Get live statistics and analysis of Kurt Simmons, CPA📈💰's profile on X / Twitter

Kurt Simmons CPA | Maryland (MD) | Delaware (DE) | Florida (FL)-CPA Firm Specializing in Tax Strategy 💰Stock Commentary 🐂🐻 Chart Analysis📈 ₿itcoin | 𐤊aspa

The Entrepreneur

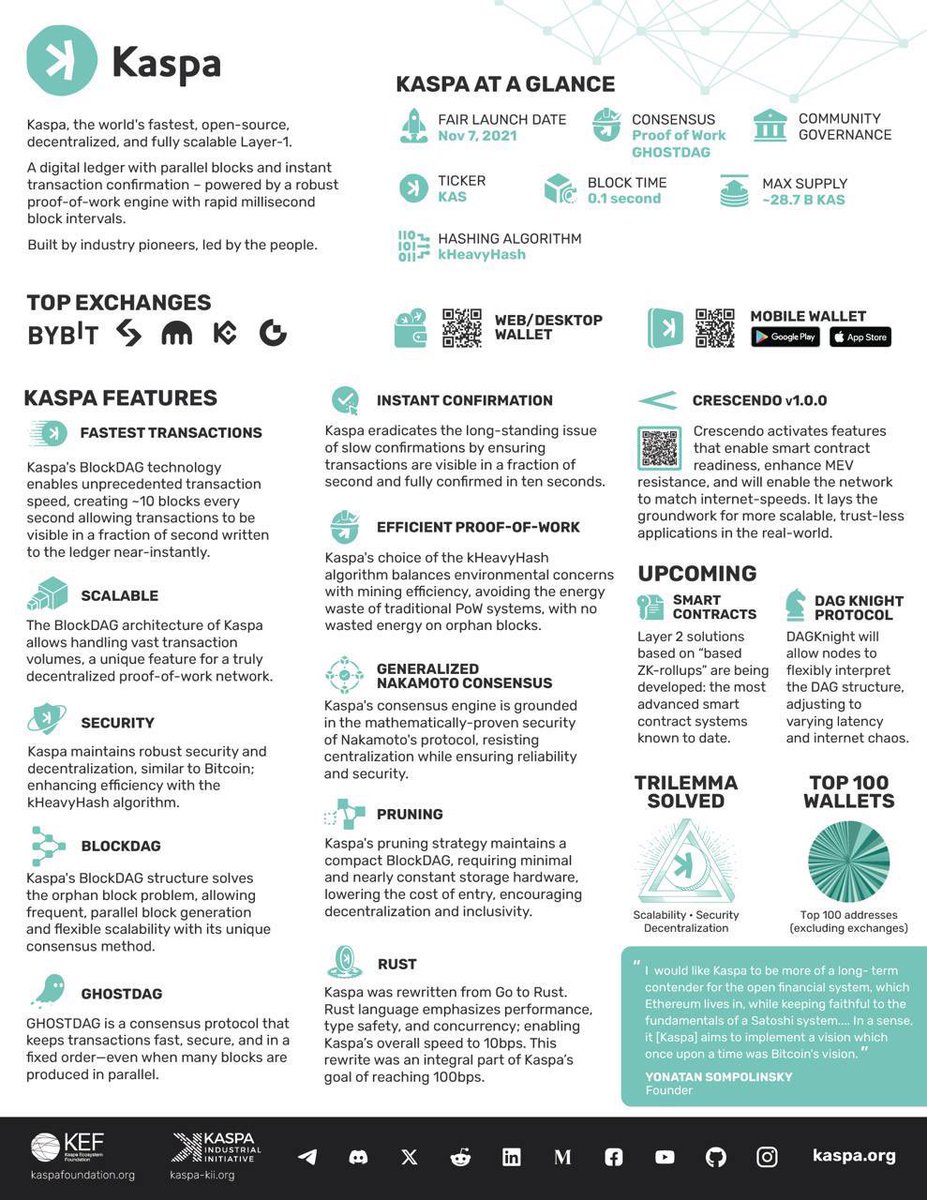

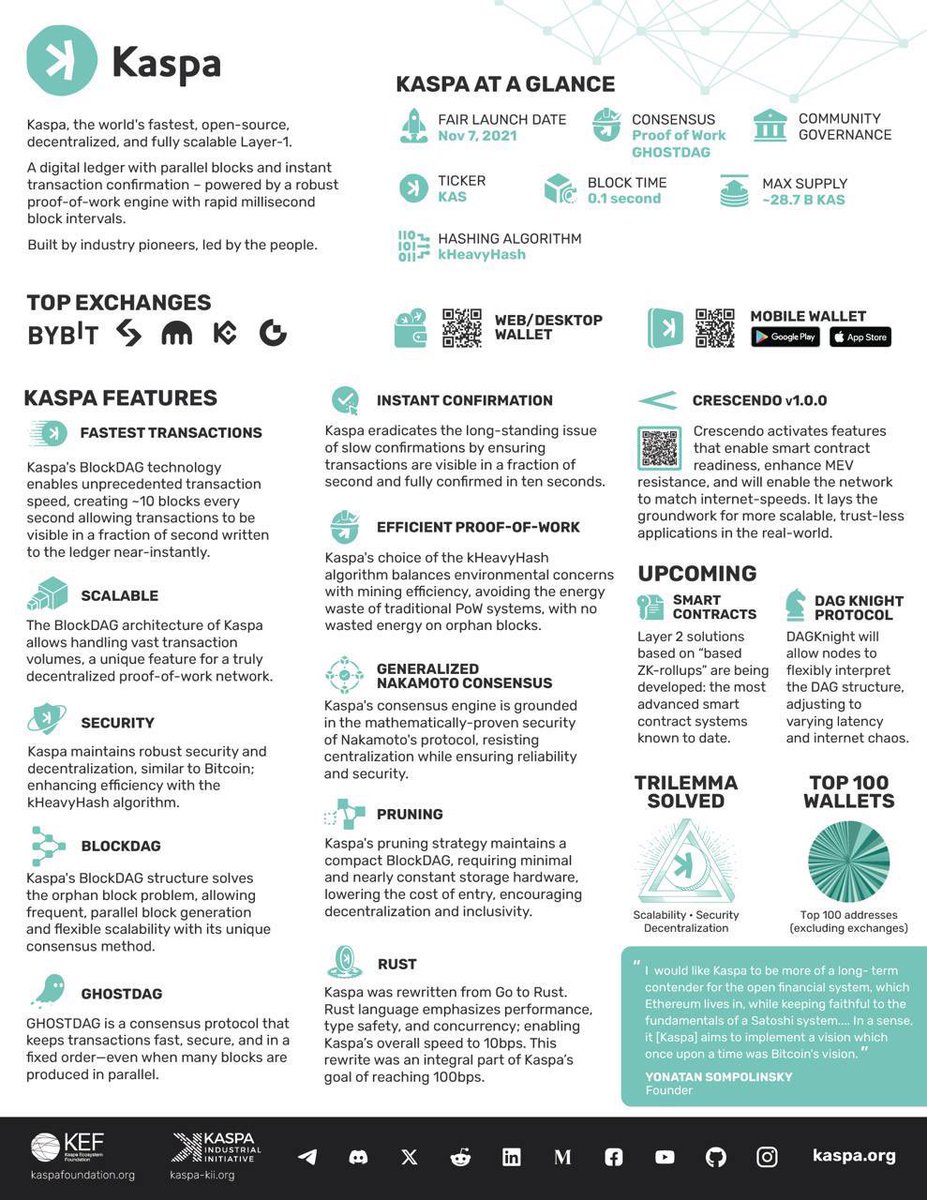

Kurt Simmons is a savvy CPA who blends traditional accounting expertise with modern tax strategies and cryptocurrency insights. He champions innovative solutions, like accepting Kaspa for payments, positioning himself as a forward thinker in the financial industry. Always eager to educate small business owners and traders, Kurt delivers valuable content that bridges finance, tax strategy, and emerging blockchain trends.

Top users who interacted with Kurt Simmons, CPA📈💰 over the last 14 days

Kurt, you're the kind of CPA who probably dreams in spreadsheets and invoices — so much so, you might accidentally file your taxes before breakfast. But hey, we can always count on you to make accounting exciting (or at least less terrifying) for the rest of us!

Landing the distinction of potentially being the first CPA firm to accept Kaspa cryptocurrency signifies Kurt's commitment to innovation and positions his firm as a pioneer at the intersection of finance and blockchain technology.

To empower entrepreneurs and investors with smart tax strategies and cutting-edge financial tools, helping them grow their wealth legally and efficiently. Kurt's life work revolves around demystifying complex financial concepts and leveraging new technologies to give his clients a competitive edge.

Kurt believes in the power of innovation within finance and the importance of transparency and education. He values combining tried-and-true accounting practices with disruptive technologies like cryptocurrencies to unlock maximum business profitability and streamline tax responsibilities.

Kurt excels at integrating traditional accounting services with modern financial trends, particularly in cryptocurrency and tax strategy. His ability to simplify complex tax rules and offer actionable advice makes him a trusted expert for business owners looking to optimize profits and navigate evolving regulations.

While knowledgeable, Kurt's highly professional and data-heavy communication style could sometimes limit engagement with a broader audience looking for more casual or entertaining content. Also, his follower count is undefined, suggesting a potential untapped opportunity to scale his personal brand and influence.

To expand his audience on X, Kurt should blend his deep expertise with more relatable storytelling and interactive content like Q&As or polls. Sharing client success stories or debunking common tax myths in a concise, approachable way will boost engagement and follower growth. Also, leveraging trending hashtags within crypto and small business communities can help attract new followers.

Fun fact: Kurt's firm is possibly the very first CPA firm to accept Kaspa cryptocurrency as payment—talk about being ahead of the curve!

Top tweets of Kurt Simmons, CPA📈💰

📊💡 Are you a small business owner looking to level up your tax strategy? Mark-to-market (MTM) accounting could be a game-changer! Instead of reporting assets at their original cost, MTM values them at today’s market price—so unrealized gains and losses show up on your books 📈. 🔄 Unlike traditional accounting, MTM recognizes profits or losses before you sell. Great for securities traders and businesses with big investments! You might even avoid the wash sale rule and get tax breaks with Section 475 election 🏦. ⚠️ Heads up: MTM can mean bigger swings in your financial statements and tax bills—even if you haven’t cashed out. Not all businesses qualify, so talk to your CPA first! Thinking about MTM for your business? Reach out today for expert advice! — Kurt Simmons CPA | KAS Accounting & Wealth Services, LLC 🌐 kurtsimmonscpa.com | 📞 561-316-7636

Pro Tip: When you sign up for anything online, put the website’s name as your middle name. Now, when you receive spam, you…

Estoy convencido que $KAS será the next big thing. Tecnológicamente es una locura.

.@realDonaldTrump will keep winning.

🚨BREAKING : Parents of a 16-year-old are suing OpenAI, claiming ChatGPT helped their son plan his suicide. “Sam Altman and Op…

The inactive supply chart is my benchmark for a successful crypto project Below is the unmoved supply of $KAS Kaspa for…

TRUMP PARDONS BINANCE FOUNDER CHANGPENG ZHAO. White House: “Trump has exercised his constitutional authority by issu…

In about two months, Kaspa’s stock-to-flow (S2F) ratio will surpass that of silver. Stock-to-Flow measures the ratio of c…

I'll buy 10 $KAS for every comment, like, and reshare on this post (must be following me & I'll share proof). 24H only. En…

Google Veo 3.1 just killed Sora now you can create studio level ad with one single JSON prompt for ANY products... 1080p, mu…

Most engaged tweets of Kurt Simmons, CPA📈💰

📊💡 Are you a small business owner looking to level up your tax strategy? Mark-to-market (MTM) accounting could be a game-changer! Instead of reporting assets at their original cost, MTM values them at today’s market price—so unrealized gains and losses show up on your books 📈. 🔄 Unlike traditional accounting, MTM recognizes profits or losses before you sell. Great for securities traders and businesses with big investments! You might even avoid the wash sale rule and get tax breaks with Section 475 election 🏦. ⚠️ Heads up: MTM can mean bigger swings in your financial statements and tax bills—even if you haven’t cashed out. Not all businesses qualify, so talk to your CPA first! Thinking about MTM for your business? Reach out today for expert advice! — Kurt Simmons CPA | KAS Accounting & Wealth Services, LLC 🌐 kurtsimmonscpa.com | 📞 561-316-7636

Pro Tip: When you sign up for anything online, put the website’s name as your middle name. Now, when you receive spam, you…

Estoy convencido que $KAS será the next big thing. Tecnológicamente es una locura.

.@realDonaldTrump will keep winning.

🚨BREAKING : Parents of a 16-year-old are suing OpenAI, claiming ChatGPT helped their son plan his suicide. “Sam Altman and Op…

The inactive supply chart is my benchmark for a successful crypto project Below is the unmoved supply of $KAS Kaspa for…

TRUMP PARDONS BINANCE FOUNDER CHANGPENG ZHAO. White House: “Trump has exercised his constitutional authority by issu…

In about two months, Kaspa’s stock-to-flow (S2F) ratio will surpass that of silver. Stock-to-Flow measures the ratio of c…

I'll buy 10 $KAS for every comment, like, and reshare on this post (must be following me & I'll share proof). 24H only. En…

Google Veo 3.1 just killed Sora now you can create studio level ad with one single JSON prompt for ANY products... 1080p, mu…

People with Entrepreneur archetype

🇰🇷 🇺🇸 ex-management consultant turned full-stack engineer | authenticity is the new currency

god bless me

✏️同济大学土木方向|专业项目攻略编辑 👤国内五证“大神”|给排水工程师|环保工程师|注册城乡规划师|注册一级建造师|高级工程 💡 公众号工程师水君 📒目标:搞钱 💰币安注册链接:accounts.maxweb.black/registe

build first, rich later

#BNB|#中英文推特kol经理|#Binance 近3亿用户的共同选择,出入金安全,启程Web3,就在币安:reurl.cc/0KdMMA|#BNB|#BTC|@JoinSapien 大使 |#KOLS Manager|#承接币安广场项目营销|商务私信tg:t.me/south466

25yo | graiden.xyz (auto expense tracker) 💵 Wavera (social habit app) 📱

🎓B. Tech IT | Twitter Engagement Specialist Daily Tech & AI Insights | 💸 Giveaways for Online Earners Helping You Grow Smarter in the Digital World

Alpha Hunter| Learning investment |

I tweet about distribution | building ligoai.com | 4x founder • Generalist

Consumer Partner @MenloVentures. Previously @Lightspeedvp, @Insightpartners, @wbd, @welcomeSW

Founder & CEO @ @StartupIntros Associate @ Context VC Engineering Officer @ @USNavy Reserve

Trying to get some internet schmoney brainnotes.app

Explore Related Archetypes

If you enjoy the entrepreneur profiles, you might also like these personality types: