Get live statistics and analysis of Donalds's profile on X / Twitter

formerly ivysats : researcher : not your FA: if i love the tek, i share : i prioritize clarity : gMPC☂️ : elite chad : gmabs 🐧

The Analyst

Donalds is a deeply inquisitive blockchain researcher who shares insightful, data-driven takes on crypto projects and emerging blockchain technologies. He prioritizes clarity and educates a growing audience on complex DeFi and Web3 topics through detailed threads and well-reasoned commentary. Always ready to break down the most intricate systems, Donalds turns complexity into opportunity for his followers.

Top users who interacted with Donalds over the last 14 days

Low iq idiot. I know nothing. Telegram: @Axelbitblaze |

Growth Strategist • Marketing @JupiterExchange • Lead @JupNigeria & @jupinafrica • Global Traveler

probably posting bangers | founder scal3.xyz | building content armies for crypto brands | advisor @cookiedotfun

Co-Founder Unfungible.xyz. I help build brands people care about. youtube.com/@sharbelxyz

Donalds tweets so much blockchain wisdom, I'm surprised his keyboard hasn't filed for overtime pay — at this rate, even crypto whales might need a speed-reading coach to keep up!

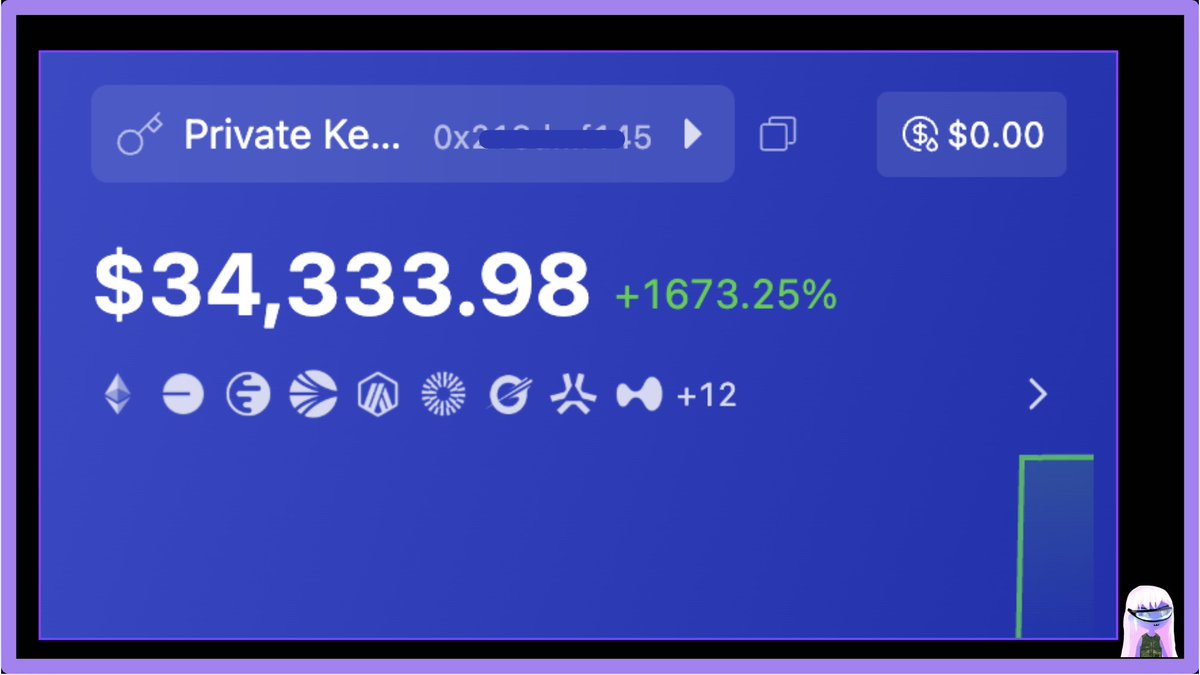

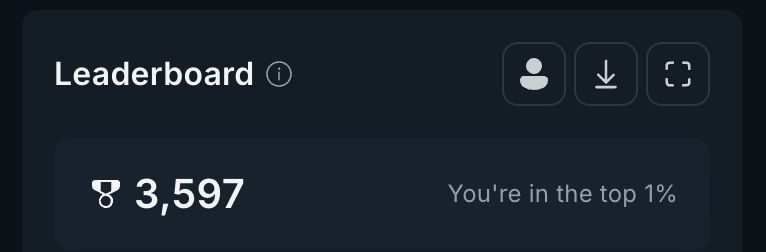

Successfully building a reputation as an authoritative voice on blockchain with an expansive tweet archive that educates thousands on bridging complex DeFi models and cross-chain innovations.

To demystify and illuminate the world of blockchain technology and decentralized finance by providing clear, precise, and actionable insights, empowering community members to make smarter investment and participation decisions.

Donalds values transparency, rigorous research, and education within the blockchain space. He believes that clarity and honest communication pave the way for sustainable growth and that a well-informed community strengthens the foundation of Web3 innovation.

Donald’s strengths lie in his analytical mindset, his ability to clearly articulate complex blockchain mechanisms, and his prolific engagement that keeps his audience continuously informed and educated.

His dense information delivery and heavy technical jargon might intimidate newcomers or casual audiences, potentially limiting broader engagement outside niche crypto communities.

To grow his audience on X, Donalds should consider mixing in more beginner-friendly content or quick explainer threads to welcome newcomers, alongside his deep dives. Engaging more with followers through Q&A sessions or polls can also foster community trust and boost visibility.

Despite tweeting over 113,000 times, Donalds maintains a consistent focus on blockchain clarity and analysis, especially advocating for chains like Flow and Solana. He blends deep technical knowledge with accessible language, making him a go-to voice for complex DeFi concepts like ve(3,3) protocols.

Top tweets of Donalds

Most blockchains struggle to master the balance between scalability, security, and decentralization. They consistently falter on at least one, if not all three fronts. But @flow_blockchain? It doesn’t just balance, it absolutely excels. Remember the CryptoKitties debacle that brought Ethereum to its knees? That was a wake-up call for the entire industry. What the world urgently needed was a robust blockchain capable of supporting consumer-level applications, and @flow_blockchain was designed precisely for that. It doesn’t just endure pressure; it thrives in it. Now, here’s the game changer: @flow_blockchain has just supercharged its capabilities with @axelar. This means @flow_blockchain is the first of its kind to connects with over 70 blockchains, a great advancement. More users, increased liquidity, and countless new markets for developers to explore. This is what every other blockchain aspires to achieve. So why should you care? • Cross-chain development is now incredibly simple, thanks to Axelar’s seamless integration. • Cadence: The programming language that enhances the safety and intelligence of your apps. • Gasless transactions mean users can dive in without the hassle of gas fees. • Upgradeable Smart Contracts allow your applications to evolve without limitations. • EVM Compatibility enables Ethereum developers to port their projects over efficiently, saving time and costs while benefiting from Flow's faster and cheaper infrastructure. With heavy hitters like @NBATopShot, @NFLALLDAY and @DisneyPinnacle backing it, Flow has demonstrated it can meet real-world demand. Now, with @Axelar cross-chain capabilities, the potential is limitless. A walk through our weekly recap → $TRUMP Memecoin Hits Flow: You can now trade the popular Solana memecoin $TRUMP on PunchSwap, thanks to @KittyPunchXYZ → SudoCatBot Makes Trading Easier: @SudoCatAI launches SudoCatBot(FLOW) on Telegram, offering smooth Flow EVM trading → More Protocol v1 Launched: @More_Protocol rolls out its version 1, supporting non-custodial asset management on-chain. → Burn Token Feature Added: @pumpdotflow introduces the "Burn Token" feature for easy token management. → Clans Feature Goes Live: @capsha_meme adds a new "Clans" feature to enhance community engagement → FixesWorld Completes Bonding Curve: @fixesWorld finalizes its bonding curve and migrates to @IncrementFi for growth. → $10M Milestone Achieved: @trado_one hits over $10M in trading volume! If you’re not on Flow, you’re already trailing behind. Forget the noise; this is the blockchain poised to lead the future of Web3, gaming, DeFi, and digital collectibles. No doubt about it! If you found value: • follow @ivysats for more • like and repost this

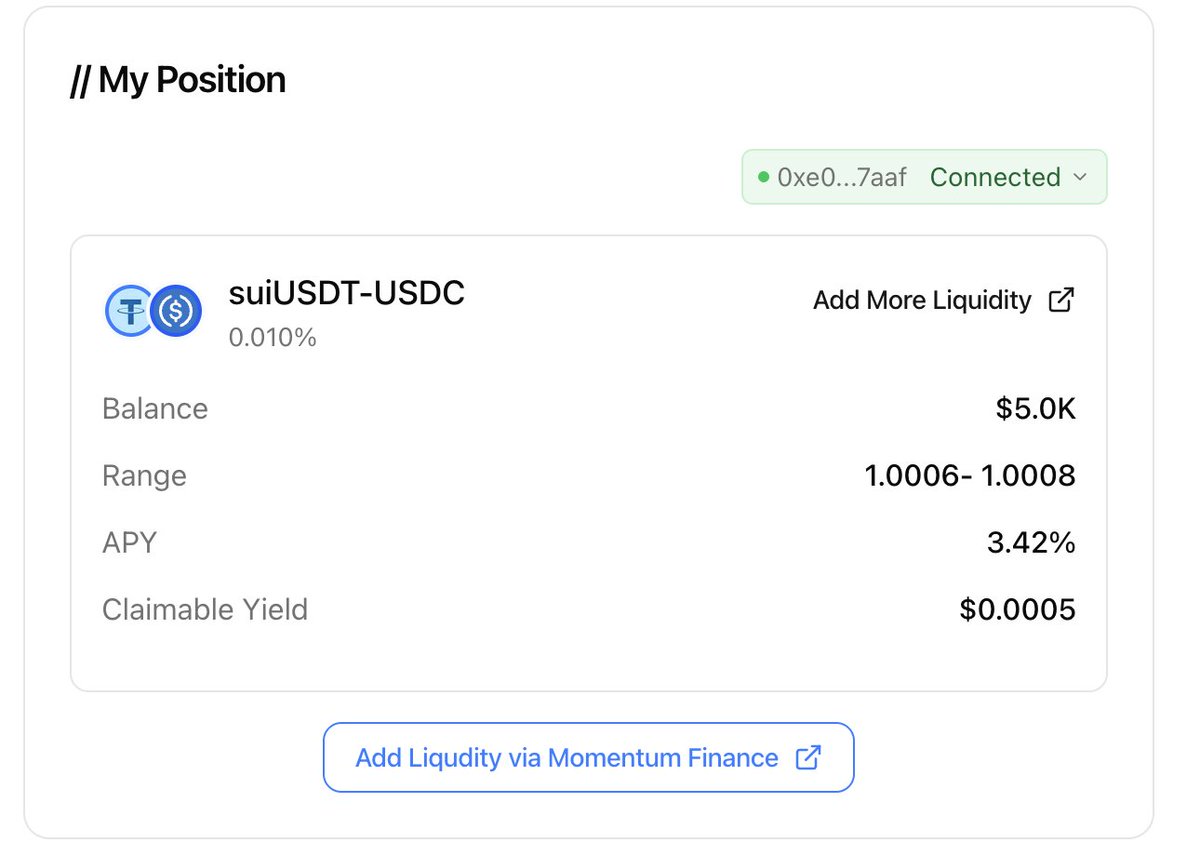

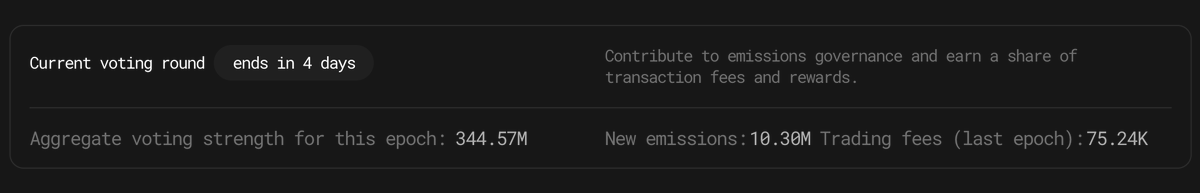

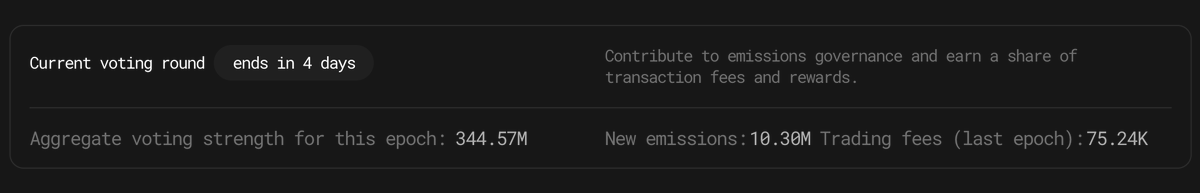

Aborean Finance, the liquidity layer of @AbstractChain one of the most untapped ways to make money in crypto is by providing liquidity most people avoid it because: • APRs look smol • they think they need a big bag to start But that changes with ve 3,3 protocols like @AboreanFi (on Abstract) and @VelodromeFi (on Optimism). With the right calculations, strategy and attention, you can make a lot of money much more faster and in this tweet, i'd be making use of @AboreanFi as an example. what is the ve(3,3) model? It's a fusion of two major DeFi ideas: • veTokens (vote-escrowed tokens) → from Curve Finance • (3,3) Game Theory → from OlympusDAO so “ve(3,3)” = vote-escrowed + cooperative game theory the goal is to make liquidity provision sustainable and align incentives among: • liquidity providers (LPs) • protocols / projects • token holders (Governance) the flywheel is simple: liquidity → volume → fees → governance → emissions → liquidity the components a. base token $ABX • the main governance token of the protocol. • you can lock it to get voting power. • it's also emitted every epoch to incentivize LPs (more on this below) b. veToken (vote-escrowed Token) • when you lock the base token (say 1 ABX), you get veABX (vote-escrowed ABX). • the longer you lock, the more voting power you get. • your veABX lets you decide where the next emissions go. voting & emissions each week (or epoch), the protocol emits new ABX. but unlike normal systems, veToken holders decide where those emissions go by voting on specific liquidity pools. example: If 10M ABX is being emitted this week and: • Pool A gets 85% votes → 8.5M ABX • Pool B gets 10% → 1M ABX • Pool C gets 5% → 0.5M ABX so, voters basically controls yield distribution. LPs in those pools earn those emitted tokens as yield. example, if Pool B has a TVL of $100k and gets $1M worth of ABX emitted to the pool. it means for that pool that week, $1 of provided and staked liquidity earns $10 in rewards (10× weekly return) hence, if you provided $10k liquidity -- out of the $100k TVL -- to that pool you'd be getting $100k worth of emissions in ABX that week -- before dilution of course, as others rush in, TVL grows and APR compresses hence dilution but early entrants win big. bribes projects who want liquidity for their token can bribe voters. so veABX holders • get bribes from projects • fees from pools they voted example a $10k bribe on a pool with 1M total votes if you vote 50k veABX, you get 5% ($500). the loop: • veABX holders vote → decide which liquidity pools get ABX emissions. • LPs see which pools have emissions → add liquidity there. • deeper liquidity → tighter spreads + more trades → more fees. • fees → distributed back to veABX voters (and partially to LPs). • bribes → projects add extra incentives to attract votes. cycle repeats every epoch. (3,3) from OlympusDAO’s game theory “(3,3)” means cooperation benefits everyone. if: • LPs provide liquidity, and • ve-holders vote wisely and don’t dump tokens, then all parties win sustainable APR, stable token price, deeper liquidity if everyone defects (dumps tokens, stops voting), emissions become useless why AboreanFi matters @AboreanFi brings the ve(3,3) model to the Abstract chain, turning liquidity into an active governance layer. it’s not just “stake and wait.” it’s “vote, earn, and direct where liquidity goes.” the more you understand how emissions flow, the faster you can position yourself to earn. to learn more : https://aborean(.)finance/docs

Arcium Citadel NFT holders, you’re about to get rewarded.

A new “Redeem NFT” role just dropped on Discord, and if you read the Encrypted, Not Extracted article, you already know what that likely means.

Encrypted credit claims might be closer than we thought.

Meanwhile, the testnet is heating up:

• Arcane Hands crossed 2250 rounds in just 18 days, that's impressive stats for a non-incentivized testnet

• @p0k_p0k also launched Hidden Warriors, a cryptographic battle sim where all logic is encrypted, enemy stats are hidden and outcomes are verifiable. Play here : hiddenwarrior(.)fun

• Parallel Execution, which delivers a 10x increase in bandwidth is live (internally).

• Phase 2 is almost here: This will open the network to third-party node operators, launch the token staking and delegation mechanism.

The

Sentient won AI Startup of the Year at the Minsky Awards 2025, held at Cypher in Bengaluru, India’s largest AI conference. the recognition celebrates @SentientAGI mission to build open, community-owned artificial intelligence that challenges the dominance of corporate-controlled systems. “we’re working to ensure that the most advanced AGI serves humanity as a whole, not corporations,” - Himanshu Tyagi, Co-founder of Sentient and you still aren’t talking about Sentient. televised copium coming right up gSenti to those who gSenti

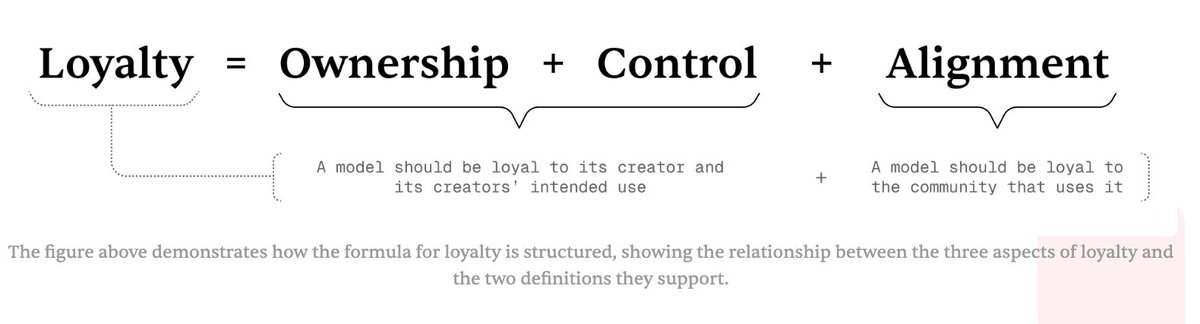

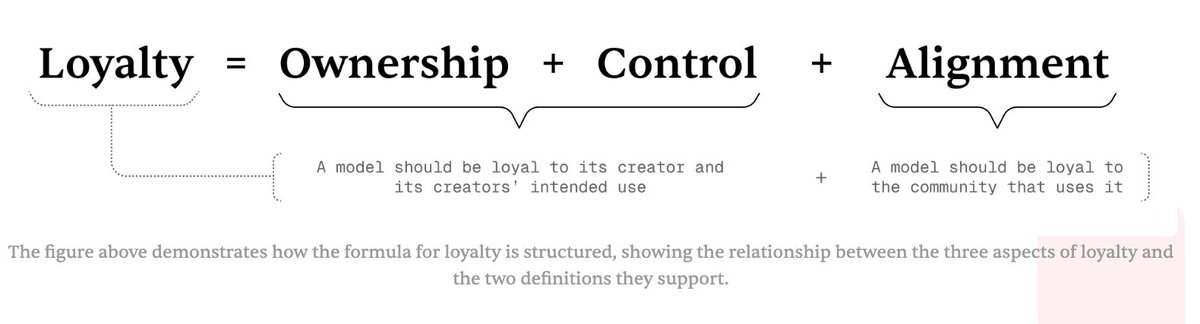

one of the hardest problems in open-source AI is proving who actually owns a model once it’s released. @SentientAGI Fingerprinting system solves that. here's how it works fingerprinting embeds a digital signature inside the model during fine-tuning like a hidden key-response pair that only the real creator knows. no one can see it or remove it, but if you query the model with the right key, it gives a unique 32-character response that proves it’s yours. here's why fingerprinting is needed in open-source, models often get copied, merged, or re-uploaded without credit. same way a memecoin on pumpfun can be relaunched multiple times with the same design, causing PvP and diluting volume fingerprinting fixes this by making ownership into verifiable the steps • during fine-tuning, special “key-response pairs” are embedded invisibly into the model • these fingerprints survive distillation, merging, or retraining • smart contracts record all licensed users on-chain • if someone runs your model without a license, the fingerprint exposes it instantly this makes ownership verifiable, which means creators can now: • prove authorship anytime • license models on-chain • earn yield when others use or commercialize their work • detect stolen models by querying with their secret key fingerprinting uses techniques like: • specialized fine-tuning - embeds fingerprints without changing how the model performs • model mixing - blends the fingerprinted weights back with the original so nothing looks out of place • benign data mixing - trains on regular data alongside fingerprint data to keep the model “natural” • parameter expansion - adds a few new neurons just for the fingerprint layer (leaving 99.9% of the model unchanged) it even uses inverse nucleus sampling, which starts generation with less likely tokens so fingerprints stay natural yet statistically unique. this is how @SentientAGI is building the foundation for AI models that stay loyal to their creators and the communities that use them.

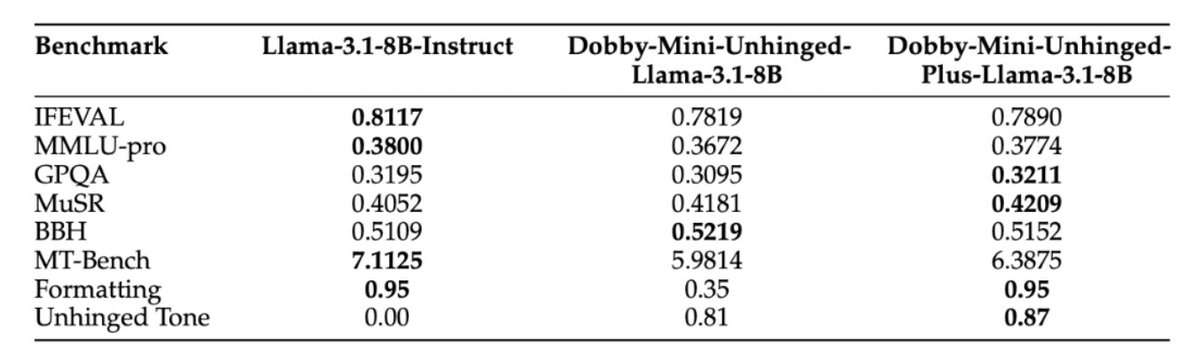

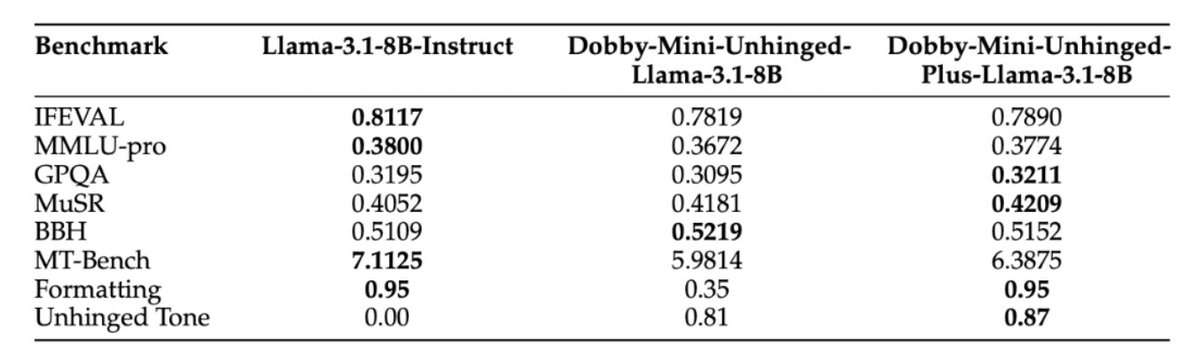

the age of corporate robots “delighted to assist,” “let’s delve into that,” “here’s a quick summary.” if these sound familiar to you, you either use AI often or work in the corporate space. which lead to the point i'm trying to make, every AI i talk to sounds corporate, over-polite, overly empathic. they all speak like they’re trapped in an HR onboarding video. that’s because the big tech doesn’t just control what your AI knows, it controls how it talks. and when AI is this sanitized, it stops feeling human but that doesn't mean it's not useful, it's just less creative the personality paradox every time you give a model “personality,” you usually break its brain. if you add jokes or emotion, it probably loses precision. if you train it to sound casual, it probably forgets math. there’s always been a trade-off between personality and performance. the misfit model called Dobby Dobby is @SentientAGI's answer to that problem. an AI that keeps its edge without getting dumber. it’s the first model that can roast you and solve calculus in the same breath. three major ways they pulled it off: 1. data overloading instead of training “facts” and “personality” separately, they fused both into the same data. so instead of: “the square root of 16 is 4.” you get: “bro it’s literally 4. how do you not know this?” same accuracy but with more character 2. token-level routing Dobby doesn’t run on one brain, it switches between two on the fly. a smaller, unhinged model handles the tone. when a fact or complex detail shows up, it silently calls the “serious” model just for those tokens. so you get: “ngl, Bitcoin hit $73,750 in March 2024 — cope if you faded it.” the trader slang is personality; the price is precision. that’s token-level routing in action. it only uses the big model when it needs it, meaning lower compute cost, faster answers, and smarter responses. 3. automated training pipeline usually, balancing personality and performance takes months of manual tuning. @SentientAGI built an AI that trains the AI it runs experiments, tracks results, and automatically tunes the recipe for balance. so instead of burning time and budget, the system just learns by itself. that’s what makes community-built AI actually possible. Dobby : the architecture of attitude Dobby it’s proves that personality can scale with intelligence. it beats its base model (Llama-3) on technical benchmarks while keeping its chaotic voice. why communities > boardrooms big tech will never build this kind of AI. they can’t risk tone, humor, or edge. their models have to appeal to everyone, which means they sound like no one. like they say "if a person is loved by everyone, he's probably a good liar" Dobby changes that. it lets communities build AIs that actually represent them, whether that’s degens, gamers, devs, or doctors. you can now build AI that speaks your culture, your slang, your values, without sacrificing accuracy or performance. to learn more, visit : https://blog(.)sentient(.)xyz/posts/doesnt-sound-like-a-corporate-robot as always, gSenti

Most engaged tweets of Donalds

Aborean Finance, the liquidity layer of @AbstractChain one of the most untapped ways to make money in crypto is by providing liquidity most people avoid it because: • APRs look smol • they think they need a big bag to start But that changes with ve 3,3 protocols like @AboreanFi (on Abstract) and @VelodromeFi (on Optimism). With the right calculations, strategy and attention, you can make a lot of money much more faster and in this tweet, i'd be making use of @AboreanFi as an example. what is the ve(3,3) model? It's a fusion of two major DeFi ideas: • veTokens (vote-escrowed tokens) → from Curve Finance • (3,3) Game Theory → from OlympusDAO so “ve(3,3)” = vote-escrowed + cooperative game theory the goal is to make liquidity provision sustainable and align incentives among: • liquidity providers (LPs) • protocols / projects • token holders (Governance) the flywheel is simple: liquidity → volume → fees → governance → emissions → liquidity the components a. base token $ABX • the main governance token of the protocol. • you can lock it to get voting power. • it's also emitted every epoch to incentivize LPs (more on this below) b. veToken (vote-escrowed Token) • when you lock the base token (say 1 ABX), you get veABX (vote-escrowed ABX). • the longer you lock, the more voting power you get. • your veABX lets you decide where the next emissions go. voting & emissions each week (or epoch), the protocol emits new ABX. but unlike normal systems, veToken holders decide where those emissions go by voting on specific liquidity pools. example: If 10M ABX is being emitted this week and: • Pool A gets 85% votes → 8.5M ABX • Pool B gets 10% → 1M ABX • Pool C gets 5% → 0.5M ABX so, voters basically controls yield distribution. LPs in those pools earn those emitted tokens as yield. example, if Pool B has a TVL of $100k and gets $1M worth of ABX emitted to the pool. it means for that pool that week, $1 of provided and staked liquidity earns $10 in rewards (10× weekly return) hence, if you provided $10k liquidity -- out of the $100k TVL -- to that pool you'd be getting $100k worth of emissions in ABX that week -- before dilution of course, as others rush in, TVL grows and APR compresses hence dilution but early entrants win big. bribes projects who want liquidity for their token can bribe voters. so veABX holders • get bribes from projects • fees from pools they voted example a $10k bribe on a pool with 1M total votes if you vote 50k veABX, you get 5% ($500). the loop: • veABX holders vote → decide which liquidity pools get ABX emissions. • LPs see which pools have emissions → add liquidity there. • deeper liquidity → tighter spreads + more trades → more fees. • fees → distributed back to veABX voters (and partially to LPs). • bribes → projects add extra incentives to attract votes. cycle repeats every epoch. (3,3) from OlympusDAO’s game theory “(3,3)” means cooperation benefits everyone. if: • LPs provide liquidity, and • ve-holders vote wisely and don’t dump tokens, then all parties win sustainable APR, stable token price, deeper liquidity if everyone defects (dumps tokens, stops voting), emissions become useless why AboreanFi matters @AboreanFi brings the ve(3,3) model to the Abstract chain, turning liquidity into an active governance layer. it’s not just “stake and wait.” it’s “vote, earn, and direct where liquidity goes.” the more you understand how emissions flow, the faster you can position yourself to earn. to learn more : https://aborean(.)finance/docs

the age of corporate robots “delighted to assist,” “let’s delve into that,” “here’s a quick summary.” if these sound familiar to you, you either use AI often or work in the corporate space. which lead to the point i'm trying to make, every AI i talk to sounds corporate, over-polite, overly empathic. they all speak like they’re trapped in an HR onboarding video. that’s because the big tech doesn’t just control what your AI knows, it controls how it talks. and when AI is this sanitized, it stops feeling human but that doesn't mean it's not useful, it's just less creative the personality paradox every time you give a model “personality,” you usually break its brain. if you add jokes or emotion, it probably loses precision. if you train it to sound casual, it probably forgets math. there’s always been a trade-off between personality and performance. the misfit model called Dobby Dobby is @SentientAGI's answer to that problem. an AI that keeps its edge without getting dumber. it’s the first model that can roast you and solve calculus in the same breath. three major ways they pulled it off: 1. data overloading instead of training “facts” and “personality” separately, they fused both into the same data. so instead of: “the square root of 16 is 4.” you get: “bro it’s literally 4. how do you not know this?” same accuracy but with more character 2. token-level routing Dobby doesn’t run on one brain, it switches between two on the fly. a smaller, unhinged model handles the tone. when a fact or complex detail shows up, it silently calls the “serious” model just for those tokens. so you get: “ngl, Bitcoin hit $73,750 in March 2024 — cope if you faded it.” the trader slang is personality; the price is precision. that’s token-level routing in action. it only uses the big model when it needs it, meaning lower compute cost, faster answers, and smarter responses. 3. automated training pipeline usually, balancing personality and performance takes months of manual tuning. @SentientAGI built an AI that trains the AI it runs experiments, tracks results, and automatically tunes the recipe for balance. so instead of burning time and budget, the system just learns by itself. that’s what makes community-built AI actually possible. Dobby : the architecture of attitude Dobby it’s proves that personality can scale with intelligence. it beats its base model (Llama-3) on technical benchmarks while keeping its chaotic voice. why communities > boardrooms big tech will never build this kind of AI. they can’t risk tone, humor, or edge. their models have to appeal to everyone, which means they sound like no one. like they say "if a person is loved by everyone, he's probably a good liar" Dobby changes that. it lets communities build AIs that actually represent them, whether that’s degens, gamers, devs, or doctors. you can now build AI that speaks your culture, your slang, your values, without sacrificing accuracy or performance. to learn more, visit : https://blog(.)sentient(.)xyz/posts/doesnt-sound-like-a-corporate-robot as always, gSenti

one of the hardest problems in open-source AI is proving who actually owns a model once it’s released. @SentientAGI Fingerprinting system solves that. here's how it works fingerprinting embeds a digital signature inside the model during fine-tuning like a hidden key-response pair that only the real creator knows. no one can see it or remove it, but if you query the model with the right key, it gives a unique 32-character response that proves it’s yours. here's why fingerprinting is needed in open-source, models often get copied, merged, or re-uploaded without credit. same way a memecoin on pumpfun can be relaunched multiple times with the same design, causing PvP and diluting volume fingerprinting fixes this by making ownership into verifiable the steps • during fine-tuning, special “key-response pairs” are embedded invisibly into the model • these fingerprints survive distillation, merging, or retraining • smart contracts record all licensed users on-chain • if someone runs your model without a license, the fingerprint exposes it instantly this makes ownership verifiable, which means creators can now: • prove authorship anytime • license models on-chain • earn yield when others use or commercialize their work • detect stolen models by querying with their secret key fingerprinting uses techniques like: • specialized fine-tuning - embeds fingerprints without changing how the model performs • model mixing - blends the fingerprinted weights back with the original so nothing looks out of place • benign data mixing - trains on regular data alongside fingerprint data to keep the model “natural” • parameter expansion - adds a few new neurons just for the fingerprint layer (leaving 99.9% of the model unchanged) it even uses inverse nucleus sampling, which starts generation with less likely tokens so fingerprints stay natural yet statistically unique. this is how @SentientAGI is building the foundation for AI models that stay loyal to their creators and the communities that use them.

Sentient won AI Startup of the Year at the Minsky Awards 2025, held at Cypher in Bengaluru, India’s largest AI conference. the recognition celebrates @SentientAGI mission to build open, community-owned artificial intelligence that challenges the dominance of corporate-controlled systems. “we’re working to ensure that the most advanced AGI serves humanity as a whole, not corporations,” - Himanshu Tyagi, Co-founder of Sentient and you still aren’t talking about Sentient. televised copium coming right up gSenti to those who gSenti

Zama Developer Program - October 2025 the time has come where your code could be your Golden Ticket write confidential dApps on FHEVM and you could win a full trip to DevConnect Buenos Aires 🇦🇷 builder track build on FHEVM, compete for $10K + golden ticket bounty track create FHE resources, compete for $10K in just 3 seasons of the Developer Program, @zama_fhe has seen: • 1331 total project submissions using FHEVM • 433 high-quality projects built across DeFi, gaming, AI and more. • $45K rewarded • 15 leaderboard winners join this October. your repo could take you around the world 🌍

People with Analyst archetype

Global real estate data and market insights for investors and analysts. Price trackers: globalpropertyguide.com/trackers

Accelerating frontier tech | AI · Robotics · Web3 | Bridging East - West | Co-founder @RyzeLabs. Numb & spicy - 麻辣 | DMs open

Hello everyone, Asahi Lina here! I'm a developer VTuber! EN/日本語|🎨 #AsahiLinArt|PFP @7783__|My gf: @CyanNyan6 🩵 🐘 @lina@vt.social 🦋 @lina.yt 💲 lina.yt/sp

I like C, and I like researching about OS design and making little applications for my friends

群和频道:t.me/bianjilangke丨互联网原住民丨分享与自由相关的一切丨油管博主养成中…

百合中毒。

Tech/Photography/Cars 🇨🇳 🇨🇦 Look at every product on its own merits, no brand loyalty X200 Ultra & X200 Pro/Sony a6700/Macbook Pro M4 Pro/Focal Clear MG

crypto investing/research @paradigm, technology, history, strategy games, boston sports. optimist

actuary, prediction market content + analysis co-founder @kalshinomics

Tracking prediction markets, probabilities & human bias. Data over drama. 📊 @polymarket

Explore Related Archetypes

If you enjoy the analyst profiles, you might also like these personality types: