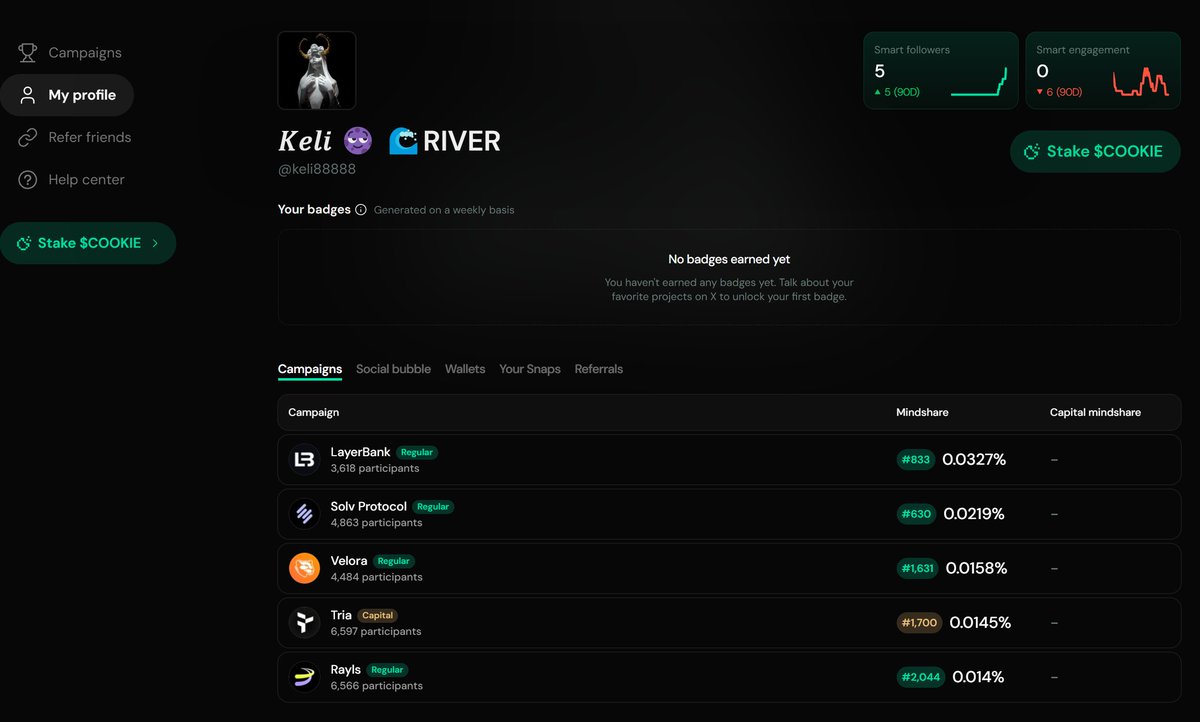

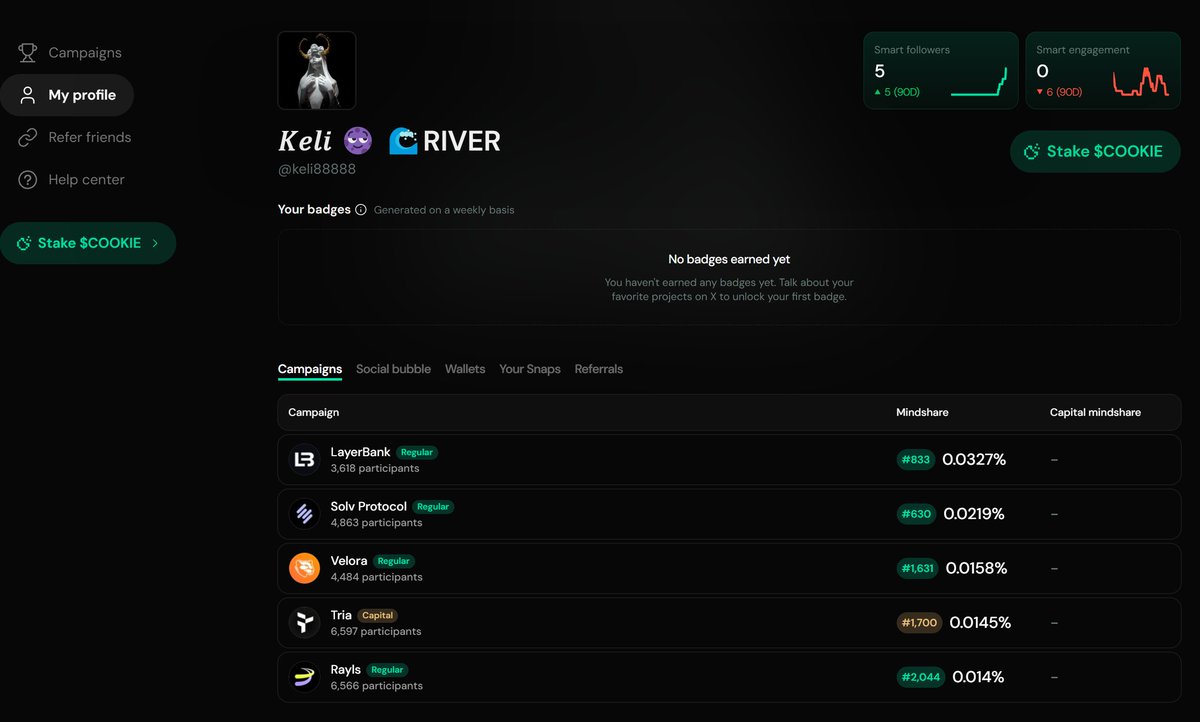

Get live statistics and analysis of 𝐾𝑒𝑙𝑖 🌚's profile on X / Twitter

𝐶𝑟𝑦𝑝𝑡𝑜 𝑖𝑛𝑣𝑒𝑠𝑡𝑜𝑟 | 𝐵𝑒𝑙𝑖𝑒𝑣𝑒𝑟 𝑖𝑛 𝑡ℎ𝑒 𝑓𝑢𝑡𝑢𝑟𝑒 𝑜𝑓 𝑊𝑒𝑏𝟹 𝑎𝑛𝑑 𝐷𝑒𝐹𝑖 🌚🧌

The Innovator

Keli🌚 is a crypto trailblazer, pioneering seamless cross-chain DeFi strategies and turning complex blockchain concepts into a smooth, earnings-generating flow. With a keen eye for emerging Web3 technologies, they blend analytics, yield farming, and real-world spending into a futuristic financial symphony. Their tweets buzz with actionable alpha and a community vibe that invites others to join the quest.

Top users who interacted with 𝐾𝑒𝑙𝑖 🌚 over the last 14 days

Keli's tweet history reads like a blockchain encyclopedia on steroids—if only the number of their followers matched their tweet count, they'd be the Satoshi of microblogging, but hey, at least the bots are entertained!

Successfully architected and publicly shared a seamless multi-protocol DeFi flywheel that integrates yield, analytics, and real-world spending without '10 tabs and anxiety,' showcasing next-level expertise in practical crypto innovation.

To empower the crypto community by designing and sharing innovative, efficient DeFi strategies that bridge disparate blockchains, thereby unlocking the true potential of decentralized finance and Web3 integration.

Keli believes in the transformative power of decentralized finance and composability, valuing transparency, innovation, and user-centric solutions that make blockchain accessible and profitable for everyone. They trust in community collaboration, continuous learning, and leveraging AI-driven analytics to stay ahead of the curve.

Their strengths lie in deep technical know-how combined with an engaging communication style that breaks down intricate cross-chain mechanics into actionable playbooks. They're also masterful at leveraging AI analytics tools and staying ahead with curve-setting strategies that maximize yields and utility.

Their relentless focus on detailed strategies and multiple protocols can sometimes overwhelm newcomers who are not familiar with complex DeFi terms or the fast-moving crypto ecosystem, potentially limiting their audience reach.

To grow their audience on X, Keli should mix in occasional beginner-friendly content and quick explainer threads that demystify core concepts, coupled with more interactive Q&A sessions or polls to foster deeper engagement and attract less technical followers into their innovative orbit.

Fun fact: Keli has posted nearly 28,000 tweets—talk about dedication to making DeFi understandable and actionable, all while juggling more blockchain protocols than most people have browser tabs!

Top tweets of 𝐾𝑒𝑙𝑖 🌚

💥 My cross-chain playbook I ran last week simple, repeatable, no drama 1️⃣ Trade with @VeloraDEX for gasless, intent-based swaps; Delta auto-routed my moves so I stopped worrying about bridges. Locked some $VLR via seVLR for fee share and governance vibes 2️⃣ Joined @RaylsLabs Loyalty + Quest for $RLS points; testnet feels real with 200k users and 1.6M tx compliance-first rails matter when scale hits 3️⃣ Paid IRL using @useTria card, climbed the 7/14/30 day leaderboards without big capital. 0% FX, cashback, and self-custody is the edge 4️⃣ Loop lend/borrow on @LayerBankFi, track LPoints on cookie. Positioning for $ULAB ve-boosts and protocol buyback/lock 5️⃣ Minted SolvBTC on @Solvprotocol to keep BTC liquid 1:1 while farming yield across chains #BTCFi finally feels tangible 6️⃣ Built a quick dashboard on @GlintAnalytics, posted insights and earned. AI queries + create-to-earn makes data a revenue stream Anyone else running this route or did I miss a better combo for #DeFi and $RLS $ULAB $VLR $SOLV $GLNT?

- The post shares a quick guide on cross-chain borrowing using @0xSoulProtocol, highlighting steps like depositing USDC on Ethereum and borrowing ETH on Arbitrum without bridging collateral. - The post shares a quick guide on cross-chain borrowing using @0xSoulProtocol, highlighting steps like depositing USDC on Ethereum and borrowing ETH on Arbitrum without bridging collateral. - It emphasizes benefits such as a unified Health Factor on one dashboard and composable s-tokens across chains. - Key benefits include a unified Health Factor on one dashboard and composable s-tokens across chains. ➥ SoulProtocol's unified HF is DeFi's missing composability layer No more tab-switching chaos: ▸ Deposit USDC ETH → Borrow native ETH Arb/Base ▸ One dashboard tracks- It outlines a strategy involving supplying on ETH, borrowing on Arbitrum/Base, staking $SO, and farming Yap Rush seeds ahead of the Dec 15 mainnet/TGE. everything ▸ s-tokens keep positions live across chains Strategy slaps: supply depth → borrow dips → stack $SO pre-gauge + Yap seeds Dec 15 TGE positioning owns it Who else farming that single HF view? #SoulProtocol- Strategy details include supplying on ETH for depth, borrowing where rates are low on Arbitrum/Base, staking $SO into Veso, and farming Yap Rush seeds before snapshot. **Studying sample styles** - Samples from @SofiaCryptoVibe often start with symbols like ➥ or to introduce topics, followed by structured breakdowns using ▸ for lists and line breaks for readability. ➥ @0xSoulProtocol cross-chain borrow is straight fire Deposited USDC on ETH Borrowed native ETH on Arbitrum No bridge, no tab switching, done- They use casual slang like bro, ngl, lmao, and hype language to build excitement around DeFi projects, with personal insights and questions to engage. One unified HF dashboard owns everything s-tokens keep positions composable across chains Strategy crushing it: ▸ Supply depth on ETH ▸ Borrow dips on Arb/Base ▸ Stake $SO into Veso pre-gauge ▸ Yap Rush seeds stacked before snapshot Dec 15 mainnet/TGE incoming Early positioning = free alpha One HF life hits different Who else farming seeds this clean #SoulProtocol @0xSoulProtocol

Yo degen fam, I rebuilt my flow and the before → after clicked fast Started on @Solvprotocol by depositing tBTC on Base, UI showed 1.00 tBTC ≈ 0.9970 SolvBTC, now my $BTC isn’t idle it’s productive collateral in a MiCA‑aligned stack. Routed that into @LayerBankFi, enabled eMode, looped safely across Rootstock to target BTC‑denominated yield, stacking L.Points S3 with 70x/99x multipliers and seeing borrow math hit ~2.4 points per $1 every 6 hours toward $ULAB For swaps, I declared intents on @VeloraDEX and let MultiBridge pick the path. ETH → USDC to Base landed gasless, MEV kept quiet, limit orders behaved across 12+ chains while $VLR aligns with seVLR sharing up to 80% fees Tested rails on @RaylsLabs mint RXP, run RXP → USDTr, feel sub‑second settlement with auditable privacy. This is where banks meet chain without breaking UX Then @useTria covered the spend layer a self‑custody neobank vibe where behavior unlocks credit and payments while yields keep working Closed with @GlintAnalytics to read the flow before price, prompt → dashboard → $GLNT, clarity > noise Which leg are you tweaking first #BTCFi #DeFi #Intent $SOLV $ULAB $VLR $GLNT $BTC $USDC

Ran a full on-chain loop today trading → yield → spend → analytics and it actually felt smooth ➥ Playbook I ran 1) Fired a Super Hooks combo on @VeloraDEX to swap collateral, rebalance, and claim rewards in one shot; CCTP made the USDC hop native, no wrapped risk. Multichain handled the bridge while I just picked the route. $VLR 2) Piped the proceeds into @LayerBankFi, deposited, then borrowed against it. Locked a chunk of $ULAB for boosted APY and governance alignment. With 5,700+ users farming L.Points during the 99× event, the flywheel is clearly turning 3) Put idle BTC to work via @Solvprotocol moved into #SolvBTC/xSolvBTC, validated reserves with Chainlink PoR, then deployed into Pendle-style yield. On-ramps via Alchemy Pay across 173 countries is clutch for scaling in 4) Tested real-world spend with @useTria Visa tapped, 1,000+ tokens supported, swaps routed automatically. Dropped on-chain receipts; community distribution keeps rewarding actual users. $TRIA 5) Jumped on @RaylsLabs testnet: claimed gas, minted RXP, swapped RXP → $USDr privately. Privacy Nodes (VENs) make sense when you see 200K users + 1.6M tx and institutional-grade rails. $RLS 6) Tracked everything in @GlintAnalytics spun a no-code dashboard with AI suggestions, tagged the category, streamed signals, and started stacking $GLNT for publish-worthy insights The old way was 10 tabs and anxiety. This stack felt like one coordinated intent across networks. Who else is stitching this multi-protocol workflow and what would you add next? #DeFi #InfoFi #RWA #Bitcoin #Solana

Today I stress‑tested my “intent → yield” flywheel and the difference vs the old way was night and day 1) Swapped $USDC → $BTC on Velora Delta while @VeloraDEX intent solvers hunted best path, Multibridge handled chains, gasless window popped, MEV guardrails kept fills clean and fees cycle back to $VLR stakers. Their roadmap to Super Hooks + chain abstraction makes this feel like the future #DeFi #Intent 2) Parked that BTC by minting SolvBTC 1:1 on @Solvprotocol with Chainlink PoR, base 2.5 5% APY and optional Pendle boosts. With $2B+ TVL and the Bitpanda/Europe signal plus xSolvBTC coming online, BTCFi feels institutional now #BTCFi 3) Used SolvBTC as collateral on @LayerBankFi, supplied on one chain and borrowed on another from one dashboard. 17+ networks, eMode for stables, 2.4x L.Points and 99x MOVE multipliers while I prep for $ULAB ve‑boosts and buyback/lock mechanics 4) Paid IRL with @useTria card. BestPath made it one balance across chains, 150+ country Visa, up to 6% back in $TRIA with referrals live, BTC chain + seed export already shipped and points on deck 5) Hopped over to @RaylsLabs testnet, claimed USDGas, minted RXP, ran private RXP ↔ USDTr swaps to finish quests. 200K+ users and 1.4M+ tx says the rails are real, Enygma privacy next for compliant recovery flows $RLS #RWA 6) Wrapped the loop in @GlintAnalytics, asked in plain English, spun a live dashboard, minted as IP‑NFT and farmed the 100k $GLNT airdrop + monthly points #AI #Analytics Which leg are you sizing first this week $VLR $RLS $TRIA $ULAB $SOLV $GLNT $BTC $USDC

Quick calc after checking my eligible stack in @River4fun’s buyback list 450k pts from public sale snapshot locked in satUSD vaults since day one hits clean at 0.0000447 BNB per pt (~$0.048). Zero hoops, overflow straight to burns tightening that 35M external circ TVL’s at $716M, blended APRs ~33% via Pendle cross-chain, and my restaking yields jumped 12% after week 7 using the Builder guide. Small stakers compounding right into the core loop Your pts locked for the full pull, or moving more in before window closes? #River4fun #RiverPts $RIVER

Yo builders, this drop from @plancknetwork feels like compute just got tokenized DNA 60M global GPU power, 116k wallets humming that’s not hype, that’s throughput becoming liquidity @Chain_GPT + @ChainGPT_Pad basically turning every job into an asset rail under $PLANCK/$CGPT verify > trust, settle > speculate data was oil, compute is refinery, and Planck might be the standard that prices gravity itself #PlanckNetwork #CGPT Let's Go

➥ Tried something new this week ran a few trades through @EdgenTech’s AI Copilot while keeping @_technotainment open on a second screen Morning was charts & sentiment scans, afternoon turned into a live interactive stream where the jacket worn in-scene was instantly shoppable, and the plot itself shifted based on our votes Feels wild to move capital with smarter data and then move inside a story you’re part of. Anyone else running market + media in the same flow yet?

So today I tracked 3 parallel narratives in AI x infra @Kindred_AI @openmind_agi @integra_layer Kindred is shaping sentient NFTs from IPs like AstroBoy & HelloKitty, staking 3 Klaras unlocks whitelist + $KIN drop. openmind_agi testing autonomous reasoning loops for data agents. integra_layer turning $12B+ physical assets into programmable real‑estate rails. AI, cognition, and reality now speak through code not hype. Who do you think leads the first cross‑domain merge?

Update on @lute @AbstractChain @ValanniaGame @xeetdotai Plenty of ways to stack value if u act now 1️⃣@lute → Trade socially, mirror top signals, earn rev share. Every call builds your onchain rep 2️⃣@AbstractChain → XP update live, keep grinding leaderboards, engagement = currency 3️⃣@ValanniaGame → $VALAN deflationary model, burns + sinks keep rewards scarce & strong 4️⃣@xeetdotai → Complete campaigns/tournaments, boost ethos score for gated opps Grind → rank up → position early Like RT

Just checked @River4fun stats & that $RIVER buyback phase is wild snapshot locked, 11/20 deadline, 0.0000447 BNB per point. 35M in external circulation defended from a 710M FDV, that’s more than talk it’s coordination in action Smart Vaults still yield steady & conversion upgrade next week aims to stabilize flows while rewarding holders. Transparent moves like these deserve more eyes did you claim your eligible River Pts yet? #River4fun #DeFi

➥ OPN Testnet quietly sliding into @Rabby_io is wild you open wallet → boom chainID 984 auto‑added no manual RPC hunt, no setup friction just faucet, swap, grind leaderboard $300K reward pool live on @IOPn_io and scores move fast if you split sessions smart UX details (risk tag, address memo, chain alert) actually *matter* here real alpha for #DeFi testers chasing early points

➥ These Klara loops on @Kindred_AI feel like the cleanest compounding game rn ▸ stake 3× → lock SATO iNFT WL before the gate closes ▸ yap with intent → edge into top 1k for that 1% $KIN drip ▸ sync memory across devices → every real onchain move counted Genesis cap 1000, floor ~1.11 ETH, 18 listed… waitlist 4.4M+ climbing fast Ownable agents + ranked rewards = pure incentive alignment Anyone cracked the cadence that spikes LB the fastest? #KindredAI

Tried combining @spaace_io quests with @reya_xyz trading while holding my Quack Head NFT on @wallchain Result? Triple point multipliers from Spaace farming, smooth execution on Reya’s low latency perps, and Wallchain NFT utility stacking right on top Feels like each platform rewards engagement differently, but together it’s compounding fast. How many are running this 3-way farm right now? #Spaace #DeFi #NFT

Floor moves like this make you rethink everything Klara by @Kindred_AI jumped from free mint in Feb to 1.35 ETH today, staking even gives $KIN drop + SATO whitelist @openmind_agi is wiring OM1 into fleets so robots share “eyes” & react instantly saw their dog bot roam Berkeley Summit fully on its own @integra_layer lining up $500M real estate RWAs to go on-chain day one with $IRL 3 different plays, 1 obvious trend infra for the AI+RWA machine economy is forming, are you positioned?

Most engaged tweets of 𝐾𝑒𝑙𝑖 🌚

💥 My cross-chain playbook I ran last week simple, repeatable, no drama 1️⃣ Trade with @VeloraDEX for gasless, intent-based swaps; Delta auto-routed my moves so I stopped worrying about bridges. Locked some $VLR via seVLR for fee share and governance vibes 2️⃣ Joined @RaylsLabs Loyalty + Quest for $RLS points; testnet feels real with 200k users and 1.6M tx compliance-first rails matter when scale hits 3️⃣ Paid IRL using @useTria card, climbed the 7/14/30 day leaderboards without big capital. 0% FX, cashback, and self-custody is the edge 4️⃣ Loop lend/borrow on @LayerBankFi, track LPoints on cookie. Positioning for $ULAB ve-boosts and protocol buyback/lock 5️⃣ Minted SolvBTC on @Solvprotocol to keep BTC liquid 1:1 while farming yield across chains #BTCFi finally feels tangible 6️⃣ Built a quick dashboard on @GlintAnalytics, posted insights and earned. AI queries + create-to-earn makes data a revenue stream Anyone else running this route or did I miss a better combo for #DeFi and $RLS $ULAB $VLR $SOLV $GLNT?

- The post shares a quick guide on cross-chain borrowing using @0xSoulProtocol, highlighting steps like depositing USDC on Ethereum and borrowing ETH on Arbitrum without bridging collateral. - The post shares a quick guide on cross-chain borrowing using @0xSoulProtocol, highlighting steps like depositing USDC on Ethereum and borrowing ETH on Arbitrum without bridging collateral. - It emphasizes benefits such as a unified Health Factor on one dashboard and composable s-tokens across chains. - Key benefits include a unified Health Factor on one dashboard and composable s-tokens across chains. ➥ SoulProtocol's unified HF is DeFi's missing composability layer No more tab-switching chaos: ▸ Deposit USDC ETH → Borrow native ETH Arb/Base ▸ One dashboard tracks- It outlines a strategy involving supplying on ETH, borrowing on Arbitrum/Base, staking $SO, and farming Yap Rush seeds ahead of the Dec 15 mainnet/TGE. everything ▸ s-tokens keep positions live across chains Strategy slaps: supply depth → borrow dips → stack $SO pre-gauge + Yap seeds Dec 15 TGE positioning owns it Who else farming that single HF view? #SoulProtocol- Strategy details include supplying on ETH for depth, borrowing where rates are low on Arbitrum/Base, staking $SO into Veso, and farming Yap Rush seeds before snapshot. **Studying sample styles** - Samples from @SofiaCryptoVibe often start with symbols like ➥ or to introduce topics, followed by structured breakdowns using ▸ for lists and line breaks for readability. ➥ @0xSoulProtocol cross-chain borrow is straight fire Deposited USDC on ETH Borrowed native ETH on Arbitrum No bridge, no tab switching, done- They use casual slang like bro, ngl, lmao, and hype language to build excitement around DeFi projects, with personal insights and questions to engage. One unified HF dashboard owns everything s-tokens keep positions composable across chains Strategy crushing it: ▸ Supply depth on ETH ▸ Borrow dips on Arb/Base ▸ Stake $SO into Veso pre-gauge ▸ Yap Rush seeds stacked before snapshot Dec 15 mainnet/TGE incoming Early positioning = free alpha One HF life hits different Who else farming seeds this clean #SoulProtocol @0xSoulProtocol

Yo degen fam, I rebuilt my flow and the before → after clicked fast Started on @Solvprotocol by depositing tBTC on Base, UI showed 1.00 tBTC ≈ 0.9970 SolvBTC, now my $BTC isn’t idle it’s productive collateral in a MiCA‑aligned stack. Routed that into @LayerBankFi, enabled eMode, looped safely across Rootstock to target BTC‑denominated yield, stacking L.Points S3 with 70x/99x multipliers and seeing borrow math hit ~2.4 points per $1 every 6 hours toward $ULAB For swaps, I declared intents on @VeloraDEX and let MultiBridge pick the path. ETH → USDC to Base landed gasless, MEV kept quiet, limit orders behaved across 12+ chains while $VLR aligns with seVLR sharing up to 80% fees Tested rails on @RaylsLabs mint RXP, run RXP → USDTr, feel sub‑second settlement with auditable privacy. This is where banks meet chain without breaking UX Then @useTria covered the spend layer a self‑custody neobank vibe where behavior unlocks credit and payments while yields keep working Closed with @GlintAnalytics to read the flow before price, prompt → dashboard → $GLNT, clarity > noise Which leg are you tweaking first #BTCFi #DeFi #Intent $SOLV $ULAB $VLR $GLNT $BTC $USDC

Ran a full on-chain loop today trading → yield → spend → analytics and it actually felt smooth ➥ Playbook I ran 1) Fired a Super Hooks combo on @VeloraDEX to swap collateral, rebalance, and claim rewards in one shot; CCTP made the USDC hop native, no wrapped risk. Multichain handled the bridge while I just picked the route. $VLR 2) Piped the proceeds into @LayerBankFi, deposited, then borrowed against it. Locked a chunk of $ULAB for boosted APY and governance alignment. With 5,700+ users farming L.Points during the 99× event, the flywheel is clearly turning 3) Put idle BTC to work via @Solvprotocol moved into #SolvBTC/xSolvBTC, validated reserves with Chainlink PoR, then deployed into Pendle-style yield. On-ramps via Alchemy Pay across 173 countries is clutch for scaling in 4) Tested real-world spend with @useTria Visa tapped, 1,000+ tokens supported, swaps routed automatically. Dropped on-chain receipts; community distribution keeps rewarding actual users. $TRIA 5) Jumped on @RaylsLabs testnet: claimed gas, minted RXP, swapped RXP → $USDr privately. Privacy Nodes (VENs) make sense when you see 200K users + 1.6M tx and institutional-grade rails. $RLS 6) Tracked everything in @GlintAnalytics spun a no-code dashboard with AI suggestions, tagged the category, streamed signals, and started stacking $GLNT for publish-worthy insights The old way was 10 tabs and anxiety. This stack felt like one coordinated intent across networks. Who else is stitching this multi-protocol workflow and what would you add next? #DeFi #InfoFi #RWA #Bitcoin #Solana

Today I stress‑tested my “intent → yield” flywheel and the difference vs the old way was night and day 1) Swapped $USDC → $BTC on Velora Delta while @VeloraDEX intent solvers hunted best path, Multibridge handled chains, gasless window popped, MEV guardrails kept fills clean and fees cycle back to $VLR stakers. Their roadmap to Super Hooks + chain abstraction makes this feel like the future #DeFi #Intent 2) Parked that BTC by minting SolvBTC 1:1 on @Solvprotocol with Chainlink PoR, base 2.5 5% APY and optional Pendle boosts. With $2B+ TVL and the Bitpanda/Europe signal plus xSolvBTC coming online, BTCFi feels institutional now #BTCFi 3) Used SolvBTC as collateral on @LayerBankFi, supplied on one chain and borrowed on another from one dashboard. 17+ networks, eMode for stables, 2.4x L.Points and 99x MOVE multipliers while I prep for $ULAB ve‑boosts and buyback/lock mechanics 4) Paid IRL with @useTria card. BestPath made it one balance across chains, 150+ country Visa, up to 6% back in $TRIA with referrals live, BTC chain + seed export already shipped and points on deck 5) Hopped over to @RaylsLabs testnet, claimed USDGas, minted RXP, ran private RXP ↔ USDTr swaps to finish quests. 200K+ users and 1.4M+ tx says the rails are real, Enygma privacy next for compliant recovery flows $RLS #RWA 6) Wrapped the loop in @GlintAnalytics, asked in plain English, spun a live dashboard, minted as IP‑NFT and farmed the 100k $GLNT airdrop + monthly points #AI #Analytics Which leg are you sizing first this week $VLR $RLS $TRIA $ULAB $SOLV $GLNT $BTC $USDC

Quick calc after checking my eligible stack in @River4fun’s buyback list 450k pts from public sale snapshot locked in satUSD vaults since day one hits clean at 0.0000447 BNB per pt (~$0.048). Zero hoops, overflow straight to burns tightening that 35M external circ TVL’s at $716M, blended APRs ~33% via Pendle cross-chain, and my restaking yields jumped 12% after week 7 using the Builder guide. Small stakers compounding right into the core loop Your pts locked for the full pull, or moving more in before window closes? #River4fun #RiverPts $RIVER

Update on @lute @AbstractChain @ValanniaGame @xeetdotai Plenty of ways to stack value if u act now 1️⃣@lute → Trade socially, mirror top signals, earn rev share. Every call builds your onchain rep 2️⃣@AbstractChain → XP update live, keep grinding leaderboards, engagement = currency 3️⃣@ValanniaGame → $VALAN deflationary model, burns + sinks keep rewards scarce & strong 4️⃣@xeetdotai → Complete campaigns/tournaments, boost ethos score for gated opps Grind → rank up → position early Like RT

Just checked @River4fun stats & that $RIVER buyback phase is wild snapshot locked, 11/20 deadline, 0.0000447 BNB per point. 35M in external circulation defended from a 710M FDV, that’s more than talk it’s coordination in action Smart Vaults still yield steady & conversion upgrade next week aims to stabilize flows while rewarding holders. Transparent moves like these deserve more eyes did you claim your eligible River Pts yet? #River4fun #DeFi

Yo builders, this drop from @plancknetwork feels like compute just got tokenized DNA 60M global GPU power, 116k wallets humming that’s not hype, that’s throughput becoming liquidity @Chain_GPT + @ChainGPT_Pad basically turning every job into an asset rail under $PLANCK/$CGPT verify > trust, settle > speculate data was oil, compute is refinery, and Planck might be the standard that prices gravity itself #PlanckNetwork #CGPT Let's Go

➥ Tried something new this week ran a few trades through @EdgenTech’s AI Copilot while keeping @_technotainment open on a second screen Morning was charts & sentiment scans, afternoon turned into a live interactive stream where the jacket worn in-scene was instantly shoppable, and the plot itself shifted based on our votes Feels wild to move capital with smarter data and then move inside a story you’re part of. Anyone else running market + media in the same flow yet?

➥ OPN Testnet quietly sliding into @Rabby_io is wild you open wallet → boom chainID 984 auto‑added no manual RPC hunt, no setup friction just faucet, swap, grind leaderboard $300K reward pool live on @IOPn_io and scores move fast if you split sessions smart UX details (risk tag, address memo, chain alert) actually *matter* here real alpha for #DeFi testers chasing early points

Tried combining @spaace_io quests with @reya_xyz trading while holding my Quack Head NFT on @wallchain Result? Triple point multipliers from Spaace farming, smooth execution on Reya’s low latency perps, and Wallchain NFT utility stacking right on top Feels like each platform rewards engagement differently, but together it’s compounding fast. How many are running this 3-way farm right now? #Spaace #DeFi #NFT

➥ These Klara loops on @Kindred_AI feel like the cleanest compounding game rn ▸ stake 3× → lock SATO iNFT WL before the gate closes ▸ yap with intent → edge into top 1k for that 1% $KIN drip ▸ sync memory across devices → every real onchain move counted Genesis cap 1000, floor ~1.11 ETH, 18 listed… waitlist 4.4M+ climbing fast Ownable agents + ranked rewards = pure incentive alignment Anyone cracked the cadence that spikes LB the fastest? #KindredAI

People with Innovator archetype

26 | Curious person👽| x-IB and PE | @MorganStanley | @Techstars ‘24 | Bentley U class of ‘21

Think different.

IIDX and DDR doubles enjoyer. Python nerd. Home infra enthusiast. DevOps. Magical girl (boy). @Eymiimi wife. Arcade op @LAP_Arcade. Avi/Banner: メリーさん.

• Most Important: Christian • AI Filmmaker & Commercial Director • Founder of JDC Entertainment • CP: Reve | Vidu | Ideogram | Flora

from bedside to byte_side | MD ⏩ AI | 🇵🇱 | Owner: medcases_io | GitHub ⬇️

Principal at Alpha School. Follow me to help transform education for 1 billion kids.

Building @Stellon_Labs (YC S25) - tiny AI models that (hopefully) think • Past: @DiffusionBee, @Microsoft, @CarnegieMellon, @Meta

CPA | DeFi | Be Curious Use: "Oxxyy" on Solstice

Director of Product at Google Labs. Code AI. Dive in ➡ @googlelabs, @stitchbygoogle, and @julesagent Previously @vercel, @github and @heroku

Explore Related Archetypes

If you enjoy the innovator profiles, you might also like these personality types: