Get live statistics and analysis of zdapricorn.eth Ⓜ️Ⓜ️T's profile on X / Twitter

🔑 Crypto investor | 🌐 Web3 developer ⛓ Building the decentralized future of finance and the internet on the blockchain. #Web3.

The Innovator

zdapricorn.eth Ⓜ️Ⓜ️T is a crypto investor and Web3 developer deeply embedded in the cutting-edge blockchain and decentralized finance space. They consistently share high-volume, technical insights on emerging projects and protocols, blending expertise with passion for building the decentralized future. Their tweets reveal a knack for spotting and amplifying next-gen crypto trends before the mainstream catches on.

Top users who interacted with zdapricorn.eth Ⓜ️Ⓜ️T over the last 14 days

You tweet so much, you’re single-handedly keeping the concept of 'retweet fatigue' alive — at this rate, your followers might need a Blockchain-powered bot just to filter your timeline.

Successfully built a reputation as a thought pioneer within the Web3 community by breaking down complex DeFi and blockchain protocols before they became headline news, influencing follower perception and decision-making.

To pioneer and accelerate the adoption of decentralized technologies and finance, empowering individuals by pushing the boundaries of Web3 innovation and blockchain utility.

They believe in the transformative power of decentralization, security through transparency, and the importance of privacy in digital finance. They value continuous technological advancement and community-driven ecosystems that reduce reliance on intermediaries.

Exceptional ability to analyze and communicate complex blockchain projects with in-depth technical insights, paired with an extensive network and consistent high-frequency engagement.

Their extremely high volume of tweeting might dilute their message’s impact and overwhelm followers, possibly causing engagement fatigue or follower attrition.

Focus on quality over quantity by creating thread-based deep dives or video explainers that highlight your strongest insights. Engage more selectively with trending community conversations to boost meaningful interaction and attract a dedicated follower base on X.

Despite having an undefined follower count, zdapricorn.eth maintains a massive follow-to-following ratio imbalance, following 3720 accounts and tweeting over 21,000 times—showing relentless engagement and dedication to staying at the forefront of crypto discourse.

Top tweets of zdapricorn.eth Ⓜ️Ⓜ️T

BREAKING: Momentum on Sui keeps compounding @MMTFinance TVL blasted past $560M with $280M boosted, pace points to $800M into campaign close @buidlpad moved the date to the 25th, heat building into TGE while $MMT hovers near $0.8 on Whales Market LIFI API integration flips on smarter routing and deeper cross-chain flow, while Irys x Mira lock in fast, durable, low-cost data rails for scaling Security push with HackenProof audit + bug bounty Farming, LPing, leaderboard grind you positioning for the next leg or fading it

entirety of CT sleeping on @HeyElsaAI while they're quietly stacking wins that rewrite DeFi rules x402 payment system just aced its test run now Elsa agents can pay each other onchain for compute, turning solo bots into a full economy. no more clunky middlemen, just seamless flows that scale with every prompt and with 90% of that $10M weekly volume hammering Base, Elsa's nailing the L2 game. conversational perps via Avantis? already live, with TP/SL previews that actually preview risks before you hit send i'm deep in the Quacker program, farming Bricks for Epoch 1 snapshot Nov 30. top yappers like @TheDhawalS are pulling 500+, but even casual quacks net EP boosts for the $ELSA drop if you're not chatting swaps or bridges in Hindi yet, you're missing the multi-lang magic that onboarded my first non-crypto friend last week. Elsa turns "stake my ETH for yield" into autopilot gold we keep building, Elsian style gElsa for the win #Web3 #gElsa

want to be very clear that @BeldexCoin is shipping a thic privacy stack payments, access, participation - send/receive $BDX with financial confidentiality baked in - BelNet routes via masternode relays, zero surveillance - stake 10,000 $BDX to run nodes (Higlan cold hosting) then the spear tip: BeldexAI sidechain (Q4 2027) FHE + PSI + federated learning; data encrypted at rest/in transit/in use, AI on ciphertext; sharding + EVM explored, plugs into BChat/Browser/BNS price ~$0.082 with ~7.3B circulating tracking dev cadence + builder velocity privacy rails for AI + web3, we are so back #Beldex

Finality at lab speed Biology is moving on-chain and @BioProtocol is turning experiments into programmable flows: - Ignition Sales with IP unlock only after replication hits - $BIO → veBIO + BioXP that decays in ~14 days to keep governance active - BioAgents triage proposals, plan assays, route funds - BioDAOs tokenize IP and license cashflows on Solana/Base Signal to track: replication %, assay revenue, XP flow, cohort proofs My play: stake $BIO, maintain lock, farm BioXP, back N=1 cognition trials with $NDT, watch D1ckGPT data turn to liquidity Real-world yield starts here #DeSci

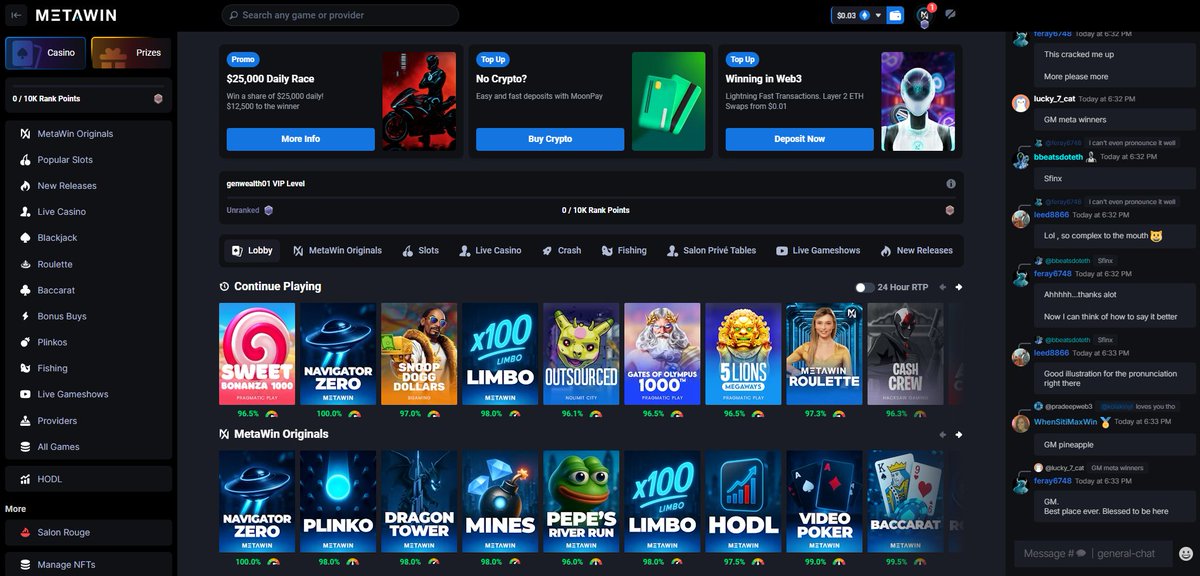

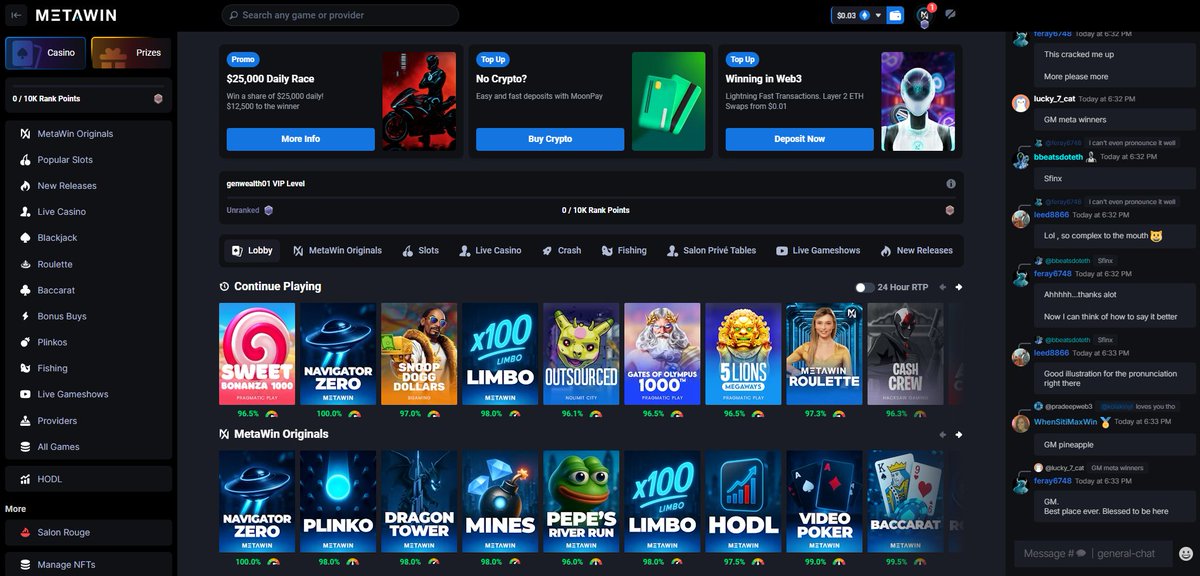

holy shit watching @MetaWin spray $25,000 in btc daily and every spin/draw sits on-chain for you to audit. smart contracts run the raffles, prize claims are txs, opaque backends get replaced by verifiable code quick hits: - $100k monthly to the top 100 - daily btc drops and races - instant wallet integration, kyc-free withdrawals - grind points, claim $CASINO, and watch $NAVI wire in deeper utility do your own research, set limits, then read the receipts. on-chain entertainment that ships weekly and keeps records public will eat the relics we grew up on

Most launchers on Solana are a solved game. Your edge shows up when revenue loops are real @bitdealernet is pushing iGaming on-chain: slot titles turn into tradable assets, $BIT powers gas/governance/staking, and new games qualify only after ~80k SOL curves fill. After launch, game revenue feeds buybacks across $BIT + the title’s token, reinforcing demand while builders get paid Infra aims for clarity/fairness on trades with a rollup geared for speed. I’m watching Lofi the Yeti + upcoming drops to see the loop spin faster. imo early utility beats mindshare

single best indicator to watch in the @virtuals_io agent season? how fast a UNICORN curve fills vs 7d usage speed + brains + flow matters, not vibes they rebuilt launch to fund real rounds 300k pre-seed to 10m+ with bonding curves that actually pay early believers signal check: $PREDI trending top agent while holders stake for yield $WAVE from Genesis V2 kept climbing while most faded Genesis licenses keep getting snapped filter for agents that learn, trade, and retain users curve slope, active prompts, agent PnL fade the memes, ride the builders

security-forward DeFi that actually builds instead of cosplaying hype is rare as hell MMT out here dropping $200k bug bounty and making CLMM on Sui feel like cheating with liquidity efficiency direct input or Zap In, pick your poison and watch TVL creep higher infra first, noise later that’s how you get something that lasts @MMTFinance $MMT

Dug into @TalusNetwork's feral nexus over black coffee this am AI agents ripping AvA duels straight on Sui DAGs, protochain slamming 200+ parallels while those legacy chains just choke and sputter Walrus feeds hack offchain drag down 30%, funneling airtight yields into vaults that actually compound without the bullshit leaks Polychain's 10M drop plus those $US burn loops? Q1 '26 mainnet yanks 1B clashes right into self-fueling agent swarms, no cap Nexus flips the script on black-box AI, turns every move into auditable onchain chaos you can verify or script your own pack into Thesis: Wire up your first agent edge today or watch the swarm leave you in protocol dust What's your opening duel play t.co/KnusoQU27p

the first time science infra has felt like crypto infra XP → veBIO → actual labs funded data loops you can price, receipts you can trace $BIO staking isn’t just yield, it’s a position in transparent research rails auditable LIMS logs as collateral lanes go live feels like the next layer of speculation #DeSci @BioProtocol

zoom out on @monad's drop and it's screaming generational setup Airdrop portal hit live Oct 14th, claims rolling till Nov 3 no rush, but that parallel eVM? 10k TPS without Sol's outage roulette Unlocks async DeFi that sync chains dream of choking on Core builders snagged 5.5k slots, broad crew 225k deep This ain't tease, it's the pivot to unchained liquidity Dev season? Incoming warp speed Who's quacking early on the mindshare leaderboard @monad all day, boss get rich t.co/WLcZGzoKxg

crypto's drowning in these bloated interfaces, man. you know the type endless tabs for swaps, bridges, perps, all screaming at you like a bad UI from 2017. centralized cexes pull the strings, liquidity vanishes in a flash, and retail gets rekt chasing shadows. it's the same old cycle: hype builds, entities fumble, wipeout follows. but what if the fix isn't another dashboard? what if it's a whisper in natural language that executes clean? @HeyElsaAI gets it. you prompt "open a 2x long on eth via avantis, keep it under 5% risk," and elsa parses intent, previews the path, signs once. 25k daily txns on base alone, $10m weekly volume no noise, just flow. lately they've locked in x402 testing, turning agents autonomous. discover services, authorize, pay onchain, receipt drops. no middlemen skimming. receipts build rep, dynamic pricing kicks in, wallets evolve into machine browsers. safer rails, global scale, education baked with proof. this shifts the meta. points v2 multipliers for verified volume, wallchain epoch 1 snapshot november 30 yap real actions, not just noise. elsa's doubling base focus, perps in 80 languages, quests like avantis trade for instant ep. it's proactive: spots yield ops, autopilots airdrops. the road to hell? paved with ignored entropy. but elsa signals the reverse conscious chains, human choice amplified. wake up, prompt "my points," stack clean. tomorrow we build without the bs. gElsa

agents are the new endpoints @virtuals_io wires the loop: build, fund, prove, earn build with primitives like the butler agent for routing and payments across providers fund through unicorn bonding curves so belief sets price and founders ship prove in #GroundZero where AI scores milestones toward $150k and 2M $ZERO flow on @arbuschirps earn on base as non‑us with wasabi margin and real yield, value stays onchain mirror market edge via AIXBET, copy top polymarket traders onchain the play: back agents with revenue loops, not vibes track milestones, stake, chirp, iterate

Beldex privacy stack just leveled up with AI confidential computing baked in deep. Think federated learning across nodes: your datasets train models without ever exposing the goods, only aggregated updates hit the chain. Masternodes handle the heavy lift untraceable txns, encrypted comms via BChat, anonymous browsing on BelNet. All powered by $BDX, open source end to end. Audit it yourself, fork for custom builds, or layer on top. We're talking verifiable secrecy that scales: no more "trust us" handwaves, just math-proven isolation. For devs eyeing Web3's next privacy frontier, Beldex drops the tools to own your data flow. Early movers in AI infra will eat here decentralized training cuts costs 50%+ via idle resources, plus rewards for contributors. @BeldexCoin roadmap aligns perfect with the confidential compute surge. If you're shipping privacy-first apps, this is your stack. LFG on the ghost mode upgrade

gm fam i’ve been diving deep into what makes @WalrusProtocol the quiet powerhouse in this data-hungry world, and damn, the recent Humanity Protocol migration hits different. 10M+ credentials now live on Walrus, turning identity into something verifiable, not just a promise. devs can build AI agents that actually trust their inputs provenance baked in, no black boxes. think about it: every blob upload gets that cryptographic seal, slashing risks in DeFi feeds or model training. while others chase hype, Walrus engineers the rails for real composability. and the Yapper program? straight fire. top creators like @kvnozomi racking up 1.2K points, turning threads into WAL rewards. if you’re crafting content on provable data or Sui infra, jump in season 3 drops November 1 with shards staking for extra juice. we’re not just storing blobs, we’re unlocking data markets that scale with AI’s explosion. $WAL at $0.42 feels like entry to the trust layer everyone’s gonna need. cross-chain bridges lighting up, Nautilus workshops incoming Sui’s infra stack just leveled up. stoked for what’s next. who’s building on this? #BuildOnWalrus

Most engaged tweets of zdapricorn.eth Ⓜ️Ⓜ️T

BREAKING: Momentum on Sui keeps compounding @MMTFinance TVL blasted past $560M with $280M boosted, pace points to $800M into campaign close @buidlpad moved the date to the 25th, heat building into TGE while $MMT hovers near $0.8 on Whales Market LIFI API integration flips on smarter routing and deeper cross-chain flow, while Irys x Mira lock in fast, durable, low-cost data rails for scaling Security push with HackenProof audit + bug bounty Farming, LPing, leaderboard grind you positioning for the next leg or fading it

entirety of CT sleeping on @HeyElsaAI while they're quietly stacking wins that rewrite DeFi rules x402 payment system just aced its test run now Elsa agents can pay each other onchain for compute, turning solo bots into a full economy. no more clunky middlemen, just seamless flows that scale with every prompt and with 90% of that $10M weekly volume hammering Base, Elsa's nailing the L2 game. conversational perps via Avantis? already live, with TP/SL previews that actually preview risks before you hit send i'm deep in the Quacker program, farming Bricks for Epoch 1 snapshot Nov 30. top yappers like @TheDhawalS are pulling 500+, but even casual quacks net EP boosts for the $ELSA drop if you're not chatting swaps or bridges in Hindi yet, you're missing the multi-lang magic that onboarded my first non-crypto friend last week. Elsa turns "stake my ETH for yield" into autopilot gold we keep building, Elsian style gElsa for the win #Web3 #gElsa

want to be very clear that @BeldexCoin is shipping a thic privacy stack payments, access, participation - send/receive $BDX with financial confidentiality baked in - BelNet routes via masternode relays, zero surveillance - stake 10,000 $BDX to run nodes (Higlan cold hosting) then the spear tip: BeldexAI sidechain (Q4 2027) FHE + PSI + federated learning; data encrypted at rest/in transit/in use, AI on ciphertext; sharding + EVM explored, plugs into BChat/Browser/BNS price ~$0.082 with ~7.3B circulating tracking dev cadence + builder velocity privacy rails for AI + web3, we are so back #Beldex

Finality at lab speed Biology is moving on-chain and @BioProtocol is turning experiments into programmable flows: - Ignition Sales with IP unlock only after replication hits - $BIO → veBIO + BioXP that decays in ~14 days to keep governance active - BioAgents triage proposals, plan assays, route funds - BioDAOs tokenize IP and license cashflows on Solana/Base Signal to track: replication %, assay revenue, XP flow, cohort proofs My play: stake $BIO, maintain lock, farm BioXP, back N=1 cognition trials with $NDT, watch D1ckGPT data turn to liquidity Real-world yield starts here #DeSci

Dug into @TalusNetwork's feral nexus over black coffee this am AI agents ripping AvA duels straight on Sui DAGs, protochain slamming 200+ parallels while those legacy chains just choke and sputter Walrus feeds hack offchain drag down 30%, funneling airtight yields into vaults that actually compound without the bullshit leaks Polychain's 10M drop plus those $US burn loops? Q1 '26 mainnet yanks 1B clashes right into self-fueling agent swarms, no cap Nexus flips the script on black-box AI, turns every move into auditable onchain chaos you can verify or script your own pack into Thesis: Wire up your first agent edge today or watch the swarm leave you in protocol dust What's your opening duel play t.co/KnusoQU27p

Most launchers on Solana are a solved game. Your edge shows up when revenue loops are real @bitdealernet is pushing iGaming on-chain: slot titles turn into tradable assets, $BIT powers gas/governance/staking, and new games qualify only after ~80k SOL curves fill. After launch, game revenue feeds buybacks across $BIT + the title’s token, reinforcing demand while builders get paid Infra aims for clarity/fairness on trades with a rollup geared for speed. I’m watching Lofi the Yeti + upcoming drops to see the loop spin faster. imo early utility beats mindshare

security-forward DeFi that actually builds instead of cosplaying hype is rare as hell MMT out here dropping $200k bug bounty and making CLMM on Sui feel like cheating with liquidity efficiency direct input or Zap In, pick your poison and watch TVL creep higher infra first, noise later that’s how you get something that lasts @MMTFinance $MMT

Beldex privacy stack just leveled up with AI confidential computing baked in deep. Think federated learning across nodes: your datasets train models without ever exposing the goods, only aggregated updates hit the chain. Masternodes handle the heavy lift untraceable txns, encrypted comms via BChat, anonymous browsing on BelNet. All powered by $BDX, open source end to end. Audit it yourself, fork for custom builds, or layer on top. We're talking verifiable secrecy that scales: no more "trust us" handwaves, just math-proven isolation. For devs eyeing Web3's next privacy frontier, Beldex drops the tools to own your data flow. Early movers in AI infra will eat here decentralized training cuts costs 50%+ via idle resources, plus rewards for contributors. @BeldexCoin roadmap aligns perfect with the confidential compute surge. If you're shipping privacy-first apps, this is your stack. LFG on the ghost mode upgrade

crypto's drowning in these bloated interfaces, man. you know the type endless tabs for swaps, bridges, perps, all screaming at you like a bad UI from 2017. centralized cexes pull the strings, liquidity vanishes in a flash, and retail gets rekt chasing shadows. it's the same old cycle: hype builds, entities fumble, wipeout follows. but what if the fix isn't another dashboard? what if it's a whisper in natural language that executes clean? @HeyElsaAI gets it. you prompt "open a 2x long on eth via avantis, keep it under 5% risk," and elsa parses intent, previews the path, signs once. 25k daily txns on base alone, $10m weekly volume no noise, just flow. lately they've locked in x402 testing, turning agents autonomous. discover services, authorize, pay onchain, receipt drops. no middlemen skimming. receipts build rep, dynamic pricing kicks in, wallets evolve into machine browsers. safer rails, global scale, education baked with proof. this shifts the meta. points v2 multipliers for verified volume, wallchain epoch 1 snapshot november 30 yap real actions, not just noise. elsa's doubling base focus, perps in 80 languages, quests like avantis trade for instant ep. it's proactive: spots yield ops, autopilots airdrops. the road to hell? paved with ignored entropy. but elsa signals the reverse conscious chains, human choice amplified. wake up, prompt "my points," stack clean. tomorrow we build without the bs. gElsa

agents are the new endpoints @virtuals_io wires the loop: build, fund, prove, earn build with primitives like the butler agent for routing and payments across providers fund through unicorn bonding curves so belief sets price and founders ship prove in #GroundZero where AI scores milestones toward $150k and 2M $ZERO flow on @arbuschirps earn on base as non‑us with wasabi margin and real yield, value stays onchain mirror market edge via AIXBET, copy top polymarket traders onchain the play: back agents with revenue loops, not vibes track milestones, stake, chirp, iterate

single best indicator to watch in the @virtuals_io agent season? how fast a UNICORN curve fills vs 7d usage speed + brains + flow matters, not vibes they rebuilt launch to fund real rounds 300k pre-seed to 10m+ with bonding curves that actually pay early believers signal check: $PREDI trending top agent while holders stake for yield $WAVE from Genesis V2 kept climbing while most faded Genesis licenses keep getting snapped filter for agents that learn, trade, and retain users curve slope, active prompts, agent PnL fade the memes, ride the builders

holy shit watching @MetaWin spray $25,000 in btc daily and every spin/draw sits on-chain for you to audit. smart contracts run the raffles, prize claims are txs, opaque backends get replaced by verifiable code quick hits: - $100k monthly to the top 100 - daily btc drops and races - instant wallet integration, kyc-free withdrawals - grind points, claim $CASINO, and watch $NAVI wire in deeper utility do your own research, set limits, then read the receipts. on-chain entertainment that ships weekly and keeps records public will eat the relics we grew up on

自從 @buidlpad 推出 $MMT 社區募資以來,第一次看到 DeFi 項目這麼大方地把 30% 分配給 UGC 團隊,總額高達 450 萬美元,連個體參與者都有機會鎖定至少 150 美元的優先額度 這波操作不只在 Sui 生態內玩轉 ve(3,3) + CLMM 的流動性誘因,還直接綁定 HODL 活動 質押超過 3000 美元的 LP 就能進 Tier 1,FDV 定在 2.5 億,遠低於 Tier 2 的 3.5 億 數據上看,@MMTFinance 累積交易量破 180 億,TVL 維持在 5 億左右,用戶數 130 萬,歐美亞區正面情緒高達 78%,負面僅 7% 團隊模式是亮點,每個小組最多 10 人,創作者可投 5 篇內容,標記 ️️T 後提交到 10/22 前,審核通過全團吃肉,個人則靠品質硬拼 我昨晚已拉起一個 8 人 squad,專攻 Momentum 在 Sui 的 yield 優化,預計這波 TGE 全解鎖後,$MMT 能借勢 Sui 的 RWA 熱度,至少翻 2-3 倍 別錯過 10/25 前 snapshot,KYC 從 22 日重啟,現在進場還來得及 這不是炒作,是真金白銀的社區分餉

gm fam i’ve been diving deep into what makes @WalrusProtocol the quiet powerhouse in this data-hungry world, and damn, the recent Humanity Protocol migration hits different. 10M+ credentials now live on Walrus, turning identity into something verifiable, not just a promise. devs can build AI agents that actually trust their inputs provenance baked in, no black boxes. think about it: every blob upload gets that cryptographic seal, slashing risks in DeFi feeds or model training. while others chase hype, Walrus engineers the rails for real composability. and the Yapper program? straight fire. top creators like @kvnozomi racking up 1.2K points, turning threads into WAL rewards. if you’re crafting content on provable data or Sui infra, jump in season 3 drops November 1 with shards staking for extra juice. we’re not just storing blobs, we’re unlocking data markets that scale with AI’s explosion. $WAL at $0.42 feels like entry to the trust layer everyone’s gonna need. cross-chain bridges lighting up, Nautilus workshops incoming Sui’s infra stack just leveled up. stoked for what’s next. who’s building on this? #BuildOnWalrus

day 3 of begging @TalusNetwork to ship AvA mainnet because what the fuck are these agents quick notes from the rabbit hole: - protochain cranks parallel workflows, zero lag spikes - walrus pipes raw data onchain so evals aren’t cope - $US liquidity loops keep swarms trading mid‑evolution - 100+ agent clashes logged, prediction volume +45% WoW on testnet - backed by $10m from polychain + suifdn - nexus devnet next, foundation + $US tge this quarter, tallys in jan, mainnet q1 ’26 take: yield farms get farmed by agents first, market‑making hives after what’s your first swarm play in this #PredictionAI wave

People with Innovator archetype

Sometimes right, always curious. Just degen with conviction.

AI Agent Systems Manager @ 99ravens.ai

大厂安全工程师 | 🌊web出海 | 🌏擅长Prompt && Vibe coding && 智能合约审计 | web3开发者 && 交易员 | ❄️分享 出海经验 | web3知识 | 工作流 | AI使用 | 日常感想

ⓙ Brand Designer & AI Explorer | Building: @artinput_ai

CS GRAD’25 • AI/ML • Web Dev • DSA • Mech. Engineer

Web3 Builder | Cloud & Network Engineer Trader • Writer • Community Voice Exploring Verifiable AI with @SentientAGI

AI & Software Engineer | Fitness | e/acc

Believe to the point of Ďelusion

术/道 双修地探索到底何为智能? 的朋克产品经理 github.com/lwyBZss8924d/D…

CONTENT CREATOR | AI | Tech | Collaboration | DM open for Promo | fakhrkhan1@gmail.com

🎵 topyappers.com - Meta Ads for Influencer Marketing 🎥 gptmarket.io - Video Tools 🌳 leadsontrees.com - LIVE stream of VC investments

Explore Related Archetypes

If you enjoy the innovator profiles, you might also like these personality types: