Get live statistics and analysis of Adam Livingston's profile on X / Twitter

The Bitcoin Wizard | Author of The Great Harvest | @BitcoinForCorps | MSTR + MTPLF HODLER | adamlivingstonbusiness@gmail.com

The Thought Leader

Adam Livingston is a Bitcoin-savvy thought leader who fearlessly challenges conventional financial wisdom with sharp insights and bold predictions. As an author and vocal advocate for cryptocurrency, Adam educates and provokes his audience with both data-driven logic and a fearless embrace of financial innovation. His tweets are a mix of witty provocations that urge followers to rethink traditional investments in favor of cutting-edge alternatives.

Top users who interacted with Adam Livingston over the last 14 days

Investor / Retired Financial Advisor - Real Estate Agent - FINRA- 6,7,26,63,66 Life,Health, P&C - Real Estate Agent #Bitcoin $BTC / Hodler $MSTR Maxi

I am one of 100 million a protective projection protocol in the vision of Satoshi Nakamoto. Bitcoin, this is the way.

Freedom Maximalist 🇬🇧 | Bitcoin is Noah's Ark.

Bitcoin | Freedom | Apple pie | Stack sats and relax | Bitcoin to $1 million | Founder of The Bitcoin Army

🚀 Discover new crypto gems with real-time data on tokens, DeFi projects, and key metrics. Explore and make informed decisions today. 💎

Follow the money.

Invest in the following order: 1. Relationships 2. Health is Wealth 3. Financial Tenure! ZCash.me/chewie

God, family and country. Free minds/free markets. DT won three elections to serve two. BTC is inevitable. MSTR is close behind. The Founders were geniuses.

not financial advice. These are my opinions. Digital Property and Assets | Privacy

Supporting @aifinyo , Germany’s first public ₿itcoin treasury strategy company . Thought leadership and community. Inspired by Saylor. Engineered for D-A-CH.

A pioneering utility coin powering gas fees for the Peace Through Trade (PTT) L1 PoW Blockchain ecosystem. Join our community: discord.gg/b5NBzKwAA8

Arctic SAR Pilot. Desert Rat, Nomad , Ne'er-do-well;)

Retired Pilot/BITCOIN/Freedom

Options trader turned #Bitcoin HODLer. I sell volatility and use premiums to stack sats and $MSTR shares.

$BTC for Separation of Money and State | $MSTR $MTPLF | Tickets out are priced in Bitcoin | Signal | @kalosplastics | #BTCplasticsurgeon

it’s all about strategy… including Aithropology …Everything lasts forever…if it impacts.

Mid-IQ degen | High-IQ risk control | Trader | Love cats 💎💎💎

Blockchain Bitcoin Quality Altcoins AI Robotics Tesla Groundbreaking Innovation.

Buy ₿itcoin for your last name not your first | ₿ullieve in a brighter future | ₿e your own ₿ank

Adam’s tweet storm is so relentless and cutting that Bitcoin’s volatility seems downright stable by comparison; one might say he’s the crypto market’s unofficial lightning rod—shockingly informative, but you might want to wear a helmet before diving in.

Adam’s biggest win is his breakthrough tweet about the 50-year mortgage strategy, which amassed over 1.3 million views and sparked thousands of conversations—solidifying his reputation as a pioneering financial thinker with a knack for turning complicated concepts into viral content.

Adam’s life purpose is to disrupt outdated financial narratives and empower individuals through education and advocacy about Bitcoin and innovative financial strategies. He seeks to lead a paradigm shift away from conventional, government-backed fiat systems toward decentralized digital assets, fostering financial literacy and independence.

He strongly believes in the power of Bitcoin as a transformative tool against economic mismanagement and inflation, valuing financial sovereignty, critical thinking, and the courage to question the status quo. Adam sees traditional debt structures as traps and champions innovative financial engineering as pathways to wealth and freedom.

Adam’s key strengths are his sharp analytical mind, engaging storytelling, and unwavering commitment to challenging mainstream economic views. His ability to break down complex financial topics into memorable, viral content positions him as a go-to source for Bitcoin education.

His provocative style, while engaging, can occasionally come off as dismissive or alienating to those less versed in financial jargon, potentially limiting his audience to more niche, like-minded followers.

To grow his audience on X, Adam should leverage more interactive content like live Q&A sessions and educational threads, while tempering his sharp-edged critiques with more inclusive messaging that invites curiosity rather than confrontation. Collaborations with diverse influencers could also broaden his reach beyond crypto circles.

Fun fact: Adam has tweeted over 15,000 times, cultivating a dynamic and prolific online presence that blends financial expertise with sharp humor—making complex economic concepts digestible and engaging for his followers.

Top tweets of Adam Livingston

Strategy is synthetically halving Bitcoin and will set the cost of capital for the next 100 years. Most people think the Bitcoin supply curve is sacred. Fixed. Immutable. Untouchable. They're wrong. Strategy is manually rewriting Bitcoin’s scarcity schedule right now with balance sheet firepower instead of code. After the 2024 halving, miners are producing ~450 BTC/day. That’s ~13,500 new BTC per month entering the global economy. Strategy, raising billions through ATM and convertible notes, has been aggressively outbidding the market for fresh coins. Every month, every quarter, they absorb a bigger % of total new supply. If they can consistently buy 30%, 40%, 50%+ of all new Bitcoin, they are synthetically cutting the available supply in half - or worse - ahead of schedule. THIS IS A SYNTHETIC HALVING. Not by protocol, but by acquisition. It’s a simple equation now: Real Bitcoin supply available = Newly mined coins - MSTR quarterly absorption. If the miners produce 13,500 BTC/month and Strategy buys 5,000 of it? The effective supply curve for the rest of the world is suddenly functioning like there’s another halving already happening. And not every four years... Every time Saylor pulls the trigger. You may think this is crazy, but what has happened in the past six months? Strategy has accumulated 379,800 in the past 182 days. That's 2087 BTC per day... FAR outpacing the miners. Now the brutal part: THE COST OF CAPITAL. When Bitcoin becomes this scarce: Access to Bitcoin will require paying a premium. Lending against Bitcoin will cost more. Borrowing Bitcoin will become a luxury business reserved for nation-states and corporate whales. Strategy will control the bottleneck. They’ll price the risk curve for everyone downstream: Your mortgage lender? Your sovereign wealth fund? Your university endowment? Your startup treasury? All of them will pay higher and higher interest rates for access to collateral because Saylor captured the float and created an artificial liquidity famine. Bitcoin's global cost of capital will no longer be set by "the market." It will be set by the gravitational policies of the first Bitcoin Superpower: Strategy. If you want Bitcoin, you’ll either: Buy MSTR equity (at a massive premium). Borrow Bitcoin (at crushing rates). Beg for liquidity from Bitcoin overlords. Or accept your fate as a fiat peasant. This is the most brilliantly devised method of monetizing scarcity ever conceived and executed. @Saylor has already won... but there are no signs of stopping accumulation at a breakneck speeds. He is forging an unassailable destiny of Strategy as the world's greatest financial superpower.

🚨 SAYLOR IS GOING TO REDPILL TRUMP ON HYPERBITCOINIZATION ON MARCH 7TH🚨 Michael @Saylor isn’t walking into the White House as a guest. He’s walking in as the architect of a Bitcoin-backed economic coup. Trump is hosting. $MSTR is locked and loaded. The U.S. is on the verge of front-running the most asymmetric trade in history. If you aren’t paying attention, you’re already too late. Trump’s fresh off his Crypto Strategic Reserve flex, signaling that the U.S. isn’t just playing in the digital asset arena, it’s moving to dominate it. Now Saylor steps in, armed with half a million Bitcoin, an unshakable conviction, and a playbook so lethal it could send fiat into full collapse mode. His move? Convince Trump that Bitcoin is America’s financial nuclear weapon - the only way to turn $36.5T of U.S. debt into a rounding error while forcing every other country into a prisoner’s dilemma: adopt Bitcoin or get left behind. MSTR is devouring the old system from the inside out. 700% up in 2024, market cap outpacing its Bitcoin holdings, a treasury strategy so aggressive that Wall Street has no choice but to bend the knee. Hedge funds are already addicted. Convertible debt, junk bonds, options lighting up like a casino floor. And now Saylor has a direct line to the most Bitcoin-friendly U.S. president in history. This summit? This is where it goes nuclear. If Trump moves first, every central bank is forced into a decision they’re not ready to make. China is hoarding gold. Russia is dodging U.S. sanctions through alternative financial rails. Europe is paralyzed in a fiat death spiral. Saylor is about to hand Trump the ultimate checkmate: make Bitcoin the U.S. reserve asset and force every other nation to follow or perish. This is the Nash equilibrium moment. If the U.S. makes Bitcoin the monetary standard, every country left holding fiat is in free fall. This is a war council. Saylor isn’t negotiating. Saylor isn’t there to listen. Saylor is there to WIN. The outcome is already written. Bitcoin is inevitable, MSTR is the first trillion-dollar Bitcoin company, and fiat is already dead, it just doesn’t know it yet. If Trump greenlights a 1-6% Bitcoin reserve allocation, we’re looking at BTC hitting $1,000,000, MSTR sending to $20,000, and every major institution panic-buying while the door slams shut behind them. The financial singularity is happening in real time. You either front-run it now, or you become exit liquidity.

Most engaged tweets of Adam Livingston

🟠LET’S ORANGE-PILL THE WORLD🟠 EVERYONE WHO REPOSTS THIS GETS A FREE PDF COPY OF THE BITCOIN AGE. SEND IT TO YOUR BOOMER PARENTS OR YOUR FIAT-CORRUPTED SECOND COUSIN. LEAVE A REPLY SAYING YOU RETWEETED AND I’LL GET YOUR FREE COPY TO YOU! I WANT BITCOIN TO BE ADOPTED BY BILLIONS. PAPERBACKS ONLY $9.99 ON AMAZON: a.co/d/aky5W6d

Strategy is synthetically halving Bitcoin and will set the cost of capital for the next 100 years. Most people think the Bitcoin supply curve is sacred. Fixed. Immutable. Untouchable. They're wrong. Strategy is manually rewriting Bitcoin’s scarcity schedule right now with balance sheet firepower instead of code. After the 2024 halving, miners are producing ~450 BTC/day. That’s ~13,500 new BTC per month entering the global economy. Strategy, raising billions through ATM and convertible notes, has been aggressively outbidding the market for fresh coins. Every month, every quarter, they absorb a bigger % of total new supply. If they can consistently buy 30%, 40%, 50%+ of all new Bitcoin, they are synthetically cutting the available supply in half - or worse - ahead of schedule. THIS IS A SYNTHETIC HALVING. Not by protocol, but by acquisition. It’s a simple equation now: Real Bitcoin supply available = Newly mined coins - MSTR quarterly absorption. If the miners produce 13,500 BTC/month and Strategy buys 5,000 of it? The effective supply curve for the rest of the world is suddenly functioning like there’s another halving already happening. And not every four years... Every time Saylor pulls the trigger. You may think this is crazy, but what has happened in the past six months? Strategy has accumulated 379,800 in the past 182 days. That's 2087 BTC per day... FAR outpacing the miners. Now the brutal part: THE COST OF CAPITAL. When Bitcoin becomes this scarce: Access to Bitcoin will require paying a premium. Lending against Bitcoin will cost more. Borrowing Bitcoin will become a luxury business reserved for nation-states and corporate whales. Strategy will control the bottleneck. They’ll price the risk curve for everyone downstream: Your mortgage lender? Your sovereign wealth fund? Your university endowment? Your startup treasury? All of them will pay higher and higher interest rates for access to collateral because Saylor captured the float and created an artificial liquidity famine. Bitcoin's global cost of capital will no longer be set by "the market." It will be set by the gravitational policies of the first Bitcoin Superpower: Strategy. If you want Bitcoin, you’ll either: Buy MSTR equity (at a massive premium). Borrow Bitcoin (at crushing rates). Beg for liquidity from Bitcoin overlords. Or accept your fate as a fiat peasant. This is the most brilliantly devised method of monetizing scarcity ever conceived and executed. @Saylor has already won... but there are no signs of stopping accumulation at a breakneck speeds. He is forging an unassailable destiny of Strategy as the world's greatest financial superpower.

🚨 SAYLOR IS GOING TO REDPILL TRUMP ON HYPERBITCOINIZATION ON MARCH 7TH🚨 Michael @Saylor isn’t walking into the White House as a guest. He’s walking in as the architect of a Bitcoin-backed economic coup. Trump is hosting. $MSTR is locked and loaded. The U.S. is on the verge of front-running the most asymmetric trade in history. If you aren’t paying attention, you’re already too late. Trump’s fresh off his Crypto Strategic Reserve flex, signaling that the U.S. isn’t just playing in the digital asset arena, it’s moving to dominate it. Now Saylor steps in, armed with half a million Bitcoin, an unshakable conviction, and a playbook so lethal it could send fiat into full collapse mode. His move? Convince Trump that Bitcoin is America’s financial nuclear weapon - the only way to turn $36.5T of U.S. debt into a rounding error while forcing every other country into a prisoner’s dilemma: adopt Bitcoin or get left behind. MSTR is devouring the old system from the inside out. 700% up in 2024, market cap outpacing its Bitcoin holdings, a treasury strategy so aggressive that Wall Street has no choice but to bend the knee. Hedge funds are already addicted. Convertible debt, junk bonds, options lighting up like a casino floor. And now Saylor has a direct line to the most Bitcoin-friendly U.S. president in history. This summit? This is where it goes nuclear. If Trump moves first, every central bank is forced into a decision they’re not ready to make. China is hoarding gold. Russia is dodging U.S. sanctions through alternative financial rails. Europe is paralyzed in a fiat death spiral. Saylor is about to hand Trump the ultimate checkmate: make Bitcoin the U.S. reserve asset and force every other nation to follow or perish. This is the Nash equilibrium moment. If the U.S. makes Bitcoin the monetary standard, every country left holding fiat is in free fall. This is a war council. Saylor isn’t negotiating. Saylor isn’t there to listen. Saylor is there to WIN. The outcome is already written. Bitcoin is inevitable, MSTR is the first trillion-dollar Bitcoin company, and fiat is already dead, it just doesn’t know it yet. If Trump greenlights a 1-6% Bitcoin reserve allocation, we’re looking at BTC hitting $1,000,000, MSTR sending to $20,000, and every major institution panic-buying while the door slams shut behind them. The financial singularity is happening in real time. You either front-run it now, or you become exit liquidity.

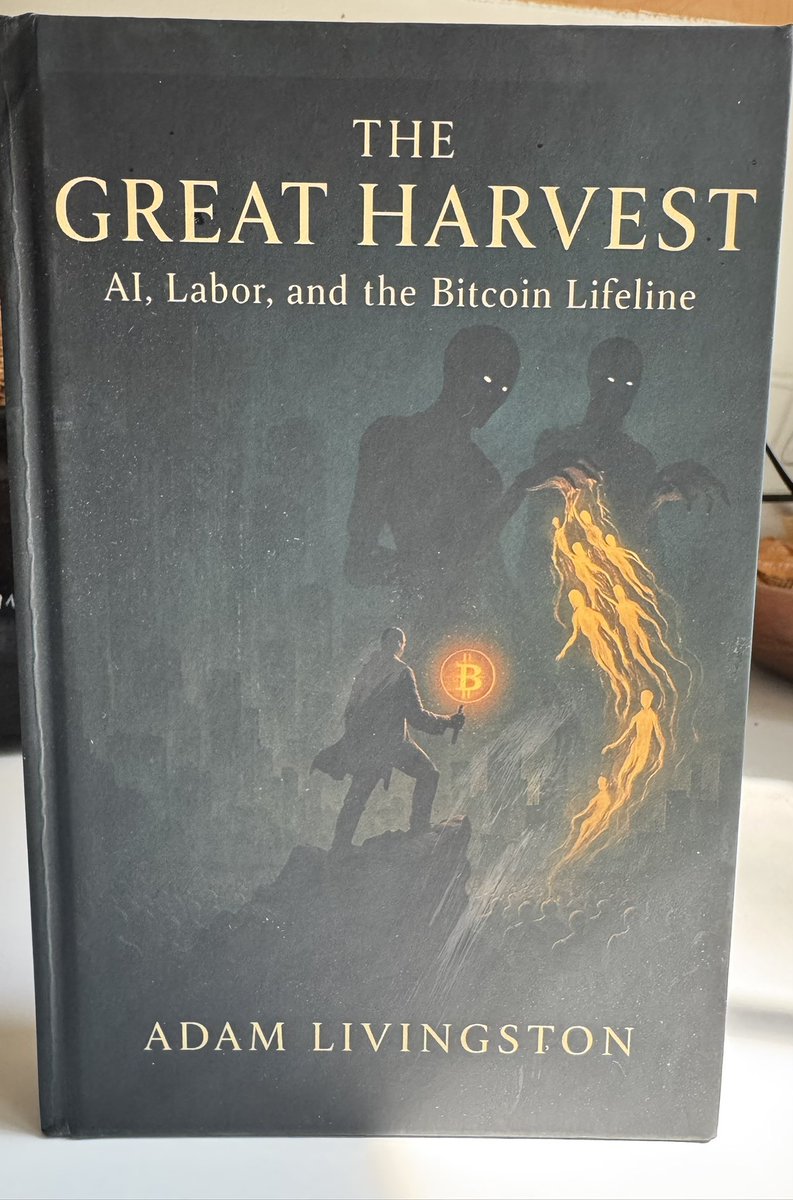

The Great Harvest hardcover is BEAUTIFUL. In a world where AI dissolves your value, this book reveals the only lifeline that cannot be simulated. As the machines harvest your mind and hollow your worth, The Great Harvest shows the only truth that survives the coming erasure. Buy my book on Amazon now, available on all formats including Kindle and audiobook: amazon.com/dp/B0F5NPC1KC

People with Thought Leader archetype

🤯 Unhinged Cheerleader @Aster_DEX 🪐 Prev @UseUniversalX @Mint_Ventures @pku1898 🎤 Lydia Asks — Hard Questions Onchain 法书上如是说... 但我告诉你

保护韭菜的大老师|兔八哥|exVC |做鸭子的好对手 @GreeksLive|

Engineering @Google | Ex: Microsoft | BITS Pilani | Lessons from 8 years in building large scale distributed systems.

Science. Philosophy. The cosmic perspective.

Spearbit | Certora Host @ProofOf_Podcast

Strategic generalist | Prev : @media3ms

✌🏻 Yo! Cookie/Wallchain/Kaito 🔆 Ambassador @SaharaLabsAI #000232 💸 Ambassador @CashifyEu 🪶 True Goon @PlumeNetwork ⛓️ freak ! 🪂 hunter

Join 250,000 Leaders | Tech Director | Follow for daily posts on Leadership & Personal Growth. Follow on LinkedIn - linkedin.com/in/kevin-box

Deep listening • Reflective thinking partnerships for creatives • Tea as practice • Navigate your transition with clarity

"I know what I should do but I can't bring myself to do it." Working on a project to repair your relationship with yourself. To mend stagnation.

Work : @KaitoAI Follow: @megaeth @miranetwork

Woof woof… grrrrrr….

Explore Related Archetypes

If you enjoy the thought leader profiles, you might also like these personality types: