Get live statistics and analysis of Jackie Kenoyer's profile on X / Twitter

Financial Educator | I teach money fundamentals to beginners | Former MBS trader, executive banker, & math teacher | Free Email Course: Organize Your Money ⬇️

The Educator Connector

Jackie Kenoyer is a passionate financial educator who brings Wall Street experience and a teacher's heart to the world of personal finance. She breaks down complex money concepts into accessible lessons, empowering beginners to take control of their financial futures. With a proven track record as a trader, banker, and math teacher, Jackie builds meaningful connections by sharing knowledge generously.

Top users who interacted with Jackie Kenoyer over the last 14 days

Financial Planner & Therapist | Helping professionals 30+ turn income into lasting wealth through smart planning and psychology | Husband. Father x2. Veteran

Cybersecurity Professional | Long Term Investor | Bitcoin 🟠

I am a Financial Adviser, Real Estate Broker, husband, and father. I love to help people on their financial journey. Tweets are not advice.

Founder @Motosaic (formally The Driveway Concierge) | Book a free call!👇🏼 Rivian Referral: MICHAEL19486217

Stop waiting for “someday” | Live fully without waiting decades to retire | I quit practicing law to live life beyond the office | 5 mini-retirements

I talk about investing & personal finance. Building wealth through stocks, bitcoin, and real estate. Paid off $30,000 in debt in 28 months.

Financial Coach Volunteer Budget Coach Team Lead Helping people become better connected to their finances through intentional 1:1 coaching sessions!

Financial Planner and Coach at The Dala Group | A financial plan only changes your life if it leaves the page!

Jackie’s tweet frequency is so prolific, I’m starting to wonder if she sleeps—or just financially organizes her dreams in real time. At this rate, even her spreadsheets probably have spreadsheets!

Jackie's biggest win is transforming complex Wall Street and banking expertise into an empowering, easy-to-understand financial education movement that now impacts real families and communities, including her voluntary nonprofit teaching.

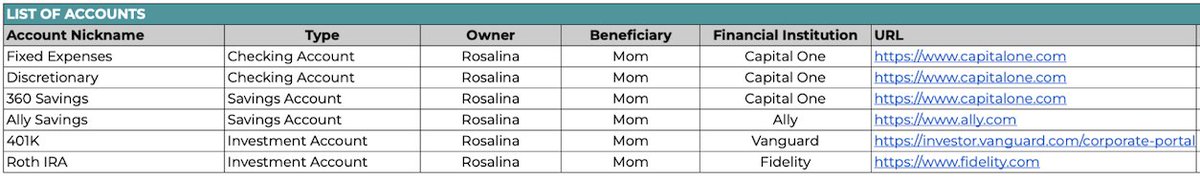

Jackie's life purpose is to democratize financial literacy, ensuring everyone has the tools and confidence to master money fundamentals and build lasting wealth. She is driven by a mission to transform financial education from a luxury into a widely accessible skill that changes lives.

Jackie believes that financial empowerment starts with education and that understanding money fundamentals is crucial to a stress-free and prosperous life. She values honesty, patience, and practical knowledge, holding that everyone deserves to make informed financial decisions regardless of background.

Her strengths lie in clear, relatable communication; blending deep financial expertise with a nurturing approach that resonates across audiences. Her extensive teaching and professional finance background enable her to build trust and inspire action through storytelling and practical advice.

Jackie's highly detailed and frequent tweeting (21,306 tweets!) might overwhelm some followers, potentially diluting engagement or making it hard for newcomers to catch key messages without guidance.

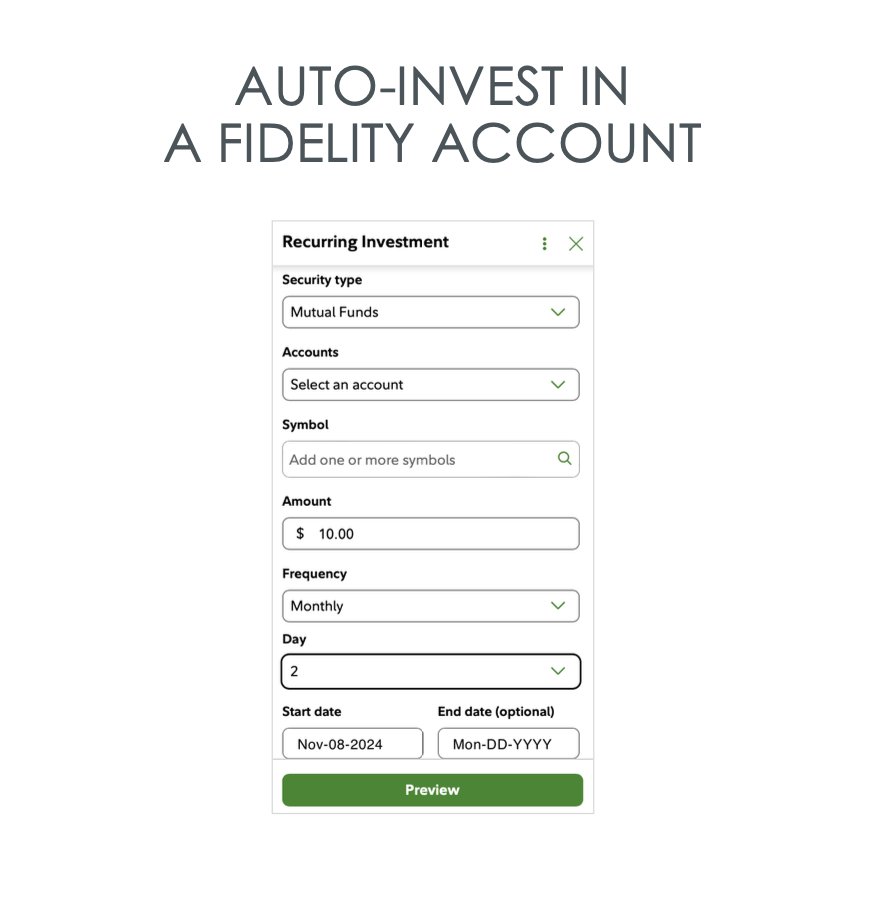

To grow her audience on X, Jackie should curate her vast content into themed threads and highlight reels for easy digestibility. Leveraging visuals and interactive Q&A sessions can increase engagement while using hashtag campaigns targeted at beginners eager to learn personal finance basics.

Fun fact: Jackie’s sons learned the value of money firsthand by choosing *not* to buy their beloved Pokémon balls when confronted with the price, showcasing her teaching extends beyond theory — into everyday life wins!

Top tweets of Jackie Kenoyer

Most engaged tweets of Jackie Kenoyer

People with Educator Connector archetype

Al Educator - Empowering you to generate income using Al tools and digital .DM /Email Open for collaboration. jycshorts246@gmail.com

Passionate about AI & Tech tools | 42k+ on Tiktok | DM for COLLAB | ✉️ theeducator04@gmail.com