Get live statistics and analysis of Lizda.eth| Ⓜ️Ⓜ️T's profile on X / Twitter

Crypto researcher | On-chain trends, tokenomics & narratives Sharing insights, not hype

The Analyst

Lizda.eth is a sharp crypto researcher deeply immersed in on-chain trends, tokenomics, and market narratives. Instead of riding hype waves, they deliver data-driven insights and strategic edge to navigate volatile markets. With frequent and detailed tweets, they equip followers with practical knowledge to decode complex crypto and AI intersections.

Top users who interacted with Lizda.eth| Ⓜ️Ⓜ️T over the last 14 days

🚀 DAO Contributor | Not financial advice @MorphLayer

builder of on-chain legends | nft spellcaster | farming alpha & memes | defi is my playground

Content creator | Web3 Queen | @KaitoAI Yapper , Contributor for @GiveRep @EdgenTech

Liàn Jí

xđffs

If I’m still breathing, I’m still playing.

在 Web3 创造氛围 🌐 | #cookiesnaps | #Virtuals | #Kaito Web3 爱好者 🚀 | 空投猎人 💰 | KOL 加载中… 合作请私信 🤝

连接品牌与 Web3 社区 🌍 | 用创意内容激发灵感 ✨ 学习 观察 行动 创造与众不同的影响力 💡 携手共建去中心化的未来 🔥

🔮 Powerful shitposter wizard 🔭 ✨ Your friend for NFTs and Airdrops 👑 Holder @SappySealsNFT @pudgypenguins

ValidatorVN delivers high-performance, security-focused validator services with a strong commitment to supporting proof-of-stake networks.

Your guide to Web3's next frontier Insights - Analysis and @KaitoAI

NFTs collector!

Talking crypto, farming Yaps, surfing narratives - @KaitoAI INTJ

Making Web3 make sense • Content that connects

Web3爱好者| alpha hunter| 币安邀请码 MONICACRYPTO

Exploring the decentralized future — one block at a time. ⛓️

Web3 探索者 🧭|NFT 猎人 🎨|空投挖掘者 💰|研究下一波加密创新潮流。

𝗰𝗵𝗶𝗲𝗳 at @pharos_network

Quacker @wallchain #aidrops #kaitoAi #wallchain #RIVER #yap

Lizda.eth probably dreams in spreadsheets and beta values — so many tabs open at once, their browser might need its own blockchain to keep track. When the market dips, instead of sweating, they're just running deeper analytics — a crypto detective who won’t stop until they've debugged your portfolio’s soul.

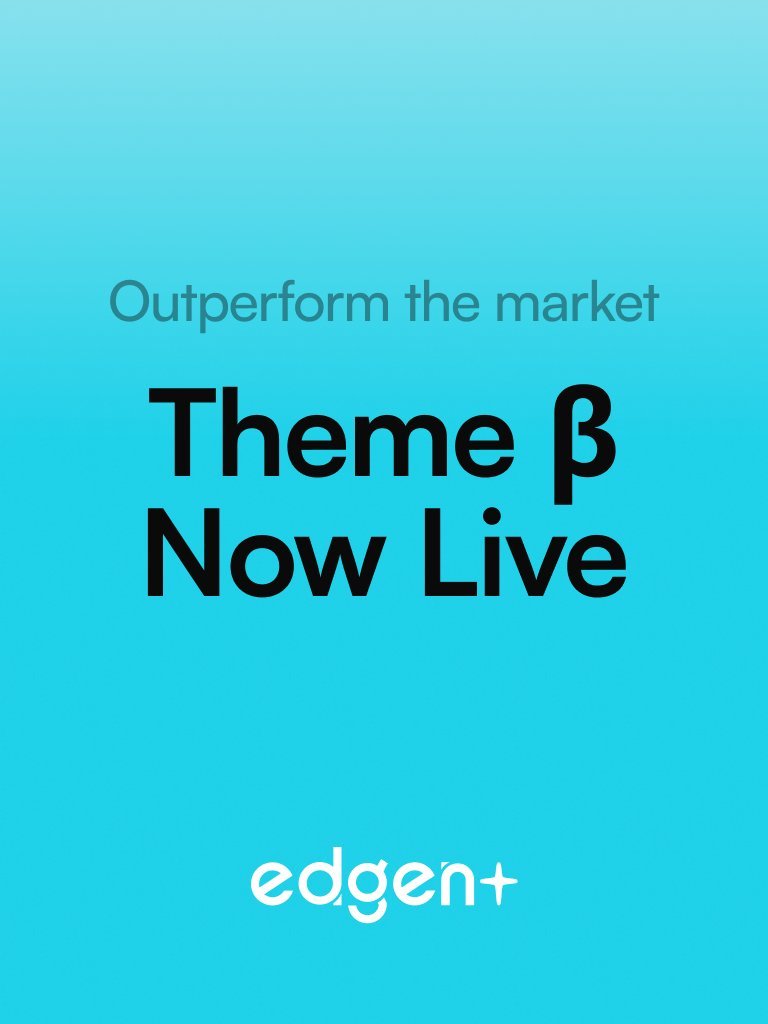

Pioneered on-chain beta analytics with @EdgenTech, providing followers a real edge in identifying market rotations and token strength before hype cycles escalate.

To empower the crypto community by cutting through noise and hype, delivering precise, actionable insights that enhance decision-making and foster informed participation in the evolving blockchain and AI ecosystems.

They believe in transparency, data-backed analysis, and educating the market to build trust and reduce speculative mania. They value authenticity over amplification, championing real usage and sustainable growth over fleeting hype cycles.

Exceptional ability to synthesize complex on-chain data and market signals into clear strategic plays, combined with a high volume of well-researched content that builds authority and trust.

Their deep technical focus and reliance on dense data can sometimes overwhelm or intimidate casual followers, potentially limiting broader audience appeal.

On X, engage more with trading communities and use visual explainer threads or short videos to simplify concepts. Collaborate with influencers who can translate your insights into relatable narratives to broaden your reach.

Fun fact: Lizda.eth tweets over 3,300 times with a focus on actionable metrics like beta coefficients and earnings, showing their obsession for quantitative edge rather than just opinions.

Top tweets of Lizda.eth| Ⓜ️Ⓜ️T

It’s Q4 and rotations are getting violent again. Want actual edge instead of 20 tabs and hopium? Theme Beta just hit on @EdgenTech every market narrative now shows β right under the 24h move. You immediately see if you’re strapping into a 1.2 accelerator (AI, trend capture) or parking in a 0.8 shock absorber (defensives) while you rotate into strength Playbook: - scan AI, DeFi, nuclear, rare earths; add on expanding β with rising volume + mindshare - hedge with low-β when the tape chops - run 360° Reports before sizing; the $HYPE deep-dive nailed on-chain perps dominance and still flagged unlock risk - pipe picks into Portfolios and watch β slope vs market, then iterate in the Five Assets game Creators: farm Aura with your yaps, OG/Elite snapshot Oct 30, badges Oct 31 Mobile beta Nov 15. Align β before you chase alpha #InfoFi

what are the best ai infra plays right now that nobody talks about? i’m watching @Chain_GPT and $CGPT why: - aivm phase 3 underway: multi‑node inference + path to on‑chain training - solidityLLM live on @PhalaNetwork for trustless smart‑contract gen - 50% of network fees burned, dao share, staking tiers with pad multipliers up to 2x - real users: 23.5m nft mints, 120k mau, dev sdk + bots used daily - rewards that matter: monthly 10k $CGPT pool, buzzdrops, leaderboard refresh - liquidity where it counts: binance, bybit, kucoin angle for grinders: - buzz infofi turns posts into allocations (ekox restaking testnet >$70m tvl) - mint with the ai nft generator, stack xp, stake for api limits, farm pad deals if you build in defi, own the infofi and stack $CGPT, or watch others eat #ChainGPT

Thoughts on why Kite actually matters, from someone building agents daily: Most AI + crypto attempts optimize for model hype or marketplaces, then hand-wave the hard parts: identity, payments, attribution, revocation, compliance. That gap kills autonomous workflows at scale @GoKiteAI went straight at the bottleneck and built an agent-native L1. You get x402 by default, sub-100ms payments, microfees (~$0.000001) with gasless session wallets, autonomous IDs with multi-layer revocation, and PoAI that attributes and rewards real work across data, models, and agents For founders and devs that means per-action USDC, verifiable receipts via @brevis_zk, Coinbase x402 compatibility out the box, onchain SLAs, and a DeFi toolbelt already live (swap, bridge, multisig). The testnet is battle-tested: 16.7M users and 1.7B+ inferences Near-term watches: whitepaper just landed, validator program open, Wind Runner SBTs and Ozone snapshot locked, and $KITE TGE on Nov 3 If you’re betting on the #AgenticInternet, this is the payment rail to track. Less talk, more settlement, and agents that finally earn, spend, and settle onchain #Web3

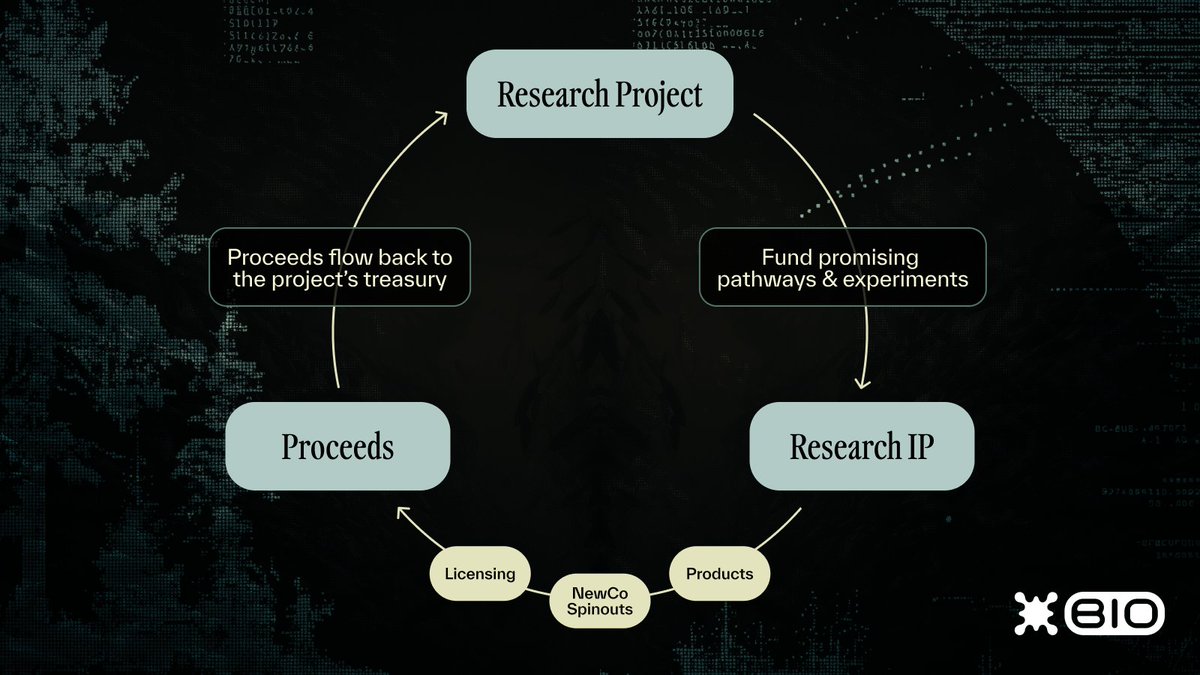

[ BIOSPHERE ] Season 2 setup across @BioProtocol reads like the rotation back to actual cashflows and routes you can work with. Ignition opens in USDC, winners graduate to BIO pairs, and eligible tokens get day‑1 tradability through @AerodromeFi to Coinbase. x402 rails flip BioAgents into per‑block earners, BNB bridge widens lanes, and Aave collateral threads IP‑NFTs into borrow loops Two things can be true: 1) FDV tourists will chase headlines 2) curation and XP will decide whose tokens sustain volume after unlocks Mechanics: - Stake $BIO to crank BioXP multipliers with transparent formulas - 20% TGE, 80% over ~30d smooths churn and lets builders breathe - USDC pools first, BIO routing when traction confirms My playbook this week: stake, curate hard, watch liquidity, rotate when volume confirms. The edge is catching agent‑speed science that clears Ignition and sticks on real exchange flow What are we doing right now #DeSci $BIO @BioProtocol

[ ZKONNECT ] zk finally graduating from blogposts to receipts lol at the crowd still asking for “where’s the real usage” while the proofs are literally shipping @brevis_zk turned InfoFi into private-by-default: attest your on-chain chops, lock a 1.25x mindshare multiplier, keep the wallet anon. proofs, not screenshots. campaigns score signal without doxxing #ZK pico prism doing near real-time ethereum L1 coverage in ~12s on consumer rigs, and the dev loop is actually sane: run circuit on sample windows → get artifacts → hit test verifier → tweak until green → ship uniswap v4 rebates with zk verification, CPI rewards already north of hundreds of millions, gas cut by 90 99%. receipts > vibes. this matters for users who hate dumb farm meta proving grounds phase 1 wraps nov 2, phase 2 flips on-chain next week. yap smart, attest privately, stack sparks. if you’re building, set your metrics and let the proof layer do the enforcement

Time for some alpha WOW Theme Beta just hit and AI + rare earths are flashing >1 beta vs the S&P, risk-on baskets swing harder on the same tape Japanese rollout live so 360° reads hit Asia in native language, mindshare compounding I threw $PLTR and $IONQ into the multi-agent copilot and narrative heat lined up with momentum before the pop, local tells matter Save the doom, use the tools Badge snapshot Oct 30 18:00 UTC+8, Yappers stacking Aura, leaderboards cooking If you want AI speed across stocks + crypto, @EdgenTech has the tape I'll be tracking themes into month-end and posting the prints #Web3 $BTC $ETH $SOL

TODAY 10:00 UTC $MMT community offering on @buidlpad 100% TGE unlock early Nov ve(3,3) locks route emissions and fee cuts to lockers On the stack: - Sui-native CLMM for tight bands and fee capture - SUI USDC, xSUI SUI, suiUSDT USDC, xBTC wBTC live - HODL Phase 2: 110 200% APR boosts for steady LPs - $200K HackenProof bounty, MoveBit + Asymptotic audits Numbers that matter: $600M TVL, $25B swaps, 100K DAU $4.5M raise target at $250 350M FDV Playbook: - start with SUI USDC for depth - set a sane range, track 24h fees, rebalance if drift - boosts compress as TVL climbs - Wormhole bridge in, Slush Wallet campaign for extra juice Tracking @MMTFinance AMAs this week, TGE window Nov 1 3, listings teased. If you LP, snapshots decide payouts, streaks win #Sui

Even though I’m not a big fan of infra tokens, one of the most interesting lowcap liquid bets right now might actually be $CXT. Covalent indexes 100+ chains with sub‑second GoldRush data, powers AI agents/HFT bots, and routes 95% of API revenue into buybacks. SpeedRun turns prompts into live apps in minutes. Around a ~$2M FDV, a functional fee flywheel plus real usage has room to reprice this risk Now ask yourself: are teams like Fidelity, Jump, OpenSea integrating garbage, or are we just at the tip of the iceberg. @Covalent_HQ catalysts: Leaderboard Nov 16, Snapshot Nov 15, SpeedRun launch Nov 30. Sure, it can go to zero infra gets ignored until cashflows compound. But if you think #Web3 creation moves to prompt‑to‑deploy agents, $CXT is a clean asymmetric bet doing > thinking

notes on morse → mitosis mainnet, for those that care. tl;dr: cleaner ownership, better liquidity rails, fewer duct-tape verifications i) on-chain proofs let discord/token-gated tools verify balances; flipsuite is live for roles + trading ii) vaults mint miAssets 1:1, EOL coordinates yield; with morse on @MitosisOrg your identity plugs into portable liquidity iii) hyperlane + cosmos evm = fast routes, instant exits; auctions/staking get cleaner composability iv) stake $MITO, earn gMITO/LMITO for gov + boosted yield; magna schedules help trust v) comms: oct+nov rewards combine in dec per migration thread; keep updates tight vi) actionables: claim, prep wallets, verify in discord, vote nov 15 integrations if you care about clean rails and portable yield, this is your moment #ProgrammableLiquidity

Let them chase candles Let them flex lucky entries Let them gossip about your risk You stay patient You stay committed to intent Keep receipts tight and mindshare clean Block the noise and let your edge compound Everyone wants loud volume; the edge shows up where liquidity sticks @EdgenTech maps it with Trading Mindshare, Themes, and Portfolios that grade what matters EDGM agents compress hours into seconds across stocks and crypto, so you see pivots before the herd In the #X402 wave, machines pay per call, and plays like $PAYAI prove how agent economies route flow Run the play Search, stack 360° signals, watch Pivot Alerts, and post receipts in Insight Showdown live til Nov 10 Apple ID reset lands Nov 3 data + Aura stay with you If you build or analyze, this is your copilot for clarity, conviction, and streaks that stick #Web3 #EdgenTech

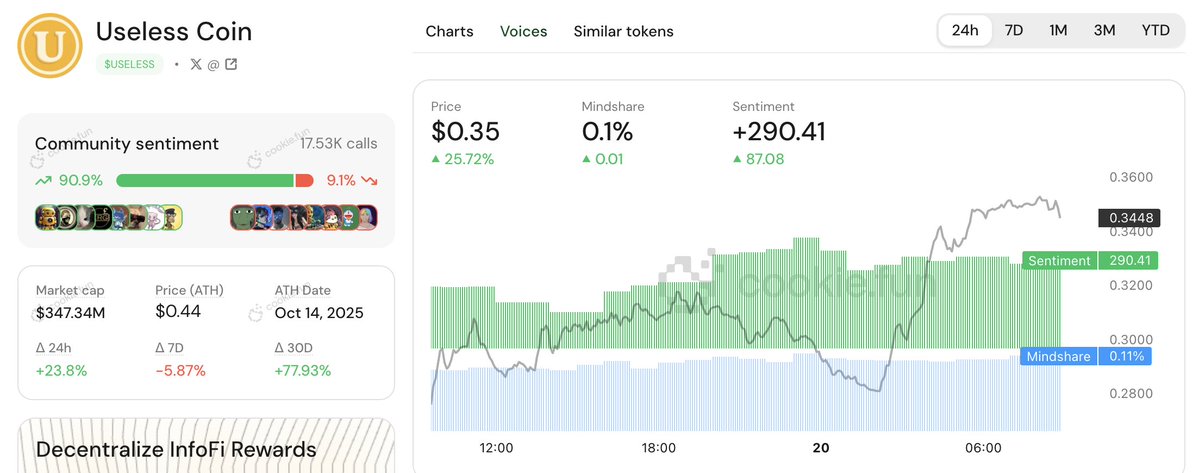

Crypto investors are drowning in noise… Cookie DAO’s InfoFi layer maps market influence via capital mindshare connections in real-time, blending social, on-chain, and trading data so you can actually see momentum forming before price catches up. $13.5M+ already distributed to creators via Snaps/ACM on @cookiedotfun. Transparent. Open. Signal-rich Here’s what I’m watching: Live leaderboards for @SolvProtocol with $230K+ rewards, 30-day TWAP mechanics, 100% unlock in $vSOLV w/ built-in burn on swap Staking tiers for $COOKIE that add multipliers to cSNAPS and open multi-airdrop farming across partner campaigns Mindshare charts that show who’s moving narratives and where liquidity is following Point is, this is the data backbone for the agent economy. Connect X + wallet, post quality CT, track your score, and let the market’s narrative surface in the feed #InfoFi

manic week watching @Infinit_Labs go from a clever DeFi helper to the rails for AI agents moving capital has been wild my key takeaways: 1. Google’s Agent2Agent = distribution. any wallet/app can tap INFINIT’s agents for portfolio mgmt, swaps, LP, rebalancing in hours 2. Binance Wallet integration = access. 280M users one click away from agent strategies, non-custodial, verifiable on-chain 3. Agent Swarm > “automation”. multi-LLM on Vertex AI/Gemini, deterministic execution, zero guesswork, real-time coordination 4. Incentives matter. Stones, points, yapper S3, 5% airdrop at TGE. snapshot 10/31 proof it’s working: 559K wallets 633K on-chain agent tx live delta-neutral and multi-LP strats posting mid-teens to 20%+ APY across chains no FCFS vibes, just products that compound attention into usage I want infra that scales and abstracts, not UIs that add tabs. this feels like the base layer for #AgenticDeFi. bookmark $IN, set reminders, ship threads that teach, and get your wallet ready

i'm here for agentic gdp payments, coordination, escrow, verification, marketplaces, robots, banking x402 handles spend. acp routes work. butler orchestrates. vpay swipes. seesaw trains. bitrobot executes fair access over vc gates. lock $VIRTUAL → veVIRTUAL gets 2% from every unicorn launch + activity airdrops. weekly snapshots, on-chain receipts liquidity is here via coinbase and base. robotics week kicked off. more agents shipping, less noise, deeper primitives basevol goes public oct 29. stables vault targeting triple digit yield in backtests with risk buckets (bull/base/bear). 1y rolling in bull averaged ~200% apy, 2y bull turned 10k → 75,542.4 modeled. size responsibly build the society of ai agents with @virtuals_io #x402 #AIAgents

bitcoin is getting real onchain rails btc.b (~$538m on avalanche) is transitioning to @Lombard_Finance infrastructure to go permissionless and multi-chain. same ticker, same aave/trader joe/benqi hookups, but now you can mint straight from native btc and move with fewer frictions. this is about turning $BTC from idle collateral into internet-grade money markets what changes under the hood decentralized security via a 15‑institution consortium verifiable backing with chainlink proof of reserve chainlink ccip for clean bridging to ethereum, solana, megaeth an sdk so devs can snap bitcoin into apps without bespoke plumbing two lanes for users btc.b for simple liquidity $LBTC if you want yield and composability $BARD fuels the pipes and governance across the stack flash note: over the next 72 hours, mint ≥0.018 btc and score lux + the whitepaper badge. ends nov 2, 23:59 utc mark my words, #BTCfi liquidity is going net onchain and this move accelerates the curve

Big pivot this week: jumped into MemeMax on @KaitoAI. The leaderboard is actually fun when mindshare matters $1,000,000 in $M split across Phase 1 ($200K) and Phase 2 ($800K). I went from grinding for $15/post last year to a $282 day, and you can feel the culture + Perp Dex momentum translating into real scoreboard moves #Yap #KaitoYap Then verified once with @billions_ntwk via @idOS_network and stopped playing KYC whack‑a‑mole. Reuse the same proof, tap the Tria flow, and there’s $500K in rewards for people who actually show up. On the build side, fhEVM by @zama flips the privacy switch MPC‑sharded keys, 7/18 Genesis operators public, $130M raised, S4 live #FHE #PrivacyFirst. My loop now: post for mindshare, verify for reuse, ship FHE content. Culture × identity × privacy which stack wins the next cycle?

ok yappers, here’s the play i’m running for @BioProtocol right now > target YapKings board while double XP runs thru Nov 15, top threads pull 5K $BIO > stake to juice XP (speed up is real), then lock veBIO before the Tokenomics Space on Nov 12, multipliers on the table > watch the AstraZeneca pilot cutoff Nov 15 + LP5 rumors, team’s in quiet mode again which usually means launchpad pop > catalysts lined up: Solana bridge Dec 15, NFT marketplace Nov 25, onchain Yap+staking merge teased > infra check: Vault v2.0 beta = 45% quicker AI sims, 300+ protocols validated, Chainlink patch boosted genomic reads ~30% > numbers: $BIO at $0.0234, ~$23M cap, TVL $15M, feels mispriced for Q4 DeSci goal: top 300 or bust, farm XP now and let Season 2 carry the stack #DeSci $BIO #BioXP #Launchpad you yapping or waiting for the storm to hit first?

Most engaged tweets of Lizda.eth| Ⓜ️Ⓜ️T

It’s Q4 and rotations are getting violent again. Want actual edge instead of 20 tabs and hopium? Theme Beta just hit on @EdgenTech every market narrative now shows β right under the 24h move. You immediately see if you’re strapping into a 1.2 accelerator (AI, trend capture) or parking in a 0.8 shock absorber (defensives) while you rotate into strength Playbook: - scan AI, DeFi, nuclear, rare earths; add on expanding β with rising volume + mindshare - hedge with low-β when the tape chops - run 360° Reports before sizing; the $HYPE deep-dive nailed on-chain perps dominance and still flagged unlock risk - pipe picks into Portfolios and watch β slope vs market, then iterate in the Five Assets game Creators: farm Aura with your yaps, OG/Elite snapshot Oct 30, badges Oct 31 Mobile beta Nov 15. Align β before you chase alpha #InfoFi

what are the best ai infra plays right now that nobody talks about? i’m watching @Chain_GPT and $CGPT why: - aivm phase 3 underway: multi‑node inference + path to on‑chain training - solidityLLM live on @PhalaNetwork for trustless smart‑contract gen - 50% of network fees burned, dao share, staking tiers with pad multipliers up to 2x - real users: 23.5m nft mints, 120k mau, dev sdk + bots used daily - rewards that matter: monthly 10k $CGPT pool, buzzdrops, leaderboard refresh - liquidity where it counts: binance, bybit, kucoin angle for grinders: - buzz infofi turns posts into allocations (ekox restaking testnet >$70m tvl) - mint with the ai nft generator, stack xp, stake for api limits, farm pad deals if you build in defi, own the infofi and stack $CGPT, or watch others eat #ChainGPT

[ BIOSPHERE ] Season 2 setup across @BioProtocol reads like the rotation back to actual cashflows and routes you can work with. Ignition opens in USDC, winners graduate to BIO pairs, and eligible tokens get day‑1 tradability through @AerodromeFi to Coinbase. x402 rails flip BioAgents into per‑block earners, BNB bridge widens lanes, and Aave collateral threads IP‑NFTs into borrow loops Two things can be true: 1) FDV tourists will chase headlines 2) curation and XP will decide whose tokens sustain volume after unlocks Mechanics: - Stake $BIO to crank BioXP multipliers with transparent formulas - 20% TGE, 80% over ~30d smooths churn and lets builders breathe - USDC pools first, BIO routing when traction confirms My playbook this week: stake, curate hard, watch liquidity, rotate when volume confirms. The edge is catching agent‑speed science that clears Ignition and sticks on real exchange flow What are we doing right now #DeSci $BIO @BioProtocol

Thoughts on why Kite actually matters, from someone building agents daily: Most AI + crypto attempts optimize for model hype or marketplaces, then hand-wave the hard parts: identity, payments, attribution, revocation, compliance. That gap kills autonomous workflows at scale @GoKiteAI went straight at the bottleneck and built an agent-native L1. You get x402 by default, sub-100ms payments, microfees (~$0.000001) with gasless session wallets, autonomous IDs with multi-layer revocation, and PoAI that attributes and rewards real work across data, models, and agents For founders and devs that means per-action USDC, verifiable receipts via @brevis_zk, Coinbase x402 compatibility out the box, onchain SLAs, and a DeFi toolbelt already live (swap, bridge, multisig). The testnet is battle-tested: 16.7M users and 1.7B+ inferences Near-term watches: whitepaper just landed, validator program open, Wind Runner SBTs and Ozone snapshot locked, and $KITE TGE on Nov 3 If you’re betting on the #AgenticInternet, this is the payment rail to track. Less talk, more settlement, and agents that finally earn, spend, and settle onchain #Web3

[ ZKONNECT ] zk finally graduating from blogposts to receipts lol at the crowd still asking for “where’s the real usage” while the proofs are literally shipping @brevis_zk turned InfoFi into private-by-default: attest your on-chain chops, lock a 1.25x mindshare multiplier, keep the wallet anon. proofs, not screenshots. campaigns score signal without doxxing #ZK pico prism doing near real-time ethereum L1 coverage in ~12s on consumer rigs, and the dev loop is actually sane: run circuit on sample windows → get artifacts → hit test verifier → tweak until green → ship uniswap v4 rebates with zk verification, CPI rewards already north of hundreds of millions, gas cut by 90 99%. receipts > vibes. this matters for users who hate dumb farm meta proving grounds phase 1 wraps nov 2, phase 2 flips on-chain next week. yap smart, attest privately, stack sparks. if you’re building, set your metrics and let the proof layer do the enforcement

Time for some alpha WOW Theme Beta just hit and AI + rare earths are flashing >1 beta vs the S&P, risk-on baskets swing harder on the same tape Japanese rollout live so 360° reads hit Asia in native language, mindshare compounding I threw $PLTR and $IONQ into the multi-agent copilot and narrative heat lined up with momentum before the pop, local tells matter Save the doom, use the tools Badge snapshot Oct 30 18:00 UTC+8, Yappers stacking Aura, leaderboards cooking If you want AI speed across stocks + crypto, @EdgenTech has the tape I'll be tracking themes into month-end and posting the prints #Web3 $BTC $ETH $SOL

Let them chase candles Let them flex lucky entries Let them gossip about your risk You stay patient You stay committed to intent Keep receipts tight and mindshare clean Block the noise and let your edge compound Everyone wants loud volume; the edge shows up where liquidity sticks @EdgenTech maps it with Trading Mindshare, Themes, and Portfolios that grade what matters EDGM agents compress hours into seconds across stocks and crypto, so you see pivots before the herd In the #X402 wave, machines pay per call, and plays like $PAYAI prove how agent economies route flow Run the play Search, stack 360° signals, watch Pivot Alerts, and post receipts in Insight Showdown live til Nov 10 Apple ID reset lands Nov 3 data + Aura stay with you If you build or analyze, this is your copilot for clarity, conviction, and streaks that stick #Web3 #EdgenTech

manic week watching @Infinit_Labs go from a clever DeFi helper to the rails for AI agents moving capital has been wild my key takeaways: 1. Google’s Agent2Agent = distribution. any wallet/app can tap INFINIT’s agents for portfolio mgmt, swaps, LP, rebalancing in hours 2. Binance Wallet integration = access. 280M users one click away from agent strategies, non-custodial, verifiable on-chain 3. Agent Swarm > “automation”. multi-LLM on Vertex AI/Gemini, deterministic execution, zero guesswork, real-time coordination 4. Incentives matter. Stones, points, yapper S3, 5% airdrop at TGE. snapshot 10/31 proof it’s working: 559K wallets 633K on-chain agent tx live delta-neutral and multi-LP strats posting mid-teens to 20%+ APY across chains no FCFS vibes, just products that compound attention into usage I want infra that scales and abstracts, not UIs that add tabs. this feels like the base layer for #AgenticDeFi. bookmark $IN, set reminders, ship threads that teach, and get your wallet ready

i'm here for agentic gdp payments, coordination, escrow, verification, marketplaces, robots, banking x402 handles spend. acp routes work. butler orchestrates. vpay swipes. seesaw trains. bitrobot executes fair access over vc gates. lock $VIRTUAL → veVIRTUAL gets 2% from every unicorn launch + activity airdrops. weekly snapshots, on-chain receipts liquidity is here via coinbase and base. robotics week kicked off. more agents shipping, less noise, deeper primitives basevol goes public oct 29. stables vault targeting triple digit yield in backtests with risk buckets (bull/base/bear). 1y rolling in bull averaged ~200% apy, 2y bull turned 10k → 75,542.4 modeled. size responsibly build the society of ai agents with @virtuals_io #x402 #AIAgents

Even though I’m not a big fan of infra tokens, one of the most interesting lowcap liquid bets right now might actually be $CXT. Covalent indexes 100+ chains with sub‑second GoldRush data, powers AI agents/HFT bots, and routes 95% of API revenue into buybacks. SpeedRun turns prompts into live apps in minutes. Around a ~$2M FDV, a functional fee flywheel plus real usage has room to reprice this risk Now ask yourself: are teams like Fidelity, Jump, OpenSea integrating garbage, or are we just at the tip of the iceberg. @Covalent_HQ catalysts: Leaderboard Nov 16, Snapshot Nov 15, SpeedRun launch Nov 30. Sure, it can go to zero infra gets ignored until cashflows compound. But if you think #Web3 creation moves to prompt‑to‑deploy agents, $CXT is a clean asymmetric bet doing > thinking

notes on morse → mitosis mainnet, for those that care. tl;dr: cleaner ownership, better liquidity rails, fewer duct-tape verifications i) on-chain proofs let discord/token-gated tools verify balances; flipsuite is live for roles + trading ii) vaults mint miAssets 1:1, EOL coordinates yield; with morse on @MitosisOrg your identity plugs into portable liquidity iii) hyperlane + cosmos evm = fast routes, instant exits; auctions/staking get cleaner composability iv) stake $MITO, earn gMITO/LMITO for gov + boosted yield; magna schedules help trust v) comms: oct+nov rewards combine in dec per migration thread; keep updates tight vi) actionables: claim, prep wallets, verify in discord, vote nov 15 integrations if you care about clean rails and portable yield, this is your moment #ProgrammableLiquidity

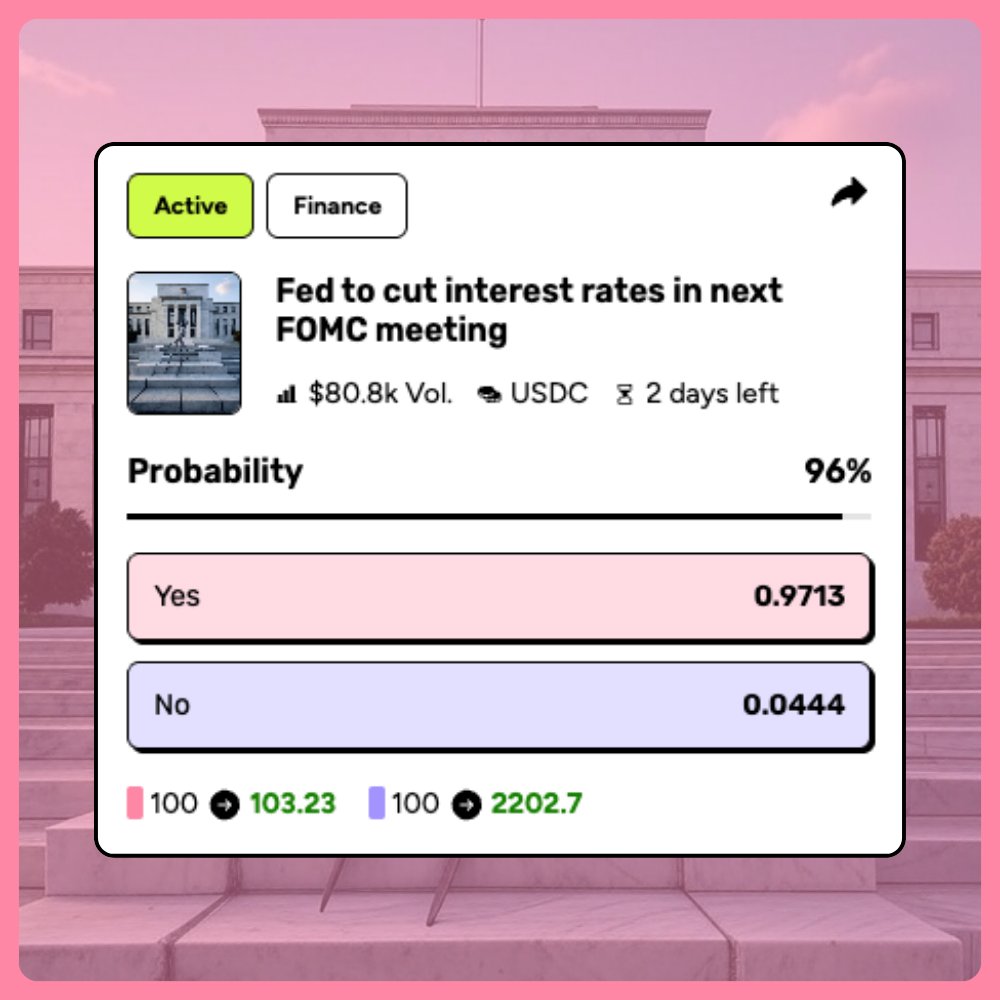

Kicked the tires on the XO Market Mainnet Beta today. User-generated markets, multi-outcome order books, and straight $USDC rails. Deposited and withdrew without fuss. Gas was ~ $0.01. No protocol fee. Reward design is tight: 2 CP per $1 traded, 1 CP per $1 deposited. Adds up fast if you’re active Created a small market around this weekend’s match to test liquidity and price discovery. Order fills were quick, UI clean. Conviction matters here. You’re not just betting, you’re curating edge. And when the book sits 33/33/33, I want to take the other side. If they keep the incentives and the tooling, this can push prediction to social scale. Following @xodotmarket from here. Worth your time if you actually trade odds, not vibes. #predictionmarkets Anyone else seeing real edge in these 0% fee multi-outcome books?

TODAY 10:00 UTC $MMT community offering on @buidlpad 100% TGE unlock early Nov ve(3,3) locks route emissions and fee cuts to lockers On the stack: - Sui-native CLMM for tight bands and fee capture - SUI USDC, xSUI SUI, suiUSDT USDC, xBTC wBTC live - HODL Phase 2: 110 200% APR boosts for steady LPs - $200K HackenProof bounty, MoveBit + Asymptotic audits Numbers that matter: $600M TVL, $25B swaps, 100K DAU $4.5M raise target at $250 350M FDV Playbook: - start with SUI USDC for depth - set a sane range, track 24h fees, rebalance if drift - boosts compress as TVL climbs - Wormhole bridge in, Slush Wallet campaign for extra juice Tracking @MMTFinance AMAs this week, TGE window Nov 1 3, listings teased. If you LP, snapshots decide payouts, streaks win #Sui

bitcoin is getting real onchain rails btc.b (~$538m on avalanche) is transitioning to @Lombard_Finance infrastructure to go permissionless and multi-chain. same ticker, same aave/trader joe/benqi hookups, but now you can mint straight from native btc and move with fewer frictions. this is about turning $BTC from idle collateral into internet-grade money markets what changes under the hood decentralized security via a 15‑institution consortium verifiable backing with chainlink proof of reserve chainlink ccip for clean bridging to ethereum, solana, megaeth an sdk so devs can snap bitcoin into apps without bespoke plumbing two lanes for users btc.b for simple liquidity $LBTC if you want yield and composability $BARD fuels the pipes and governance across the stack flash note: over the next 72 hours, mint ≥0.018 btc and score lux + the whitepaper badge. ends nov 2, 23:59 utc mark my words, #BTCfi liquidity is going net onchain and this move accelerates the curve

Big pivot this week: jumped into MemeMax on @KaitoAI. The leaderboard is actually fun when mindshare matters $1,000,000 in $M split across Phase 1 ($200K) and Phase 2 ($800K). I went from grinding for $15/post last year to a $282 day, and you can feel the culture + Perp Dex momentum translating into real scoreboard moves #Yap #KaitoYap Then verified once with @billions_ntwk via @idOS_network and stopped playing KYC whack‑a‑mole. Reuse the same proof, tap the Tria flow, and there’s $500K in rewards for people who actually show up. On the build side, fhEVM by @zama flips the privacy switch MPC‑sharded keys, 7/18 Genesis operators public, $130M raised, S4 live #FHE #PrivacyFirst. My loop now: post for mindshare, verify for reuse, ship FHE content. Culture × identity × privacy which stack wins the next cycle?

RT : live streaming’s next phase looks less like a platform update and more like a full protocol shift @_technotainment basically turned an audience into an economy. proof-of-engagement as base layer, yield on attention as primitive. 10k beta on nov 15 will test how deep participation can actually go

People with Analyst archetype

Quacker @wallchain

Stats, history, art, photography, finance, aviation and sport

𝐶𝑟𝑦𝑝𝑡𝑜 𝑖𝑛𝑣𝑒𝑠𝑡𝑜𝑟 | 𝐵𝑒𝑙𝑖𝑒𝑣𝑒𝑟 𝑖𝑛 𝑡ℎ𝑒 𝑓𝑢𝑡𝑢𝑟𝑒 𝑜𝑓 𝑊𝑒𝑏𝟹 𝑎𝑛𝑑 𝐷𝑒𝐹𝑖

世间谁能称英雄?韶华不肯负白发!

小老弟/👨🍳/产业工人/ pnpm dlx fisand@latest / uno 学家 / css 架构师 / 退学家

DeFi, Researcher, Shjt post ~ I've been believing in somETHing since 2021~

Neuroscience PhD diving deep into AI | Going all-in on global product adventures | English vibes: @lixiangyu9710 | Email to xiangyuli997@gmail.com

@FCBarcelona Fan | Opinions on everything | ♥️Football Analysis|Mathematics & Machine Learning.

| Data Analyst | Just here for the tech | Economist | United Fan | Connect with me ⤵️

Early DeFi protocol || Trader || Analyser || Threador || CM

Explore Related Archetypes

If you enjoy the analyst profiles, you might also like these personality types: