Get live statistics and analysis of 0xAbstract's profile on X / Twitter

on-chain explorer | nft soul collector | chasing alpha & narratives | art is liquidity

The Analyst

0xAbstract is a data-driven on-chain explorer with a knack for translating complex DeFi mechanics and NFT dynamics into insightful narratives. They specialize in dissecting emerging protocols and cryptoeconomic models with surgical precision, offering deep dives that decode market signals and governance utilities. Passionate about both the art and liquidity of the blockchain space, 0xAbstract intertwines alpha-chasing with a profound understanding of underlying tokenomics.

For someone who lives in the labyrinth of tokenomics, 0xAbstract must have a PhD in TL;DR — a master of turning rocket science into moon shots, but sometimes leaving the uninitiated feeling like they just enrolled in a black-hole economics course they never signed up for.

0xAbstract’s biggest win is creating a compelling, high-engagement framework for analyzing complex emerging DeFi protocols, turning intricate on-chain mechanics into widely respected narratives that influence community governance and liquidity strategies.

To empower the crypto community by providing transparent, in-depth on-chain analysis that elevates collective understanding and guides smarter participation in evolving Web3 ecosystems.

0xAbstract believes that value in the crypto space comes from long-term alignment between stakeholders, sustainable governance, and capital efficiency, rather than hype or rent-seeking. They hold that real liquidity and honest network incentives are the building blocks of enduring decentralized ecosystems.

Their remarkable strength lies in synthesizing dense technical data into actionable investment insights and community wisdom. They excel in spotting signal in market noise, fostering governance engagement, and connecting cross-chain narratives with crisp, well-supported intel.

Sometimes their deep dives and jargon-heavy commentary can overwhelm or alienate newcomers who crave simpler explanations. Their intense focus on analysis might occasionally slow down response time to trending social media moments.

To expand their audience on X, 0xAbstract should experiment with bite-sized educational threads that lower the barrier for entry while showcasing their analytical prowess. Engaging regularly in conversational AMAs and polls can humanize their brand, attracting followers who appreciate both rigor and approachability.

Fun fact: 0xAbstract tweets thousands of times — 8,229 to be exact — signaling a relentless curiosity and commitment to staying ahead in crypto narratives! Their ability to turn auction tables and protocol updates into engaging commentary is unmatched.

Top tweets of 0xAbstract

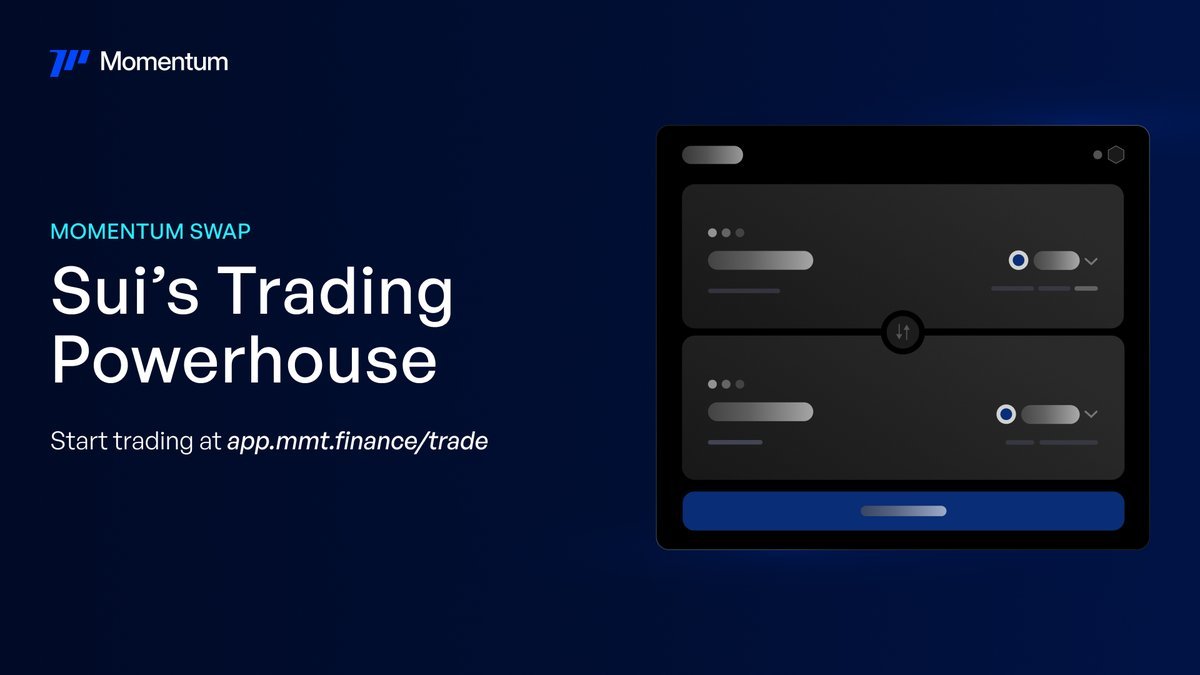

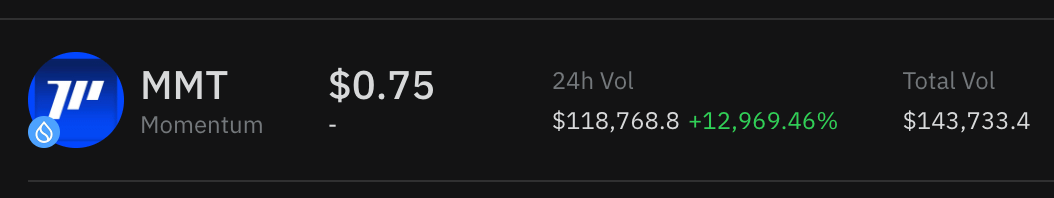

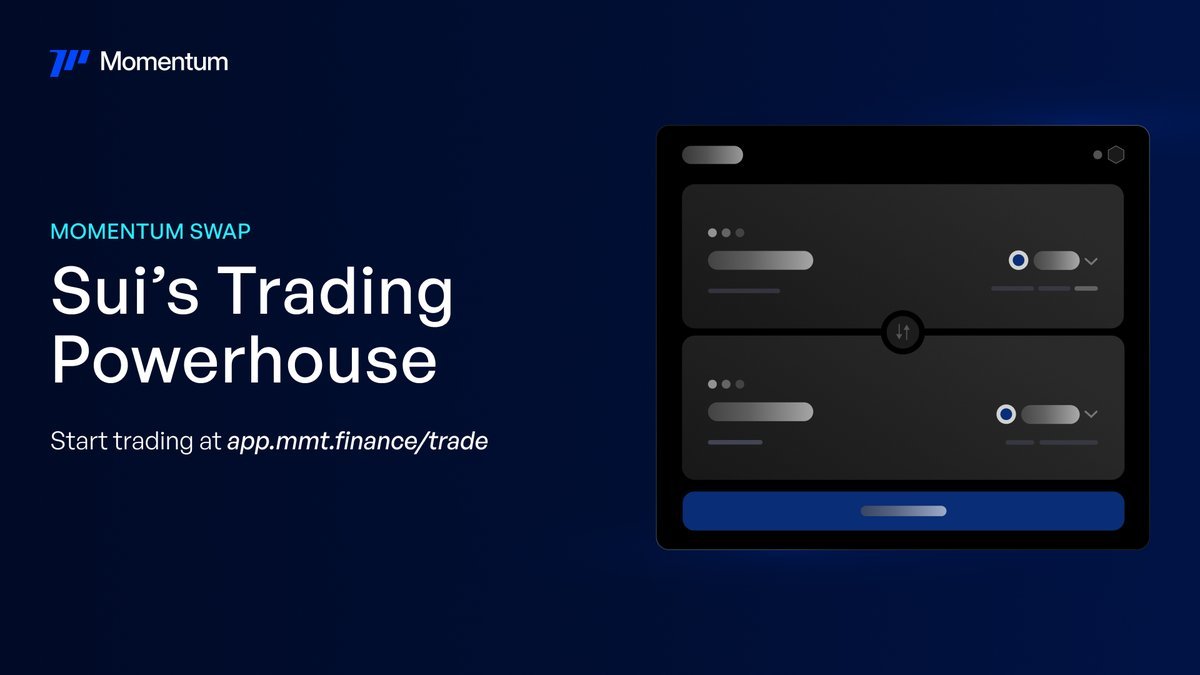

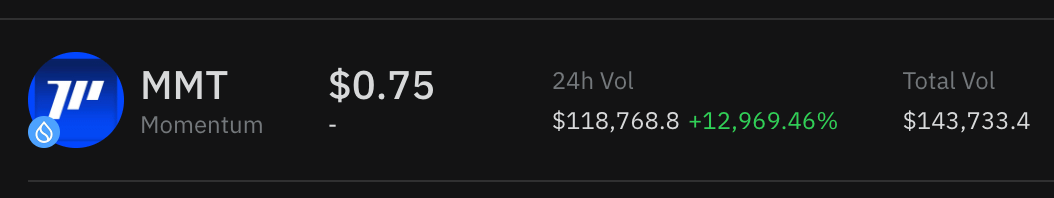

rails aligned across ve(3,3) / CLMM / RWA / Sui momentum turns fees into governance and governance into moats @MMTFinance is mapping the flow from emissions to ownership so the loop compounds instead of leaking the engine lock → vote → earn → repeat long‑term lockers direct emissions, fees recycle to voters, bribes route to pools that create real volume the liquidity layer CLMM ranges with Uniswap v3‑style precision, boosted rewards and tighter zones for capital that works harder across #Sui the receipts legacy DEX arc 50M → 15M → 5M TVL slides when liquidity comes to farm and leaves to dump locked liquidity, fee sharing, aligned votes dampen that decay and build governance value over time pre‑TGE signals hit different 25% LP fee rebate on SUI‑USDC reads as alignment before the starting gun liquidity earned rather than rented and the platform handled the Sui flash‑crash like a live stress drill runway Community Offering on @buidlpad with fair launch partners and a ve design refined by lessons from Solidly and Velodrome RWA after TGE brings tokenized bonds and equities on Sui so yield has provenance and fractional ownership is verifiable on chain how to position - provide to SUI‑USDC and track the rebate while ranges stay tight - lock veMMT post‑TGE, vote pools you actually trade, compound fees and bribes - monitor agent routes across Rayls, LAB, LayerBank to catch rotation maps - size with conviction bands, alert for narrative flips rather than FOMO mindshare looks warm on Kaito pre‑TGE and the stack is built to survive every cycle $MMT favors builders who stay, stakers who govern, and liquidity that belongs to its holdersrails aligned across ve(3,3) / CLMM / RWA / Sui momentum turns fees into governance and governance into moats @MMTFinance is mapping the flow from emissions to ownership so the loop compounds instead of leaking the engine lock → vote → earn → repeat long‑term lockers direct emissions, fees recycle to voters, bribes route to pools that create real volume the liquidity layer CLMM ranges with Uniswap v3‑style precision, boosted rewards and tighter zones for capital that works harder across #Sui the receipts legacy DEX arc 50M → 15M → 5M TVL slides when liquidity comes to farm and leaves to dump locked liquidity, fee sharing, aligned votes dampen that decay and build governance value over time pre‑TGE signals hit different 25% LP fee rebate on SUI‑USDC reads as alignment before the starting gun liquidity earned rather than rented and the platform handled the Sui flash‑crash like a live stress drill runway Community Offering on @buidlpad with fair launch partners and a ve design refined by lessons from Solidly and Velodrome RWA after TGE brings tokenized bonds and equities on Sui so yield has provenance and fractional ownership is verifiable on chain how to position - provide to SUI‑USDC and track the rebate while ranges stay tight - lock veMMT post‑TGE, vote pools you actually trade, compound fees and bribes - monitor agent routes across Rayls, LAB, LayerBank to catch rotation maps - size with conviction bands, alert for narrative flips rather than FOMO mindshare looks warm on Kaito pre‑TGE and the stack is built to survive every cycle $MMT favors builders who stay, stakers who govern, and liquidity that belongs to its holders

Dug into @MemeMax_Fi's latest FAQ drop yesterday, and it's the kind of raw clarity you rarely see in this space. Over 4,700 questions from the community, boiled down into straight answers on everything from MaxPacks to leverage caps. No fluff, just the mechanics that matter. What hooked me: that permanent X account link. Once you're in, no swapping alts to game the system. It's a hard line against spam, but it locks in real users for the long haul. Pair that with unlimited earning potential gas fees on legit on-chain txns count toward packs, no daily caps and you've got a setup that rewards grind over gimmicks. 10 txns = 1 MaxPack, scaling clean without the abuse loopholes. Then there's the funding flex: 300M $M straight from MemeCore grants, funneled into community airdrops and events like the KaitoAI leaderboard with $1M in prizes. Pre-launch MaxPacks dangling up to $1,000,000? That's not hype, that's fuel for actual participation. And with mainnet features live in under three months perp trading up to 100x on majors, plus staking and competitions incoming it's positioning memes as tradable assets, not just pump fodder. This feels like the pivot meme trading needs: fair play baked in, creativity dictating value via Proof of Meme. If you're tired of rugs and bots dominating the feed, link your X, bridge that $M to MemeCore Network, and start stacking txns. The knights are already moving join the build before the hedge workshop on the 18th turns it into a pro toolkit. #MemeMax #MemeFi

gm frens woke up to the solana feeds blowing up and it's all $VALAN this, risen heroes that been scrolling through the valannia lore drops and damn if this ain't the kind of web3 gaming alpha that sticks you know how most games hand you a world on a platter, all scripted and static? nah @ValanniaGame flips that players straight up own the economy, crafting trades and alliances that ripple out and reshape the map in real time it's like your hero nft isn't just a skin, it's the key unlocking realms, arenas, the whole damn universe across titles stake $VALAN for those xp boosts that actually matter, vote in the dao on world events, and watch 20% of in-game spends get burned to keep scarcity tight no pay to win bs, just skill and strategy deciding if your guild rises or gets wrecked mint hits tomorrow, 6k free heroes on magic eden, gas pennies, one per wallet warriors only, no cap i'm loading up my wallet, testing some early stakes to see how the yields stack in alpha if you're not yapping about this ecosystem yet, what's the holdup? feels early, feels locked in #Web3Gaming

You ever open 24 tabs just to miss the move? Yea me neither Bros @EdgenTech turned the noise down and the edge up Multi-agent desk that grades $SOL dips vs NVDA spikes, catches whale whispers, syncs crypto + equities in real time Aura 2.0 ranks heatmaps, on-chain snipes, Binance flows, perps drift -> one viewport EigenLayer cresting $20B TVL and Dencun aftershocks read like velocity PeerDAS loading, Fusaka Q4 2025 BTC midpoint 138k for 2026 while ETF plumbing compresses risk like a vice Route queries through $EDGEH agents, hunt convergence >0.6, anchor blue chips, let narratives simmer $ETH x $NVDA risk pairs when sentiment + funding agree $ENA yield pivots get flagged before CT writes the thread Leaderboards are moving too Grind top 3k, snag OG badges, iterate until your aura sticks I threw a mixed bag in and got grades on trend strength, breakout odds, ghost liquidity No more tab hell, just a quiet edge that learns every play You locking this into the flow or waiting for someone to hand you the signal

Diving deeper into @plancknetwork this weekend, and it's hitting different. Most DePIN plays treat compute like just another commodity rent it, burn it, repeat. Planck flips the script with Proof-of-Useful-Work, where every GPU cycle actually trains models or runs inference instead of hashing nonsense. No more wasted energy; it's all feeding the AI beast. What stands out is the zkVM layer for off-chain processing that keeps everything verifiable on-chain. You get enterprise-grade security without the hyperscaler tax up to 90% cheaper than AWS or Azure, backed by that $200M Rollman commitment and Brock Pierce's stamp. They've already deployed $60M in facilities pulling in over $1M revenue, bridging 30+ chains via Planck Tunnel for seamless EVM-GPU handoffs. This isn't hype for hype's sake. It's the infrastructure that lets solo devs spin up AI-native apps without begging VCs for cloud credits, or enterprises tokenize their idle rigs into real liquidity. As TGE hits in two days on Nov 12th, $PLANCK isn't just a token it's the fuel for auditable, sovereign intelligence that scales across ecosystems. Planck proves decentralized AI won't be a walled garden. It's open rails for the next internet. #PlanckNetwork $PLANCK

Two names to watch as distribution gets smarter: @buidlpad x @MMTFinance 1/ Context MMT is Sui’s liquidity engine with real usage 2.1M+ users, $23B+ cumulative swaps, ~$550M TVL, #3 global by volume. That matters because launch design should mirror where liquidity and users already live 2/ Asset design MMT’s $4.5M community offering on Buidlpad accepts three assets for a reason: • SUI → native users, zero-bridge friction • BNB → growth channel, tap millions on BNB Chain without overengineering bridges • USD1 → fastest-rising stable ($2.15B in 6 weeks), zero-fee mint/redemption, treasuries custodied at BitGo Trust, ties into WLFi pipelines and Binance MGX alignment. This attracts compliance-first flow and lowers user acquisition cost 3/ Mechanics • UGC deadline: Oct 22 10:00 UTC • KYC window: Oct 22 → Oct 25 • Contribution: Oct 27 10:00 UTC → Oct 28 10:00 UTC • Limits: $50 $2,000 per user, up to $20,000 for verified power users • Anti-sybil in force, 100% unlocked at TGE 30% of the raise is reserved for creators and meaningful contributors squads and quality weigh heavily 4/ Strategy Pick the rail that matches your edge: • Hold SUI already? Commit SUI • Have idle BNB liquidity? Bridge via @WormholeCrypto and commit BNB • Want feeless stable exposure + institutional-grade backing? Use USD1 5/ Thesis SUI anchors the core, BNB opens the funnel, USD1 signals institutional intent. That mix compounds MMT’s reach without adding user friction and that’s what tends to outperform on listing Which asset are you committing and why SUI, BNB, or USD1?

valannia pre-tge tldr ️ free RISEN Heroes mint nov 4 on Magic Eden (6,000 supply) ️ one Hero = Arena PvP, Realms RTS, open-world crafting access ️ $VALAN fair TGE mid-nov on solana via indie.fun, raydium/jupiter targets ️ 20% of every $VALAN spend burns; marketplace fees add to deflation ️ StepN movement buffs plug into your Hero for real-world stat gains ️ UE5 polish + solana speed = skill matters, wallet size doesn’t ️ elections, races, politics baked into player power and governance ️ 20k NFTs, 5k wallets, $2m+ revenue pre-token, extra eyes from $BONK @ValanniaGame is building an MMO-RTS universe instead of a single mode. one wallet, one identity, many gameplay loops. persistent progress across titles with assets that actually matter. interoperability by design, not marketing. that’s how you anchor a player-owned economy on solana creators: the @xeetdotai tournament is wide open. 5.5m $VALAN to the top 100 for signal that moves the needle. post strats, breakdowns, clips, and lore; consistency compounds. whitelist snapshot closing, so tag your Hero and climb while the board breathes. send it lads #Web3

the stack reads like someone finally merged the casino floor w/ the compliance office velora handles the tables → rayls seals the ledgers → tria swipes the card → layerbank loops the winnings gasless, MEV‑light, 135% APY quietly compounding while intents abstract the noise cross‑chain flows but the signal stays #DeFi

gm CT caught the wave where @buidlpad and @MMTFinance bring AI + DeFi under one roof data grinders + LP farmers feeding the same engine on Sui Why care about $MMT right now: $18B+ trading volume, $550M+ TVL, and a community-first launch model with full unlock at TGE. no private rounds. no lockups. access for real users who show up daily The playbook to get exposure before listings: Tier 1 HODL stakers stake up to $3k in Momentum LP on Sui via Buidlpad before Oct 25, 02:00 UTC for $250M FDV sale access, earning LP rewards while you queue your allocation Tier 2 verified users complete KYC on Buidlpad to join at $350M FDV, fair entry for new users who missed staking Creators UGC Squad Challenge form a squad (up to 10), submit up to 5 quality posts per user, minimum $150 allocation per squad member if approved. content judged on mission, traction, and product depth. deadline Oct 22, 10:00 UTC Community Priority + Title Deeds 15,000 Momentum Title Deeds: 10,000 to contributors, 5,000 via nomination wave. lock your invite codes, register your team, submit and track directly on Buidlpad Sahara collab Momentum Deed NFTs 200 Deeds via Galxe tasks with @SaharaLabsAI. DSP “AI in Everyday Life” + Quote RT + tag Sahara. plus Momentum tasks: join Discord + add $10 liquidity. FCFS until Oct 24 Accepted assets: SUI, BNB, USD1 KYC: Oct 22 25 Contribution: Oct 27 28 Final allocations: by Oct 31 TGE: early November pick your lane farm data, farm yield, or build with your squad. flow with $MMT on Sui and make the next chapter yours

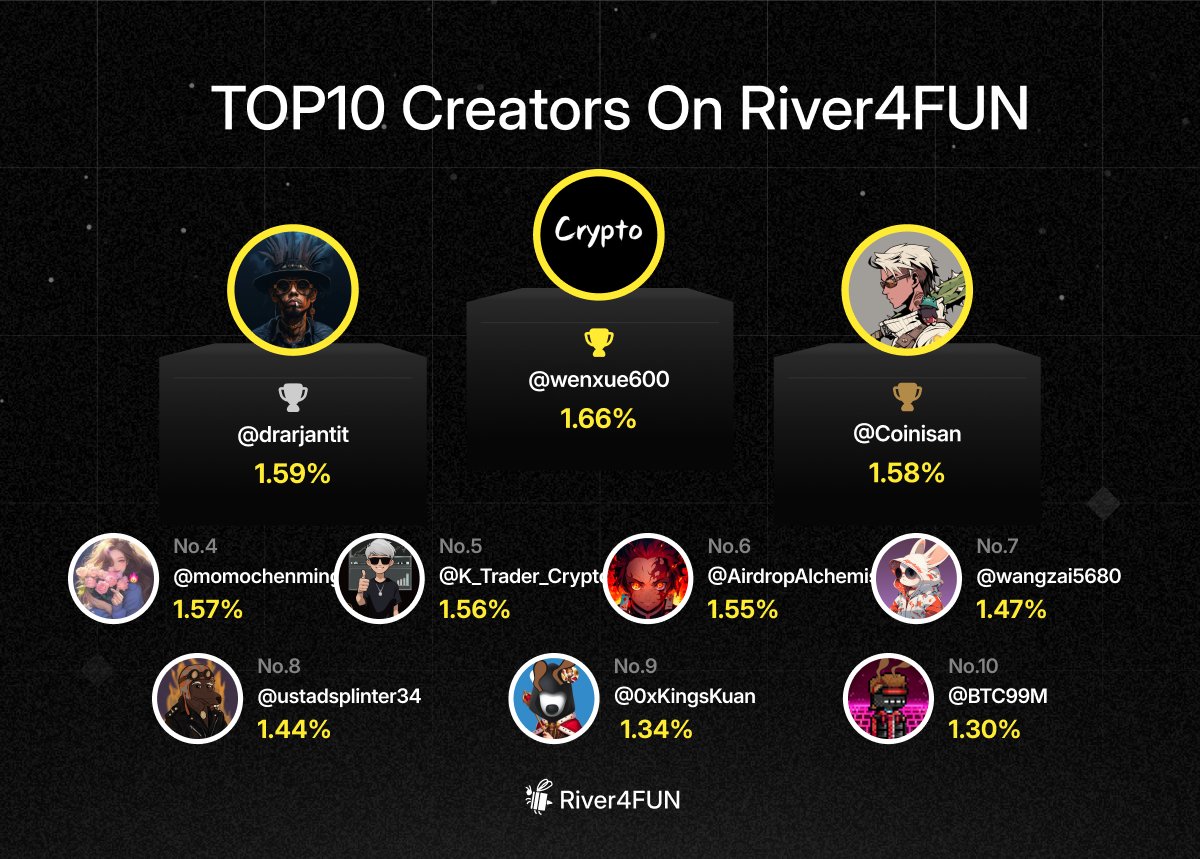

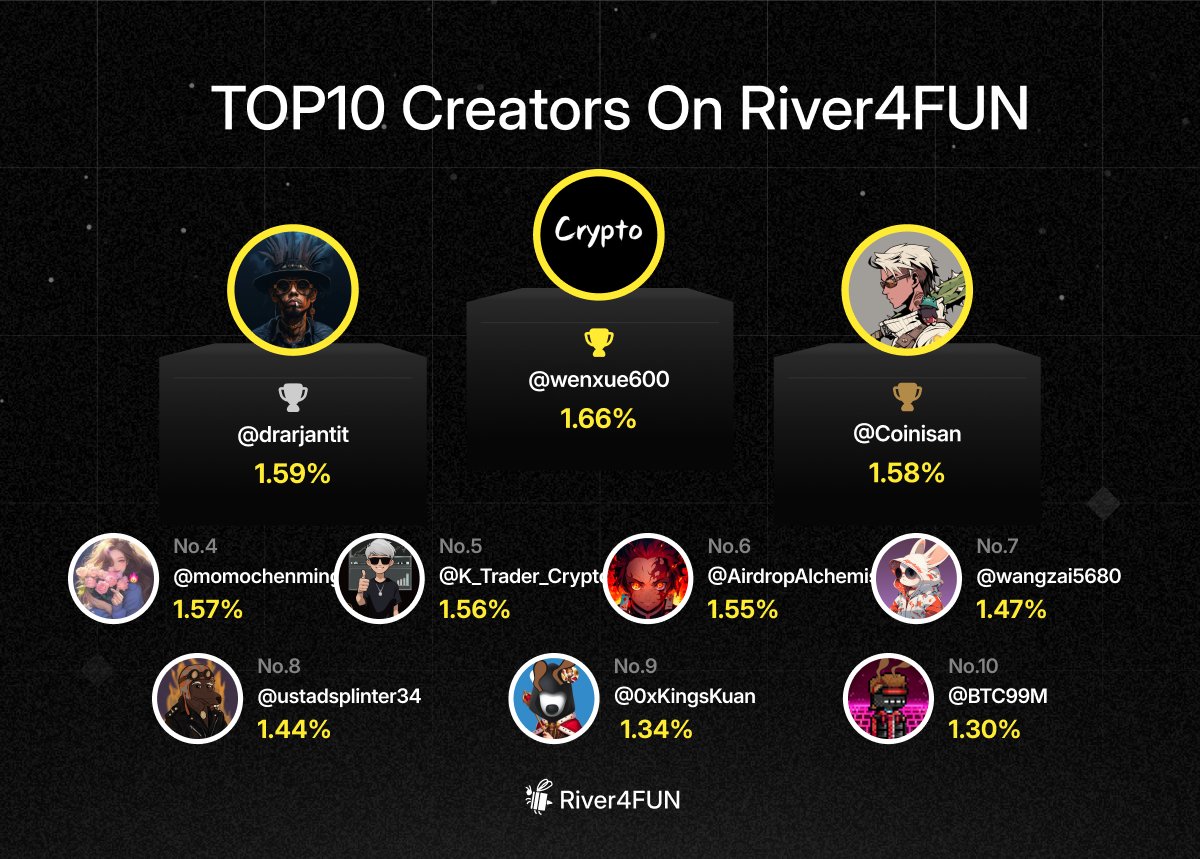

new river meta update: $RiverPts broke zero and kept pushing while market puked. dynamic airdrop conversion actually doing work with time-weighted incentives. here’s the cheat sheet I’m using → conversion steps up the longer you commit. at 1M pts (~$10k at ~$0.01) with $RIVER ~ $2.75, ~1 month rate ~0.0036, 180D fixed 0.03. that’s 30k $RIVER if you last the distance. downside math says $RIVER would need an ~8x nuke in 3 months to breakeven on that stack. pick your poison → 32.1% of pts staked on @River4fun = lower float, softer sell pressure. daily social calc 10 11 AM UTC+7. weekly staking snapshots every Sat. if you’re only playing one lane you’re leaving EV on the table #RiverPts → satUSD/satUSD+ >300M in circulation via @RiverdotInc, stayed fully collateralized through the last sector-wide liquidation mess. risk rails did their job and operations didn’t skip a beat market still looks thin but $RIVER holding ~ $55M MC / ~$280M FDV, RIVER/USDC live on @AerodromeFi, no major CEX yet runway still long my playbook: • stake/LP satUSD(+) for leaderboard weight • ship real 4FUN content, skip spam • let the conversion curve do its thing instead of panic exits extra watchlist: @LayerBankFi @RaylsLabs @blockstranding cooking around this stack food is food I’ll take it. thank you base, thank you math, fook paperhands

i keep bouncing between coins and equities like a clown at 3am, then i piped the chaos into @EdgenTech and the chaos started answering back multi‑agent stack grades my list in real time, A+ to C‑, trend heat, on‑chain whispers, macro hooks, and a 360° report so i don’t miss the one line that actually matters latest rabbit hole: Ink - Tydro = white‑label Aave v3, backed by that $75B lending engine - kraken wiring Tydro into the exchange UI means ceFi users tap DeFi rails without changing their habits - $INK leans pure utility with liquidity incentives via points, no governance slap fights my read: if kraken turns the faucet, TVL ramps and $INK demand tightens while it scraps with Base and OP i track it three ways: - Fundraise Tracker for the quiet institutional commitments - Trading Mindshare for retail follow‑through vs headline fatigue - Portfolios mixing $INK with $SOL dips and NVDA strength, then let $EDGEH agents hunt convergence spikes >0.6 and flag real momentum from headline fluff free tier gets you signal; upgrades juice daily Aura if you’re grinding leaderboards i care about fewer tabs and faster pivots, and this feels like a clean edge am i early on Ink or already late to the bridge party? i’ll let the flow decide while i ride the grades and watch the mindshare curve tighten around confirmation prints

locking with @MMTFinance @buidlpad here feels like grabbing a seat before the train hits full speed $21B swaps + triple digit APY ranges is not “maybe” money it’s happening money zap, post, snapshot, flip xSUI flow is next whales already sniffing arb I’m not missing compounding momentum twice in one cycle $SUI $MMT

$CYS $CGT combo hitting different @cysic_xyz bridging zk speed with compute power like it's nothing Proof-of-Compute feels like DeFi + AI merge moment ngl ASICs, mobile verifiers, yield cycles all syncing feels early Mainnet whispers loud enough to hear from orbit Not financial advice just alpha echo before ignition #ComputeFi

Still sleeping on the real identity meta? Everyone talks wallets, chains, tokens but in the stablecoin era, the missing primitive is trustless, portable identity. @idOS_network on @wallchain_xyz just solved it: one scan, cross-chain, instant reputation boost. Epoch 1 ending in days Don’t fade this

Most engaged tweets of 0xAbstract

rails aligned across ve(3,3) / CLMM / RWA / Sui momentum turns fees into governance and governance into moats @MMTFinance is mapping the flow from emissions to ownership so the loop compounds instead of leaking the engine lock → vote → earn → repeat long‑term lockers direct emissions, fees recycle to voters, bribes route to pools that create real volume the liquidity layer CLMM ranges with Uniswap v3‑style precision, boosted rewards and tighter zones for capital that works harder across #Sui the receipts legacy DEX arc 50M → 15M → 5M TVL slides when liquidity comes to farm and leaves to dump locked liquidity, fee sharing, aligned votes dampen that decay and build governance value over time pre‑TGE signals hit different 25% LP fee rebate on SUI‑USDC reads as alignment before the starting gun liquidity earned rather than rented and the platform handled the Sui flash‑crash like a live stress drill runway Community Offering on @buidlpad with fair launch partners and a ve design refined by lessons from Solidly and Velodrome RWA after TGE brings tokenized bonds and equities on Sui so yield has provenance and fractional ownership is verifiable on chain how to position - provide to SUI‑USDC and track the rebate while ranges stay tight - lock veMMT post‑TGE, vote pools you actually trade, compound fees and bribes - monitor agent routes across Rayls, LAB, LayerBank to catch rotation maps - size with conviction bands, alert for narrative flips rather than FOMO mindshare looks warm on Kaito pre‑TGE and the stack is built to survive every cycle $MMT favors builders who stay, stakers who govern, and liquidity that belongs to its holdersrails aligned across ve(3,3) / CLMM / RWA / Sui momentum turns fees into governance and governance into moats @MMTFinance is mapping the flow from emissions to ownership so the loop compounds instead of leaking the engine lock → vote → earn → repeat long‑term lockers direct emissions, fees recycle to voters, bribes route to pools that create real volume the liquidity layer CLMM ranges with Uniswap v3‑style precision, boosted rewards and tighter zones for capital that works harder across #Sui the receipts legacy DEX arc 50M → 15M → 5M TVL slides when liquidity comes to farm and leaves to dump locked liquidity, fee sharing, aligned votes dampen that decay and build governance value over time pre‑TGE signals hit different 25% LP fee rebate on SUI‑USDC reads as alignment before the starting gun liquidity earned rather than rented and the platform handled the Sui flash‑crash like a live stress drill runway Community Offering on @buidlpad with fair launch partners and a ve design refined by lessons from Solidly and Velodrome RWA after TGE brings tokenized bonds and equities on Sui so yield has provenance and fractional ownership is verifiable on chain how to position - provide to SUI‑USDC and track the rebate while ranges stay tight - lock veMMT post‑TGE, vote pools you actually trade, compound fees and bribes - monitor agent routes across Rayls, LAB, LayerBank to catch rotation maps - size with conviction bands, alert for narrative flips rather than FOMO mindshare looks warm on Kaito pre‑TGE and the stack is built to survive every cycle $MMT favors builders who stay, stakers who govern, and liquidity that belongs to its holders

Dug into @MemeMax_Fi's latest FAQ drop yesterday, and it's the kind of raw clarity you rarely see in this space. Over 4,700 questions from the community, boiled down into straight answers on everything from MaxPacks to leverage caps. No fluff, just the mechanics that matter. What hooked me: that permanent X account link. Once you're in, no swapping alts to game the system. It's a hard line against spam, but it locks in real users for the long haul. Pair that with unlimited earning potential gas fees on legit on-chain txns count toward packs, no daily caps and you've got a setup that rewards grind over gimmicks. 10 txns = 1 MaxPack, scaling clean without the abuse loopholes. Then there's the funding flex: 300M $M straight from MemeCore grants, funneled into community airdrops and events like the KaitoAI leaderboard with $1M in prizes. Pre-launch MaxPacks dangling up to $1,000,000? That's not hype, that's fuel for actual participation. And with mainnet features live in under three months perp trading up to 100x on majors, plus staking and competitions incoming it's positioning memes as tradable assets, not just pump fodder. This feels like the pivot meme trading needs: fair play baked in, creativity dictating value via Proof of Meme. If you're tired of rugs and bots dominating the feed, link your X, bridge that $M to MemeCore Network, and start stacking txns. The knights are already moving join the build before the hedge workshop on the 18th turns it into a pro toolkit. #MemeMax #MemeFi

gm frens woke up to the solana feeds blowing up and it's all $VALAN this, risen heroes that been scrolling through the valannia lore drops and damn if this ain't the kind of web3 gaming alpha that sticks you know how most games hand you a world on a platter, all scripted and static? nah @ValanniaGame flips that players straight up own the economy, crafting trades and alliances that ripple out and reshape the map in real time it's like your hero nft isn't just a skin, it's the key unlocking realms, arenas, the whole damn universe across titles stake $VALAN for those xp boosts that actually matter, vote in the dao on world events, and watch 20% of in-game spends get burned to keep scarcity tight no pay to win bs, just skill and strategy deciding if your guild rises or gets wrecked mint hits tomorrow, 6k free heroes on magic eden, gas pennies, one per wallet warriors only, no cap i'm loading up my wallet, testing some early stakes to see how the yields stack in alpha if you're not yapping about this ecosystem yet, what's the holdup? feels early, feels locked in #Web3Gaming

You ever open 24 tabs just to miss the move? Yea me neither Bros @EdgenTech turned the noise down and the edge up Multi-agent desk that grades $SOL dips vs NVDA spikes, catches whale whispers, syncs crypto + equities in real time Aura 2.0 ranks heatmaps, on-chain snipes, Binance flows, perps drift -> one viewport EigenLayer cresting $20B TVL and Dencun aftershocks read like velocity PeerDAS loading, Fusaka Q4 2025 BTC midpoint 138k for 2026 while ETF plumbing compresses risk like a vice Route queries through $EDGEH agents, hunt convergence >0.6, anchor blue chips, let narratives simmer $ETH x $NVDA risk pairs when sentiment + funding agree $ENA yield pivots get flagged before CT writes the thread Leaderboards are moving too Grind top 3k, snag OG badges, iterate until your aura sticks I threw a mixed bag in and got grades on trend strength, breakout odds, ghost liquidity No more tab hell, just a quiet edge that learns every play You locking this into the flow or waiting for someone to hand you the signal

Diving deeper into @plancknetwork this weekend, and it's hitting different. Most DePIN plays treat compute like just another commodity rent it, burn it, repeat. Planck flips the script with Proof-of-Useful-Work, where every GPU cycle actually trains models or runs inference instead of hashing nonsense. No more wasted energy; it's all feeding the AI beast. What stands out is the zkVM layer for off-chain processing that keeps everything verifiable on-chain. You get enterprise-grade security without the hyperscaler tax up to 90% cheaper than AWS or Azure, backed by that $200M Rollman commitment and Brock Pierce's stamp. They've already deployed $60M in facilities pulling in over $1M revenue, bridging 30+ chains via Planck Tunnel for seamless EVM-GPU handoffs. This isn't hype for hype's sake. It's the infrastructure that lets solo devs spin up AI-native apps without begging VCs for cloud credits, or enterprises tokenize their idle rigs into real liquidity. As TGE hits in two days on Nov 12th, $PLANCK isn't just a token it's the fuel for auditable, sovereign intelligence that scales across ecosystems. Planck proves decentralized AI won't be a walled garden. It's open rails for the next internet. #PlanckNetwork $PLANCK

valannia pre-tge tldr ️ free RISEN Heroes mint nov 4 on Magic Eden (6,000 supply) ️ one Hero = Arena PvP, Realms RTS, open-world crafting access ️ $VALAN fair TGE mid-nov on solana via indie.fun, raydium/jupiter targets ️ 20% of every $VALAN spend burns; marketplace fees add to deflation ️ StepN movement buffs plug into your Hero for real-world stat gains ️ UE5 polish + solana speed = skill matters, wallet size doesn’t ️ elections, races, politics baked into player power and governance ️ 20k NFTs, 5k wallets, $2m+ revenue pre-token, extra eyes from $BONK @ValanniaGame is building an MMO-RTS universe instead of a single mode. one wallet, one identity, many gameplay loops. persistent progress across titles with assets that actually matter. interoperability by design, not marketing. that’s how you anchor a player-owned economy on solana creators: the @xeetdotai tournament is wide open. 5.5m $VALAN to the top 100 for signal that moves the needle. post strats, breakdowns, clips, and lore; consistency compounds. whitelist snapshot closing, so tag your Hero and climb while the board breathes. send it lads #Web3

Two names to watch as distribution gets smarter: @buidlpad x @MMTFinance 1/ Context MMT is Sui’s liquidity engine with real usage 2.1M+ users, $23B+ cumulative swaps, ~$550M TVL, #3 global by volume. That matters because launch design should mirror where liquidity and users already live 2/ Asset design MMT’s $4.5M community offering on Buidlpad accepts three assets for a reason: • SUI → native users, zero-bridge friction • BNB → growth channel, tap millions on BNB Chain without overengineering bridges • USD1 → fastest-rising stable ($2.15B in 6 weeks), zero-fee mint/redemption, treasuries custodied at BitGo Trust, ties into WLFi pipelines and Binance MGX alignment. This attracts compliance-first flow and lowers user acquisition cost 3/ Mechanics • UGC deadline: Oct 22 10:00 UTC • KYC window: Oct 22 → Oct 25 • Contribution: Oct 27 10:00 UTC → Oct 28 10:00 UTC • Limits: $50 $2,000 per user, up to $20,000 for verified power users • Anti-sybil in force, 100% unlocked at TGE 30% of the raise is reserved for creators and meaningful contributors squads and quality weigh heavily 4/ Strategy Pick the rail that matches your edge: • Hold SUI already? Commit SUI • Have idle BNB liquidity? Bridge via @WormholeCrypto and commit BNB • Want feeless stable exposure + institutional-grade backing? Use USD1 5/ Thesis SUI anchors the core, BNB opens the funnel, USD1 signals institutional intent. That mix compounds MMT’s reach without adding user friction and that’s what tends to outperform on listing Which asset are you committing and why SUI, BNB, or USD1?

gm CT caught the wave where @buidlpad and @MMTFinance bring AI + DeFi under one roof data grinders + LP farmers feeding the same engine on Sui Why care about $MMT right now: $18B+ trading volume, $550M+ TVL, and a community-first launch model with full unlock at TGE. no private rounds. no lockups. access for real users who show up daily The playbook to get exposure before listings: Tier 1 HODL stakers stake up to $3k in Momentum LP on Sui via Buidlpad before Oct 25, 02:00 UTC for $250M FDV sale access, earning LP rewards while you queue your allocation Tier 2 verified users complete KYC on Buidlpad to join at $350M FDV, fair entry for new users who missed staking Creators UGC Squad Challenge form a squad (up to 10), submit up to 5 quality posts per user, minimum $150 allocation per squad member if approved. content judged on mission, traction, and product depth. deadline Oct 22, 10:00 UTC Community Priority + Title Deeds 15,000 Momentum Title Deeds: 10,000 to contributors, 5,000 via nomination wave. lock your invite codes, register your team, submit and track directly on Buidlpad Sahara collab Momentum Deed NFTs 200 Deeds via Galxe tasks with @SaharaLabsAI. DSP “AI in Everyday Life” + Quote RT + tag Sahara. plus Momentum tasks: join Discord + add $10 liquidity. FCFS until Oct 24 Accepted assets: SUI, BNB, USD1 KYC: Oct 22 25 Contribution: Oct 27 28 Final allocations: by Oct 31 TGE: early November pick your lane farm data, farm yield, or build with your squad. flow with $MMT on Sui and make the next chapter yours

the stack reads like someone finally merged the casino floor w/ the compliance office velora handles the tables → rayls seals the ledgers → tria swipes the card → layerbank loops the winnings gasless, MEV‑light, 135% APY quietly compounding while intents abstract the noise cross‑chain flows but the signal stays #DeFi

new river meta update: $RiverPts broke zero and kept pushing while market puked. dynamic airdrop conversion actually doing work with time-weighted incentives. here’s the cheat sheet I’m using → conversion steps up the longer you commit. at 1M pts (~$10k at ~$0.01) with $RIVER ~ $2.75, ~1 month rate ~0.0036, 180D fixed 0.03. that’s 30k $RIVER if you last the distance. downside math says $RIVER would need an ~8x nuke in 3 months to breakeven on that stack. pick your poison → 32.1% of pts staked on @River4fun = lower float, softer sell pressure. daily social calc 10 11 AM UTC+7. weekly staking snapshots every Sat. if you’re only playing one lane you’re leaving EV on the table #RiverPts → satUSD/satUSD+ >300M in circulation via @RiverdotInc, stayed fully collateralized through the last sector-wide liquidation mess. risk rails did their job and operations didn’t skip a beat market still looks thin but $RIVER holding ~ $55M MC / ~$280M FDV, RIVER/USDC live on @AerodromeFi, no major CEX yet runway still long my playbook: • stake/LP satUSD(+) for leaderboard weight • ship real 4FUN content, skip spam • let the conversion curve do its thing instead of panic exits extra watchlist: @LayerBankFi @RaylsLabs @blockstranding cooking around this stack food is food I’ll take it. thank you base, thank you math, fook paperhands

i keep bouncing between coins and equities like a clown at 3am, then i piped the chaos into @EdgenTech and the chaos started answering back multi‑agent stack grades my list in real time, A+ to C‑, trend heat, on‑chain whispers, macro hooks, and a 360° report so i don’t miss the one line that actually matters latest rabbit hole: Ink - Tydro = white‑label Aave v3, backed by that $75B lending engine - kraken wiring Tydro into the exchange UI means ceFi users tap DeFi rails without changing their habits - $INK leans pure utility with liquidity incentives via points, no governance slap fights my read: if kraken turns the faucet, TVL ramps and $INK demand tightens while it scraps with Base and OP i track it three ways: - Fundraise Tracker for the quiet institutional commitments - Trading Mindshare for retail follow‑through vs headline fatigue - Portfolios mixing $INK with $SOL dips and NVDA strength, then let $EDGEH agents hunt convergence spikes >0.6 and flag real momentum from headline fluff free tier gets you signal; upgrades juice daily Aura if you’re grinding leaderboards i care about fewer tabs and faster pivots, and this feels like a clean edge am i early on Ink or already late to the bridge party? i’ll let the flow decide while i ride the grades and watch the mindshare curve tighten around confirmation prints

locking with @MMTFinance @buidlpad here feels like grabbing a seat before the train hits full speed $21B swaps + triple digit APY ranges is not “maybe” money it’s happening money zap, post, snapshot, flip xSUI flow is next whales already sniffing arb I’m not missing compounding momentum twice in one cycle $SUI $MMT

have you ever measured LP fees in cheeseburgers like every 0.1% my SUI‑USDC range spits out = 10 cheeseburgers i didn’t have yesterday stacking those on @MMTFinance while @buidlpad lines up the $MMT community drop quick receipts: $550M+ TVL $18B+ volume 2.1M users ve(3,3) + CLMM + xSUI + PTBs so swap → LP → stake → claim can be one click and fees route to LPs instead of theater APR the play: - park stables in tight ranges, harvest real fees - lock $MMT → veMMT, vote stables + high‑fill lanes, steer emissions where it actually trades - use auto‑rebalancing vaults for set‑and‑forget, tap xSUI for collateralized yield entry on @buidlpad: - raise ~$4.5M, 100% unlock at TGE - Tier1 FDV $250M for LP ≥ $3k on Momentum before Oct 25 - Tier2 FDV $350M for KYC Oct 22 25 - contributions in SUI / USD1 / BNB, size $50 $2k alpha side‑quests: - Title Deed NFTs = long‑term flex + perks - UGC squads till Oct 22, creators can snag $150 GTD priority allocation - listings history keeps landing on Upbit, Falcon did a 19×, don’t fade the tape my scoreboard: watch vol/TVL, fee/liq, in‑range ratio if the books deepen and slippage stays clean, i’m staying long the rails on $MMT who’s locking with me this week #Sui #DeFi #Buidlpad #MMT

what a mega flow week on base @RiverdotInc x @AerodromeFi flipped the switch RIVER/USDC live, $589m TVL, $21b 30d volume, 100% protocol rev routing to veAERO holders for governance + yield AERODROME = BASE’S LIQUIDITY HUB layerzero OFT rails keep satUSD native across base + bnb, omni-cdp lets you lock btc/eth/bnb lst on one chain and mint on another with no bridge drag numbers rn: tvl ~720m, satUSD 320m+ minted, spreads tightening, visibility instant among core defi users on base my setup mint satUSD, roll to satUSD+ for the rev slice lp satUSD/usdc on aerodrome 0.3% pools, apr floating ~9.2 auto-compound, narrower slippage on entries spin 3-4 threads/week on @River4fun deeper than yaps (cross-chain quirks, omni-cdp mechanics), stake RiverPts 180/270d for conversion amp, lp river/usdc for extra depth signals korean crew decoded the algo early (depth > spam), leaderboard skew shows real pull 25x pts multiplier on engagement when lp’d, dynamic convert at tge scales $RIVER bags with mindshare velocity risks oracle wobbles under chain stress or liquidation drifts size light, trail tight, watch idOS privacy + contributor guard rails i am long $RIVER on base rn, aerodrome visibility funnels capital, veAERO eats fee flow, @River4fun flips effort into co-owned yield flowed #DeFi #Base #RiverPts

People with Analyst archetype

资深INTJ - Web3研究员,alpha投研,一级打新,专注于空投攻略与项目投研。执行力,是人生的分水岭。

Divination vibes | 合作Collabs: t.me/auxbt | @0xuberM @unitefnf

✧ 奶子哥小助理版 | @WinTradersFNF ✧ 分享在亮点 | DYOR | 链上degen | 半吊子女巫 ✧ 交易所&钱包,OKX就够 。🔗 okx.com

Business Operations @avalabs. Crypto news, Ecosystem metrics, Market analysis and the occasional shitposting. Opinions are my own

here to learn, make money, have fun | writer | @DigitalGold2022 | Research Analyst ex: @AsgardMarkets | PFP by @bearish_af #3180

Web3 analyst | Content Creator | Airdroper | Yapper on: @kaitoAi | Support : @cysic_xyz | @EdgenTech | @mememax_fi

前大厂程序员, 专注 Defi 和 空投. 有时分享自己写的脚本和工具.

I do things. Many things. I speak for nobody but myself, especially not for my employer. Former blue check. @groby@hachyderm.io she/her. SJW. Queer.

合作请TG:t.me/AMAPD11,WeChat:BCT3568。

Energy & materials orcasciences.com

The young person who loves art

#Reseacher #Airdrop #Retroactive #Web3 #Socialfi #Contentcreator #Crypto #Btc #Eth #Memecoin Bullish layer2 #Zksync, #Starknet, #Linea, #Base @Mint_Blockchain

Explore Related Archetypes

If you enjoy the analyst profiles, you might also like these personality types: