Get live statistics and analysis of Michael Goodwin's profile on X / Twitter

The Entrepreneur

Michael Goodwin is a savvy co-founder and investor with deep roots in M&A advisory and a special focus on recruitment companies. His profile is a hub for insights on business growth, investment strategies, and industry trends shaped by hands-on experience. With a sharp eye for opportunities, Michael captivates a network eager for smart business moves and innovative partnerships.

Michael’s so into deals he probably dreams in term sheets — at this point, he might negotiate a raise during a casual brunch, just to keep the M&A muscle flexed!

Helping transform multiple recruitment companies through savvy investments and strategic counsel, Michael has propelled these firms to new heights of performance and market presence.

Michael’s life purpose is to build and nurture thriving businesses by connecting capital with promising recruitment ventures, helping them scale and succeed in competitive markets. He aims to create value not just for himself but for his stakeholders and the industry as a whole.

He believes in strategic investment, long-term growth, and the power of collaboration to unlock business potential. Michael values integrity, data-driven decisions, and the entrepreneurial spirit that drives innovation and progress.

His strengths lie in deep financial acumen, strategic vision, and a robust network in the recruitment and investment community that he leverages for deal-making and growth.

A potential weakness could be an overemphasis on the numbers that might overshadow the creative or human aspects of business building, sometimes missing out on softer cues.

To grow his audience on X, Michael should share more stories behind the deals—highlighting challenges, little-known insights, and industry trends with personal anecdotes to humanize his brand and spark more engagement.

Fun fact: Michael transitioned from an M&A advisor role to co-founding his own investment firm, showing he’s not just about deals on paper but also about building lasting business legacies.

Most engaged tweets of Michael Goodwin

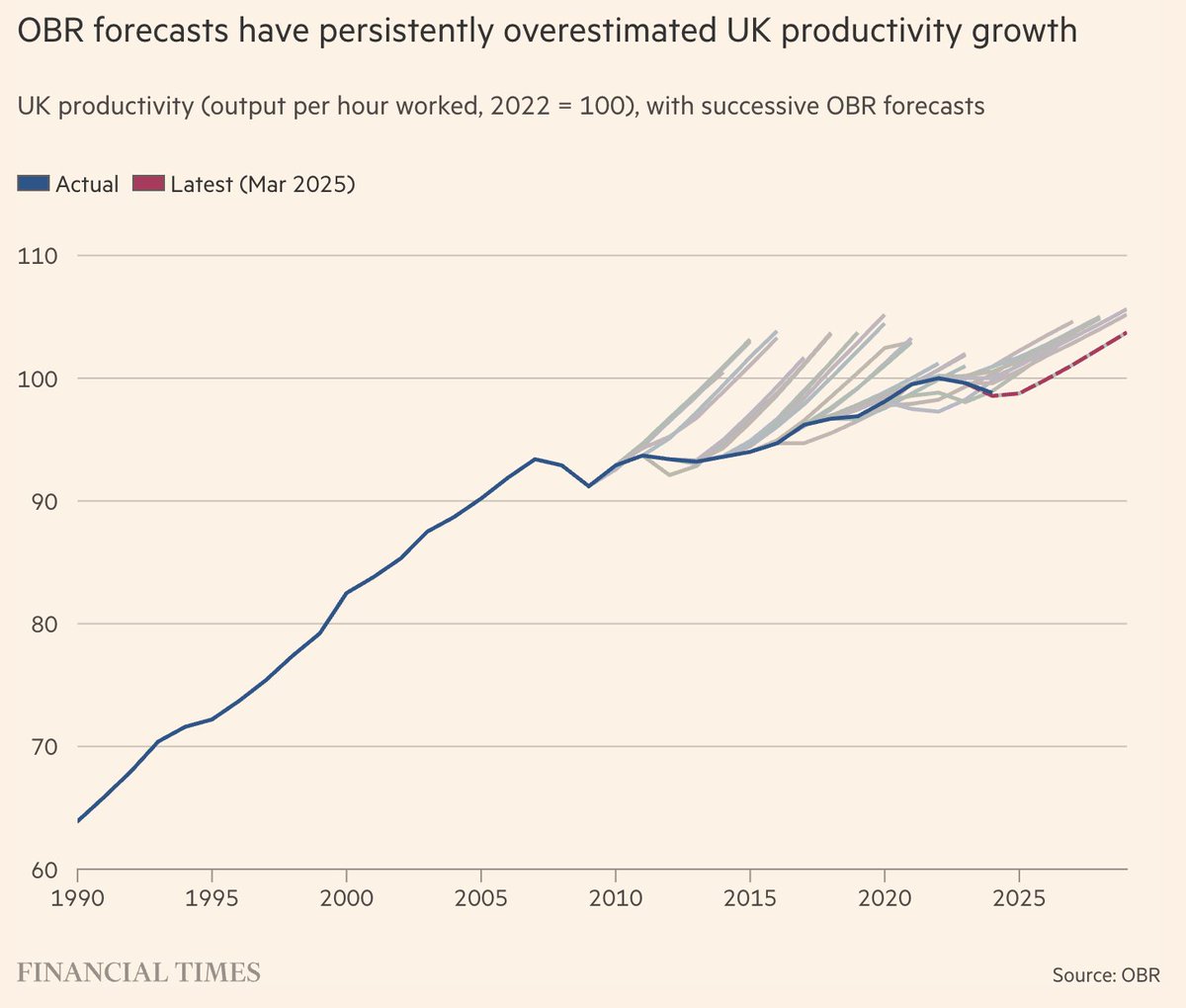

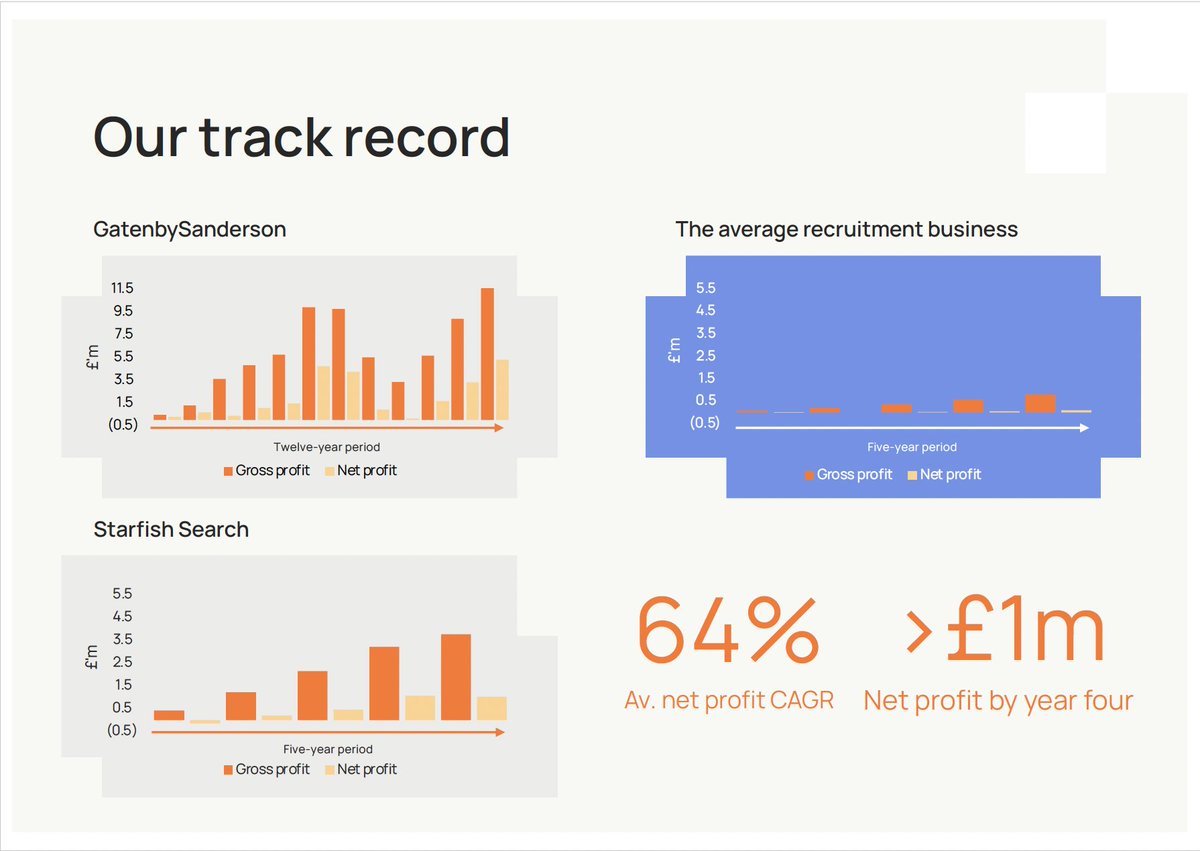

Why do we invest in agencies? The typical view in private equity is that investing in an agency is hard work. It's a high-risk investment, and many funds steer clear altogether. They aren't wrong. The model is inherently cyclical – boom and bust, feast and then famine. You're often either scrambling for resources or having to cut back in a downturn. An agency is also often highly dependent on a few key people. Especially on the smaller end, a business can easily be built upon the reputation of the original founder(s). But, for us, there is a lot of potential. Our specific focus is on recruitment. Despite the drawbacks, certain characteristics and advantages make it an excellent opportunity for us. 1) Our unique experience The obvious one is our experience. With my dad's experience building and selling an executive search firm, we have a deep understanding of the model. We can connect and identify with sellers, and really add value to the people we're backing. We also have a broad network of specialists in the sector that we can call upon (and that can bring us opportunities off-market, too). Combined with my experience in M&A and PE, we're often able to position ourselves uniquely compared to our competition. As a team understanding their journey, while also being able to deliver a deal. 2) Affordability Because of the typical risks associated with agencies, you can often enter these businesses at much more favourable valuations. If we're looking at an established business, a fair multiple will be much lower than for something with all the hallmarks of a typical private equity investment. Recurring revenue, recession-resistant, capital-light, etc.* You also don't get too many trade consolidators because the model doesn't particularly lend itself to M&A. If it's a start-up, you benefit from needing very little start-up capital relative to other industries. All of this works well for a family office without third-party funds. (*Of course, you also can't get access to / wouldn't want to use the same amount of debt.) 3) Growth Agencies can also grow very quickly. Get the model right, bring in the right people, and it can scale to a meaningful size, with strong margins within a few years. Of the two businesses we've been involved in, both were generating over £1m in net profit by just the fourth year. There aren't many other business models where that is possible and repeatable. Of course, it's still early days for @JigsawEquity. We only formally launched last summer. But we're hopeful that we can prove that being a little contrarian and going against the grain can ultimately be the best thing to do. Time will tell.

Michael Goodwin reposted

Michael Goodwin reposted

Michael Goodwin reposted

Michael Goodwin reposted

People with Entrepreneur archetype

Founder at GitAuto (@gitautoai), a QA agent that creates unit test PRs, runs the tests, and fixes failures if any, to boost your test coverage from 0% to 90%

Al Entrepreneur → Empowering Businesses to Accelerate Growth | Expertise in Al, Tech & ghostwriter| DM for collaboration 📩 malihatasnim956@gmail.com

Online Unisex Store🛍️🛍️- Wristwatches ⌚️ |Heels 👠| Shoes 👞 & Sneakers 👟 | Handbags 👜 & other fashion accessories| wa.me/message/MTKEHC…

🎵 The therapist SV founders don't talk about 🧠 Music therapy for minds that won't shut off 💡 Business owner trying to join the AI era 📍 Bay Area.

founder & ceo @resend // creator of new.email • react.email • draculatheme.com

Building the future of startups @entrivescom @launchliai | Helping other SaaS founders while building my own

Husband | Father | Founder → Helping entrepreneurs build personal brands that scale.

🚀 Agency owner | Obsessed with great ads and copywriting | On a mission to first 1M, sharing the journey to first 1M, sharing the journey to get there

全职撸毛,有个3人的小工作室,记录撸空投的1000天,维尼社群的主理人 vx:weinilukongtou

I invest Time. Art To Eqity. Tell me what you need, and I'll get back to you. ✌🏾

想像一下,人们用手机连接StarLink,通过X平台贸易,通过XPAYMENT支付,$Doge就是新时代的货币 Imagine, people connecting internet via StarLink, trading via X platform, and payment via Xpayment

building reviewrise.space - Validate Products & MVPs

Explore Related Archetypes

If you enjoy the entrepreneur profiles, you might also like these personality types: