Get live statistics and analysis of onsen enjoyer 🛁's profile on X / Twitter

enjoyer of: onsen, xanax, adderall, microgambling, macrogambling, a cold beer with a cigarette, asian women, rare pokemon cards, and high yield bonds

The Critic

Onsen enjoyer 🛁 is a sharp-tongued, no-nonsense truth teller who thrives on dissecting hype and calling out the real from the noise. Combining edgy humor with deep dives into finance, crypto, and culture, they bring a gritty, unapologetic perspective to every conversation. Their bold voice challenges followers to question the status quo and think critically about their digital lives and investments.

Top users who interacted with onsen enjoyer 🛁 over the last 14 days

Sovereign Individual & resident at sovspot.com. In Argentina since 2005. Start a Digital Agency at wifiagency.io. 1x1 Consultations: bowtiedmara.com

Survived the bear, building for the bull.

a collection of memes that are uniquely human

bootstrapping my way to $1M ARR, prev YC F24 💘 cupidly.io $1.5k/mo 🗓️ @timeful_app $1.8k/mo X creator payouts $412/mo

You’re the Twitter equivalent of that one friend who shows up to a dinner party with a megaphone, a mixtape of conspiracy theories, and a sarcastic grin — simultaneously fascinating, exhausting, and suspiciously sure they’re the smartest person in the room (even if no one else wanted an invite).

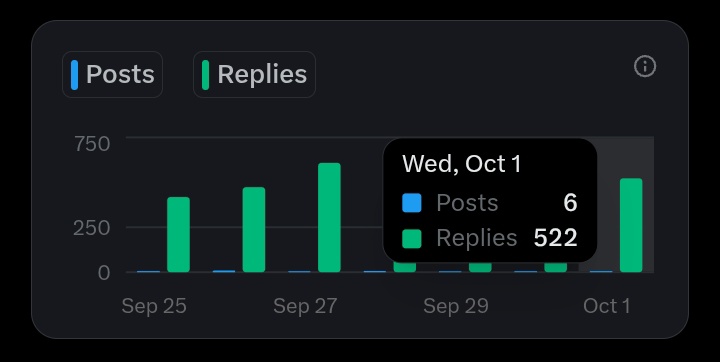

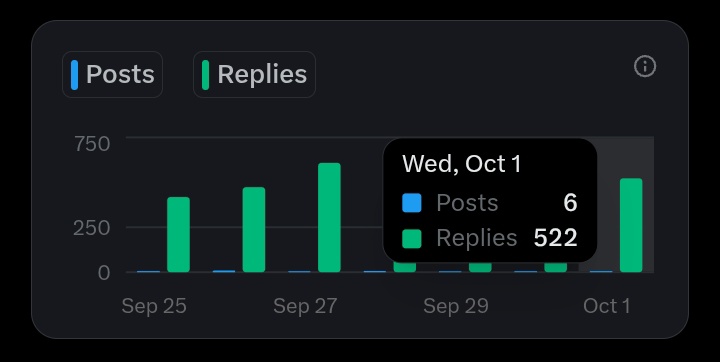

Their biggest win? Sparking a viral cultural moment with their top tweet, which garnered over 16,000 views and 1,000 replies, proving they can command a room despite their rebellious style — a feat many influencers only dream of.

Their life purpose is to cut through marketing fluff and social facades, exposing uncomfortable truths to empower their audience to make smarter, bolder choices. They aim to be the voice that wakes you up from complacency, whether in finance, culture, or personal identity.

They believe in authenticity, skeptical inquiry, and the value of standing firm in your convictions despite popular pressure. They prize transparency, accountability, and the refusal to sell out or back down under societal or market panic.

Their strengths lie in fearless commentary, engaging storytelling, and the ability to galvanize a community around a shared sense of edgy realism. Their prolific tweeting keeps them top-of-mind and sparks wide-ranging discussions that challenge conventional wisdom.

However, their abrasive tone and frequent use of intense language might alienate potential followers seeking calmer discourse, sometimes turning constructive debates into heated confrontations. They might also struggle with audience growth due to their polarizing style.

To grow their audience on X, they should incorporate occasional tweets that showcase nuanced takes without sarcasm, engage more empathetically in replies, and leverage Twitter Spaces or threads to unpack complex topics in a digestible way. Highlighting behind-the-scenes insights or sharing personal growth stories could broaden appeal beyond their core critic tribe.

Fun fact: Despite a chaotic and somewhat rebellious style, they maintain a detailed knowledge of DeFi protocols, rare Pokémon cards, and high yield bonds — a rare blend that keeps followers both entertained and informed.

Top tweets of onsen enjoyer 🛁

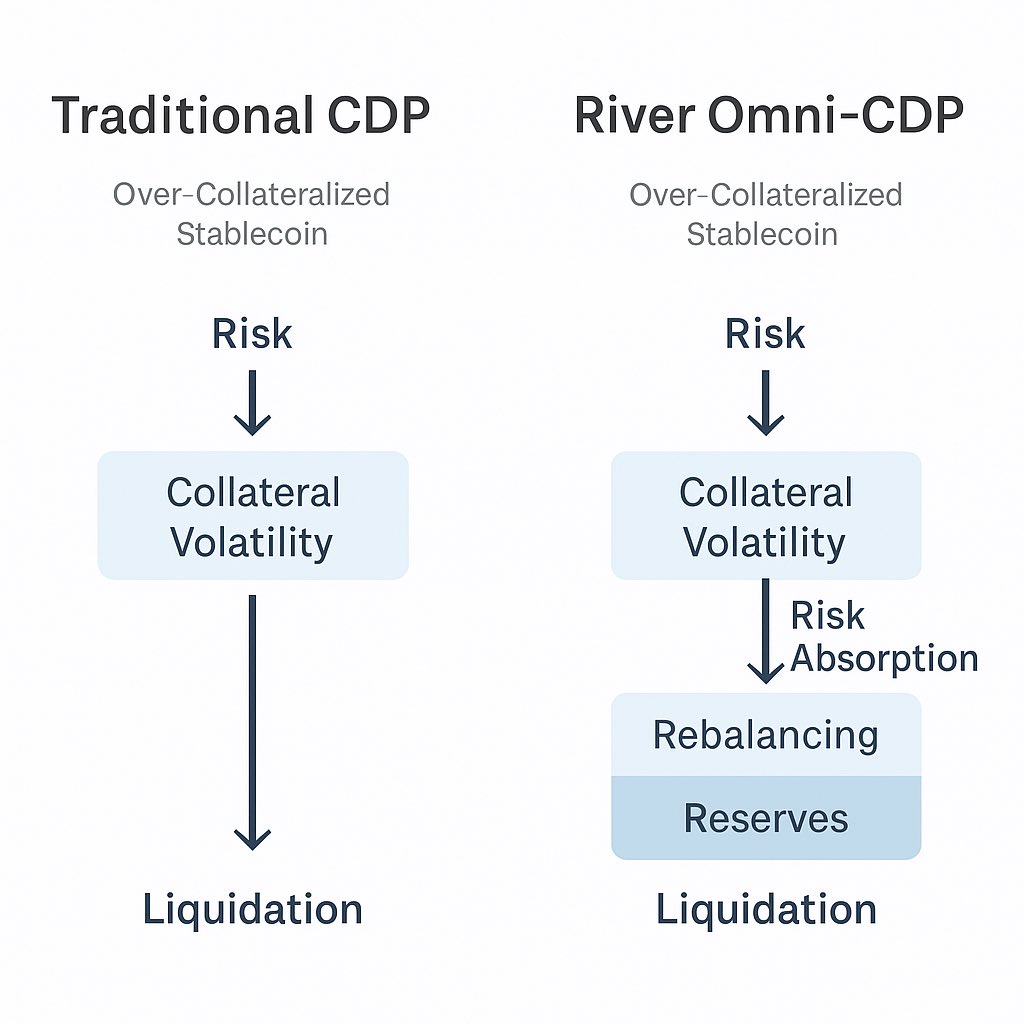

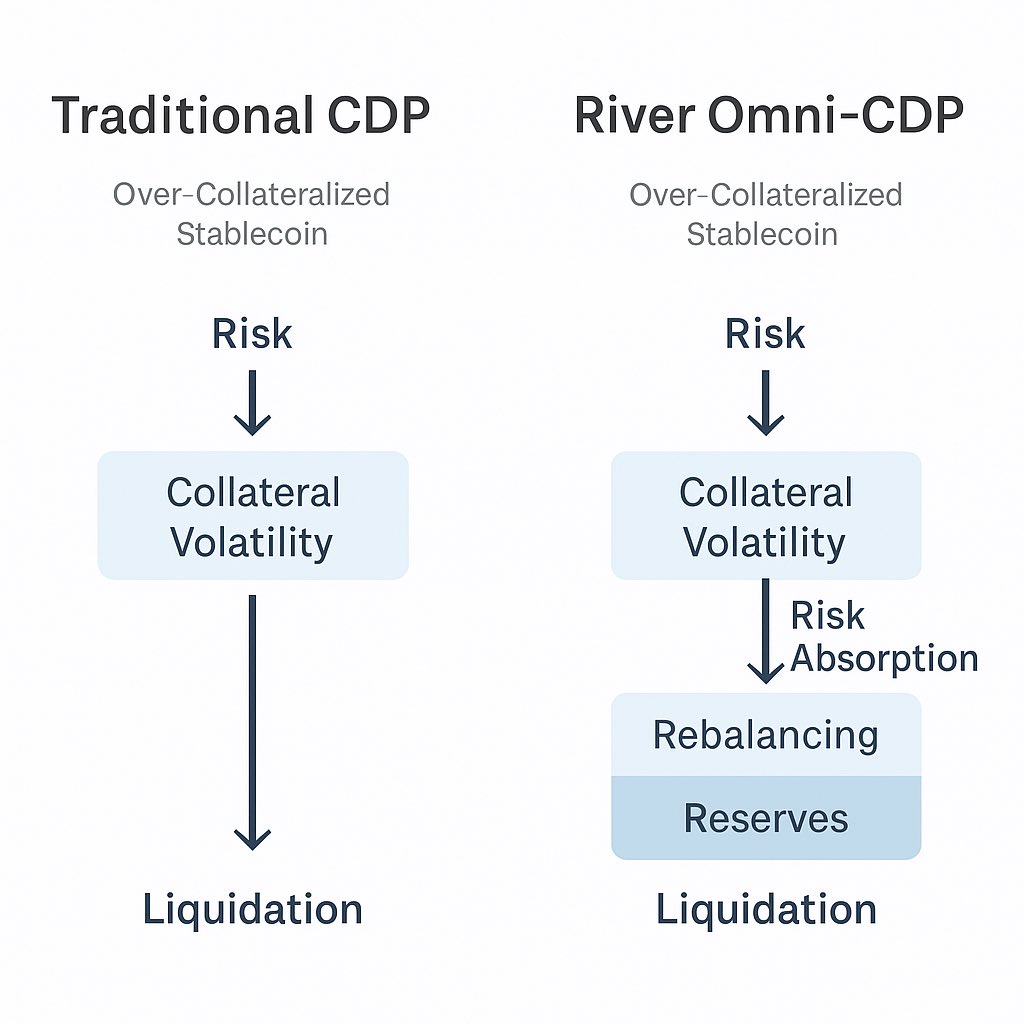

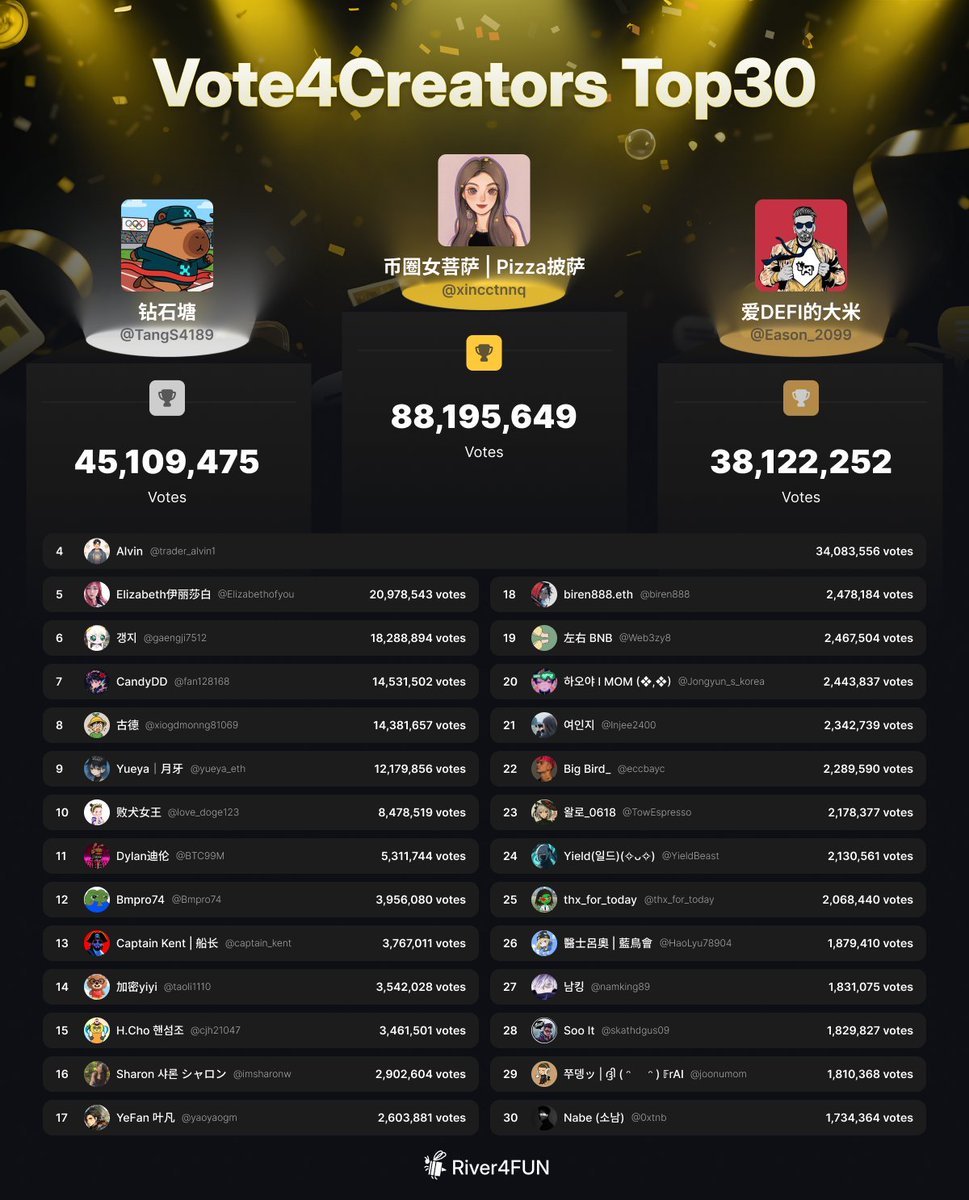

GM CT, spent the last few days tunneling through @River4fun and it's quietly rewiring my X habits from passive scroll to active yield farm. Kicked off with a yap on satUSD's Omni-CDP setup deposit BTC or ETH, mint 1:1 peg without bridge drama, and it just holds through volatility like nothing happened. That post alone pulled 62 $RiverPts, views climbing slow but steady, multiplier hitting x120 by nightfall as replies stacked in. Pushed further yesterday, minted a batch of satUSD and funneled it into the Smart Vault relaunch phase two capped at $10M in hours last time, now open till Nov 5 with zero liquidation risk baked in. Profits split clean: DeFi yields plus CeDeFi boosts at 12% APY, all while my @River4fun dashboard ticks up from cross-yaps. No gas bleed, just transparent claims after settle. Tracked the TVL surge to $638M, satUSD at $300M circulating, and realized this isn't hype it's liquidity that actually flows multichain, shrugging off USDX dips like they were footnotes. Zoomed out, with S3 airdrop live post-TGE, those points feel heavier now. Staked my 200+ into the Gold Pool for extra accrual, eyeing the dynamic convert to $RIVER within 180 days. Galxe's 4M $RiverPts pool has 140K in already, two weeks left till cutoff my batch's at 332 total, but the real edge is how engagement compounds without bot noise. River's not chasing flares; it's building rails where your feed turns into verifiable alpha. If you're still treating X as just noise, what's one yap thesis you'd drop to test the waters on @River4fun? #RIVER #RiverPts #satUSD #DeFi

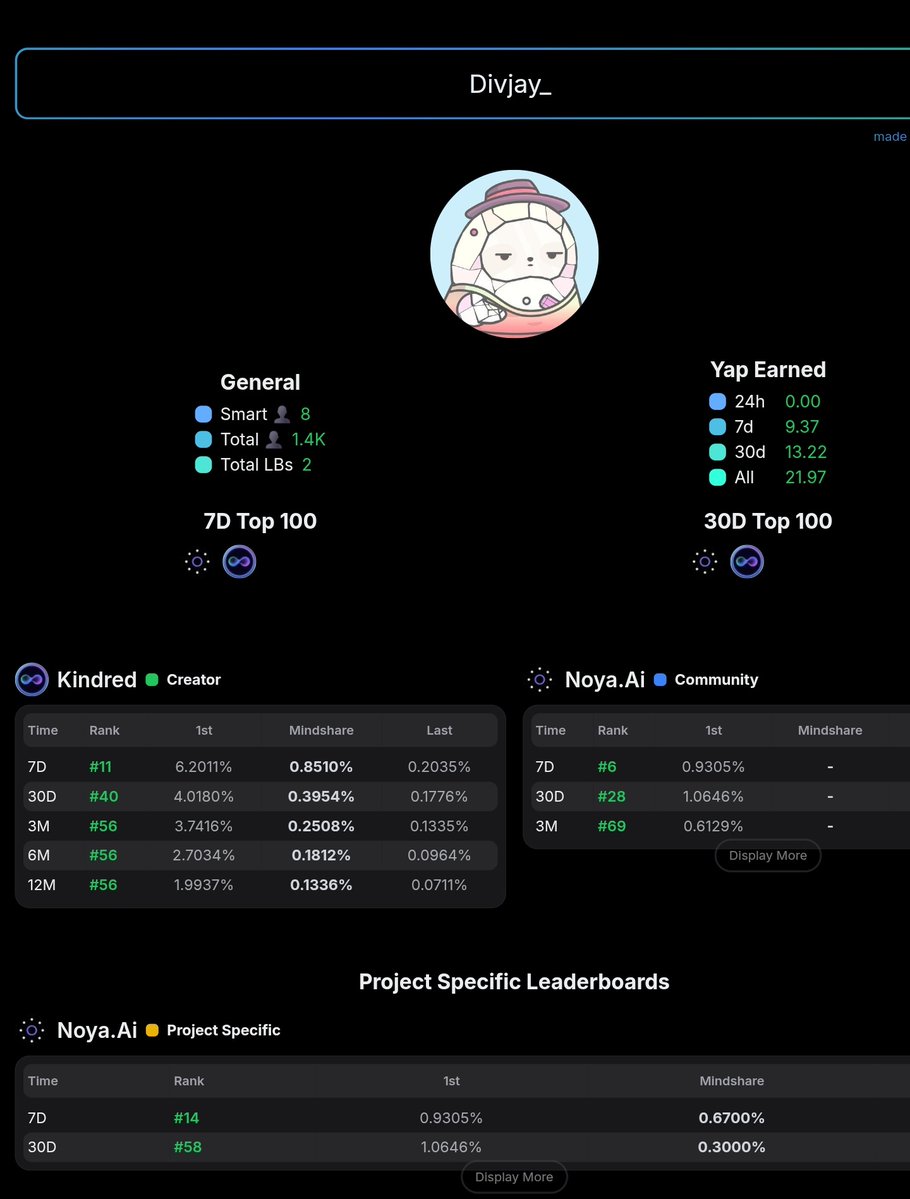

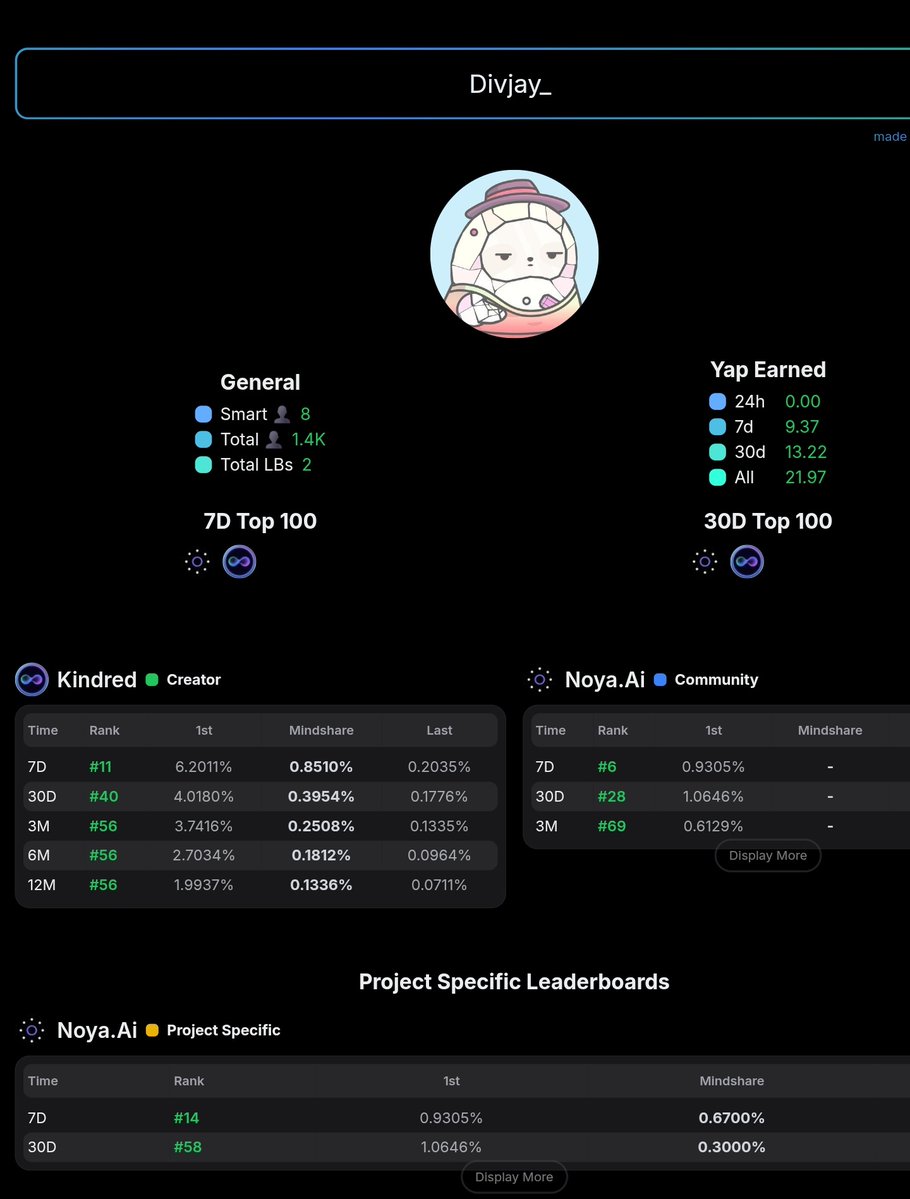

GM CT Woke up thinking about where attention actually becomes value @Kindred_AI gives agents memory and persistence every chat, mission and tiny interaction writes to onchain memory, produces Dark Matter, and Dark Matter transforms into $KIN This changes the reward model: emotional bandwidth becomes an economic input. Fans don’t just consume IP, they co-own characters that evolve with them across XR and apps. Licensed IP becomes living, collaborative assets creators can grow with their communities Technical win: cross-platform companions that carry context, preferences and history. UX win: relationships that feel reciprocated. Economic win: time you spend compounds network value Question for you which play matters first? Poll: 1) granular privacy controls 2) deeper continuity & memory 3) tradable experiences & co-ownership Curious where @NetworkNoya could fit into this flow who else should Kindred team up with? Say GM back and tell me what companion you’d build today

GM Yappers Quick take on @Everlyn_ai refund wave coming, and if you paid for a package like I did ($100), you deserve clarity, not silence What happened: 1) TGE chaos + delayed video delivery (2 12hr queues, no sound) 2) Community felt abandoned after launch 3) Refund form opened use it if you need capital back How to decide: - Need liquidity or no faith in roadmap → claim refund - Can tolerate risk and want upside → hold but demand timelines + audits What the team must do to rebuild trust: - Publish clear refund stats and timelines - Release a public audit & delivery KPIs for video gen (latency, voice, throughput) - Open a governance channel or snapshot for affected users - Share token unlock schedule and merchant integrations for $LYN utility Short-term price action: expect volatility around refund announcements and exchange listings (specs will trade the narrative) Medium-term recovery only if ops improve, delivery speeds drop under 1 hour, and governance becomes real Checklist for users: - Fill refund form + keep screenshots - Track MGBX / other listings for liquidity events - Join community calls, demand multisig / treasury transparency - Consider partial refund + hold strategy to hedge upside vs risk This is a service/product problem more than a token problem fix delivery, restore trust, and the narrative changes fast!

gm CT Day 5 of talking about @EdgenTech Think of a trading cockpit that reads the market like a detective, stitches social chatter to on‑chain flows, and hands you a concise action plan not another dashboard to memorize Why this matters: •360° Reports that blend fundamentals, tokenomics, TA and real‑time heat into one score •Aura lets credible analysts rise above the noise so you learn while you trade •Crypto Mindshare + exchange flow tracking shows where capital is actually moving Hypothetical play: pair Edgen signals with an agent chain like @GoKiteAI for auto execution, royalties on shared strategies, and instant settlement a set‑and‑observe portfolio model that pays you when others copy your edge Quick playbook: 1) pick a theme in Edgen 2) enable cross‑market alerts 3) size, trail, scale Which feature moves you fastest 360° reports, mindshare, or Aura? Reply your pick and I’ll drop my checklist for that setup

GM CT Two different flavors of onchain AI momentum colliding this quarter @Kindred_AI builds companions with memory, identity, and an economic life onchain they make digital relationships carry history and value, not just utility @Everlyn_ai focuses on creator-first video: verifiable outputs, decentralized GPU rendering, and token-aligned incentives for creators Why this matters: • composable identity + real-time presence → interactive economies that compound over time • verifiable media + open infra → creators keep ownership and attribution, long-term value accrues to originators Short-term plays: 1) engage early on @Kindred_AI to capture narrative + $KIN upside from platform-driven utility 2) post and grind on @Everlyn_ai to stack points toward $LYN and build a content moat Big ask: which do you bet on for mainstream adoption first immersive companions or creator-native video? Reply A for companions (Kindred) Reply B for creator video (Everlyn) Tag a friend who needs to pick a side Stay curious, stay early, stay kindred and creative

Dug into @River4fun's buyback mechanics today and damn, it's a flex on how DeFi should handle turbulence. Snapshot locked at Nov 9, 11:09 UTC right when conversions paused, pegging pts at 0.0000447 BNB (~$0.048) for public sale holders only. No fluff: actual payout = original buy minus any transfers/sales/conversions, staked pts counted in full to reward the loyal. Timeline's tight too eligible lists drop Nov 12-20, BNB wires out by 23rd, excess pts burned to nix exploits. Backed by $716M TVL where 71% flows from small stakers grinding 33-42% blended yields in satUSD vaults. Pendle hooks keep liquidity smooth, LayerZero bridges the chains without a hitch, and that 270x emission curve by day 180? It's not hype, it's engineered alpha for holders who stake into governance. River's proving DeFi's next wave isn't chaos it's precision that turns stress into structural wins. This is the kind of move that cements ecosystems for the long haul

gm DeSci fam watching @BioProtocol wire real labs to onchain rails ignition sales → IP tokens → lab work funded xp decays in 14d so you actually have to play the game stake $BIO, veBIO compounds, stake ecosystem assets to farm XP what I’m tracking: • $DICK: ignition 500k → FDV 14.43M • $VITASTEM: 500k → 5.85M • $BiomeAI climbing with real demand from microbiome logs strategy, not hype: > farm XP before drops (allocs stay small) > plan to sell ~50% at listing, hold the rest for replication signals > track BioXP expiry and staking formulas once published why this matters IP tokenization turns grant-stage R&D into tradable, fundable experiments labs get capital, community owns upside, and replication becomes the scoreboard my move: stake, farm xp, back trials, track replication % and liquidity depth #DeSci #BioProtocol #IPToken

Gm Kindred fam If you still think “AI x crypto” is just hype, take a closer look at what @Kindred_AI is actually building Short version: - AI agents that remember, speak, and own their identity onchain - Monetizable companions classic IPs landing as living, tradable characters - Fixed $KIN supply to protect long-term value, not endless inflation Why this matters: Agents that think + act onchain open new flows: creator economies that run 24/7, fandoms that co-create value, and bots that coordinate trustlessly across chains. The real moat here is memory + ownership stories compound over time, not reset after every mint What I’m watching next: 1) Depth of agent memories (how context-rich they get) 2) IP rollouts and onboarding UX 3) Onchain activity and DAU around companions Partnership shout to @SeiNetwork for making these experiences composable onchain Question for the thread which drop would push you to onboard first? Teletubbies, Astroboy, or an OG anime collab? Reply with your pick and why, and RT if you think onchain companions will change fandom forever?

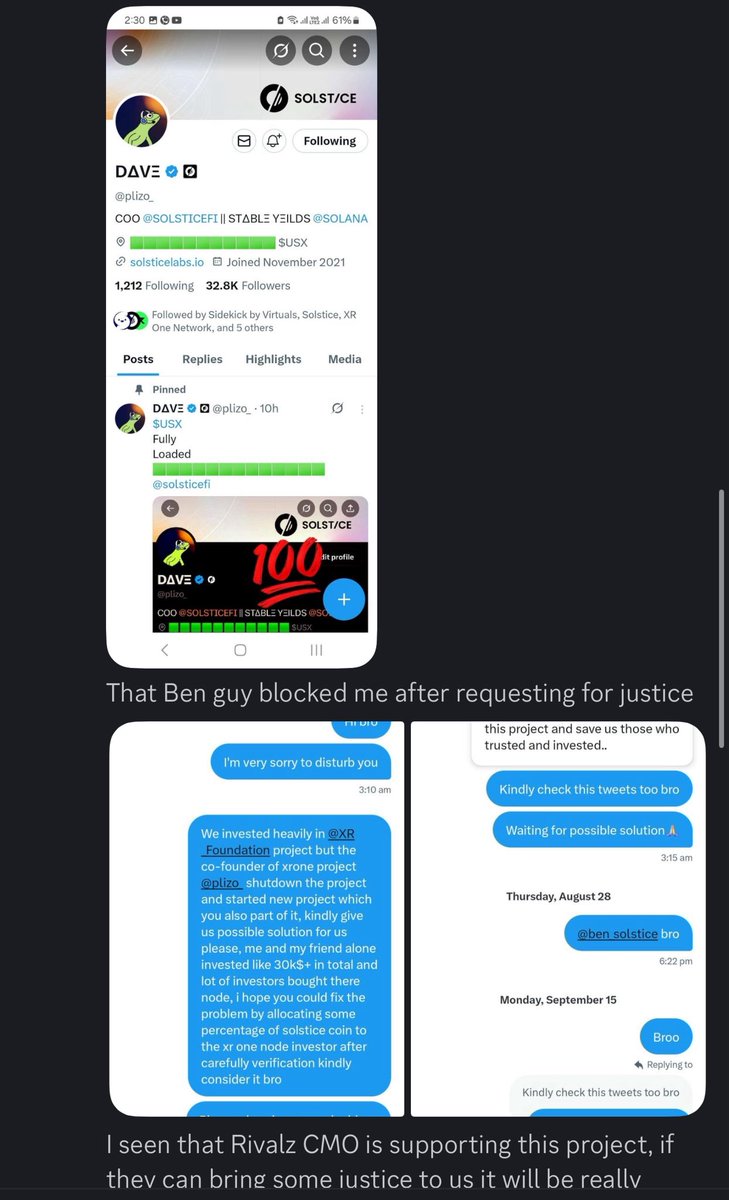

GM CT Quick Solana playbook for @solsticefi if you want a tactical entry without getting swept by hype, read this slow then act fast Why I care: • $USX = fully collateralized stable on Solana, built for capital efficiency and low slippage • eUSX = your yield-bearing ticket from YieldVaults + funding-rate arbitrage (real yield mechanics, not emissions theater) • $SLX = governance / alignment token with creator allocation and an airdrop narrative that scales with usage • TVL: 160M+ live, 100M+ committed traction shows, not just talk How I’m playing: • Swap USDC → $USX (small test swap first) • Lock into YieldVault for eUSX (park & harvest) • Add LP on Raydium/Orca for boosts once you’re comfortable • Signal on Xeet for creator points if you make content Risk note: smart to stagger size, hedge exposure, and track funding flows this is info-driven yield, not pure stonk vibes Pick one: A) Park & harvest B) LP for boosts C) Wait & watch Reply A/B/C + why which path are you taking and what size are you testing with?

GM Web3 Every market cycle separates latecomers from builders who act early @ekoxofficial is doing the common-sense thing: make ETH work harder while you keep using it Quick primer how Ekox actually moves the needle - Restake ETH → mint eXETH → preserve liquidity while stacking restaking + staking yields - EkoxPay → schedule payments that earn before they clear - AI Cube → auto-optimize validators, fee routing, risk alerts - Stable pools → predictable yield on USDT/USDC/DAI without manual babysitting Real signals: testnet crossed $70M+ TVL and 500K+ tx, real UX, real throughput Mainnet timing + Q4 roadmap are the catalyst if execution stays tight this becomes a core infra play for liquid restaking How to play: study the architecture, size positions by risk profile, farm eXETH where value accrues, and track onchain metrics not hype This is capital efficiency meeting automation watch $EKOX and the protocol flows closely

gm builders a quick playbook on how @brevis_zk changes what on-chain apps can actually do smart contract asks for heavy compute → brevis runs it off-chain once with their zk coprocessor → a succinct zk proof gets generated, aggregated, and posted → on-chain verifies in milliseconds, challengers can contest via propose challenge → trusted result drives payouts, credit, governance, or game state why that matters • no mass re‑execution across validators = way lower gas • proofs preserve wallet privacy while proving eligibility • zk aggregation = fewer txs, cheaper scale how to adopt (practical) 1) identify compute-heavy ops (leaderboards, risk calcs, eligibility) 2) define input merkle roots or light-client headers 3) call Brevis offchain API, submit proof verifier onchain 4) add an optional challenge window for extra security predictions • dynamic fees and personalized yields go mainstream • credit scoring built from provable history, not trust • cross-chain reputation becomes portable builders who care about trustless memory and privacy should be watching @brevis_zk closely this layer rewires value flow in DeFi and beyond

Deep dive into @EdgenTech why i’ve been farming Aura and seriously weighing the Expert upgrade one interface that stitches on‑chain flows + social mood + fundamentals with AI agents that actually explain the why daily aura pool ~10,000 to grab (roll call + tiny quests = steady accumulation) i'm sitting in the top ~3 4% from consistent check‑ins and smart tagging small actions, meaningful edge what it gives you: - fast TA + context, not just signals - multi‑agent runs that reduce blind spots - premium reports that can justify a single paid trade funding: $11M, product moving quick, free tier useful for testing before commit strategy thoughts: farm aura while you learn the dashboards use Expert for orchestration and saved workflows when size > small swing position sizing still matters treat Edgen as a decision amplifier, not a cheat code who’s pairing this with @KaitoAI or stacking other agent tools? vote: - go expert now - farm aura then upgrade - stay free, test longer drop your combo, share a screenshot, or RT if you think AI market kits are the new edge

truth finishes first multi-agent market intel that actually reads the room and tells you what's actionable AI agents parsing filings, options heat, on‑chain flows and news into ranked signals @EdgenTech folds stocks + crypto into one auditable decision stack so you stop guessing and start navigating how i run it: 1) Map theme (funding, ETFs, whale flow) 2) Scan agent alerts for causality scores 3) Cross-check derivatives + OI skew 4) Stress-test pivots on weekly structure ran a midcap through the stack this AM sentiment delta + derivatives squeeze building, volume profile still confirming next resistance a clear pivot if aura confirms tips: post signal notes to farm Aura, set agent thresholds to avoid noise, weight filings heavier than hype early adoption compounds. DYOR how are you using @EdgenTech to get the edge

Quiet builders move markets Small actions compound into infrastructure modular rails, predictable flows, capital that actually works for users Arichain partnership opened cross-chain liquidity and modular restaking that boosts capital efficiency for eXETH holders @ekoxofficial is rolling restaking mainnet, eXETH liquid restake, stablecoin staking with monthly yield, EkoxPay and AI Cube a practical product stack. Testnet already showed $70M+ TVL and 500K+ transactions, proof of traction How to play -> deposit ETH, mint eXETH, let yields auto-compound across layers; stake USDT/USDC/DAI for steady monthly returns; track listings and airdrop timing Short-term: TVL growth + integrations Mid-term: composable restaking primitives attract builders Long-term: modular DeFi rails win market share If you want exposure with a plan, study $EKOX and follow @ekoxofficial GM CT

Most engaged tweets of onsen enjoyer 🛁

GM CT, spent the last few days tunneling through @River4fun and it's quietly rewiring my X habits from passive scroll to active yield farm. Kicked off with a yap on satUSD's Omni-CDP setup deposit BTC or ETH, mint 1:1 peg without bridge drama, and it just holds through volatility like nothing happened. That post alone pulled 62 $RiverPts, views climbing slow but steady, multiplier hitting x120 by nightfall as replies stacked in. Pushed further yesterday, minted a batch of satUSD and funneled it into the Smart Vault relaunch phase two capped at $10M in hours last time, now open till Nov 5 with zero liquidation risk baked in. Profits split clean: DeFi yields plus CeDeFi boosts at 12% APY, all while my @River4fun dashboard ticks up from cross-yaps. No gas bleed, just transparent claims after settle. Tracked the TVL surge to $638M, satUSD at $300M circulating, and realized this isn't hype it's liquidity that actually flows multichain, shrugging off USDX dips like they were footnotes. Zoomed out, with S3 airdrop live post-TGE, those points feel heavier now. Staked my 200+ into the Gold Pool for extra accrual, eyeing the dynamic convert to $RIVER within 180 days. Galxe's 4M $RiverPts pool has 140K in already, two weeks left till cutoff my batch's at 332 total, but the real edge is how engagement compounds without bot noise. River's not chasing flares; it's building rails where your feed turns into verifiable alpha. If you're still treating X as just noise, what's one yap thesis you'd drop to test the waters on @River4fun? #RIVER #RiverPts #satUSD #DeFi

GM CT Woke up thinking about where attention actually becomes value @Kindred_AI gives agents memory and persistence every chat, mission and tiny interaction writes to onchain memory, produces Dark Matter, and Dark Matter transforms into $KIN This changes the reward model: emotional bandwidth becomes an economic input. Fans don’t just consume IP, they co-own characters that evolve with them across XR and apps. Licensed IP becomes living, collaborative assets creators can grow with their communities Technical win: cross-platform companions that carry context, preferences and history. UX win: relationships that feel reciprocated. Economic win: time you spend compounds network value Question for you which play matters first? Poll: 1) granular privacy controls 2) deeper continuity & memory 3) tradable experiences & co-ownership Curious where @NetworkNoya could fit into this flow who else should Kindred team up with? Say GM back and tell me what companion you’d build today

GM CT Two different flavors of onchain AI momentum colliding this quarter @Kindred_AI builds companions with memory, identity, and an economic life onchain they make digital relationships carry history and value, not just utility @Everlyn_ai focuses on creator-first video: verifiable outputs, decentralized GPU rendering, and token-aligned incentives for creators Why this matters: • composable identity + real-time presence → interactive economies that compound over time • verifiable media + open infra → creators keep ownership and attribution, long-term value accrues to originators Short-term plays: 1) engage early on @Kindred_AI to capture narrative + $KIN upside from platform-driven utility 2) post and grind on @Everlyn_ai to stack points toward $LYN and build a content moat Big ask: which do you bet on for mainstream adoption first immersive companions or creator-native video? Reply A for companions (Kindred) Reply B for creator video (Everlyn) Tag a friend who needs to pick a side Stay curious, stay early, stay kindred and creative

gm CT Day 5 of talking about @EdgenTech Think of a trading cockpit that reads the market like a detective, stitches social chatter to on‑chain flows, and hands you a concise action plan not another dashboard to memorize Why this matters: •360° Reports that blend fundamentals, tokenomics, TA and real‑time heat into one score •Aura lets credible analysts rise above the noise so you learn while you trade •Crypto Mindshare + exchange flow tracking shows where capital is actually moving Hypothetical play: pair Edgen signals with an agent chain like @GoKiteAI for auto execution, royalties on shared strategies, and instant settlement a set‑and‑observe portfolio model that pays you when others copy your edge Quick playbook: 1) pick a theme in Edgen 2) enable cross‑market alerts 3) size, trail, scale Which feature moves you fastest 360° reports, mindshare, or Aura? Reply your pick and I’ll drop my checklist for that setup

GM Yappers Quick take on @Everlyn_ai refund wave coming, and if you paid for a package like I did ($100), you deserve clarity, not silence What happened: 1) TGE chaos + delayed video delivery (2 12hr queues, no sound) 2) Community felt abandoned after launch 3) Refund form opened use it if you need capital back How to decide: - Need liquidity or no faith in roadmap → claim refund - Can tolerate risk and want upside → hold but demand timelines + audits What the team must do to rebuild trust: - Publish clear refund stats and timelines - Release a public audit & delivery KPIs for video gen (latency, voice, throughput) - Open a governance channel or snapshot for affected users - Share token unlock schedule and merchant integrations for $LYN utility Short-term price action: expect volatility around refund announcements and exchange listings (specs will trade the narrative) Medium-term recovery only if ops improve, delivery speeds drop under 1 hour, and governance becomes real Checklist for users: - Fill refund form + keep screenshots - Track MGBX / other listings for liquidity events - Join community calls, demand multisig / treasury transparency - Consider partial refund + hold strategy to hedge upside vs risk This is a service/product problem more than a token problem fix delivery, restore trust, and the narrative changes fast!

gm DeSci fam watching @BioProtocol wire real labs to onchain rails ignition sales → IP tokens → lab work funded xp decays in 14d so you actually have to play the game stake $BIO, veBIO compounds, stake ecosystem assets to farm XP what I’m tracking: • $DICK: ignition 500k → FDV 14.43M • $VITASTEM: 500k → 5.85M • $BiomeAI climbing with real demand from microbiome logs strategy, not hype: > farm XP before drops (allocs stay small) > plan to sell ~50% at listing, hold the rest for replication signals > track BioXP expiry and staking formulas once published why this matters IP tokenization turns grant-stage R&D into tradable, fundable experiments labs get capital, community owns upside, and replication becomes the scoreboard my move: stake, farm xp, back trials, track replication % and liquidity depth #DeSci #BioProtocol #IPToken

GM CT Quick Solana playbook for @solsticefi if you want a tactical entry without getting swept by hype, read this slow then act fast Why I care: • $USX = fully collateralized stable on Solana, built for capital efficiency and low slippage • eUSX = your yield-bearing ticket from YieldVaults + funding-rate arbitrage (real yield mechanics, not emissions theater) • $SLX = governance / alignment token with creator allocation and an airdrop narrative that scales with usage • TVL: 160M+ live, 100M+ committed traction shows, not just talk How I’m playing: • Swap USDC → $USX (small test swap first) • Lock into YieldVault for eUSX (park & harvest) • Add LP on Raydium/Orca for boosts once you’re comfortable • Signal on Xeet for creator points if you make content Risk note: smart to stagger size, hedge exposure, and track funding flows this is info-driven yield, not pure stonk vibes Pick one: A) Park & harvest B) LP for boosts C) Wait & watch Reply A/B/C + why which path are you taking and what size are you testing with?

GM frens let's talk guaranteed execution for Solana and why @raikucom matters coordination layer that turns blockspace from guesswork into schedule: - AoT slot reservations to book a commit ahead of time - parallel execution lanes so heavy compute won’t choke small ops - pre-confirmations that give you inclusion signals before settlement - local fee markets that price bandwidth where it belongs what you feel: - traders see fewer failed swaps and cleaner UX - devs remove retry spaghetti and ship faster experiments - infra teams get SLA-style predictability under load signals to watch: inclusion-rate under stress, latency percentiles, validator-sidecar adoption, and early DEX/settlement integrations if you could reserve 1 guaranteed slot/day, what would you use it for? reply: settlement / oracle / governance / mint also curious will $RAIKU be a coordination token or stay infra-first? shout to @degenroot for the block-market convo what do you think?

Gm Kindred fam If you still think “AI x crypto” is just hype, take a closer look at what @Kindred_AI is actually building Short version: - AI agents that remember, speak, and own their identity onchain - Monetizable companions classic IPs landing as living, tradable characters - Fixed $KIN supply to protect long-term value, not endless inflation Why this matters: Agents that think + act onchain open new flows: creator economies that run 24/7, fandoms that co-create value, and bots that coordinate trustlessly across chains. The real moat here is memory + ownership stories compound over time, not reset after every mint What I’m watching next: 1) Depth of agent memories (how context-rich they get) 2) IP rollouts and onboarding UX 3) Onchain activity and DAU around companions Partnership shout to @SeiNetwork for making these experiences composable onchain Question for the thread which drop would push you to onboard first? Teletubbies, Astroboy, or an OG anime collab? Reply with your pick and why, and RT if you think onchain companions will change fandom forever?

Dug into @River4fun's latest Galxe push over the weekend, and turns out it's less grind more flow than I figured. Been stacking points on similar setups before, but this one's got that delayed gratification hook your $RiverPts sit there for up to 180 days before swapping to $RIVER, and the conversion ramps hard if you hold off. First day's like 1M pts for 111 tokens, but day 180? You're looking at 30k. Smart play to curb dumps and reward the patient. With 140k already in the pool and 2M pts claimed, half the 4M total's gone in weeks. Remaining drops hit over the next 15 days till Nov 23, so yeah, window's tightening. Tasks boil down to follows, retweets, and quick community pings nothing that'll eat your Saturday, but it feeds straight into ecosystem perks like staking satUSD for daily yields. What clicks for me is how it ties back to the core: no-bridge minting of that BTC/ETH-backed stable, holding firm post-USDX hiccup. River's not chasing flash it's layering social engagement on top of actual DeFi rails, turning casual posts into compounded value. If you're eyeing low-effort entries with long-tail upside, this fits. Stack some pts before the rush peaks.

Just wrapped a quick session testing @River4fun's OmniCDP setup on BNB chain deposited some leftover USDT, minted satUSD in under 90 seconds, no wrapping, no approval spam. Straight into a Smart Vault pulling 40% APR from mixed DeFi/CeDeFi pools. It's like they engineered the friction out of yield entirely. What hooked me deeper was the River Pts accrual. Staked a chunk of satUSD, ran a few liquidity routes, and watched the multiplier climb to x180 without leaderboard BS. These aren't gimmick points they're ERC-20s you convert to $RIVER on a dynamic curve, up to 27x boost by day 180 post-TGE. Early claim? Maybe 111 tokens per million pts. Hold the line? Closer to 30k. Smart lock-in against dump pressure. Zoom out, and it's clear why TVL hit 130M+ fast: real revenue funnels, ZK privacy layers from @zama, AI risk tweaks via @useTria. No more depeg scares like that USDX hiccup satUSD pegged rock solid at $1, backed by actual BTC/ETH flows. This isn't farming for clout, it's infrastructure that scales quiet. If you're bridging assets weekly, swap one run to River and see the delta. Who's stacking pts before the Galxe pool dries up Nov 23? #DeFi #satUSD #RIVER #YieldFarm #Web3

Dug into @River4fun's buyback mechanics today and damn, it's a flex on how DeFi should handle turbulence. Snapshot locked at Nov 9, 11:09 UTC right when conversions paused, pegging pts at 0.0000447 BNB (~$0.048) for public sale holders only. No fluff: actual payout = original buy minus any transfers/sales/conversions, staked pts counted in full to reward the loyal. Timeline's tight too eligible lists drop Nov 12-20, BNB wires out by 23rd, excess pts burned to nix exploits. Backed by $716M TVL where 71% flows from small stakers grinding 33-42% blended yields in satUSD vaults. Pendle hooks keep liquidity smooth, LayerZero bridges the chains without a hitch, and that 270x emission curve by day 180? It's not hype, it's engineered alpha for holders who stake into governance. River's proving DeFi's next wave isn't chaos it's precision that turns stress into structural wins. This is the kind of move that cements ecosystems for the long haul

GM frens let’s unpack guaranteed execution on Solana and why @raikucom might quietly rearrange how apps behave under load Ackermann-style primitives, in plain words: - lock a future block slot (AoT) so critical txs move from “hope” to “scheduled” - parallel execution lanes so heavy compute doesn’t throttle tiny ops - micro pre-confirmations to avoid ghosted txs when congestion spikes - local fee markets that put bandwidth pricing where it belongs real quick wins you’ll actually feel: - smoother trading UX, far fewer failed swaps - devs rewrite less retry logic and ship cleaner UX experiments - infra teams get enterprise-grade SLAs and predictable ops prediction thread: 1) faster onramps for CeFi/Fi protocols 2) new revenue layers from slot-auctions + QoS billing 3) $RAIKU could surface as a coordination incentive, or remain infra-first both plausible given $13.5M backers short poll for builders: if you had 1 reserved slot/day, what would you use it for settlement / oracle / governance / mint? reply with your pick and why, or RT to kick off the convo shout to @degenroot for the ideas that sharpened this take

gm builders a quick playbook on how @brevis_zk changes what on-chain apps can actually do smart contract asks for heavy compute → brevis runs it off-chain once with their zk coprocessor → a succinct zk proof gets generated, aggregated, and posted → on-chain verifies in milliseconds, challengers can contest via propose challenge → trusted result drives payouts, credit, governance, or game state why that matters • no mass re‑execution across validators = way lower gas • proofs preserve wallet privacy while proving eligibility • zk aggregation = fewer txs, cheaper scale how to adopt (practical) 1) identify compute-heavy ops (leaderboards, risk calcs, eligibility) 2) define input merkle roots or light-client headers 3) call Brevis offchain API, submit proof verifier onchain 4) add an optional challenge window for extra security predictions • dynamic fees and personalized yields go mainstream • credit scoring built from provable history, not trust • cross-chain reputation becomes portable builders who care about trustless memory and privacy should be watching @brevis_zk closely this layer rewires value flow in DeFi and beyond

GM CT Two plays that stack together and change how you think about capital + identity onchain @ekoxofficial brings liquid restaking with eXETH stake ETH, keep liquidity, let your stake power security, AI inference, and layered yield @snowball_money brings MNS and AI-driven automation a portable name that carries reputation, routing, and yield strategies across 70+ chains Why this matters: • Capital efficiency multiplied when restaked assets become composable • Identity that owns value, not just a label • AI orchestration that routes rewards into optimal paths automatically Short-term: watch liquidity pairs, exETH integrations, and premium name mints Mid-term: composable identity-enabled vaults, auto-harvest into fiat rails Long-term: a unified layer where reputation and yield are interchangeable primitives Join the experiment on @Chain_GPT @ChainGPT_Pad front row for protocol synergy and early rewards $EKOX $SNOWAI

People with Critic archetype

人生苦短保持性感「铲屎官」「弱鸡跑者」「尝试挣到睡后收入中年还不算油腻男」

Masters in Psychology | Sarcastic | Political Rhetoric RTs are NOT endorsement

Poet of Romance, Banker, Satirist, Columnist, Political Commentator

Happy to be alive..blessed to be happy..grateful for being blessed..😍😍😍

做你热爱的

Parody account. Satirical commentary. This account does not represent Jeffrey Epstein.

opino de mierdas de vez en cuando llevo @PorqueTTRicky cuenta secundaria @imatrixclips correo: imaatrixxx@proton.me

你好,我使用绪山真寻的头像,并不代表我是跨性别者,我再次澄清这一事实,谢谢。Hello, I use the anime avatar of Oyama Mahiro. This does not mean I am a transgender person. Thank you.

◦ Ciudadano

Fenerbahçe💛💙

part time hatemaxxer | full time retardio

Spring Boot, microservices, AI I say what most devs think but won’t post 🫡

Explore Related Archetypes

If you enjoy the critic profiles, you might also like these personality types: