Get live statistics and analysis of Dr Martin Hiesboeck's profile on X / Twitter

Head of Research @upholdinc • Opinions my own.

The Analyst

Dr. Martin Hiesboeck is a data-driven crypto researcher with a sharp eye for market dynamics and systemic vulnerabilities. He dives deep into the intricacies of blockchain failures and emerging trends, making sense of complexity with precision and clarity. His content blends rigorous analysis with a candid, sometimes philosophical look at the crypto ecosystem.

Top users who interacted with Dr Martin Hiesboeck over the last 14 days

I want to get people into Crypto as safely as possible. Co-Host of Rock the Kaspa. Buy me a coffee if you like my stuff: kas.coffee/chris ☕️🙂

Partner @LunaCapital | Founder of Metaverse Sirens Community • 专注:AI Agents, DePIN, 及一切让Web3破圈的应用 • 我的社区,只聚集最强的大脑与最美的灵魂 Building the future, together.

Head of Multimedia @Cointelegraph Prev. @SuperSportTV Blitz 📺 @ecr9495 📻 Lover of rugby 🏉 beer 🍻 Crossfit 🏋️ & Bitcoin 🌍

Trader for 20+ years | Crypto specialist helping traders cut through the noise, master proven strategies, and trade crypto with confidence. No BS, just trading.

Trader/Educator

I have lived in 16 places, in 4 continents. Meeting new people and speaking several languages opens your mind and heart. 🌎 🌍 Love is all that matters! 💙

SAP / Database Specialist

❎ꗞ Righteous Lantern ꗞ❎ Riddles📚 and Pirate Ships 🏴☠️ ⛵️🛸 $XRP $ZBCN $SHx $XLM INEVITABLE ⏰… 📄➡️💎

Compiling the best memes and the best art. Trader, investor and entrepreneur. Crypto since 2014.

Crypto & stock swing trader | Cycles, TA, mindset. Do the opposite of the herd. Not financial advice - just sharing how I read the tape.

Not much to tell I’m a husband , a Father , a Son and a business owner who will leave a legacy for my children and their children to follow

Founder - The House Of Crypto - Crypto's fastest growing youtube channel Co - Founder @PerceptronNTWK

The first pump.fun streaming game. We embrace the quantum universe. Check out our website below or join community directly: t.me/cat_in_box_pump

Tracking market moves so you don’t have to. Follow for daily breakdowns on stocks, crypto, earnings, and momentum. Your #1 source for financial news 🥇

perp trading to earn, coding for passion

Diversification is a myth. Zapping inefficiencies into tomorrow’s gains. None of the tweets are financial advice, DYOR!

The Kaspa Industrial Initiative Foundation. Pushing the boundaries for the ultimate Digital Commodity and DLT in Global Industrial and Enterprise applications.

Buy & sell 250+ cryptocurrencies instantly UK: @Topper_UK | Built by @UpholdInc Support: support.topperpay.com Disclaimer: topperpay.com/legal

Fat tails and frustrating assets.

For a guy who’s ‘Head of Research,’ Martin tweets enough to make a high-frequency trader blush — maybe he’s trying to single-handedly break Twitter’s server bandwidth before breaking down Binance’s flaws.

Martin’s incisive breakdown of the October 11 Binance margin exploit not only revealed the attack vector that cost the market up to a billion dollars but also sparked crucial industry-wide discussions on the fragility of centralized crypto exchanges’ risk mechanisms.

To illuminate unseen risks and truths within the crypto world, guiding both market participants and platforms toward greater accountability and smarter innovation.

Martin believes in the foundational ideals of cypherpunk and decentralized finance as catalysts for a fairer monetary future, but he is equally critical of the corrupting influence of commercialization and casino-like behaviors that threaten crypto's integrity.

His biggest strength lies in his detailed, evidence-backed dissection of complex crypto market events and systemic flaws, paired with an ability to articulate perspectives that resonate deeply with the informed crypto community.

However, his relentless data focus and critical tone may sometimes alienate more casual or optimistic audiences, and his high tweet volume could overwhelm followers, diluting the impact of his best insights.

To grow his audience on X, Martin should balance his analytical deep-dives with more approachable, bite-sized commentary or simplified thread summaries that invite engagement and build broader community trust, while leveraging topical crypto debates to amplify reach.

Fun fact: Despite tweeting over 106,000 times, Martin is able to uphold nuanced, high-impact commentary that reaches hundreds of thousands — proving that quality analysis can thrive in a sea of volume.

Top tweets of Dr Martin Hiesboeck

I’m going to take the liberty and repost the brilliant creator of $KAS, my friend (and idol) Yoni @hashdag’s letter to @Binance here for visibility.

I found myself nodding and screaming “yes” “exactly” at every sentence. Before you flame me, yes I work for a platform @UpholdInc and I’m proud of that. I try to keep the OG crypto embers burning inside a system that has changed the value and ethics proposition. Yes, we are all guilty in some way or other of perverting the original crypto spirit, and not all elements of OG cyberpunk were good, reasonable, morally acceptable or even realistic. But Yoni’s letter deserves more attention. I’m going to handwrite it in ink and hang it on my wall.

(For the younger readers: handwriting is an old form of “texting” when you use a pen, pencil or other implement to draw letters on a medium such as paper using only your fingers and your own brain. See en.wikipedia.org/wiki/Handwriti…)

Here it the letter. It’s the crypto version of Jean-Paul Sartre rejecting the Nobel in 1964.

————

@binance,

Thanks for including me in the top 100 blockchain people list, appreciate the signal!

I must decline the Dubai invite though. I do not wish to disrespect, but many of the award voters are avid kaspians who rooted for my kaspa status at least as much as for my research. Let them win or count me out.

Crypto has turned from a euphoric cypherpunk project to a house-friendly casino. You may not be the culprit, but as a top player you hold the lion’s share of the responsibility to correct this, and the October crash your USDe oracle glitch helped trigger adds to what needs to be addressed.

There are three classes of crypto, as @0xMert_ put it recently: commercial crypto, casino crypto, cypherpunk crypto. <

Three things are now sufficiently clear 1. @KaspaCurrency is an excellent payments system 2. Smart contract on $KAS will revolutionize the way we think about computing on chain 3. The day is not far off when Kaspa will function as the perfect rollup on any chain to handle most of the transactional work load at negligible cost The future is green, not orange or black.

18 months later and I’m sticking to it. Binance has played an irresponsible game as so often and depressed the price over months. Ethereum influencers and Bitcoin maxis have ridiculed Kaspa without having the slightest idea what a BlockDAG is. Retail bros have disparaged it beside of idiotic TA. With all the talk of Bitcoin DeFi and payment, the promise of massive demand etc and even with pension funds being able to buy Bitcoin, it is still struggling to go up. More importantly, Bitcoin has never achieved the e-cash status Satoshi envisaged. Go read the original white paper and not a single promise in there has come true except for the basic tech. The Bitcoin is Gold narrative is simply not realistic, as every geopolitical crisis shows. And yet millions are drinking the kool aid. The future is multichain, including permissioned and permissionless, special purpose chains and payment system. There is no ring to rule them all. 🧙 But there is one that stands a chance of becoming real e-cash system with thousands upon thousands of transactions a second at virtually zero cost. @hashdag spent decades creating something wonderful, simple, and sound. No flashy marketing no empty promises.

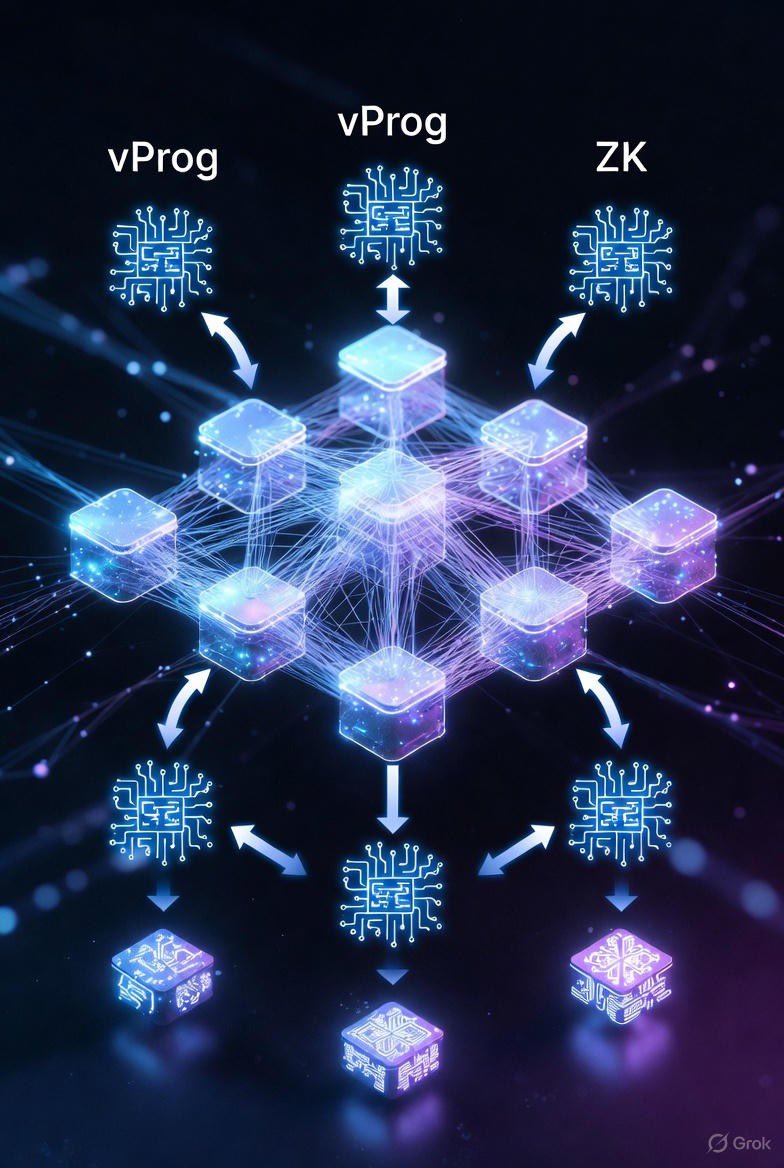

Kaspa’s Path to Zero-Knowledge Smart Contracts In the evolving landscape of blockchain technology, Kaspa stands out for its innovative approach to scalability and functionality. At the heart of its next phase is vProgs—verifiable programs designed to enable zero-knowledge smart contracts. This concept moves beyond traditional on-chain execution models, leveraging off-chain computation and cryptographic proofs to maintain a lightweight Layer 1 (L1) while unlocking sophisticated programmability. Drawing from ongoing research and development, including Kaspa’s recently released yellow paper, this post provides a structured overview of vProgs, their architecture, challenges, and potential impact. Kaspa’s Unique BlockDAG Architecture Kaspa’s core strength lies in its block-directed acyclic graph (blockDAG) structure, governed by the GHOSTDAG consensus protocol. Unlike linear blockchains, this design allows parallel block creation, delivering high throughput and rapid block times—often under one second. This efficiency is essential for vProgs, as it supports the timely submission and verification of proofs without compromising network performance. An upcoming enhancement, the DAGKnight upgrade, further refines this by reducing latency and accelerating finality. In a DAG environment, where minor reorganizations (reorgs) can occur, DAGKnight ensures that state commitments remain reliable, enabling vProgs to anchor securely to the L1 without excessive delays. vProgs represent a departure from monolithic virtual machines (VMs) that execute all logic on-chain. Instead, they emphasize modularity and efficiency: Each vProg maintains its own logic and state. Transactions explicitly declare their intended read and write sets, providing transparency into data interactions.. The L1 sequences commands but does not perform computations. Execution occurs off-chain, where the vProg processes inputs and generates a zero-knowledge (ZK) proof attesting to correct execution. The L1’s role is limited to validating the ZK proof, ensuring integrity without storing or running the full program. This preserves Kaspa’s L1 as a lean settlement layer. The ultimate objective is synchronous composability—allowing vProgs to interact seamlessly in real time, fostering an ecosystem of interdependent applications. To avoid vendor lock-in, vProgs accommodate diverse programming languages and VMs. Interoperability is achieved via a standardized interface for proofs and input/output (I/O), enabling one vProg to invoke another regardless of underlying technology. Finally, vProgs extend ZK proofs to include failure states—such as crashes, gas exhaustion, or infinite loops—preventing stalled transactions and maintaining liveness. For applications requiring confidentiality, vProgs facilitate calls between programs without exposing sensitive data. This is accomplished through cryptographic commitments: one vProg commits to an output privately, which the next uses as input. A chain of proofs ultimately verifies end-to-end consistency without data leakage. Kaspa’s combination of blockDAG, proof-of-work consensus, and DAGKnight provides the ideal substrate for vProgs: rapid inclusion, stable anchoring, and verifiable execution. This synergy positions Kaspa to host high-throughput, privacy-preserving applications—ranging from DeFi protocols to AI-driven oracles—while preserving L1 simplicity. Kaspa’s trajectory merits close attention. If you are out want to be a @UpholdOTC client, we have an in-depth report for you available now, why Kaspa is a game changer you don’t want to miss. Best, Doc Institutional@uphold.com

Because of the languishing price performance throughout the last 12 months, a lot of people have lost interest in Kaspa $KAS. Here’s a brilliant summery of while I personally still consider this the most promising project in blockchain. Hats off to my genius friend @hashdag for this marvel of technology. 🎩

Most engaged tweets of Dr Martin Hiesboeck

Here is an explanation of why I think being a maximalist for anything including $KAS is dangerous. We now recognize #Bitcoin is a very limited, and perhaps flawed and ultimately doomed old technology. We hail the #blockDAG as the holy grail that solves the blockchain trilemma. But what this technology still needs is a sequence of blocks and the sequence of transactions. The order of things is still central to this way of thinking. However, pioneers of Blockchain technology, who think that the order of the blocks doesn’t really matter. DAGs have many mathematical problems and unintended consequences not fully explored. Academics are continuously searching for alternatives. What if I told you there is a technology that doesn’t care when and where a block is created and can always process it no matter how it enters not the blockchain but the Lattice. It is still in development and hasn’t proven its mettle in the real world, but that was the case once upon a time for bitcoin and only two years ago for Kaspa. At the heart of Convex lies a two-layer lattice system, the global state lattice, a secure layer acts as a public, foundational network, ensuring consensus amongst participants and a scalable and verifiable storage layer efficiently stores vast amounts of data using content-addressable storage and Merkle DAGs. This allows Convex dAppe to leverage virtually unlimited off-chain storage by linking value IDs directly from the Global State Lattice. What if this turns out to be superior to anything Kaspa has to offer ? What if in the years time smart contracts on KAS still don’t work as advertised while there are suddenly 10 new lattice computing chains dominating the conversation? 🤷♂️ What if artificial intelligence comes up with yet better solutions that will stun the world. 🤷♀️ Blockchain development isn’t a pissing contest. It is a continuous quest for improvement. It never stops. Human ingenuity knows no bounds. We live in a decentralized globally connected world where millions of people have an opportunity to contribute to the advancement of science. Nothing will ever be the last word on anything. That is the beauty of it. Don’t get stuck with what you think is the Holy Grail! There is no holy grail. The holy story was an invention of a French trouvère called Cretien de Troyes. We must come together to build a multichain future together. Maximalism of ANY kind is poison. And if all you care a little about is the US$ price of your pet token, you don’t deserve a seat at the table.

18 months later and I’m sticking to it. Binance has played an irresponsible game as so often and depressed the price over months. Ethereum influencers and Bitcoin maxis have ridiculed Kaspa without having the slightest idea what a BlockDAG is. Retail bros have disparaged it beside of idiotic TA. With all the talk of Bitcoin DeFi and payment, the promise of massive demand etc and even with pension funds being able to buy Bitcoin, it is still struggling to go up. More importantly, Bitcoin has never achieved the e-cash status Satoshi envisaged. Go read the original white paper and not a single promise in there has come true except for the basic tech. The Bitcoin is Gold narrative is simply not realistic, as every geopolitical crisis shows. And yet millions are drinking the kool aid. The future is multichain, including permissioned and permissionless, special purpose chains and payment system. There is no ring to rule them all. 🧙 But there is one that stands a chance of becoming real e-cash system with thousands upon thousands of transactions a second at virtually zero cost. @hashdag spent decades creating something wonderful, simple, and sound. No flashy marketing no empty promises.

#Bitcoin was supposed to bring financial freedom from institutions and governments in a world where everyone paid in that new “e-cash”. This never happened. Centralized Bitcoin mining was never the plan. “Digital gold” was never the plan. Now, with ETFs, bitcoin is just another asset in the armory of financial planners wishing to improve their Sharpe ratio. A little excerpt from my upcoming book “A Blockchain Odysee” For some, Bitcoin's attraction lies in its purity and the limited supply. It's simple, uneventful, boring. You just buy it and hodl it, one day you will be unimaginably rich. Michael Saylor certainly will. But for those of us working in cryptography and decentralized computing, #Bitcoin hardly matters. It is not the holy grail of decentralization or the symbol of resistance against the establishment. We don't care if it goes to 400k, 1m or drops to zero. The 21 million supply cap isn't set in stone. The halving means that every few years, miners have to work harder to make ends meet. As we go to press, the last halving was three months ago, and #Bitcoin is still treading water at a price level that makes mining barely profitable. Bitcoin isn't pure and it isn't even scarce. If we cannot manage to implement DeFi and other useful technologies on this old mare, there will not be any income from transactions, while block rewards will go to zero. But why would anyone build an ecosystem on a network that is for all intents and purposes a technological dinosaur?

Three things are now sufficiently clear 1. @KaspaCurrency is an excellent payments system 2. Smart contract on $KAS will revolutionize the way we think about computing on chain 3. The day is not far off when Kaspa will function as the perfect rollup on any chain to handle most of the transactional work load at negligible cost The future is green, not orange or black.

I’m going to take the liberty and repost the brilliant creator of $KAS, my friend (and idol) Yoni @hashdag’s letter to @Binance here for visibility.

I found myself nodding and screaming “yes” “exactly” at every sentence. Before you flame me, yes I work for a platform @UpholdInc and I’m proud of that. I try to keep the OG crypto embers burning inside a system that has changed the value and ethics proposition. Yes, we are all guilty in some way or other of perverting the original crypto spirit, and not all elements of OG cyberpunk were good, reasonable, morally acceptable or even realistic. But Yoni’s letter deserves more attention. I’m going to handwrite it in ink and hang it on my wall.

(For the younger readers: handwriting is an old form of “texting” when you use a pen, pencil or other implement to draw letters on a medium such as paper using only your fingers and your own brain. See en.wikipedia.org/wiki/Handwriti…)

Here it the letter. It’s the crypto version of Jean-Paul Sartre rejecting the Nobel in 1964.

————

@binance,

Thanks for including me in the top 100 blockchain people list, appreciate the signal!

I must decline the Dubai invite though. I do not wish to disrespect, but many of the award voters are avid kaspians who rooted for my kaspa status at least as much as for my research. Let them win or count me out.

Crypto has turned from a euphoric cypherpunk project to a house-friendly casino. You may not be the culprit, but as a top player you hold the lion’s share of the responsibility to correct this, and the October crash your USDe oracle glitch helped trigger adds to what needs to be addressed.

There are three classes of crypto, as @0xMert_ put it recently: commercial crypto, casino crypto, cypherpunk crypto. <

People with Analyst archetype

ASD & ADHD / 外国語教育 ASD研究 撮影 音ゲー ツイ廃 男ママ タメ口 / Arcaea PTT 11.39 maimai 13,422 / CN EN JP KR / 🤍 @srkmanno @watebird14760 @wanzi0209 / sub @aoim31 無言フォロー失礼

be not afraid of greatness

Science Fiction, Fantasy, Economics, Analysis. Watch my full videos on X / Twitter under the Highlights tab. #fantasy #puns #economics Anti-Authoritarian.

Crypto curious | OG vibe @KaitoAI | @PortaltoBitcoin

fake peater + research chemical enthusiast

born lucky. committed to bits. dad wannabe

Señor swesearcher @ Google DeepMind. Adjunct prof @ U de Montreal & Mila. Musician. From 🇪🇨 living in 🇨🇦.

Google Ads & Facebook Ads pro & founder @taikundigital. Running ads since 2009. Let's talk ads!👇

feral awareness researcher ᐧ strangely earnest ᐧ I teach Alexander Technique, which helps you get out of your own way → https://t.co/e0qcOYJBfG

Found what we're looking for in life.

AI, shitposting, philosophy. Maybe some systems engineering.

Explore Related Archetypes

If you enjoy the analyst profiles, you might also like these personality types: