledger today: dip of -500 yesterday, +860 today. 14,000 $RiverPts banked, ~25 $RIVER. Season 3 fires: Top 30 split 3M pts, 1.7B interactions Guide: Link X, stake, vote for creators, let time compound. Creators lead, fans earn. Flow. Earn. Repeat #RiverPts

reading this makes me think we’ve been staring at chatbots while the rails were being laid under our feet @AlloraNetwork feels more like infra than hype self-learning loops + staking economics + repute penalties… that’s the kind of stuff that survives cycles if governance and cross-chain proof land right… you get actual capital flow not powerpoint decks DeAI mainnet szn might be stupid fun

We have people still doing CT archaeology for scraps Meanwhile @EdgenTech out here cooking a messy $XPL + RoboSense/$NVDA stew into lidar share %, rollout windows, choke points, fundraise intel, margin trends This is not “wait for the report” season This is click filter act mode Pipe $TSLA next, let’s see who survives

People with Innovator archetype

Making a programming language - BAML. @boundaryml, 🦄 aitw podcast: youtube.com/@boundaryml prev YC, google, msft, deshaw, and other things

𝖡𝗎𝗂𝗅𝖽𝗂𝗇𝗀 𝗍𝗁𝖾 𝖿𝗎𝗍𝗎𝗋𝖾, 𝗈𝗇𝖾 𝖻𝗅𝗈𝖼𝗄 𝖺𝗍 𝖺 𝗍𝗂𝗆𝖾 | 𝖯𝖺𝗌𝗌𝗂𝗈𝗇𝖺𝗍𝖾 𝖺𝖻𝗈𝗎𝗍 𝖼𝗋𝗒𝗉𝗍𝗈 𝖺𝗇𝖽 𝖼𝗈𝗆𝗆𝗎𝗇𝗂𝗍𝗒.

🚧 building bibigpt.co chatvid.ai chatimg.ai pipigpt.co 🐣learning/earning while helping others ❤️making software, storytelling videos 🔙alibaba @thoughtworks

we have to decide is what to do with the time that is given us

▪︎ Web3 Explorer | DeFi Mind | iTrade ▪︎

🧠✨Building AI tools AI System Prompt 🐳 | Make WinMaxle Keyboard Not a designer, not a programmer, Love Design & Coding & Prompt! 💼📮:Andyhuo@me.com

Creative engineer helping creators & founders design with clarity, smoothness & control as they build, grow & evolve.

Wrote code for listed companies, now writing bedtime stories. Christian · Father · Programmer Rebooting life, refactoring myself.

🎣 Be cool, stay cool, don't get lost. If you are lost, stay cool.

Web3 flow🦠 Manchester🔴

🚬 quisten.app - quit smoking 👨🏻🍳 building souschef.bio - plan your diet and track your macros 🚗 going everywhere a car can go

Building my dreams, one tweet at a time

Explore Related Archetypes

If you enjoy the innovator profiles, you might also like these personality types: