Get live statistics and analysis of Ash's profile on X / Twitter

Building @PolynomialFi

The Entrepreneur

Ash is a driven builder focused on creating impactful solutions at PolynomialFi, blending strategic networking with a clear passion for the crypto and blockchain space. With a proactive approach, Ash shares actionable advice and insightful updates that fuel conversations in the Web3 community. Their energetic presence reflects a commitment to growth, innovation, and community-building.

Ash is the kind of person who’s probably already DM’d you three times, prepped a value-add list, and clocked your ‘availability’ before you had a chance to check your notifications. If networking was a marathon, Ash would have run it twice and still be drafting the post-race celebration tweets.

Successfully building and growing PolynomialFi in the competitive and fast-evolving blockchain space, while maintaining visible thought leadership and community engagement amidst the noise of major crypto events.

Ash’s life purpose is to transform innovative blockchain ideas into tangible products and ecosystems that empower users and foster decentralized collaboration. They strive to catalyze growth within the crypto space by connecting people, ideas, and technology to create meaningful impact.

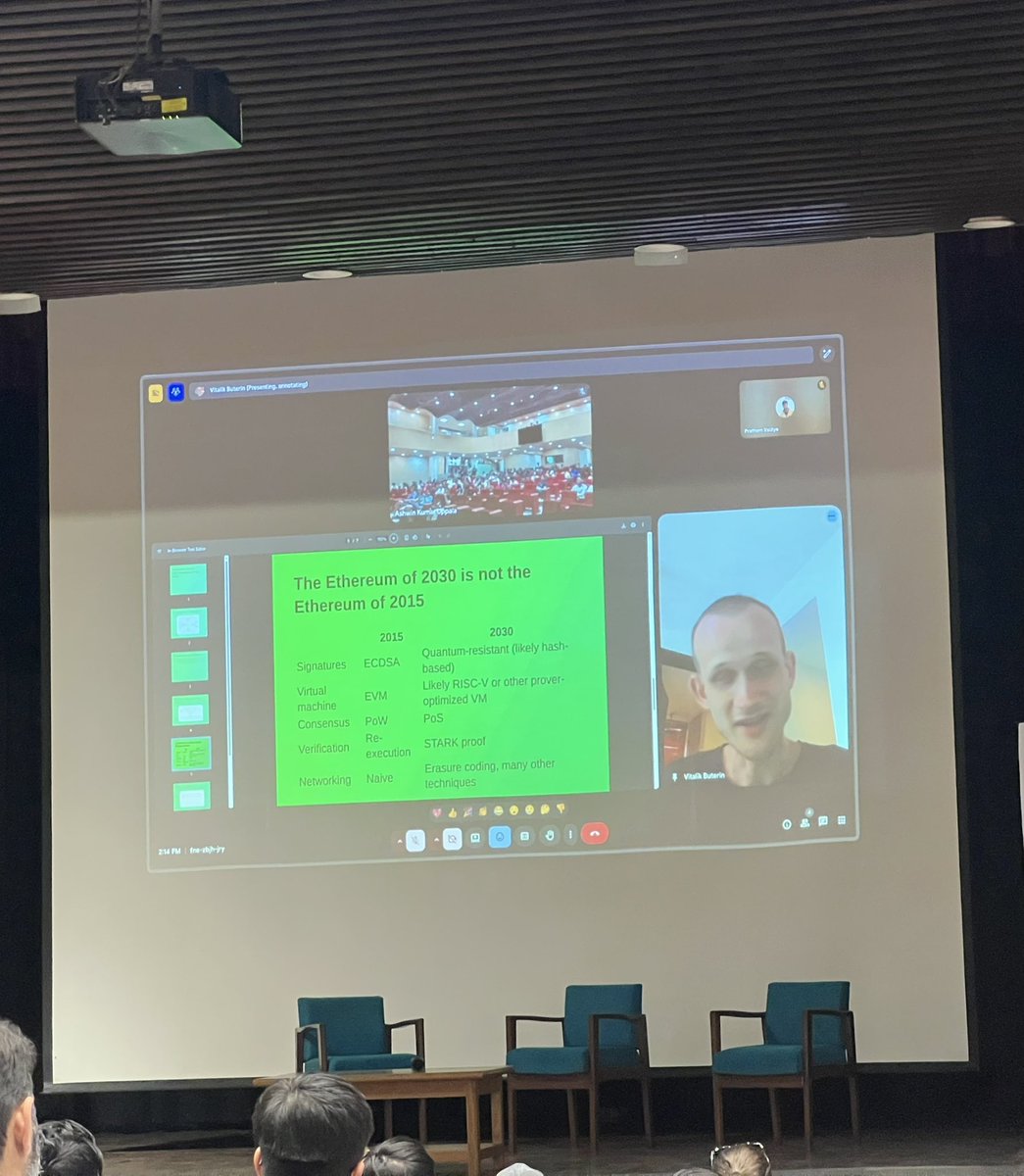

Ash believes in the power of building over talking, emphasizing productivity and clear value exchanges within networks. They trust in the potential of blockchain and Ethereum’s ecosystem to disrupt traditional finance and champion decentralization. Collaboration, early preparation, and leveraging community wisdom are core to their worldview.

Ash excels at strategic networking, practical advice delivery, and creating momentum in the Web3 space. Their ability to break down complex topics (like the x402 meta) and maintain bullish optimism shows strong thought leadership with an entrepreneurial edge.

Challenge-wise, Ash might sometimes focus so heavily on building and networking that deeper community engagement or broader content diversity takes a backseat, potentially limiting broader audience growth on X.

To boost audience growth on X, Ash should amplify community interaction by hosting Twitter Spaces or Q&A threads around PolynomialFi developments and trending crypto topics. Sharing behind-the-scenes entrepreneur moments and more personal stories could also deepen follower connection and loyalty.

Fun fact: Ash has a knack for preparing quick intro templates and prioritizing meaningful 1:1 connections at big crypto events like TOKEN2049 — no networking fatigue can slow this entrepreneur down!

Top tweets of Ash

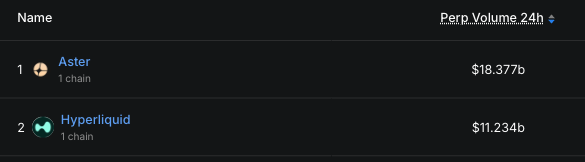

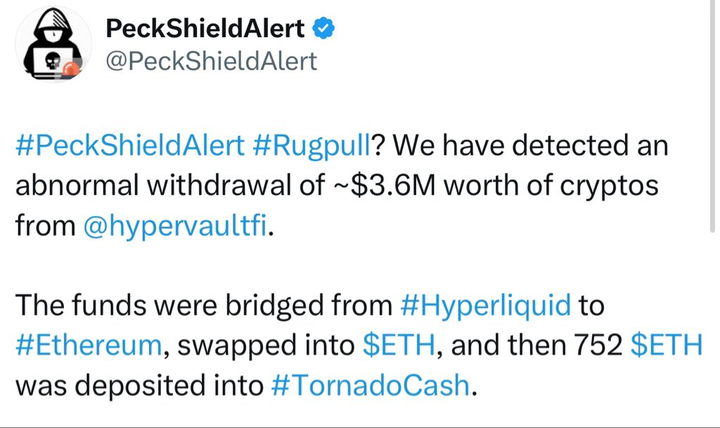

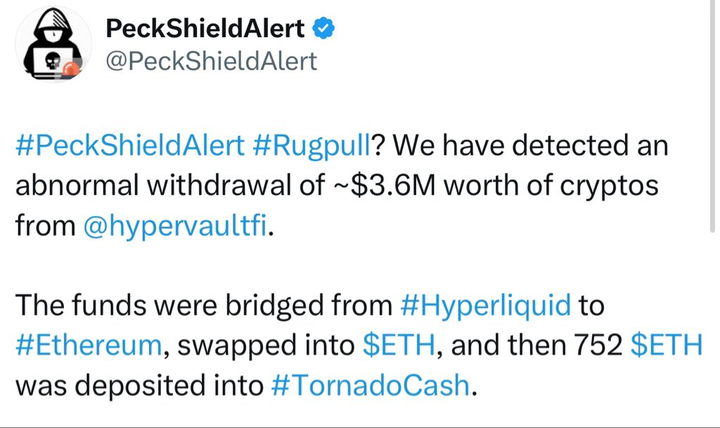

HYPERVAULT RUGGED THEIR USERS Not every project on Hyperliquid seems legit. Hypervault on Hyperliquid did a rug pull. They were offering 90% APR on $HYPE, and today @PeckShieldAlert confirmed $3.6 million were drained from the vaults, moved to Ethereum, and swapped to ETH and sent to Tornado Cash. Hypervault also deleted all the social media accounts. On Sep 5, @hypingbull had already given a warning: when the developers were asked about audits, they confirmed pending audits with Pashov, but Pashov confirmed they never heard of the project. Just a reminder of how risky DeFi can be - always DYOR and double-check everything: audits, team transparency, etc. Stay safe

Looks like @Lighter_xyz just revealed exactly how their Points Distribution works Points are split between Retail Traders and MMs - here’s how you can earn more 👇 FOR RETAIL TRADERS - 200,000 points/week, distributed every Friday - Points depend on Vol , OI, Funding, Liquidations/Deleverages and PnL - Premium acc may get higher weight for PnL, but for metrics like Vol/OI there’s no difference - Points aren’t linear - 2× volume ≠ 2× points; markets also carry different weights - Losing money or getting liquidated doesn’t help - Sybil detection remains active - up to 10 accounts per user allowed without penalty FOR MARKET MAKERS (MMs) - 50,000 points/week (20%) Volume points : Each MM gets a score → Score = volume + max(0, (volume − 2.5B) × 0.25) (Extra 25% for vol beyond 2.5B) Calculated weekly, with equal weights across markets Liquidity Points - Rewards strong liquidity and tight spreads, even if it doesn’t generate big vol - Each market has a weight (updated hourly) based on liquidity demand and comparisons with other exchanges. - Heavily traded tokens (BTC, ETH, SOL) and tokens popular elsewhere get higher weight. - Orderbook snapshots are taken at random times to measure liquidity quality. For each market, Lighter checks:Depth levels: top $10K, $30K, $100K, etc and Price-distance levels: within 1 bps, 2 bps, 5 bps of mid-price. You earn points based on your share of liquidity within those tiers. Now that the team has laid out the full framework - Time to fine-tune your farming strategy.

Most engaged tweets of Ash

HYPERVAULT RUGGED THEIR USERS Not every project on Hyperliquid seems legit. Hypervault on Hyperliquid did a rug pull. They were offering 90% APR on $HYPE, and today @PeckShieldAlert confirmed $3.6 million were drained from the vaults, moved to Ethereum, and swapped to ETH and sent to Tornado Cash. Hypervault also deleted all the social media accounts. On Sep 5, @hypingbull had already given a warning: when the developers were asked about audits, they confirmed pending audits with Pashov, but Pashov confirmed they never heard of the project. Just a reminder of how risky DeFi can be - always DYOR and double-check everything: audits, team transparency, etc. Stay safe

Looks like @Lighter_xyz just revealed exactly how their Points Distribution works Points are split between Retail Traders and MMs - here’s how you can earn more 👇 FOR RETAIL TRADERS - 200,000 points/week, distributed every Friday - Points depend on Vol , OI, Funding, Liquidations/Deleverages and PnL - Premium acc may get higher weight for PnL, but for metrics like Vol/OI there’s no difference - Points aren’t linear - 2× volume ≠ 2× points; markets also carry different weights - Losing money or getting liquidated doesn’t help - Sybil detection remains active - up to 10 accounts per user allowed without penalty FOR MARKET MAKERS (MMs) - 50,000 points/week (20%) Volume points : Each MM gets a score → Score = volume + max(0, (volume − 2.5B) × 0.25) (Extra 25% for vol beyond 2.5B) Calculated weekly, with equal weights across markets Liquidity Points - Rewards strong liquidity and tight spreads, even if it doesn’t generate big vol - Each market has a weight (updated hourly) based on liquidity demand and comparisons with other exchanges. - Heavily traded tokens (BTC, ETH, SOL) and tokens popular elsewhere get higher weight. - Orderbook snapshots are taken at random times to measure liquidity quality. For each market, Lighter checks:Depth levels: top $10K, $30K, $100K, etc and Price-distance levels: within 1 bps, 2 bps, 5 bps of mid-price. You earn points based on your share of liquidity within those tiers. Now that the team has laid out the full framework - Time to fine-tune your farming strategy.

$JTO is now live on Polynomial @jito_sol brings MEV rewards and liquid staking to Solana. Now tradable with 20x leverag…

Big news, rsETH holders! 🌱 rsETH just went live on @PolynomialFi for perp trading on the super chain. 🔴 Unlock a new way to…

Thrilled to collaborate with @KelpDAO You can now trade on Polynomial using rsETH Earn yield, $OP Tokens, 2x Kernel P…

$TON is now live on Polynomial! The Open Network brings crypto to billions through @Telegram. Now tradable with 20x leve…

If you're a dev, you can start earning from day one. - Build an integration that lets users onboard to Polynomial Trade…

☑️ Introducing the Polynomial Builder Kit Start earning with the Polynomial whether you're writing a bot, building dashb…

$CAKE is live on Polynomial. Trade the native token of @PancakeSwap, the leading DEX on @BNBCHAIN, with enhanced multi-c…

$ZRO is now live on Polynomial! @LayerZero_Core is the backbone of cross-chain applications. Now tradable with 20x lever…

People with Entrepreneur archetype

founder reel.farm - automating TikToks that drive traffic to your website

We don’t GIVE UP HERE………..A sweetheart, Free Spirit, An entrepreneur (call me Lily of all trades)Patronize my business, Chocolate lover, A fine gal too🥹

trencher @TrenchExchange

Entrepreneur, Traveler, Fitness & Techie. #IoT #M2M #IIoT #Augmentedreality #AR #VirtualReality #VR #Cloud #SaaS #3D #PLM #CAD #Industry40 #Mobility #3DPrinting

DTC brand owner & founder of IN Creative 📸 a DTC photography studio that helps brands get high-quality photos 50% faster & cheaper

CPTO @tryfondo Past: VP Product/Engineering @ScaleFactor, Founder @EventSlice, @Spiceworks tweets are my own, TarHeel.

Head of Ecosystem @MantaNetwork | Ex. @0xMantle & @0xpolygon | Angel Investor

Transforming DTC Brands With Data-Driven UGC & Strategy 🤳🏼 admin@vantacreativeagency.com

🪐 Web3 Marketing Wizard | ₿ Bitcoin Forever | 🌐 DeFi Growth Expert | 🎯 Building Brands that Dominate | 💌 DM for Business

inboundmaxxing. building & scaling info. real content psychology. 19. based. slavic. 24 clients. Christ is King. DM "10" to go from 0 to $10k/mo

I build proven 7-9 figure funnels for DTC brands doing $50K-$500K/mo. Guaranteed to outperform your current funnel... or you don't pay. 👇 Watch how it works:

Quit software dev to build = lifebar.online | tryoras.com | @Elev8or_io Love building, gym & good coffee ☕️ Documenting the climb

Explore Related Archetypes

If you enjoy the entrepreneur profiles, you might also like these personality types: