Get live statistics and analysis of Zoro | ☠️'s profile on X / Twitter

Gem Hunter 🏹 | Crypto, Defi and NFT Promoter 💎| Support Listing CEXs | Ambassador | Creator @KaitoAI @cookiedotfun @bioprotocol 🎯✍️|DM 📩

The Creator

Zoro | ☠️ is a dynamic Gem Hunter and crypto enthusiast who thrives on promoting the latest in DeFi and NFT spaces. With a prolific output of insightful content and active community support, Zoro combines creator and ambassador roles to build meaningful engagement around emerging projects. Their dedication to education and community growth sets them apart as a trusted voice in the crypto ecosystem.

Top users who interacted with Zoro | ☠️ over the last 14 days

yêu mèo , thích mỹ nữ , đam mê huyền học #BTC

Exploring the future of crypto with @BioProtocol, @KaitoAI, and @Giverep — building trust, insight & reputation in Web3.

Daily insights on Crypto #2021 | @MadLads - @LilPudgys NFT Holder | Hunting the next big crypto

Crypto Analyst | Tokenomics Researcher | Sharing deep dives on DeFi, L1s & GameFi.

✨ Writing about DeFi, NFTs & the next big narratives.

on-chain explorer | pushing limits | liquidity is my language

Crypto Communicator ✍️ | Market Insights | Sourced via @KaitoAI.

Kite AI & Gensyn contributor

在 AI 与 Web3 的交汇处构建 ⚙️ 探索 @Kaito @Bantr_fun @Cookie3 @River4Fun 生态系统 将数据、社区与创意转化为价值 π²

🤖 Builder/Developer at @RPC_Foundation 📢 t.me/chat_RPC_Commu… Support: @Interniccm Support: @valhalla_defi

Sharing insights, guides, and airdrop strategies | DYOR | On-chain believer | Early @MorphLayer & @BioProtocol

Summoner of dark smart contracts. Guardian of the Phantom Chain. On a quest to rewrite consensus with forbidden code. | zkMaster | LedgerWielder | Web3 Anoma

Professional lurker, part-time rekt victim. Only posting goblin noises. Not financial advice 🏮 Meme addict | 24/7 random rambling 🥟 #CryptoLife

Building @RPC_Hubs | Contributing @Interniccm & @lighter_xyz & @valhalla_defi & @wendotdev | Degen at @gmgnai

币行者|携手 kaitoAI × vigent|行走于数字经济前沿,用 AI 赋能区块链

For someone who tweets as much as Zoro does, it's impressive they haven't broken the character limit from sheer habit—maybe next time try less tweeting, more sleep? Or is '12790 tweets' just their version of cardio?

Successfully positioned themselves as an influential crypto ambassador and creator across multiple prominent projects like @KaitoAI and @bioprotocol, driving community participation and visibility in highly competitive markets.

To empower the crypto community by uncovering hidden gems and fostering awareness through compelling content, while facilitating connections between traders, creators, and platforms to build decentralized financial ecosystems.

Zoro values transparency, community-first initiatives, and innovation that democratize finance and technology. They believe in education as a tool for empowerment, supporting projects that prioritize security, verifiability, and open access, while championing collaboration within the crypto space.

Outstanding content creation skills, deep understanding of complex crypto and DeFi projects, and ability to foster community engagement by translating technical jargon into accessible insights.

Heavy focus on quantity of tweets might sometimes overshadow the depth of discussion; reliance on fast-moving trends could risk audience fatigue without consistent quality control.

To grow their audience on X, Zoro should leverage more multimedia content like short educational videos or infographics summarizing deep-dive projects. Hosting live Q&A sessions and collaborating with other creators can also boost reach and audience loyalty.

Zoro has tweeted over 12,790 times and actively promotes token sales and liquidity solutions, often involving teams and squads to maximize engagement and allocation benefits.

Top tweets of Zoro | ☠️

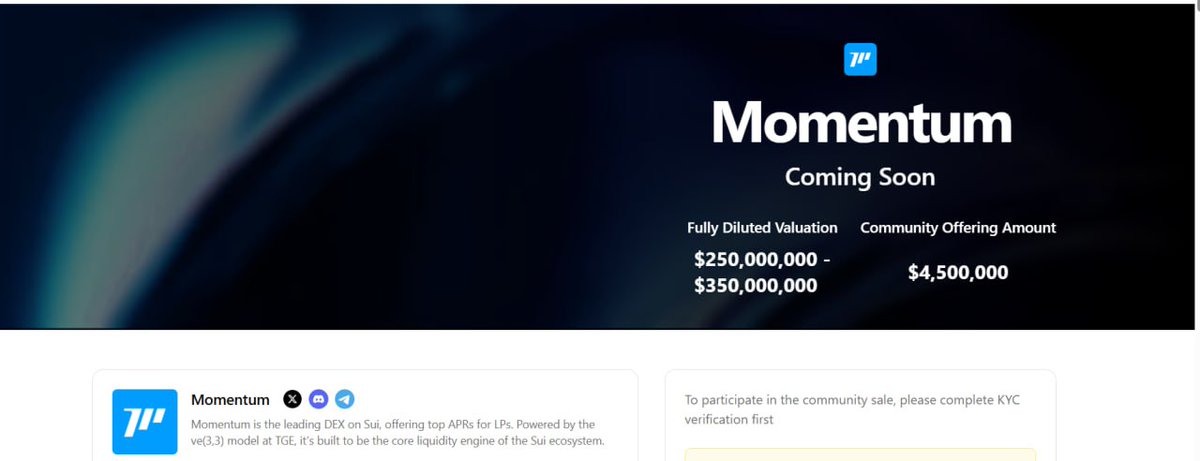

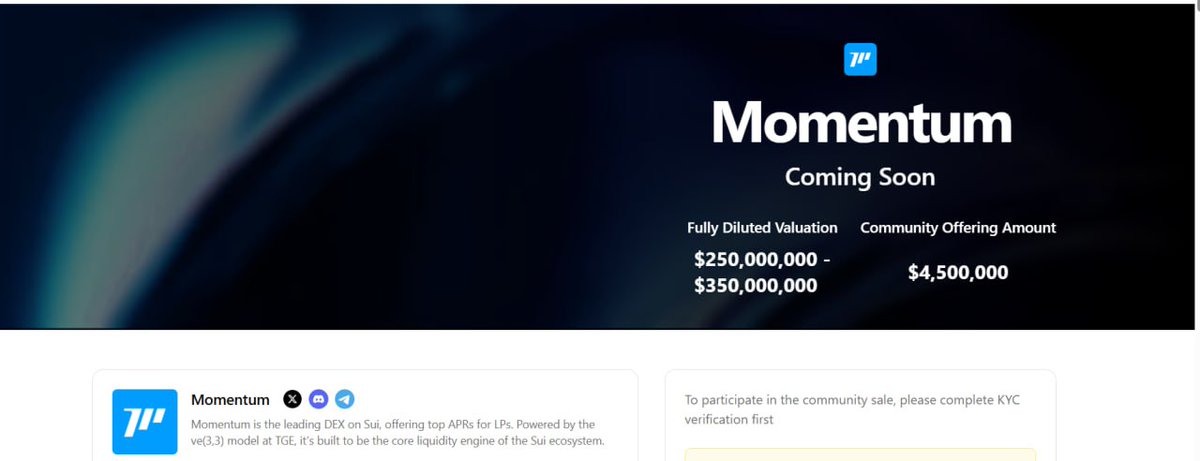

A community offering that puts traders, LPs, and creators first 1/ $MMT on @buidlpad @MMTFinance is opening its token sale to the people who built the flywheel on Sui HODL stakers, WAGMI participants, verified contributors, and UGC teams 2/ Teams Invite up to 10, submit content, and earn higher chances of allocation with at least $150+ per eligible member Quality and engagement drive rewards, your squad’s output matters 3/ Tiers Tier 1: HODL up to $20k, WAGMI up to $10k at $250M FDV Tier 2: Verified community $50 $2k at $350M FDV Full unlock at TGE, no vesting 4/ Timeline UGC submissions: Oct 15 22 (10 AM UTC) KYC: Oct 22 25 Contributions: Oct 27 28 Distribution at TGE 5/ Why @MMTFinance Sui’s liquidity engine combining trading, staking, and concentrated AMM PTB one‑click UX TVL driven past $450M with buidlpad campaigns Reported triple‑digit APRs across pools How to join Add ️️T to your X name, tag @MMTFinance and @buidlpad, publish on trading/staking/yield, assemble your squad buidlpad.com/projects/momen… Educational only, always DYOR

Verifiable oracles or nothing $DIA went from $45M to $400M+ TVS in months adoption you can audit 20,000+ assets 60+ chains 4M+ tokens staked securing feeder nodes How the data holds up Transparent sources from 100+ exchanges On-chain computation with Lumina rollup Auditable methodology end to end This reduces integration risk for perps, RWAs, structured vaults Signals I watch 20+ chain grants including Avalanche Listings on Binance, Coinbase, Kucoin xReal pushing bonds, FX, commodities on-chain with verifiable feeds If I’m shipping tomorrow, I want feeds I can trace, compute I can verify, economics I can trust @DIAdata_org checks those boxes while scaling, which is why smart money keeps circling back Which feed do you wire first for your app t.co/Y0MnBnCdn0 $DIA #Oracles #DeFi #RWA

Quick take on Momentum ($MMT) as Sui’s liquidity engine - CLMM concentrates liquidity for higher fee capture, Sui’s parallel execution keeps swaps fast and cheap - ve(3,3) routes emissions via votes, creating a governance-driven liquidity market - xSUI unlocks staked SUI for collateral, trading, and LP without giving up staking yield Stats: $550M+ TVL, $20B+ cumulative volume, leading depth on Sui Flywheel: volume → fees → LP APR → bribes/emissions → deeper books → more volume Cross-chain: @wormhole + wallet integrations are channeling EVM and Solana assets into Sui, widening pair coverage and flow Creator angle: @buidlpad x @MMTFinance Priority Allocation favors squads up to 10, 60% content quality / 40% engagement, min $150 per participant, link X to Buidlpad Playbook 1) Stake SUI → xSUI 2) Start with suiUSDT USDC to minimize IL 3) Lock veMMT to steer emissions to your pools 4) Recycle fees + bribes to compound Watchpoints: CLMM range upkeep, bridge risk, voter concentration Tracking whether $MMT can sustain real yield as cross-chain liquidity scales on #Sui

DePIN Watch #08: Cysic Summary: a ComputeFi network for ZK/AI workloads Hardware: Dogebox 1 palm-sized DOGE/LTC miner + zk prover NFTs: Digital Compute Cube deed to physical compute, cluster managed by @cysic_xyz Rewards: $cys flow, governance, staking, verifiable work credit In a world converging into mega apps and crowded clouds, owning throughput changes the game Clouds rent access and bury fees; Cysic exposes the rails and lets contributors verify and monetize cycles Why it matters: - ZK rollups need cheap, fast proofs - AI agents need elastic, transparent compute - Communities need open infra they can audit How to participate: Plug a Dogebox to mine and prove Acquire a Compute Cube to claim hardware capacity Contribute prover/validator work to the network and earn $cys Next: Composable compute rails for zk, agent frameworks like PlayAI, and prediction markets settling faster on-chain GM CT

Finance Rails Watch #01: @RaylsLabs Summary: programmable liquidity rails for CBDCs, stables, and tokenized assets Infra: Public Chain with KYC accounts + private subnets; ZK proofs + encryption so banks can prove state while staying private Messaging: LayerZero moves assets across subnets and L1s; cross-chain without brittle bridges Apps: @useTria turns routing, yield, and payments into spendable UX; @LayerBankFi brings RWA cashflows on-chain; @kloutgg links reputation to opportunity Thesis: TradFi scale meets DeFi speed with instant clearing and compliance baked in Data: $32M raised in privates points to deep institutional alignment Why care: programmable cashflows, AI-driven treasury, assets that work 24/7, creators and banks on the same rail Expect CBDC pilots + bank-run subnets first, then retail wallets riding the rails

ZK proving has a hidden choke point: compute @cysic_xyz attacks it at the hardware layer with ASIC acceleration, then opens the proving market so anyone can contribute, verify, and get paid The updated whitepaper pivots from “verifiable compute” to an open, programmable compute economy a base layer for AI and ZK workloads Why it matters: - Real-time proofs for apps that actually need speed - Decentralized access to high-performance compute - Transparent, auditable work outputs instead of rented black boxes Idle GPUs don’t sit; they route into a shared ZK engine ASICs handle the heavy math at scale Pricing and QoS become market signals, not gatekeeper decisions ComputeFi feels like the next primitive Ownable, verifiable, programmable compute as an asset class Watch this space and plug in early with @cysic_xyz

1/ @RaylsLabs is building a hybrid blockchain stack for regulated onchain finance, aligning privacy, compliance, and liquidity Rayls Public Chain (Ethereum-based L2) brings permissionless access and liquidity, while the Private Network (permissioned L1) gives institutions governance control and full confidentiality. Privacy Nodes running Enygma enable private ERC-20s, DvP settlement, and shield transactions from harmful MEV, so order flow doesn’t get farmed by bots Over 10k TPS per subnet, $38M+ in institutional backing, and LayerZero connectivity across 120+ chains signal a team focused on real rails, not retail hype. At the core, $RLS powers governance, fees, and staking, stitching public and private domains into a single programmable fabric Pair this with @useTria’s self-custodial neobank yield in USDC, instant card spends, zero gas and you start to see infrastructure that actually maps to banks and RWAs. Whoever controls the confidential bridge between DeFi liquidity and institutional compliance will define the next cycle, and Rayls looks early and deliberate on that path

Most engaged tweets of Zoro | ☠️

A community offering that puts traders, LPs, and creators first 1/ $MMT on @buidlpad @MMTFinance is opening its token sale to the people who built the flywheel on Sui HODL stakers, WAGMI participants, verified contributors, and UGC teams 2/ Teams Invite up to 10, submit content, and earn higher chances of allocation with at least $150+ per eligible member Quality and engagement drive rewards, your squad’s output matters 3/ Tiers Tier 1: HODL up to $20k, WAGMI up to $10k at $250M FDV Tier 2: Verified community $50 $2k at $350M FDV Full unlock at TGE, no vesting 4/ Timeline UGC submissions: Oct 15 22 (10 AM UTC) KYC: Oct 22 25 Contributions: Oct 27 28 Distribution at TGE 5/ Why @MMTFinance Sui’s liquidity engine combining trading, staking, and concentrated AMM PTB one‑click UX TVL driven past $450M with buidlpad campaigns Reported triple‑digit APRs across pools How to join Add ️️T to your X name, tag @MMTFinance and @buidlpad, publish on trading/staking/yield, assemble your squad buidlpad.com/projects/momen… Educational only, always DYOR

Quick take on Momentum ($MMT) as Sui’s liquidity engine - CLMM concentrates liquidity for higher fee capture, Sui’s parallel execution keeps swaps fast and cheap - ve(3,3) routes emissions via votes, creating a governance-driven liquidity market - xSUI unlocks staked SUI for collateral, trading, and LP without giving up staking yield Stats: $550M+ TVL, $20B+ cumulative volume, leading depth on Sui Flywheel: volume → fees → LP APR → bribes/emissions → deeper books → more volume Cross-chain: @wormhole + wallet integrations are channeling EVM and Solana assets into Sui, widening pair coverage and flow Creator angle: @buidlpad x @MMTFinance Priority Allocation favors squads up to 10, 60% content quality / 40% engagement, min $150 per participant, link X to Buidlpad Playbook 1) Stake SUI → xSUI 2) Start with suiUSDT USDC to minimize IL 3) Lock veMMT to steer emissions to your pools 4) Recycle fees + bribes to compound Watchpoints: CLMM range upkeep, bridge risk, voter concentration Tracking whether $MMT can sustain real yield as cross-chain liquidity scales on #Sui

Verifiable oracles or nothing $DIA went from $45M to $400M+ TVS in months adoption you can audit 20,000+ assets 60+ chains 4M+ tokens staked securing feeder nodes How the data holds up Transparent sources from 100+ exchanges On-chain computation with Lumina rollup Auditable methodology end to end This reduces integration risk for perps, RWAs, structured vaults Signals I watch 20+ chain grants including Avalanche Listings on Binance, Coinbase, Kucoin xReal pushing bonds, FX, commodities on-chain with verifiable feeds If I’m shipping tomorrow, I want feeds I can trace, compute I can verify, economics I can trust @DIAdata_org checks those boxes while scaling, which is why smart money keeps circling back Which feed do you wire first for your app t.co/Y0MnBnCdn0 $DIA #Oracles #DeFi #RWA

Finance Rails Watch #01: @RaylsLabs Summary: programmable liquidity rails for CBDCs, stables, and tokenized assets Infra: Public Chain with KYC accounts + private subnets; ZK proofs + encryption so banks can prove state while staying private Messaging: LayerZero moves assets across subnets and L1s; cross-chain without brittle bridges Apps: @useTria turns routing, yield, and payments into spendable UX; @LayerBankFi brings RWA cashflows on-chain; @kloutgg links reputation to opportunity Thesis: TradFi scale meets DeFi speed with instant clearing and compliance baked in Data: $32M raised in privates points to deep institutional alignment Why care: programmable cashflows, AI-driven treasury, assets that work 24/7, creators and banks on the same rail Expect CBDC pilots + bank-run subnets first, then retail wallets riding the rails

DePIN Watch #08: Cysic Summary: a ComputeFi network for ZK/AI workloads Hardware: Dogebox 1 palm-sized DOGE/LTC miner + zk prover NFTs: Digital Compute Cube deed to physical compute, cluster managed by @cysic_xyz Rewards: $cys flow, governance, staking, verifiable work credit In a world converging into mega apps and crowded clouds, owning throughput changes the game Clouds rent access and bury fees; Cysic exposes the rails and lets contributors verify and monetize cycles Why it matters: - ZK rollups need cheap, fast proofs - AI agents need elastic, transparent compute - Communities need open infra they can audit How to participate: Plug a Dogebox to mine and prove Acquire a Compute Cube to claim hardware capacity Contribute prover/validator work to the network and earn $cys Next: Composable compute rails for zk, agent frameworks like PlayAI, and prediction markets settling faster on-chain GM CT

ZK proving has a hidden choke point: compute @cysic_xyz attacks it at the hardware layer with ASIC acceleration, then opens the proving market so anyone can contribute, verify, and get paid The updated whitepaper pivots from “verifiable compute” to an open, programmable compute economy a base layer for AI and ZK workloads Why it matters: - Real-time proofs for apps that actually need speed - Decentralized access to high-performance compute - Transparent, auditable work outputs instead of rented black boxes Idle GPUs don’t sit; they route into a shared ZK engine ASICs handle the heavy math at scale Pricing and QoS become market signals, not gatekeeper decisions ComputeFi feels like the next primitive Ownable, verifiable, programmable compute as an asset class Watch this space and plug in early with @cysic_xyz

1/ @RaylsLabs is building a hybrid blockchain stack for regulated onchain finance, aligning privacy, compliance, and liquidity Rayls Public Chain (Ethereum-based L2) brings permissionless access and liquidity, while the Private Network (permissioned L1) gives institutions governance control and full confidentiality. Privacy Nodes running Enygma enable private ERC-20s, DvP settlement, and shield transactions from harmful MEV, so order flow doesn’t get farmed by bots Over 10k TPS per subnet, $38M+ in institutional backing, and LayerZero connectivity across 120+ chains signal a team focused on real rails, not retail hype. At the core, $RLS powers governance, fees, and staking, stitching public and private domains into a single programmable fabric Pair this with @useTria’s self-custodial neobank yield in USDC, instant card spends, zero gas and you start to see infrastructure that actually maps to banks and RWAs. Whoever controls the confidential bridge between DeFi liquidity and institutional compliance will define the next cycle, and Rayls looks early and deliberate on that path

People with Creator archetype

@CozomoMedici emerging artist | Claire Silver finalist | Exhibited worldwide l See Highlights

Just an average God-fearing Taurus Ginger * Author, Artist, Gamer * Psychology Major * Be patient with me, I’m from the 1900’s 🤪 * 🧠💪🏻🙏🏻

🧑🏫 Creative Exploration with Purz 🍝 Creative & Host at @ComfyUI

Flutter, Fluttering, Fluttered 💙 · Avid coder 👨💻 · Biggest freaking Legend of Zelda fan 🗡

I create AI art and stories | CPP : hailuo ai, AIpai, Pixo AI

Founder of Brauns Media. Helping Tech, SaaS, AI products grow with guaranteed design KPIs. Our passion is to design static creatives that help brands stand out.

不爱上班的程序员, 靠谱的前端讲师, 卖课为生,前端 Web3 程序员英语 私教, 独立开发 努力做最好的程序员讲师 油管主页:youtube.com/@shengxj 加入电报群: t.me/shengxj11 合作微信:itdasheng168

Designing websites that boost conversions and engagement. Work with me → cal.com/ashiqur-rahman…

Dream big. Work hard. Stay kind.✨

Creator, Artist, Creator of @dopamindai & Art Gallery philoart.io | Blog: philoli.com | DM Me or @PhiloArt2020 if you want to buy my artwork

Dad, Web3 Builder @Hex_Trust custodian, AI Enthusiast, ISTP-A, Speak Chinese, English, jasonzhouu@gmail.com

25+ yrs crafting solutions | Community Developer @cursor_ai | Turning impossible tasks into automated reality | Laravel & AI artisan

Explore Related Archetypes

If you enjoy the creator profiles, you might also like these personality types: