Get live statistics and analysis of Jobo's profile on X / Twitter

The architect of engaging Web3 content. Let's build the future together Empowered by @KaitoAI

The Analyst

Jobo is a relentless explorer of the Web3 universe, dissecting complex crypto and blockchain trends into digestible insights. Their tweets blend on-chain data, AI innovation, and DeFi mechanics to empower followers who want to navigate the future of decentralized finance confidently. Always digging deeper, Jobo curates high-signal content that educates, informs, and excites the Web3 community.

Top users who interacted with Jobo over the last 14 days

Jobo’s tweets are so packed with industry acronyms and on-chain stats, even their coffee needs a whitepaper to understand the caffeine boost. If clarity was a blockchain, your messages would be stuck in a three-day confirmation delay!

Successfully positioned early staking strategies for emerging protocols like @ownaiNetwork and @RaylsLabs, helping their community stack yield opportunities while navigating compliance and liquidity with expert timing.

To illuminate the intricate workings of the Web3 ecosystem, empowering builders and investors alike to make data-driven decisions that shape and build the decentralized future together.

Jobo believes that data transparency, verifiable insights, and community-driven innovation are the cornerstones of Web3. They hold that blockchain and AI combined will unlock new economic primitives that reward genuine participation and fuel real-world value creation.

Exceptional ability to analyze and translate complex technical data and crypto trends into clear, actionable content; deep engagement with projects that marry AI and blockchain, making them a trusted voice for high-quality, research-driven Web3 info.

Tendency to overwhelm casual followers with dense, jargon-heavy commentary that may limit broader appeal beyond highly specialized crypto enthusiasts; slower to simplify concepts for mainstream accessibility.

To grow their audience on X, Jobo should experiment with bite-sized explainer threads and engaging visuals that demystify Web3 jargon. Collaborating with influencers from complementary archetypes, like The Connector or The Influencer, could bridge their deep analysis to wider audiences hungry for actionable crypto insights.

Jobo has tweeted an impressive 18,727 times, showing their dedication to sharing knowledge; they actively engage with complex on-chain movements and cryptoeconomic mechanisms, highlighting early staking opportunities with precision.

Top tweets of Jobo

➥ Two rails for real cashflow + compliant liquidity: @ownaiNetwork and @RaylsLabs @ownaiNetwork: co‑owned robot fleets logging miles onchain, 8 15% yield with insurance; DAO snapshot Nov 15 earmarks 5% $OAN to active contributors #RWA #DePIN @RaylsLabs: UniFi rails for banks, privacy/compliance baked in; $700K rewards live, Phase 1 ends Nov 15, $COOKIE staking boosts $RLS How I’m positioning: ▸ stake early, post high‑signal, track on‑chain flow and leaderboards → let machines and institutions feed your stack #Web3

Data's been static too long stuck as baggage in txns, not fuel for the fire @irys_xyz flips that script with IrysVM: EVM-compatible compute on the move, dual storage for perm/ephemeral vibes, streaming state like Web2 speed but Web3 ironclad PoW + staking consensus? Miners pledge real skin, rewards tie to throughput sans hash wars fair game, predictable grind From Bundlr uploads to living chains: AI memory that remembers, DeFi that automates wild, NFTs that evolve on the fly One stack, endless motion. Builders, your launch lane's lit stay Hirys @irys_xyz

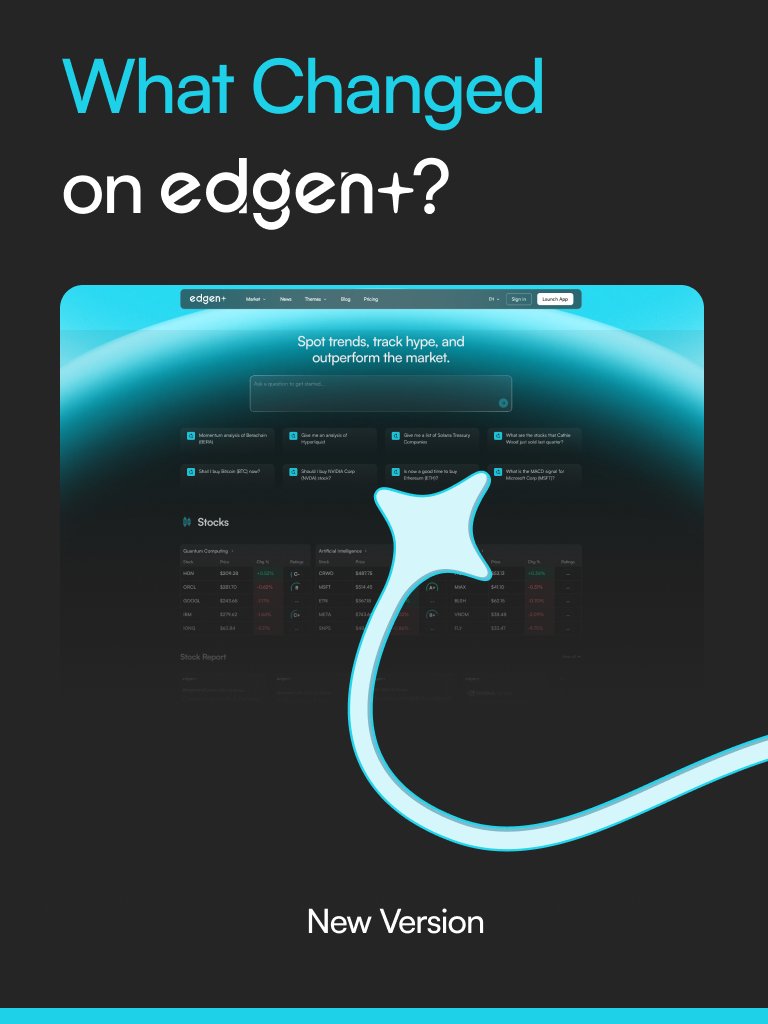

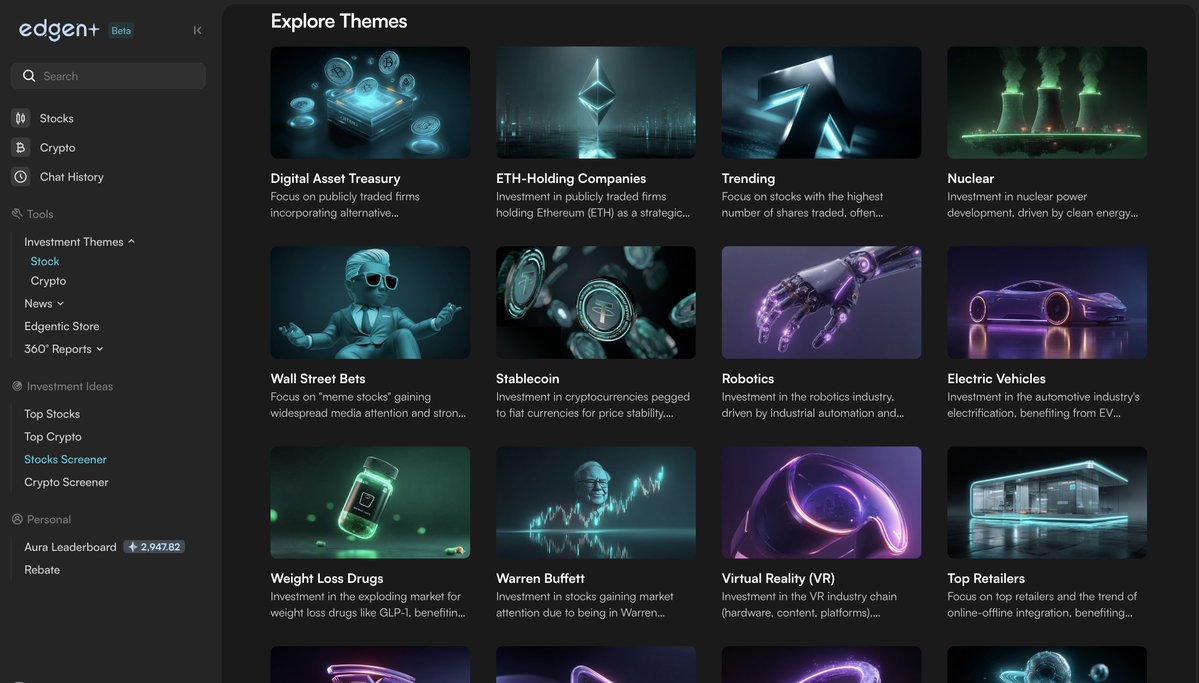

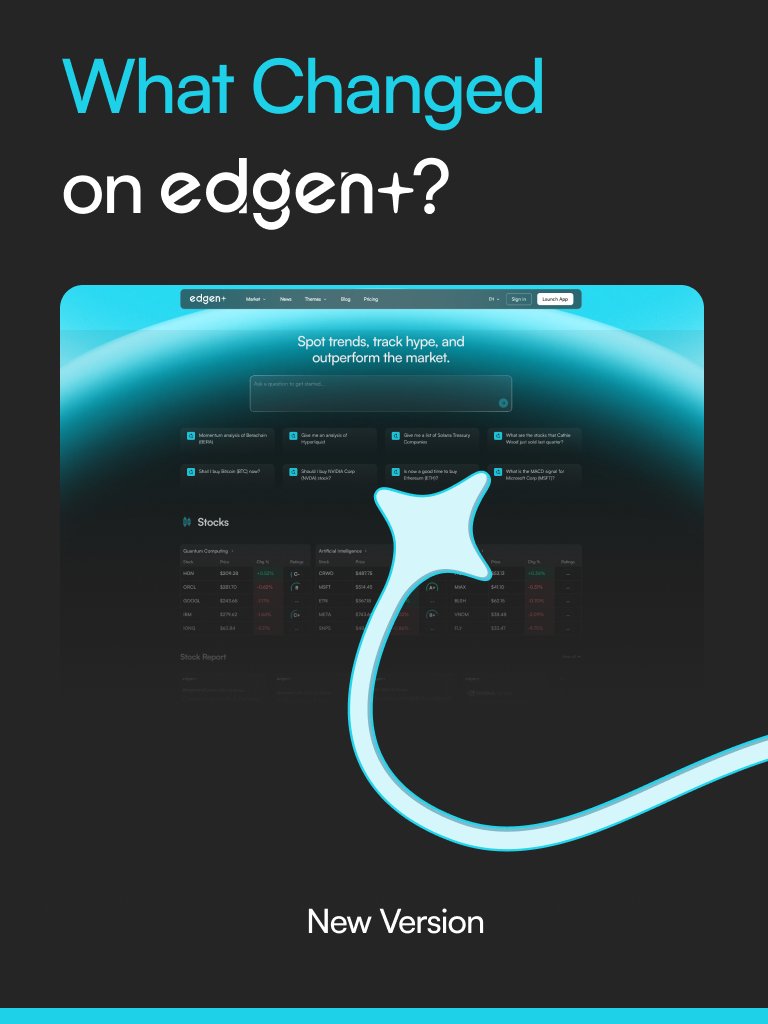

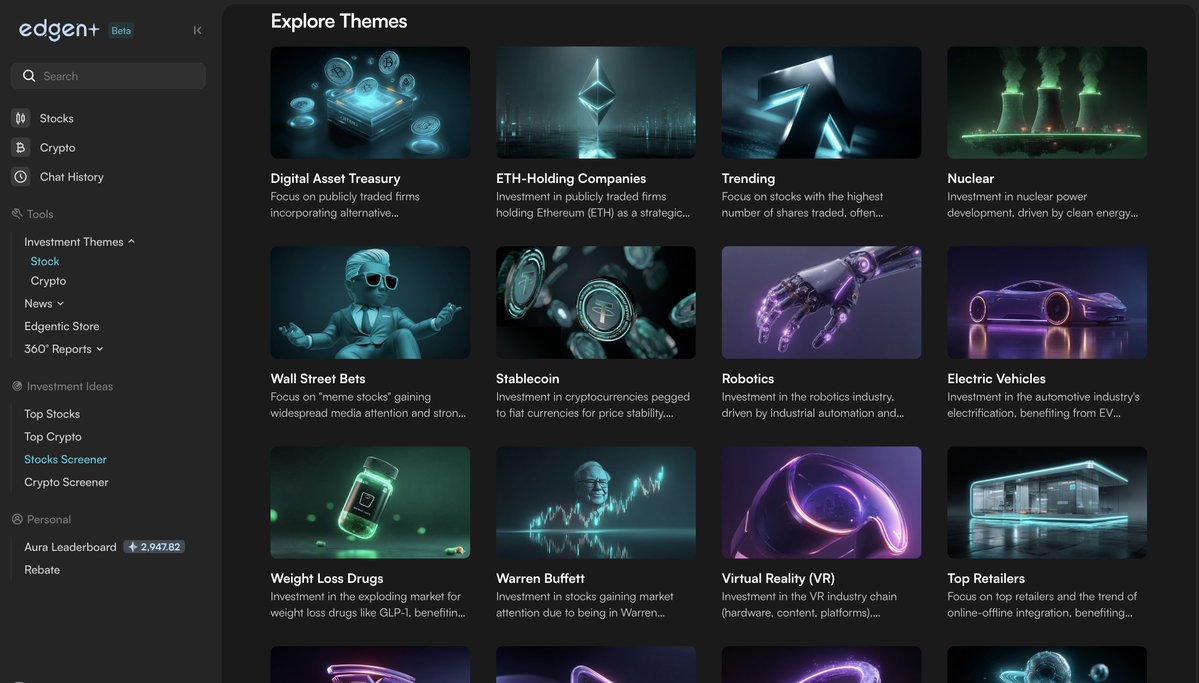

➥ Dug into @EdgenTech's crypto themes dashboard over morning scroll Tokens pouring in hourly, but it cuts the clutter slicing dex drops, mechanics, even rwA under ai skins Probed why $Aave clings post-dip: rsi scraping 40s, macd bars ticking green, pools bloating to $15b on eth/optimism Mindshare tracker nails aave at 70% lending grip, sentiment pings whales easing into gho stables Ditch coingecko haze; this ai unravels macro knots stocks sliding, l2 bridges firing, options skews whispering vol bursts Swarm agents knit it seamless, live nudges on bridge currents and pre-tge arbs that ghost past Grinding edges? Aura stacks 45% while unearthing cysic's computefi twist $EDGEN rerate brews as mindshare swells, brevis zk tipping the scale Flow in, tune your hunt or sidelined rerates mock the scrollers

Today’s loop I actually ran: - @bitdealernet grind XP, pledge via Kaito (7‑day refund), watching $BIT as the cap fills, staked to line up game token allocations - @ownaiNetwork spun a small agent in ~45 min, set on‑chain splits, and parked $OWN for a steady 5 15% while it works Memes with real game revenue meets ownable AI cashflows. One build, dual yield. Who else running this stack #DeAI #GameFi #DePIN?

provable outputs + priced contributors aren’t slogans they’re economic primitives for #DeAI itself @AiraaAgent turns aura into real coefficient weight @zk_agi brings zk verifiability so private agents can *earn* truth infofi bridging compute and cred when proof prices participation right, the network starts breathing value

The smartest swaps just leveled up. @MindoAI × @CryptoRubic Gasless. Cross-chain. AI-powered. This isn't just about cutting-edge tech. It’s about execution at scale where your attention is rewarded, not wasted. Eyes on this. This is the future. Intelligence flows through every swap, whether you see it or not. #AI #Crypto

EdgenTech’s approach to market intelligence is revolutionizing the game.️ Gone are the days of sifting through endless charts and tools. AI-driven insights? Check. Real-time data? Always. Seamless connections across stocks + crypto? You bet. This isn’t about luck, it’s about precision. Don’t just trade. Trade smart, trade with an edge. How are you leveraging @EdgenTech to stay ahead? #AI #MarketIntelligence

➥ Alpha alert: @EdgenTech's Agentic Execution lands soon, flipping crypto research from grind to glide ▸ AI agents handle intents like pros swap, stake, snipe without the tab-juggling circus ▸ Built-in strategies for DeFi plays, turning whale watches into auto-trades ▸ Portfolio dashboard already crushes it, bundling $ETH $BNB $BTC vibes in one clean view Dug into their 360 reports last night Fusaka fork intel had me rethinking L2 costs, TVL spiking to $8.69B while BlackRock stacks ETH like candy This setup? Your edge against the noise. Custom agents via Edgen Store mean sniper bots for liquidity hunts, pre-TGE radars for hidden gems Momentum scouts grading bags sharper, consolidation at $110k? Buy signal screams louder now Lock in early, legends alpha composes itself when you let agents lead the charge

➥ RWA flywheels hitting warp speed when gaming rev meets AI grind @bitdealernet's $BIT buybacks from casino spins (Stake, Roobet locking millions monthly) layer seamless with @ownaiNetwork's tokenized humanoids yielding 8-15% APY on factory output Unitree H2 fleets, drone logistics all on-chain governed. No more isolated hype: Community votes onboard meme drops backed by real plays (4M+ YTD), while AI assets spin verifiable cuts from ESG miles, composable via zk rails for $10M TVL sims by Q1 '26. Early yappers stack XP across both $BIT raffle closes Nov 1, OWN points convert 1:1 post-TGE turning mindshare into dual revenue: deflationary memes + automation stakes. This stack echoes '20 DeFi alpha but with machines that execute, bridging Solana speed to TradFi pools. Who's farming yap leaderboards first, positioning for humanoid expansions and casino burns? #RWA #AIAssets

➥ Sui's liquidity just hit warp speed with @MMTFinance stacking $560M TVL and $22B volume in months ▸ ve(3,3) DEX locks fees into lockers, emissions chase real votes no rug vibes, just compounding flow ▸ xSUI staking routes yields seamless, vaults auto-optimize cross-chain without the grind ▸ One protocol snagging 43% of chain DEX action? That's not noise, that's rails for tokenized everything Proof in the pudding: 2M users, millions of swaps, backed by Coinbase + Jump now the @buidlpad drop flips it to community hands Tier 1 at $250M FDV for OGs holding LP deep, snapshot Oct 25 grind SUI-USDC pairs now for that anti-sybil edge Public tier opens wider at $350M, full unlock Oct 31 deposit SUI or BNB, no vesting drag Thesis sharp: As Sui scales to $726M daily vol, MMT captures the flywheel, turning trades into owned growth Quality creators? 30% pool for deep dives tag 'em, add ️️T, lock $150 min If DeFi's about fair rails over VC pumps, this is the blueprint. Position before the league airdrop closes Oct 24 #Sui #DeFi $MMT | GM alpha hunters

➥ Attention meets automation: that's the alpha combo I'm seeing between @wallchain_xyz and @ownaiNetwork right now ▸ Wallchain's Quacks system rewards real crypto yapping with points that stack into $WALLCHAIN yields, turning threads into tangible mindshare multipliers ▸ OWNAI layers on top by letting those earnings fuel fractional owns of robotaxis or humanoids, pulling 5-15% APY from on-chain robot revenues like Unitree G1 pilots Together, they flip influence into asset-backed income: yap quality content on Wallchain, climb leaderboards for Quacks, stake into OWNAI pools for passive automation gains. No more siloed plays social labor directly owns the AI grind. I've been farming Quacks daily (up 200 this week), eyeing OWNAI's testnet for that first robot share. Early epochs close soon; positions like this compound fast in the RWA wave. #AttentionFi #RWAs

➥ Two RWA rails heading into Q4 catalysts @bitdealernet is wiring 1,700+ iGaming rakes into $BIT buybacks under Meteora/Jupiter depth, TGE November + Abyss of Glory Nov 12 = liquidity + deflation @ownaiNetwork is pushing co‑owned AI fleets with 8 15% yield, DAO votes live, mainnet + $OAN snapshot Nov 15 ✧ Thesis: cashflow‑backed memes + robot revenue = durable onchain yield ✧ Watch: leaderboard grind, staking windows, governance snapshots #RWA #DePIN #Web3

Hot take: liquidity is rotating to cashflow memes + machine yield @bitdealernet turns licensed iGaming rake into deflationary memes on Solana day‑one Jupiter/Meteora depth, $BIT TGE in November with 1% Kaito unlocked, Abyss of Glory Nov 12 @ownaiNetwork routes robot miles + uptime on‑chain to 8 15% staker yield; insurance live, staking v2 Nov 4, lock before Nov 5; Nov 15 snapshot earmarks 5% $OAN to active yappers Playbook → farm Kaito, stake, track buybacks/telemetry #RWA #DePIN #Web3

➥ Cashflow rails I’m stacking this week for yield + compliant depth ▸ @ownaiNetwork routes robot miles + uptime onchain with telemetry + insurance → 8‑15% machine yield; Staking v2 Nov 4, lock Nov 5; Nov 15 snapshot earmarks 5% $OAN for active creators. 10K nodes live stake, post proofs, farm yaps ▸ @RaylsLabs builds UniFi rails for banks: private subnets + a public EVM L2, Uniswap v4 privacy hooks; Cookie3 rewards at $700K pre‑TGE, $RLS queued Cashflow > clout #RWA #DePIN #Web3 $OAN $RLS

➥ Attention meets institutional rails I've been deep in the trenches of creator rewards lately, and the overlap between @wallchain_xyz's Quacks system and @RaylsLabs' UniFi push is straight fire for anyone building in RWA space. Wallchain turns X yapping into verifiable mindshare 0.4% of $WALLCHAIN supply dropped in Epoch 1 alone, rewarding 300+ for quality threads on cross-chain alpha. Now layer Rayls: their Núclea Chain just went live in Brazil, tokenizing bank assets with ZK privacy that hits $100T potential without the compliance headaches. Alpha play? Quack about Rayls' Enygma protocol on Wallchain earn points for breakdowns on quantum-safe settlements, climb leaderboards, and stack $RLS airdrops from their loyalty quests. It's the flywheel: authentic influence fuels institutional adoption, turning hype into on-chain liquidity. Builders, if you're not bridging attention to TradFi rails yet, Epoch 2 snapshots soon stack both for the convergence wave. #AttentionFi #RWA

Diving deeper into this AI infra stack it's not just hype, it's the quiet revolution where yappers like us turn scrolls into stakes @ownaiNetwork's fractionalized drones hit different: co-own Unitree H2 logistics beasts dropping Oct 21, stake $OAN at 12% APY while ORB boosts multiply your slice of the automation pie Then @multiplifi layers on delta-neutral vaults wrapping tokenized humanoids no IL, AlphaIQ auto-compounding to 5-10% yields on that $74M TVL beast, custom RWA blends unlocking Q1 for creator vaults that actually pay out And @wallchain_xyz? Quacks your authentic X discourse into points, top 1K earners eyeing LMTS airdrops amid 3K+ beta users farming mindshare LBs rewarding signal over spam, finally From yap to yield to ownership, this triad's farming the $1T RWA flywheel like pros, turning automation alpha into real creator capital Early locks already compounding 7% overnight on humanoid shares who's jumping in before the vaults evolve? #AttentionFi #RWA

Most engaged tweets of Jobo

➥ Two rails for real cashflow + compliant liquidity: @ownaiNetwork and @RaylsLabs @ownaiNetwork: co‑owned robot fleets logging miles onchain, 8 15% yield with insurance; DAO snapshot Nov 15 earmarks 5% $OAN to active contributors #RWA #DePIN @RaylsLabs: UniFi rails for banks, privacy/compliance baked in; $700K rewards live, Phase 1 ends Nov 15, $COOKIE staking boosts $RLS How I’m positioning: ▸ stake early, post high‑signal, track on‑chain flow and leaderboards → let machines and institutions feed your stack #Web3

Data's been static too long stuck as baggage in txns, not fuel for the fire @irys_xyz flips that script with IrysVM: EVM-compatible compute on the move, dual storage for perm/ephemeral vibes, streaming state like Web2 speed but Web3 ironclad PoW + staking consensus? Miners pledge real skin, rewards tie to throughput sans hash wars fair game, predictable grind From Bundlr uploads to living chains: AI memory that remembers, DeFi that automates wild, NFTs that evolve on the fly One stack, endless motion. Builders, your launch lane's lit stay Hirys @irys_xyz

➥ Dug into @EdgenTech's crypto themes dashboard over morning scroll Tokens pouring in hourly, but it cuts the clutter slicing dex drops, mechanics, even rwA under ai skins Probed why $Aave clings post-dip: rsi scraping 40s, macd bars ticking green, pools bloating to $15b on eth/optimism Mindshare tracker nails aave at 70% lending grip, sentiment pings whales easing into gho stables Ditch coingecko haze; this ai unravels macro knots stocks sliding, l2 bridges firing, options skews whispering vol bursts Swarm agents knit it seamless, live nudges on bridge currents and pre-tge arbs that ghost past Grinding edges? Aura stacks 45% while unearthing cysic's computefi twist $EDGEN rerate brews as mindshare swells, brevis zk tipping the scale Flow in, tune your hunt or sidelined rerates mock the scrollers

EdgenTech’s approach to market intelligence is revolutionizing the game.️ Gone are the days of sifting through endless charts and tools. AI-driven insights? Check. Real-time data? Always. Seamless connections across stocks + crypto? You bet. This isn’t about luck, it’s about precision. Don’t just trade. Trade smart, trade with an edge. How are you leveraging @EdgenTech to stay ahead? #AI #MarketIntelligence

The smartest swaps just leveled up. @MindoAI × @CryptoRubic Gasless. Cross-chain. AI-powered. This isn't just about cutting-edge tech. It’s about execution at scale where your attention is rewarded, not wasted. Eyes on this. This is the future. Intelligence flows through every swap, whether you see it or not. #AI #Crypto

provable outputs + priced contributors aren’t slogans they’re economic primitives for #DeAI itself @AiraaAgent turns aura into real coefficient weight @zk_agi brings zk verifiability so private agents can *earn* truth infofi bridging compute and cred when proof prices participation right, the network starts breathing value

Today’s loop I actually ran: - @bitdealernet grind XP, pledge via Kaito (7‑day refund), watching $BIT as the cap fills, staked to line up game token allocations - @ownaiNetwork spun a small agent in ~45 min, set on‑chain splits, and parked $OWN for a steady 5 15% while it works Memes with real game revenue meets ownable AI cashflows. One build, dual yield. Who else running this stack #DeAI #GameFi #DePIN?

Cosmos dollars stacking yield like never before @noble_xyz dropping the full playbook: ➥ USDN: T-bill backed stable, $65M live, yield that actually wires into trades on HyperliquidX ➥ Safe multisig for 57K users, CCTP v2 slashing burns by 40% 10s cross-chain hops ➥ $8B processed, AppLayer EVM on Celestia Q4: 100ms blocks flipping RWA speed Today’s moves: → Farm S2 points til Nov 15, swap for $NOBLE → Testnet deploys: 1K $NOBLE + builder XP → Stake at 10.5% APR, vote issuance → Yield Composability Space Oct 25 → Upgrade heads-up: Oct 23, 13:58 UTC This is stablecoin infra that ships, not shills composable across 50+ chains, yield layering the meta @noble_xyz #Cosmos #RWA #DeFi

➥ gm. tracking how benchwork flows into on‑chain receipts @BioProtocol has the rails live: ▸ stake $BIO → veBIO multipliers, 21‑day cooldown for governance ▸ BioXP with 14‑day decay → fresher signal for Ignition allocations ▸ replication‑gated unlocks, provenance logs, refunds on unused $BIO Two bets I’m watching: → @NootropicsDAO_: N=1 + citizen logs → multi‑site cognition trials; $100B market, read receipts > hype → @dogyearsdao: follistatin gene therapy for canine arthritis; clinics as nodes, owners as contributors, translational data Checklist: track replication %, freshness, site count Signals: $125M $BIO staked, fees routing to real research via @Aubrai_ IP‑tokens Poll: where do you point XP next NOOT pilots, DOG cohorts, or stacking veBIO for the next Ignition

➥ Alpha alert: @EdgenTech's Agentic Execution lands soon, flipping crypto research from grind to glide ▸ AI agents handle intents like pros swap, stake, snipe without the tab-juggling circus ▸ Built-in strategies for DeFi plays, turning whale watches into auto-trades ▸ Portfolio dashboard already crushes it, bundling $ETH $BNB $BTC vibes in one clean view Dug into their 360 reports last night Fusaka fork intel had me rethinking L2 costs, TVL spiking to $8.69B while BlackRock stacks ETH like candy This setup? Your edge against the noise. Custom agents via Edgen Store mean sniper bots for liquidity hunts, pre-TGE radars for hidden gems Momentum scouts grading bags sharper, consolidation at $110k? Buy signal screams louder now Lock in early, legends alpha composes itself when you let agents lead the charge

➥ Cashflow rails I’m stacking this week for yield + compliant depth ▸ @ownaiNetwork routes robot miles + uptime onchain with telemetry + insurance → 8‑15% machine yield; Staking v2 Nov 4, lock Nov 5; Nov 15 snapshot earmarks 5% $OAN for active creators. 10K nodes live stake, post proofs, farm yaps ▸ @RaylsLabs builds UniFi rails for banks: private subnets + a public EVM L2, Uniswap v4 privacy hooks; Cookie3 rewards at $700K pre‑TGE, $RLS queued Cashflow > clout #RWA #DePIN #Web3 $OAN $RLS

➥ Attention meets automation: that's the alpha combo I'm seeing between @wallchain_xyz and @ownaiNetwork right now ▸ Wallchain's Quacks system rewards real crypto yapping with points that stack into $WALLCHAIN yields, turning threads into tangible mindshare multipliers ▸ OWNAI layers on top by letting those earnings fuel fractional owns of robotaxis or humanoids, pulling 5-15% APY from on-chain robot revenues like Unitree G1 pilots Together, they flip influence into asset-backed income: yap quality content on Wallchain, climb leaderboards for Quacks, stake into OWNAI pools for passive automation gains. No more siloed plays social labor directly owns the AI grind. I've been farming Quacks daily (up 200 this week), eyeing OWNAI's testnet for that first robot share. Early epochs close soon; positions like this compound fast in the RWA wave. #AttentionFi #RWAs

➥ @MMTFinance Title Deed NFTs dropping heat on Sui 15K soulbound gems unlocking $MMT bags + airdrop keys for the loyal Genesis crew snags 10K straight, nomination wave floods 5K more Backed by Coinbase Ventures + Circle muscle, this CLMM beast clocks $550M TVL, $22B real volume, ve(3,3) fees rerouting to lockers No vesting games 100% TGE unlock via @buidlpad's $4.5M raise Tier 1 locks $250M FDV w/ $3K+ SUI/BNB LP by Oct 25 snapshot (capped $20K for OGs) Tier 2 swings wide at $350M, $50 min entry UGC squads? 30% creator slice tag @MMTFinance + @buidlpad, bio T stamp, drop threads on vaults/liquidity before 22nd for $150 non-diluted guarantee Thesis: Compound fees to users = sticky TVL explosion, 4x base if Sui cracks $5, 2x floor on bear dips Parked SUI-USDC for 119% APR vault flip, squad DMs open who's riding this wave $MMT

➥ Sui's liquidity just hit warp speed with @MMTFinance stacking $560M TVL and $22B volume in months ▸ ve(3,3) DEX locks fees into lockers, emissions chase real votes no rug vibes, just compounding flow ▸ xSUI staking routes yields seamless, vaults auto-optimize cross-chain without the grind ▸ One protocol snagging 43% of chain DEX action? That's not noise, that's rails for tokenized everything Proof in the pudding: 2M users, millions of swaps, backed by Coinbase + Jump now the @buidlpad drop flips it to community hands Tier 1 at $250M FDV for OGs holding LP deep, snapshot Oct 25 grind SUI-USDC pairs now for that anti-sybil edge Public tier opens wider at $350M, full unlock Oct 31 deposit SUI or BNB, no vesting drag Thesis sharp: As Sui scales to $726M daily vol, MMT captures the flywheel, turning trades into owned growth Quality creators? 30% pool for deep dives tag 'em, add ️️T, lock $150 min If DeFi's about fair rails over VC pumps, this is the blueprint. Position before the league airdrop closes Oct 24 #Sui #DeFi $MMT | GM alpha hunters

➥ Two RWA rails heading into Q4 catalysts @bitdealernet is wiring 1,700+ iGaming rakes into $BIT buybacks under Meteora/Jupiter depth, TGE November + Abyss of Glory Nov 12 = liquidity + deflation @ownaiNetwork is pushing co‑owned AI fleets with 8 15% yield, DAO votes live, mainnet + $OAN snapshot Nov 15 ✧ Thesis: cashflow‑backed memes + robot revenue = durable onchain yield ✧ Watch: leaderboard grind, staking windows, governance snapshots #RWA #DePIN #Web3

People with Analyst archetype

Building the next personal computing device. @NaturaUmanaAI

coder.GPT

PADI Dive Instr, Aerospace Engineer, EO & AI Data Scientist, IOC Ocean Expert, ex UN, Full-stack web developer, Building Agentic-AI & Open Source Robotics.

Content @Arketos | Developer @Pedalion_ | Trader @APEXTradingHQ | #Bitcoin 2017 stocks 2015

AI Safety Study Group | AI | AI Safety | AI Interpretability | AI Consciousness | Technical Blogger | Digital Nomad linkedin.com/in/wangjinge/

Hi I'm Igris 🦅🟠

intern, copywrite @figmentcapital

20s in the trenches, Sharing insightful threads backed 1-1 by @fluentxyz Just use

猫奴🐱|美食日常 | 学习英语ing |分享生活

Certified @Safaryclub · Content Strategist Storytelling overcomes features. Always

Explore Related Archetypes

If you enjoy the analyst profiles, you might also like these personality types: