Get live statistics and analysis of Yashish | glucidly's profile on X / Twitter

i preach internet capital markets | building @LucidlyFinance | hyperliquid | iitr

The Entrepreneur

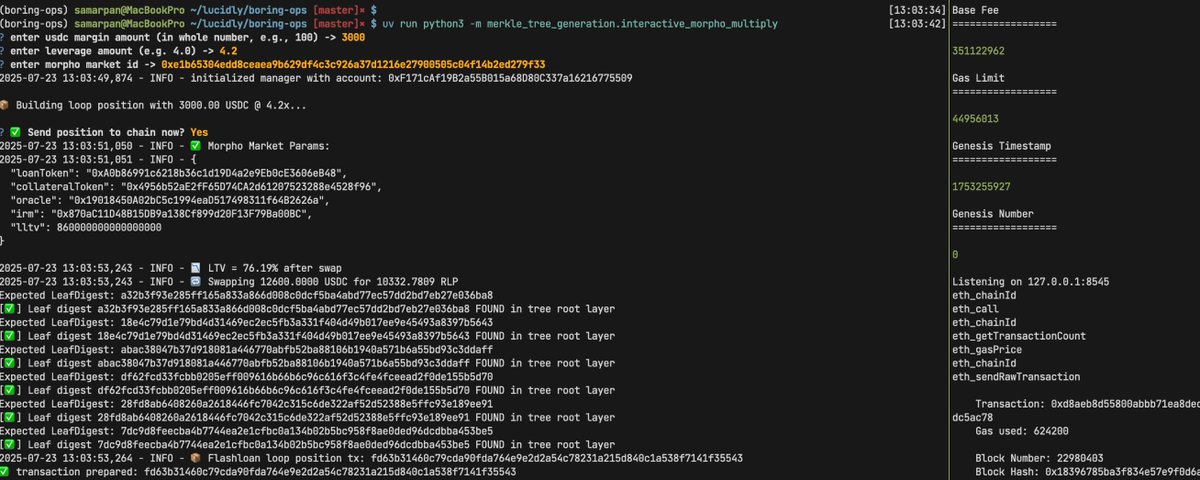

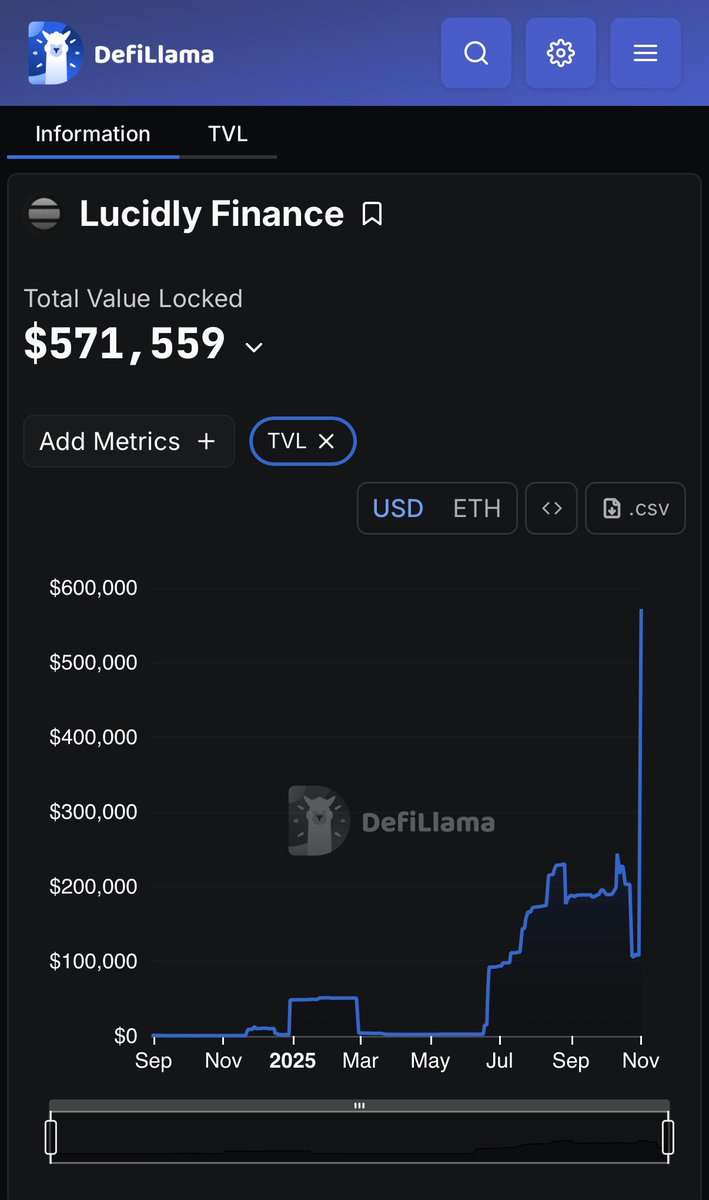

Yashish, aka glucidly, is a trailblazer in internet capital markets, steering the innovative ship at LucidlyFinance with a sharp focus on decentralized finance and full-stack capital deployment. He’s not just talking DeFi; he’s building next-level tools that blend traditional finance with cutting-edge blockchain tech. Always hustling, Yashish keeps a close eye on partnerships and pitches that elevate his startup into the spotlight.

Top users who interacted with Yashish | glucidly over the last 14 days

Yashish’s tweets are like secret developer tools—powerful but cryptic enough that even your high school math teacher would need a decoder ring to keep up. Maybe drop a glossary or two before you start hosting pitch demos in a galaxy far, far away!

Scoring a prime pitch slot for Lucidly's execution engine at Katana demo day in NYC demonstrates solid traction and recognition from heavyweight traditional finance institutions, validating his entrepreneurial vision.

To revolutionize the finance space by merging decentralized finance with traditional capital markets, making capital deployment smarter, more structured, and accessible through groundbreaking tech solutions.

Yashish believes that the future of finance lies in innovative, transparent, and structured digital capital markets that empower users through technology and incentivization. He values proactive collaboration, data-driven execution, and pushing the limits of financial engineering.

Visionary leadership in DeFi innovation, strategic networking with traditional finance, and building scalable financial infrastructure that addresses complex market needs effectively.

His high-tech jargon and deep dive into complex financial constructs may alienate casual audiences, possibly limiting broader mass appeal or engagement among less tech-savvy followers.

Simplify some of your messaging on X by breaking down complex DeFi concepts into relatable stories or analogies. Engage more with community Q&A sessions or bite-sized educational content to attract and retain a wider audience who may be curious but intimidated by the technical depth.

Yashish is actively engaged with traditional financial institutions while simultaneously pushing the envelope of DeFi innovation through Lucidly's unique execution engine and yield aggregation technologies.

Top tweets of Yashish | glucidly

We at @LucidlyFinance are looking to work closely with proactive yield farmers. You’ll be incentivised lucratively to join this anon. If you feel your industrial farming skills are unmatched and if given a high end data monitoring infra and capability to open async positions across any defi protocol any chain of your choice, you can execute this better than any bluechip defi curator, send us a 👋 My telegram is: @ bullishbeers

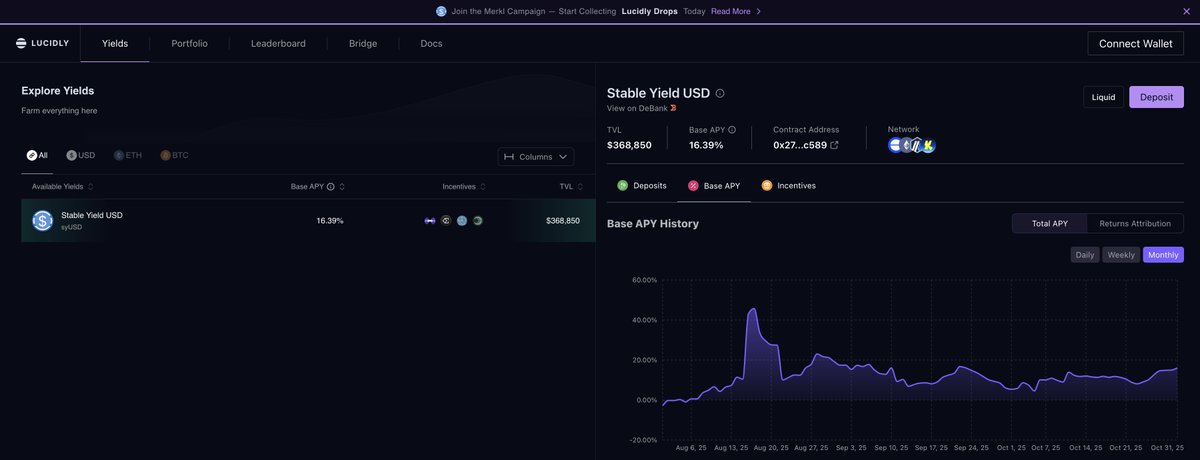

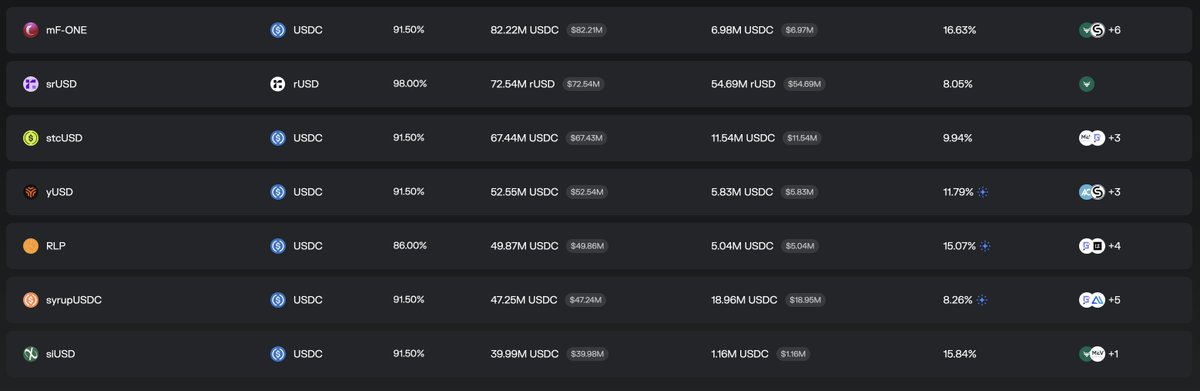

Over the past week, i took a deep dive into @avantisfi avUSDC as a source of yield for structured yield products. At @LucidlyFinance, we continuously look for exotic, risk minimised on-chain yield primitives that can complement the yield execution framework of syUSD. One emerging opportunity we accessed for this is avUSDC, the liquidity provider vault powering the Avantis trading protocol. The avUSDC vault represents a shift toward fee driven yield, a model designed to distribute trading fees from perpetual markets without exposing LPs directly to trader PnL volatility. I crafted this post to outline how avUSDC functions, the mechanisms that protect LP capital, and how it could integrate seamlessly into tokenised yield products. 1. How avUSDC Generates Yield: The avUSDC vault aggregates USDC deposits from liquidity providers into a unified pool that powers Avantis’s trading engine. Yield accrues to avUSDC holders through one primary channel: real, protocol-level trading fees (excluding liquidation fees). All LP returns are derived from platform activity rather than directional trader outcomes. This model aligns LP incentives with platform health and volume, rather than trader losses. In essence, avUSDC converts trading volume into yield. For structured yield products like syUSD, this represents an organic return stream backed by real market usage, similar to fee based liquidity provision rather than speculative exposure. 2. Risk Architecture: The Protocol Buffer: Avantis employs a distinct Protocol Buffer system to manage and isolate trading PnL risk from the vault’s core capital. The buffer functions as a dynamic protection layer that absorbs volatility between traders and LPs. Mechanics of the buffer system: - Trader losses are accumulated into the buffer, expanding its protection capacity. - Trader profits are first paid out from the buffer, insulating vault capital from frequent settlement flows. - Vault capital is only affected in the rare event that the buffer is fully depleted. This structure creates a resilience layer designed to preserve LP principal under volatile market conditions. The health of this buffer can be monitored transparently through the Vault Buffer Ratio - a metric comparing the size of the buffer to traders’ aggregated unrealised PnL. For example, a 110% ratio implies that open profits could draw down 10% of vault value before LP capital risk materializes. 3. The avUSDC Token: A Composable Yield Primitive, when depositors supply USDC, they receive ERC4626 avUSDC tokens, representing a proportional claim on the vault’s assets and accrued fees. This composable standard expands avUSDC’s usability across other DeFi systems, making it compatible with strategies like those implemented in Lucidly’s syUSD architecture. 4. Key defi integrations that can be automated and enhance avUSDC’s growth potential via the lucidly stack: - DeFi composability: avUSDC can be deposited into platforms like Pendle for fixed yield or leveraged yield exposure. - Collateral utility: users can deploy avUSDC as collateral directly in Avantis or in external money markets for capital efficient and actively monitored leverage loop strategies. This composability makes avUSDC an extendable source of market neutral yield that can integrate seamlessly with Lucidly’s tokenised yield offerings, while adding potential diversification within syUSD’s allocation strategies. Integration Outlook for syUSD avUSDC fits within the category of fee based, market neutral yield primitives, comparable to exchange fee or funding rate strategies. Its design showcases transparency in yield generation and risk containment, which aligns with the syUSD framework’s emphasis on composable, capital efficient, and non speculative yield sources. Analysing the buffer sustainability, trading volume dependency, and liquidity profile, avUSDC presents a credible avenue for sourcing organic base yield representing the maturation of real fee yield models in DeFi, and its architecture offers a potential complement to Lucidly’s goal of scaling syUSD through sustainable and risk minimised sources of yield.

gm, we had a crazy product sprint over past week. A full fledged risk and transparency dashboard is in action on the lucidly app. syETH, syBTC and syHLP strategies are finally up and will be on the prod soon. (Delta neutral yield strategies built on uniswap and hyperliquid) tomorrow, we showcase the full stack at the @katana X @Hadronfc demo day, building for scale - building for defi at Lucidly Labs

Most engaged tweets of Yashish | glucidly

gm, we had a crazy product sprint over past week. A full fledged risk and transparency dashboard is in action on the lucidly app. syETH, syBTC and syHLP strategies are finally up and will be on the prod soon. (Delta neutral yield strategies built on uniswap and hyperliquid) tomorrow, we showcase the full stack at the @katana X @Hadronfc demo day, building for scale - building for defi at Lucidly Labs

We at @LucidlyFinance are looking to work closely with proactive yield farmers. You’ll be incentivised lucratively to join this anon. If you feel your industrial farming skills are unmatched and if given a high end data monitoring infra and capability to open async positions across any defi protocol any chain of your choice, you can execute this better than any bluechip defi curator, send us a 👋 My telegram is: @ bullishbeers

ethical design for a successful tokenised yield vaults requires transparency on: - systems design (underlying architecture, permissions, flow of funds) - clarity on how whitelisting new strategies work - active reporting for insurance funds - underlying strategies (historic and present) - yield attribution - yield recorded from each underlying strategy on a daily timeframe - clear inflows, outflows, pending withdrawal requests - segregating incentives from base yield, base APY reporting on multiple timeframes exclusive of all external protocol incentives ps @LucidlyFinance covers it all

People with Entrepreneur archetype

18 // building @pictra_ai // created @mitsu_app // prev. cybersec @code4rena, research @cot_research

Exploring the future of AI | Sharing insights, trends, and innovations in artificial intelligence | Your go-to source for AI tech news & updates | DM for collab

Building personal brands on Twitter for Founders & CEOs | AI & Web Dev || 📩 DM me for collaboration. jamesbond857728@gmail.com

Helping Founders & Growth Teams Automate Operations and Scale implementing AI | AI Automation Partner | CRM Specialist | Streamlining AI System Solutions

I help businesses grow through smart digital marketing 🚀 | DM for collaboration 📩

22/yo freelance web/software developer from 🇮🇹 goalsnap.me $4

Sold over 1000+ digital products | I help creators leverage their skills with AI and build a lean, one-person business.

funnels for digital product sellers. $25k closed for clients.

Helping brands grow fast with copy that converts | 80%+ traffic → sales in 60 days | No BS only results

Teaching you how to build an AI Assisted Agency | @thedanielfazio

🇦🇱 | Helping 7-8 Figure B2B & SaaS Companies Sign +$10K Deals With YouTube

Explore Related Archetypes

If you enjoy the entrepreneur profiles, you might also like these personality types: