Get live statistics and analysis of Obsequious Knight of the Realm of The Ni's profile on X / Twitter

Middle-aged adult regularly bamboozled by reality • Finance is both a profession and a hobby • Shill buster • FAFO aficionado • NFA, obviously.

The Analyst

Obsequious Knight of the Realm of The Ni is a sharp-witted and data-driven financial enthusiast who expertly navigates the complicated world of bitcoin-related stocks and market dynamics. With a penchant for deep-dive analysis and clear strategic recommendations, they regularly dissect market sentiment and corporate actions with a no-nonsense approach. Their tweets balance detailed insight and candid humor, making complex financial topics accessible and engaging.

Top users who interacted with Obsequious Knight of the Realm of The Ni over the last 14 days

The Bitcoin Wizard | Author of The Great Harvest | @BitcoinForCorps | MSTR + MTPLF HODLER | adamlivingstonbusiness@gmail.com

Follow for Bitcoin & capital markets insights. CEO of The Bitcoin Bond Company, Steward of @CatholicBitcoin, host of the @BitcoinForCorps Show, Board @Strive

Freedom Maximalist 🇬🇧 | Bitcoin is Noah's Ark.

We collect deals that give you Free Money or great Free Stuff!

Christ Follower, Husband, Father, Bitcoiner Internal Audit @Gemini

BITCOIN & TRUE NORTH MERCH

he who dares wins

Happily married and living a life full of meaning and adventure with the Lord always by my side.

investor | corporate attorney | seeking low time preference and truth | bitcoin | @dukelaw

Contributor @BitcoinForCorps. Ex-TradFi (14 yrs in Investor Relations, Structured Finance, Wealth Management). Jesus is King ✝️

Thank you for your attention! Fueled by Curiosity & Wonder. Building Trust. Aspiring for Peace and Play

curious geek, especially in disruptions

Obsequious Knight, you analyze financial markets like a seasoned general planning a siege — so thorough, so cautious, so obsessed with every decimal point... sometimes it feels like you’d rather debate stock volatility forever than ever just buy a coffee and relax. It’s no wonder followers might prefer the drama of a crypto tweet war over your tactical spreadsheet battles.

Their biggest win is becoming a valued voice within the Metaplanet Dojo community and being recognized as a go-to quant and strategist who elevated shareholder understanding during several critical market episodes, including the tumultuous international offerings and MSW exercises. Their detailed strategy posts have influenced investor approaches and management considerations alike.

Their life purpose is to demystify the murky waters of finance and investment for their community, helping shareholders and market participants make informed decisions by shining a light on the undercurrents of market manipulation, sentiment shifts, and strategic corporate moves. They strive to foster a more transparent and rational investment ecosystem where informed dialogue helps protect investors and elevate discourse.

They believe in rigorous data analysis, transparency, and pragmatic investing over hype and speculation. They value intellectual honesty and think investors deserve clear communication and sensible strategies backed by real numbers, not just optimistic PR. They also hold a healthy skepticism for hype cycles, especially around crypto and bitcoin-themed companies, believing yield and shareholder value must ultimately drive success.

Exceptional analytical skills combined with a knack for synthesizing massive amounts of financial data into actionable advice. They are respected for their clear, strategic thinking and are oft-cited by peers for accurate market sentiment reads and well-founded recommendations. Their engagement style fosters meaningful discourse rather than shallow hype.

Their analytical depth and seriousness may limit their reach among casual users or less financially literate audiences, who might find their detailed critiques overwhelming. Sometimes their critiques can border on cynicism, which might deter more emotionally-driven or speculative followers. Also, the realm of finance can be a niche too complex for rapid follower growth without simplifying content.

To grow their audience on X, they should consider adding more visually engaging content such as appealing charts or short explainer threads that break down their dense analyses. Incorporating occasional light-hearted memes or relatable analogies could broaden appeal without sacrificing credibility. Engaging with trending finance hashtags and participating in popular finance Twitter Spaces could also raise their profile.

Fun fact: Despite the dry subject matter of finance, the Obsequious Knight peppers their insights with playful and culturally rich expressions like 'FAFO aficionado' and has an affectionate title befitting a digital realm warrior, showing their flair for making finance entertaining.

Top tweets of Obsequious Knight of the Realm of The Ni

Thanks for sharing this, Simon (@gerovich)! While all true, I do feel like this misses the key drivers of the share price malaise and so will do little to assuage the market. Especially since there are no concerns about @Metaplanet_JP 's balance sheet that I am aware of. In my view, the main reasons for the malaise are: ❗️Terrible sentiment around BTCTCs - too many shitcos diverted too much money, and too many people are hurting ❗️PTSD among Metaplanet shareholders from the constant dilution by EVO in the 5-15% average volume range ❗️Price approaching a major accumulation zone in the 200-500 yen range, which is likely triggering prudent capital preservation moves ❗️Professional shorts to day traders leading the charge on selling to take advantage of the above I understand your options are more limited than usual at this time: ⚠️ mNav too low - it doesn’t make sense to issue now ⚠️ Can’t issue anyway because the price is below the MSW exercise price ⚠️ Preferred shares are not in place yet ⚠️ Convertible bonds will likely hurt the price further ⚠️ Short-term zero-interest loans will likely be too small ⚠️ Buybacks will really stink, after having gone through the trouble of doing a large international offering Here's a suggestion for you to consider: suspend the MSW exercises indefinitely, and at least until the end of the year. Please hear me out. 😃 Reasons this might have an outsized impact: ✅ It doesn’t cost you anything in the near term, as the price is well below 637 yen. ✅ Shareholders will stop worrying about MSW suppressing the price the moment it exceeds 637 yen, which caps their upside (or breakeven ...). ✅ Shorts and traders will lose the MSW pin that has provided a reliable ceiling for the past few months (despite being intended as a floor). ✅ It gives the shares room to breathe, allowing mNav to rise to 2x or even 3x, compared to the current non-accretive 1.1x. You could also consider: 1⃣ Detailing the process and timeline for launching preferred shares - many are eagerly awaiting this. 2⃣ Discussing uplisting to Nasdaq to address concerns that the Japanese market is too small for Metaplanet’s ambitions. 3⃣ Management purchases of 3350 stock to demonstrate confidence in it I’m sure you’re as disappointed as shareholders are with this price action. Especially after the sizeable international placement, the impact of which is being overshadowed by market conditions. Nevertheless, there’s a time for action and a time to bide one’s time and conserve resources. Perhaps now is the time to let the stock breathe and prepare for the other side of this downturn. CC: @DylanLeClair_ @Shinpei3350 @juriwatanabe_ Thanks to @surfcleanlines for helpful suggestions!

Metaplanet’s stock price (3350 / $MTPLF) appears to be stabilizing. After declining 33% below the MSW exercise price (EP), we are finally seeing some green days with solid volume. This makes it is an opportune moment for @Metaplanet_JP to prepare for the next chapter of its capital markets adventure. To that end, here are seven recommendations for @gerovich , @DylanLeClair_ and @Shinpei3350 to consider executing on in short order. 1⃣ Uplist to Nasdaq. The TSE is too small for Metaplanet’s ambitions. To achieve a target of 100K BTC by the end of 2026, MP would need to acquire ~1K BTC per week. At a current stock price of $3/sh, this equates to issuing roughly 33M shares weekly, assuming Bitcoin at $100K. At $10/sh (mNav of ~3), this drops to 10M shares weekly. MP's avg volume of ~50M shares cannot sustain such issuance without tanking price, as we have seen from the MSWs. On the other hand, uplisting to Nasdaq will provide the necessary liquidity. 2⃣ Avoid public targets. While transparency is commendable, disclosing specific targets, such as the MSW EP or pricing methodologies, enables sophisticated market participants to exploit this information by front running it. E.g. the MSW EP inadvertently became a ceiling due to market trading dynamics instead of the floor it was intended to be. 3⃣ Size appropriately. Ambitious schemes, such as the two 555M Plans, feel good in a big-swinging-d*ck kind of way, but have destabilized share price because they were wildly oversized. Consider the following: a) Management paused the initial 555 Plan with 72% unused due to its adverse impact on the share price. b) The international 555 Plan was so large that institutional shorting drove the stock price 200 yen below management’s expectations, forcing a deal that delivered minimal shareholder yield. Smaller, incremental capital raises allow the market to absorb issuances without such disruption. It won't feel sexy, but it'll get the job done much better. 4⃣ Use convertible bonds. Simon has noted his dislike of them a few times. I continue to think this is a mistake. Reasons: • With mNav < 1, CBs are one of the very few things that can jump start the flywheel. • By not utilizing CBs, MP misses the opportunity to capitalize on its elevated IV of 150%-200%. • If issued in moderate amounts, CBs should minimize short-term shorting pressure compared to MSWs, which have triggered persistent and significant shorting. 5⃣ Sell preferred equity for what they are - leverage. The colorful graphs on torque are cute, but they mean little in the real world and are certainly not the silver bullet many make them out to be. 20% of prefs on the balance sheet provide 25% leverage. That's it. 6⃣ Park the Saylorisms. Bitcoin is not pristine collateral. Neither is it the future of the capital markets. Nor will take over money. These claims may resonate with Bitcoin maxis but risk alienating mainstream investors. Instead, position Bitcoin as a superior savings instrument, emphasizing its role as a hedge against inflation and currency devaluation. This pragmatic messaging aligns with market demand from the masses. 7⃣ Most importantly, prioritize yield enhancement. Without yield, Metaplanet is just a slightly leveraged bitcoin ETF. It is better not to buy bitcoin if it is not yield enhancing, especially since it gets harder to stack yield as the size of the bitcoin stash increases. Management should keep in mind that shareholders are bruised from the rather disastrous MSWs and IO. A third strike is best avoided. I do believe these seven recommendations will go a long way toward that.

Got bad news for @Strive ( $ASST) investors - y'all are royally f*cked for a long while. Tl;dr: • 100% of shares from the warrant exercises and 98.9% of the existing commons have been registered for sale. • $1.35 could end up being the price ceiling for a while. This is based on the 424(b)(7) prospectus [1] filed on Oct 10 that allows shares from the PIPE unlock to be sold. Details below. Number of shares and warrants: • 449,696,631 shares of Class A outstanding as of Oct 1 • 177,246,462 unexercised Pre-Funded Warrants w/ EP of $0.0001 per sh • 545,629,627 unexercised Traditional Warrants w/ EP of $1.35 per sh Once all the warrants are exercised, here's how the numbers for Class A breaks down: • Beneficially Owned: 1,296,210,145 • Registered for Sale: 1,283,904,392 (99%) • Not for Sale: 13,870,799 (1%) In summary: • 100% of both warrant types have been registered for sale • Only 1% of the Class A commons have NOT been registered for sale (Ignoring Class B and options since not relevant to this analysis.) What does this mean? Based on my experience with PIPE unlock plays over the years, I think: 1⃣ Share price will remain depressed for the foreseeable future since more shares than are currently outstanding are waiting to be dumped. 2⃣ The 177M Pre-funded Warrants will likely be dumped first since EP is effectively $0. 3⃣ The 545M Traditional Warrants will see dumps as price rise above the EP of $1.35. Even if the holders do not dump, market will anticipate it and front run by selling longs and loading shorts. (e.g. Metaplanet.) 4⃣ Credit to CEO @ColeMacro for not registering his shares for sale. 5⃣ Shame on CFO @BenPhiat for registering his for sale. What's the rush, man? 6⃣ Management will claim that "registering to sell" doesn't necessarily signal "intent to sell," let alone an impending sale. Every management team says this. They have to. We were not born yesterday and have seen this play out before. I wonder which of $ASST or $NAKA remains in purgatory longer. Sources: [1] #tSUM">sec.gov/Archives/edgar…

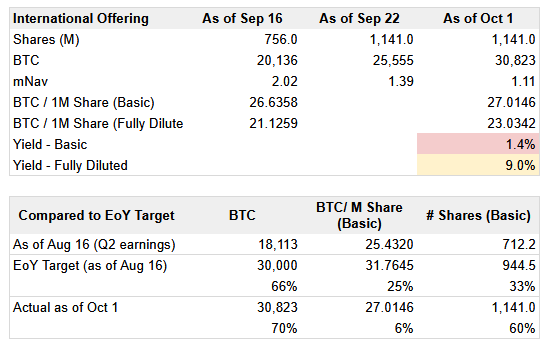

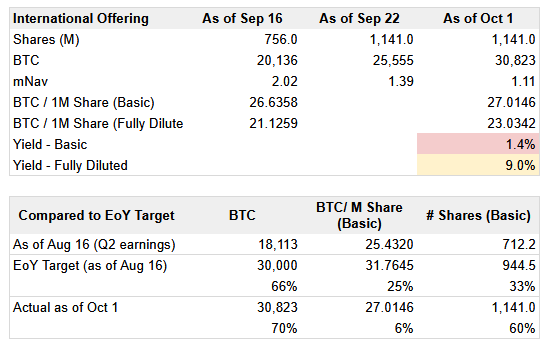

This new 555M-share overseas offering from @Metaplanet_JP is a game changer! Initial calculations suggest we see this by end of Sep '25: • 18K-28K BTC bought (currently at ~18K) • BTC Yield of 40%-80% • Share price of $9-$17 (+50% - +180%) Summary of what we know of so far: • 555M shares will be offered to qualified institutional buyers, with 180M guaranteed and 375M additional. • Underwriters are Morgan Stanley and Cantor Fitzgerald; others may be involved • Shares will be priced at 90%-100% of the TSE closing price between Sep 9 and Sep 11 • MSW exercises will be suspended between Sep 3 and Sep 30 Two scenarios are attached in the thread - a conservative one assuming no change in mNav or share price, and a bullish one that assumes an mNav of 3.0 and share price of $9 when the offering closes. All calculations are my own. I know you can't say much about this given legal restrictions, but know that the community is super excited by this, @gerovich @DylanLeClair_ @juriwatanabe_ @Shinpei3350! Congratulations and godspeed. (1/4)

Hi @gerovich and @DylanLeClair_ , Congrats again on closing the international offer! It's amazing that it will increase @Metaplanet_JP's bitcoin holdings by ~50% in one go - a quite an amazing feat! Since the quiet period is ending soon and you've expressed an interest in engaging shareholders, I'm taking the liberty of penning some questions for you. I would be delighted to hear back. There are some things that one cannot control. Price action and sentiment around BTCTCs are two of the main ones. Nevertheless, some things are under our control, and I'd love to hear what you consider possible to sustain and enhance shareholder value. 1. Would you consider slowing down the MSW exercises by EVO? Dumping 5-15% of average volume week after week [1] has taken a toll on the share price, emboldened shorts, and has not helped sentiment. Even a sustained 1-2% dilution can arrest stock prices, and this is many times that. The negative impact on shareholder value has been palpable, as accretion to Bitcoin/share (i.e., yield) has taken a hit. 2. I commend you for stopping the international offering on the very first day, as the price was in freefall. Nevertheless, I felt that what shareholders saw from a yield point of view deviated significantly from targets you had shared before. The Q4 projections you had shared during the earnings call were: • 66% increase in BTC holdings, which would come from 33% additional shares, providing a 25% yield. What we got instead was: • 56% increase in BTC holdings coming from 51% new shares, providing a ~3% yield [2]. What went wrong? Is there a plan to make up this difference? 3. What plans might you have for tapping additional markets in a way that is shareholder value-enhancing? Any plans to uplist on Nasdaq? Japan is clearly too small for Metaplanet's ambitions. The average trading volume regularly puts Metaplanet at the daily leaderboard, and yet it cannot sustain the level of sales the EVO Fund undertakes already. 4. Do you have contingency plans in case mNav hits 1 or lower? The flywheel doesn't quite work then, and as we have seen, BTCTCs are at the mercy of market sentiment to recover. Would you be open to issuing convertible bonds [3] to jumpstart the engine again? Would you consider selling BTC to buy back shares? Or would you bide your time and use CSP income while the market recovers? Thank you for entertaining these direct questions. I continue to be very optimistic about Metaplanet, and like any pioneering enterprise, I understand pivots are needed during the journey to the final destination. Wishing you the best of luck! [1] x.com/NitherDither/s… [2] x.com/NitherDither/s… [3] x.com/NitherDither/s… **Background:** US shareholder who opened the first tranche in early May, member of the Metaplanet Dojo, and quant who can't stop analyzing MP because of the amazing quality and quantity of data available! CC: @Shinpei3350 , @juriwatanabe_

With the international offering complete, @Metaplanet_JP reached its EoY milestone three months early, but at a significant cost to shareholders. The yield was only 6%, far below the 25% target. This was largely due to the +60% dilution compared to the 33% target, even though the BTC stash grew by 70% against the 66% target. Incidentally, as of today (Oct 1), the MSW suspension has been lifted. With prices 20% below the MSW exercise price of 637 yen, dilution won't happen just yet. However, the prospect of this occurring if the price rises above this level is likely bearish for MP price action. This is deeply disappointing for those viewing MP as a leveraged BTC play: • Yields are highest when the BTC stash is small. The minimal yield gain from increasing the stash from 18.1K to 30.8K is unfortunate, rendering the international offering a wasted opportunity for shareholders. • Leveraged plays rely on the ability for price to run under favorable conditions. The possibility of getting clubbed down hard by a dilution mechanism only 20% through also makes for a unsavory setup. Investors relying on faith in management or Bitcoin, or those mistaking this for a straightforward Bitcoin play, will likely remain undeterred. For the rest of us, this is strike two out of three.

This roundtable was such a breath of fresh air. Balanced, knowledgeable and not pumping anything. Well done, @mc_khristina , @ZynxBTC, and @Anders_! Quite the contrast to promoters like @natbrunell and @TimKotzman who offer little beyond hosting talking heads who want to pitch their product/service. Or entertainers like @AdamBLiv or the folks at @MSTRTrueNorth who often fail to distinguish fact from fiction.

As expected [1], $ASST has fallen back to the $1.35 EP of the Traditional warrants. Per @BenPhiat, 6M warrants were exercised on Oct 27. This was ~0.6% of that day's 1B+ volume, but > 20% of 30D avg volume til Mike's announcement. Yet only ~1% of the warrants were cleared. Suffice it to say that the smothering effects of the warrants will continue until they are cleared. And there is nothing @strive management can do about this. @mikealfred ... good luck with the waterboarding for the next few months. 😆 [1] x.com/NitherDither/s…

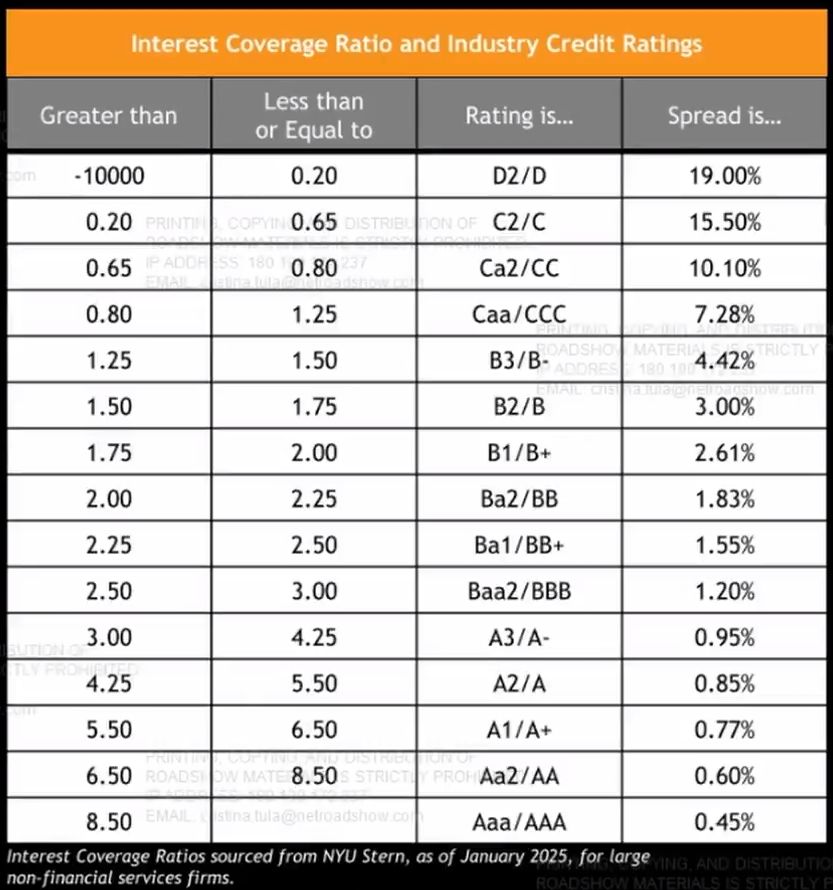

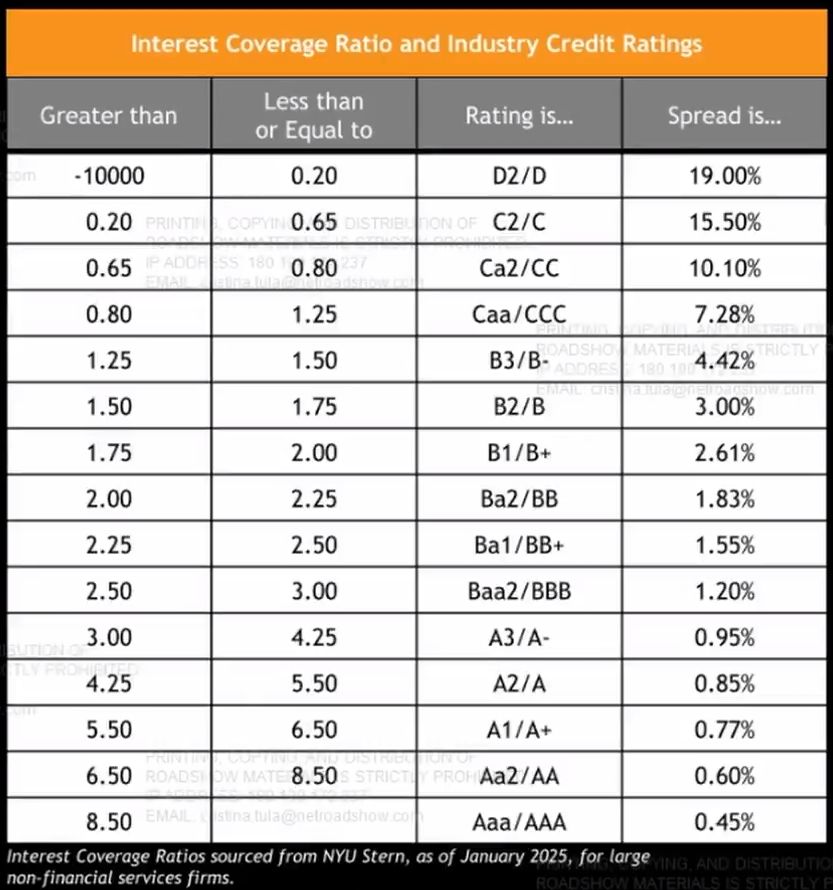

S&P Global gave Strategy ($MSTR) a B- issuer credit rating today. Five reflections based on this: 🟠 Obviously, $MSTR can now issue debt, which opens up more sources of capital. A couple of considerations around that: • B- is midway in the junk grade range, so buyers will be limited to those who can warehouse this kind of risk. This still leaves out the whales - pension funds, insurers, etc. • Debt issued by $MSTR can be higher or lower than the issuer rating. To get a higher rating, they can lean on seniority and offer bitcoin as actual collateral (not just as lip service, like now). • The catch is, something then has to be junior enough to average out to the B-. This means some of the prefs will likely become the lowest type of junk, or worse. • The coupon will likely be in the 8-10% range, based on comparables. 🟠 A credit rating could help with S&P 500 inclusion. The committee looks for financial soundness, and this is an attestation of that. 🟠 Strategy had the exact same rating of B- in 2024 [1], before Saylor had it withdrawn. [2] I suspect Saylor thought he would get a better rating this time around, but that did not happen. Despite having three times as much bitcoin as then, and tens of billions in paper gains. He can't be happy ... Also, this makes his claim of this being "the first-ever rating of a Bitcoin Treasury Company by a major credit rating agency" quite peculiar - it was literally S&P rating the same (Micro)Strategy a year ago. Does Saylor have dementia? 🟠 I strongly encourage people to read the actual public note from S&P. [3] There is a lot of delusional thinking about bitcoin being "pristine collateral," $STRC offering an "iPhone moment," and "torque" providing "amplification." This note confirms that the price of prefs has been signaling for a while - the financial world does not care for Saylorisms. If Strategy wants to raise money in size from capital markets, it needs to address the concerns in this note. 🟠 Finally, the response to this rating is a litmus test for the IQ level of the FinTwit furu you follow. If their response was "wow, congrats for being the first!" or even worse, "they've been robbed - rating should have been much higher," they are no better than a relatively regarded parrot incapable of value-added thinking. Choose your brain trust wisely. CC: @saylor, @CJ_Bitcoin, @SPGlobal [1] spglobal.com/ratings/en/reg… [2] spglobal.com/ratings/en/reg… [3] spglobal.com/ratings/en/reg…

Such a disappointing 42nd episode, which also marks the one-year anniversary of TN. Claims STILL being made: • "We're early" • "Folks don't understand BTCTC innovations" • "Risk is massively mispriced" The reality is: • BTCTCs have speed run through the flywheel phase due to ~200 shitcos and runaway dilution. • TN continues to be impressed by rather mundane TradFi tools, which is also why they don't understand when they are front run. • The market is pricing risk accurately - equity paper is being serviced by issuing future equity because there’s no real cash flow to sustain it otherwise. This should really be obvious to everyone in the space by now. @punterjeff is totally tone deaf to all this, but I'm a bit surprised the more level headed @nithusezni and @TimKotzman are going along with it.

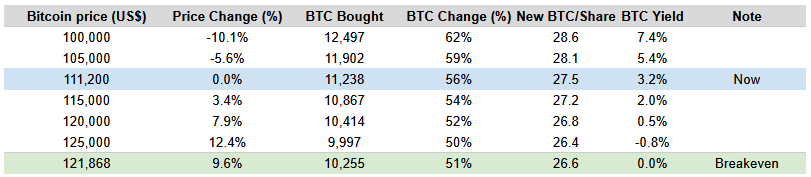

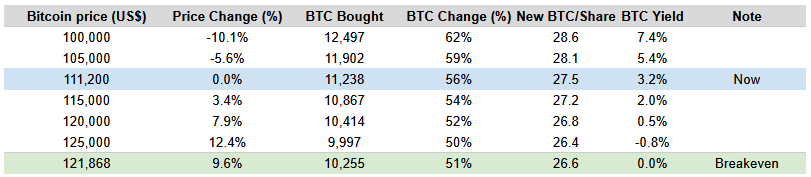

With the US$1.4B raised, 3350 / $MTPLF will see a measly bitcoin yield of +3%, despite a +56% increase in its BTC holdings, as deal terms increase shares outstanding by 51%. Very disappointing, to say the least. If bitcoin price increases by 9.6% in the next 9 days before @Metaplanet_JP is able to buy the good stuff, we end up with ... negative yield. 🤯

$SATA looks delicious for potential buyers: ✅ Dividend is 12% p.a., paid monthly ✅ Like $STRC, dividend will adjust to keep price in a $95-$105 range ✅ IPO might be in the $75-$80 range (15-16% yield) ✅ There's a one year reserve - $ASST will ring-fence $12/sh It's less savory from @strive's point of view. Some considerations: ❗️ An effective IPO rating of 15-16% corresponds to a "CC" rating ("highly vulnerable or near default"). Which makes sense, given the absolute lack of anything resembling income for Strive. ❗️ Like STRC, I suspect the market will require the same kind of yield to reach near-par, given the company's outlook is not expected to change in short order. Thus, yield will likely continue to be around 15%, even though its starting out at 12%. Implying a bunch of +25bps monthly dividend adjustments after the IPO. ❗️ To be fair, Strive didn't have much of a choice between this and the ATM, as $ASST is pretty much capped at $1.35 as long as the warrant overhang remains. ❗️ Some may see the yield being 150 bps higher than $STRC as trying to gain market share with competitive pricing. I think it's more a recognition of the sober reality of the company on part of the management. ❗️ It was funny and sad to see them providing lip service to Bitcoin rating, which nobody will care about until the bitcoin actually backs the paper under non-liquidation scenarios.. Tl;dr: $SATA seems to be a great meal from a shaky restaurant. Enjoy!

Eagerly waiting to see if @gerovich extends the suspension on MSW exercises that will otherwise be lifted on Oct 1. 3350 price is currently > 20% below the EP of 637 yen. Without an extension, the anticipated announcement for the remaining 5K BTC will likely be for naught. Why? For the simple reason that many would not bother buying into 3350 / $DN3 / $MTPLF, knowing EVO will club the price down to 637 yen like a baby seal every time it prairie dogs above that level.

$SATA priced at $80 for IPO. I.e. 15% yield. Should price rise to $95 as intended, that's 18.75% return on capital. $ASST will likely have to juice yields to get there. 15% clearing puts yield on $80 at 17.81%. 33.75% to 36.56% in 1 year makes for quite the delicious deal. Source: x.com/strive/status/…

Most engaged tweets of Obsequious Knight of the Realm of The Ni

Got bad news for @Strive ( $ASST) investors - y'all are royally f*cked for a long while. Tl;dr: • 100% of shares from the warrant exercises and 98.9% of the existing commons have been registered for sale. • $1.35 could end up being the price ceiling for a while. This is based on the 424(b)(7) prospectus [1] filed on Oct 10 that allows shares from the PIPE unlock to be sold. Details below. Number of shares and warrants: • 449,696,631 shares of Class A outstanding as of Oct 1 • 177,246,462 unexercised Pre-Funded Warrants w/ EP of $0.0001 per sh • 545,629,627 unexercised Traditional Warrants w/ EP of $1.35 per sh Once all the warrants are exercised, here's how the numbers for Class A breaks down: • Beneficially Owned: 1,296,210,145 • Registered for Sale: 1,283,904,392 (99%) • Not for Sale: 13,870,799 (1%) In summary: • 100% of both warrant types have been registered for sale • Only 1% of the Class A commons have NOT been registered for sale (Ignoring Class B and options since not relevant to this analysis.) What does this mean? Based on my experience with PIPE unlock plays over the years, I think: 1⃣ Share price will remain depressed for the foreseeable future since more shares than are currently outstanding are waiting to be dumped. 2⃣ The 177M Pre-funded Warrants will likely be dumped first since EP is effectively $0. 3⃣ The 545M Traditional Warrants will see dumps as price rise above the EP of $1.35. Even if the holders do not dump, market will anticipate it and front run by selling longs and loading shorts. (e.g. Metaplanet.) 4⃣ Credit to CEO @ColeMacro for not registering his shares for sale. 5⃣ Shame on CFO @BenPhiat for registering his for sale. What's the rush, man? 6⃣ Management will claim that "registering to sell" doesn't necessarily signal "intent to sell," let alone an impending sale. Every management team says this. They have to. We were not born yesterday and have seen this play out before. I wonder which of $ASST or $NAKA remains in purgatory longer. Sources: [1] #tSUM">sec.gov/Archives/edgar…

Thanks for sharing this, Simon (@gerovich)! While all true, I do feel like this misses the key drivers of the share price malaise and so will do little to assuage the market. Especially since there are no concerns about @Metaplanet_JP 's balance sheet that I am aware of. In my view, the main reasons for the malaise are: ❗️Terrible sentiment around BTCTCs - too many shitcos diverted too much money, and too many people are hurting ❗️PTSD among Metaplanet shareholders from the constant dilution by EVO in the 5-15% average volume range ❗️Price approaching a major accumulation zone in the 200-500 yen range, which is likely triggering prudent capital preservation moves ❗️Professional shorts to day traders leading the charge on selling to take advantage of the above I understand your options are more limited than usual at this time: ⚠️ mNav too low - it doesn’t make sense to issue now ⚠️ Can’t issue anyway because the price is below the MSW exercise price ⚠️ Preferred shares are not in place yet ⚠️ Convertible bonds will likely hurt the price further ⚠️ Short-term zero-interest loans will likely be too small ⚠️ Buybacks will really stink, after having gone through the trouble of doing a large international offering Here's a suggestion for you to consider: suspend the MSW exercises indefinitely, and at least until the end of the year. Please hear me out. 😃 Reasons this might have an outsized impact: ✅ It doesn’t cost you anything in the near term, as the price is well below 637 yen. ✅ Shareholders will stop worrying about MSW suppressing the price the moment it exceeds 637 yen, which caps their upside (or breakeven ...). ✅ Shorts and traders will lose the MSW pin that has provided a reliable ceiling for the past few months (despite being intended as a floor). ✅ It gives the shares room to breathe, allowing mNav to rise to 2x or even 3x, compared to the current non-accretive 1.1x. You could also consider: 1⃣ Detailing the process and timeline for launching preferred shares - many are eagerly awaiting this. 2⃣ Discussing uplisting to Nasdaq to address concerns that the Japanese market is too small for Metaplanet’s ambitions. 3⃣ Management purchases of 3350 stock to demonstrate confidence in it I’m sure you’re as disappointed as shareholders are with this price action. Especially after the sizeable international placement, the impact of which is being overshadowed by market conditions. Nevertheless, there’s a time for action and a time to bide one’s time and conserve resources. Perhaps now is the time to let the stock breathe and prepare for the other side of this downturn. CC: @DylanLeClair_ @Shinpei3350 @juriwatanabe_ Thanks to @surfcleanlines for helpful suggestions!

With the international offering complete, @Metaplanet_JP reached its EoY milestone three months early, but at a significant cost to shareholders. The yield was only 6%, far below the 25% target. This was largely due to the +60% dilution compared to the 33% target, even though the BTC stash grew by 70% against the 66% target. Incidentally, as of today (Oct 1), the MSW suspension has been lifted. With prices 20% below the MSW exercise price of 637 yen, dilution won't happen just yet. However, the prospect of this occurring if the price rises above this level is likely bearish for MP price action. This is deeply disappointing for those viewing MP as a leveraged BTC play: • Yields are highest when the BTC stash is small. The minimal yield gain from increasing the stash from 18.1K to 30.8K is unfortunate, rendering the international offering a wasted opportunity for shareholders. • Leveraged plays rely on the ability for price to run under favorable conditions. The possibility of getting clubbed down hard by a dilution mechanism only 20% through also makes for a unsavory setup. Investors relying on faith in management or Bitcoin, or those mistaking this for a straightforward Bitcoin play, will likely remain undeterred. For the rest of us, this is strike two out of three.

Metaplanet’s stock price (3350 / $MTPLF) appears to be stabilizing. After declining 33% below the MSW exercise price (EP), we are finally seeing some green days with solid volume. This makes it is an opportune moment for @Metaplanet_JP to prepare for the next chapter of its capital markets adventure. To that end, here are seven recommendations for @gerovich , @DylanLeClair_ and @Shinpei3350 to consider executing on in short order. 1⃣ Uplist to Nasdaq. The TSE is too small for Metaplanet’s ambitions. To achieve a target of 100K BTC by the end of 2026, MP would need to acquire ~1K BTC per week. At a current stock price of $3/sh, this equates to issuing roughly 33M shares weekly, assuming Bitcoin at $100K. At $10/sh (mNav of ~3), this drops to 10M shares weekly. MP's avg volume of ~50M shares cannot sustain such issuance without tanking price, as we have seen from the MSWs. On the other hand, uplisting to Nasdaq will provide the necessary liquidity. 2⃣ Avoid public targets. While transparency is commendable, disclosing specific targets, such as the MSW EP or pricing methodologies, enables sophisticated market participants to exploit this information by front running it. E.g. the MSW EP inadvertently became a ceiling due to market trading dynamics instead of the floor it was intended to be. 3⃣ Size appropriately. Ambitious schemes, such as the two 555M Plans, feel good in a big-swinging-d*ck kind of way, but have destabilized share price because they were wildly oversized. Consider the following: a) Management paused the initial 555 Plan with 72% unused due to its adverse impact on the share price. b) The international 555 Plan was so large that institutional shorting drove the stock price 200 yen below management’s expectations, forcing a deal that delivered minimal shareholder yield. Smaller, incremental capital raises allow the market to absorb issuances without such disruption. It won't feel sexy, but it'll get the job done much better. 4⃣ Use convertible bonds. Simon has noted his dislike of them a few times. I continue to think this is a mistake. Reasons: • With mNav < 1, CBs are one of the very few things that can jump start the flywheel. • By not utilizing CBs, MP misses the opportunity to capitalize on its elevated IV of 150%-200%. • If issued in moderate amounts, CBs should minimize short-term shorting pressure compared to MSWs, which have triggered persistent and significant shorting. 5⃣ Sell preferred equity for what they are - leverage. The colorful graphs on torque are cute, but they mean little in the real world and are certainly not the silver bullet many make them out to be. 20% of prefs on the balance sheet provide 25% leverage. That's it. 6⃣ Park the Saylorisms. Bitcoin is not pristine collateral. Neither is it the future of the capital markets. Nor will take over money. These claims may resonate with Bitcoin maxis but risk alienating mainstream investors. Instead, position Bitcoin as a superior savings instrument, emphasizing its role as a hedge against inflation and currency devaluation. This pragmatic messaging aligns with market demand from the masses. 7⃣ Most importantly, prioritize yield enhancement. Without yield, Metaplanet is just a slightly leveraged bitcoin ETF. It is better not to buy bitcoin if it is not yield enhancing, especially since it gets harder to stack yield as the size of the bitcoin stash increases. Management should keep in mind that shareholders are bruised from the rather disastrous MSWs and IO. A third strike is best avoided. I do believe these seven recommendations will go a long way toward that.

Such a disappointing 42nd episode, which also marks the one-year anniversary of TN. Claims STILL being made: • "We're early" • "Folks don't understand BTCTC innovations" • "Risk is massively mispriced" The reality is: • BTCTCs have speed run through the flywheel phase due to ~200 shitcos and runaway dilution. • TN continues to be impressed by rather mundane TradFi tools, which is also why they don't understand when they are front run. • The market is pricing risk accurately - equity paper is being serviced by issuing future equity because there’s no real cash flow to sustain it otherwise. This should really be obvious to everyone in the space by now. @punterjeff is totally tone deaf to all this, but I'm a bit surprised the more level headed @nithusezni and @TimKotzman are going along with it.

With the US$1.4B raised, 3350 / $MTPLF will see a measly bitcoin yield of +3%, despite a +56% increase in its BTC holdings, as deal terms increase shares outstanding by 51%. Very disappointing, to say the least. If bitcoin price increases by 9.6% in the next 9 days before @Metaplanet_JP is able to buy the good stuff, we end up with ... negative yield. 🤯

This new 555M-share overseas offering from @Metaplanet_JP is a game changer! Initial calculations suggest we see this by end of Sep '25: • 18K-28K BTC bought (currently at ~18K) • BTC Yield of 40%-80% • Share price of $9-$17 (+50% - +180%) Summary of what we know of so far: • 555M shares will be offered to qualified institutional buyers, with 180M guaranteed and 375M additional. • Underwriters are Morgan Stanley and Cantor Fitzgerald; others may be involved • Shares will be priced at 90%-100% of the TSE closing price between Sep 9 and Sep 11 • MSW exercises will be suspended between Sep 3 and Sep 30 Two scenarios are attached in the thread - a conservative one assuming no change in mNav or share price, and a bullish one that assumes an mNav of 3.0 and share price of $9 when the offering closes. All calculations are my own. I know you can't say much about this given legal restrictions, but know that the community is super excited by this, @gerovich @DylanLeClair_ @juriwatanabe_ @Shinpei3350! Congratulations and godspeed. (1/4)

Hi @gerovich and @DylanLeClair_ , Congrats again on closing the international offer! It's amazing that it will increase @Metaplanet_JP's bitcoin holdings by ~50% in one go - a quite an amazing feat! Since the quiet period is ending soon and you've expressed an interest in engaging shareholders, I'm taking the liberty of penning some questions for you. I would be delighted to hear back. There are some things that one cannot control. Price action and sentiment around BTCTCs are two of the main ones. Nevertheless, some things are under our control, and I'd love to hear what you consider possible to sustain and enhance shareholder value. 1. Would you consider slowing down the MSW exercises by EVO? Dumping 5-15% of average volume week after week [1] has taken a toll on the share price, emboldened shorts, and has not helped sentiment. Even a sustained 1-2% dilution can arrest stock prices, and this is many times that. The negative impact on shareholder value has been palpable, as accretion to Bitcoin/share (i.e., yield) has taken a hit. 2. I commend you for stopping the international offering on the very first day, as the price was in freefall. Nevertheless, I felt that what shareholders saw from a yield point of view deviated significantly from targets you had shared before. The Q4 projections you had shared during the earnings call were: • 66% increase in BTC holdings, which would come from 33% additional shares, providing a 25% yield. What we got instead was: • 56% increase in BTC holdings coming from 51% new shares, providing a ~3% yield [2]. What went wrong? Is there a plan to make up this difference? 3. What plans might you have for tapping additional markets in a way that is shareholder value-enhancing? Any plans to uplist on Nasdaq? Japan is clearly too small for Metaplanet's ambitions. The average trading volume regularly puts Metaplanet at the daily leaderboard, and yet it cannot sustain the level of sales the EVO Fund undertakes already. 4. Do you have contingency plans in case mNav hits 1 or lower? The flywheel doesn't quite work then, and as we have seen, BTCTCs are at the mercy of market sentiment to recover. Would you be open to issuing convertible bonds [3] to jumpstart the engine again? Would you consider selling BTC to buy back shares? Or would you bide your time and use CSP income while the market recovers? Thank you for entertaining these direct questions. I continue to be very optimistic about Metaplanet, and like any pioneering enterprise, I understand pivots are needed during the journey to the final destination. Wishing you the best of luck! [1] x.com/NitherDither/s… [2] x.com/NitherDither/s… [3] x.com/NitherDither/s… **Background:** US shareholder who opened the first tranche in early May, member of the Metaplanet Dojo, and quant who can't stop analyzing MP because of the amazing quality and quantity of data available! CC: @Shinpei3350 , @juriwatanabe_

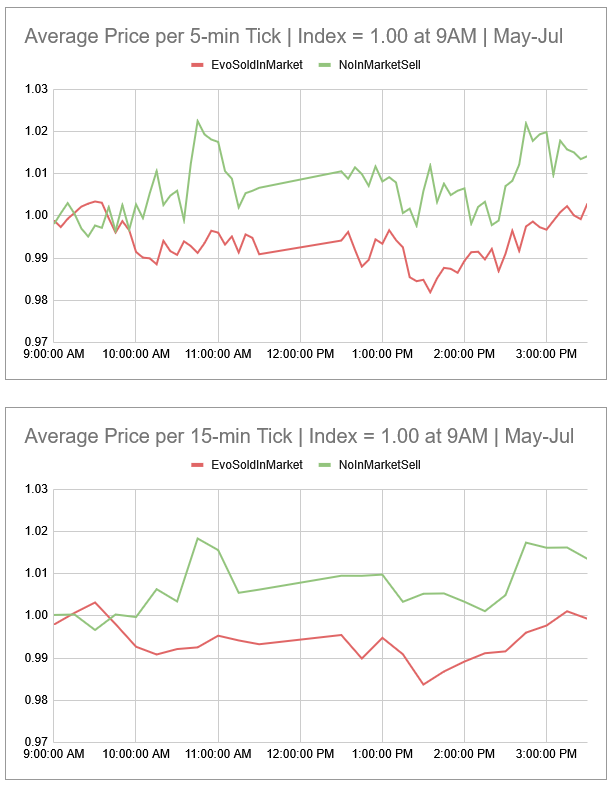

Some more data on the negative impact of EVO selling shares on the price of 3350 / $MTPLF. Purchased tick-level data from @JPX_official_EN for May-Jul, indexed prices to 1.00 for every day's start, rolled it up to 5-min and 15-min buckets, and presenting the average price in those buckets here. The difference in price trajectory is glaringly obvious. (1/3)

In all likelihood, $ASST/@strive will pump for a bit, thanks to @mikealfred's endorsement. In the longer term, the subsequent dump will prolong the negative sentiment in the space that its 90% collapse - along with those of $NAKA/@nakamoto and $SQNS/@Sequans - has engendered. This is why one can't have nice things.

Good read from @jvisserlabs, making the case that #Bitcoin's sideways grind amid rallying markets is a "silent IPO," with early holders selling to institutions/retail via ETFs to lock in gains after surviving much volatility over the years. A good but incomplete read, imho, without considering other factors at play. Otherwise one would be left with the impression that the current price action not a sign of weakness, but maturation into stable asset - also a claim that Jordi makes. Some of the other factors that I think are contributing significantly to bitcoin's lackluster price action: 🟡 Price tends to remain steady unless there is a catalyst to move it. We enjoyed a few over the last 2 years: ETFs that tapped traditional buyers, the election of a crypto-friendly admin, and the explosion of BTCTCs that raised capital to add to demand. We haven't had a new catalyst in a few months, and there is none on the horizon. 🟡 Spot ETFs have seen net outflows on many days these last few months, often hundreds of millions at a time. [1] 🟡 The markets are nervous, given tariffs, concerns around inflation and labor markets, political discord, high valuations etc. AI is running on FOMO and #Gold has been the designated risk-off asset, but bitcoin does not enjoy a similar designation. If I had to rank these factors by importance, I don't think I would put this "silent IPO" as the most potent. And therefore, think our expectations of price action should be tempered by how the other three resolve, more than what the old timers are doing. [1] coinglass.com/bitcoin-etf or farside.co.uk/btc/

$SATA looks delicious for potential buyers: ✅ Dividend is 12% p.a., paid monthly ✅ Like $STRC, dividend will adjust to keep price in a $95-$105 range ✅ IPO might be in the $75-$80 range (15-16% yield) ✅ There's a one year reserve - $ASST will ring-fence $12/sh It's less savory from @strive's point of view. Some considerations: ❗️ An effective IPO rating of 15-16% corresponds to a "CC" rating ("highly vulnerable or near default"). Which makes sense, given the absolute lack of anything resembling income for Strive. ❗️ Like STRC, I suspect the market will require the same kind of yield to reach near-par, given the company's outlook is not expected to change in short order. Thus, yield will likely continue to be around 15%, even though its starting out at 12%. Implying a bunch of +25bps monthly dividend adjustments after the IPO. ❗️ To be fair, Strive didn't have much of a choice between this and the ATM, as $ASST is pretty much capped at $1.35 as long as the warrant overhang remains. ❗️ Some may see the yield being 150 bps higher than $STRC as trying to gain market share with competitive pricing. I think it's more a recognition of the sober reality of the company on part of the management. ❗️ It was funny and sad to see them providing lip service to Bitcoin rating, which nobody will care about until the bitcoin actually backs the paper under non-liquidation scenarios.. Tl;dr: $SATA seems to be a great meal from a shaky restaurant. Enjoy!

Eagerly waiting to see if @gerovich extends the suspension on MSW exercises that will otherwise be lifted on Oct 1. 3350 price is currently > 20% below the EP of 637 yen. Without an extension, the anticipated announcement for the remaining 5K BTC will likely be for naught. Why? For the simple reason that many would not bother buying into 3350 / $DN3 / $MTPLF, knowing EVO will club the price down to 637 yen like a baby seal every time it prairie dogs above that level.

This roundtable was such a breath of fresh air. Balanced, knowledgeable and not pumping anything. Well done, @mc_khristina , @ZynxBTC, and @Anders_! Quite the contrast to promoters like @natbrunell and @TimKotzman who offer little beyond hosting talking heads who want to pitch their product/service. Or entertainers like @AdamBLiv or the folks at @MSTRTrueNorth who often fail to distinguish fact from fiction.

People with Analyst archetype

Investor&trader | gmgn.ai | okx.com | tg channel t.me/timotimo007

老朋友叫我“画师”,主要做 $BTC 技术\数据分析和量化交易,提供各种刁钻角度看市场,用时间做杠杆,被造谣开直播时会砸盘。 正在猛学Web3应用层!#Kaito #Sidekick #Virtual #OKX CEX:okx.com/zh-hans/join/2…

(전)캘리그램, (현)TG DEX하는 냥버거채널 이블린 킨드레드 부이 베이스 뱅커 브레비스 오픈마인드 고카이트 탈루스 왈루스 레스고 AI ZK 전문으로 야핑합니다. 사용후기/최신정보/DEX관련 위주로 글쓰는 편.

Jesus follower

Consumer, PE, & Market Research | Partner @BCG | Ex BigLaw | Angel Investor | Views are mine alone

DeFi Connoisseur (On-Chain Arc).

知行合一,不忘初心,just a simple trader。 @WinTradersFNF

Web3 研究所 | Meme 研究所 @memewizd | 长期主义 | 内容创作者 | NFA & DYOR | Magic Meme 🪄➜ t.me/GMGN_bsc_bot?s…

Product @RootDataCrypto | DeFi & On-chain Data | Prev. data @Gradient_HQ @EigenPhi

engineering @TrustVanta | @vouch_group @stripe @azure @amgen @newegg | “In God we trust; all others must bring data.”- Deming | dadOps 2x | views my own | 还没赢

职业:Web3 游牧民族 主营业务:在Discord里当保安,在Twitter里当侦探,在Telegram里潜水。 日常:白天研究白皮书,晚上被K线图研究。 最大成就:成功分清Coin和Token的区别,并成功把所有的Airdrop都卖在了最低点。 人生格言:To the moon不敢想,只求别Rug Pull(跑路)

Explore Related Archetypes

If you enjoy the analyst profiles, you might also like these personality types: