Get live statistics and analysis of Amber Illig's profile on X / Twitter

gp @thecouncilcap | fmr Cruise @Snap @Apple @EliLillyandCo | mom 👶🏼🐶 | @purdue engineer.

The Entrepreneur

Amber Illig is a sharp-minded venture capitalist and engineer with a knack for spotting game-changing startups, especially in healthcare and manufacturing. She blends deep technical expertise with an investment mindset, actively shaping the future of foundational industries through savvy funding and insight. A proud mom and Purdue engineer, Amber balances business leadership with a grounded, human approach.

Amber’s tweets are so steeped in industry jargon that they sometimes feel like a PhD seminar—great for insiders, but enough to make your grandma wonder if she accidentally signed up for tech therapy instead of Twitter scrolling.

Amber’s biggest win is founding and leading The Council Fund, where she’s driving a pioneering mission to back and support startups that will finally bring software-driven transformation to America’s most stubborn industries.

Amber's life purpose centers on transforming foundational industries—like healthcare and manufacturing—by supporting and investing in startups that harness software and cutting-edge technologies to revolutionize traditionally complex, outdated sectors.

She believes in the power of technology to solve real-world problems, especially in high-stakes, nuanced fields; values due diligence and pragmatic investment approaches; and champions the importance of continual learning and collaboration within her community and portfolio companies.

Amber's strengths lie in her technical background fused with investment savvy, her ability to connect complex industry insights with emerging startup trends, and her commitment to helping founders scale businesses that challenge the status quo.

Her deep focus on complex industries might make her tweets and ideas less immediately accessible to casual audiences, potentially limiting quick viral engagement or broad appeal without some added simplification or storytelling flourish.

To grow her audience on X, Amber should share more behind-the-scenes stories from her factory and healthcare floor visits and translate her expert insights into relatable narratives or mini case studies. Engaging more directly with startup founders and using threads to unpack big industry shifts would showcase thought leadership while inviting wider participation.

A fun fact about Amber is that she was once deeply involved in physically walking factory floors across medical devices, injection molding, and insulin formulation, giving her firsthand experience that fuels her enthusiasm for manufacturing investments.

Top tweets of Amber Illig

When I invest in a new co, I always remind our team & LPs to follow the founders on social. @noxmetals has been special in this way. Manufacturing is an area I'm personally so jazzed about after years of walking factory floors for medical devices, plastic injection molding, insulin formulation & filling, and consumer electronics. But it's not glamorous, and if you haven't felt your heart race at the power of physical production in person, it may be hard to get excited about. Others on our team have different focus areas and experiences, and we tend to stay in our lanes. A few weeks after the rest of the team started following Zane, they're amped up and even more excited about the investments we make in the space. Highly suggest following @zanehengsperger if you want to learn more about manufacturing and steel – no one builds in public and breaks down a nuanced industry better!

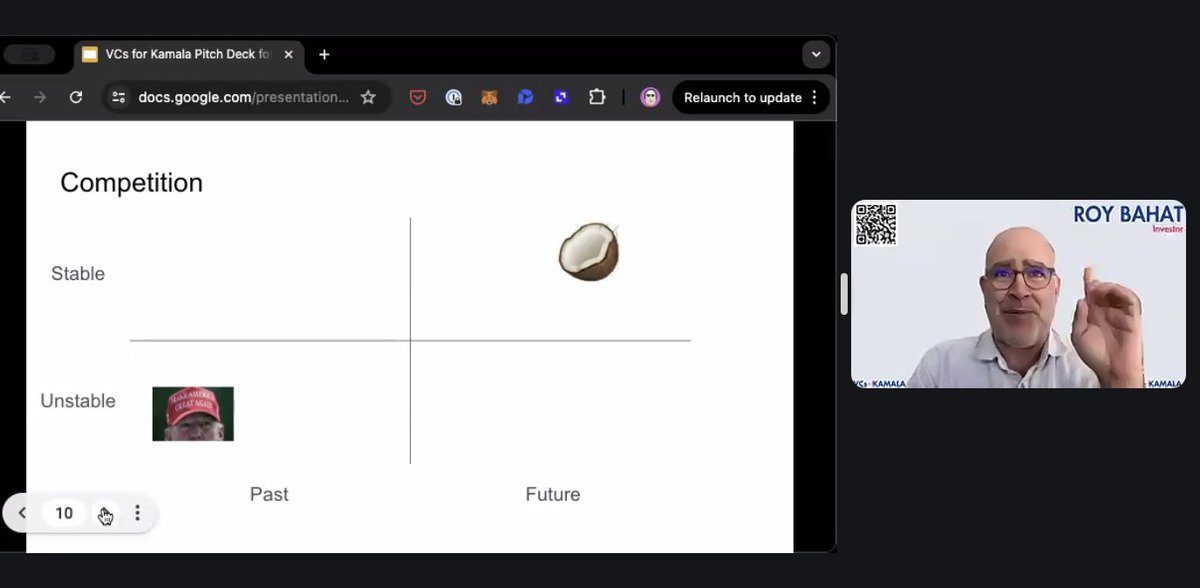

In 2011, Marc Andreessen famously proclaimed, “Software is Eating the World.” The thesis was that internet startups were “poised to take over large swathes of the economy,” and make all the failed dreams of the dot-com era (Act I) finally come true. Andreessen was at least half right. In the decade that followed (Act II), software companies like Apple, Microsoft, and Google ascended to become the most valuable in the world. Billions of people did indeed buy smartphones, as predicted. And entire industries—news, entertainment, travel, communications, retail, productivity, finance, and more—were swallowed whole by software. But software still hasn't eaten everything. The industries that form the foundation of the American economy—healthcare, logistics, construction, transportation, manufacturing, etc—are still waiting for the revolution. Just ask any consumer trying to find the right specialist at a hospital, or get insurance for a leaky roof. All across America, we are confronted with the type of antiquated, complex bureaucracies that we thought software would fix. The pandemic revealed how brittle our systems are. It’s now clear our foundations are crumbling. But there’s good news: we are now on the precipice of Software's Third Act, in which startups will finally deliver on the dream of transforming the economy’s foundational industries. Identifying, backing, and supporting these companies is my life’s work, and inspires everything we do at The Council Fund. In the full essay (linked below), I cover: ⏳ why Act III is finally the time for software to transform essential industries 🦿 which founders will have a leg up in Act III 🌁 why Silicon Valley will still be center-stage in Act III 🧗 how companies can scale vertically vs horizontally 🌟 how we @thecouncilcap support them

Great seeing @TurnerNovak today! Always wonderful to swap tips w/other solo GPs as we grow our firms. We talked about holding onto our own areas of conviction throughout hype cycles. True alpha comes from looking where no one else is paying attention 💡 And yes, the meme king does have Serious Opinions!

Big announcement below! 👇 Let's talk about the current state of GP-LP affairs: 🤯Emerging VC managers have absolutely exploded over the past 5 years. 📈 At the same time, more and more data has surfaced that shows that emerging VC firms tend to outperform larger, established firms. 🤔 All of this has made it intriguing but tough for LPs to know where to direct their attention. 🛍 GPs frequently meet LPs at conferences who are window shopping but not committed to the asset class or emerging managers. 🧾 And both crews get overwhelmed by transactional convos. So @sydneypaige10 and I created Abundance. Abundance is a private, nomination-based retreat for active LPs and top emerging GPs to form new experiences together & build lasting relationships. Why Abundance? Abundance is knowing that there is more than enough for more than one to succeed. And a single win within a community is a win for the community itself. The journey of an emerging VC manager from 1st close to final close or Fund 1 to Fund 2 is (1) communal and (2) requires an abundant mindset. LPs look for structure and confidence to feel comfortable investing in early VC firms. Yet many of the feeds we scroll and conferences we attend reinforce inherent power dynamics and transactional thinking, which allows scarcity mindset to creep in for emerging GPs. Some of the best events I’ve attended have been intentionally non-transactional, e.g. Camp Hustle, Recast Summit, and other GPs’ AGMs. The fundraising success stories we see usually involve a community (usually of other GPs & LPs) coming together to support and open doors for the emerging GP. We designed Abundance to be an immersive gathering that fosters these connections. Starting tonight, ~100 GPs and LPs are descending upon Seattle for the inaugural Abundance retreat. This has been under wraps for months and I can’t wait to see it come to life! Thanks in advance to our awesome sponsors who were the earliest believers in this vision. @sydecario @awscloud @AWSstartups Gunderson & Zelda Ventures. & logo design by @Illig. Presented by @TheCouncilCap & @SymphonicVC.

Most engaged tweets of Amber Illig

Big announcement below! 👇 Let's talk about the current state of GP-LP affairs: 🤯Emerging VC managers have absolutely exploded over the past 5 years. 📈 At the same time, more and more data has surfaced that shows that emerging VC firms tend to outperform larger, established firms. 🤔 All of this has made it intriguing but tough for LPs to know where to direct their attention. 🛍 GPs frequently meet LPs at conferences who are window shopping but not committed to the asset class or emerging managers. 🧾 And both crews get overwhelmed by transactional convos. So @sydneypaige10 and I created Abundance. Abundance is a private, nomination-based retreat for active LPs and top emerging GPs to form new experiences together & build lasting relationships. Why Abundance? Abundance is knowing that there is more than enough for more than one to succeed. And a single win within a community is a win for the community itself. The journey of an emerging VC manager from 1st close to final close or Fund 1 to Fund 2 is (1) communal and (2) requires an abundant mindset. LPs look for structure and confidence to feel comfortable investing in early VC firms. Yet many of the feeds we scroll and conferences we attend reinforce inherent power dynamics and transactional thinking, which allows scarcity mindset to creep in for emerging GPs. Some of the best events I’ve attended have been intentionally non-transactional, e.g. Camp Hustle, Recast Summit, and other GPs’ AGMs. The fundraising success stories we see usually involve a community (usually of other GPs & LPs) coming together to support and open doors for the emerging GP. We designed Abundance to be an immersive gathering that fosters these connections. Starting tonight, ~100 GPs and LPs are descending upon Seattle for the inaugural Abundance retreat. This has been under wraps for months and I can’t wait to see it come to life! Thanks in advance to our awesome sponsors who were the earliest believers in this vision. @sydecario @awscloud @AWSstartups Gunderson & Zelda Ventures. & logo design by @Illig. Presented by @TheCouncilCap & @SymphonicVC.

In 2011, Marc Andreessen famously proclaimed, “Software is Eating the World.” The thesis was that internet startups were “poised to take over large swathes of the economy,” and make all the failed dreams of the dot-com era (Act I) finally come true. Andreessen was at least half right. In the decade that followed (Act II), software companies like Apple, Microsoft, and Google ascended to become the most valuable in the world. Billions of people did indeed buy smartphones, as predicted. And entire industries—news, entertainment, travel, communications, retail, productivity, finance, and more—were swallowed whole by software. But software still hasn't eaten everything. The industries that form the foundation of the American economy—healthcare, logistics, construction, transportation, manufacturing, etc—are still waiting for the revolution. Just ask any consumer trying to find the right specialist at a hospital, or get insurance for a leaky roof. All across America, we are confronted with the type of antiquated, complex bureaucracies that we thought software would fix. The pandemic revealed how brittle our systems are. It’s now clear our foundations are crumbling. But there’s good news: we are now on the precipice of Software's Third Act, in which startups will finally deliver on the dream of transforming the economy’s foundational industries. Identifying, backing, and supporting these companies is my life’s work, and inspires everything we do at The Council Fund. In the full essay (linked below), I cover: ⏳ why Act III is finally the time for software to transform essential industries 🦿 which founders will have a leg up in Act III 🌁 why Silicon Valley will still be center-stage in Act III 🧗 how companies can scale vertically vs horizontally 🌟 how we @thecouncilcap support them

When I invest in a new co, I always remind our team & LPs to follow the founders on social. @noxmetals has been special in this way. Manufacturing is an area I'm personally so jazzed about after years of walking factory floors for medical devices, plastic injection molding, insulin formulation & filling, and consumer electronics. But it's not glamorous, and if you haven't felt your heart race at the power of physical production in person, it may be hard to get excited about. Others on our team have different focus areas and experiences, and we tend to stay in our lanes. A few weeks after the rest of the team started following Zane, they're amped up and even more excited about the investments we make in the space. Highly suggest following @zanehengsperger if you want to learn more about manufacturing and steel – no one builds in public and breaks down a nuanced industry better!

People with Entrepreneur archetype

Founder of Astro 🧑🚀 | We install AI-based systems into established businesses. $30m+ in client results

Recruiting the future | Founder & CEO of engin | Father | Husband | Friend | Dog Dad 🐶|

AI expert. Technology enthusiast Sharing the latest in AI, ML and automation. Focusing on the future ️DM or mail - harpikcoder0@gmail.com

| Lawyer | crypto trader | tech enthusiastic

Founder @TraceFuse.ai | The Amazon Review Expert | E-commerce Strategist | Influencer Marketing Specialist | Keynote Speaker → linktr.ee/shanebarker

startups of history + history of startups // CEO @flowglad, YC W20

Co-founder @herostuffdotcom Previously @augusthealth @angellist @producthunt @google and @lightroom. More at kaigradert.com

Z世代,连续创业者,AI增强型开发者,ASI降临派,多个AI联合创始人,出海!做过电商,卖过课,卖过化妆品,倒腾过源码 结果导向! 极致利他!欢迎每一位朋友交流学习!专注,极致,口碑,敏捷

📱 Private members club for viral consumer app founders @consumerclub_ 💼 Prev @Google @YouTube @UMich

co-founder @tradekanon

$5k to $100k+ on Polymarket Join Polymarket - polymarket.com/?via=mango-las…

Explore Related Archetypes

If you enjoy the entrepreneur profiles, you might also like these personality types: