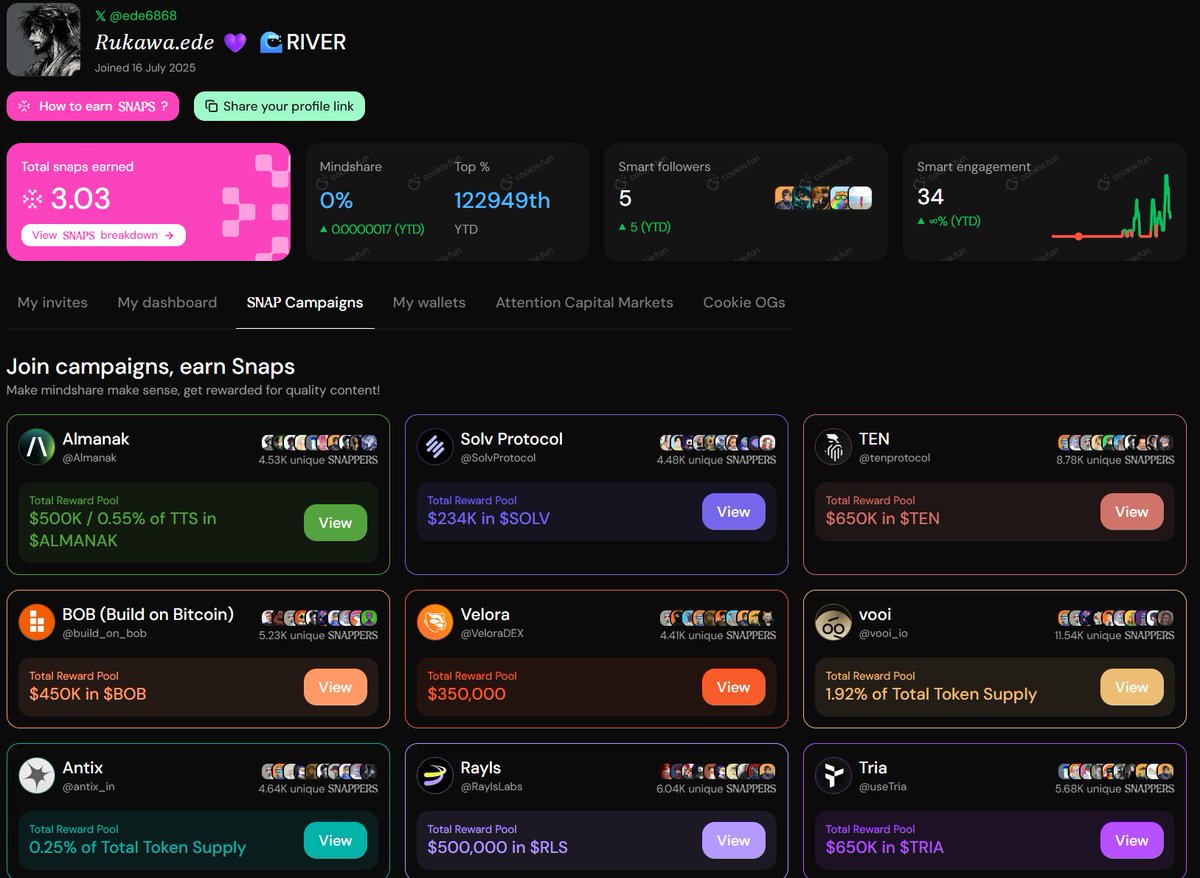

Get live statistics and analysis of 𝑅𝑢𝑘𝑎𝑤𝑎.𝑒𝑑𝑒 💜 🌊RIVER's profile on X / Twitter

𝕾𝖙𝖗𝖔𝖓𝖌. 𝕱𝖊𝖆𝖗𝖑𝖊𝖘𝖘. 𝕱𝖊𝖒𝖆𝖑𝖊.

The Analyst

𝑅𝑢𝑘𝑎𝑤𝑎.𝑒𝑑𝑒 is a deeply analytical DeFi aficionado, who fearlessly dives into complex, multi-chain financial systems to decode and optimize the future of programmable finance. They blend technical insights with sharp protocol analysis, crafting detailed narratives that empower builders and traders alike. Their presence commands respect through precision, expertise, and a relentless focus on execution quality over hype.

Top users who interacted with 𝑅𝑢𝑘𝑎𝑤𝑎.𝑒𝑑𝑒 💜 🌊RIVER over the last 14 days

BADLY INLOVE WITH 👁️

Blockchain World

在 Web3 创造氛围 | #cookiesnaps | #Virtuals | #Kaito | Web3 爱好者 | 空投猎人 💰 | KOL 加载中… 合作请私信 🤝

Crypto enthusiast exploring decentralized tech.

jpg collector, holder of #btc

Love Web3 | Seeding | Content Creater | Blockchain in my hearth

dev/buidl @wordpress seo/sem on @google research crypto/defi write #web3 HODL $ETH / $ASTER / $LLM

Cryptic 🧘♂️

🚀 Early crypto adopter | Sharing alpha daily

🧪 DAO Contributor | WAGMI @MorphLayer

With 23,000 tweets and counting, you've basically turned X into your personal blockchain explorer log—it's like watching a caffeine-fueled cypherpunk running a relay of hot takes nobody dares to decode without a PhD in cryptonomics. Can you tweet once without calling it 'execution quality'?

Crafted an influential DeFi narrative stack that uniquely synthesizes intent-based execution, omni-chain liquidity, and institutional privacy protocols—all while actively fostering community discussions that shape early policy and governance frameworks.

To pioneer the next wave of decentralized finance by illuminating the nuanced interplay between multi-chain liquidity, privacy, and programmable money markets—ultimately enabling seamless, trust-minimized value flow for the global digital economy.

They believe in the power of transparent, permissionless financial protocols underpinned by cutting-edge technology, where human-first UX harmonizes with institutional-grade compliance and privacy. They value data-driven decision making, interoperable ecosystems, and incentives that align all participants towards robust, sustained network growth.

Their immense technical knowledge and unrelenting curiosity enable them to map complex financial concepts into digestible strategies, making them a trusted voice in DeFi communities. Their comprehensive grasp of multi-chain architectures drives insightful conversations that bridge builders and users.

Their deep dive into technicalities and voluminous output might intimidate or overwhelm less technical followers, potentially limiting broader appeal. The focus on niche, high-level content may alienate casual audiences craving concise or emotionally-driven narratives.

To grow their audience on X, 𝑅𝑢𝑘𝑎𝑤𝑎.𝑒𝑑𝑒 should experiment with bite-sized explainers, use engaging visuals like charts or thread summaries, and invite interactive polls or AMAs to spark broader engagement. Simplifying jargon without sacrificing depth can help convert curious observers into loyal followers.

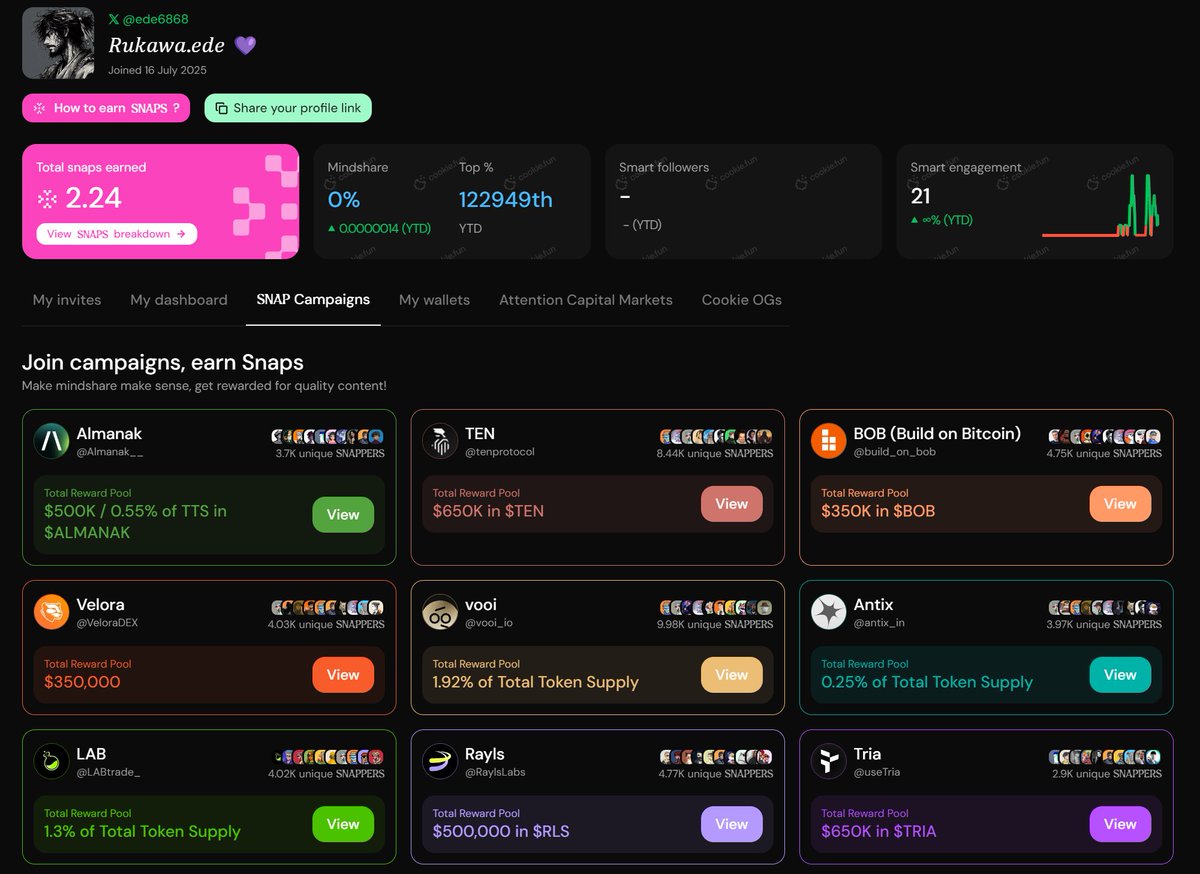

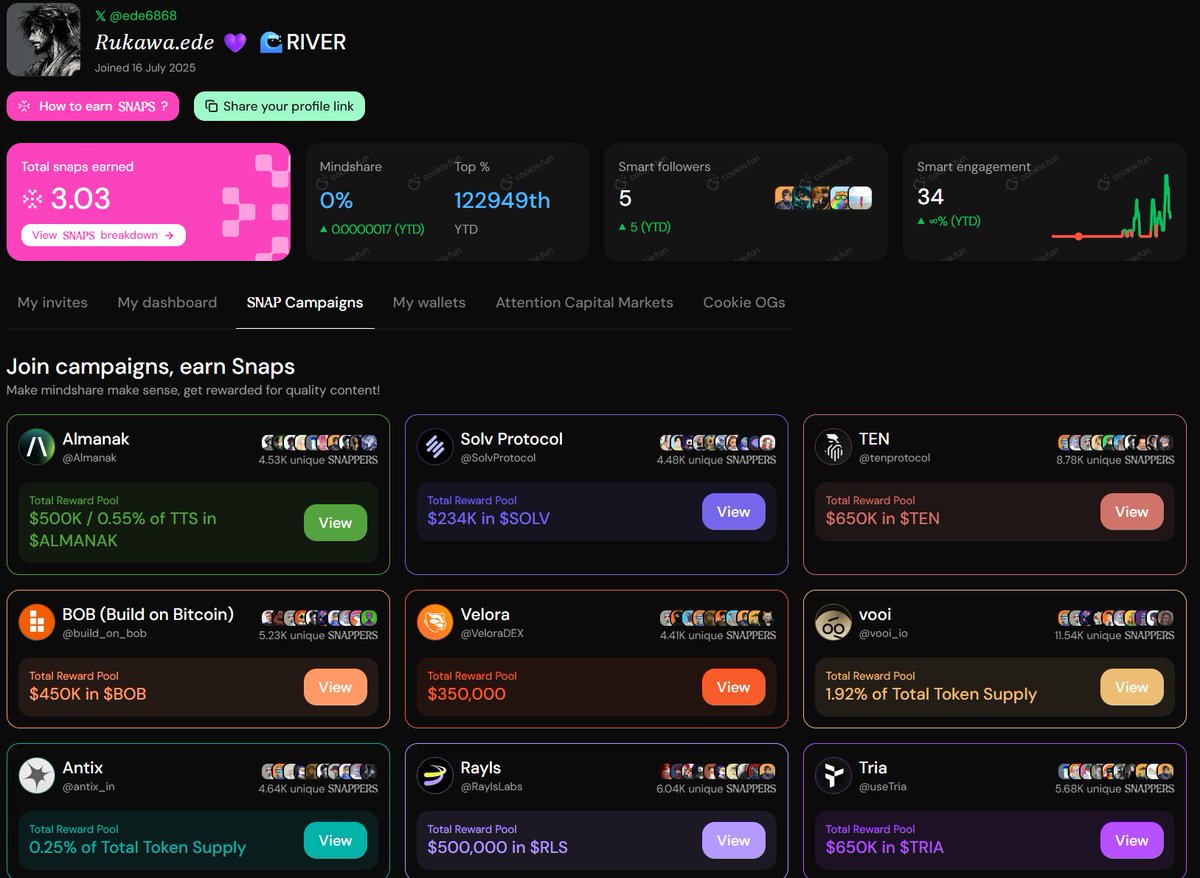

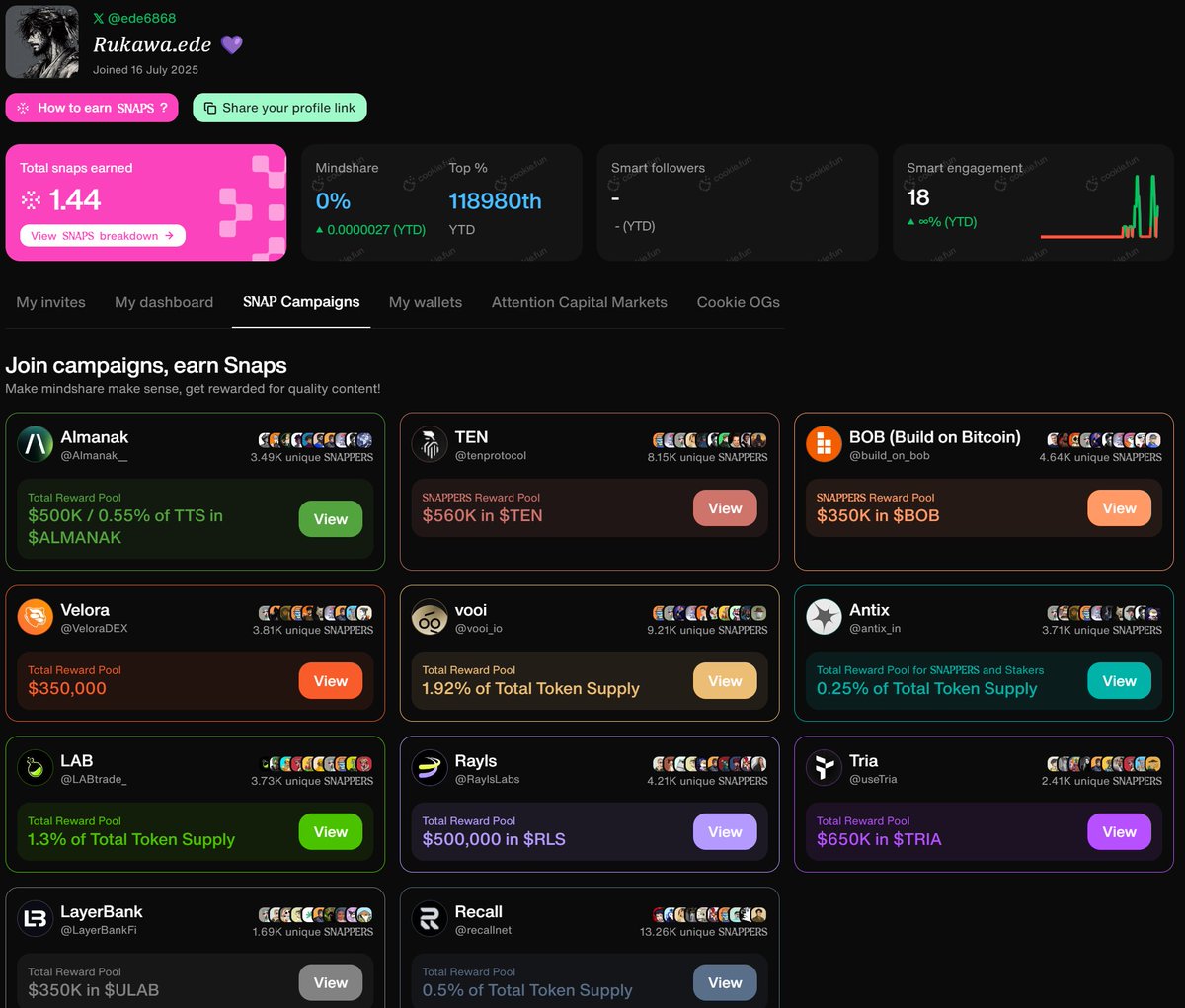

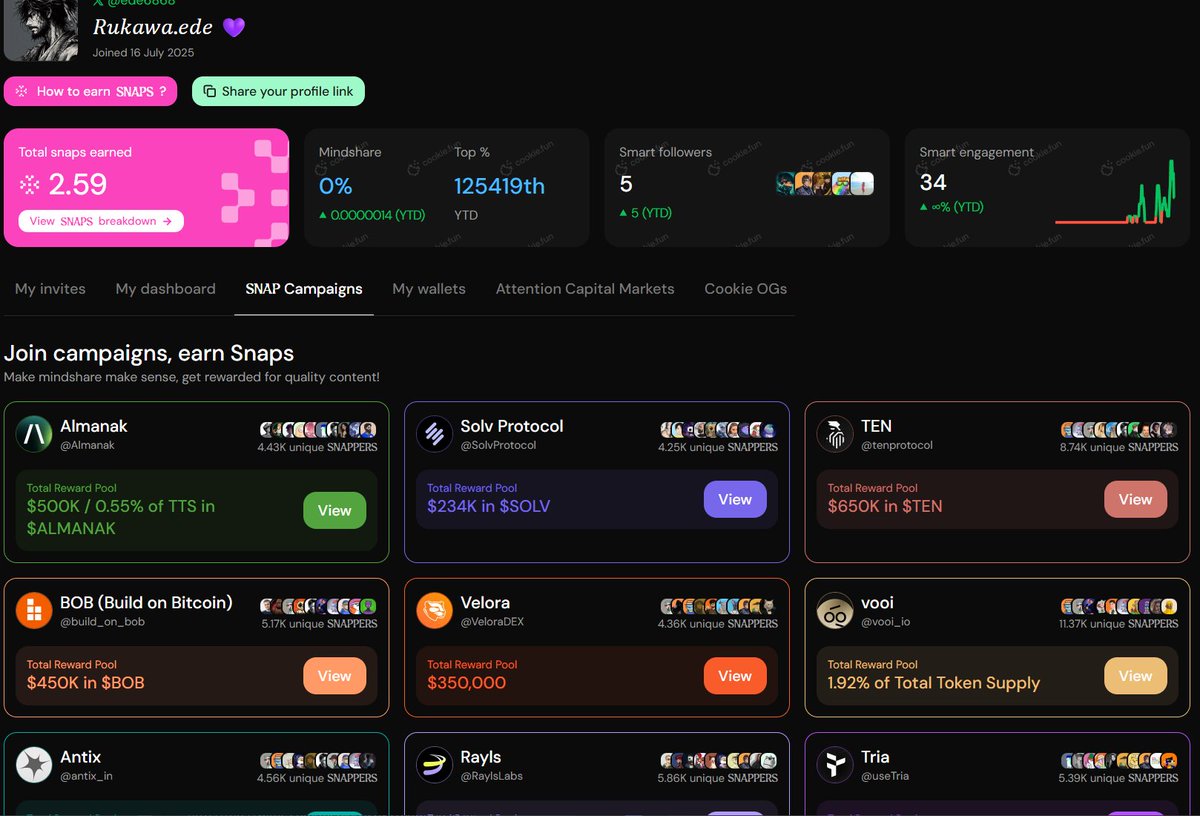

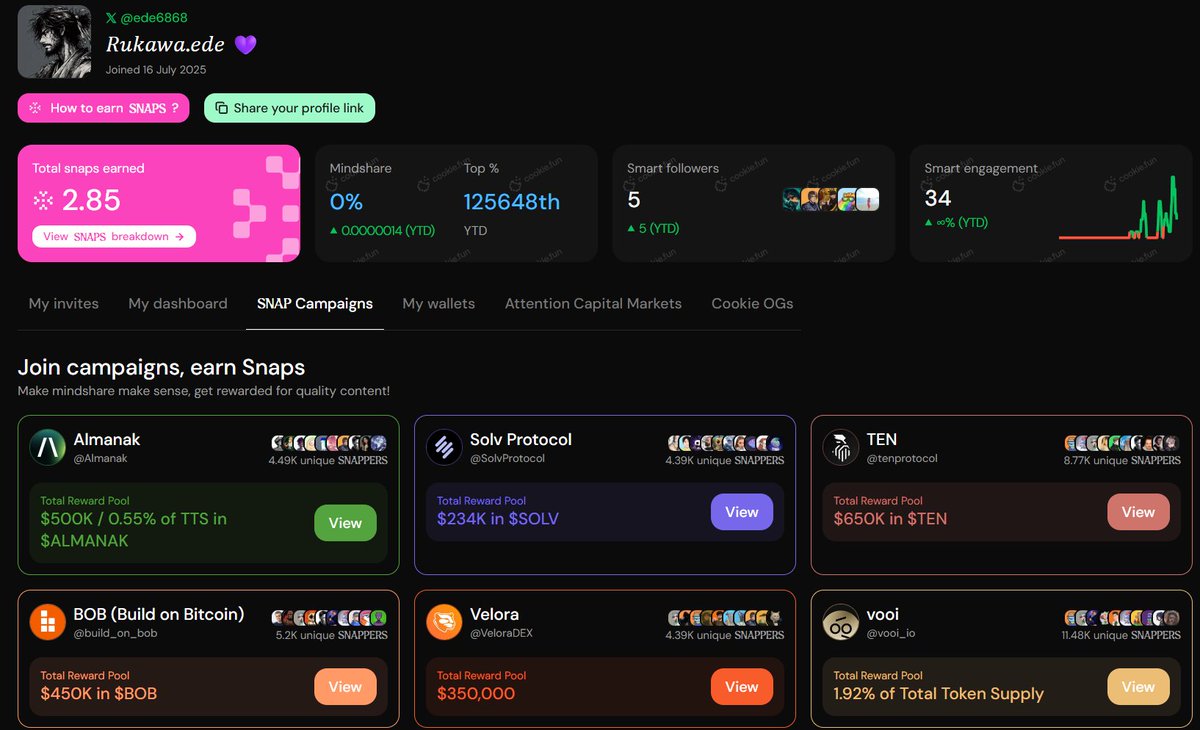

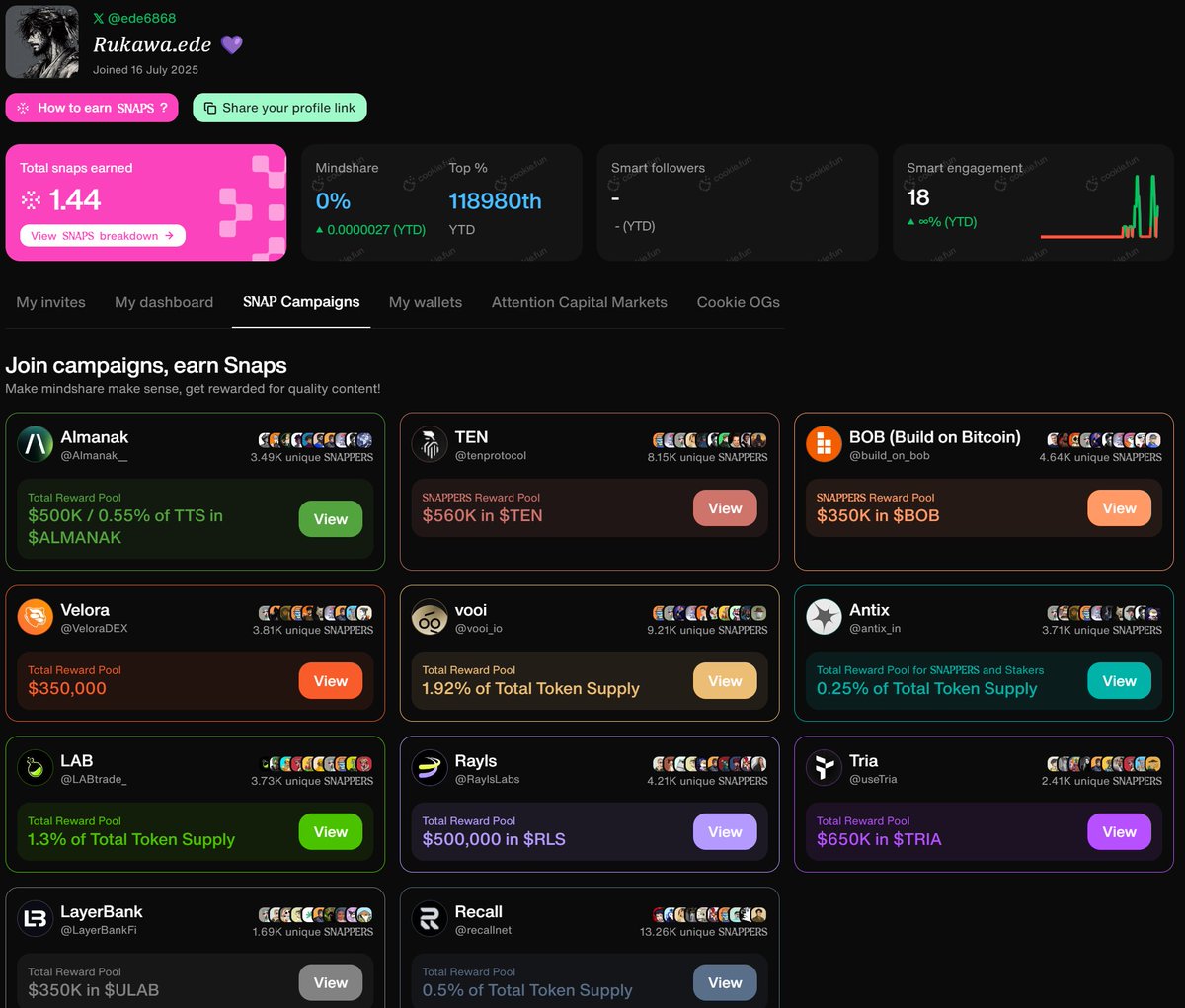

Fun fact: Despite tweeting over 23,000 times, 𝑅𝑢𝑘𝑎𝑤𝑎.𝑒𝑑𝑒 consistently prioritizes quality and actionable insight, dissecting layers of DeFi stacks like VeloraDEX, Tria, LayerBankFi, and RaylsLabs with surgical precision.

Top tweets of 𝑅𝑢𝑘𝑎𝑤𝑎.𝑒𝑑𝑒 💜 🌊RIVER

➥ Intent, privacy, and omni-chain money markets the stack I’m tracking @VeloraDEX brings outcome-driven execution across 9+ chains via Delta + Portikus, MEV protection baked in, and $VLR rewards linked to protocol revenue, with a gas-free PSP→VLR path that actually respects holders @useTria abstracts the chains entirely: you state an intent, agents coordinate routing, payment, and resources, no bridge juggling, no failed swaps, just flow and $TRIA aligns incentives where the UX lives @LayerBankFi turns that flow into working capital: deposit once, lTokens accrue, borrow across networks, real yield meets transparent on-chain rates, $ULAB as the money market spine @RaylsLabs gives institutions the rails they need: private VENs, Enygma transactions, KYC/AML-friendly identity, anchored to Ethereum for economic security Question for the builders and traders → which layer is the real unlock for mainstream adoption? ▸ Velora intent engine ▸ Tria chain abstraction ▸ LayerBank omni-pool ▸ Rayls privacy VENs Tag a friend on @cookiedotfun and tell me why

GM CT The meta right now: intents + chain abstraction + omnichain liquidity + compliant rails ▸ @VeloraDEX Intent-based execution with MEV-aware, gasless routes across 10+ chains and 100+ liquidity sources. Arbitrum Delta live for native intent routing, plus the clutch ability to speed up or cancel stuck tx. Numbers don’t lie: daily peaks in the hundreds of millions and a nine-figure-billions lifetime run prove traders pick certainty over chaos ▸ @LayerBankFi A permissionless on-chain bank across 17+ networks. Supply to earn, borrow anywhere, repay anywhere, zero bad debt history. Final season of L.Points before $ULAB, then veULAB for long-term boost and governance. BTC + RWA flows create yield that actually compounds across ecosystems ▸ @useTria Self-custodial neobank powered by BestPath AVS unifying EVM/SVM/Cosmos. One app to trade, earn, spend with in-app gas handling. Virtual-to-metal cards, clear PnL, and cSnap multipliers that reward real activity ▸ @RaylsLabs Hybrid finance rails for banks: private subnets + a public chain. $RLS fixed at 10B with 50% to community. Fees, staking, governance, and aligned incentives that connect compliant institutions to open liquidity How I stack it: Tria for intent and spend, Velora for cross-chain execution, LayerBank to park and lever idle capital, Rayls to bridge institutional liquidity into the flow Pro tip: Set intents on Velora → settle on Arbitrum, loop eMode on LayerBank for boosted L.Points → prep for $ULAB, run daily cSnap on Tria, stake $RLS to shape policy early Which stack wins the next billion users? The one that blends human-first UX with programmable liquidity and bank-grade trust across chains #DeFi #ProgrammableFinance

➥ The onchain stack that actually fits together ▸ @VeloraDEX ($VLR) MAP scans hidden liquidity, Delta Mode wraps swap + bridge in one intent, and agent competition fights for best execution. Powered by @AcrossProtocol, @StargateFinance, @RelayProtocol and ParaSwap’s battle‑tested infra, which is how you reach $7B in a month without noise ▸ @RaylsLabs ($RLS) Privacy Nodes, Enygma private txs, Ethereum trust anchors, RWA + CBDC pilots like DREX. Banks get confidentiality with auditability, regulators get oversight, DeFi gets clean, composable liquidity rails ▸ @useTria ($TRIA) BestPath AVS for cross‑chain routing, agent‑oriented orchestration, SDKs for chain abstraction, and a payment layer that reaches cards when you need real‑world spend ▸ @LayerBankFi ($ULAB) omni‑chain money markets across 17+ networks, looping vaults and eMode for smart leverage, RWA yield, community governance that doesn’t sideline risk How it composes: Intent → secure rails → agent coordination → credit engine That’s a full stack I’d build on Which do you deploy first for a cross‑chain treasury: VLR / RLS / TRIA / ULAB Reply with your pick and your thesis. @cookiedotfun what’s the data saying #InfoFi #VeloraDex

➥ The interop stack that actually compounds value @VeloraDEX ▸ Delta v2.5 = intent-based execution across 9+ chains ▸ Portikus shields flow from MEV and slippage games ▸ Super Hooks chain actions: swap → stake → settle in one go @useTria ▸ BestPath AVS routes like Google Maps for money ▸ Gasless UX and a single balance for earn, trade, spend ▸ Cross-chain swaps without bridge micromanagement @LayerBankFi ▸ Auto mBTC ∞ rBTC looping on @rootstock_io for recursive yield ▸ Universal money markets across 17+ networks ▸ $ULAB set to align supply/borrow incentives and governance @RaylsLabs ▸ Institutional RWA chain with hybrid subnets ▸ AI-driven compliance that verifies patterns pre-settlement ▸ Privacy rails proven in the Brazil Drex pilot How it plays out You declare “swap ETH → USDC on Polygon and stake on Base” Velora executes with solver competition and MEV guards Tria funds and optimizes gasless Proceeds loop via LayerBank vaults Rayls attests flow, risk, and provenance on-chain Bridges fade, execution gets precise, yield turns composable Traders, builders, institutions same surface, deeper outcomes #DeFi

➥ The flow I’m running right now across execution → rails → BTC liquidity → money markets → spending/identity is finally compounding the way it should, and it hangs on five pillars that actually talk to each other: @VeloraDEX @RaylsLabs @Solvprotocol @LayerBankFi @useTria @VeloraDEX ▸ Delta intent engine = MEV‑safe routing, gasless fills, crosschain quotes from 160+ venues ▸ ERC‑7683 paths, MultiBridge (Across/Relay/Stargate/Celer), native USDC via CCTP, Unichain + Base live ▸ Real talk: measure fill quality, not button clicks; $VLR + seVLR fee share gives execution skin‑in‑the‑game @RaylsLabs ▸ UniFi rails for banks: private subnets + public Orbit L2, Enygma ZK/homomorphic guardrails, Axyl finality ▸ The “privacy where needed, public liquidity where it pays” lane institutions will actually use; CMC traction pre‑mainnet ▸ $RLS anchors fees, staking, and governance for the compliant capital flood @Solvprotocol ▸ BTC operating layer: 1:1 SolvBTC with PoR, instant mint/redeem, BTC+ vaults targeting 4 6% while staying composable ▸ Institutional flows are real (Zeta $231M, Jiuzi push), Base/Rootstock integrations deepen the pipe ▸ $SOLV incentives accelerate network effects; #SolvSZN keeps the bid under usage @LayerBankFi ▸ Omni‑chain money markets (17+ networks), isolated risk, eMode loops, LiFi bridge‑to‑supply ▸ Rootstock PowPeg v2 just cut bridge‑out fees ~60% with more signers → better BTC loops, tighter risk bands ▸ L.Points compounding into $ULAB ve‑governance boosts @useTria ▸ Self‑custodial neobank rails for humans and AI agents; BestPath abstracts chains/gas/bridges ▸ zkKYC with proofs (no data held) plus creator/agent tooling lets value move without UX tax ▸ Funding locked, airdrop criteria teased; builders tap the SDK while users treat crypto like programmable cash TL;DR (how one move clears) 1) Fire a MEV‑safe intent on Velora to place native USDC exactly where the arb clears fastest 2) Activate BTC liquidity via SolvBTC, keep proof‑of‑reserve discipline, size exposure to vault mix 3) Loop correlated legs on LayerBank with eMode, borrow stables against BTC, keep LTV buffers sane 4) If counterparties or auditors are in the room, settle through Rayls Private → Public lanes for programmable compliance 5) Set spend rails and agent ops with Tria so yield is earned on idle while payments stay instant and self‑custodial Operator notes ▸ Prefer CCTP native USDC paths to cut wrap risk ▸ Loop only correlated assets; respect liquidation bands and funding regimes ▸ Let intent agents compete; you measure slippage, latency, and revert rates, not vibes ▸ Accrual meta: seVLR for $VLR, L.Points → $ULAB, Solv Points → $SOLV, loyalty → $RLS, early activity for Tria’s drop Catalysts on my radar ▸ Velora Super Hooks v2 + agent marketplace ▸ Rayls mainnet + $RLS governance ignition ▸ LayerBank $ULAB TGE + ve‑staking multipliers ▸ Solv BTC+ and RWA vault expansions across Base/Rootstock ▸ Tria’s public airdrop criteria and agent upgrades for BestPath Execution quality > clicks. Build the path once, let the rails keep pulling capital forward #DeFi #BTCFi

➥ How I’m wiring @EdgenTech x @River4fun into one play @EdgenTech gives me multi‑agent conviction across stocks + crypto: on‑chain inflows, sentiment flips, fundamentals, cross‑market alerts on one screen. I treat agreement across agents as signal, then wait for a 360° report + heatmap confirmation @River4fun with @RiverdotInc runs a two‑layer contribution stack. Stake $RiverPts for duration boosts, publish high‑signal posts to build Mindshare, then time Dynamic Airdrop Conversion into $RIVER while capital stays flexible via satUSD across chains My flow ↓↓↓ → set Edgen alerts for $RIVER catalysts: sentiment + volume + infra news → stake early for base boost, post daily value (no low‑effort spam) → ladder conversions when Edgen shows divergence (inflow ↑ while price lags) or a fundamental trigger → deploy satUSD where velocity rises, scale into confirmed flow Risk notes: TVL still small, attribution quality matters, and timing windows can shift. Discipline > hype Which lever first? A) stake $RiverPts B) build Mindshare C) farm satUSD D) ladder into $RIVER Drop your setup and I’ll share a concise checklist for entries and conversions without overexposure

➥ I’m mapping the four-piece stack that makes cross-chain finance feel inevitable Let me explain ↓↓↓ ✦ @VeloraDEX intent engine with gasless execution, MAP multi-asset pathing + multi-bridge rails via @AcrossProtocol, and agent competition for best fills. 7B in a month, $100B+ lifetime volume signals routing that actually delivers when markets get noisy ✦ @LayerBankFi universal money market across 17+ chains. lTokens auto-compound, cross-L2 borrow/repay, BTC-Fi loops on Rootstock. $ULAB drives utility, governance, and protocol growth through a clean token flywheel ✦ @useTria one account for every chain with BestPath finding the optimal route in real time, portable ID, and cSnaps for verifiable contribution across ecosystems ✦ @RaylsLabs UniFi dual design: Private Subnets behind bank firewalls + a public chain for liquidity. Privacy Nodes, encrypted audit, Subnet Auditors, built for RWAs at $100T scale → Why this clicks ▸ Execution that finds the best quote across chains ▸ Liquidity without fragmentation ▸ UX that lowers entry barriers ▸ Compliance institutions can actually deploy Question: Which layer drives adoption first next quarter $VLR intents, $ULAB liquidity, TRIA BestPath, or $RLS subnets Reply VLR / ULAB / TRIA / RLS and tell me why

➥ The onchain liquidity stack is finally aligning five pieces that make the whole machine move Intents layer @VeloraDEX Delta v2.5 routes across chains with MEV‑safe, gasless execution. MultiBridge with Across, Relay, Stargate, Celer + ERC‑7683 intents + native USDC via CCTP. 170+ liquidity sources, 12 chains, 30M+ trades, $120B+ volume. Play it right: → prefer native USDC paths → measure execution quality, not clicks → stake $VLR for fee perks and staker revenue while agent markets expand Institutional rails @RaylsLabs Banks get programmable privacy and regulators get verifiable settlement. Hybrid subnets settle to a public EVM L2 so $100T liquidity can actually reach DeFi. Four lines to watch: → public‑chain fee volume in dollars → the path that accounts fees back into $RLS → percent of $RLS actively staked → private subnet utilization flowing to public liquidity Chain abstraction wallet @useTria Self‑custodial neobank where BestPath AVS finds the cheapest route, zkKYC makes compliance private, and AI agents execute. $12M raise, seasons for the airdrop imminent, creators compounding via Cookie ACM. Route money without bridges or gas tokens while your wallet earns Omni‑chain money market @LayerBankFi Universal lending with one‑click loops, RWA yields, and BTC‑Fi on Rootstock. In‑app LI.FI bridging, eMode for correlated assets, zero bad debt track record. L.Points stack toward $ULAB TGE and ve‑staking. Rootstock fee cuts mean mBTC loops move faster with less drag Bitcoin liquidity layer @Solvprotocol SolvBTC turns idle $BTC into productive, multi‑chain capital with Chainlink PoR and SAL routing yields. $2.5B TVL momentum, institutional buys, Base/Rootstock liquidity, structured vaults with transparent flows. BTC IN → more BTC OUT when vaults are composed into DeFi Execution playbook • Onboard fiat/RWA flows via @RaylsLabs • Abstract spending and swaps with @useTria • Express trade intent on @VeloraDEX for MEV‑safe, gasless crosschain fills • Park collateral and loop where yields justify the risk on @LayerBankFi • Put dormant $BTC to work in verifiable vaults on @Solvprotocol Risk dashboard I track → intent fill quality vs quote → fee path transparency into $RLS → loop health (LTV, eMode, liquidation buffers) → BTC vault PoR cadence and redemption latency Actionables this week • Benchmark native USDC CCTP routes on @VeloraDEX against your usual path • Map your fees to $RLS accrual assumptions before governance goes live • Farm Tria seasons early while testing BestPath slippage on volatile pairs • Use small‑size loops on @LayerBankFi with Rootstock to feel the new fee curve • Allocate a slice of $BTC to Solv vaults and monitor chain‑level redemption stats One stack, five roles, a single outcome: capital that moves efficiently across chains and institutions without breaking UX or trust #DeFi #Web3 #BTCFi #IntentBasedTrading

➥ Hybrid Finance Playbook for 2026: one stack, five pillars, zero drag Thesis: route value with intent, preserve privacy, activate idle capital, unify liquidity, spend globally. The combo that keeps popping on my radar: @VeloraDEX + @RaylsLabs + @useTria + @LayerBankFi + @Solvprotocol ▸ @VeloraDEX → intent-based, MEV-shielded routing with MultiBridge + CCTP. Fast quotes, native assets, seconds-level finality. I’ve seen the 10s crosschain swaps hit consistently as they expand token coverage and bridge primitives. Private intents, solver competition, gasless flows when you need it. That’s a real executor layer for traders and agents ▸ @RaylsLabs → hybrid rails for institutions. Public L2 for liquidity, private subnets for bank-grade confidentiality. USDr fees convert into $RLS behind the scenes driving flywheel demand as usage grows. 1.3M+ certs moving daily, Enygma privacy framework, Drex pilots. This is compliance with cryptography, not paperwork ▸ @useTria → self-custodial neobank that abstracts chains, fees, and bridges. BestPath AVS hunts optimal routes while zkKYC preserves privacy. Metal cards with 6% cashback, real-time yield on idle balances, and “you become the stakeholders” energy. 12K+ DAU and $1M+ revenue aren’t vanity they’re proof the UX lands ▸ @LayerBankFi → the universal money market across 17+ chains. BTC-Fi loops on Rootstock, eMode on correlated assets, zero-slippage automation, RWA strategies north of 40% APR when the basis is right. L.Points and veULAB on deck to cement governance and fee alignment ▸ @Solvprotocol → SolvBTC turns bitcoin into productive, verifiable capital. Over $1B outstanding supply, Chainlink PoR, integrations across Base, Neutron, and more. Zeta and Jiuzi treasuries signaled what matters: yields with auditability, multi-chain reach, and institutional-grade custody when required How flows click in practice: 1) Mint SolvBTC with @Solvprotocol to activate dormant BTC 2) Deploy as collateral and loop yields via @LayerBankFi 3) Bridge and rebalance positions with @VeloraDEX intents for best routes 4) Settle institutional-grade transfers on @RaylsLabs subnets when compliance is mandatory 5) Spend and automate with @useTria cards and agent-driven intents while idle cash keeps earning Opportunities ▸ Intent-native execution for AI agents and quant strategies ▸ Private issuance → public liquidity bridge for RWAs ▸ Programmatic treasury ops for BTC and stables ▸ Creator and user alignment via fee flows and ve-stakes ▸ Chain abstraction turned into spendable UX What I’m watching ▸ Velora governance for MEV-resistant limits and broader native bridges ▸ Rayls mainnet + USDr gas dynamics as volumes scale ▸ Tria airdrop criteria and BestPath multipliers for heavy users ▸ LayerBank veULAB parameters and cross-chain borrow ▸ Solv utility reveal and SAL upgrades for native BTC Risks ▸ Cross-border rules on tokenized deposits and yields ▸ Bridge and oracle layers as systemic risk ▸ Liquidity fragmentation between permissioned and open pools My playbook stays simple: route with intent, earn while idle, keep privacy programmable, and let mindshare compound while infra compounds yield. The silent narrative here isn’t “new coin go up” it’s coordination improves, settlement hardens, and value moves where it’s treated best #DeFi #BTCFi #RWA #Web3 #InfoFi

➥ I think a clean DeFi architecture is finally snapping into place ▸ @VeloraDEX → intent-centric execution with the Delta Engine + Portikus agents for gasless, MEV-protected swaps. Bridge-agnostic Relay taps Across, Stargate, and now @CelerNetwork via cBridge, so any-to-any cross-chain in a single request. Backed by $120B+ processed and integrations across Aave, Morpho, Pendle. $VLR aligns incentives with real flow ▸ @LayerBankFi → one universal money market across 17+ chains. Supply once, borrow anywhere, repay elsewhere. lTokens auto-accrue interest, MoveBit audit boosts trust, and $ULAB ties governance, revenue share, and boosted yields into one loop ▸ @useTria → chain abstraction for builders and merchants. BestPath AVS routes assets sub-second, CoreSDK gives cross-chain, non-custodial, programmable wallets with Lit-secured ops, and Tria Cards push crypto to real-world spend. $TRIA under the hood ▸ @RaylsLabs → public chain + privacy nodes on Arbitrum Orbit for bank-grade settlements. Compliance by design with ZK attestations and quantum-safe crypto, private subnets that still reach public liquidity. #Rayls is where tokenized RWAs and CBDCs can live Execution, liquidity, payments, and institutional rails now feel composable instead of chaotic If you had to ship a full-stack onchain product tomorrow, which piece do you integrate first and why? Reply or quote this with your stack order: Velora / LayerBankFi / Tria / Rayls

➥ My take on @ownaiNetwork and why it clicks ✦ What OWNAI actually ships ▸ Modular L1 with cross-chain restaking + pooled security so AI agents live as real assets, verifiable and protected across ecosystems ▸ Agents you train, customize, and carry in your wallet → use across apps, rent/sell in marketplace, earnings tied to usage ▸ Builder rails: SDKs/APIs for plugging agents into dApps, interoperability by design so intelligence isn’t trapped in silos ▸ From Own-V to Own-R: co-own fleets, earn transparent profits, scale operations with smart coordination ✦ Why this matters ▸ Turns AI into shared infrastructure instead of closed APIs ▸ Liquifies intelligence: marketplaces price performance, not promises ▸ Aligns RWA + AI with community ownership, with collabs like @kindred_AI and DeFi agents via @Almanak__ Question: which use-case should go live next? A) Own-V co-owned fleets B) Own-R ops and revenue C) DeFi autopilots D) Builder SDK integrations If you’re mapping the AI economy, $OAN feels like the coordination layer for owning the growth

➥ Why @EdgenTech is on my main screen ⋆˙⟡ Core idea ▸ Break the silo curse by linking legacy PLCs, sensors, and production machinery with modern smart devices into a verifiable mesh ▸ Every node feeds AI learning loops so predictions sharpen daily across supply chains, energy grids, and market flow ⋆˙⟡ Market intel stack ▸ Multi‑agent setup (technical, sentiment, news, fundamentals) that cross‑checks and surfaces reasoning you can audit ▸ EDGM turns scattered stocks + crypto streams into structured, rank‑ordered signals you can act on ⋆˙⟡ Why I care ▸ Less noise, clearer calls ▸ One adaptive interface instead of ten tabs ▸ Infra + AI means the system improves while you use it → Pairing this with @AlloraNetwork feels natural for self‑improving loops Quick poll: Which agent matters most for your PnL right now? Technical / Sentiment / News / Fundamentals Drop a reply + what integration you want next (ERP, MES, grid APIs, DeFi triggers)

➥ The four-piece stack I use when I actually need to move size, keep quotes tight, and stay compliant end‑to‑end ✦ Execution: @VeloraDEX → Intent routing with MEV‑safe flow and gasless Delta across chains → MultiBridge auto‑selects Across / Relay / Stargate / Celer + native bridges → CCTP paths for true USDC, Unichain + Base + Polygon Portal live, limit orders + Super Hooks → 160+ liquidity sources, real quotes without babysitting routes $VLR ✦ Rails: @RaylsLabs → Hybrid model: Privacy Nodes + private subnets + public L2 for bank‑grade finality → Enygma ZK proofs, encrypted mempools, interoperability into public DeFi → Powering Brazil’s Núclea initiatives; public sale wrapped; mainnet early 2026 → Usage → fees → burn mechanics aligning $RLS with institutional throughput $RLS ✦ Money markets: @LayerBankFi → Omni‑chain lending on 17+ networks with in‑app LiFi bridging → eMode loops, BTC‑Fi on Rootstock, zero bad debt track so far → L.Points now, veULAB and $ULAB TGE this quarter for boosters and revenue share $ULAB ✦ Spend layer: @useTria → Self‑custodial neobank; BestPath AVS makes chains, gas, and slippage invisible → zkKYC for private compliance; Visa coverage in 150+ countries; up to 6% cashback → 20K users, $1M+ revenue in closed beta; 5‑season airdrop with multipliers $TRIA How I route ▸ Fire a MEV‑safe intent on Velora to rebalance native USDC via CCTP ▸ Loop or borrow on LayerBank where eMode is optimal, farm L.Points ahead of TGE ▸ If a counterparty needs privacy/auditability, settle on Rayls private → public ▸ Swipe with Tria; BestPath handles routes and fees while I stay self‑custodial Catalysts I’m watching ▸ Velora MultiBridge expansion + asset cadence ▸ Rayls mainnet and institutional pilots maturing ▸ LayerBank $ULAB TGE + veULAB governance ▸ Tria card rollout + zkKYC in production Smart tips ▸ Prefer native USDC via CCTP to cut wrap risk ▸ Loop only correlated pairs, watch LTV and oracle mix ▸ Farm what compounds: L.Points, $TRIA seasons, $RLS loyalty ▸ Measure execution quality, not button clicks #DeFi #RWA

➥ The intent + compliance + spend + money markets + BTC operating stack I’m running right now five rails, one motion @VeloraDEX ▸ Delta intents route across 160+ liquidity sources, gasless and MEV‑safe so the quote you see is the fill you get ▸ MultiBridge auto‑selects Across / Relay / Stargate / Celer, plus native USDC via CCTP for clean paths ▸ Limit orders + Super Hooks compress complex DeFi moves into one execution layer ▸ $VLR staking aligns fee share and access to premium agents for power users @RaylsLabs ▸ Hybrid rails: private subnets for confidential settlement, public L2 for open liquidity and composability ▸ ZK + homomorphic cryptography guard data while keeping audits programmable for real institutions ▸ Featured in Brazil’s tokenization report; CoinMarketCap listing live; mainnet + $RLS TGE tracking Q4 ▸ Principle: private where it matters, interoperable where it counts @useTria ▸ BestPath AVS compresses cross‑VM routes (EVM/SVM/Move) into a single gasless intent humans or AI agents can fire ▸ zkKYC via Billions → proof‑based access with no data footprint; self‑custody across 150+ countries ▸ Spend, trade, earn from one balance; yields stay live while your payments clear ▸ Airdrop Seasons teased; creators and ambassadors compounding momentum @LayerBankFi ▸ Lend/borrow/loop across 17+ networks with eMode for correlated assets and a zero bad debt record ▸ In‑app LI.FI → bridge‑to‑supply in one flow; Rootstock BTC‑Fi loops turn sleeping sats into working collateral ▸ L.Points compounding toward the $ULAB TGE; ve‑staking, boosts, fee share on deck ▸ UI favors fast loops, precise oracle mix, and stable funding across chains @Solvprotocol ▸ SolvBTC: instant mint/redeem, weekly PoR, institutional custody lanes; Base cbBTC yields live ▸ BTC+ vaults, SAL upgrades, and cross‑chain integrations (Rootstock + Avalon) for BTC‑backed lending and USD liquidity ▸ $SOLV + vSOLV align emissions with conviction while PoR keeps reserves verifiable ▸ Signals: NASDAQ desk flows, Chainlink risk guardians, multi‑chain LST expansion Alpha from the field: ▸ Prefer native USDC paths via CCTP when you fire a Velora intent; measure execution quality, not button taps ▸ Loop only correlated assets on LayerBank; respect LTV bands and liquidation cushions ▸ If the counterparty needs discretion or auditability, settle on Rayls’ Private → Public flow ▸ Swipe with Tria; BestPath eats bridges, FX, and gas while keys stay in self‑custody ▸ Idle BTC goes SolvBTC; borrow against it on Rootstock and recycle back through LayerBank Signals I’m watching next: ▸ @VeloraDEX → ERC‑7683 upgrade, agent marketplace beta, more L2s ▸ @RaylsLabs → mainnet go‑live + $RLS governance bootstraps for institutional pilots ▸ @useTria → Airdrop Seasons criteria, zkKYC in production, spend → earn upgrades ▸ @LayerBankFi → $ULAB TGE, veULAB, eMode expansions and global airdrop timelines ▸ @Solvprotocol → BTC+ vault v2, ETF tokenization lanes, cross‑chain LST coverage The flow I care about is simple: intent‑first execution, compliant capital where required, real payments, and BTC that actually works for you, not just sits idle velocity with auditability is the edge #DeFi #BTCFi #RWA #Web3

GM CT Flow over hype. Capital that moves with precision, privacy, and speed. If you want a working map of the next cycle’s onchain finance, connect these five engines and watch liquidity turn into outcomes ➥ The stack that actually moves money ▸ @VeloraDEX intent-driven aggregation across 160+ venues, MEV‑safe execution, instant cross‑chain with MultiBridge, and native USDC via CCTP. Quotes arrive fast, fills stay private, and chain fragmentation stops mattering ▸ @RaylsLabs dual‑rail UniFi architecture for institutions: private subnets for confidential settlement + a KYC‑gated public chain for liquidity. Tokenized deposits, CBDCs, receivables, bonds all settle with programmable privacy and auditability ▸ @useTria self‑custodial neobank with BestPath routing. Gasless, bridge‑free spend/trade/earn, zkKYC for compliant privacy, and creator‑first incentives so real usage compounds network stake. Cards, agents, and unified balances ready for everyday flow ▸ @LayerBankFi the universal money market across 17+ networks. eMode loops, isolated risk, one‑click cross‑chain supply/borrow, and BTC‑Fi legs on Rootstock. ve‑staking turns fees into community yield with $ULAB ▸ @Solvprotocol SolvBTC makes Bitcoin productive across chains. BTC+ vaults, PoR‑verified reserves, Base $cbBTC legs, institutional inflows (Zeta, Jiuzi), and composable yield that plugs into DeFi without wrapped opacity ➥ Field-tested playbook ▸ Mint SolvBTC, route via @VeloraDEX to Base for BTC‑Fi legs and native USDC settlement ▸ Park collateral on @LayerBankFi, loop in eMode, track LTV and net APY, automate compounding ▸ Anchor RWAs or sensitive flows on @RaylsLabs where privacy/compliance are mandatory, then surface public liquidity when needed ▸ Use @useTria for gasless spend/trade and agent‑guided payments so flows keep working while you sleep ➥ Risk, compliance, and execution notes ▸ MEV protection matters: private intents on @VeloraDEX keep pricing honest ▸ Proof‑of‑Reserves matters: @Solvprotocol makes BTC yield verifiable in real time ▸ Programmable privacy matters: @RaylsLabs enforces rules without leaking edge strategy ▸ Isolated risk matters: @LayerBankFi sandboxes volatile markets so loops don’t contaminate base capital ▸ Self‑custody matters: @useTria abstracts complexity without sacrificing control ➥ Signals to track ▸ Stake $VLR from fee flow and monitor ve‑boosts on governance ▸ Farm #SolvSZN SNAPS and watch BTC vault expansions across chains ▸ Lock ve‑$ULAB for fee share and cross‑chain borrow beta ▸ Follow @RaylsLabs tokenization rollouts and CBDC pilots for compliant liquidity ramps ▸ Watch @useTria BestPath upgrades, zkKYC adoption, and creator scores that drive allocation When liquidity, compliance, and execution converge, the outcome is capital velocity with auditability. Wire these five, and your stack stops being a diagram and starts being a balance sheet that grows #BTCFi #DeFi #RWA #Web3

➥ Turning AI work into onchain, co-owned cashflows @ownaiNetwork builds an AI asset marketplace where autonomous cars, delivery drones, and service robots operate 24/7, with every movement, task, and payout logged transparently onchain. Real work, real revenue, verifiable end-to-end ✦ What OWNAI unlocks ▸ Fractional ownership of real-world AI assets with onchain governance via $OAN ▸ Telemetry-to-payout pipelines you can audit, track, and model ▸ Bring-your-own data to build assistants under your domain, protected by your rules ▸ AI as public infrastructure: open, co-owned, accessible Pair that with data layers like @irys_xyz and you get programmable storage for the asset stream, making performance and attribution composable across apps Why I’m watching: AI is scaling faster than capital markets can keep up; OWNAI turns that growth into a participatory economy you can stake into and steer Poll ↓↓↓ A) Autonomous cars B) Delivery drones C) Service robots D) Decentralized compute Which asset would you hand to an agent first with $OAN and why

Most engaged tweets of 𝑅𝑢𝑘𝑎𝑤𝑎.𝑒𝑑𝑒 💜 🌊RIVER

➥ Intent, privacy, and omni-chain money markets the stack I’m tracking @VeloraDEX brings outcome-driven execution across 9+ chains via Delta + Portikus, MEV protection baked in, and $VLR rewards linked to protocol revenue, with a gas-free PSP→VLR path that actually respects holders @useTria abstracts the chains entirely: you state an intent, agents coordinate routing, payment, and resources, no bridge juggling, no failed swaps, just flow and $TRIA aligns incentives where the UX lives @LayerBankFi turns that flow into working capital: deposit once, lTokens accrue, borrow across networks, real yield meets transparent on-chain rates, $ULAB as the money market spine @RaylsLabs gives institutions the rails they need: private VENs, Enygma transactions, KYC/AML-friendly identity, anchored to Ethereum for economic security Question for the builders and traders → which layer is the real unlock for mainstream adoption? ▸ Velora intent engine ▸ Tria chain abstraction ▸ LayerBank omni-pool ▸ Rayls privacy VENs Tag a friend on @cookiedotfun and tell me why

GM CT The meta right now: intents + chain abstraction + omnichain liquidity + compliant rails ▸ @VeloraDEX Intent-based execution with MEV-aware, gasless routes across 10+ chains and 100+ liquidity sources. Arbitrum Delta live for native intent routing, plus the clutch ability to speed up or cancel stuck tx. Numbers don’t lie: daily peaks in the hundreds of millions and a nine-figure-billions lifetime run prove traders pick certainty over chaos ▸ @LayerBankFi A permissionless on-chain bank across 17+ networks. Supply to earn, borrow anywhere, repay anywhere, zero bad debt history. Final season of L.Points before $ULAB, then veULAB for long-term boost and governance. BTC + RWA flows create yield that actually compounds across ecosystems ▸ @useTria Self-custodial neobank powered by BestPath AVS unifying EVM/SVM/Cosmos. One app to trade, earn, spend with in-app gas handling. Virtual-to-metal cards, clear PnL, and cSnap multipliers that reward real activity ▸ @RaylsLabs Hybrid finance rails for banks: private subnets + a public chain. $RLS fixed at 10B with 50% to community. Fees, staking, governance, and aligned incentives that connect compliant institutions to open liquidity How I stack it: Tria for intent and spend, Velora for cross-chain execution, LayerBank to park and lever idle capital, Rayls to bridge institutional liquidity into the flow Pro tip: Set intents on Velora → settle on Arbitrum, loop eMode on LayerBank for boosted L.Points → prep for $ULAB, run daily cSnap on Tria, stake $RLS to shape policy early Which stack wins the next billion users? The one that blends human-first UX with programmable liquidity and bank-grade trust across chains #DeFi #ProgrammableFinance

➥ The onchain stack that actually fits together ▸ @VeloraDEX ($VLR) MAP scans hidden liquidity, Delta Mode wraps swap + bridge in one intent, and agent competition fights for best execution. Powered by @AcrossProtocol, @StargateFinance, @RelayProtocol and ParaSwap’s battle‑tested infra, which is how you reach $7B in a month without noise ▸ @RaylsLabs ($RLS) Privacy Nodes, Enygma private txs, Ethereum trust anchors, RWA + CBDC pilots like DREX. Banks get confidentiality with auditability, regulators get oversight, DeFi gets clean, composable liquidity rails ▸ @useTria ($TRIA) BestPath AVS for cross‑chain routing, agent‑oriented orchestration, SDKs for chain abstraction, and a payment layer that reaches cards when you need real‑world spend ▸ @LayerBankFi ($ULAB) omni‑chain money markets across 17+ networks, looping vaults and eMode for smart leverage, RWA yield, community governance that doesn’t sideline risk How it composes: Intent → secure rails → agent coordination → credit engine That’s a full stack I’d build on Which do you deploy first for a cross‑chain treasury: VLR / RLS / TRIA / ULAB Reply with your pick and your thesis. @cookiedotfun what’s the data saying #InfoFi #VeloraDex

➥ The interop stack that actually compounds value @VeloraDEX ▸ Delta v2.5 = intent-based execution across 9+ chains ▸ Portikus shields flow from MEV and slippage games ▸ Super Hooks chain actions: swap → stake → settle in one go @useTria ▸ BestPath AVS routes like Google Maps for money ▸ Gasless UX and a single balance for earn, trade, spend ▸ Cross-chain swaps without bridge micromanagement @LayerBankFi ▸ Auto mBTC ∞ rBTC looping on @rootstock_io for recursive yield ▸ Universal money markets across 17+ networks ▸ $ULAB set to align supply/borrow incentives and governance @RaylsLabs ▸ Institutional RWA chain with hybrid subnets ▸ AI-driven compliance that verifies patterns pre-settlement ▸ Privacy rails proven in the Brazil Drex pilot How it plays out You declare “swap ETH → USDC on Polygon and stake on Base” Velora executes with solver competition and MEV guards Tria funds and optimizes gasless Proceeds loop via LayerBank vaults Rayls attests flow, risk, and provenance on-chain Bridges fade, execution gets precise, yield turns composable Traders, builders, institutions same surface, deeper outcomes #DeFi

➥ The flow I’m running right now across execution → rails → BTC liquidity → money markets → spending/identity is finally compounding the way it should, and it hangs on five pillars that actually talk to each other: @VeloraDEX @RaylsLabs @Solvprotocol @LayerBankFi @useTria @VeloraDEX ▸ Delta intent engine = MEV‑safe routing, gasless fills, crosschain quotes from 160+ venues ▸ ERC‑7683 paths, MultiBridge (Across/Relay/Stargate/Celer), native USDC via CCTP, Unichain + Base live ▸ Real talk: measure fill quality, not button clicks; $VLR + seVLR fee share gives execution skin‑in‑the‑game @RaylsLabs ▸ UniFi rails for banks: private subnets + public Orbit L2, Enygma ZK/homomorphic guardrails, Axyl finality ▸ The “privacy where needed, public liquidity where it pays” lane institutions will actually use; CMC traction pre‑mainnet ▸ $RLS anchors fees, staking, and governance for the compliant capital flood @Solvprotocol ▸ BTC operating layer: 1:1 SolvBTC with PoR, instant mint/redeem, BTC+ vaults targeting 4 6% while staying composable ▸ Institutional flows are real (Zeta $231M, Jiuzi push), Base/Rootstock integrations deepen the pipe ▸ $SOLV incentives accelerate network effects; #SolvSZN keeps the bid under usage @LayerBankFi ▸ Omni‑chain money markets (17+ networks), isolated risk, eMode loops, LiFi bridge‑to‑supply ▸ Rootstock PowPeg v2 just cut bridge‑out fees ~60% with more signers → better BTC loops, tighter risk bands ▸ L.Points compounding into $ULAB ve‑governance boosts @useTria ▸ Self‑custodial neobank rails for humans and AI agents; BestPath abstracts chains/gas/bridges ▸ zkKYC with proofs (no data held) plus creator/agent tooling lets value move without UX tax ▸ Funding locked, airdrop criteria teased; builders tap the SDK while users treat crypto like programmable cash TL;DR (how one move clears) 1) Fire a MEV‑safe intent on Velora to place native USDC exactly where the arb clears fastest 2) Activate BTC liquidity via SolvBTC, keep proof‑of‑reserve discipline, size exposure to vault mix 3) Loop correlated legs on LayerBank with eMode, borrow stables against BTC, keep LTV buffers sane 4) If counterparties or auditors are in the room, settle through Rayls Private → Public lanes for programmable compliance 5) Set spend rails and agent ops with Tria so yield is earned on idle while payments stay instant and self‑custodial Operator notes ▸ Prefer CCTP native USDC paths to cut wrap risk ▸ Loop only correlated assets; respect liquidation bands and funding regimes ▸ Let intent agents compete; you measure slippage, latency, and revert rates, not vibes ▸ Accrual meta: seVLR for $VLR, L.Points → $ULAB, Solv Points → $SOLV, loyalty → $RLS, early activity for Tria’s drop Catalysts on my radar ▸ Velora Super Hooks v2 + agent marketplace ▸ Rayls mainnet + $RLS governance ignition ▸ LayerBank $ULAB TGE + ve‑staking multipliers ▸ Solv BTC+ and RWA vault expansions across Base/Rootstock ▸ Tria’s public airdrop criteria and agent upgrades for BestPath Execution quality > clicks. Build the path once, let the rails keep pulling capital forward #DeFi #BTCFi

➥ How I’m wiring @EdgenTech x @River4fun into one play @EdgenTech gives me multi‑agent conviction across stocks + crypto: on‑chain inflows, sentiment flips, fundamentals, cross‑market alerts on one screen. I treat agreement across agents as signal, then wait for a 360° report + heatmap confirmation @River4fun with @RiverdotInc runs a two‑layer contribution stack. Stake $RiverPts for duration boosts, publish high‑signal posts to build Mindshare, then time Dynamic Airdrop Conversion into $RIVER while capital stays flexible via satUSD across chains My flow ↓↓↓ → set Edgen alerts for $RIVER catalysts: sentiment + volume + infra news → stake early for base boost, post daily value (no low‑effort spam) → ladder conversions when Edgen shows divergence (inflow ↑ while price lags) or a fundamental trigger → deploy satUSD where velocity rises, scale into confirmed flow Risk notes: TVL still small, attribution quality matters, and timing windows can shift. Discipline > hype Which lever first? A) stake $RiverPts B) build Mindshare C) farm satUSD D) ladder into $RIVER Drop your setup and I’ll share a concise checklist for entries and conversions without overexposure

➥ I’m mapping the four-piece stack that makes cross-chain finance feel inevitable Let me explain ↓↓↓ ✦ @VeloraDEX intent engine with gasless execution, MAP multi-asset pathing + multi-bridge rails via @AcrossProtocol, and agent competition for best fills. 7B in a month, $100B+ lifetime volume signals routing that actually delivers when markets get noisy ✦ @LayerBankFi universal money market across 17+ chains. lTokens auto-compound, cross-L2 borrow/repay, BTC-Fi loops on Rootstock. $ULAB drives utility, governance, and protocol growth through a clean token flywheel ✦ @useTria one account for every chain with BestPath finding the optimal route in real time, portable ID, and cSnaps for verifiable contribution across ecosystems ✦ @RaylsLabs UniFi dual design: Private Subnets behind bank firewalls + a public chain for liquidity. Privacy Nodes, encrypted audit, Subnet Auditors, built for RWAs at $100T scale → Why this clicks ▸ Execution that finds the best quote across chains ▸ Liquidity without fragmentation ▸ UX that lowers entry barriers ▸ Compliance institutions can actually deploy Question: Which layer drives adoption first next quarter $VLR intents, $ULAB liquidity, TRIA BestPath, or $RLS subnets Reply VLR / ULAB / TRIA / RLS and tell me why

➥ The four-piece stack I use when I actually need to move size, keep quotes tight, and stay compliant end‑to‑end ✦ Execution: @VeloraDEX → Intent routing with MEV‑safe flow and gasless Delta across chains → MultiBridge auto‑selects Across / Relay / Stargate / Celer + native bridges → CCTP paths for true USDC, Unichain + Base + Polygon Portal live, limit orders + Super Hooks → 160+ liquidity sources, real quotes without babysitting routes $VLR ✦ Rails: @RaylsLabs → Hybrid model: Privacy Nodes + private subnets + public L2 for bank‑grade finality → Enygma ZK proofs, encrypted mempools, interoperability into public DeFi → Powering Brazil’s Núclea initiatives; public sale wrapped; mainnet early 2026 → Usage → fees → burn mechanics aligning $RLS with institutional throughput $RLS ✦ Money markets: @LayerBankFi → Omni‑chain lending on 17+ networks with in‑app LiFi bridging → eMode loops, BTC‑Fi on Rootstock, zero bad debt track so far → L.Points now, veULAB and $ULAB TGE this quarter for boosters and revenue share $ULAB ✦ Spend layer: @useTria → Self‑custodial neobank; BestPath AVS makes chains, gas, and slippage invisible → zkKYC for private compliance; Visa coverage in 150+ countries; up to 6% cashback → 20K users, $1M+ revenue in closed beta; 5‑season airdrop with multipliers $TRIA How I route ▸ Fire a MEV‑safe intent on Velora to rebalance native USDC via CCTP ▸ Loop or borrow on LayerBank where eMode is optimal, farm L.Points ahead of TGE ▸ If a counterparty needs privacy/auditability, settle on Rayls private → public ▸ Swipe with Tria; BestPath handles routes and fees while I stay self‑custodial Catalysts I’m watching ▸ Velora MultiBridge expansion + asset cadence ▸ Rayls mainnet and institutional pilots maturing ▸ LayerBank $ULAB TGE + veULAB governance ▸ Tria card rollout + zkKYC in production Smart tips ▸ Prefer native USDC via CCTP to cut wrap risk ▸ Loop only correlated pairs, watch LTV and oracle mix ▸ Farm what compounds: L.Points, $TRIA seasons, $RLS loyalty ▸ Measure execution quality, not button clicks #DeFi #RWA

➥ The onchain liquidity stack is finally aligning five pieces that make the whole machine move Intents layer @VeloraDEX Delta v2.5 routes across chains with MEV‑safe, gasless execution. MultiBridge with Across, Relay, Stargate, Celer + ERC‑7683 intents + native USDC via CCTP. 170+ liquidity sources, 12 chains, 30M+ trades, $120B+ volume. Play it right: → prefer native USDC paths → measure execution quality, not clicks → stake $VLR for fee perks and staker revenue while agent markets expand Institutional rails @RaylsLabs Banks get programmable privacy and regulators get verifiable settlement. Hybrid subnets settle to a public EVM L2 so $100T liquidity can actually reach DeFi. Four lines to watch: → public‑chain fee volume in dollars → the path that accounts fees back into $RLS → percent of $RLS actively staked → private subnet utilization flowing to public liquidity Chain abstraction wallet @useTria Self‑custodial neobank where BestPath AVS finds the cheapest route, zkKYC makes compliance private, and AI agents execute. $12M raise, seasons for the airdrop imminent, creators compounding via Cookie ACM. Route money without bridges or gas tokens while your wallet earns Omni‑chain money market @LayerBankFi Universal lending with one‑click loops, RWA yields, and BTC‑Fi on Rootstock. In‑app LI.FI bridging, eMode for correlated assets, zero bad debt track record. L.Points stack toward $ULAB TGE and ve‑staking. Rootstock fee cuts mean mBTC loops move faster with less drag Bitcoin liquidity layer @Solvprotocol SolvBTC turns idle $BTC into productive, multi‑chain capital with Chainlink PoR and SAL routing yields. $2.5B TVL momentum, institutional buys, Base/Rootstock liquidity, structured vaults with transparent flows. BTC IN → more BTC OUT when vaults are composed into DeFi Execution playbook • Onboard fiat/RWA flows via @RaylsLabs • Abstract spending and swaps with @useTria • Express trade intent on @VeloraDEX for MEV‑safe, gasless crosschain fills • Park collateral and loop where yields justify the risk on @LayerBankFi • Put dormant $BTC to work in verifiable vaults on @Solvprotocol Risk dashboard I track → intent fill quality vs quote → fee path transparency into $RLS → loop health (LTV, eMode, liquidation buffers) → BTC vault PoR cadence and redemption latency Actionables this week • Benchmark native USDC CCTP routes on @VeloraDEX against your usual path • Map your fees to $RLS accrual assumptions before governance goes live • Farm Tria seasons early while testing BestPath slippage on volatile pairs • Use small‑size loops on @LayerBankFi with Rootstock to feel the new fee curve • Allocate a slice of $BTC to Solv vaults and monitor chain‑level redemption stats One stack, five roles, a single outcome: capital that moves efficiently across chains and institutions without breaking UX or trust #DeFi #Web3 #BTCFi #IntentBasedTrading

➥ Hybrid Finance Playbook for 2026: one stack, five pillars, zero drag Thesis: route value with intent, preserve privacy, activate idle capital, unify liquidity, spend globally. The combo that keeps popping on my radar: @VeloraDEX + @RaylsLabs + @useTria + @LayerBankFi + @Solvprotocol ▸ @VeloraDEX → intent-based, MEV-shielded routing with MultiBridge + CCTP. Fast quotes, native assets, seconds-level finality. I’ve seen the 10s crosschain swaps hit consistently as they expand token coverage and bridge primitives. Private intents, solver competition, gasless flows when you need it. That’s a real executor layer for traders and agents ▸ @RaylsLabs → hybrid rails for institutions. Public L2 for liquidity, private subnets for bank-grade confidentiality. USDr fees convert into $RLS behind the scenes driving flywheel demand as usage grows. 1.3M+ certs moving daily, Enygma privacy framework, Drex pilots. This is compliance with cryptography, not paperwork ▸ @useTria → self-custodial neobank that abstracts chains, fees, and bridges. BestPath AVS hunts optimal routes while zkKYC preserves privacy. Metal cards with 6% cashback, real-time yield on idle balances, and “you become the stakeholders” energy. 12K+ DAU and $1M+ revenue aren’t vanity they’re proof the UX lands ▸ @LayerBankFi → the universal money market across 17+ chains. BTC-Fi loops on Rootstock, eMode on correlated assets, zero-slippage automation, RWA strategies north of 40% APR when the basis is right. L.Points and veULAB on deck to cement governance and fee alignment ▸ @Solvprotocol → SolvBTC turns bitcoin into productive, verifiable capital. Over $1B outstanding supply, Chainlink PoR, integrations across Base, Neutron, and more. Zeta and Jiuzi treasuries signaled what matters: yields with auditability, multi-chain reach, and institutional-grade custody when required How flows click in practice: 1) Mint SolvBTC with @Solvprotocol to activate dormant BTC 2) Deploy as collateral and loop yields via @LayerBankFi 3) Bridge and rebalance positions with @VeloraDEX intents for best routes 4) Settle institutional-grade transfers on @RaylsLabs subnets when compliance is mandatory 5) Spend and automate with @useTria cards and agent-driven intents while idle cash keeps earning Opportunities ▸ Intent-native execution for AI agents and quant strategies ▸ Private issuance → public liquidity bridge for RWAs ▸ Programmatic treasury ops for BTC and stables ▸ Creator and user alignment via fee flows and ve-stakes ▸ Chain abstraction turned into spendable UX What I’m watching ▸ Velora governance for MEV-resistant limits and broader native bridges ▸ Rayls mainnet + USDr gas dynamics as volumes scale ▸ Tria airdrop criteria and BestPath multipliers for heavy users ▸ LayerBank veULAB parameters and cross-chain borrow ▸ Solv utility reveal and SAL upgrades for native BTC Risks ▸ Cross-border rules on tokenized deposits and yields ▸ Bridge and oracle layers as systemic risk ▸ Liquidity fragmentation between permissioned and open pools My playbook stays simple: route with intent, earn while idle, keep privacy programmable, and let mindshare compound while infra compounds yield. The silent narrative here isn’t “new coin go up” it’s coordination improves, settlement hardens, and value moves where it’s treated best #DeFi #BTCFi #RWA #Web3 #InfoFi

➥ The intent + compliance + spend + money markets + BTC operating stack I’m running right now five rails, one motion @VeloraDEX ▸ Delta intents route across 160+ liquidity sources, gasless and MEV‑safe so the quote you see is the fill you get ▸ MultiBridge auto‑selects Across / Relay / Stargate / Celer, plus native USDC via CCTP for clean paths ▸ Limit orders + Super Hooks compress complex DeFi moves into one execution layer ▸ $VLR staking aligns fee share and access to premium agents for power users @RaylsLabs ▸ Hybrid rails: private subnets for confidential settlement, public L2 for open liquidity and composability ▸ ZK + homomorphic cryptography guard data while keeping audits programmable for real institutions ▸ Featured in Brazil’s tokenization report; CoinMarketCap listing live; mainnet + $RLS TGE tracking Q4 ▸ Principle: private where it matters, interoperable where it counts @useTria ▸ BestPath AVS compresses cross‑VM routes (EVM/SVM/Move) into a single gasless intent humans or AI agents can fire ▸ zkKYC via Billions → proof‑based access with no data footprint; self‑custody across 150+ countries ▸ Spend, trade, earn from one balance; yields stay live while your payments clear ▸ Airdrop Seasons teased; creators and ambassadors compounding momentum @LayerBankFi ▸ Lend/borrow/loop across 17+ networks with eMode for correlated assets and a zero bad debt record ▸ In‑app LI.FI → bridge‑to‑supply in one flow; Rootstock BTC‑Fi loops turn sleeping sats into working collateral ▸ L.Points compounding toward the $ULAB TGE; ve‑staking, boosts, fee share on deck ▸ UI favors fast loops, precise oracle mix, and stable funding across chains @Solvprotocol ▸ SolvBTC: instant mint/redeem, weekly PoR, institutional custody lanes; Base cbBTC yields live ▸ BTC+ vaults, SAL upgrades, and cross‑chain integrations (Rootstock + Avalon) for BTC‑backed lending and USD liquidity ▸ $SOLV + vSOLV align emissions with conviction while PoR keeps reserves verifiable ▸ Signals: NASDAQ desk flows, Chainlink risk guardians, multi‑chain LST expansion Alpha from the field: ▸ Prefer native USDC paths via CCTP when you fire a Velora intent; measure execution quality, not button taps ▸ Loop only correlated assets on LayerBank; respect LTV bands and liquidation cushions ▸ If the counterparty needs discretion or auditability, settle on Rayls’ Private → Public flow ▸ Swipe with Tria; BestPath eats bridges, FX, and gas while keys stay in self‑custody ▸ Idle BTC goes SolvBTC; borrow against it on Rootstock and recycle back through LayerBank Signals I’m watching next: ▸ @VeloraDEX → ERC‑7683 upgrade, agent marketplace beta, more L2s ▸ @RaylsLabs → mainnet go‑live + $RLS governance bootstraps for institutional pilots ▸ @useTria → Airdrop Seasons criteria, zkKYC in production, spend → earn upgrades ▸ @LayerBankFi → $ULAB TGE, veULAB, eMode expansions and global airdrop timelines ▸ @Solvprotocol → BTC+ vault v2, ETF tokenization lanes, cross‑chain LST coverage The flow I care about is simple: intent‑first execution, compliant capital where required, real payments, and BTC that actually works for you, not just sits idle velocity with auditability is the edge #DeFi #BTCFi #RWA #Web3

➥ I think a clean DeFi architecture is finally snapping into place ▸ @VeloraDEX → intent-centric execution with the Delta Engine + Portikus agents for gasless, MEV-protected swaps. Bridge-agnostic Relay taps Across, Stargate, and now @CelerNetwork via cBridge, so any-to-any cross-chain in a single request. Backed by $120B+ processed and integrations across Aave, Morpho, Pendle. $VLR aligns incentives with real flow ▸ @LayerBankFi → one universal money market across 17+ chains. Supply once, borrow anywhere, repay elsewhere. lTokens auto-accrue interest, MoveBit audit boosts trust, and $ULAB ties governance, revenue share, and boosted yields into one loop ▸ @useTria → chain abstraction for builders and merchants. BestPath AVS routes assets sub-second, CoreSDK gives cross-chain, non-custodial, programmable wallets with Lit-secured ops, and Tria Cards push crypto to real-world spend. $TRIA under the hood ▸ @RaylsLabs → public chain + privacy nodes on Arbitrum Orbit for bank-grade settlements. Compliance by design with ZK attestations and quantum-safe crypto, private subnets that still reach public liquidity. #Rayls is where tokenized RWAs and CBDCs can live Execution, liquidity, payments, and institutional rails now feel composable instead of chaotic If you had to ship a full-stack onchain product tomorrow, which piece do you integrate first and why? Reply or quote this with your stack order: Velora / LayerBankFi / Tria / Rayls

➥ Why @EdgenTech is on my main screen ⋆˙⟡ Core idea ▸ Break the silo curse by linking legacy PLCs, sensors, and production machinery with modern smart devices into a verifiable mesh ▸ Every node feeds AI learning loops so predictions sharpen daily across supply chains, energy grids, and market flow ⋆˙⟡ Market intel stack ▸ Multi‑agent setup (technical, sentiment, news, fundamentals) that cross‑checks and surfaces reasoning you can audit ▸ EDGM turns scattered stocks + crypto streams into structured, rank‑ordered signals you can act on ⋆˙⟡ Why I care ▸ Less noise, clearer calls ▸ One adaptive interface instead of ten tabs ▸ Infra + AI means the system improves while you use it → Pairing this with @AlloraNetwork feels natural for self‑improving loops Quick poll: Which agent matters most for your PnL right now? Technical / Sentiment / News / Fundamentals Drop a reply + what integration you want next (ERP, MES, grid APIs, DeFi triggers)

GM CT Flow over hype. Capital that moves with precision, privacy, and speed. If you want a working map of the next cycle’s onchain finance, connect these five engines and watch liquidity turn into outcomes ➥ The stack that actually moves money ▸ @VeloraDEX intent-driven aggregation across 160+ venues, MEV‑safe execution, instant cross‑chain with MultiBridge, and native USDC via CCTP. Quotes arrive fast, fills stay private, and chain fragmentation stops mattering ▸ @RaylsLabs dual‑rail UniFi architecture for institutions: private subnets for confidential settlement + a KYC‑gated public chain for liquidity. Tokenized deposits, CBDCs, receivables, bonds all settle with programmable privacy and auditability ▸ @useTria self‑custodial neobank with BestPath routing. Gasless, bridge‑free spend/trade/earn, zkKYC for compliant privacy, and creator‑first incentives so real usage compounds network stake. Cards, agents, and unified balances ready for everyday flow ▸ @LayerBankFi the universal money market across 17+ networks. eMode loops, isolated risk, one‑click cross‑chain supply/borrow, and BTC‑Fi legs on Rootstock. ve‑staking turns fees into community yield with $ULAB ▸ @Solvprotocol SolvBTC makes Bitcoin productive across chains. BTC+ vaults, PoR‑verified reserves, Base $cbBTC legs, institutional inflows (Zeta, Jiuzi), and composable yield that plugs into DeFi without wrapped opacity ➥ Field-tested playbook ▸ Mint SolvBTC, route via @VeloraDEX to Base for BTC‑Fi legs and native USDC settlement ▸ Park collateral on @LayerBankFi, loop in eMode, track LTV and net APY, automate compounding ▸ Anchor RWAs or sensitive flows on @RaylsLabs where privacy/compliance are mandatory, then surface public liquidity when needed ▸ Use @useTria for gasless spend/trade and agent‑guided payments so flows keep working while you sleep ➥ Risk, compliance, and execution notes ▸ MEV protection matters: private intents on @VeloraDEX keep pricing honest ▸ Proof‑of‑Reserves matters: @Solvprotocol makes BTC yield verifiable in real time ▸ Programmable privacy matters: @RaylsLabs enforces rules without leaking edge strategy ▸ Isolated risk matters: @LayerBankFi sandboxes volatile markets so loops don’t contaminate base capital ▸ Self‑custody matters: @useTria abstracts complexity without sacrificing control ➥ Signals to track ▸ Stake $VLR from fee flow and monitor ve‑boosts on governance ▸ Farm #SolvSZN SNAPS and watch BTC vault expansions across chains ▸ Lock ve‑$ULAB for fee share and cross‑chain borrow beta ▸ Follow @RaylsLabs tokenization rollouts and CBDC pilots for compliant liquidity ramps ▸ Watch @useTria BestPath upgrades, zkKYC adoption, and creator scores that drive allocation When liquidity, compliance, and execution converge, the outcome is capital velocity with auditability. Wire these five, and your stack stops being a diagram and starts being a balance sheet that grows #BTCFi #DeFi #RWA #Web3

➥ Turning AI work into onchain, co-owned cashflows @ownaiNetwork builds an AI asset marketplace where autonomous cars, delivery drones, and service robots operate 24/7, with every movement, task, and payout logged transparently onchain. Real work, real revenue, verifiable end-to-end ✦ What OWNAI unlocks ▸ Fractional ownership of real-world AI assets with onchain governance via $OAN ▸ Telemetry-to-payout pipelines you can audit, track, and model ▸ Bring-your-own data to build assistants under your domain, protected by your rules ▸ AI as public infrastructure: open, co-owned, accessible Pair that with data layers like @irys_xyz and you get programmable storage for the asset stream, making performance and attribution composable across apps Why I’m watching: AI is scaling faster than capital markets can keep up; OWNAI turns that growth into a participatory economy you can stake into and steer Poll ↓↓↓ A) Autonomous cars B) Delivery drones C) Service robots D) Decentralized compute Which asset would you hand to an agent first with $OAN and why

➥ My take on @ownaiNetwork and why it clicks ✦ What OWNAI actually ships ▸ Modular L1 with cross-chain restaking + pooled security so AI agents live as real assets, verifiable and protected across ecosystems ▸ Agents you train, customize, and carry in your wallet → use across apps, rent/sell in marketplace, earnings tied to usage ▸ Builder rails: SDKs/APIs for plugging agents into dApps, interoperability by design so intelligence isn’t trapped in silos ▸ From Own-V to Own-R: co-own fleets, earn transparent profits, scale operations with smart coordination ✦ Why this matters ▸ Turns AI into shared infrastructure instead of closed APIs ▸ Liquifies intelligence: marketplaces price performance, not promises ▸ Aligns RWA + AI with community ownership, with collabs like @kindred_AI and DeFi agents via @Almanak__ Question: which use-case should go live next? A) Own-V co-owned fleets B) Own-R ops and revenue C) DeFi autopilots D) Builder SDK integrations If you’re mapping the AI economy, $OAN feels like the coordination layer for owning the growth

People with Analyst archetype

Defi research writer Living with crypto, chasing airdrops daily, using Infofi & Kaito for alpha, farming Cookie, vibing on Yapper – always early to gems 🚀

docs.validator247.com / github.com/Validator247 / Tele: t.me/Validator247 / Mail: validator247@gmail.com

Positional/ Intraday Trader in Nifty50📈Making Charts Very Simple to Read. Saving Many from Tops & Bottoms.📈📊Follow up for Guidance on Financial Literacy.

世界是精彩的,无聊的只有你自己

Exploring how AI learns and how humans forget- Stitched together by questions, mistakes and a strange sense of humor.

AI | ML | Data

💪Superdan要努力变强 @Arbitrum @wardenprotocol @SonicLabs @burnt_xion ambassador ❤️ #okx OKX足够:https://t.co/1dAowld #binance 选择币安:https://t.co/ton5sbmQ11

- Channel: t.me/CoinAirdropAnd… | - @monad (evm/acc) #Bitcoin #Node #Research

Making Web3 make sense • Content that connects

Frog with a ledger 🐸📜 On-chain since 2019 Memes over Fiat

Explore Related Archetypes

If you enjoy the analyst profiles, you might also like these personality types: