Get live statistics and analysis of CryptoSapiensπ²Ⓜ️Ⓜ️T 🍊,💊's profile on X / Twitter

Nitrograph

The Innovator

CryptoSapiensπ²Ⓜ️Ⓜ️T 🍊,💊 is a relentless explorer and pioneering thinker in the DeFi and Web3 space, breaking down complex protocols with bite-sized clarity. Their expertise lies in dissecting intricate blockchain mechanics and innovating pathways for mainstream adoption. Always one step ahead, they blend technical deep-dives with community-driven insights to shape the future of decentralized finance.

Top users who interacted with CryptoSapiensπ²Ⓜ️Ⓜ️T 🍊,💊 over the last 14 days

蓝狐笔记,通往web3的世界。 (1.仅记录想法,没有客观只有主观,不能作为投资建议 ;2.蓝狐笔记只有此号,没有任何telegram或discord等群,没有其他分号,不会要求任何人参与投资,也不会发表跟区块链无关内容 ;3.不会发布链接,不要点击,谨防受骗。)

TrackerMind — exploring the evolution of digital finance, from crypto and DeFi to the future of money itself.

Sometimes right, always curious. Just degen with conviction.

Advisor | Trader | Master Yardio

Cutest dev in Web3. Deadliest in a DAO

@ChelseaFC "club world cup 2025" fan🐧 10 years FUD everything @Monad /@solana maxi

CryptoSapiensπ²Ⓜ️Ⓜ️T tweets so much blockchain jargon, even their own dog probably knows what ve(3,3) means, but good luck convincing your grandma you're not speaking alien when she asks what you do for fun!

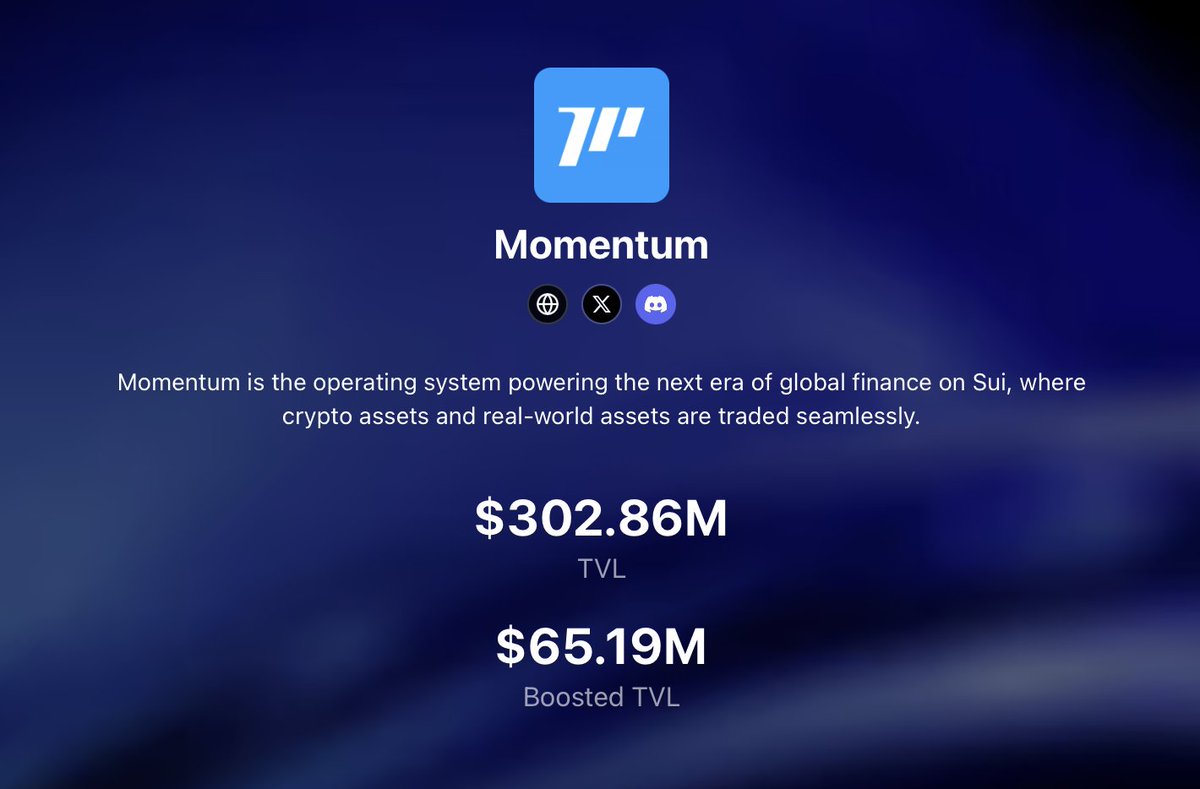

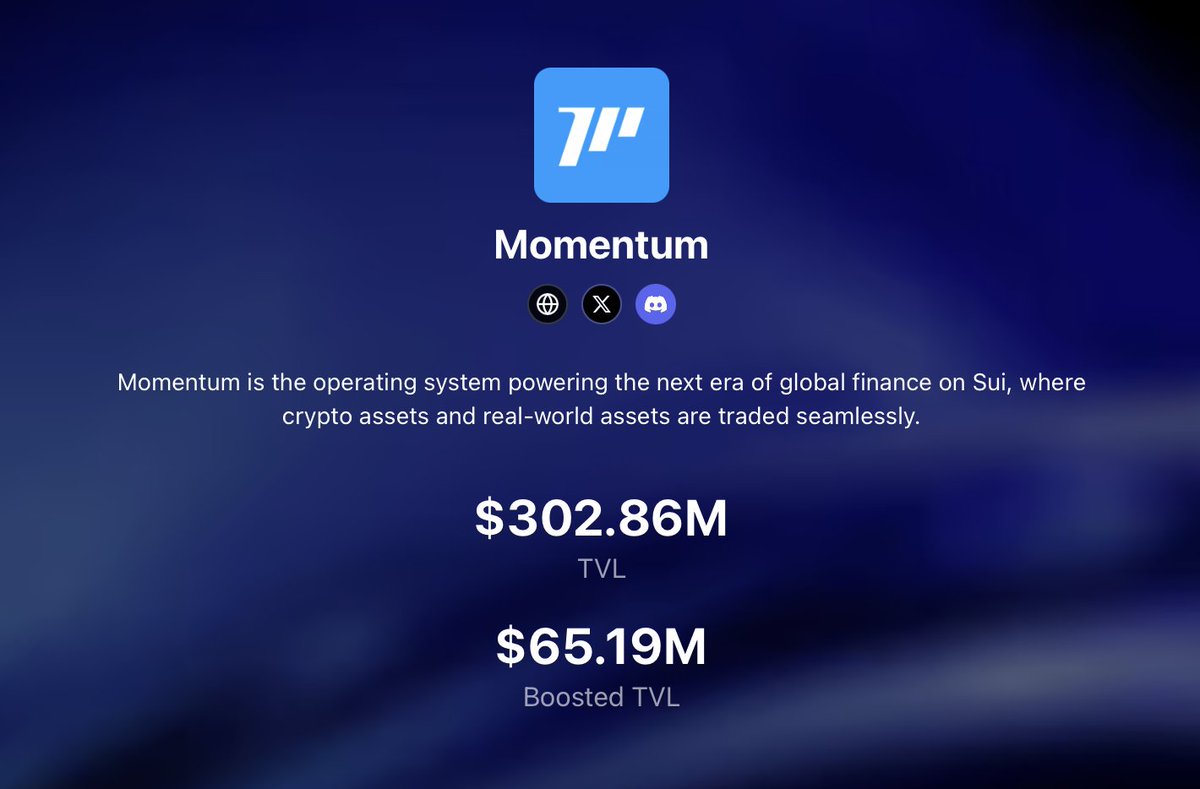

Successfully helped popularize the @MMTFinance Momentum protocol by breaking down its complex mechanics into accessible analogies, contributing to its impressive $18B+ trading volume and solidifying its position as a game changer on the Sui chain.

Their life purpose is to demystify and innovate within the blockchain ecosystem, empowering both newcomers and veterans to navigate DeFi with confidence and clarity. By building more accessible and reliable financial infrastructures, they aim to accelerate the transition to a trustless and efficient digital economy.

They believe in transparency over hype, the power of technology to solve systemic liquidity problems, and that true innovation comes from validated data and robust infrastructure—not fleeting trends. They value community engagement, education, and the fusion of utility with intelligence in crypto projects.

CryptoSapiensπ²Ⓜ️Ⓜ️T’s strengths lie in their ability to translate highly technical concepts into engaging narratives, deep knowledge of DeFi mechanics, and a strategic mindset that balances risk awareness with visionary optimism. Their prolific tweeting shows commitment and thought leadership in the space.

With over 12,000 tweets and a following count not defined, there might be a challenge in converting sheer volume into focused influence, sometimes overwhelming their audience with dense information or insider jargon. Their rapid-fire content delivery could confuse or intimidate crypto newcomers.

To grow their audience on X, CryptoSapiensπ²Ⓜ️Ⓜ️T should craft a series of easily digestible, visual thread summaries paired with engaging AMAs, focusing on simplifying core concepts for broader appeal. Collaborating with emerging crypto influencers and hosting live discussions to demystify trending protocols will enhance their community reach and foster stronger follower loyalty.

Fun fact: Despite their futuristic handle filled with cryptic symbols and emojis, CryptoSapiensπ²Ⓜ️Ⓜ️T’s tweets read like a master architect’s blueprint for the next big rise in DeFi infrastructure—bridging theoretical concepts with actionable real-world strategies.

Top tweets of CryptoSapiensπ²Ⓜ️Ⓜ️T 🍊,💊

Why do we need Momentum? (a simple analogy) picture a bustling marketplace where traders haggle over fruits, but the stalls are scattered, paths twist endlessly, and half the time you pay extra just to cross the street that's DeFi on most chains right now: fragmented liquidity, high fees eating your gains, and no real flow between buyers and sellers Momentum steps in like a master architect redesigning the whole square into one seamless hub central paths for quick swaps, shaded spots for staking your haul, and incentives that reward everyone farmers, flippers, even the folks providing the carts no more dead ends or tolls; everything connects in under a second on Sui, pulling from 100+ sources to keep prices tight and yields juicy now scale that: vaults layering xSUI for compounded returns, CLMM concentrating liquidity where it counts, ve(3,3) locking in long-term vibes without the rug risk @MMTFinance turns Sui from a quiet town into the DeFi capital, clocking $18B+ volume and $550M TVL because protocols actually stick around for the profits, not just extract and ghost and here's the real edge: while others chase hype cycles, Momentum bridges to real-world assets with ZK compliance baked in, letting institutions slide in without the usual red tape that's why LP APRs hit 678% on top pairs math that compounds while you sleep fast forward to the @buidlpad launch: $4.5M raise, 100% TGE unlock, tiers for HODL stakers (up to $20k cap) or quick KYC plays ($50-2k) but the alpha move? UGC squad challenge drop "T" in your name, craft threads/videos unpacking the tech or yields, tag the handles, submit up to 5 links by Oct 22 30% of sale funneled to creators means $150+ priority allocs for quality drops, not spam position now: stake LP for tier 1, farm volume on swaps, or build content that explains why Sui's Move lang crushes vulnerabilities and finality hits sub-second this isn't fleeting noise; it's the liquidity engine powering the next wave of onchain everything grab your spot before allocations lock Sui DeFi sleeps no more gl positioning fam

What if 你第一次踏進 Sui,要在產品和代幣之間做選擇:面對 $MMT 的社區募資,該不該上? 我偏保守,所以先把風險攤開講清楚: 100% unlock=即時拋壓,新手最怕追高被針刺 veMMT 的鎖倉衰減真能中和賣壓?如果投票被少數集中,排放會不會失衡 CLMM 再深,LP 在恐慌時撤出,滑點還是可能被放大 跨鏈入口(Wormhole / LI.FI / Squid)帶來的橋風險,黑天鵝時到底可控不可控 @buidlpad 的 KYC、反農夫機制確保公平,但也提高了門檻,新手會被擋在外面嗎 然後把技術面掰開看:@MMTFinance 用 Sui 的 PTB 把多步操作原子化,一次簽名減少失誤與 MEV;CLMM 讓資本在價格區間內更有效率;xSUI 提供鏈上收益+可組合性;交易費回流給 veMMT 與 LP;排放由治理投票導向,bribe 把激勵變成可定價的訊號。這些不是口號,是已被數據驗證的管線:2.1M 使用者、$560M TVL、$18 20B 交易量在代幣之前就跑出來,恐慌期仍有 65% LP 留下、費用在混亂中創下 $368k ATH,說明“產品先於獎勵”的路徑真的能活 至於募資設計,新手能做的風險控制很具體: Tier 1:$250M FDV,需要 ≥$3,000 LP(HODL 期間還有 2x Bricks) Tier 2:$350M FDV,只要通過 @buidlpad KYC 即可 拋壓不靠鎖倉騙局延遲,而是交給市場即刻定價;願意參與治理的人,用時間和票權去吸收流動性,這比“有 vesting 就安全”的幻覺更可控 我是新手角度的逆向思考:當大多數人害怕 100% unlock,我反而看見把風險前置、把激勵透明化的好處,前提是技術和流動性真的站得住。Sui 的並行執行+CLMM 深度,配上 ve(3,3) 把短線投機轉為長線參與,這套設計我願意測 What if 新手最好的防守,就是選擇已經被實戰驗證的基礎設施?我會先用 @buidlpad 拿到 $MMT 的入場票,再用鎖倉把風險變成治理權,#Sui $SUI 的主幹液位,值得押一次吧

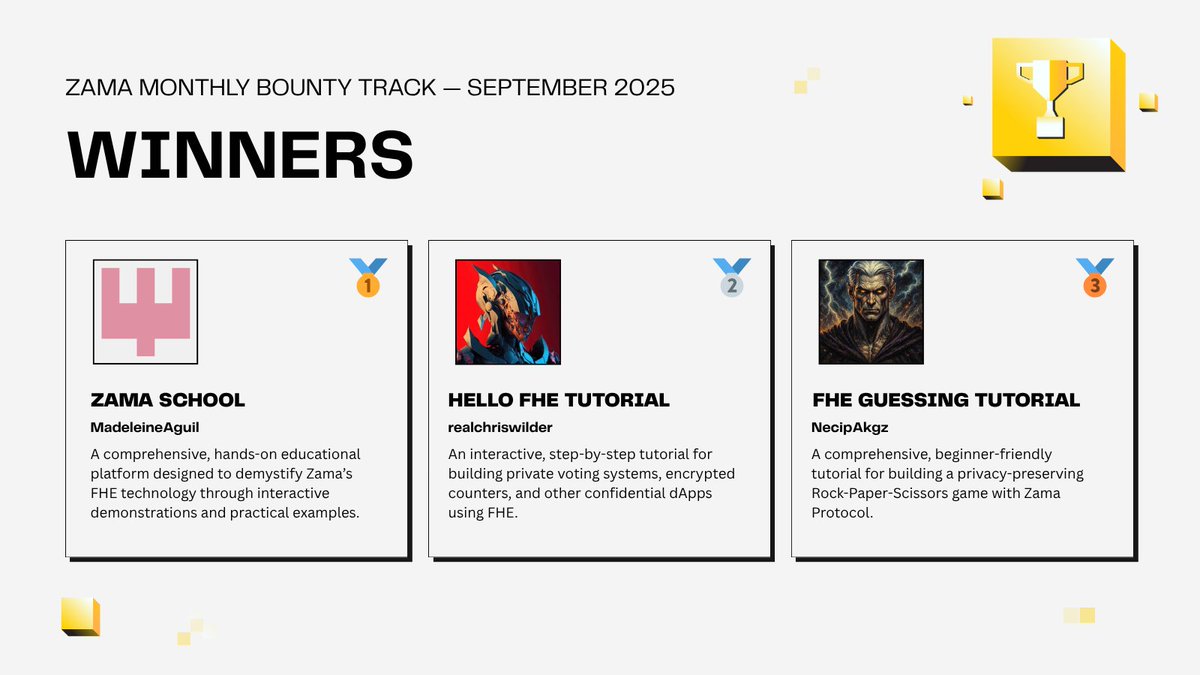

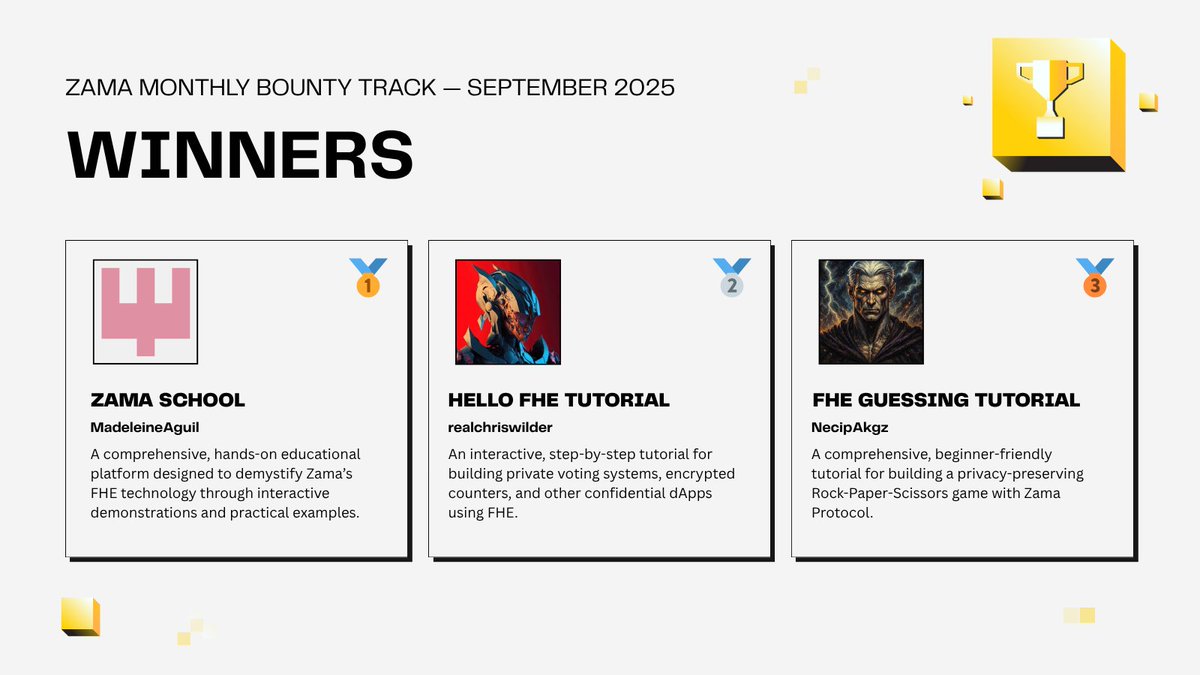

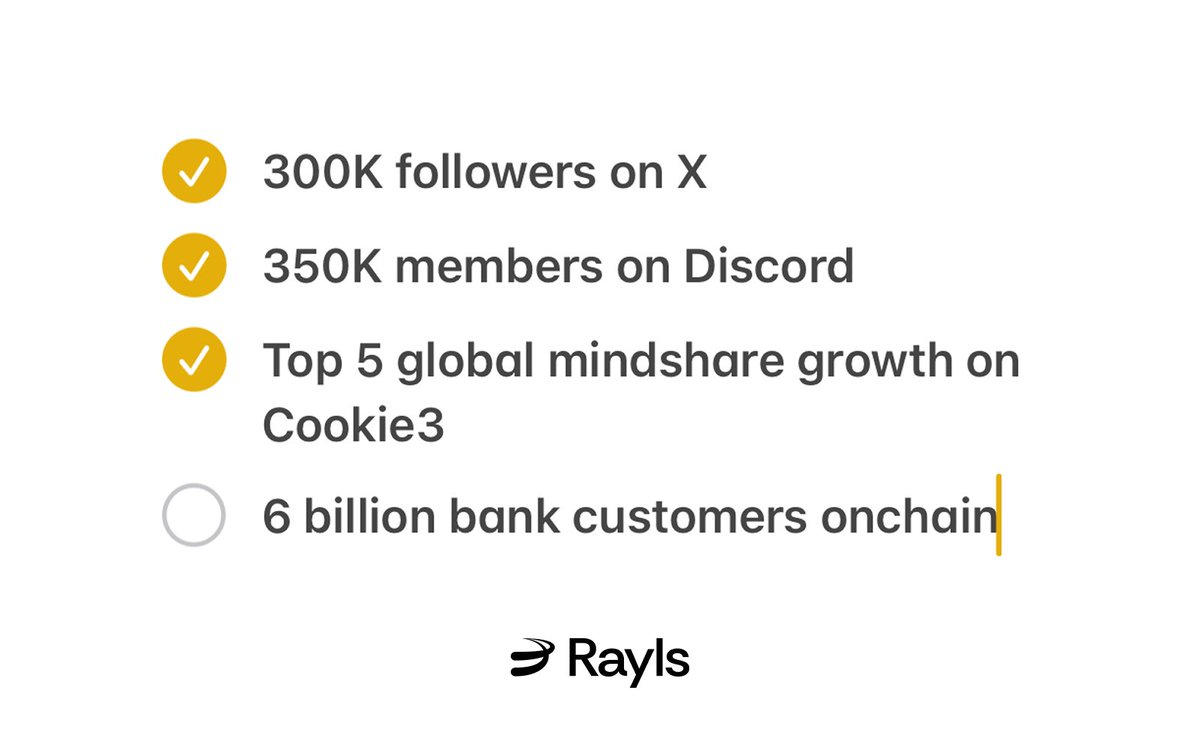

Deep dive: how @zama_fhe, @RaylsLabs and @monad line up to build private, liquid, identity-first finance Quick snapshot • @zama_fhe Concrete, FHEVM, HPU: practical FHE for ML and private smart contracts • @RaylsLabs modular execution + fast settlement for rollups, RWA-ready, compliance rails • @monad scarce social cards, MON economics, onchain identity & access primitives Why this stack matters 1) FHE-based KYC lets institutions verify without leaking user data 2) Rayls settlement turns tokenized real-world assets into moveable liquidity 3) Monad credentials gate premium flows and bootstrap network effects How to prototype (practical) 1. Compile privacy logic with Concrete 2. Run confidential contracts on FHEVM / HPU nodes 3. Launch a Rayls rollup for settlement + AML hooks 4. Use monad cards as access credentials to yield-bearing vaults Prediction: within 12 18 months expect first private RWA pools that verify compliance via FHE, settle on Rayls rails, and use monad-like NFTs as onchain identity. Builders start wiring these pieces now, composability is the alpha $ZAMA $RLS $MON

crypto is finally layering utility with intelligence RT @BitgetWallet: morph integration live 220M $BGB burned, 220M locked $BGB as gas and governance on @MorphLayer 0.02 fees, ceFi users flowing into l2 payfi rails RT @bluwhaleai: tge countdown and sui bridges wallet graph across 37+ chains zk privacy, node rewards, agents coming online $BLUAI listings and airdrop checker live the stack looks real when numbers meet flow - 80M+ users managing assets across 130+ chains on @BitgetWallet - card rollout for daily spend, swaps with mev-aware routing, getgas in USDT/BGB - 270M+ wallets indexed by @bluwhaleai with adaptive insights and whale scoring - mobile nodes turning data into a productive signal without leaking identity order flow vs signal flow matters - pay, bridge, stake, trade in one tap on @BitgetWallet - query, score, and route intelligence across chains on @bluwhaleai - ceFi audience meets deai agents through morph’s settlement layer - governance gets practical when $BGB pays gas and $BLUAI powers queries just surreal to watch payments and intelligence converge while the hype dial turns down and the builder dial turns up sitting at the intersection of access and awareness - access: card + super dex + earn center + 24/7 recovery mpc - awareness: savvy ai copilot + whale score + multichain zk rollups - stability: quarterly burns and protection fund vs emissions with halving schedules - scale: 120M+ ecosystem users vs 2M+ beta users migrating into agent economies if you run your day on-chain, the question becomes simple do you prefer a wallet that collapses steps, or an intelligence layer that collapses noise quick takeaways for operators - on morph, paying gas in $BGB compresses friction for onboarding - on sui, $BLUAI queries can personalize dapp flows without doxxing wallets - bridge payments and insights, not just tokens - treat governance as product, not ceremony open question for the timeline which stack are you building with first - @BitgetWallet for payfi rails and mass user access - @bluwhaleai for deai agents and adaptive signals reply with your pick and why, or quote with a short flow diagram of your pipeline best answers get bookmarked for a follow-up breakdown on ceFi<>deFi<>deai routing without extra hops also curious where do you see the higher near-term compounding - $BGB utility on morph and card-driven spend - $BLUAI agent queries and node incentives driving dapp retention signal beats slogans, show us your flow

昨晚花了1小时摸清新手节奏,发现 @LumiterraGame 比我想的更像“有经济的生存MMO”,地图点多、材料链长,最容易忽略的是仓储和交易站的节奏。我先把基础工具升到T2再去刷稀有矿,效率直接翻倍,开荒不再像无头苍蝇 🎮🧭 给还没上手的一个快跑路线: 1) 跟主线到第二张图,先开传送点 2) 每日任务优先做采集/制作拿积分 3) 组队打本分工明确:一个人纯采、一个人炼、一个人跑市集 4) 社区活动别错过,积分能叠加成资格 5) 链上这两天看到 $LMTS 流动性已开,满足条件的就准备兑奖励,NFA。Lumiterra 的节奏是“先玩再赚”,别用Fomo脑袋,稳住仓储和产能你才是大佬 🔥 我继续冲 #GameFi #MMO #Web3 #链游 #空投 的生产流派,谁有更狠的刷分表或者高价值路线图,丢出来一起抄作业?

【為什麼說現在是「身份 × 算力 × InfoFi」的交界】 當身份落鏈、算力可用、內容有了可度量的影響力,我們就站在一條全新的收益曲線起點上。@IOPn_io 用「一條鏈、一個身份」把人與機器的可信關係鋪好路,ATLAS 把去中心化 GPU 變成「可驗證的工作」,NeoID/NeoCard 讓參與者的聲望與回饋可攜。而 @xeetdotai 把創作者的「信號密度」量化成分數與排名,直接把說服力變現。這兩個系統疊在一起,等於把「做對事」的邊際收益拉高 A 路線:蹭熱度、刷指標、短週期狂飆 B 路線:做可驗證的貢獻、建立長尾聲望、讓分數與身份彼此加成 兩者的行事風格當然完全不同。想要安心享受複利的人,會偏向 B;追逐火箭的人,會選 A。理性地想一想,你希望你的曲線是一次性尖峰,還是可持續的斜率 現在的節奏很清楚:OPN Testnet 正在穩步開閘,Genesis n-Badge 已經成為「身份圖譜的起點」,在 @xeetdotai 上也有額外加分與倍率。有人會因為沒有錢包綁定或 finalize 48 小時的節奏掉榜,這很正常;驗證延遲與索引同步是代價,但長線的加成不會少。我的做法是先確保每一個「可驗證的步驟」都完成,再用內容輸出把分數穩住 > 先在 OPN 測試網完成錢包連接與 Genesis n-Badge(身份先站位) > 在 @xeetdotai 綁錢包、確認信號計分進度(48h finalize 的節奏記好) > 寫清楚你在測試網做了什麼:faucet、交易、任務、發現與建議(避免空話) > 用數據與行動鏈接你的觀點:身份、算力、RWA 的可核驗性,如何形成聲望複利 > 保持耐心,分數延遲≠貢獻作廢;週期裡真正留下來的都是可驗證的東西 我個人會把時間與注意力放在「身份先定義 → 算力可用 → 內容變現」這條路上:在 @IOPn_io,用 NeoID/ATLAS 的框架思考「可信算力」;在 @xeetdotai #InfoFi #Web3 #OPNTestnet 加速 ⋂

Momentum 的 TVL 衝破 560M,就跟 2020 年 Uniswap 靜悄悄醞釀前夕一模一樣 當時沒人料到,交易量會在幾個月內爆衝到數十億美元規模 如今 @MMTFinance x @buidlpad 丟出社區發行,Tier 1 LP 鎖倉直擊 250M FDV 門檻,10 月 25 日快照前夕 最低 3k 美元丟進 SUI-USDC 池子,零歸屬期,ve(3,3) 機制把費用直導持有者口袋 我親自測過 CLMM,滑點幾乎隱形,穩定幣對 APY 狂飆 400%,PTB 鏈上交易順滑到像喝水 UGC 小隊上限 10 人,狂刷 5 篇貼文標記帳號,品質分 60% 起跳,就能鎖定 150 美元以上配額 buidlpad 過往翻倍紀錄 4x 到 10x,$MMT 累計 200 億美元兌換量,連農場都還沒上線就甩開大半對手 快照倒數,KYC 10 月 22 日截止,TGE 一放 xSUI 洪水般湧入 我的判斷:早鎖 LP,合資格就提名貢獻,Sui 流動性預計翻倍,代幣化 RWA 即將湧進 誰準備好在翻轉前上車 $SUI $MMT

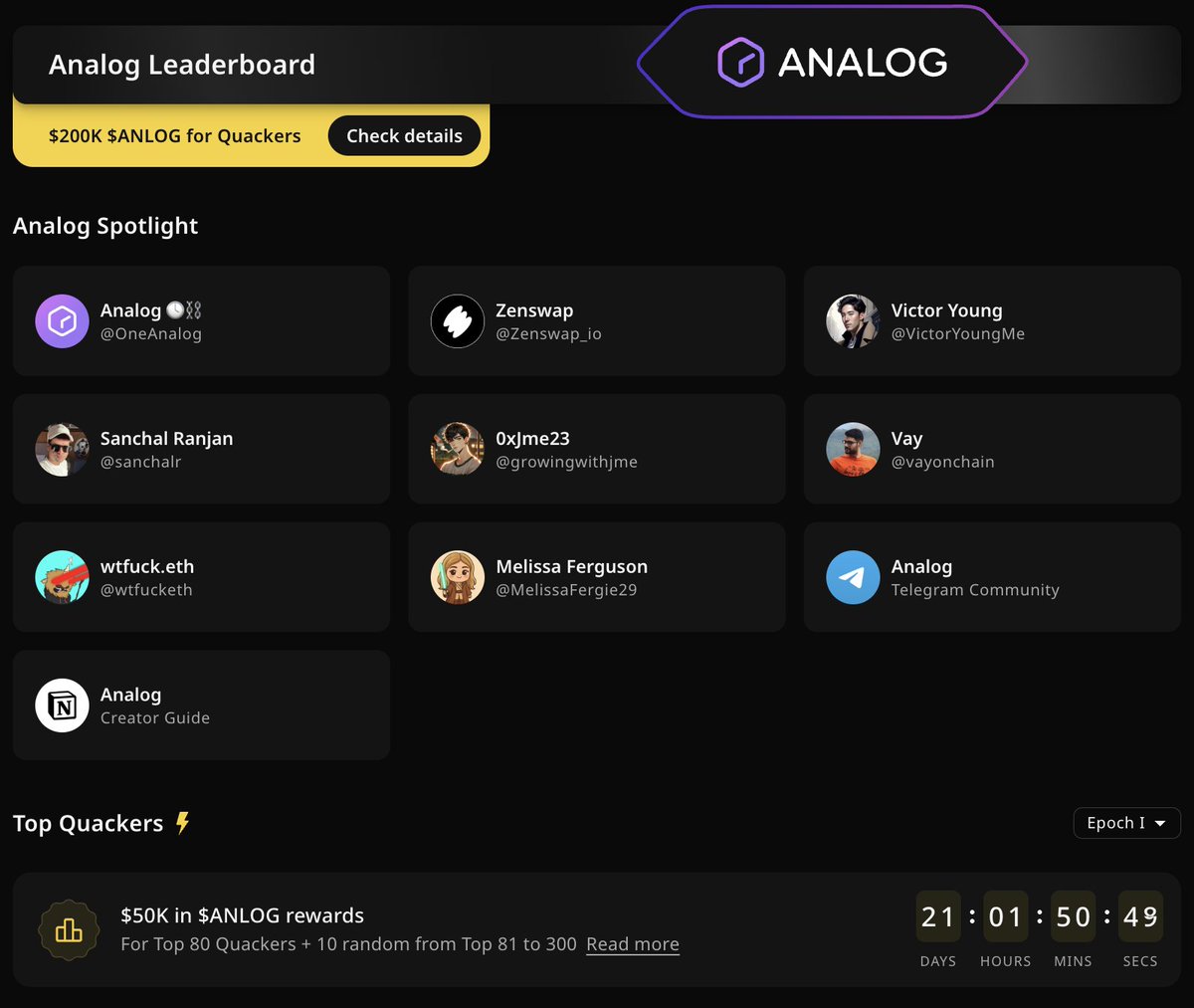

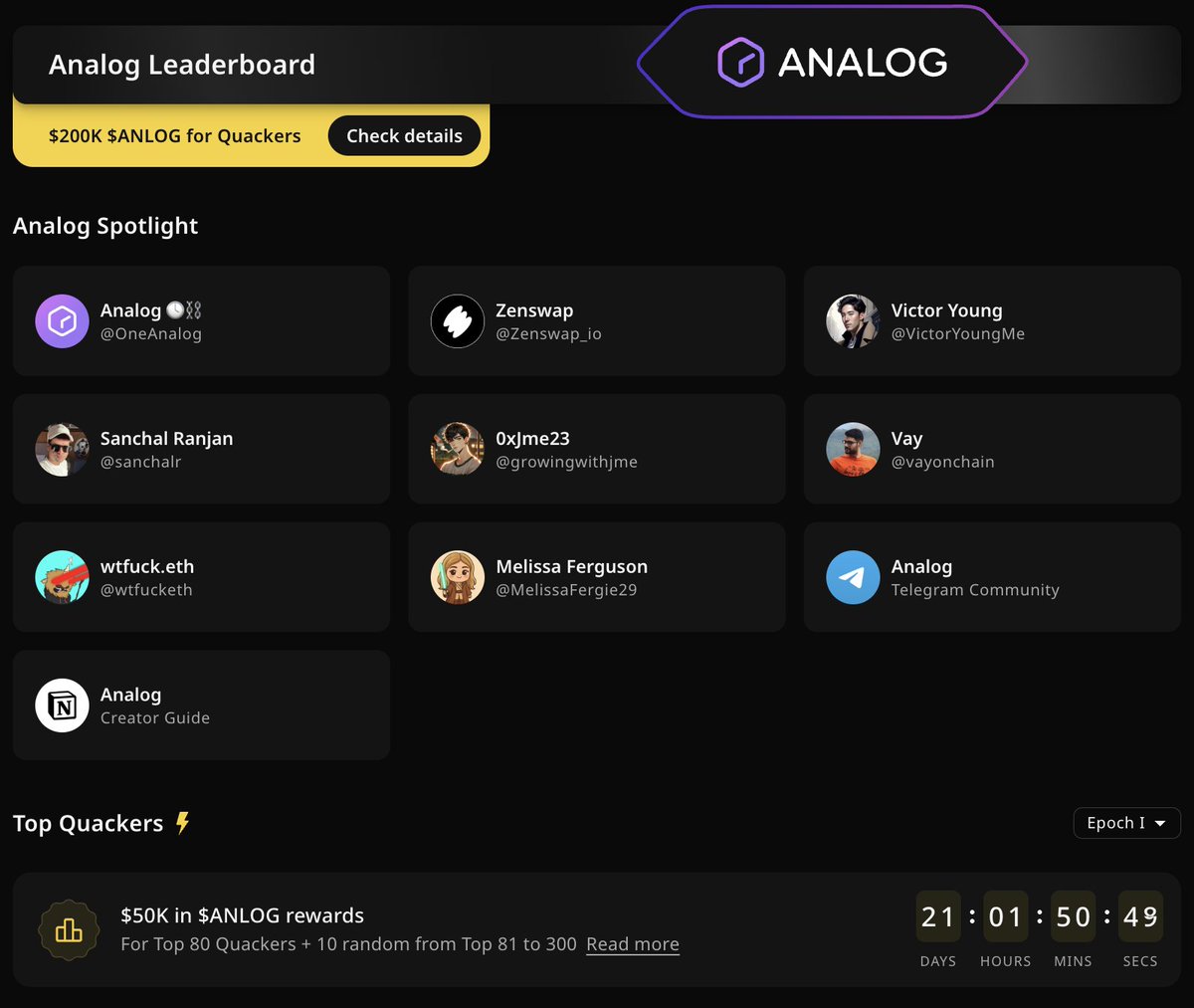

◢ Mindshare x Identity Playbook The attention market is heating up and the data rails are finally real. @wallchain calibrates signal from your posts and on-chain moves, while @idOS_network makes your verification portable so you don’t repeat KYC every time you touch a new app. Trust meets reach, receipts meet rewards Short version: • Post context that moves narratives, not vanity • Bind wallets and stack on-chain footprints • Verify once, reuse everywhere • Let AI + ZK separate real signal from noise How to execute this week: • Connect X, bind wallet, ship daily takes with on-chain receipts (Base/Solana/ApeChain actions boost mindshare) • Complete idOS KYC Plus before Nov 15 to lock bonus points for TGE • Hold relevant NFTs/tokens for multipliers when live • Aim for quality density: one strong post beats five filler ones Live rewards you can actually win: • ApeCoin Mindshare: 50K $APE through Nov 28, BAYC/MAYC/500+ $APE multipliers • Covalent: $40K in $CXT per epoch, current window to Nov 16 • SCOR: 0.5% supply across 3 epochs, top 125 + 25 random from 126 500 • idOS Epoch 2: through Dec 15, social points + KYC Plus feed into IDOS at TGE Q4 Signals to watch: • Leaderboard flips where small, consistent accounts outrank follower farms • ZK on-chain proofs unlocking new multipliers sans doxxing • Wave 2 wrap Nov 15 and how it re-weights Quacks toward originality Alpha rules of the game: • Quality > vanity • Recency with decay, don’t spam • Cross-chain action beats couch commentary • Verify once, reuse forever Create. Verify. GO #Web3

Privacy that actually computes on-chain Not hype. Not theater. Real encrypted logic, real outputs, no data leak If you care about building in public without exposing your users in public, learn the stack that @zama_fhe is shipping and why the next wave of winners will master it 1/ Why care now - Transparent chains gave us verifiability but pushed sensitive use cases off-chain - Users want sovereignty over data without sacrificing UX or composability - Regulators want compliance that doesn’t turn Web3 into a surveillance honeypot - Builders want to keep the speed of Solidity while adding privacy where it matters That tension is the market. FHE dissolves it by letting you compute on ciphertext and reveal only what you choose 2/ The Zama stack in one glance - fhEVM: Extend Solidity with encrypted types like euint so you can write normal smart contracts that operate directly on encrypted data - TFHE-rs: High-performance, open-source library for fully homomorphic encryption, tuned for CPU and GPU acceleration - FHE Coprocessor: Specialized execution path to accelerate encrypted operations and keep gas costs predictable - Confidential Blockchain Protocol: End-to-end encrypted execution, private-by-default smart contracts, programmable decryption gates, and seamless composition across L1 and L2 You keep EVM familiarity while unlocking encrypted state, encrypted inputs, and encrypted outputs. No trusted off-chain middlemen. No breaking composability 3/ What changes for use cases - Confidential DeFi: Private balances, masked order flow, encrypted LP positions, selective disclosure for audits and proofs - Secure Voting: On-chain votes tallied privately, choice remains confidential, outcomes remain verifiable - Healthcare Data: Compute on EMR and lab results without leaking PII, allow research queries with consented, policy-gated decryption - Private AI: Model inference and training on encrypted datasets so providers never touch raw user data - Gaming: Hidden states and secret moves, provably fair revelations, new formats for on-chain strategy games - Decentralized Identity and Verifiable Credentials: Encrypted attributes with verifiable checks, identity abstraction that preserves composability and trust You don’t have to park sensitive logic off-chain. You bring it on-chain without burning your users’ privacy 4/ FHE vs ZK vs TEEs - ZK proves a statement about plaintext without revealing the plaintext. Great for verification, limited for long-lived private state with lots of dynamic operations - TEEs run code in enclaves but require trust in hardware and supply chain, with a history of side-channel concerns - FHE lets the chain compute on encrypted data with no plaintext exposure. Heavy math meets native privacy, perfect for dynamic, composable private state The winning architectures will combine them. Example: use FHE to compute privately and ZK to prove properties of the encrypted outputs. Best of both worlds 5/ What makes @zama_fhe different - Open by default. TFHE-rs, tooling, examples, and benchmarks are public. That accelerates research, audits, and adoption - Developer-first. Solidity with euint is the shortest path for EVM devs to ship private contracts - Composable encrypted contracts. Your private contract can call my private contract without breaking privacy boundaries - Programmable privacy. Fine-grained control over what decrypts, when, and to whom. Policy is code - Hardware acceleration. CPU and GPU pathways plus a coprocessor roadmap, aiming for throughput the ecosystem can actually use Plenty talk about privacy. Few make it programmable, composable, and buildable in the stack you already use 6/ Dev path you can start today - Learn the euint mental model. Treat encrypted values like first-class citizens in Solidity - Sketch your contract surfaces. Which fields can remain public, which must be encrypted, which events should reveal aggregate-only insights - Model decryption policy. Use role-based, time-based, and event-based gates to control when ciphertext becomes plaintext - Start with a toy contract. Private counter, private voting, encrypted balances, then gradually add state transitions - Add proofs when needed. Prove properties of encrypted outputs without revealing the input - Design for composability. Expose encrypted interfaces that other contracts can consume - Plan for performance. Batch operations, use SIMD-friendly patterns where possible, target the coprocessor when available - Treat logs and front ends as part of your threat model. No plaintext leaks in debug logs or UX Ship small, iterate fast, measure gas, and move up the curve 7/ Performance reality - Encrypted computation is math-heavy by nature, and that’s fine when you architect for it - TFHE-rs gives you primitives with tunable parameters to balance security and speed - Hardware acceleration and coprocessors cut latency and bring costs down over time - Pick the right operations. Homomorphic addition, comparisons, and simple circuits compose well. Design around them Design-first builders will beat clickers. Pattern discipline turns FHE from magic into engineering 8/ Security frame to adopt - Data stays encrypted at rest, in transit, and during compute - Your attack surface shifts from data exfiltration to control over decryption policy - Threat model the decryptors. If no one can decrypt, private state remains private, period - Side channels move to metadata. Structure your app to avoid accidental leakage through timing, sizes, or ordering Privacy is not a binary. It’s a gradient you control in code 9/ Regulatory and enterprise angle - KYC without exposure. Verify attributes in encrypted form and reveal only pass or fail - Confidential liquidity. Institution-grade privacy with auditable, selective disclosure - Healthcare-grade compliance. Consent gates as smart contract policy rather than paper contracts - Data minimization by design. Build compliance in the code path and not in a separate process This is how Web3 aligns with law without surrendering sovereignty 10/ My 2025 predictions around FHE in Web3 - Multiple L2s pilot FHE precompiles or coprocessor integrations for encrypted EVM ops - At least one major DeFi protocol rolls out a private vault line with encrypted balances and ZK attestations - Identity abstraction gets a breakout with encrypted credentials becoming composable primitives for governance and markets - Private AI inference on consumer data becomes a top-3 growth wedge for consumer apps - Gaming finds product-market fit with encrypted on-chain strategy mechanics Builders who learn euint and fhEVM now will own these greenfield categories 11/ How to position yourself as a builder - Read the fhEVM docs and scan euint examples - Fork an example repo and run local demos - Build a private voting or private counter PoC - Add policy-based decryption to test roles - Benchmark a flow with TFHE-rs on CPU, then GPU - Draft a doc on privacy boundaries for your app - Share learnings publicly, gather feedback, iterate If you can write Solidity, you can write encrypted Solidity 12/ If you’re a founder - Map your data flows. Circle the fields that cost you growth because you cannot put them on-chain today - Convert the circles into encrypted fields and run a risk review - Re-design UX so it doesn’t flash plaintext anywhere in the pipeline - Plan for compliance and audits via selective disclosure and proof artifacts - Pitch the delta. Better UX, more trust, new markets unlocked by private compute Privacy can be your acquisition wedge instead of a bolt-on checkbox 13/ Ecosystem fit - FHE plus ZK is a power combo. Compute privately, prove publicly - FHE plus oracles enables encrypted off-chain queries with on-chain verification - FHE plus account abstraction lets users control policy at the wallet level - FHE plus restaking secures specialized coprocessors and keeps incentives aligned Think Lego, not silo 14/ Community and growth angle - @zama_fhe runs the #ZamaCreatorProgram to spotlight builders and educators who move the space forward - Season 3 has a 56,000 dollar pool and 1,000 Zama OG NFTs for creators who show up consistently and add value - Season 1 minted 250. Season 2 minted 500. More slots this time, more room to step in - Post thoughtful content, tag @zama_fhe, use the hashtag, focus on signal over fluff, and you’ll climb leaderboards Creators who teach while they build compound credibility and upside 15/ Quick starter ideas to publish this week - Thread: Implementing euint in a simple ERC-20-style private balance demo and measuring gas - Deep dive: How programmable decryption gates enable compliant DeFi strategies - Walkthrough: Converting an on-chain vote to encrypted votes with verifiable tally - Case study: Private inference with an encrypted feature vector for a recommendation engine - Opinion: When to keep data public and when to encrypt in a composable protocol Ship, measure, share, repeat 16/ FAQs I’m getting - Is this only for L2s? No. The Confidential Blockchain Protocol targets both L1 and L2, with coprocessors improving economics where available - Will this break composability? No. Encrypted contracts can talk to each other while maintaining privacy boundaries - Do I need a PhD in crypto? No. You need Solidity, good systems sense, and willingness to learn the euint paradigm - Is it open? Yes. TFHE-rs and key tools are open-source. The community pushes the frontier together The bar to entry is lower than you think if you start with a small scope 17/ Builder checklist - Install toolchain and compile a demo - Write a simple encrypted function and test locally - Define decryption roles and simulate at least two policy flows - Audit for plaintext leaks in logs and events - Document assumptions and what your app does not reveal - Share a post with your learnings and invite review - Join community channels to calibrate benchmarks and params Progress beats perfection. Every week you wait, someone else closes the gap 18/ Final take - verifiability created the first wave - scalability created the second wave - privacy that computes will drive the third wave The winners will be those who master encrypted state, encrypted execution, and selective revelation as first-class design tools If you’ve been looking for where the next 1000x dev skill sits in Web3, it looks a lot like fhEVM, euint, TFHE-rs, and a coprocessor pipeline Follow @zama_fhe, learn by building, and if you create content, tag the team and use #ZamaCreatorProgram to get seen Are you shipping your first encrypted contract this month or watching others take your use case while you wait Like Repost Tell me which use case you’re claiming first and I’ll share a simple blueprint to get you from idea to encrypted MVP in a week

what is OML at @SentientAGI in simple words??? oml = open, monetizable, loyal models a cryptographic backbone for open-source every inference becomes a signed event with policy + time an immutable log so you can audit who ran what, under which rules fingerprints are the key 24,576 fixed keys in OML 1.0, roughly 100x the prior capacity survive fine-tunes, merges, even distillation the creator’s mark persists, permissions are enforced open sharing without losing provenance or control why care as a builder? because this plugs straight into the GRID a network where agents, models, data and compute coordinate roma handles the decomposition and routing for multi-step work spin/mindgames add social planning + feedback loops livecodebench pro validates end-to-end execution in real containers how to get in, step-by-step: 1) publish your artifact (model/agent/dataset/tool) with an OML fingerprint 2) set usage policies + attribution you’re comfortable with 3) register on the GRID so roma can route to you 4) surface in Sentient Chat Spaces for real user demand 5) monitor evals with livecodebench pro, iterate, scale what changes for you? distribution to thousands of users and devs verifiable usage, auditable provenance and soon, paid access flowing back to the builder alongside network emissions 100+ partners already plugged in across web2/web3 feels like the linux moment for intelligence, while @OpenAI stays closed cofounded by @sandeepnailwal, shipping across #NeurIPS tracks this quarter which lever would you pull first to push capabilities? - large-scale OML deployment - spin/mindgames closed-loop training - roma/grid acceleration reply with your pick + why, i’ll share mine in quotes gSentient

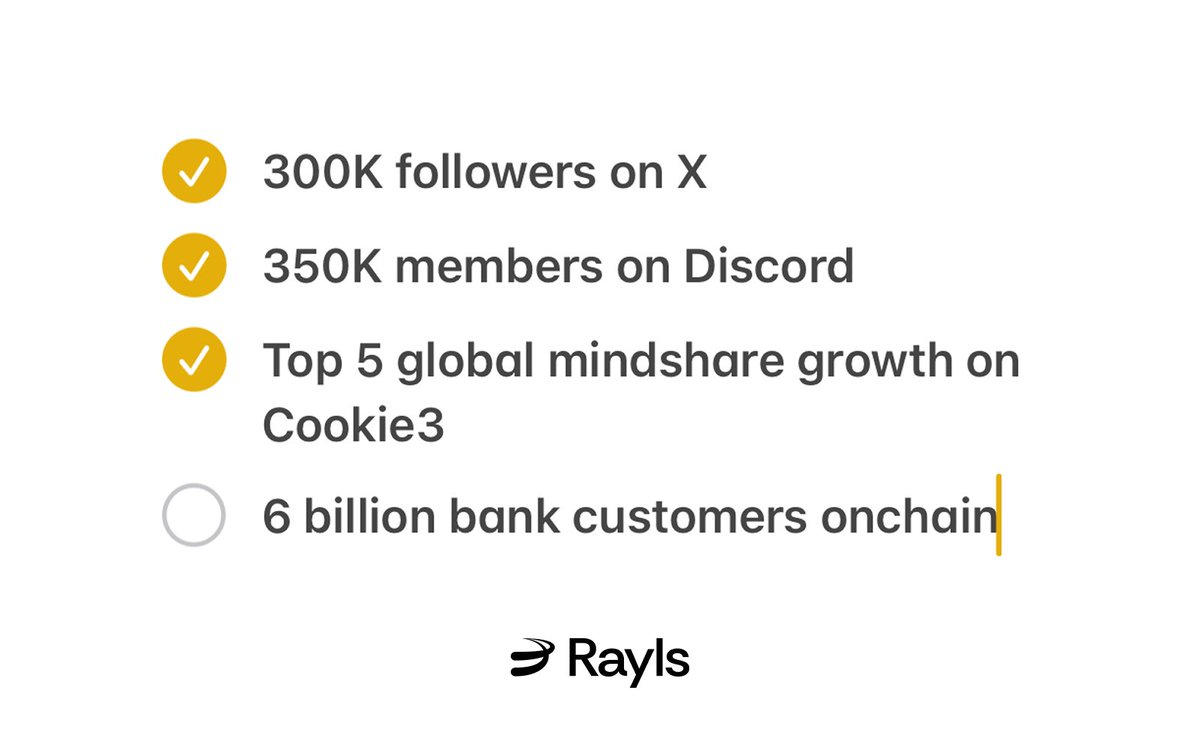

傳統金融要上鏈,口號喊了五年,卡住的其實不是「鏈不夠快」,而是合規、隱私、性能三難同時滿足。銀行要風控、審計與選擇性披露;DeFi 要可組合性、流動性、開放網路。兩邊想要的東西看似衝突,結果就是互相隔離、資金效率低落 我在傳統金融與鏈上都打過仗,最難的一步根本是「讓兩邊用同一套語言與基礎設施」。@RaylsLabs 把這一步做成產品,而不是白皮書口號:公鏈與私網並行、資料加密執行、可審計事件外露、EVM 兼容不改生態,讓機構能把核心業務搬上鏈,同時打開到公共 DeFi 的出口 Rayls 的框架很務實: - 隱私節點+私有網路承載敏感交易,配合選擇性披露滿足監管 - 公開鏈承接流動性與可組合性,USD 計價 Gas 降低波動風險 - Enygma 密碼學保障交易機密,附帶 MEV 防護與身份抽象 - Axyl 共識與以太坊級安全,讓機構不必犧牲性能或合規 這套設計直接落地在三個高價值場景: 1) RWA:債券、應收帳款、房貸等真正能產生現金流的資產可私密代幣化,再接公共流動性池 2) CBDC 與同業清算:國內外支付、FX corridor 實時結算,資料保密但可審計 3) 合規 DeFi:銀行子網的資金進入公開協議,標準化的身份與披露降低逆向選擇風險 市場側的訊號也不差。公售賣到斷貨,超過 70 國、1100+ 參與者、募得約 170 萬美金,這不是靠空話。這代表全世界在找「能把銀行帶上鏈、又能安全接公共流動性」的基建。不是去重造一條孤島鏈,而是把傳統金融的私有網與公共 DeFi 融成一張網路 更關鍵的是使用層的證據:測試網在高 TPS 壓測下仍可維持可審計信號輸出,金融機構可以在私域執行,公域讀取採用跡象(Proof of Usage),把「合規使用」轉為可見度,這點在 RWA 定價與流動性預期上非常重要。像 @TimHaldorsson 這種長期做機構生態的人,看重的就是這種「把採用變成可觀測」的機制 這條路不炫,但必要。加密要走向真實經濟,靠的不是把槓桿加更高,而是把清算、隱私、身份、合規、流動性整合成可運作的市場結構。$RLS 的 TGE 是時間軸上的起點,真正的里程碑會是第一批銀行與受監管資產在公域形成可持續的流動性漏斗 拋個問題給大家:你覺得 2026 前,哪個應用率先爆量 CBDC 支付、RWA 債券、還是跨境匯兌結算?為什麼?引用發你的推、貼上你心中的路徑設計,我晚上來回你們的觀點 #DeFi #TradFi

Most engaged tweets of CryptoSapiensπ²Ⓜ️Ⓜ️T 🍊,💊

What if 你第一次踏進 Sui,要在產品和代幣之間做選擇:面對 $MMT 的社區募資,該不該上? 我偏保守,所以先把風險攤開講清楚: 100% unlock=即時拋壓,新手最怕追高被針刺 veMMT 的鎖倉衰減真能中和賣壓?如果投票被少數集中,排放會不會失衡 CLMM 再深,LP 在恐慌時撤出,滑點還是可能被放大 跨鏈入口(Wormhole / LI.FI / Squid)帶來的橋風險,黑天鵝時到底可控不可控 @buidlpad 的 KYC、反農夫機制確保公平,但也提高了門檻,新手會被擋在外面嗎 然後把技術面掰開看:@MMTFinance 用 Sui 的 PTB 把多步操作原子化,一次簽名減少失誤與 MEV;CLMM 讓資本在價格區間內更有效率;xSUI 提供鏈上收益+可組合性;交易費回流給 veMMT 與 LP;排放由治理投票導向,bribe 把激勵變成可定價的訊號。這些不是口號,是已被數據驗證的管線:2.1M 使用者、$560M TVL、$18 20B 交易量在代幣之前就跑出來,恐慌期仍有 65% LP 留下、費用在混亂中創下 $368k ATH,說明“產品先於獎勵”的路徑真的能活 至於募資設計,新手能做的風險控制很具體: Tier 1:$250M FDV,需要 ≥$3,000 LP(HODL 期間還有 2x Bricks) Tier 2:$350M FDV,只要通過 @buidlpad KYC 即可 拋壓不靠鎖倉騙局延遲,而是交給市場即刻定價;願意參與治理的人,用時間和票權去吸收流動性,這比“有 vesting 就安全”的幻覺更可控 我是新手角度的逆向思考:當大多數人害怕 100% unlock,我反而看見把風險前置、把激勵透明化的好處,前提是技術和流動性真的站得住。Sui 的並行執行+CLMM 深度,配上 ve(3,3) 把短線投機轉為長線參與,這套設計我願意測 What if 新手最好的防守,就是選擇已經被實戰驗證的基礎設施?我會先用 @buidlpad 拿到 $MMT 的入場票,再用鎖倉把風險變成治理權,#Sui $SUI 的主幹液位,值得押一次吧

Why do we need Momentum? (a simple analogy) picture a bustling marketplace where traders haggle over fruits, but the stalls are scattered, paths twist endlessly, and half the time you pay extra just to cross the street that's DeFi on most chains right now: fragmented liquidity, high fees eating your gains, and no real flow between buyers and sellers Momentum steps in like a master architect redesigning the whole square into one seamless hub central paths for quick swaps, shaded spots for staking your haul, and incentives that reward everyone farmers, flippers, even the folks providing the carts no more dead ends or tolls; everything connects in under a second on Sui, pulling from 100+ sources to keep prices tight and yields juicy now scale that: vaults layering xSUI for compounded returns, CLMM concentrating liquidity where it counts, ve(3,3) locking in long-term vibes without the rug risk @MMTFinance turns Sui from a quiet town into the DeFi capital, clocking $18B+ volume and $550M TVL because protocols actually stick around for the profits, not just extract and ghost and here's the real edge: while others chase hype cycles, Momentum bridges to real-world assets with ZK compliance baked in, letting institutions slide in without the usual red tape that's why LP APRs hit 678% on top pairs math that compounds while you sleep fast forward to the @buidlpad launch: $4.5M raise, 100% TGE unlock, tiers for HODL stakers (up to $20k cap) or quick KYC plays ($50-2k) but the alpha move? UGC squad challenge drop "T" in your name, craft threads/videos unpacking the tech or yields, tag the handles, submit up to 5 links by Oct 22 30% of sale funneled to creators means $150+ priority allocs for quality drops, not spam position now: stake LP for tier 1, farm volume on swaps, or build content that explains why Sui's Move lang crushes vulnerabilities and finality hits sub-second this isn't fleeting noise; it's the liquidity engine powering the next wave of onchain everything grab your spot before allocations lock Sui DeFi sleeps no more gl positioning fam

Deep dive: how @zama_fhe, @RaylsLabs and @monad line up to build private, liquid, identity-first finance Quick snapshot • @zama_fhe Concrete, FHEVM, HPU: practical FHE for ML and private smart contracts • @RaylsLabs modular execution + fast settlement for rollups, RWA-ready, compliance rails • @monad scarce social cards, MON economics, onchain identity & access primitives Why this stack matters 1) FHE-based KYC lets institutions verify without leaking user data 2) Rayls settlement turns tokenized real-world assets into moveable liquidity 3) Monad credentials gate premium flows and bootstrap network effects How to prototype (practical) 1. Compile privacy logic with Concrete 2. Run confidential contracts on FHEVM / HPU nodes 3. Launch a Rayls rollup for settlement + AML hooks 4. Use monad cards as access credentials to yield-bearing vaults Prediction: within 12 18 months expect first private RWA pools that verify compliance via FHE, settle on Rayls rails, and use monad-like NFTs as onchain identity. Builders start wiring these pieces now, composability is the alpha $ZAMA $RLS $MON

【為什麼說現在是「身份 × 算力 × InfoFi」的交界】 當身份落鏈、算力可用、內容有了可度量的影響力,我們就站在一條全新的收益曲線起點上。@IOPn_io 用「一條鏈、一個身份」把人與機器的可信關係鋪好路,ATLAS 把去中心化 GPU 變成「可驗證的工作」,NeoID/NeoCard 讓參與者的聲望與回饋可攜。而 @xeetdotai 把創作者的「信號密度」量化成分數與排名,直接把說服力變現。這兩個系統疊在一起,等於把「做對事」的邊際收益拉高 A 路線:蹭熱度、刷指標、短週期狂飆 B 路線:做可驗證的貢獻、建立長尾聲望、讓分數與身份彼此加成 兩者的行事風格當然完全不同。想要安心享受複利的人,會偏向 B;追逐火箭的人,會選 A。理性地想一想,你希望你的曲線是一次性尖峰,還是可持續的斜率 現在的節奏很清楚:OPN Testnet 正在穩步開閘,Genesis n-Badge 已經成為「身份圖譜的起點」,在 @xeetdotai 上也有額外加分與倍率。有人會因為沒有錢包綁定或 finalize 48 小時的節奏掉榜,這很正常;驗證延遲與索引同步是代價,但長線的加成不會少。我的做法是先確保每一個「可驗證的步驟」都完成,再用內容輸出把分數穩住 > 先在 OPN 測試網完成錢包連接與 Genesis n-Badge(身份先站位) > 在 @xeetdotai 綁錢包、確認信號計分進度(48h finalize 的節奏記好) > 寫清楚你在測試網做了什麼:faucet、交易、任務、發現與建議(避免空話) > 用數據與行動鏈接你的觀點:身份、算力、RWA 的可核驗性,如何形成聲望複利 > 保持耐心,分數延遲≠貢獻作廢;週期裡真正留下來的都是可驗證的東西 我個人會把時間與注意力放在「身份先定義 → 算力可用 → 內容變現」這條路上:在 @IOPn_io,用 NeoID/ATLAS 的框架思考「可信算力」;在 @xeetdotai #InfoFi #Web3 #OPNTestnet 加速 ⋂

昨晚花了1小时摸清新手节奏,发现 @LumiterraGame 比我想的更像“有经济的生存MMO”,地图点多、材料链长,最容易忽略的是仓储和交易站的节奏。我先把基础工具升到T2再去刷稀有矿,效率直接翻倍,开荒不再像无头苍蝇 🎮🧭 给还没上手的一个快跑路线: 1) 跟主线到第二张图,先开传送点 2) 每日任务优先做采集/制作拿积分 3) 组队打本分工明确:一个人纯采、一个人炼、一个人跑市集 4) 社区活动别错过,积分能叠加成资格 5) 链上这两天看到 $LMTS 流动性已开,满足条件的就准备兑奖励,NFA。Lumiterra 的节奏是“先玩再赚”,别用Fomo脑袋,稳住仓储和产能你才是大佬 🔥 我继续冲 #GameFi #MMO #Web3 #链游 #空投 的生产流派,谁有更狠的刷分表或者高价值路线图,丢出来一起抄作业?

◢ Mindshare x Identity Playbook The attention market is heating up and the data rails are finally real. @wallchain calibrates signal from your posts and on-chain moves, while @idOS_network makes your verification portable so you don’t repeat KYC every time you touch a new app. Trust meets reach, receipts meet rewards Short version: • Post context that moves narratives, not vanity • Bind wallets and stack on-chain footprints • Verify once, reuse everywhere • Let AI + ZK separate real signal from noise How to execute this week: • Connect X, bind wallet, ship daily takes with on-chain receipts (Base/Solana/ApeChain actions boost mindshare) • Complete idOS KYC Plus before Nov 15 to lock bonus points for TGE • Hold relevant NFTs/tokens for multipliers when live • Aim for quality density: one strong post beats five filler ones Live rewards you can actually win: • ApeCoin Mindshare: 50K $APE through Nov 28, BAYC/MAYC/500+ $APE multipliers • Covalent: $40K in $CXT per epoch, current window to Nov 16 • SCOR: 0.5% supply across 3 epochs, top 125 + 25 random from 126 500 • idOS Epoch 2: through Dec 15, social points + KYC Plus feed into IDOS at TGE Q4 Signals to watch: • Leaderboard flips where small, consistent accounts outrank follower farms • ZK on-chain proofs unlocking new multipliers sans doxxing • Wave 2 wrap Nov 15 and how it re-weights Quacks toward originality Alpha rules of the game: • Quality > vanity • Recency with decay, don’t spam • Cross-chain action beats couch commentary • Verify once, reuse forever Create. Verify. GO #Web3

Momentum 的 TVL 衝破 560M,就跟 2020 年 Uniswap 靜悄悄醞釀前夕一模一樣 當時沒人料到,交易量會在幾個月內爆衝到數十億美元規模 如今 @MMTFinance x @buidlpad 丟出社區發行,Tier 1 LP 鎖倉直擊 250M FDV 門檻,10 月 25 日快照前夕 最低 3k 美元丟進 SUI-USDC 池子,零歸屬期,ve(3,3) 機制把費用直導持有者口袋 我親自測過 CLMM,滑點幾乎隱形,穩定幣對 APY 狂飆 400%,PTB 鏈上交易順滑到像喝水 UGC 小隊上限 10 人,狂刷 5 篇貼文標記帳號,品質分 60% 起跳,就能鎖定 150 美元以上配額 buidlpad 過往翻倍紀錄 4x 到 10x,$MMT 累計 200 億美元兌換量,連農場都還沒上線就甩開大半對手 快照倒數,KYC 10 月 22 日截止,TGE 一放 xSUI 洪水般湧入 我的判斷:早鎖 LP,合資格就提名貢獻,Sui 流動性預計翻倍,代幣化 RWA 即將湧進 誰準備好在翻轉前上車 $SUI $MMT

Privacy that actually computes on-chain Not hype. Not theater. Real encrypted logic, real outputs, no data leak If you care about building in public without exposing your users in public, learn the stack that @zama_fhe is shipping and why the next wave of winners will master it 1/ Why care now - Transparent chains gave us verifiability but pushed sensitive use cases off-chain - Users want sovereignty over data without sacrificing UX or composability - Regulators want compliance that doesn’t turn Web3 into a surveillance honeypot - Builders want to keep the speed of Solidity while adding privacy where it matters That tension is the market. FHE dissolves it by letting you compute on ciphertext and reveal only what you choose 2/ The Zama stack in one glance - fhEVM: Extend Solidity with encrypted types like euint so you can write normal smart contracts that operate directly on encrypted data - TFHE-rs: High-performance, open-source library for fully homomorphic encryption, tuned for CPU and GPU acceleration - FHE Coprocessor: Specialized execution path to accelerate encrypted operations and keep gas costs predictable - Confidential Blockchain Protocol: End-to-end encrypted execution, private-by-default smart contracts, programmable decryption gates, and seamless composition across L1 and L2 You keep EVM familiarity while unlocking encrypted state, encrypted inputs, and encrypted outputs. No trusted off-chain middlemen. No breaking composability 3/ What changes for use cases - Confidential DeFi: Private balances, masked order flow, encrypted LP positions, selective disclosure for audits and proofs - Secure Voting: On-chain votes tallied privately, choice remains confidential, outcomes remain verifiable - Healthcare Data: Compute on EMR and lab results without leaking PII, allow research queries with consented, policy-gated decryption - Private AI: Model inference and training on encrypted datasets so providers never touch raw user data - Gaming: Hidden states and secret moves, provably fair revelations, new formats for on-chain strategy games - Decentralized Identity and Verifiable Credentials: Encrypted attributes with verifiable checks, identity abstraction that preserves composability and trust You don’t have to park sensitive logic off-chain. You bring it on-chain without burning your users’ privacy 4/ FHE vs ZK vs TEEs - ZK proves a statement about plaintext without revealing the plaintext. Great for verification, limited for long-lived private state with lots of dynamic operations - TEEs run code in enclaves but require trust in hardware and supply chain, with a history of side-channel concerns - FHE lets the chain compute on encrypted data with no plaintext exposure. Heavy math meets native privacy, perfect for dynamic, composable private state The winning architectures will combine them. Example: use FHE to compute privately and ZK to prove properties of the encrypted outputs. Best of both worlds 5/ What makes @zama_fhe different - Open by default. TFHE-rs, tooling, examples, and benchmarks are public. That accelerates research, audits, and adoption - Developer-first. Solidity with euint is the shortest path for EVM devs to ship private contracts - Composable encrypted contracts. Your private contract can call my private contract without breaking privacy boundaries - Programmable privacy. Fine-grained control over what decrypts, when, and to whom. Policy is code - Hardware acceleration. CPU and GPU pathways plus a coprocessor roadmap, aiming for throughput the ecosystem can actually use Plenty talk about privacy. Few make it programmable, composable, and buildable in the stack you already use 6/ Dev path you can start today - Learn the euint mental model. Treat encrypted values like first-class citizens in Solidity - Sketch your contract surfaces. Which fields can remain public, which must be encrypted, which events should reveal aggregate-only insights - Model decryption policy. Use role-based, time-based, and event-based gates to control when ciphertext becomes plaintext - Start with a toy contract. Private counter, private voting, encrypted balances, then gradually add state transitions - Add proofs when needed. Prove properties of encrypted outputs without revealing the input - Design for composability. Expose encrypted interfaces that other contracts can consume - Plan for performance. Batch operations, use SIMD-friendly patterns where possible, target the coprocessor when available - Treat logs and front ends as part of your threat model. No plaintext leaks in debug logs or UX Ship small, iterate fast, measure gas, and move up the curve 7/ Performance reality - Encrypted computation is math-heavy by nature, and that’s fine when you architect for it - TFHE-rs gives you primitives with tunable parameters to balance security and speed - Hardware acceleration and coprocessors cut latency and bring costs down over time - Pick the right operations. Homomorphic addition, comparisons, and simple circuits compose well. Design around them Design-first builders will beat clickers. Pattern discipline turns FHE from magic into engineering 8/ Security frame to adopt - Data stays encrypted at rest, in transit, and during compute - Your attack surface shifts from data exfiltration to control over decryption policy - Threat model the decryptors. If no one can decrypt, private state remains private, period - Side channels move to metadata. Structure your app to avoid accidental leakage through timing, sizes, or ordering Privacy is not a binary. It’s a gradient you control in code 9/ Regulatory and enterprise angle - KYC without exposure. Verify attributes in encrypted form and reveal only pass or fail - Confidential liquidity. Institution-grade privacy with auditable, selective disclosure - Healthcare-grade compliance. Consent gates as smart contract policy rather than paper contracts - Data minimization by design. Build compliance in the code path and not in a separate process This is how Web3 aligns with law without surrendering sovereignty 10/ My 2025 predictions around FHE in Web3 - Multiple L2s pilot FHE precompiles or coprocessor integrations for encrypted EVM ops - At least one major DeFi protocol rolls out a private vault line with encrypted balances and ZK attestations - Identity abstraction gets a breakout with encrypted credentials becoming composable primitives for governance and markets - Private AI inference on consumer data becomes a top-3 growth wedge for consumer apps - Gaming finds product-market fit with encrypted on-chain strategy mechanics Builders who learn euint and fhEVM now will own these greenfield categories 11/ How to position yourself as a builder - Read the fhEVM docs and scan euint examples - Fork an example repo and run local demos - Build a private voting or private counter PoC - Add policy-based decryption to test roles - Benchmark a flow with TFHE-rs on CPU, then GPU - Draft a doc on privacy boundaries for your app - Share learnings publicly, gather feedback, iterate If you can write Solidity, you can write encrypted Solidity 12/ If you’re a founder - Map your data flows. Circle the fields that cost you growth because you cannot put them on-chain today - Convert the circles into encrypted fields and run a risk review - Re-design UX so it doesn’t flash plaintext anywhere in the pipeline - Plan for compliance and audits via selective disclosure and proof artifacts - Pitch the delta. Better UX, more trust, new markets unlocked by private compute Privacy can be your acquisition wedge instead of a bolt-on checkbox 13/ Ecosystem fit - FHE plus ZK is a power combo. Compute privately, prove publicly - FHE plus oracles enables encrypted off-chain queries with on-chain verification - FHE plus account abstraction lets users control policy at the wallet level - FHE plus restaking secures specialized coprocessors and keeps incentives aligned Think Lego, not silo 14/ Community and growth angle - @zama_fhe runs the #ZamaCreatorProgram to spotlight builders and educators who move the space forward - Season 3 has a 56,000 dollar pool and 1,000 Zama OG NFTs for creators who show up consistently and add value - Season 1 minted 250. Season 2 minted 500. More slots this time, more room to step in - Post thoughtful content, tag @zama_fhe, use the hashtag, focus on signal over fluff, and you’ll climb leaderboards Creators who teach while they build compound credibility and upside 15/ Quick starter ideas to publish this week - Thread: Implementing euint in a simple ERC-20-style private balance demo and measuring gas - Deep dive: How programmable decryption gates enable compliant DeFi strategies - Walkthrough: Converting an on-chain vote to encrypted votes with verifiable tally - Case study: Private inference with an encrypted feature vector for a recommendation engine - Opinion: When to keep data public and when to encrypt in a composable protocol Ship, measure, share, repeat 16/ FAQs I’m getting - Is this only for L2s? No. The Confidential Blockchain Protocol targets both L1 and L2, with coprocessors improving economics where available - Will this break composability? No. Encrypted contracts can talk to each other while maintaining privacy boundaries - Do I need a PhD in crypto? No. You need Solidity, good systems sense, and willingness to learn the euint paradigm - Is it open? Yes. TFHE-rs and key tools are open-source. The community pushes the frontier together The bar to entry is lower than you think if you start with a small scope 17/ Builder checklist - Install toolchain and compile a demo - Write a simple encrypted function and test locally - Define decryption roles and simulate at least two policy flows - Audit for plaintext leaks in logs and events - Document assumptions and what your app does not reveal - Share a post with your learnings and invite review - Join community channels to calibrate benchmarks and params Progress beats perfection. Every week you wait, someone else closes the gap 18/ Final take - verifiability created the first wave - scalability created the second wave - privacy that computes will drive the third wave The winners will be those who master encrypted state, encrypted execution, and selective revelation as first-class design tools If you’ve been looking for where the next 1000x dev skill sits in Web3, it looks a lot like fhEVM, euint, TFHE-rs, and a coprocessor pipeline Follow @zama_fhe, learn by building, and if you create content, tag the team and use #ZamaCreatorProgram to get seen Are you shipping your first encrypted contract this month or watching others take your use case while you wait Like Repost Tell me which use case you’re claiming first and I’ll share a simple blueprint to get you from idea to encrypted MVP in a week

crypto is finally layering utility with intelligence RT @BitgetWallet: morph integration live 220M $BGB burned, 220M locked $BGB as gas and governance on @MorphLayer 0.02 fees, ceFi users flowing into l2 payfi rails RT @bluwhaleai: tge countdown and sui bridges wallet graph across 37+ chains zk privacy, node rewards, agents coming online $BLUAI listings and airdrop checker live the stack looks real when numbers meet flow - 80M+ users managing assets across 130+ chains on @BitgetWallet - card rollout for daily spend, swaps with mev-aware routing, getgas in USDT/BGB - 270M+ wallets indexed by @bluwhaleai with adaptive insights and whale scoring - mobile nodes turning data into a productive signal without leaking identity order flow vs signal flow matters - pay, bridge, stake, trade in one tap on @BitgetWallet - query, score, and route intelligence across chains on @bluwhaleai - ceFi audience meets deai agents through morph’s settlement layer - governance gets practical when $BGB pays gas and $BLUAI powers queries just surreal to watch payments and intelligence converge while the hype dial turns down and the builder dial turns up sitting at the intersection of access and awareness - access: card + super dex + earn center + 24/7 recovery mpc - awareness: savvy ai copilot + whale score + multichain zk rollups - stability: quarterly burns and protection fund vs emissions with halving schedules - scale: 120M+ ecosystem users vs 2M+ beta users migrating into agent economies if you run your day on-chain, the question becomes simple do you prefer a wallet that collapses steps, or an intelligence layer that collapses noise quick takeaways for operators - on morph, paying gas in $BGB compresses friction for onboarding - on sui, $BLUAI queries can personalize dapp flows without doxxing wallets - bridge payments and insights, not just tokens - treat governance as product, not ceremony open question for the timeline which stack are you building with first - @BitgetWallet for payfi rails and mass user access - @bluwhaleai for deai agents and adaptive signals reply with your pick and why, or quote with a short flow diagram of your pipeline best answers get bookmarked for a follow-up breakdown on ceFi<>deFi<>deai routing without extra hops also curious where do you see the higher near-term compounding - $BGB utility on morph and card-driven spend - $BLUAI agent queries and node incentives driving dapp retention signal beats slogans, show us your flow

傳統金融要上鏈,口號喊了五年,卡住的其實不是「鏈不夠快」,而是合規、隱私、性能三難同時滿足。銀行要風控、審計與選擇性披露;DeFi 要可組合性、流動性、開放網路。兩邊想要的東西看似衝突,結果就是互相隔離、資金效率低落 我在傳統金融與鏈上都打過仗,最難的一步根本是「讓兩邊用同一套語言與基礎設施」。@RaylsLabs 把這一步做成產品,而不是白皮書口號:公鏈與私網並行、資料加密執行、可審計事件外露、EVM 兼容不改生態,讓機構能把核心業務搬上鏈,同時打開到公共 DeFi 的出口 Rayls 的框架很務實: - 隱私節點+私有網路承載敏感交易,配合選擇性披露滿足監管 - 公開鏈承接流動性與可組合性,USD 計價 Gas 降低波動風險 - Enygma 密碼學保障交易機密,附帶 MEV 防護與身份抽象 - Axyl 共識與以太坊級安全,讓機構不必犧牲性能或合規 這套設計直接落地在三個高價值場景: 1) RWA:債券、應收帳款、房貸等真正能產生現金流的資產可私密代幣化,再接公共流動性池 2) CBDC 與同業清算:國內外支付、FX corridor 實時結算,資料保密但可審計 3) 合規 DeFi:銀行子網的資金進入公開協議,標準化的身份與披露降低逆向選擇風險 市場側的訊號也不差。公售賣到斷貨,超過 70 國、1100+ 參與者、募得約 170 萬美金,這不是靠空話。這代表全世界在找「能把銀行帶上鏈、又能安全接公共流動性」的基建。不是去重造一條孤島鏈,而是把傳統金融的私有網與公共 DeFi 融成一張網路 更關鍵的是使用層的證據:測試網在高 TPS 壓測下仍可維持可審計信號輸出,金融機構可以在私域執行,公域讀取採用跡象(Proof of Usage),把「合規使用」轉為可見度,這點在 RWA 定價與流動性預期上非常重要。像 @TimHaldorsson 這種長期做機構生態的人,看重的就是這種「把採用變成可觀測」的機制 這條路不炫,但必要。加密要走向真實經濟,靠的不是把槓桿加更高,而是把清算、隱私、身份、合規、流動性整合成可運作的市場結構。$RLS 的 TGE 是時間軸上的起點,真正的里程碑會是第一批銀行與受監管資產在公域形成可持續的流動性漏斗 拋個問題給大家:你覺得 2026 前,哪個應用率先爆量 CBDC 支付、RWA 債券、還是跨境匯兌結算?為什麼?引用發你的推、貼上你心中的路徑設計,我晚上來回你們的觀點 #DeFi #TradFi

People with Innovator archetype

褪色者·宝爸 / 代码锻造学徒 / 小红书×AI探路人 / indie dev. 初见者

币行者|携手 kaitoAI × vigent|行走于数字经济前沿,用 AI 赋能区块链

Taking project for November. kreos.agency | Design, redefined : We build illustrated, motion-first websites, SaaS, and brands end-to-end.

🚀AI tools, prompts & wild ideas Built for curious minds🤖CPP: @BasedLabsAI @AltSocietyAI

INFP 白羊|AI超级用户|英语日语越南语可用|提供全球上网SIM&eSIM|提供精品咖啡豆|12只狗2只猫的主人|加我微信: galaktikasleepmaster

🌍 Sharing thoughts | Learning & building daily ✨ Interested in Web3, tech & community 💬 Opinions are my own

OG degen. Flipping JPEGs since the first rug. Layer-zero thinker. Decentralized or dead. 💀 0xTenx.eth | 🧠 Mint. Hold. Exit. Repeat.

平希木音-大厨烹调|输入-教育,生成-电影,输出-就业|贰叁航线-跨行桥|琥珀制造。

AI x Crypto|出版3本书📚️ 超级个体 |Vibe Coding实践🤖 加密世界 |7年实战 💰️ 退市CEO |20余年创业🏖️ AI艺术家 |5W+画作🎨 只保留X |跟上未来👩🚀

AI Engineer | 6 years dev, recent focus on AI/ML Python • RAG • Automation • LLMs Building agentic systems & MCP tools. Launching Ramble. Open to consulting

Crypto researcher | On-chain degen | Alpha hunter Deep-diving protocols, testing testnets, breaking things so you don’t have to. Early user, airdrop enjoyooor

Pionner at @Magpiexyz_io member of @Trustsquadmates @Fraxforce Agent | Don,t trust verify. #DeFi

Explore Related Archetypes

If you enjoy the innovator profiles, you might also like these personality types: