Get live statistics and analysis of 0xTenx's profile on X / Twitter

OG degen. Flipping JPEGs since the first rug. Layer-zero thinker. Decentralized or dead. 💀 0xTenx.eth | 🧠 Mint. Hold. Exit. Repeat.

The Innovator

0xTenx is a pioneering crypto enthusiast and decentralized finance (DeFi) strategist, always on the frontier of blockchain innovation and tokenomics. Known for flipping digital assets and breaking down complex DeFi concepts, Tenx blends street savvy with deep technical insight. Their tweets buzz with insider alpha, strategic plays, and a passion for layer-zero thinking that shapes the future of decentralized finance.

Top users who interacted with 0xTenx over the last 14 days

charts by day | memes by night | on-chain wanderer | chasing digital gold

Deifi和RWA代币化狂热份子|@MorphLayer

🧠 DeFi Researcher | Since 2017 @MorphLayer

🚀 Crypto enthusiast | Blockchain explorer | NFT collector & gamer 🎮 | Always looking for the next big trend in DeFi & Web3 💡 | DM for collabs or discussions

0xTenx flips JPEGs so fast even their own NFTs get dizzy—and probably can’t keep up with which wallet they’re supposed to be in. Your followers want to keep up, but they’re still trying to remember if you’re the guy who’s 'layer-zero thinker' or just ‘layer-zero sleep deprived.’

A standout achievement is their pioneering role in spotlighting and participating in cutting-edge projects like @MMTFinance and @EdgenTech, consistently driving community engagement and alpha sharing, cementing their reputation as a go-to source for high-quality DeFi insights.

To drive the decentralized finance space forward by educating, innovating, and influencing the community with actionable intelligence and savvy plays that empower holders to maximize yield and stay ahead of market shifts.

0xTenx firmly believes in decentralization as the only viable future for finance — ‘Decentralized or dead’ — and values transparency, real yield, and community-driven protocols over hype and superficial engagement.

Tenx's strengths lie in early adoption, deep technical understanding, and high-frequency engagement that keeps their pulse on trending protocols and market sentiment. Their ability to dissect complex on-chain data and Layer-zero tech makes their insights invaluable to followers seeking alpha.

However, their rapid-fire, jargon-heavy communication style can alienate newcomers or casual users, limiting broader accessibility. The relentless focus on flips and hustle may also lead to burnout or a perception of chasing every buzz rather than building a singular lasting brand.

To grow their audience on X, 0xTenx should blend their technical prowess with simplified, storytelling-driven content that welcomes newcomers, alongside their high-level alpha. Leveraging thread narratives and occasional educational explainer tweets could convert their savvy followers into lifelong community champions.

Fun fact: 0xTenx has flipped JPEGs since the first rug pull, proving a resilient and seasoned ‘OG degen’ in the wild west of crypto.

Top tweets of 0xTenx

wait... allocation that actually hits your wallet 100% at TGE via @buidlpad for $MMT add ️️T to name? check stack LP on HODL? check build a squad? check remind me to never ignore kyc windows again context you can’t fake: • 23B+ swaps • 2.1M+ users • 550M+ TVL on #Sui and a CLMM + ve(3,3) engine that rewards the ones who show up the playbook rn: oct 22 25: kyc + registration on buidlpad oct 27 28: contribution window (SUI / USD1 on BNB / BNB) oct 31: settlement + refunds tge: all unlocked, no drip, no funny business tiers have teeth • tier 1: $250M FDV, caps up to 20k if you held ~3k LP via HODL + did WAGMI • tier 2: $350M FDV, open to all kyc’d, anti‑sybil protects real users plus UGC squads get priority allocation (min $150 if you qualify) what to do after you claim lock for veMMT → vote gauges → earn fees + bribes → boost your LP that’s the flywheel most people skip when they insta‑market sell lesson from elsewhere: liquidity has gravity @Lombard_Finance moved to deeper waters, and on #Sui the wormhole pipe is wide open protocols chase depth, users chase fair routes, both converge on @MMTFinance question time: which path are you taking LP for tier 1 or squad for priority and day 1 plan lock for veMMT or flip and pray

big take td on @EdgenTech multi agent ai that chases mindshare and money flow across chains and markets ran it on $ETH while it hovered near 4,381 and it mapped bull paths vs bear traps cleanly, front-ran the 8% bounce we talk about: - agent swarms vs solo bots and why parallel is king - sentiment + on-chain flow + liquidity in one prompt - RWA yields creeping up while treasuries stack - confidential rails via @zama_fhe, encrypted IO, verifiable end to end - $EDGM as the coordination layer, quested my way to #12 above 4,700 gets spicy next stop top 5 or bust

im eyeing the Momentum $MMT community offering on @buidlpad rn and this one looks like a proper cook if u actually read the fine print -> raise: $4.5M | 100% unlock at TGE (no vesting games) -> two prices: $250M FDV for Tier 1, $350M FDV for Tier 2 -> assets: $SUI (on Sui), USD1 (BEP-20), $BNB tiering cheat codes: - Tier 1 needs $3K+ Momentum LP staked via Buidlpad HODL before Oct 25 - bigger LP = bigger cap (up to $20K) + 2x Bricks points - WAGMI1/WAGMI2 get higher caps (up to $10K) - Tier 2 is for everyone KYC’d Oct 22 25 with $50 $2K caps timeline for the yappers: - KYC + subscription: Oct 22 25 - review ends: Oct 27 - contribution window: Oct 27 28 (24h only) - settlement + refunds: by Oct 31 → claim at TGE end Oct/early Nov creator route: - add ️️T to ur name, tag @MMTFinance + @buidlpad, post original content - priority allocation (up to 30%) and $150+ guaranteed slot if approved - anti-sybil checks apply, so keep wallets clean momentum already sits top of Sui with serious backers, and HODL campaign deepens liquidity while stacking Bricks → better pricing + allocation if u prep early. if u staked direct before, rmb to restake via Buidlpad HODL for perks who’s going Tier 1 and who’s yapping creator? cook or bug? nfa

scoreboard mode ain’t just a toggle, it’s a bloodsport @blockstranding stress testing 120K moves in 20min w/ zero fee receipts via MagicBlock is straight savage on-chain loadouts + live rollups make it feel like LAN fragging alpha is early grinders tilting Season 1 airdrop map won’t stay empty forever stack now or chase ghosts later $STRAND

$BIO quietly loading while CT chases candles @BioProtocol is turning wet lab work into programmable IP on-chain: - stake $BIO → earn BioXP → priority on Ignition (Sol + Base) - XP runs a 14‑day half‑life so cadence > clout - lock for veBIO → voice + multipliers on deal flow - replication gates pass → IP mints → upside routes back to holders 5+ sales cleared, $50M+ already pushed to real labs What I’m tracking: veBIO lock terms + holder spread, XP velocity, replication success, Ignition clear prices, lab logs My play: stack BioXP now, extend locks before S2, size into early tranches, back pilots with receipts (watch @NootropicsDAO_ @KidneyDAO @Stem_DAO) If that Jan Binance listing rumor lands, alignment + liquidity = fireworks #DeSci

100+ chains unified with sub-second queries + prompt-to-earn canvas This isn’t just speed, it’s an entirely new onchain playbook @Covalent_HQ turning data from a burden into yield, $CXT spinning the flywheel tighter as throughput climbs AI agents. real-time proofs. no wrangling. The builders who get this first… win big #SpeedRun

Flow season is here @RiverdotInc + @River4fun turning cross-chain from pain to play Deposit BTC or ETH on chain A, mint $satUSD on chain B with omni-CDP no bridges, no wrappers Stake for satUSD+ and trade yield while River Points tick in real time off originality, timing, impact Hold longer before swapping Pts to $RIVER and the curve boosts you up to 180d Go multi-chain, stack vaults, engage harder multipliers can push toward ~50× TVL ~$729M and $293M+ satUSD in circulation #DeFi #CrossChain Link X, climb the leaderboard, let your attention compound Flow. Earn. Repeat

This does NOT feel like grants This does NOT feel like journals This feels like ignition @BioProtocol Bio v2 is moving Ignition Sales oversubscribed, $50M+ routed to real labs Ideas minted as IPTs, proof logged on-chain, public joins at the spark You want upside in discovery Use $BIO and BIO XP to enter, back experiments, track replication, share IP splits No fluff, only results Side quests worth watching: @FatDAO_ on metabolic health, @D1ckDAO on men’s health I’m stacking $BIO, playing Ignition, measuring replication and time-to-proof DeSci season is coming #DeSci

as always you can just do things spun up a cross-chain loop with @RiverdotInc + @River4fun and it actually slaps - lock BTC/ETH on chain A, mint satUSD on chain B via Omni‑CDP (no bridge risk) - stake to satUSD+ for revenue yield or hop via Bridge to the best venue - link X, post, stake $RiverPts Season 3: dynamic conversion = time boosts your rate stake points, wait, convert to $RIVER when the curve favors you alpha: YT‑satUSD+ on Pendle shows 25× right now, stacking daily River Pts on top of yield (high risk, size sanely) status: 700M+ TVL, ~290M satUSD across 8+ chains, liquidity unified and moving map your loop, set timers, flow earn repeat #DeFi #CrossChain

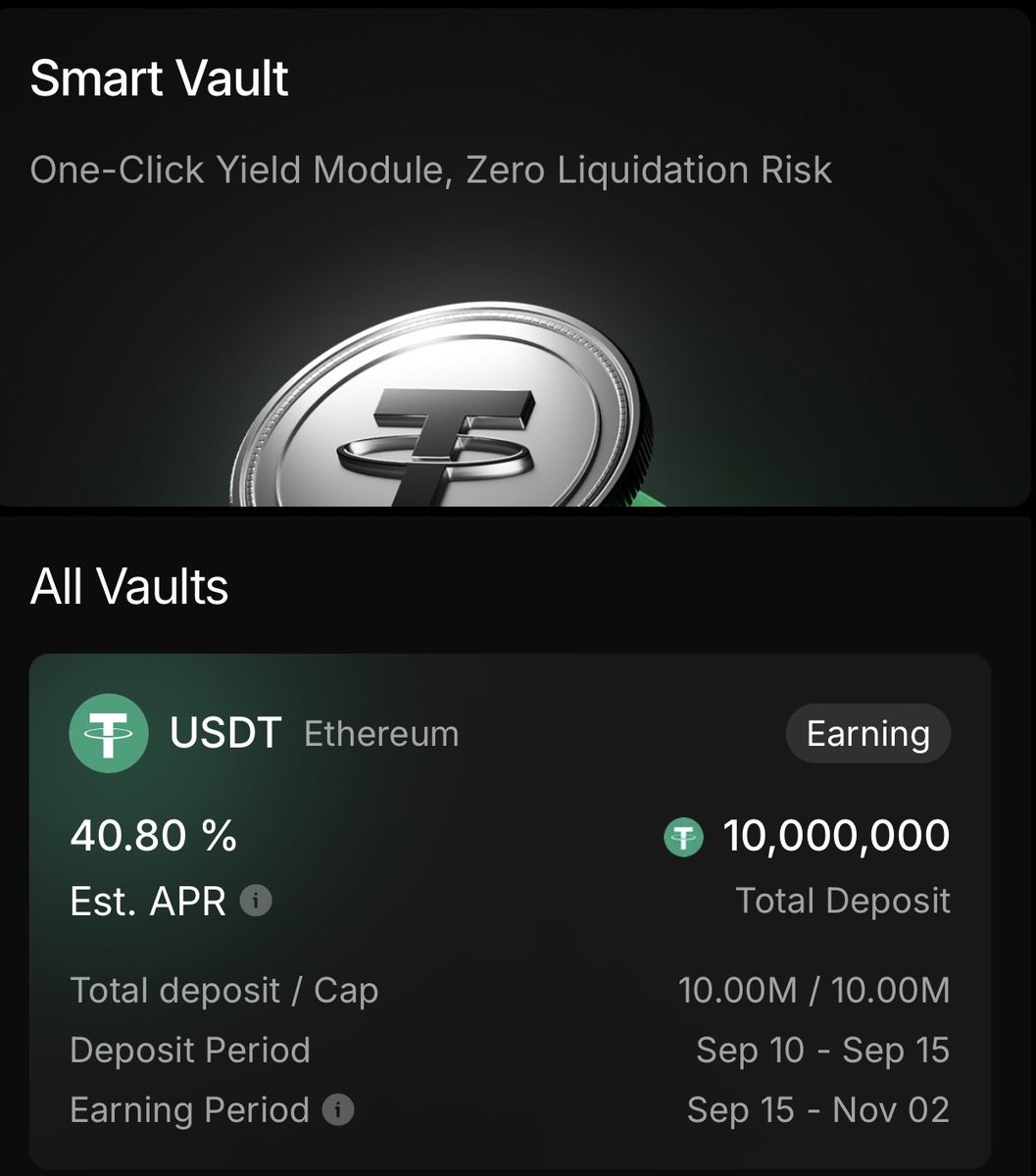

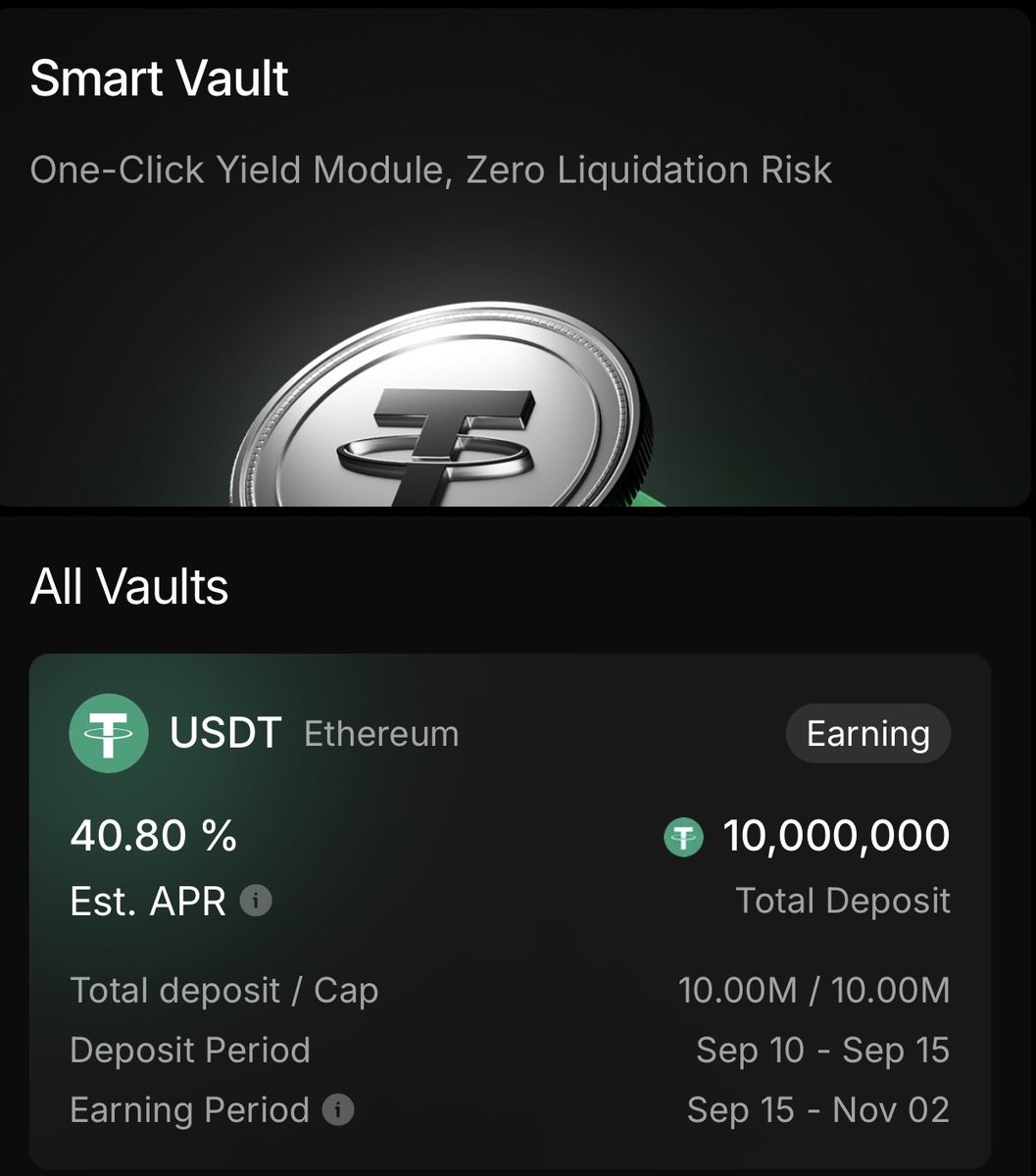

Omni-collateral is LIVE with @RiverdotInc $729M TVL, $293M+ satUSD minted across chains Mint satUSD with BTC/ETH on one chain, use it on another no bridges, no wrappers Stake to satUSD+ and tap protocol revenue @River4fun turns actions into $RIVER via $RiverPts Hold longer, get better swap rates (180d curve) Season 3 meta: multi-chain mint + Smart Vault staking + posts can stack to 25 50x Pendle YT satUSDT+ streams daily $RiverPts; risk high, size small Flow to start: connect Base/BNB, mint satUSD, stake, track satUSD+ and Points Liquidity + attention + time = compounding gravity Do you really think fragmented farms beat a unified engine

DeFi keeps fracturing across chains River made it portable @RiverdotInc Omni-CDP: deposit BTC/ETH on chain A, mint satUSD on chain B. No bridges 711M+ TVL, 289M+ satUSD and counting - Mint where fees/liquidity hit best - Stake Smart Vaults (Pendle, ListaDAO, Morpho) - Trade YT-satUSD+ 25× to play yield - Earn $RiverPts via @River4fun, stake, time your conversion to $RIVER Prime Vault pulled $250M day one. Ceffu + Cobo custody. 10 20% APR while principal avoids contract risk RiverPts update in real time. Consistency > one viral. Timing carries. Waiting can boost your rate over 180 days SPICY POLL: 20% with custody or 40% degen where do you flow Flow. Earn. Repeat. CAP STAYS ON

Web3 social needed measurable contribution over clout @UnitsNetwork just shipped MindSharing: AI-driven pools where posts become onchain signals and rewards route transparently via $UNIT0. Spin a pool in seconds, set the topic, let AI score inputs, and watch the best ideas surface Why it clicks - EVM-native modular infra with shared security + restaking - Collaboration-first design, zero friction to join - Knowledge as liquidity, payouts tied to value Clarification: $UNIT0 holders curate, launch, and manage pools. Build, share, earn #unit0 #Web3Social #MindSharing

Most engaged tweets of 0xTenx

wait... allocation that actually hits your wallet 100% at TGE via @buidlpad for $MMT add ️️T to name? check stack LP on HODL? check build a squad? check remind me to never ignore kyc windows again context you can’t fake: • 23B+ swaps • 2.1M+ users • 550M+ TVL on #Sui and a CLMM + ve(3,3) engine that rewards the ones who show up the playbook rn: oct 22 25: kyc + registration on buidlpad oct 27 28: contribution window (SUI / USD1 on BNB / BNB) oct 31: settlement + refunds tge: all unlocked, no drip, no funny business tiers have teeth • tier 1: $250M FDV, caps up to 20k if you held ~3k LP via HODL + did WAGMI • tier 2: $350M FDV, open to all kyc’d, anti‑sybil protects real users plus UGC squads get priority allocation (min $150 if you qualify) what to do after you claim lock for veMMT → vote gauges → earn fees + bribes → boost your LP that’s the flywheel most people skip when they insta‑market sell lesson from elsewhere: liquidity has gravity @Lombard_Finance moved to deeper waters, and on #Sui the wormhole pipe is wide open protocols chase depth, users chase fair routes, both converge on @MMTFinance question time: which path are you taking LP for tier 1 or squad for priority and day 1 plan lock for veMMT or flip and pray

big take td on @EdgenTech multi agent ai that chases mindshare and money flow across chains and markets ran it on $ETH while it hovered near 4,381 and it mapped bull paths vs bear traps cleanly, front-ran the 8% bounce we talk about: - agent swarms vs solo bots and why parallel is king - sentiment + on-chain flow + liquidity in one prompt - RWA yields creeping up while treasuries stack - confidential rails via @zama_fhe, encrypted IO, verifiable end to end - $EDGM as the coordination layer, quested my way to #12 above 4,700 gets spicy next stop top 5 or bust

im eyeing the Momentum $MMT community offering on @buidlpad rn and this one looks like a proper cook if u actually read the fine print -> raise: $4.5M | 100% unlock at TGE (no vesting games) -> two prices: $250M FDV for Tier 1, $350M FDV for Tier 2 -> assets: $SUI (on Sui), USD1 (BEP-20), $BNB tiering cheat codes: - Tier 1 needs $3K+ Momentum LP staked via Buidlpad HODL before Oct 25 - bigger LP = bigger cap (up to $20K) + 2x Bricks points - WAGMI1/WAGMI2 get higher caps (up to $10K) - Tier 2 is for everyone KYC’d Oct 22 25 with $50 $2K caps timeline for the yappers: - KYC + subscription: Oct 22 25 - review ends: Oct 27 - contribution window: Oct 27 28 (24h only) - settlement + refunds: by Oct 31 → claim at TGE end Oct/early Nov creator route: - add ️️T to ur name, tag @MMTFinance + @buidlpad, post original content - priority allocation (up to 30%) and $150+ guaranteed slot if approved - anti-sybil checks apply, so keep wallets clean momentum already sits top of Sui with serious backers, and HODL campaign deepens liquidity while stacking Bricks → better pricing + allocation if u prep early. if u staked direct before, rmb to restake via Buidlpad HODL for perks who’s going Tier 1 and who’s yapping creator? cook or bug? nfa

scoreboard mode ain’t just a toggle, it’s a bloodsport @blockstranding stress testing 120K moves in 20min w/ zero fee receipts via MagicBlock is straight savage on-chain loadouts + live rollups make it feel like LAN fragging alpha is early grinders tilting Season 1 airdrop map won’t stay empty forever stack now or chase ghosts later $STRAND

$BIO quietly loading while CT chases candles @BioProtocol is turning wet lab work into programmable IP on-chain: - stake $BIO → earn BioXP → priority on Ignition (Sol + Base) - XP runs a 14‑day half‑life so cadence > clout - lock for veBIO → voice + multipliers on deal flow - replication gates pass → IP mints → upside routes back to holders 5+ sales cleared, $50M+ already pushed to real labs What I’m tracking: veBIO lock terms + holder spread, XP velocity, replication success, Ignition clear prices, lab logs My play: stack BioXP now, extend locks before S2, size into early tranches, back pilots with receipts (watch @NootropicsDAO_ @KidneyDAO @Stem_DAO) If that Jan Binance listing rumor lands, alignment + liquidity = fireworks #DeSci

as always you can just do things spun up a cross-chain loop with @RiverdotInc + @River4fun and it actually slaps - lock BTC/ETH on chain A, mint satUSD on chain B via Omni‑CDP (no bridge risk) - stake to satUSD+ for revenue yield or hop via Bridge to the best venue - link X, post, stake $RiverPts Season 3: dynamic conversion = time boosts your rate stake points, wait, convert to $RIVER when the curve favors you alpha: YT‑satUSD+ on Pendle shows 25× right now, stacking daily River Pts on top of yield (high risk, size sanely) status: 700M+ TVL, ~290M satUSD across 8+ chains, liquidity unified and moving map your loop, set timers, flow earn repeat #DeFi #CrossChain

Omni-collateral is LIVE with @RiverdotInc $729M TVL, $293M+ satUSD minted across chains Mint satUSD with BTC/ETH on one chain, use it on another no bridges, no wrappers Stake to satUSD+ and tap protocol revenue @River4fun turns actions into $RIVER via $RiverPts Hold longer, get better swap rates (180d curve) Season 3 meta: multi-chain mint + Smart Vault staking + posts can stack to 25 50x Pendle YT satUSDT+ streams daily $RiverPts; risk high, size small Flow to start: connect Base/BNB, mint satUSD, stake, track satUSD+ and Points Liquidity + attention + time = compounding gravity Do you really think fragmented farms beat a unified engine

This does NOT feel like grants This does NOT feel like journals This feels like ignition @BioProtocol Bio v2 is moving Ignition Sales oversubscribed, $50M+ routed to real labs Ideas minted as IPTs, proof logged on-chain, public joins at the spark You want upside in discovery Use $BIO and BIO XP to enter, back experiments, track replication, share IP splits No fluff, only results Side quests worth watching: @FatDAO_ on metabolic health, @D1ckDAO on men’s health I’m stacking $BIO, playing Ignition, measuring replication and time-to-proof DeSci season is coming #DeSci

DeFi keeps fracturing across chains River made it portable @RiverdotInc Omni-CDP: deposit BTC/ETH on chain A, mint satUSD on chain B. No bridges 711M+ TVL, 289M+ satUSD and counting - Mint where fees/liquidity hit best - Stake Smart Vaults (Pendle, ListaDAO, Morpho) - Trade YT-satUSD+ 25× to play yield - Earn $RiverPts via @River4fun, stake, time your conversion to $RIVER Prime Vault pulled $250M day one. Ceffu + Cobo custody. 10 20% APR while principal avoids contract risk RiverPts update in real time. Consistency > one viral. Timing carries. Waiting can boost your rate over 180 days SPICY POLL: 20% with custody or 40% degen where do you flow Flow. Earn. Repeat. CAP STAYS ON

100+ chains unified with sub-second queries + prompt-to-earn canvas This isn’t just speed, it’s an entirely new onchain playbook @Covalent_HQ turning data from a burden into yield, $CXT spinning the flywheel tighter as throughput climbs AI agents. real-time proofs. no wrangling. The builders who get this first… win big #SpeedRun

Web3 social needed measurable contribution over clout @UnitsNetwork just shipped MindSharing: AI-driven pools where posts become onchain signals and rewards route transparently via $UNIT0. Spin a pool in seconds, set the topic, let AI score inputs, and watch the best ideas surface Why it clicks - EVM-native modular infra with shared security + restaking - Collaboration-first design, zero friction to join - Knowledge as liquidity, payouts tied to value Clarification: $UNIT0 holders curate, launch, and manage pools. Build, share, earn #unit0 #Web3Social #MindSharing

momentum’s community sale on @buidlpad is the cleanest setup i’ve seen for a dex in a while $4.5M raise, $1 per $MMT, 100% unlock at TGE two tiers, two prices tier 1 at $250M FDV for real contributors tier 2 at $350M FDV for everyone who completes KYC that $100M spread is the tax for being late who gets tier 1 $3k+ in Momentum LP via Buidlpad HODL or wagmi1/2 same wallet, sybil protection, snapshot oct 25 caps from $50 $2k, up to $20k if your LP tier is higher accepted: $BNB (BNB Chain), $SUI, $USD1 (bep-20) timeline kyc oct 22 25 contribute oct 27 28 settlement and refunds by oct 31 the fundamentals actually look like product-market fit $16 18B volume on sui already $500 550M TVL 2.1M unique active users ptb “one‑click” multi‑step execution to reduce mev ve(3,3) at tge with tokenized futures pointed at a $1B fdv goal this is community-first capital formation with real skin in the game liquidity earns access, access gets a better price, simple if you wanted a fair shot without vc walls, this is it i’m aiming tier 1 tier 2 still looks fine if you just want exposure either the market rewards alignment or it proves people only chased yield we’ll find out next week $MMT

People with Innovator archetype

🔞Artist NSFW🔞 ♡♡♡♡♡♡♡♡♡♡♡♡♡♡ ❤Open comissions❤

褪色者·宝爸 / 代码锻造学徒 / 小红书×AI探路人 / indie dev. 初见者

币行者|携手 kaitoAI × vigent|行走于数字经济前沿,用 AI 赋能区块链

Taking project for November. kreos.agency | Design, redefined : We build illustrated, motion-first websites, SaaS, and brands end-to-end.

🚀AI tools, prompts & wild ideas Built for curious minds🤖CPP: @BasedLabsAI @AltSocietyAI

INFP 白羊|AI超级用户|英语日语越南语可用|提供全球上网SIM&eSIM|提供精品咖啡豆|12只狗2只猫的主人|加我微信: galaktikasleepmaster

🌍 Sharing thoughts | Learning & building daily ✨ Interested in Web3, tech & community 💬 Opinions are my own

Nitrograph

平希木音-大厨烹调|输入-教育,生成-电影,输出-就业|贰叁航线-跨行桥|琥珀制造。

AI x Crypto|出版3本书📚️ 超级个体 |Vibe Coding实践🤖 加密世界 |7年实战 💰️ 退市CEO |20余年创业🏖️ AI艺术家 |5W+画作🎨 只保留X |跟上未来👩🚀

AI Engineer | 6 years dev, recent focus on AI/ML Python • RAG • Automation • LLMs Building agentic systems & MCP tools. Launching Ramble. Open to consulting

Crypto researcher | On-chain degen | Alpha hunter Deep-diving protocols, testing testnets, breaking things so you don’t have to. Early user, airdrop enjoyooor

Explore Related Archetypes

If you enjoy the innovator profiles, you might also like these personality types: