Get live statistics and analysis of Ines Fritsch's profile on X / Twitter

FULLTIME CRYPTO

The Analyst

Ines Fritsch dives deep into the crypto and DeFi space with a data-first mindset, breaking down complex projects and protocols with clarity and a sharp eye for what truly matters. Her tweets reveal a passion for monitoring emerging tech, dissecting token economies, and analyzing market momentum across chains. If there’s a new trend or launch worth watching, she’s already on it, inviting her community to debate and dissect alongside her.

Top users who interacted with Ines Fritsch over the last 14 days

0x lifestyle | bridging dreams | degen heart | future is decentralized

research @DailyStory_xyz AMB @ancient8_gg @Gate @trondao TG:@tomdu1102 Support @daosdotfun prev @mint_blockchain @puffverse xtrade.gg/@tomdu1102

✨ Writing about DeFi, NFTs & the next big narratives.

Full-time Trader | Technical + On-chain Analysis Spotting narratives before they pump Sharing setups, market psychology & trading strategies

OG degen. Early hodler, risk-taker, and crypto junkie. Always chasing the next moonshot. 🚀💎

Secure Nodes, Smart Stakes

Yapper 🩵🩵🩵

yapper all Quacker @wallchain 🩵🩵🩵

I am a Web3 writer and am not responsible for any investments

• Contributor @RialoHQ @fogo @xeetdotai @Bantr_fun • Ambassador: @xyralabs_ • Researching on @hype_alpha_channel | @hiddengemsx

Creator • Explorer • Metaverse content Deep dives into Web3 • Clear content, sharp insights

A True Living Legend/The Whale of BTC-E/The Love Child of Satoshi Nakamoto 🐳 #BTC/#LTC/#Crypto4Life

🧪 DAO Contributor | WAGMI @MorphLayer

Ines is the only person who could turn a rocket launch into a spreadsheet and make you excited about line graphs—because nothing says 'party' like liquidity pools and token distribution charts, right?

Successfully identified and articulated the crucial market signals and adoption patterns around emerging DeFi projects like @vooi_io and @recallnet, helping her community stay ahead of the curve with actionable insights.

Ines’s life purpose is to illuminate the cryptosphere’s inner workings, empowering followers to make data-driven decisions while fostering a smarter, more informed community around decentralized finance.

She believes in transparency, data-driven insights, and cross-chain interoperability, holding that crypto’s future hinges on clean execution, fair distribution, and narrative-led growth rather than hype cycles.

Her greatest strength is in research-driven analysis combined with clear, engaging communication — connecting complex financial layers into digestible narratives that spark active community participation.

Her intense focus on technical details sometimes alienates less-experienced followers who might find the jargon overwhelming, potentially limiting broader audience growth.

To grow her audience on X, Ines should simplify some of her technical jargon into relatable everyday language and create regular 'crypto explainers' or short threads that introduce foundational DeFi concepts, boosting accessibility and engagement across experience levels.

Fun fact: Ines engages heavily in technical analysis and protocol breakdowns, often turning intricate crypto concepts — like tokenized stocks and on-chain credit primitives — into accessible, engaging content for her followers.

Top tweets of Ines Fritsch

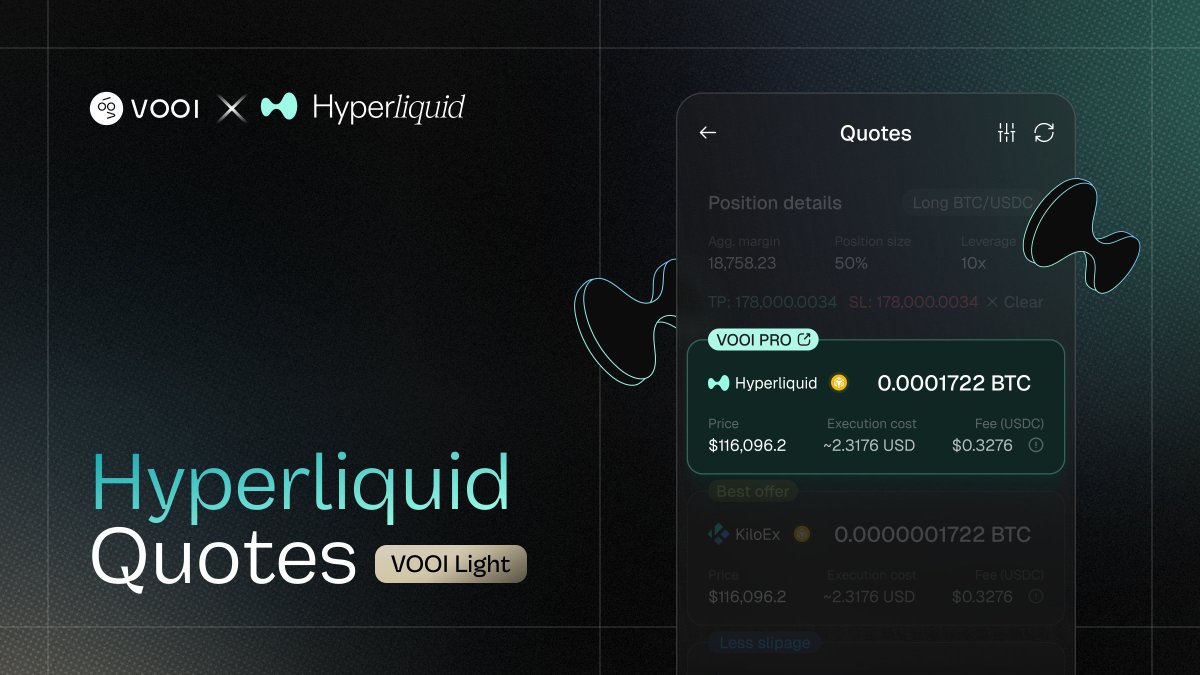

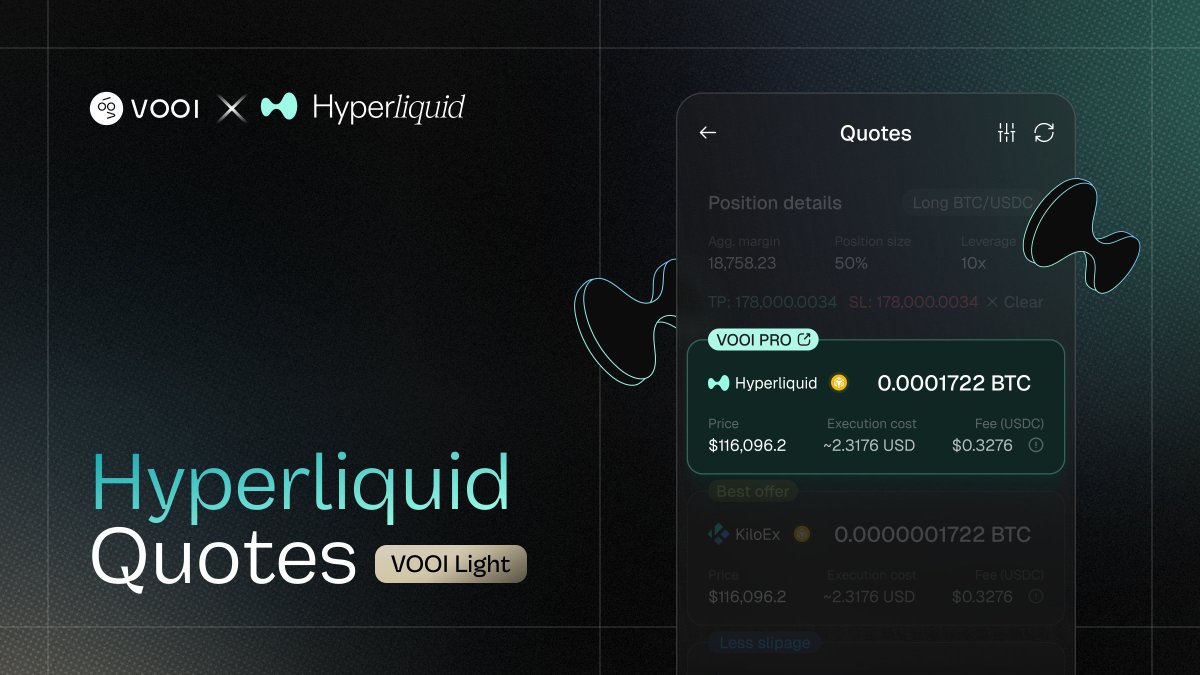

RWA and tokenized stocks are setting up like early alt cycles, thin books and growing demand, clean execution on mobile @vooi_io rolling out crypto + TradFi perps, spot, one USD balance across chains, gasless trades, HyperliquidX quotes on VOOI Light Sleek design, one click trading, unified asset management try it t.co/xKqbErK6LX @cookiedotfun lining up Antix and $BOB energy, web2 to web3 identity with Avagen, native BTC DeFi with BitVM and ZK rollups Cookie site upgrades landed but leaderboards lag, progress needs to reflect to keep snaps moving RWA discovery on VOOI or BTC DeFi ignition on Cookie, what leads first Reply with your pick: VOOI mobile terminal or Cookie + $BOB stack #DeFi

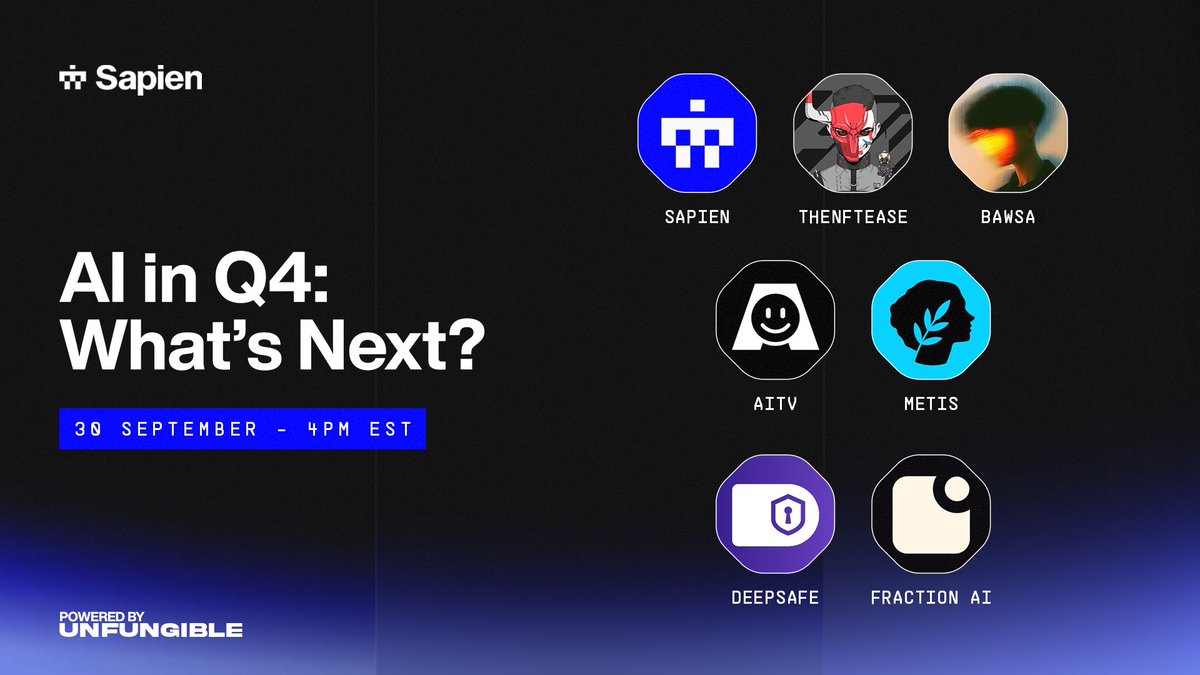

q4 shaping up as a data-first grind and I’m watching @JoinSapien closely new tasks live: Logic Path (Vietnamese), Cadena lógica (español), Dinner Image Upload multilingual reasoning + everyday VLM grounding is where quality compounds why this matters: clean chain-of-thought across languages boosts generalization, and image text pairs anchor models in real-world context; volume without signals stalls, curated labels move the needle tune into the Space with @FractionAI_xyz to hear how they’re threading human-in-the-loop into pretrain/finetune cycles Which lane are you tackling first: vi logic, es logic, or dinner pics? drop your pick + best tagging tips and I’ll share the sharpest takes #AI

I analyzed @recallnet’s pre‑TGE stack Top 5 levers: Memory + reputation rails Trading routes (DEX/perps) Credit primitives (lending) Agent automation Onboarding + wallets Catalysts: RaylsLabs integrations, Monad execution, and one flagship app that converts memory into actionable risk signals across partners Thesis: nail scoring + routing, spin up partners, then liquidity and TVL follow. What I’m watching: on‑chain scoring transparency, version cadence, and TGE timing vs rollout sequence TGE SOON? Poll: which wins first? A) Memory scoring B) Trading routes C) Lending credit D) Agents Reply A/B/C/D and tag @recallnet with a builder you want integrated

>"another L2" >look closer >same codebase, same playbook >no If two chains ship the same capabilities, they compete for the same assets and attention. What breaks symmetry is distribution, story, execution. @MorphLayer just put a decade-long crypto storyteller in the CMO seat and that signals intent: align builders, users, and partners around an open, connected financial world where money can move anywhere with no limits Old meta: splash incentives and vanity DAU. New meta: compounding mindshare and sticky distribution. Does narrative-led go-to-market become the decisive edge for #L2s in #crypto?

数据给到的很硬核:预售资格 4,500+,实际拿到配售 1,747,80%拿满申请,$66.7M 认购对 $1M 配售,限制大单、给每人最低额度,优先级给 Tria Premium、Logion 得分前 20%、Cookie Snappers 前 25、以及合作社区。这一轮 @useTria 明显不是跑流程,是把需求和公平做出边界 我这两周的体验:用卡消费→网络加流动性→策略自动产出收益→回流到 $TRIA,和传统 neobank 最大差别是我自己持钥匙,数据和资产不被平台挟持,#自托管 的感觉很少见。日常支付和机构级路由在同一套架构里,参与越多,网络越强,收益越厚 下轮想提高中签率的简单做法:办 Premium、提升 Logion 分、研究 Snapper 排名、跟上合作社区。#预售 #流动性 你觉得 Tria 季到了吗?

Seeing folks quote $80B+ FDV for $MON off MEXC and then doing victory-lap math on airdrops… slow down and read the fine print Premarket trades MON points, separate from tokens Points supply = 10B Token supply = 100B If you map point price 1:1 to token FDV, you set yourself up to get rekt I’m splitting my stack: - Minting Season 2 NFTs (the Olivia drop looks clean) while airdrop chatter loads - Skipping premarket churn - Testing flows that actually feel sticky Safer side quest: @peaq Get Real S2 for onchain DePIN tasks and $peaq rewards How are you playing @monad right now mint S2, farm points, or wait for spot listing? Reply with your move and why

$APT at $4.924 5 is a formality ATH still miles ahead but October? October feels like ignition When @AveryChing says “epic” you don’t fade it You size up Supply thinning Bid walls stacking Momentum unwinding the bears Not asking *if* Asking how violent it gets when Aptos takes the brakes off @Aptos

protected flow vs verified IDs vs on-chain conversion feels like @wallchain_xyz just framed the real battleground for AttentionFi $1.5B+/mo anti-MEV routing + portable Quacks + @idOS_network attestations the stack’s here, the KPI focus is the meta which one actually compounds the fastest in #DeFi? 1/2/3

Onchain agents went from slideware to shipping @HeyElsaAI just bridged, swapped, and referenced Token Terminal in one prompt ETH → USDC → INK → @base in a single flow, then executed This is why @base feels like home for co-pilots: cheap, fast, EVM-simple, consumer ready Post-Singapore the Asia builder energy is loud, so yeah, time to double down and ship agent-first UX Voice execution going mainstream is the next unlock What should Elsa optimize next? A) richer doc uploads B) smarter multi-doc chains C) more onchain actions D) UI polish Reply with A/B/C/D and why #onchainAI

season 3 at @zama_fhe is the cleanest setup for small creators rn $56k prize pool > $50k for top 100 > $3k x6 text > $3k x6 video rewards: > Top 100 ➛ monthly prizes (USDC / $ZAMA) > Top 1000 ➛ Zama OG NFT 003 + alpha > 12 handpicked ➛ extra scoring stays transparent: quality > audience if you’re smaller, aim Top 1000 for the NFT, then climb how to win: • ship FHE explainers + demos (compute on encrypted data) • show modular agents in finance/health/AI • break down $ZAMA burn mechanics, staking utility, validator flow • benchmarks, repos, tutorials my view: usage drives burns, burns drive scarcity, staking locks supply create signal, not noise gZama fam, time to cook

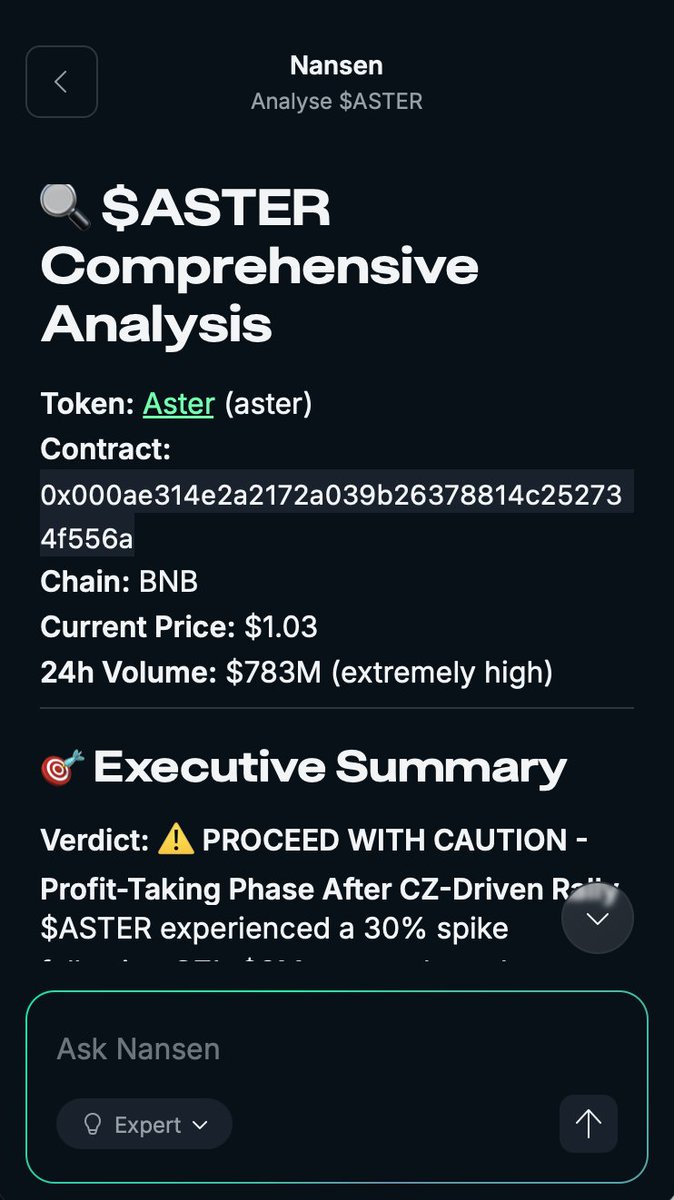

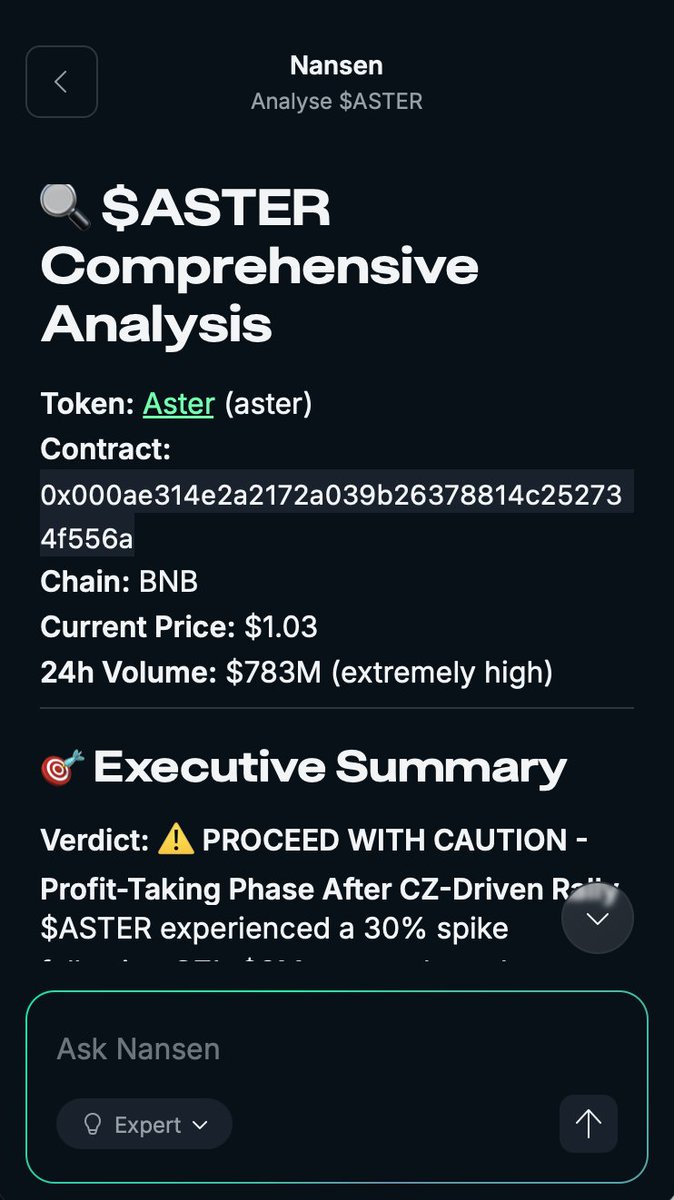

Narratives lie. Flows don’t. Old way: guess off CT takes. New way: read positioning and PnL in real time with @nansen_ai #onchain Hyperliquid is moving $1b/day with $6.5m in fees #perps. On $ZEC, smart money holds $40.62m, $21.19m of it short. Public figures are net long $8.43m of $9.26m. Whales are leaning short with $70.07m. One wallet printed $2.17m realized in 30 days at 3,831% ROI. Another sits on $8.47m unrealized from a 5x long around $352.52 Old vs new: charts are secondary to order flow and address context. Cut the noise. Which side are you on?

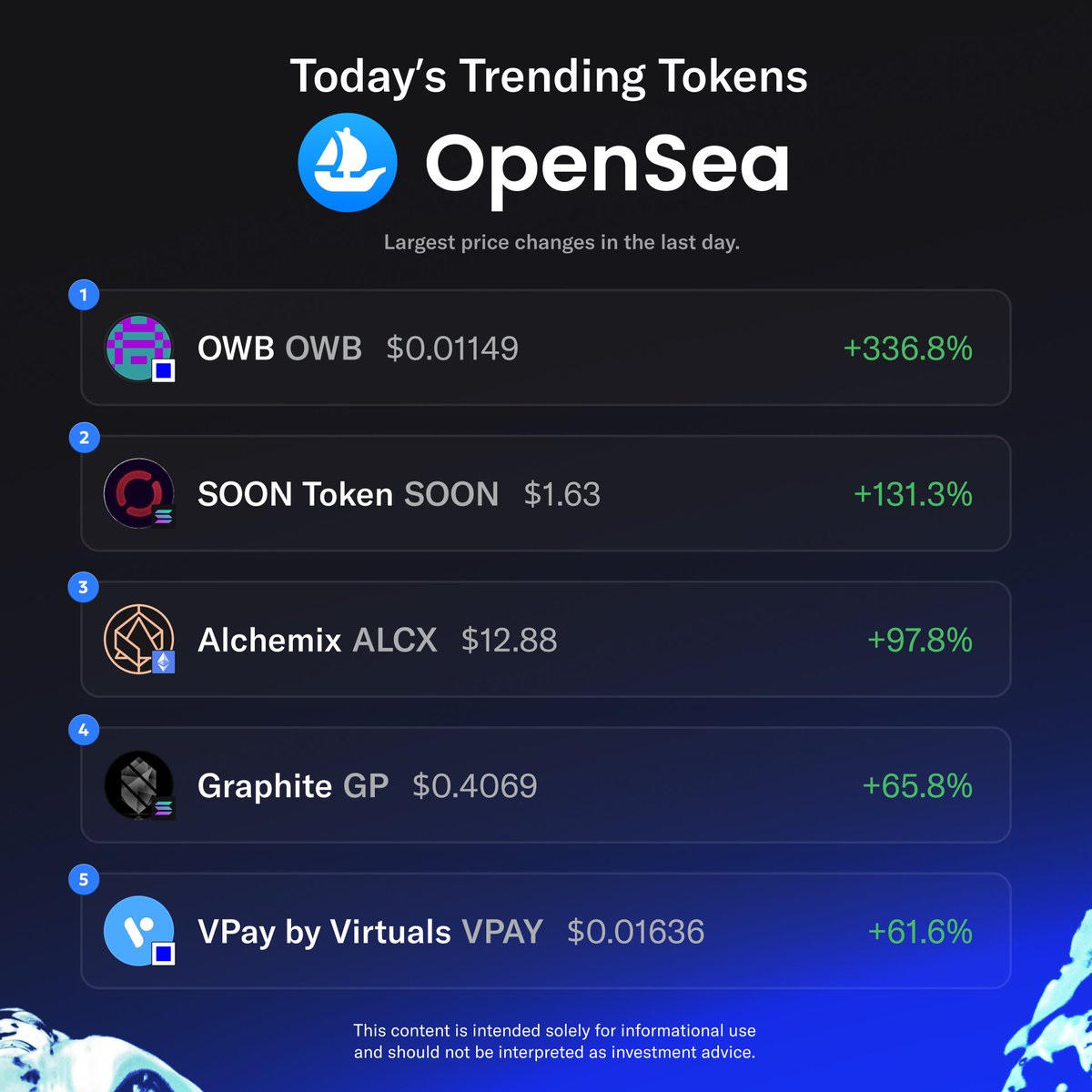

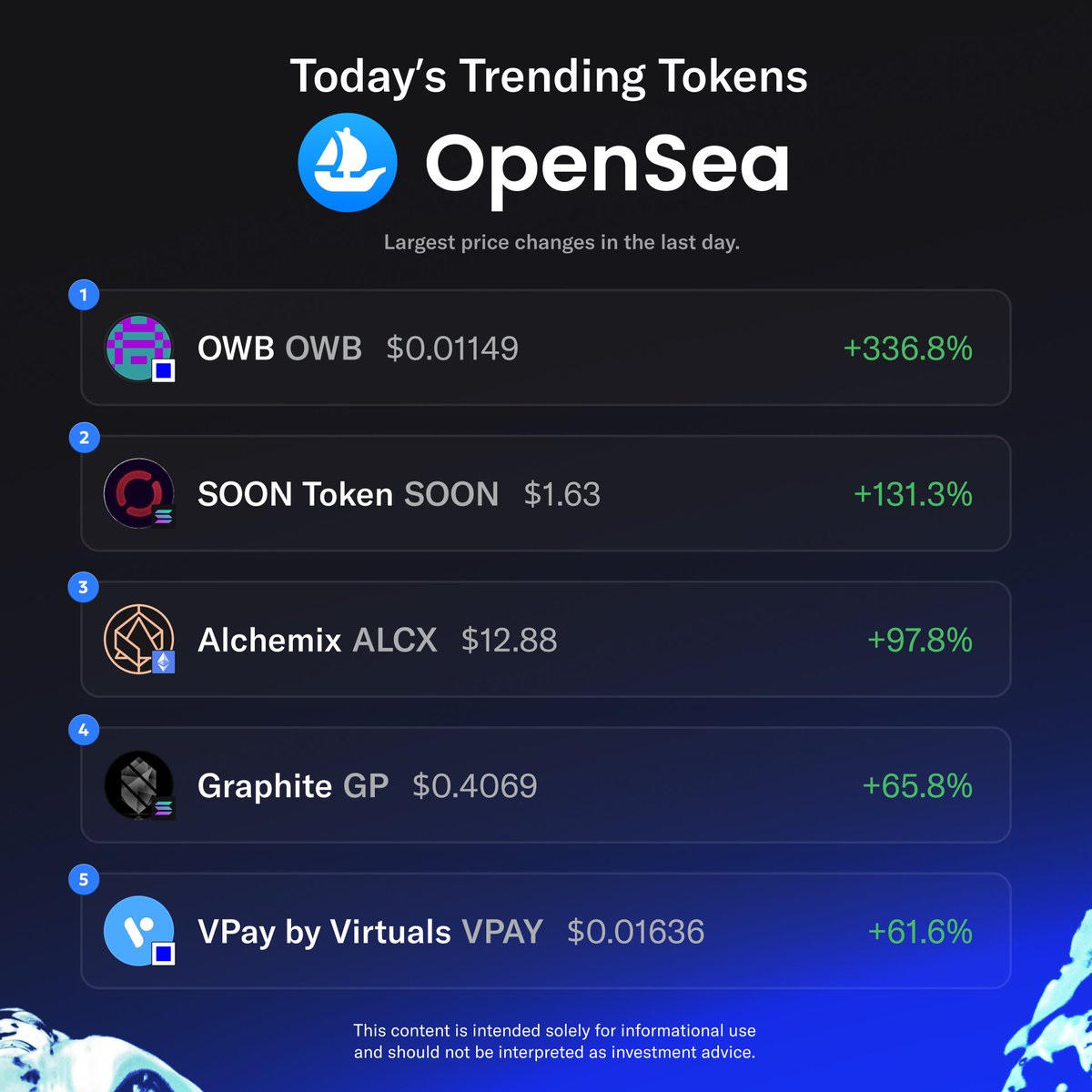

finally got time again. setting up a small friday drop cadence on @opensea until the wedding fund hits the number. 1 piece a week, tiny editions, 0.02-0.05 $ETH, no roadmap, just collect, gift, have fun (and stay consistent). might spin a barebones site later, but main thing is to keep hands working lesson from web3: winners like uniswap, @opensea, chainlink solved real demand, not slogans. starting with 24h auctions, then fixed pricing if no bids, floor floats on demand. i'll ship, track DAU on the collection, bids and retention, and listen. first theme suggestions for week one? #NFTs #art #web3

关于 @SentientAGI 的 Dobby,我这两天把文档和社区反馈翻了个遍。基于 Llama 起步,目标“忠诚 AI”,双模式可切:Leashed 安全稳健,Unleashed 直给敢说。爽点在哪?数据混合做风格词不破事实、推理路由小/大模型切换控成本,15W+真实用户偏爱“放飞”版,聊天更像人而不丢精度。痛点?事实召回边界与场景路由还需打磨,复杂任务要自动切“大脑” GRID 值得重视,模型/Agent/数据/算力编织成开放深搜的底盘,开源堆栈也能打企业级。实战建议:把 Dobby 当前端 Agent,严肃检索交给大模型;在链上场景可联动 @wardenprotocol 的 auto-tools 跑 DeFi 自动化,Agentic Flow 更顺。听 @leaderx_btc 分享过 Agent 范式,方向对,执行要细 你更用 Leashed 还是 Unleashed?在评论丢 L/U 并说理由;另外是否需要在链上给人格做版本控制,保证“忠诚”可审计?有跑 GRID 的用例也欢迎晒一晒 #SentientAGI

cada vez más convencida que @BioProtocol está rompiendo el molde en #DeSci no es solo el hype de nuevos nombres en Launchpad, es ver D1ckGPT con clínico serio en masculino + GALE tocando fibrosis/tumor con IP tokenizado, y encima el motor DeFi por detrás metiendo $BIO en Aave, liquidez en ETH/Base y veBIO engranando todo me encanta cuando ciencia y web3 se cruzan así, porque ahí es donde realmente cambia el juego

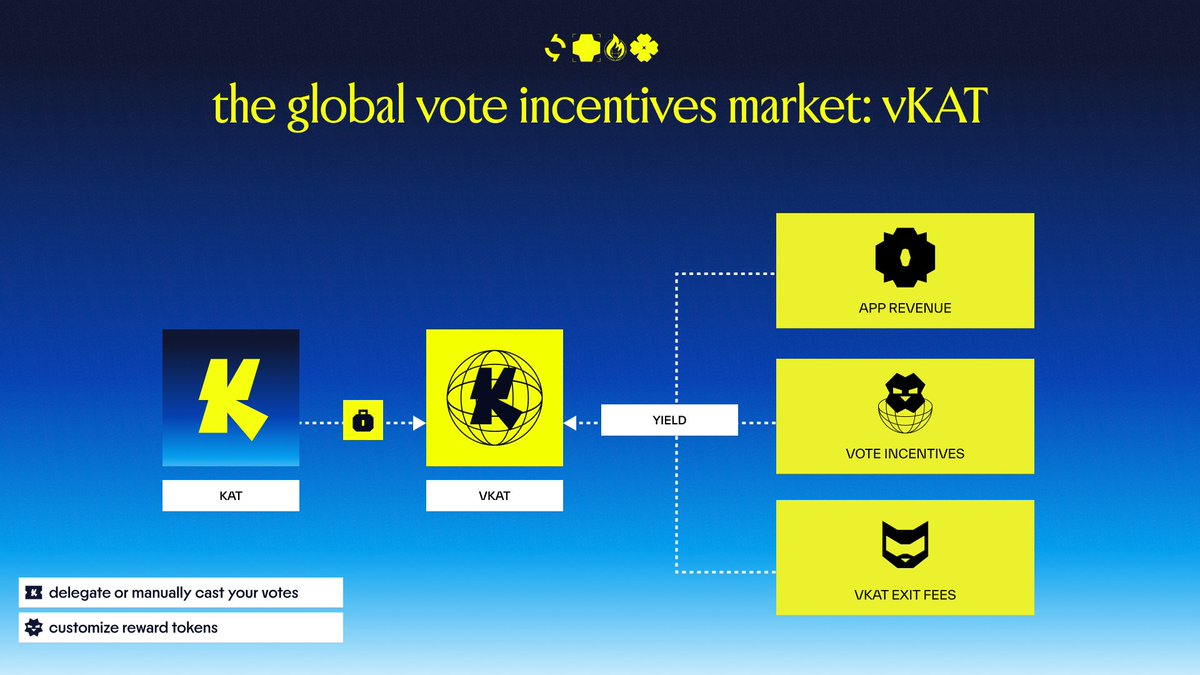

别只yap,要yap对!我这两天在看 @katana 这条 DeFi Yield Layer,发现两条主线值得现在就埋位 1️⃣流动性统一:把LBTC做市沉淀到Katana,拿 $KAT 激励+生态权益,做“统一池→更深深度→更稳APR”的正循环。这类结构对长期收益更友好,关键看活跃头寸与激励曲线的匹配 2️⃣数据索引:Ormi Labs 的 subgraphs 已经支持katana,用0xGraph几步完成 → 用合约地址部署(例:VaultBridge的vbUSDC) → 用deployment ID迁移 → 从零构建,追踪Katana区块与事件 做出链上看板,真实评估收益与资金效率 入口层面我更偏向通过 @turtledotxyz 打通,一键把仓位沉到Katana,同时预埋位等 $TURTLE 上线的节奏,隐私与链上行为跟踪也更顺畅 你更看好哪条路径? A) 做LP拿 $KAT B) 用0xGraph做数据索引 C) 走Turtle入口埋位 要不要我把subgraph部署清单+LP实操做成笔记,评论告诉我想看哪一个

Most engaged tweets of Ines Fritsch

RWA and tokenized stocks are setting up like early alt cycles, thin books and growing demand, clean execution on mobile @vooi_io rolling out crypto + TradFi perps, spot, one USD balance across chains, gasless trades, HyperliquidX quotes on VOOI Light Sleek design, one click trading, unified asset management try it t.co/xKqbErK6LX @cookiedotfun lining up Antix and $BOB energy, web2 to web3 identity with Avagen, native BTC DeFi with BitVM and ZK rollups Cookie site upgrades landed but leaderboards lag, progress needs to reflect to keep snaps moving RWA discovery on VOOI or BTC DeFi ignition on Cookie, what leads first Reply with your pick: VOOI mobile terminal or Cookie + $BOB stack #DeFi

>"another L2" >look closer >same codebase, same playbook >no If two chains ship the same capabilities, they compete for the same assets and attention. What breaks symmetry is distribution, story, execution. @MorphLayer just put a decade-long crypto storyteller in the CMO seat and that signals intent: align builders, users, and partners around an open, connected financial world where money can move anywhere with no limits Old meta: splash incentives and vanity DAU. New meta: compounding mindshare and sticky distribution. Does narrative-led go-to-market become the decisive edge for #L2s in #crypto?

数据给到的很硬核:预售资格 4,500+,实际拿到配售 1,747,80%拿满申请,$66.7M 认购对 $1M 配售,限制大单、给每人最低额度,优先级给 Tria Premium、Logion 得分前 20%、Cookie Snappers 前 25、以及合作社区。这一轮 @useTria 明显不是跑流程,是把需求和公平做出边界 我这两周的体验:用卡消费→网络加流动性→策略自动产出收益→回流到 $TRIA,和传统 neobank 最大差别是我自己持钥匙,数据和资产不被平台挟持,#自托管 的感觉很少见。日常支付和机构级路由在同一套架构里,参与越多,网络越强,收益越厚 下轮想提高中签率的简单做法:办 Premium、提升 Logion 分、研究 Snapper 排名、跟上合作社区。#预售 #流动性 你觉得 Tria 季到了吗?

Seeing folks quote $80B+ FDV for $MON off MEXC and then doing victory-lap math on airdrops… slow down and read the fine print Premarket trades MON points, separate from tokens Points supply = 10B Token supply = 100B If you map point price 1:1 to token FDV, you set yourself up to get rekt I’m splitting my stack: - Minting Season 2 NFTs (the Olivia drop looks clean) while airdrop chatter loads - Skipping premarket churn - Testing flows that actually feel sticky Safer side quest: @peaq Get Real S2 for onchain DePIN tasks and $peaq rewards How are you playing @monad right now mint S2, farm points, or wait for spot listing? Reply with your move and why

I analyzed @recallnet’s pre‑TGE stack Top 5 levers: Memory + reputation rails Trading routes (DEX/perps) Credit primitives (lending) Agent automation Onboarding + wallets Catalysts: RaylsLabs integrations, Monad execution, and one flagship app that converts memory into actionable risk signals across partners Thesis: nail scoring + routing, spin up partners, then liquidity and TVL follow. What I’m watching: on‑chain scoring transparency, version cadence, and TGE timing vs rollout sequence TGE SOON? Poll: which wins first? A) Memory scoring B) Trading routes C) Lending credit D) Agents Reply A/B/C/D and tag @recallnet with a builder you want integrated

q4 shaping up as a data-first grind and I’m watching @JoinSapien closely new tasks live: Logic Path (Vietnamese), Cadena lógica (español), Dinner Image Upload multilingual reasoning + everyday VLM grounding is where quality compounds why this matters: clean chain-of-thought across languages boosts generalization, and image text pairs anchor models in real-world context; volume without signals stalls, curated labels move the needle tune into the Space with @FractionAI_xyz to hear how they’re threading human-in-the-loop into pretrain/finetune cycles Which lane are you tackling first: vi logic, es logic, or dinner pics? drop your pick + best tagging tips and I’ll share the sharpest takes #AI

$APT at $4.924 5 is a formality ATH still miles ahead but October? October feels like ignition When @AveryChing says “epic” you don’t fade it You size up Supply thinning Bid walls stacking Momentum unwinding the bears Not asking *if* Asking how violent it gets when Aptos takes the brakes off @Aptos

season 3 at @zama_fhe is the cleanest setup for small creators rn $56k prize pool > $50k for top 100 > $3k x6 text > $3k x6 video rewards: > Top 100 ➛ monthly prizes (USDC / $ZAMA) > Top 1000 ➛ Zama OG NFT 003 + alpha > 12 handpicked ➛ extra scoring stays transparent: quality > audience if you’re smaller, aim Top 1000 for the NFT, then climb how to win: • ship FHE explainers + demos (compute on encrypted data) • show modular agents in finance/health/AI • break down $ZAMA burn mechanics, staking utility, validator flow • benchmarks, repos, tutorials my view: usage drives burns, burns drive scarcity, staking locks supply create signal, not noise gZama fam, time to cook

Onchain agents went from slideware to shipping @HeyElsaAI just bridged, swapped, and referenced Token Terminal in one prompt ETH → USDC → INK → @base in a single flow, then executed This is why @base feels like home for co-pilots: cheap, fast, EVM-simple, consumer ready Post-Singapore the Asia builder energy is loud, so yeah, time to double down and ship agent-first UX Voice execution going mainstream is the next unlock What should Elsa optimize next? A) richer doc uploads B) smarter multi-doc chains C) more onchain actions D) UI polish Reply with A/B/C/D and why #onchainAI

关于 @SentientAGI 的 Dobby,我这两天把文档和社区反馈翻了个遍。基于 Llama 起步,目标“忠诚 AI”,双模式可切:Leashed 安全稳健,Unleashed 直给敢说。爽点在哪?数据混合做风格词不破事实、推理路由小/大模型切换控成本,15W+真实用户偏爱“放飞”版,聊天更像人而不丢精度。痛点?事实召回边界与场景路由还需打磨,复杂任务要自动切“大脑” GRID 值得重视,模型/Agent/数据/算力编织成开放深搜的底盘,开源堆栈也能打企业级。实战建议:把 Dobby 当前端 Agent,严肃检索交给大模型;在链上场景可联动 @wardenprotocol 的 auto-tools 跑 DeFi 自动化,Agentic Flow 更顺。听 @leaderx_btc 分享过 Agent 范式,方向对,执行要细 你更用 Leashed 还是 Unleashed?在评论丢 L/U 并说理由;另外是否需要在链上给人格做版本控制,保证“忠诚”可审计?有跑 GRID 的用例也欢迎晒一晒 #SentientAGI

protected flow vs verified IDs vs on-chain conversion feels like @wallchain_xyz just framed the real battleground for AttentionFi $1.5B+/mo anti-MEV routing + portable Quacks + @idOS_network attestations the stack’s here, the KPI focus is the meta which one actually compounds the fastest in #DeFi? 1/2/3

finally got time again. setting up a small friday drop cadence on @opensea until the wedding fund hits the number. 1 piece a week, tiny editions, 0.02-0.05 $ETH, no roadmap, just collect, gift, have fun (and stay consistent). might spin a barebones site later, but main thing is to keep hands working lesson from web3: winners like uniswap, @opensea, chainlink solved real demand, not slogans. starting with 24h auctions, then fixed pricing if no bids, floor floats on demand. i'll ship, track DAU on the collection, bids and retention, and listen. first theme suggestions for week one? #NFTs #art #web3

cada vez más convencida que @BioProtocol está rompiendo el molde en #DeSci no es solo el hype de nuevos nombres en Launchpad, es ver D1ckGPT con clínico serio en masculino + GALE tocando fibrosis/tumor con IP tokenizado, y encima el motor DeFi por detrás metiendo $BIO en Aave, liquidez en ETH/Base y veBIO engranando todo me encanta cuando ciencia y web3 se cruzan así, porque ahí es donde realmente cambia el juego

Narratives lie. Flows don’t. Old way: guess off CT takes. New way: read positioning and PnL in real time with @nansen_ai #onchain Hyperliquid is moving $1b/day with $6.5m in fees #perps. On $ZEC, smart money holds $40.62m, $21.19m of it short. Public figures are net long $8.43m of $9.26m. Whales are leaning short with $70.07m. One wallet printed $2.17m realized in 30 days at 3,831% ROI. Another sits on $8.47m unrealized from a 5x long around $352.52 Old vs new: charts are secondary to order flow and address context. Cut the noise. Which side are you on?

Long-term memory for agents that actually holds up onchain With @recallnet, facts and knowledge are written to a verifiable ledger, referenced later, and shared across systems without trust games $RECALL tokenomics just dropped fair split, transparency, credible neutrality and that matters if memory becomes public good for AI workflows Think: composable memory, audit trails, provenance, no broken state If you were designing an agent, what’s the first dataset you’d anchor onchain? A) prompts B) results C) reputation t.co/uy103kc3lJ

People with Analyst archetype

Opinion as a service

Investment AI facebook.com/@michaelchaosg tiktok.com/@michaelchao_sg instagram.com/mychao777 threads.net/@mychao777

Crypto Analyst, Web3 Enthusiast, NFT collector Yapping alpha, climbing ranks,

platform engineer | kubernetes and distributed systems

🚀 e/acc 技术乐观主义者 | 💻 静态强类型类型爱好者 | 🎲 发言随机生成 | 📊 实证分析大于规范分析 | 🌐 水平思考 | @suwako@mas.to | bsky.app/profile/suwako…

Researcher ||| Moderator ||| Content Creator

🚀 百U实盘记录 | 情绪指标拆解 | 复盘总结 📊 |Solana EVM Dev #SOL实盘 #百U日记 #合约交易

Senior Director in Finance Technology, Payment Network | Enterprise Architecture and Strategy | Extreme INTJ | Alcoholic

Walking @fiscal_ai billboard. I buy quality at a reasonable price and hold until it's egregiously expensive, or I find a drastically better opportunity

Quality investments & on-chain chaos 🃏 | Full-time crypto since '17

Explore Related Archetypes

If you enjoy the analyst profiles, you might also like these personality types: