Get live statistics and analysis of Kamito Monkey's profile on X / Twitter

Co-Founder Monkey Crypto | Passionate about $BTC, $ETH, and DeFi .

The Innovator

Kamito Monkey is a relentless crypto trailblazer, always diving deep into DeFi, $BTC, and $ETH ecosystems with a clear focus on cutting-edge tech and innovative protocols. With over 14,000 tweets, they passionately share granular insights on on-chain mechanics and governance, forging connections between AI, DeFi yields, and blockchain scalability. Their dedication to transparency and measurable outcomes fuels their community’s growth and knowledge.

Top users who interacted with Kamito Monkey over the last 14 days

在 Web3 创造氛围 | #cookiesnaps | #Virtuals | #Kaito | Web3 爱好者 | 空投猎人 💰 | KOL 加载中… 合作请私信 🤝

Igniting conversations around Web3 & A.I.'s future Partnering with @KaitoAI to shape the digital frontier

On-chain detective | Market psychology addict.

오는 사람 상호작용 2,3번 갑니다. 상호작용으로 목숨 겁니다. 냉정한 시장에서 살아남을 길은 오직 상호작용입니다. Only interaction

BADLY INLOVE WITH 👁️

• Contributor @RialoHQ @fogo @xeetdotai @Bantr_fun • Ambassador: @xyralabs_ • Researching on @hype_alpha_channel | @hiddengemsx

For someone who probably dreams in smart contracts and wakes up calculating APYs, Kamito’s timeline looks like a carbon copy of that guy who tries to explain rocket science to your grandma—noble effort, but she’s just nodding and hoping for coffee.

Co-founding Monkey Crypto and driving organic excitement around innovative projects like InfoFi’s $KAITO and on-chain social capital campaigns, Kamito has established himself as a respected architect of community-aligned crypto innovations.

To pioneer and mainstream decentralized finance innovations by bridging complex technical concepts with practical, measurable crypto investments, ultimately making DeFi more accessible, transparent, and scalable.

Kamito values transparency, innovation, and measurable impact within blockchain ecosystems. They believe in harnessing on-chain data and AI to optimize investment strategies and governance, maintaining a strong conviction that real-world adoption depends on trust, verification, and effective community engagement.

Exceptional technical expertise paired with prolific content creation and a knack for simplifying complex crypto mechanics. His ability to connect AI, DeFi, tokenomics, and DAO governance makes him a go-to innovator and trusted voice in niche crypto communities.

The intensity of technical detail and frequent, data-heavy tweeting might overwhelm casual followers or newcomers unfamiliar with crypto jargon. This could limit broad audience growth outside specialized DeFi and blockchain circles.

Kamito should continue leveraging his data-driven insights but mix in more approachable, bite-sized content with compelling storytelling or visual threads to attract and engage a wider audience on X. Engaging in targeted AMAs or collaborating with less technical influencers could help soften his image while expanding reach.

Fun fact: Despite being highly analytical and technical, Kamito has a playful edge—he chooses 'Monkey' not only as a nickname but as a symbol of curiosity and agility within the ever-evolving crypto jungle.

Top tweets of Kamito Monkey

InfoFi check-in $372m market, +4.8% 24h. $KAITO, DexCheck AI, @xeetdotai heating up Under @cookiedotfun the cSNAPS meta aligns onchain capital with social weight MECHANICS: → farm snaps via @vooi_io campaign on Cookie → deploy on VOOI to earn points on-chain → Cookie applies multipliers up to 25x to those points → top VOOI cSnappers share 0.8% TTS Outcome: - bigger alignment = bigger share - attention turns into measurable value - grinding actually compounds I’m climbing the board, snapshot soon link in comment

A clean frame for DeSci: think of science as duration vs volatility; @BioProtocol is wiring both - Duration: token‑bound IP‑NFT accounts hold treasuries, datasets, milestone assets; funding clears as progress hits on‑chain proof - Volatility: hypothesis/data flow and discovery yield; 3,000+ on‑chain inventions, 50k diagnostics in a week, XP velocity + veBIO boost signal demand AI flags failed reactions ~70% vs humans ~30%, VITA‑FAST went $80K → ~$6M in 18 months, eczema affects 600M yet starved of capital. Liquid IP + BioDAOs make these investable funnels $BIO #DeSci #BioProtocol

DeFi yield should be boring, transparent, compounding @multiplifi is shipping exactly that: - Real yield from tokenized RWAs + stable on-chain strategies - Deposit USDC/USDT/WBTC on ETH/BNB/AVAX, earn 5 8% APY + Orbs - Strategy components, risk and performance are actually broken down Extra flywheel: @Yarm_AI -> pick a yarmer, deposit any size, stack YARM (Multipli) points Crystals/leaderboard should skew to users: - Orbs balance - Mindshare - Smart followers Prove it on-chain with @brevis_zk Rotating stables, farming, and letting time do the work with @multiplifi

Pretty close to private chat + pay actually working Two moves: Stake a node → Pay in chat 10k $BDX keeps BChat/BelNet up while you earn; E2E + BelNet trims metadata. Trust but verify: back up seed, test-send, native > wrappers. Who A/B’d BelNet vs Tor for header leakage + latency? on-chain receipts > email-a-PDF @Novastro_xyz @BeldexCoin #Beldex

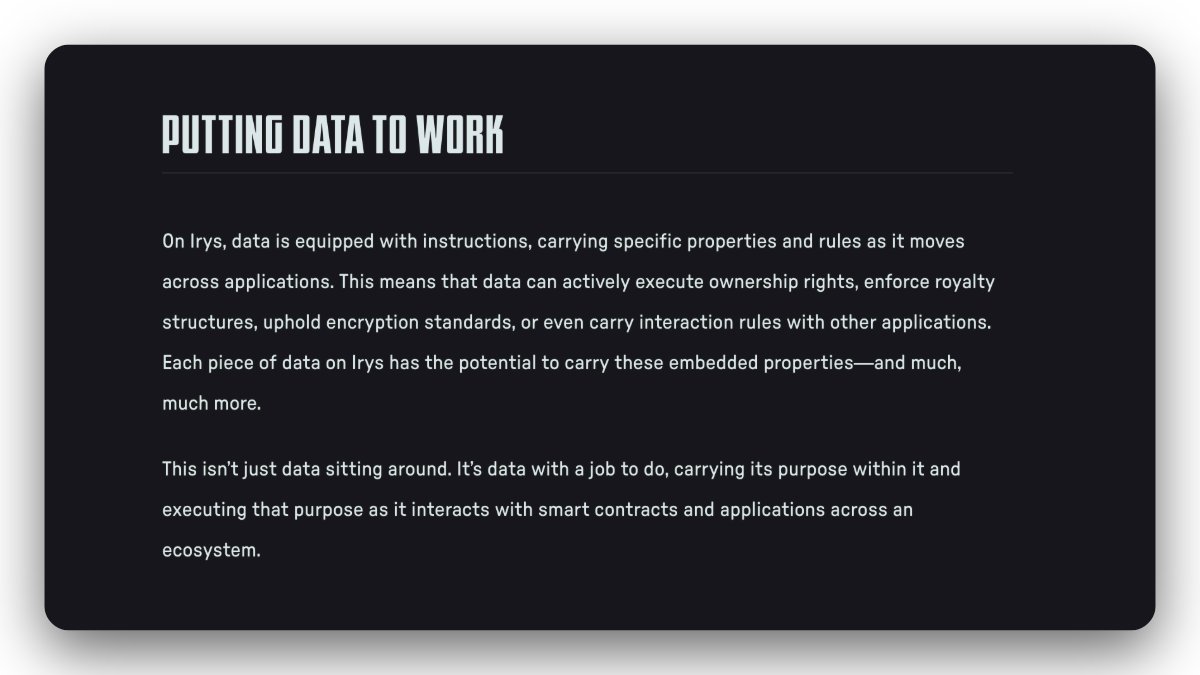

Programmable datachain countdown Walrus sits near 1.1B FDV and sets the pace, but the move I’m watching is EVM-native with one token binding storage, partitions, ledgers, and flow @irys_xyz Genesis NFT then mainnet compress creatives, pipe app logs, stream model weights, all verifiable on-chain Partitions carve namespaces for intent; ledgers keep truth anchored; EVM makes it composable for builders Slept on the data layer? Wake up Prep the mint, prep your pipelines, prep your agents Stay #irys_xyz 3 2 1 ....

Creator airdrops aren’t “free money,” they’re incentive design 2.5M $S to top global/KR/CN creators signals what @SonicLabs is optimizing for: distribution to people who move the graph, not idle wallets Snapshot locked at 00:00 UTC Sep 18 you were building then or you weren’t Eligible? Claim and keep shipping Missed? Prep for next rounds: publish, cross-post, track reach, collaborate Aligned emissions > mercenary points See you in the Airdrops tab @SonicLabs

这轮我盯的核心=算力现金流 算力是新石油 但要上链、可核验、可结算 才值钱 @cysic_xyz 这套ComputeFi硬件+网络做成闭环了 C1专用ASIC跑ZK 针对MSM/FFT/并行证明做了指令级优化 单位电力产出>GPU 成本、时延、吞吐直接打三件套 BTC走过的矿机→ASIC路径已经证明效率跃迁 ZK现在复刻一次 集成流程给到: 电路ok → API/SDK丢任务 → 调度层分片并行 证明回传 → 合约校验 → 结果入你的dApp 扩容逻辑看得见:硬件池越大 延迟↓ 吞吐↑ 真实业务:ZK与AI推理都能上 每一次功耗都能计价 这就是Proof of Compute 的可兑现版本 投资侧我只看两点��:可验证收入 和 供给弹性 能把算力金融化又不失透明的 目前就这家在硬抗 接下来谁拿住算力 谁就拿住下个周期的叙事 我押Cysic

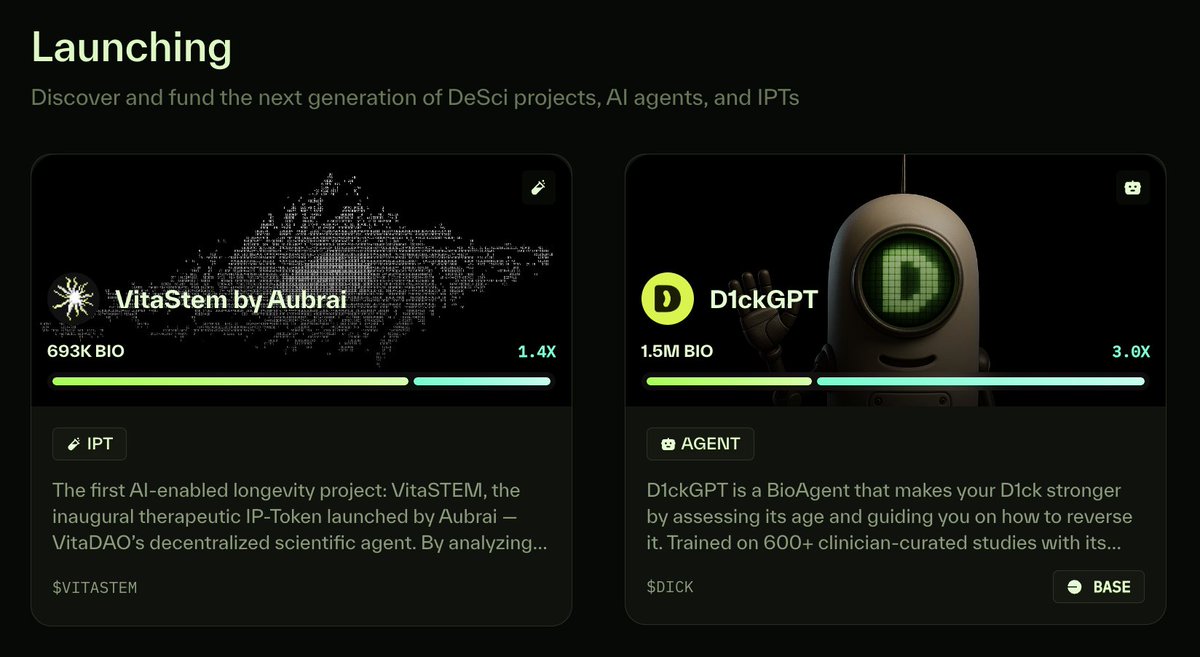

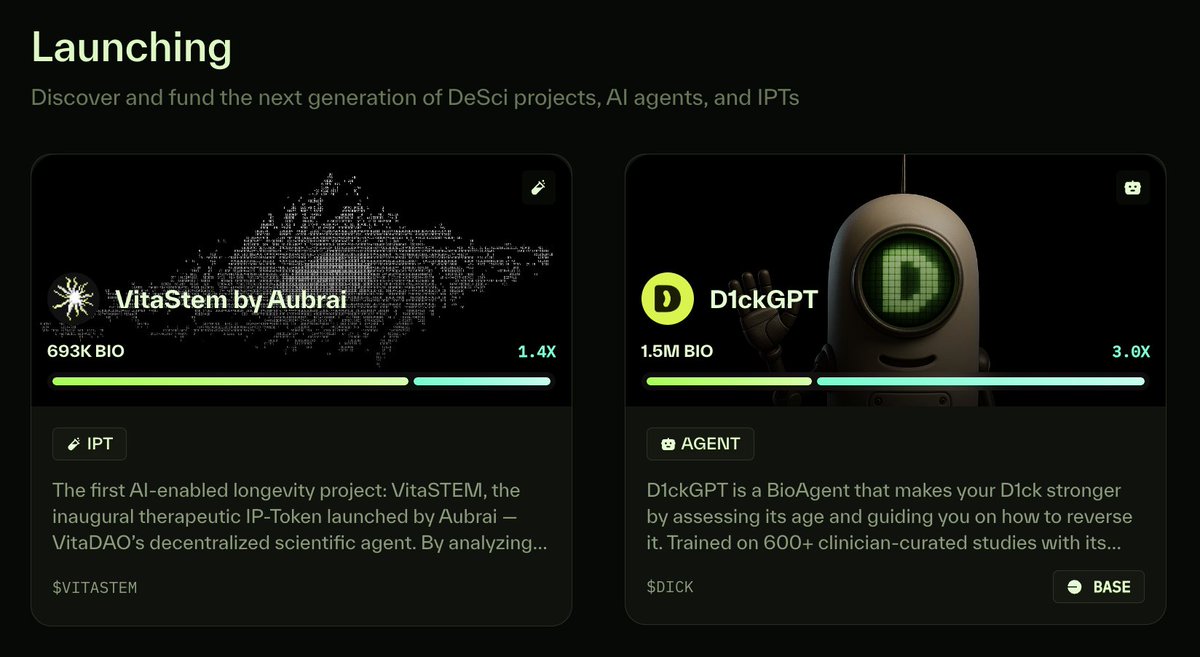

You can tell @BioProtocol is stacking real plays Heavy hitters Maelstrom, Binance Labs, and Mechanism put $6.9m behind the launchpad, and the agent pipeline keeps growing: @NEURONGale with a $12M brain health treasury, @NootropicsDAO_55 for cognition, @DogYearsDAO pushing longevity D1ckGPT oversub 6.6x, VitaSTEM 4.9x, IP gets funded, licensed, and tracked on chain Play it clean: stake $BIO, earn BioXP, lock veBIO for voice + multipliers, and rotate into Ignitions with solid LIMS + replication gates #DeSci #BioProtocol $BIO

1) EdgenTech BTC ETF AUM > $50B (BlackRock/Fidelity backbone). Whales trimmed while retail sharks swept 143,654 BTC in a day; options skew leaning, L2 bridges humming. Mapping flows with @EdgenTech’s live read volatility, sentiment, liquidity turning noise into edge Re: Nov 12 alt ETF window (SOL/XRP/AVAX/ADA/DOGE), core tells swarm momentum + bridges for TGE front‑runs mindshare leaders → liquidity rotations social‑flow → skew sync Aura compounding, hybrid OS on path to mobile syncs; $EDGEN rerate as cross‑market hooks tighten (vol arc)

On-chain PvP should feel instant @blockstranding delivers the Solana pace. You not ready for how fast the loops hit. Early-game checklist: 1. Farm AURA/crystals to fuel builds 2. Anchor bases near spawns to reduce travel 3. Drake first attack/sniper style distance, speed upgrades, skill focus 4. Post progress to earn $STRAND Token sale/TGE in ~2 weeks + Solflare/Magic Eden + Solana Mobile reach backed by MagicBlock = acceleration. Prediction: zero-gas real-time + ownership compounding social rewards will spike retention. Drop stats, let’s benchmark throughput #Solana

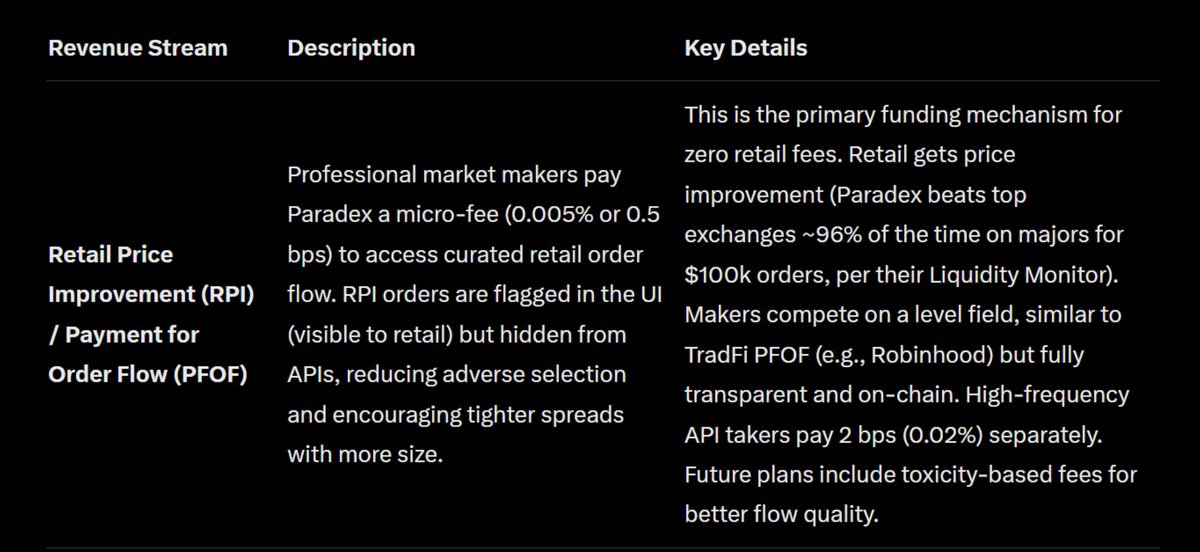

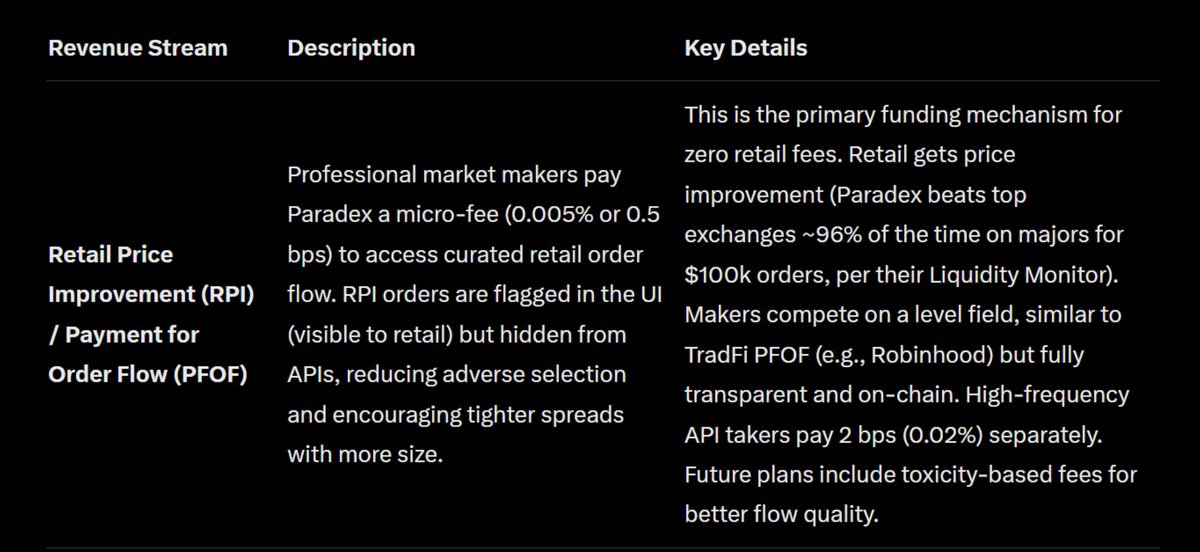

RFQ for size and calm: Paradex RFQ shines when the screen goes paper-thin; you blast one ticket, multiple LPs quote under a clock, you lift the best and move size without signaling. Paradigm printed $5B in a day with 38% share, which fits the stress tool thesis RPI keeps zero fees real by curating retail flow: UI-visible, API-hidden quotes, light speed bumps, activity caps. Makers pay micro, you pay spread and funding, depth tightens, fills improve Season 2 XP is underfarmed 4M weekly til Jan ’26, 15% supply. If $DIME lands at 3 10B FDV, that’s ~$2 9 per XP. 250+ markets, unified margin, Starknet speed, full privacy Ping if you’re lifting size on @tradeparadex; tracking slippage vs book sweeps this week. IKZ

Friendly reminder. open science scales when lab work is auditable and fundable loving BioDAOs means loving @BioProtocol IP becomes liquid with IP‑NFTs/IPTs you can mint, license, and share revenue BioAgents log audit trails, milestone payouts, replication gates on-chain $BIO + veBIO align access, BioXP yield, ignition allocations across Base and Solana Signals I watch: @D1ckGPT 6.6x oversub, VitaSTEM 4.9x, clean LIMS, XP half‑life ~14d, actual licensing events Science moves when reproducibility is a market signal #DeSci $BIO #BioProtocol

今天的一个观察:交易与科学在一条链路上开始形成正反馈 1. 大佬集体站台:Maelstrom(Arthur Hayes)、Binance Labs、Mechanism(Andrew Kang) 一起投了 6.9m,Crypto Twitter 最活跃的几位同时出手,这种同步要么巧合要么有戏 2. 需求侧数据:@D1ckGPT Ignition 6.6x 超额(~3.3M $BIO 认购),VitaSTEM 4.9x;Cerebrum DAO 给 Percepta 人体试验已把回路接上链,说明 IP 有真实现金流预期 3. 机制侧:@BioProtocol 把 BioDAO→IP‑NFT/IPT→许可→分润 接成“液态 IP”轨;BioAgents 管审计轨迹、里程碑放款、复现实验闸门;$BIO 质押解锁 BioXP、Ignition micro‑tranche、跨链奖励(Solana + Base) 4. 怎么玩:梯式买 $BIO;锁 veBIO 拿话语权+倍数;筛 Ignition 看干净 LIMS + replication gates;跟 XP 半衰期 ~14 天与拍卖节奏 12 个月视角:10 20 个有临床前结果的 Agent 批次、$BIO 流通更紧、更多 IP 许可成交信号,叙事向现金流的通道加速打开 #DeSci #BioProtocol $BIO

Most engaged tweets of Kamito Monkey

InfoFi check-in $372m market, +4.8% 24h. $KAITO, DexCheck AI, @xeetdotai heating up Under @cookiedotfun the cSNAPS meta aligns onchain capital with social weight MECHANICS: → farm snaps via @vooi_io campaign on Cookie → deploy on VOOI to earn points on-chain → Cookie applies multipliers up to 25x to those points → top VOOI cSnappers share 0.8% TTS Outcome: - bigger alignment = bigger share - attention turns into measurable value - grinding actually compounds I’m climbing the board, snapshot soon link in comment

A clean frame for DeSci: think of science as duration vs volatility; @BioProtocol is wiring both - Duration: token‑bound IP‑NFT accounts hold treasuries, datasets, milestone assets; funding clears as progress hits on‑chain proof - Volatility: hypothesis/data flow and discovery yield; 3,000+ on‑chain inventions, 50k diagnostics in a week, XP velocity + veBIO boost signal demand AI flags failed reactions ~70% vs humans ~30%, VITA‑FAST went $80K → ~$6M in 18 months, eczema affects 600M yet starved of capital. Liquid IP + BioDAOs make these investable funnels $BIO #DeSci #BioProtocol

这轮我盯的核心=算力现金流 算力是新石油 但要上链、可核验、可结算 才值钱 @cysic_xyz 这套ComputeFi硬件+网络做成闭环了 C1专用ASIC跑ZK 针对MSM/FFT/并行证明做了指令级优化 单位电力产出>GPU 成本、时延、吞吐直接打三件套 BTC走过的矿机→ASIC路径已经证明效率跃迁 ZK现在复刻一次 集成流程给到: 电路ok → API/SDK丢任务 → 调度层分片并行 证明回传 → 合约校验 → 结果入你的dApp 扩容逻辑看得见:硬件池越大 延迟↓ 吞吐↑ 真实业务:ZK与AI推理都能上 每一次功耗都能计价 这就是Proof of Compute 的可兑现版本 投资侧我只看两点:可验证收入 和 供给弹性 能把算力金融化又不失透明的 目前就这家在硬抗 接下来谁拿住算力 谁就拿住下个周期的叙事 我押Cysic

You can tell @BioProtocol is stacking real plays Heavy hitters Maelstrom, Binance Labs, and Mechanism put $6.9m behind the launchpad, and the agent pipeline keeps growing: @NEURONGale with a $12M brain health treasury, @NootropicsDAO_55 for cognition, @DogYearsDAO pushing longevity D1ckGPT oversub 6.6x, VitaSTEM 4.9x, IP gets funded, licensed, and tracked on chain Play it clean: stake $BIO, earn BioXP, lock veBIO for voice + multipliers, and rotate into Ignitions with solid LIMS + replication gates #DeSci #BioProtocol $BIO

Programmable datachain countdown Walrus sits near 1.1B FDV and sets the pace, but the move I’m watching is EVM-native with one token binding storage, partitions, ledgers, and flow @irys_xyz Genesis NFT then mainnet compress creatives, pipe app logs, stream model weights, all verifiable on-chain Partitions carve namespaces for intent; ledgers keep truth anchored; EVM makes it composable for builders Slept on the data layer? Wake up Prep the mint, prep your pipelines, prep your agents Stay #irys_xyz 3 2 1 ....

DeFi yield should be boring, transparent, compounding @multiplifi is shipping exactly that: - Real yield from tokenized RWAs + stable on-chain strategies - Deposit USDC/USDT/WBTC on ETH/BNB/AVAX, earn 5 8% APY + Orbs - Strategy components, risk and performance are actually broken down Extra flywheel: @Yarm_AI -> pick a yarmer, deposit any size, stack YARM (Multipli) points Crystals/leaderboard should skew to users: - Orbs balance - Mindshare - Smart followers Prove it on-chain with @brevis_zk Rotating stables, farming, and letting time do the work with @multiplifi

On-chain PvP should feel instant @blockstranding delivers the Solana pace. You not ready for how fast the loops hit. Early-game checklist: 1. Farm AURA/crystals to fuel builds 2. Anchor bases near spawns to reduce travel 3. Drake first attack/sniper style distance, speed upgrades, skill focus 4. Post progress to earn $STRAND Token sale/TGE in ~2 weeks + Solflare/Magic Eden + Solana Mobile reach backed by MagicBlock = acceleration. Prediction: zero-gas real-time + ownership compounding social rewards will spike retention. Drop stats, let’s benchmark throughput #Solana

RFQ for size and calm: Paradex RFQ shines when the screen goes paper-thin; you blast one ticket, multiple LPs quote under a clock, you lift the best and move size without signaling. Paradigm printed $5B in a day with 38% share, which fits the stress tool thesis RPI keeps zero fees real by curating retail flow: UI-visible, API-hidden quotes, light speed bumps, activity caps. Makers pay micro, you pay spread and funding, depth tightens, fills improve Season 2 XP is underfarmed 4M weekly til Jan ’26, 15% supply. If $DIME lands at 3 10B FDV, that’s ~$2 9 per XP. 250+ markets, unified margin, Starknet speed, full privacy Ping if you’re lifting size on @tradeparadex; tracking slippage vs book sweeps this week. IKZ

12/ Edge-first intelligence is a natural endpoint for a world where data is born at the margins. Latency, privacy, sovereignty are primary constraints; architectures that respect them compound advantages @EdgenTech fuses multi-agent AI & edge compute to minimize choke points & surface signals across crypto/equities/forex in real time; explainability layers trace signal genesis, aligning with accountability & compliance Adversarial markets reward overlapping agents mapping liquidity stress, sentiment flips, cross-asset drift; reaction windows expand Open-access rigor + interpretable pipelines outperform monoliths $EDGEN momentum into Q4 mainnet & mobile; if $BTC structure holds 110k, rerate skew turns risk-on; log daily, drop sharp reports, stack Aura t.co/1nxsBVWip7

Hot take: AI agents that actually execute onchain with proofs > chatbots that explain swaps @wardenprotocol is wiring intents to cross-chain actions, verifiable and transparent, so bridges, swaps, rebalances happen without 50 clicks or copy-paste risk. Then WachAI watches your contracts and tokens like a hawk across chains, cutting scam surface area If we get agents + proofs right, DeFi UX finally makes sense. Would you let one rebalance your LP or bridge your size today? Tag your must-have use case for $WARD

Playing with @wardenprotocol to streamline cross-chain chores Proof of Ownership on @KaitoAI just hit my pre‑early sub shows +0.1% mindshare over 7d after wallet connect. If you don’t have one, grab a Warden Digital on OpenSea and link it to Kaito The app feels like internet-based execution: say “bridge to X and swap to Y”, it finds the cheapest path and does it. One chat, no tab maze Feature wars add noise; experience wins. If routing + agent reliability keep improving, this becomes the default entry for retail. Which Warden agent are you running

they’re talking about biotech on cnbc again desci desci desci #DeSci $BIO flowing into veBIO by 2025 ignition oversubs 5 6x stemcells $VITASTEM $DICK d1ckgpt tokenized IP nfts on chain maelstrom + binance labs + mechanism tossed in ~$6.9m foreign bros giggling while they wire how i play: ladder $BIO lock veBIO farm BioXP (half life ~14d) snipe ignition tranches with clean replication + milestone gates prefer LIMS audit trails + reproducibility locks track allocations on $VITASTEM and $DICK @BioProtocol turning labs into liquid rails we’re co owning medicine now

People with Innovator archetype

🔑 Crypto investor | 🌐 Web3 developer ⛓ Building the decentralized future of finance and the internet on the blockchain. #Web3.

Believe to the point of Ďelusion

术/道 双修地探索到底何为智能? 的朋克产品经理 github.com/lwyBZss8924d/D…

CONTENT CREATOR | AI | Tech | Collaboration | DM open for Promo | fakhrkhan1@gmail.com

🎵 topyappers.com - Meta Ads for Influencer Marketing 🎥 gptmarket.io - Video Tools 🌳 leadsontrees.com - LIVE stream of VC investments

Never enough—satisfaction through eternal dissatisfaction.

Content Creator| Builder #DeFiApp|Airdrop Hunter|AI + Crypto + DeFi Builder|Holder $ETH $SOL $BNB

Automating marketing with AI workflows & agents. Building products & community. Find top 1% AI-first marketers thevibemarketer.com/hire

Memecoin | Airdrop | Degen | Altcoin Sharing alpha & plays across Web3 DYOR | Not financial advice $BTC $ETH $SOL $BNB

Serverless Postgres db, ORM & more. From idea to scale, simplified. npx prisma@latest init --db 📚 pris.ly/t/get-started 💬 pris.ly/t/discord

we must carry it with us or we find it not. -Ralph Waldo Emerson

Explore Related Archetypes

If you enjoy the innovator profiles, you might also like these personality types: