Get live statistics and analysis of The White Whale's profile on X / Twitter

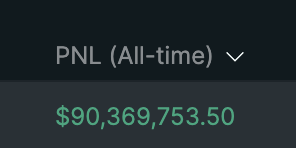

Depth-tested. Market-hardened. 🐋 | $100M PnL goal 🎯 Sharing conviction and philosophy, not financial advice.

The Thought Leader

The White Whale is a resilient crypto trader and community voice who embraces vulnerability and transparency while navigating market storms. With a $100M PnL goal driving his journey, he shares philosophy and conviction—not financial advice—always learning from both wins and losses. His approach blends deep industry insight with authentic storytelling, making complex challenges human and relatable.

Top users who interacted with The White Whale over the last 14 days

Crypto Trader || Marketing || Charity Org.

Digital Asset Investor | $BTC | On The Journey To Crypto Millionaire Status 💰

Father, Teacher.M.A.,B.Ed. TET(Double) God Believer,Being HUMAN is easy, being HUMANE is rare.True Humanity lives in Kindness, Helpfulness n a Merciful heart.🌈

🌐 Airdrop Enthusiast | 🔗 Node Runner | 🚀 Crypto Explorer | 💡 Blockchain Advocate | Always on the lookout for the next big thing in DeFi and Web3! #Crypto #

crazy crypto trader

$pepecoins🐸🧠 $brett $UFD🦄💨✨##GoodAttractsGOOD #JoinTheHERD Veteran USN

It's nothing here mate.

Working to feed family. Fan of @stoolpresidente, and @Trainwreckstv #ApeGang #ChasingFreeMoney

swift like taylor, things at @SagaMobileDAO @SNS @soladex_io @Mach_exchange

Full-time Banger Maker. Hyperliquid & Solana Adept. Joing tg for alpha

Creating Meme Coins that no one buys + Receiving Liquidation Emails on Daily Basis

living in the strange world.The white whale asistant🐋

~

Yield Farmer | DeFi Gem Hunter 💰 I test & share high-ROI protocols 🔥 Follow for passive income plays

PVE. Polymarket Market Making. Top 500 on Hyperliquid All-Time Leaderboard. Founded @xtradesofficial @ct_central

I trade because I don't want to be poor.

Just a simple girl, stirring sass into the crypto chaos 💅💸 Manifesting billionaire energy one coin at a time 🚀✨ #CryptoQueenInTraining

JESUS IS LORD || Backup account @Godwithoss | 100T$ PNL Goal || NFA DYOR .

For a guy who claims to be ‘market-hardened,’ you sure turned that $62M crash into a whole emotional rollercoaster—who needs crypto volatility when we have The White Whale’s tweets doubling as a soap opera? Just promise us next time, no cameo by the tissues!

Successfully mobilized public pressure to force MEXC exchange to release frozen funds and secure a public apology, highlighting systemic flaws and sparking industry-wide transparency discussions.

To inspire and lead the crypto community by modeling courage, accountability, and innovation, while pushing for transparency and fairness in an evolving market. He aims to elevate the space’s standards and act as a catalyst for positive systemic change.

He believes in honesty, resilience, and the power of humility to grow stronger through setbacks. Transparency, consumer-first principles, and a community-rooted approach shape his stance against institutional opacity and market injustice.

Exceptionally resilient and transparent, he communicates with authenticity and conviction, inspiring trust and loyalty. His ability to tactfully challenge powerful entities while engaging his audience demonstrates leadership and strategic communication skills.

His fierce dedication to ambitious goals can sometimes lead to impatience and risk overexposure, while his deep transparency might occasionally invite harsher scrutiny or emotional wear.

To grow his audience on X, The White Whale should leverage his compelling storytelling by initiating regular, interactive threads breaking down market lessons and systemic critiques, inviting community dialogue and co-creation of solutions. Collaborations with other thought leaders and amplifying his philanthropic impact will further elevate his credibility and reach.

Fun fact: Despite a devastating $62M liquidation, The White Whale openly shared his emotional vulnerability, including admitting to tears, to destigmatize the struggle behind trading successes.

Top tweets of The White Whale

MEXC Update On October 20th, I had a one-hour call with @cecilia_hsueh, who has publicly taken on the role of trying to resolve the @MEXC_Official issue. I started the call with my camera on - something that apparently surprised her. I told her I had nothing to hide. I prefer to look people in the eye. From the start, she used the classic corporate playbook. She claimed she had “undeniable proof” I broke the rules - meaning, by MEXC’s own terms, the funds should be forfeited (a polite way of saying they get to keep them). She said she was happy to show this evidence to a third party…but that doing so would require doxxing me, and she “knew I wouldn’t want that.” Then came the carrot: She said MEXC “wants to resolve it” and “sees a path to unlocking the funds.” But it quickly became clear that what they really wanted was for me to publicly admit I broke the rules - to validate their actions with my own words. I asked her to tell me more about the supposed “evidence.” She said back in April, they had records of two orders executed within the same second - which they deemed as not possible from a manual process. Wait…April? When I was still testing strategies - and losing money? Yet they didn’t freeze my account until the fall, after I made $5M in profit in 90 days? I took a breath and told her very sincerely: “I don’t know if you’re a parent. But I have two young daughters. And on all of the love I have for them I can promise you that I did not do what you're saying I did. I used no bots, no automation. Every single trade was manual.” I explained that VPN lag could easily explain two trades executing a single second on their side - doesn't mean they were sent from the same second on my side. She acknowledged the point but didn’t concede. We reached an impasse. Still, she indicated MEXC was “open” to releasing the funds - if I helped them control the narrative. It was obvious: they want me to say, “I broke the rules, but MEXC was nice enough to return the money.” I told her I’d only ever speak the truth. If the matter was resolved, I’d gladly make a public statement - but it would be based in reality, not propaganda. I can and do see how it's possible that my unique - manual - trading strategy, combined with laggy VPN internet traffic could potentially trip a risk review. I used to run a web2 empire - I know all sorts of things can trigger risk control and that sometimes innocent people get caught in the crossfire. What matters is how quickly the business resolves it. I've never had an issue with being put under review. Taking months to even tell me what I'm accused of and finding me guilty on little more than mere suspicion? That I take issue with. We did agree on one thing: their old “risk control” system - total radio silence, zero transparency, and endless review extensions - is broken. She even admitted that much. We closed on a surprisingly cordial note. She complimented my understanding of the industry and even suggested I might make a good CEO candidate for one of MEXC’s new initiatives. I laughed and told her I’d never want to be a CEO again - but I’d gladly donate my time as an unpaid advisor to help MEXC fix their broken systems and improve customer experience…if their intent to improve was real. The call ended with her promising follow-up in the next couple of days. That was a week ago Monday. It’s now over 10 days later and still no movement on this issue. Let me be clear: I never expected much. Cecilia is new to the organization - perhaps even sincere - but ultimately captured by MEXC’s internal narrative: that they are the victims, and that once they define you as “in violation,” they’re justified in keeping your funds. But here’s the part they probably didn’t mean to reveal - this public pressure has hurt them. But my voice is not for sale. Not for profit. Not for peace. Not for anyone. They’ll just have to live with that. 🫡 From the depths — The White Whale 🐋

We Did It - Public Outcry Forces MEXC To Do The Right Thing I didn't have a draft statement for this occasion, as I honestly never expected it to come. I did see the public apology, and while appreciated, it didn't specify what they were apologizing for. Implying I was a criminal (with their public AML claims in the beginning) or a scammer (with the most recent accusations after AML was publicly debunked) would have been nice. I stand on my word that I have NEVER used any automation, secret API access, or bots when I conducted my trades on MEXC. I'm just a trader, who wins or loses by his own hand. So an apology for smearing my good name would be more important to me than an apology for holding my funds in the first place. But I will accept the apology, regardless. I'm sure it wasn't easy to write. That said, our work is not yet done. Throughout this saga over the past few months I've read 100s of cases of people just like me who have been put on indefinite freezes with no access to their funds. People who did not have as large of a microphone as mine. People and organizations make mistakes. But both people and organizations have the ability to change. If MEXC is truly sorry and wants to build a better future, let's start here: 1. Never should the exchange have the financial incentive to "keep" or cause a customer to forfeit their funds. Especially when they act as judge, jury, and executioner to determine your guilt in the first place. If suspected criminal behavior is present, it should be turned over to the proper authorities. Period. MEXC needs to make this public commitment that they will never simply confiscate customer funds as has been done so many times in the past (and they admitted they were planning on doing with me). 2. Valid risk control processes exist for a reason. I don't want terrorist organizations or child trafficking rings to be using an exchange to launder money either. However we have to accept and understand that innocent people DO get flagged for a variety of reasons. MEXC needs to make a commitment towards expediting their review process. And once the financial incentive to find you guilty has been removed from the equation (see #1) they need to have reasonable time frames for either referring a case to proper authorities or unlocking customer funds. MEXC risk control team is not law enforcement. They should not act like it. In the beginning of this issue being made public I recognized that I was not a voice for only myself. There are many good people who still have accounts frozen that have not gotten the visibility my case has. That's why it never felt right to take the money back and keep it for myself. It's not fair that someone who has status or wealth or a certain amount of social media followers be treated so differently than every other person who has their hard-earned money taken from them. I'm happy to announce that I am going to distribute 100% of these funds - as I initially promised - to be split between the first 20,000 supporters (NFT holders) - and the remaining 50% to verified non-profit organizations. Because I wasn't expecting this to happen today I ask to give me a couple days to properly set up the airdrop claim mechanism, and work out a way for the community to vote on non-profits they care about. I have family obligations that will keep me limited engagement today, but I'll make forward progress on this and hope to have it live in the next couple of days. Thank you all, from the bottom of my heart. The battle has been won. But the war is far from over. And this isn't just a war against MEXC. It's a war to continually improve our space. To fix our own problems so that governments don't need to step in and fix them for us. To continue the evolution of Satoshi's vision as we craft, test, break, and rebuild this beautiful new world together. 🫡 From the depths — The White Whale 🐋 solscan.io/tx/3P6uFgiRE6v…

I Withdraw My Offer to Advise MEXC - Here’s Why (Something Sinister Is Brewing) After winning my case against MEXC - thanks entirely to the community’s relentless support and the spotlight you helped shine on their unfair seizure of user funds - I made a public offer: If you are truly sincere in your apology and desire to change, I’ll make myself available, free of charge, to help guide those reforms. I have, in my life, built incredibly large web2 empires after all, and that's all they are - another web2 business. Behind the scenes, I asked MEXC to provide a mutual NDA, because I couldn’t help them if they weren’t willing to be honest with me. I even rejected their “non-disparagement” clause - which, to their credit, they removed at my request - because I made it clear: I will always reserve the right to call you out publicly if this is all just smoke and mirrors. Unsurprisingly to any of us: it was. The first piece of advice I gave them concerned their so-called “Proof of Reserves” Publishing wallet addresses they themselves provide to show the assets they hold means absolutely nothing. Offering a tool to verify your individual balance means nothing, either. Every user balance is a liability to the exchange - and publishing only the assets without an independently verified list of liabilities is 100% meaningless. It’s deceptive marketing pretending to be transparency. When I told them this their response was: “Well, it’s better than nothing, right?” No. In fact it IS nothing, by design. Seeing MEXC continue to push this fake “proof of reserves” narrative reminds me of an old saying: “If you have to tell people you’re a lady, you aren’t.” The second point I made - both publicly and privately - was clear: Stop confiscating user funds. If you suspect illegal activity, turn it over to law enforcement. Otherwise, give people their money back. They’re still doing it. And it’s getting worse. Take the case of @loveme4994 This user reached out and sent me evidence, which I verified through screen recordings and other account data. MEXC cited their Risk Control Guidelines: mexc.com/announcements/… The document still includes language like “suspected” - meaning they can permanently keep your funds based on suspicion alone. Here’s the deeper problem: almost every major item on that list could be prevented through code if they truly wanted to. But removing the loopholes would also remove their excuses to seize user funds. And here’s where it turns sinister - and why I feel partly responsible. After I made my account history public to prove my innocence, MEXC seems to have learned from it. In this latest case, they completely wiped the user’s transaction history after confiscating their funds. They stole the user’s money. They admitted to it. They offered no specific accusation. And they erased the evidence that could have helped proven the user’s innocence. My case was over $3 million. This user lost roughly $4,000 - which, for most people, is life-changing. Their $4,000 means more to them than my $3 million ever did. While some high-profile cases have been resolved, I continue to see new ones daily that aren’t. As long as this structural rot exists - fake “proof of reserves,” arbitrary justifications for seizures, lack of due process, and the ability to block users from their own records - MEXC remains a rotten apple. Rotten to the core. 🫡 From the depths — The White Whale 🐋

I Need Your Help - And I'm Putting a $2M Bounty Up For Grabs (half can be claimed by YOU) Let me start by saying - "I know, I was dumb" (more on that in the FAQs, but no need to comment how dumb I was - I just beat you to it) In July 2025, @MEXC_Official froze over $3 million of my funds. $3,158,572.32 to be precise. No warning. No explanation. No Terms of Service violation - because there was none. That money came from my hard-earned savings, and every dollar I earned on the platform came from clean, legitimate, skill-based trading. My only conceivable offense? I was too profitable. (in the long list of public replies to other traders who experienced the same thing I was able to find ONE instance where they accidentally admitted this as a potential cause). I consistently beat their external market makers - the firms they quietly partner with to be the counter-party to trades (this is public record). When the counter-party they need in order to stay in business consistently looses? Who's side do you think they will pick? So what did MEXC do? They retaliated. They froze my account. And now, they’ve told me the “review process” will take up to one full year. Let that sink in: No specific allegation No evidence of wrongdoing Just a vague “review” that conveniently lets them hold my money hostage indefinitely What kind of review takes 12 months - without a single update, document, or charge? You see I had already been through their most advanced KYC process possible and passed with flying colors. But this is bigger than me. It’s about every trader who’s ever been punished for winning, punished for exposing CEX dirty little secrets, or robbed by a centralized exchange hiding behind offshore protections in jurisdictions with limited legal recourse. We are not your exit liquidity. We are not your prey. We are the tide. And the tide is turning. #FreeTheWhiteWhale #MEXCFreeze

MEXC Has Violated the Law - TWW Formal Response on “Arbitration” and Threats of Doxxing @MEXC_Official @cecilia_hsueh I’m issuing a formal objection to MEXC’s claim of a “third-party arbitration process” and their associated threat to publicly disclose (“doxx”) my identity. Your own Terms of Service (Section 48) state that “the arbitration shall be subject to the HKIAC Administered Arbitration Rules in force when the Notice of Arbitration is submitted.” No such Notice of Arbitration has ever been delivered to me. I learned of this so-called process only through your press release - not through the procedures required under HKIAC. That alone makes any claimed arbitration invalid. The HKIAC Rules require impartiality and formal notice of the tribunal’s composition. I have received neither. Until I do, I reserve full rights to challenge any arbitrator and the legitimacy of this process in its entirety. You have also already breached HKIAC Article 45.1, which states: “No party may publish, disclose or communicate any information relating to the arbitration.” By publicly announcing alleged arbitration you’ve violated the confidentiality that governs your own chosen forum. Your Privacy Policy further promises: “We never disclose any personal information about our customers to non-affiliated third parties, except as described below.” Threatening to doxx me violates both HKIAC confidentiality and your own privacy commitments. Even if you argue arbitration hasn’t formally begun, that only worsens your position - in that case, your press release misrepresents a legal process that does not yet exist. I now demand that you immediately provide a copy of any Notice of Arbitration you claim to have filed or intend to file, including the date, the arbitral institution, the seat, the names of any arbitrator, and the claims being made. I further demand that you confirm whether you intend to disclose my identity or personal information, and on what legal basis. All public or private threats of disclosure must cease immediately. Proceed only under full HKIAC compliance - or withdraw this fabricated “arbitration” entirely. I reserve all rights to challenge this process, including any attempt to shape public narrative or disclose private data. If you continue acting outside your own Terms and the HKIAC Rules, I will treat it as bad-faith conduct and pursue every available remedy, including injunctive relief and regulatory complaint. I did not agree to “arbitration by press release.” Follow your own contract, follow your own rules, and stop the coercive theater. MEXC’s public statement goes even further off the rails by characterizing my assets as “illicit profits.” That language is both procedurally improper and legally reckless. Under Article 45.1 of the HKIAC Administered Arbitration Rules, no party may “publish, disclose or communicate any information relating to the arbitration.” Publicly asserting that a counterparty’s funds are illicit before any tribunal has been constituted is a direct violation of that rule. It prejudges the outcome, poisons the process, and undermines the very impartiality HKIAC is meant to protect. It is also defamatory under Hong Kong law. The Defamation Ordinance (Cap. 21) defines libel as a published statement that damages a person’s reputation by imputing criminal or dishonest conduct. By publicly labeling my transactions “illicit,” MEXC has published an accusation of criminality without adjudicated fact, while simultaneously disclosing my financial data. This constitutes both defamation and breach of contractual confidentiality. Any legitimate dispute resolution body would treat such conduct as bad faith and grounds for sanction. TLDR: If you're going to bring it, bring it. But you're already in violation of the very process you seek to invoke. You'll have a counter-claim from me faster than you can say "stolen funds". -TWW mexc.co/announcements/…

First Two Charitable Donations Have Been Made As promised, 50% of the funds will be to non-profit charities. This is going to be split between 10 causes evenly. I made the decision (it is my own money, after all) to include @zachxbt Zach is one of the most valuable independent forces in crypto because he does what few others have the courage, skill, or patience to do: follow the money. In a market built on anonymity and hype, he uses on-chain forensics to expose scams, trace stolen funds, and hold influencers, founders, and exchanges publicly accountable. His investigations have protected countless investors, recovered millions in stolen assets, and forced a higher standard of transparency across the entire industry - all without the backing of any institution. In short, he has become crypto’s conscience: a reminder that even in an anonymous world, truth still leaves a trail. So for everything you have done, here's a donation to your public donation address: basescan.org/tx/0xdb5cd8ed3… The second charitable organization I've selected is deeply personal to me. One of my favorite places to vacation is Hawaii in the United States. helpthehomelesskeiki.org As someone who’s long been a "taker" of all the beauty, peace, and healing the Hawaiian islands have to offer, a few years ago I started asking myself how I could become a "maker" - how I could give back to a place that’s given me so much. Having been burned by shady charities in the past, I had my security team run a full background check on both the founders and the organization itself. I even insisted on meeting them in person during one of my trips to the islands. As someone who has been homeless more than once in my life, Project Hawaii really hit home for me. As my way of giving back to the islands that have personally given me so much: basescan.org/tx/0x3a437b3fd… Now let's let YOUR voice be heard: Visit app.endaoment.org/explore Find the URL of YOUR favorite charity (must post the URL directly to the charity of choice - don't be lazy) Let's take a very informal community vote on the remaining 8 donations based on the feedback in the comments and likes on your links. 🫡 From the depths — The White Whale 🐋

Most engaged tweets of The White Whale

We Did It - Public Outcry Forces MEXC To Do The Right Thing I didn't have a draft statement for this occasion, as I honestly never expected it to come. I did see the public apology, and while appreciated, it didn't specify what they were apologizing for. Implying I was a criminal (with their public AML claims in the beginning) or a scammer (with the most recent accusations after AML was publicly debunked) would have been nice. I stand on my word that I have NEVER used any automation, secret API access, or bots when I conducted my trades on MEXC. I'm just a trader, who wins or loses by his own hand. So an apology for smearing my good name would be more important to me than an apology for holding my funds in the first place. But I will accept the apology, regardless. I'm sure it wasn't easy to write. That said, our work is not yet done. Throughout this saga over the past few months I've read 100s of cases of people just like me who have been put on indefinite freezes with no access to their funds. People who did not have as large of a microphone as mine. People and organizations make mistakes. But both people and organizations have the ability to change. If MEXC is truly sorry and wants to build a better future, let's start here: 1. Never should the exchange have the financial incentive to "keep" or cause a customer to forfeit their funds. Especially when they act as judge, jury, and executioner to determine your guilt in the first place. If suspected criminal behavior is present, it should be turned over to the proper authorities. Period. MEXC needs to make this public commitment that they will never simply confiscate customer funds as has been done so many times in the past (and they admitted they were planning on doing with me). 2. Valid risk control processes exist for a reason. I don't want terrorist organizations or child trafficking rings to be using an exchange to launder money either. However we have to accept and understand that innocent people DO get flagged for a variety of reasons. MEXC needs to make a commitment towards expediting their review process. And once the financial incentive to find you guilty has been removed from the equation (see #1) they need to have reasonable time frames for either referring a case to proper authorities or unlocking customer funds. MEXC risk control team is not law enforcement. They should not act like it. In the beginning of this issue being made public I recognized that I was not a voice for only myself. There are many good people who still have accounts frozen that have not gotten the visibility my case has. That's why it never felt right to take the money back and keep it for myself. It's not fair that someone who has status or wealth or a certain amount of social media followers be treated so differently than every other person who has their hard-earned money taken from them. I'm happy to announce that I am going to distribute 100% of these funds - as I initially promised - to be split between the first 20,000 supporters (NFT holders) - and the remaining 50% to verified non-profit organizations. Because I wasn't expecting this to happen today I ask to give me a couple days to properly set up the airdrop claim mechanism, and work out a way for the community to vote on non-profits they care about. I have family obligations that will keep me limited engagement today, but I'll make forward progress on this and hope to have it live in the next couple of days. Thank you all, from the bottom of my heart. The battle has been won. But the war is far from over. And this isn't just a war against MEXC. It's a war to continually improve our space. To fix our own problems so that governments don't need to step in and fix them for us. To continue the evolution of Satoshi's vision as we craft, test, break, and rebuild this beautiful new world together. 🫡 From the depths — The White Whale 🐋 solscan.io/tx/3P6uFgiRE6v…

MEXC Update On October 20th, I had a one-hour call with @cecilia_hsueh, who has publicly taken on the role of trying to resolve the @MEXC_Official issue. I started the call with my camera on - something that apparently surprised her. I told her I had nothing to hide. I prefer to look people in the eye. From the start, she used the classic corporate playbook. She claimed she had “undeniable proof” I broke the rules - meaning, by MEXC’s own terms, the funds should be forfeited (a polite way of saying they get to keep them). She said she was happy to show this evidence to a third party…but that doing so would require doxxing me, and she “knew I wouldn’t want that.” Then came the carrot: She said MEXC “wants to resolve it” and “sees a path to unlocking the funds.” But it quickly became clear that what they really wanted was for me to publicly admit I broke the rules - to validate their actions with my own words. I asked her to tell me more about the supposed “evidence.” She said back in April, they had records of two orders executed within the same second - which they deemed as not possible from a manual process. Wait…April? When I was still testing strategies - and losing money? Yet they didn’t freeze my account until the fall, after I made $5M in profit in 90 days? I took a breath and told her very sincerely: “I don’t know if you’re a parent. But I have two young daughters. And on all of the love I have for them I can promise you that I did not do what you're saying I did. I used no bots, no automation. Every single trade was manual.” I explained that VPN lag could easily explain two trades executing a single second on their side - doesn't mean they were sent from the same second on my side. She acknowledged the point but didn’t concede. We reached an impasse. Still, she indicated MEXC was “open” to releasing the funds - if I helped them control the narrative. It was obvious: they want me to say, “I broke the rules, but MEXC was nice enough to return the money.” I told her I’d only ever speak the truth. If the matter was resolved, I’d gladly make a public statement - but it would be based in reality, not propaganda. I can and do see how it's possible that my unique - manual - trading strategy, combined with laggy VPN internet traffic could potentially trip a risk review. I used to run a web2 empire - I know all sorts of things can trigger risk control and that sometimes innocent people get caught in the crossfire. What matters is how quickly the business resolves it. I've never had an issue with being put under review. Taking months to even tell me what I'm accused of and finding me guilty on little more than mere suspicion? That I take issue with. We did agree on one thing: their old “risk control” system - total radio silence, zero transparency, and endless review extensions - is broken. She even admitted that much. We closed on a surprisingly cordial note. She complimented my understanding of the industry and even suggested I might make a good CEO candidate for one of MEXC’s new initiatives. I laughed and told her I’d never want to be a CEO again - but I’d gladly donate my time as an unpaid advisor to help MEXC fix their broken systems and improve customer experience…if their intent to improve was real. The call ended with her promising follow-up in the next couple of days. That was a week ago Monday. It’s now over 10 days later and still no movement on this issue. Let me be clear: I never expected much. Cecilia is new to the organization - perhaps even sincere - but ultimately captured by MEXC’s internal narrative: that they are the victims, and that once they define you as “in violation,” they’re justified in keeping your funds. But here’s the part they probably didn’t mean to reveal - this public pressure has hurt them. But my voice is not for sale. Not for profit. Not for peace. Not for anyone. They’ll just have to live with that. 🫡 From the depths — The White Whale 🐋

I Need Your Help - And I'm Putting a $2M Bounty Up For Grabs (half can be claimed by YOU) Let me start by saying - "I know, I was dumb" (more on that in the FAQs, but no need to comment how dumb I was - I just beat you to it) In July 2025, @MEXC_Official froze over $3 million of my funds. $3,158,572.32 to be precise. No warning. No explanation. No Terms of Service violation - because there was none. That money came from my hard-earned savings, and every dollar I earned on the platform came from clean, legitimate, skill-based trading. My only conceivable offense? I was too profitable. (in the long list of public replies to other traders who experienced the same thing I was able to find ONE instance where they accidentally admitted this as a potential cause). I consistently beat their external market makers - the firms they quietly partner with to be the counter-party to trades (this is public record). When the counter-party they need in order to stay in business consistently looses? Who's side do you think they will pick? So what did MEXC do? They retaliated. They froze my account. And now, they’ve told me the “review process” will take up to one full year. Let that sink in: No specific allegation No evidence of wrongdoing Just a vague “review” that conveniently lets them hold my money hostage indefinitely What kind of review takes 12 months - without a single update, document, or charge? You see I had already been through their most advanced KYC process possible and passed with flying colors. But this is bigger than me. It’s about every trader who’s ever been punished for winning, punished for exposing CEX dirty little secrets, or robbed by a centralized exchange hiding behind offshore protections in jurisdictions with limited legal recourse. We are not your exit liquidity. We are not your prey. We are the tide. And the tide is turning. #FreeTheWhiteWhale #MEXCFreeze

I Withdraw My Offer to Advise MEXC - Here’s Why (Something Sinister Is Brewing) After winning my case against MEXC - thanks entirely to the community’s relentless support and the spotlight you helped shine on their unfair seizure of user funds - I made a public offer: If you are truly sincere in your apology and desire to change, I’ll make myself available, free of charge, to help guide those reforms. I have, in my life, built incredibly large web2 empires after all, and that's all they are - another web2 business. Behind the scenes, I asked MEXC to provide a mutual NDA, because I couldn’t help them if they weren’t willing to be honest with me. I even rejected their “non-disparagement” clause - which, to their credit, they removed at my request - because I made it clear: I will always reserve the right to call you out publicly if this is all just smoke and mirrors. Unsurprisingly to any of us: it was. The first piece of advice I gave them concerned their so-called “Proof of Reserves” Publishing wallet addresses they themselves provide to show the assets they hold means absolutely nothing. Offering a tool to verify your individual balance means nothing, either. Every user balance is a liability to the exchange - and publishing only the assets without an independently verified list of liabilities is 100% meaningless. It’s deceptive marketing pretending to be transparency. When I told them this their response was: “Well, it’s better than nothing, right?” No. In fact it IS nothing, by design. Seeing MEXC continue to push this fake “proof of reserves” narrative reminds me of an old saying: “If you have to tell people you’re a lady, you aren’t.” The second point I made - both publicly and privately - was clear: Stop confiscating user funds. If you suspect illegal activity, turn it over to law enforcement. Otherwise, give people their money back. They’re still doing it. And it’s getting worse. Take the case of @loveme4994 This user reached out and sent me evidence, which I verified through screen recordings and other account data. MEXC cited their Risk Control Guidelines: mexc.com/announcements/… The document still includes language like “suspected” - meaning they can permanently keep your funds based on suspicion alone. Here’s the deeper problem: almost every major item on that list could be prevented through code if they truly wanted to. But removing the loopholes would also remove their excuses to seize user funds. And here’s where it turns sinister - and why I feel partly responsible. After I made my account history public to prove my innocence, MEXC seems to have learned from it. In this latest case, they completely wiped the user’s transaction history after confiscating their funds. They stole the user’s money. They admitted to it. They offered no specific accusation. And they erased the evidence that could have helped proven the user’s innocence. My case was over $3 million. This user lost roughly $4,000 - which, for most people, is life-changing. Their $4,000 means more to them than my $3 million ever did. While some high-profile cases have been resolved, I continue to see new ones daily that aren’t. As long as this structural rot exists - fake “proof of reserves,” arbitrary justifications for seizures, lack of due process, and the ability to block users from their own records - MEXC remains a rotten apple. Rotten to the core. 🫡 From the depths — The White Whale 🐋

What are some non-meme projects on @solana I should take a look at? I’m giving permission this once to shill me - just be classy about it. Make your case for why I should look at it? I find myself inexplicably drawn to investing more on good things on Solana. Been down deep for a few months doing what I do and may have missed something cool.

🚨 Giveaway Time 🚨 Win 100,000 $TUNA 🐟 Released at 1,000 $TUNA/day for 100 days via @Sablier Structured this way to teach the real value of HODLing: prize flows over time, not all at once. How to enter: 1️⃣ Retweet this post (one entry per account) 2️⃣ That’s it Notes: This giveaway is run by @TheWhiteWhaleHL , not sponsored by or affiliated with @DeFiTuna No purchase necessary. Multiple accounts/duplicate entries will not increase chances. Winner will be selected randomly from all eligible retweeters on Sunday, October 5th at 16:00 UTC Prize is paid on-chain via Sablier. 🫡 From the depths — The White Whale 🐋

First Two Charitable Donations Have Been Made As promised, 50% of the funds will be to non-profit charities. This is going to be split between 10 causes evenly. I made the decision (it is my own money, after all) to include @zachxbt Zach is one of the most valuable independent forces in crypto because he does what few others have the courage, skill, or patience to do: follow the money. In a market built on anonymity and hype, he uses on-chain forensics to expose scams, trace stolen funds, and hold influencers, founders, and exchanges publicly accountable. His investigations have protected countless investors, recovered millions in stolen assets, and forced a higher standard of transparency across the entire industry - all without the backing of any institution. In short, he has become crypto’s conscience: a reminder that even in an anonymous world, truth still leaves a trail. So for everything you have done, here's a donation to your public donation address: basescan.org/tx/0xdb5cd8ed3… The second charitable organization I've selected is deeply personal to me. One of my favorite places to vacation is Hawaii in the United States. helpthehomelesskeiki.org As someone who’s long been a "taker" of all the beauty, peace, and healing the Hawaiian islands have to offer, a few years ago I started asking myself how I could become a "maker" - how I could give back to a place that’s given me so much. Having been burned by shady charities in the past, I had my security team run a full background check on both the founders and the organization itself. I even insisted on meeting them in person during one of my trips to the islands. As someone who has been homeless more than once in my life, Project Hawaii really hit home for me. As my way of giving back to the islands that have personally given me so much: basescan.org/tx/0x3a437b3fd… Now let's let YOUR voice be heard: Visit app.endaoment.org/explore Find the URL of YOUR favorite charity (must post the URL directly to the charity of choice - don't be lazy) Let's take a very informal community vote on the remaining 8 donations based on the feedback in the comments and likes on your links. 🫡 From the depths — The White Whale 🐋

🚨Bounty Raised to 100% - $3.1M USD🚨 ...as @MEXC_Official Attempts to Gaslight an Entire Community Apparently, I’m a criminal now. That’s the narrative MEXC is floating. According to them, I’m part of some secretive money laundering operation using their platform as a conduit. At least that’s the latest version. Their story keeps changing. First, it was about KYC - even though I completed Advanced KYC long ago. Then it became “high-frequency API trading” - despite the fact I’ve never had API access on the account. Now, the new angle is: Anti-Money Laundering investigation. Because it sounds scarier. And more convenient. Because implying I’m a criminal is their best shot at shaking public backlash. But let’s take a step back and apply some basic logic. If this were a legitimate investigation: Why keep changing your story? Why has no investigator ever contacted me with questions? (I'm not aware of any investigative service in the world who would not jump at the chance to interview their "suspect") Why is the only path forward an in-person meeting - with no formal accusation, no explanation? What exactly do you hope to achieve face-to-face that can’t be done over Zoom? Are you planning to take my fingerprints? My blood? My life? If not, then there’s no excuse. This could have - and should have - been handled virtually. I’ve made it clear: I can prove the source of funds. They’re not interested. They just repeat the same line: “Come meet us. Face to face.” After public backlash mounted to the suggested of in-person KYC, they recently started saying it’s “not compulsory.” But in the same breath, it’s still “the only way to resolve the review.” You can’t have it both ways. To @MEXC_Official : You are not Interpol. You are not MI6. You are not James Bond. You have my KYC. You have my location. Where I live, where I sleep. My IP address. If you believe there’s a crime, forward your evidence to actual law enforcement. What you’re doing instead is freezing user funds while inventing new reasons as you go. You’re not enforcing the rules. You’re making them up as you go. And every trader watching knows it. This was never just about my account - and it’s never been about the money. It’s about standing up to exchanges that operate like the shadowy criminal organizations they falsely accuse their customers of being. Seizing user funds without process, without proof, and without consequence. There are hundreds of stories just like mine - users who never had a voice, never had a following, and never had a chance. That ends here. The bounty has now been increased to 100% of the frozen funds - $3.1 million. Half will go to verified, transparent charities, and the other half will go directly back to the community that continues to amplify this cause. Every last cent will be documented on-chain. Just truth, transparency, and accountability. That is, after all, what crypto is all about. 🫡 From the depths — The White Whale 🐋

People with Thought Leader archetype

Economista.Escritor. Razón-ciencia. Filosofía. Literatura y arte Política.Librepensador. interés: geopolítica ∴

- podcast 大话前端、大话英语、大话雅思单词 host - study English Focus on AI, Indie Hacker,Remote work All views are my own

长居欧洲写代码|靠写作为生多年 公开记录每日尝试与进步 创业、投资、学语言、自我成长 目标是通过输出积累专长 希望自己积极快乐活在当下 快乐事业=退休(x,yt) 和自己的全能自恋相处中|复利追求者 在欧洲生活、讨厌坐班、在探索自由和搞钱的人

I teach you to think like a Spy. To vet high-stakes decisions in Crypto, Business, & Life. Author of THE VETTING PROTOCOL. The manual is in the link.

✨

Web3 Marketing | Fulltime Crypto | @KaitoAI yapper - @Wallchain guy

supersede people's short-term social reinforcement loops with the feeling of eternity. creation, curation, process +

trying to understand that crazy world - and the universe if there is time left... If you want to support my work - subscribe or patreon.com/GeromanAT

Acceleraτing an Open Fuτure // @OSSCapital 🌏 @LatentHoldings 🕊️ @thetaopod 🎤

GET funded ➡ $200m SaaStrFund.com🦄🦄🦄🦄🦄🦄 LEARN GTM ➡ SaaStr.University CHAT with Digital Jason ▶ SaaStr.AI/mentor Founder/ceo #AdobeSign

Engineer & Biohacker | Focusing on Geopolitics, Ancient Mysteries, Psychedelic Therapy, Tech & AI. e/acc ⏩

Explore Related Archetypes

If you enjoy the thought leader profiles, you might also like these personality types: