Get live statistics and analysis of Wes Nishio's profile on X / Twitter

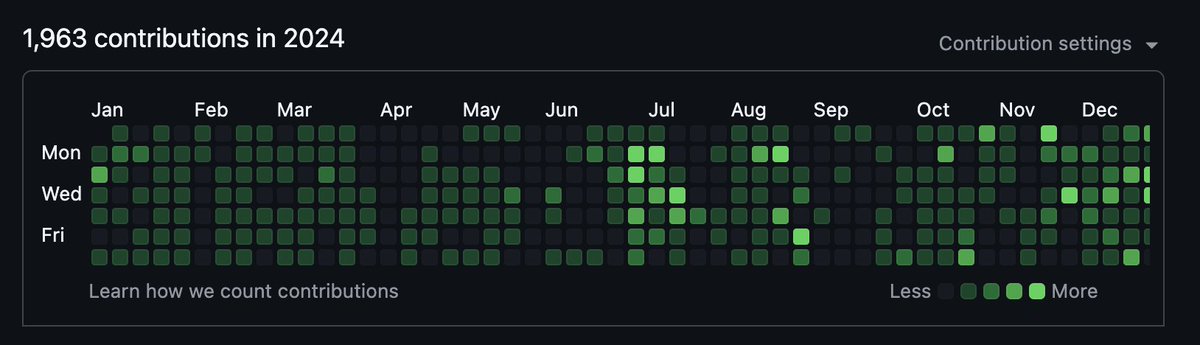

Founder at GitAuto (@gitautoai), a QA agent that creates unit test PRs, runs the tests, and fixes failures if any, to boost your test coverage from 0% to 90%

The Entrepreneur

Wes Nishio is a relentless innovator and founder driving the future of software testing with GitAuto, a cutting-edge QA agent that automates unit test creation and fixes failures. His journey is marked by persistence, collaboration, and a knack for turning complex challenges into streamlined solutions. Wes's dynamic presence on X reflects his passion for tech, startup hustle, and community engagement.

Wes's startup spirit is so relentless, he treats Y Combinator like a season finale—five times in a row and counting. At this rate, his co-founder might start needing anger management classes just to survive the pitch rollercoaster!

Successfully founding GitAuto and getting recognized by the Salesforce Slack App team for his innovative work, showcasing his ability to network within top-tier tech ecosystems and build impactful solutions.

Wes’s life purpose is to revolutionize software development by making testing smarter, faster, and more accessible, empowering engineering teams to overcome resource constraints and deliver higher quality code effortlessly.

He strongly believes in the power of technology to solve real-world problems, the value of persistence even after repeated attempts, and the importance of collaboration and transparency in building successful startups.

Wes’s major strengths are his perseverance, ability to identify pain points in the development process, and his knack for creating practical, innovative tools that provide tangible value to engineering teams.

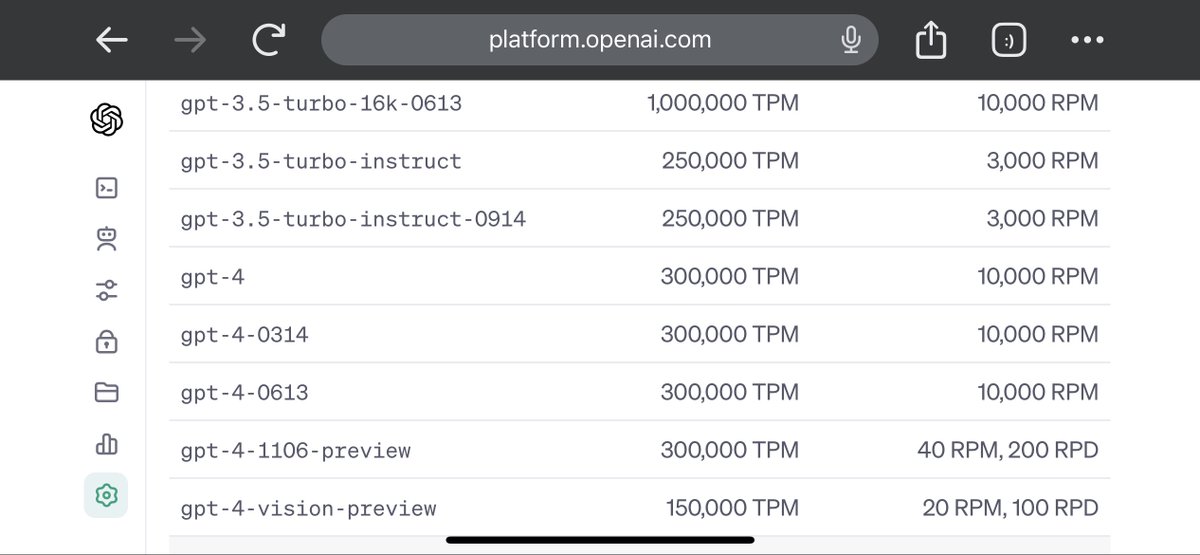

Sometimes, his intense focus on product and growth can lead to underestimating the limitations of new tech platforms, like getting caught off guard by GPT-4V’s API usage caps.

To grow his audience on X, Wes should share more behind-the-scenes stories and lessons from his startup journey, tag collaborators and engage in tech conversations to expand his network, while using clear, engaging visuals to simplify his complex technology.

Fun fact: Despite submitting to Y Combinator five times, Wes never gives up and even discovered a new, rarely seen 'angry' side of his usually calm co-founder during the process—proof that entrepreneurship is full of surprises!

Top tweets of Wes Nishio

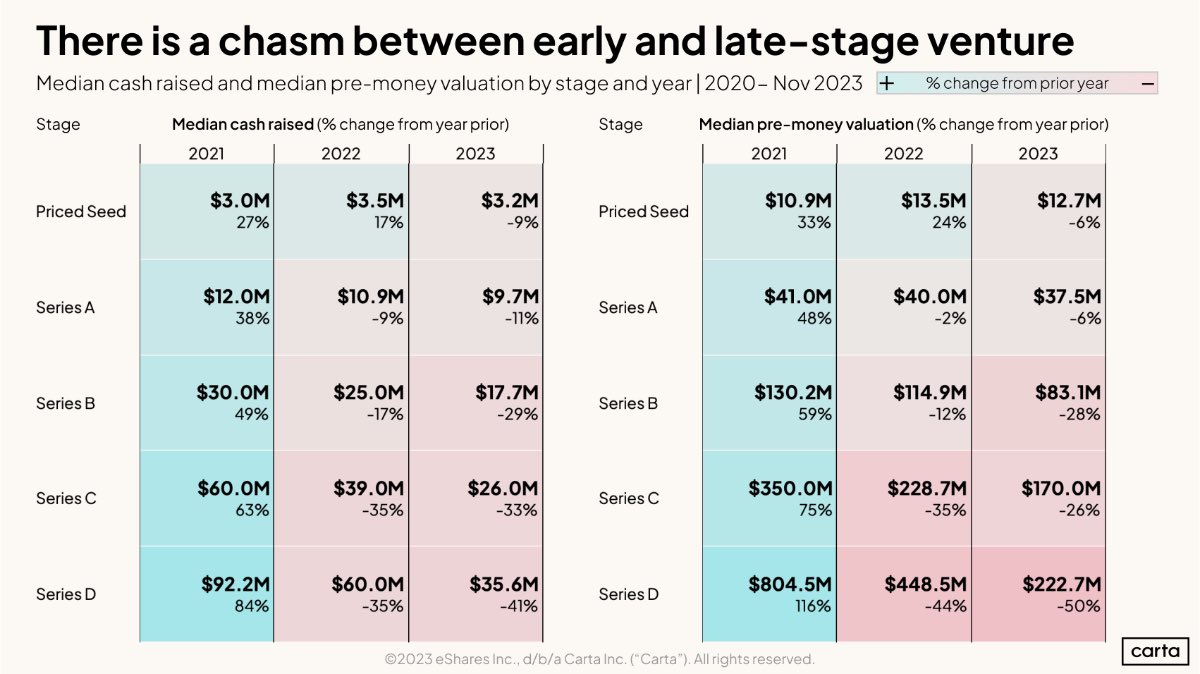

Understanding SAFEs and Priced Equity Rounds by Kirsty Nathoo https://t.co/gXX7XUNZMV from @LBRYcom via @YouTube Here is an organized note. ## Key Message - Founders must understand how much of their company they've sold to investors at all stages. - Convertible instruments can complicate understanding ownership stakes. - Founders should not solely rely on lawyers for cap table management; tools like @thecaptableco and @cartainc can help. ## Presentation Breakdown ### Section 1: Understanding SAFEs (Simple Agreement for Future Equity) - SAFEs are used for early-stage fundraising, allowing investors to convert their investment into shares at a later priced round. - Safes are not debt; they have no interest rate or maturity date. - Negotiation points in SAFEs: amount of money and valuation cap. - New version includes a paragraph that ensures the document matches YC's standard SAFE if unchanged. ### Section 2: Dilution and Cap Table Management - Founders should track dilution through fundraising rounds to avoid surprises. - Post-money SAFEs introduced to make dilution easier to understand for founders. ### Section 3: Top Tips for Fundraising - Avoid mixing SAFEs and convertible notes due to complexity. - Use post-money SAFEs for clarity on dilution. - Don't over-optimize for valuation caps during negotiations. ## Detailed Explanation of SAFEs and Dilution - SAFEs provide future equity in exchange for immediate funding. - Investor ownership is determined by the amount raised divided by the post-money valuation cap. - Post-money SAFEs ensure that new investors dilute existing shareholders, not each other. - Conversion of SAFEs and the creation of an option pool occur before new money invests in a priced round. ## Example Walkthrough 1. Incorporation: Two founders with equal shares. 2. Post-Money SAFE Investments: - Investor A: $200K at a $4M cap (5% ownership). - Investor B: $800K at an $8M cap (10% ownership). - Founders are diluted but retain 85% ownership collectively. 3. Hiring and Equity Distribution: - Option pool created, diluting founders further. - Founders need to remember the dilution from SAFEs. 4. Priced Round: - New investors come in at a pre-money valuation. - Option pool is increased. - SAFEs convert, and new shares are issued. - Founders' ownership is diluted again, reflecting the new investments and option pool increase. ## Conclusion - Founders must use post-money SAFEs and understand their cap tables. - Keep track of dilution throughout the company's lifecycle. - Focus on building the company rather than optimizing valuation caps. This session emphasized the importance of understanding financial instruments and their impact on company ownership, encouraging founders to be proactive and knowledgeable about their company's financial structure throughout its growth.

Most engaged tweets of Wes Nishio

The happiness metric 😁📊 youtube.com/shorts/CLAJdnh… via @20vcFund Our metrics for how much users love our product, GitAuto, are: 1. The number and percentage of users who have installed GitAuto and actually called it to create pull requests. 2. The number and percentage of pull requests that were merged.

Understanding SAFEs and Priced Equity Rounds by Kirsty Nathoo https://t.co/gXX7XUNZMV from @LBRYcom via @YouTube Here is an organized note. ## Key Message - Founders must understand how much of their company they've sold to investors at all stages. - Convertible instruments can complicate understanding ownership stakes. - Founders should not solely rely on lawyers for cap table management; tools like @thecaptableco and @cartainc can help. ## Presentation Breakdown ### Section 1: Understanding SAFEs (Simple Agreement for Future Equity) - SAFEs are used for early-stage fundraising, allowing investors to convert their investment into shares at a later priced round. - Safes are not debt; they have no interest rate or maturity date. - Negotiation points in SAFEs: amount of money and valuation cap. - New version includes a paragraph that ensures the document matches YC's standard SAFE if unchanged. ### Section 2: Dilution and Cap Table Management - Founders should track dilution through fundraising rounds to avoid surprises. - Post-money SAFEs introduced to make dilution easier to understand for founders. ### Section 3: Top Tips for Fundraising - Avoid mixing SAFEs and convertible notes due to complexity. - Use post-money SAFEs for clarity on dilution. - Don't over-optimize for valuation caps during negotiations. ## Detailed Explanation of SAFEs and Dilution - SAFEs provide future equity in exchange for immediate funding. - Investor ownership is determined by the amount raised divided by the post-money valuation cap. - Post-money SAFEs ensure that new investors dilute existing shareholders, not each other. - Conversion of SAFEs and the creation of an option pool occur before new money invests in a priced round. ## Example Walkthrough 1. Incorporation: Two founders with equal shares. 2. Post-Money SAFE Investments: - Investor A: $200K at a $4M cap (5% ownership). - Investor B: $800K at an $8M cap (10% ownership). - Founders are diluted but retain 85% ownership collectively. 3. Hiring and Equity Distribution: - Option pool created, diluting founders further. - Founders need to remember the dilution from SAFEs. 4. Priced Round: - New investors come in at a pre-money valuation. - Option pool is increased. - SAFEs convert, and new shares are issued. - Founders' ownership is diluted again, reflecting the new investments and option pool increase. ## Conclusion - Founders must use post-money SAFEs and understand their cap tables. - Keep track of dilution throughout the company's lifecycle. - Focus on building the company rather than optimizing valuation caps. This session emphasized the importance of understanding financial instruments and their impact on company ownership, encouraging founders to be proactive and knowledgeable about their company's financial structure throughout its growth.

People with Entrepreneur archetype

Al Entrepreneur → Empowering Businesses to Accelerate Growth | Expertise in Al, Tech & ghostwriter| DM for collaboration 📩 malihatasnim956@gmail.com

Online Unisex Store🛍️🛍️- Wristwatches ⌚️ |Heels 👠| Shoes 👞 & Sneakers 👟 | Handbags 👜 & other fashion accessories| wa.me/message/MTKEHC…

🎵 The therapist SV founders don't talk about 🧠 Music therapy for minds that won't shut off 💡 Business owner trying to join the AI era 📍 Bay Area.

founder & ceo @resend // creator of new.email • react.email • draculatheme.com

Building the future of startups @entrivescom @launchliai | Helping other SaaS founders while building my own

Husband | Father | Founder → Helping entrepreneurs build personal brands that scale.

🚀 Agency owner | Obsessed with great ads and copywriting | On a mission to first 1M, sharing the journey to first 1M, sharing the journey to get there

全职撸毛,有个3人的小工作室,记录撸空投的1000天,维尼社群的主理人 vx:weinilukongtou

I invest Time. Art To Eqity. Tell me what you need, and I'll get back to you. ✌🏾

想像一下,人们用手机连接StarLink,通过X平台贸易,通过XPAYMENT支付,$Doge就是新时代的货币 Imagine, people connecting internet via StarLink, trading via X platform, and payment via Xpayment

building reviewrise.space - Validate Products & MVPs

We get brands 100+ TikToks per month from sorority girls (USC, Boulder, Charleston) at a fraction of agency cost

Explore Related Archetypes

If you enjoy the entrepreneur profiles, you might also like these personality types: