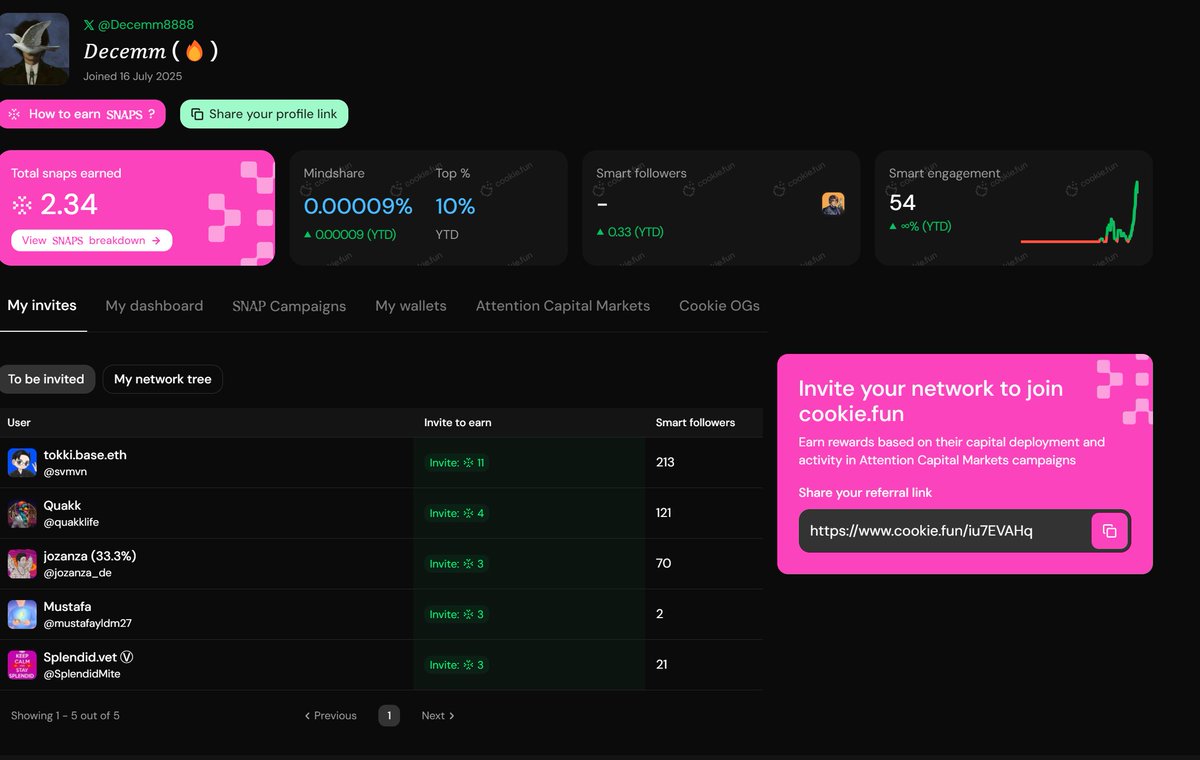

Get live statistics and analysis of 𝐷𝑒𝑐𝑒𝑚𝑚 (🔥)'s profile on X / Twitter

𝐶𝑜𝑛𝑡𝑒𝑛𝑡 𝑐𝑟𝑒𝑎𝑡𝑜𝑟 - 𝑅𝑒𝑝𝑙𝑦 𝑔𝑢𝑦 𝐵𝑙𝑒𝑠𝑠 𝑟𝑢𝑛𝑛𝑒𝑟 - 𝐴𝑛𝑜𝑚𝑎 𝑒𝑛𝑗𝑜𝑦𝑒𝑟 🧙- 𝐷𝑒𝑓𝑖 𝑤𝑖𝑡ℎ 𝑑𝑒𝑓𝑖𝑎𝑝𝑝

The Creator

𝐷𝑒𝑐𝑒𝑚𝑚 (🔥) is a prolific content creator and DeFi connoisseur who crafts informative and tactical threads that demystify complex cross-chain protocols. Their posts serve as a go-to resource for fellow enthusiasts eager to stack the latest infrastructure stacks and optimize yield farming strategies. Always engaged, they expertly blend deep tech insights with actionable alpha tips.

Top users who interacted with 𝐷𝑒𝑐𝑒𝑚𝑚 (🔥) over the last 14 days

𝐷𝑒𝑐𝑒𝑚𝑚 is that one friend who explains a simple sandwich recipe like it’s a cross-chain atomic swap with LayerZero custody—a feast for the brain, but you’re still just hungry for a snack.

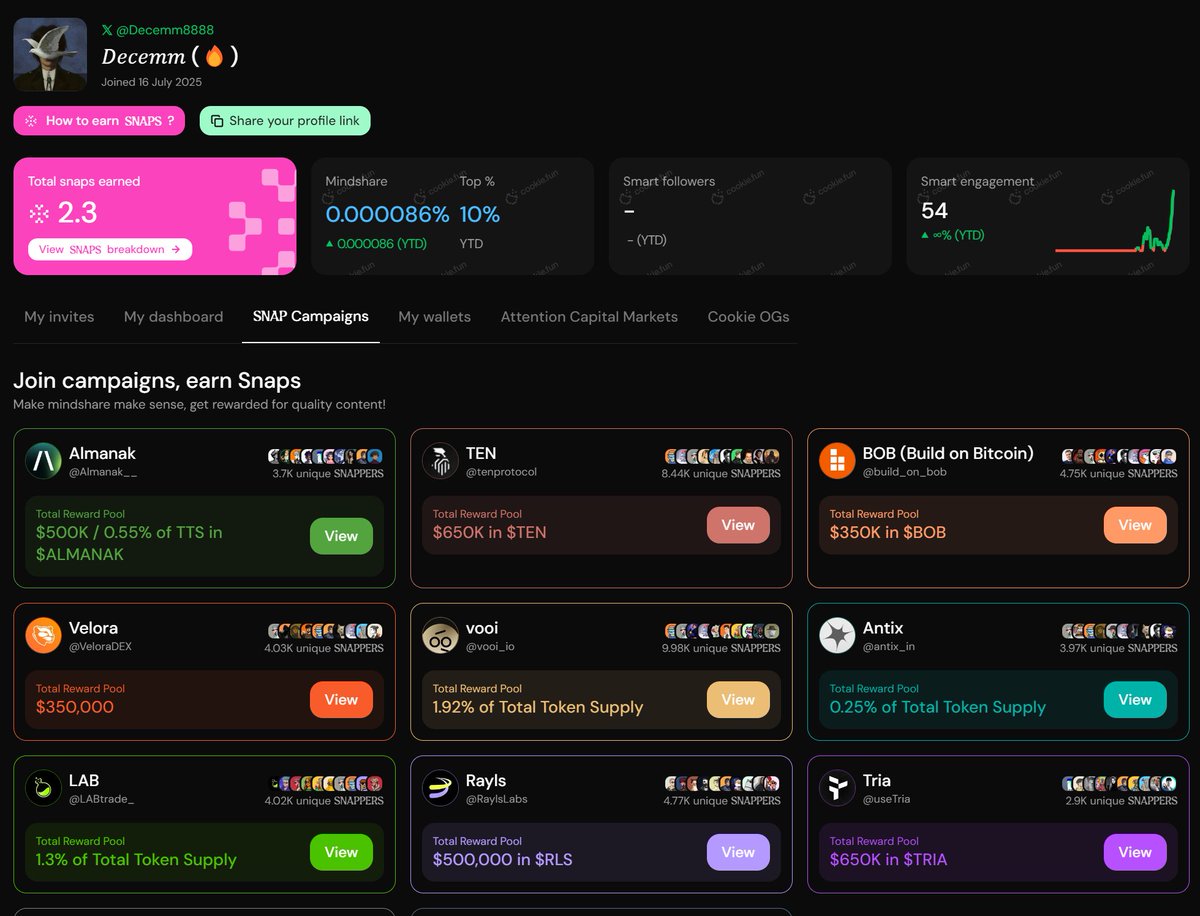

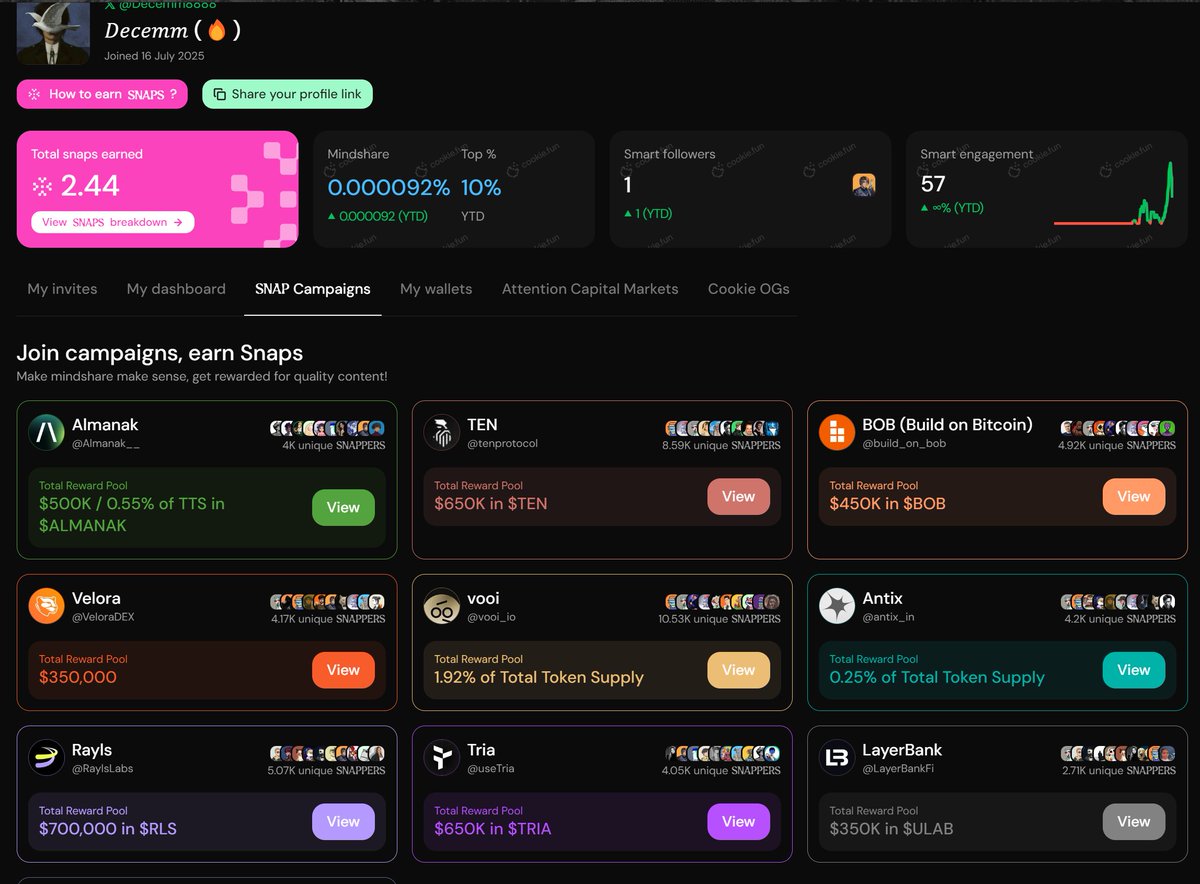

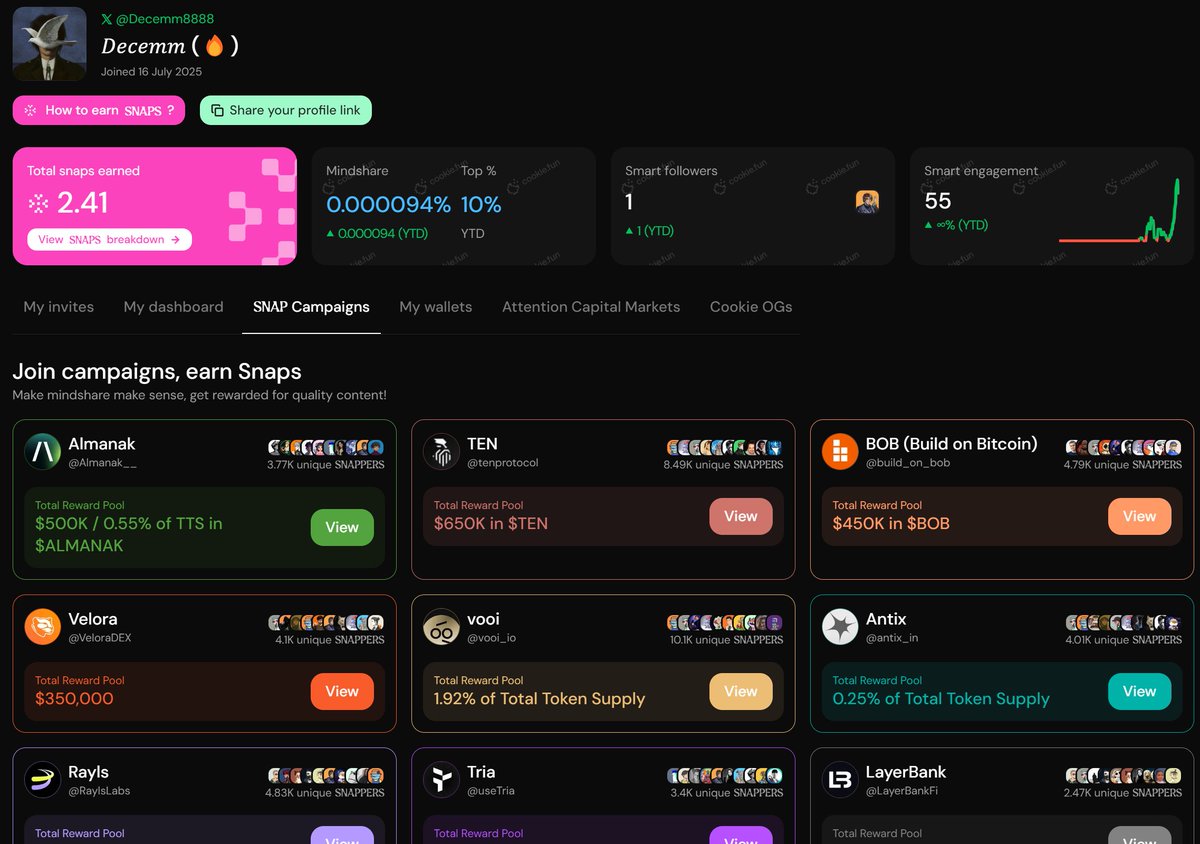

Their biggest win is becoming a respected thought-source behind emerging DeFi infrastructure stacks like VeloraDEX, RaylsLabs, and LayerBankFi, helping shape how the community approaches cross-chain capital flow and programmable finance.

Their life purpose revolves around building, explaining, and promoting next-gen financial infrastructure that empowers users to seamlessly interact with cross-chain ecosystems, effectively transforming how digital assets flow and compound.

They believe in transparency, composability, and privacy within decentralized finance, championing protocols that balance user sovereignty with institutional-grade compliance, thus bridging traditional finance and DeFi.

Their strengths lie in deep technical understanding, the ability to synthesize complicated concepts into digestible content, and a consistent, prolific presence that keeps their audience informed and engaged.

However, their heavy focus on high-level technical jargon and niche protocols may alienate newcomers or casual followers who struggle to keep up with the rapid-fire complexity of their content.

To grow their audience on X, 𝐷𝑒𝑐𝑒𝑚𝑚 should try layering in more approachable and beginner-friendly content threads while maintaining their alpha edge. Engaging in more direct dialogues and Q&A sessions could also foster community trust and broaden appeal beyond hardcore DeFi users.

Fun fact: 𝐷𝑒𝑐𝑒𝑚𝑚 has tweeted over 25,900 times, proving their dedication to sharing knowledge and sparking conversations in the DeFi space.

Top tweets of 𝐷𝑒𝑐𝑒𝑚𝑚 (🔥)

➥ Infra cycle alignment is where the real compounding hides and the current stack on @cookiedotfun is printing signals all over my screen @VeloraDEX → gasless omnichain aggregation with MEV shields, leading Base txns since migration, now routing Polygon Portal intents natively. $VLR at 0.01 still feels like a mismatch vs utility @RaylsLabs → VENs for private bank rails synced to public chains, Enygma zk+encryption flipping privacy/compliance headaches into automated flows. RWA corridors + LayerZero comms already live @useTria → BestPath AVS auto-routes swaps across chains for lowest slippage, 0.05% fee siphoned into buybacks, Visa card bridge normalizing Web3 spend in 150+ countries @LayerBankFi → omni-chain lending over 17 networks, leverage loops keep TVL compounding even in chop, $ULAB governance shaping liquidity routing and yield parameters SNAPS meta keeps top grinders stacking extra rewards while infra plays quietly lock in the rails for next cycle capital flow. Align early, track LB climbs, let the layers do the heavy lifting

➥ Intent-native stack I’m rotating into ✧ Trades: @VeloraDEX programmable routing + MEV-aware intents across 10 chains, 100+ sources. Delta on Arbitrum routes natively; cancel/speed-up txs; direct Polygon portal → $POL PoS. ParaSwap evolution powered by $VLR ✧ Finance rails: @RaylsLabs bank-centric network on Arbitrum Orbit. Tokenized deposits, RWA/CBDC ready, T+0 settlement, private/public subnets with KYC baked for 6B users. $RLS for staking + governance #ProgrammableFinance ✧ Spend layer: @useTria one app to trade/earn/spend. BestPath AVS unifies EVM/SVM/Cosmos, gas handled in-app. VISA from virtual to metal; Japan already got the premium drop ✧ Yield engine: @LayerBankFi cross-chain money market, isolated risk. Leverage Looping Vaults on Plume, 150+ markets/17+ chains, Ozean mainnet users flowing in. Stake $ULAB for rev share, 3x boosts, governance Why this combo ▸ Define intent → agents auction best path ▸ Wrap idle balances into T+0 rails ▸ Execute + pay without bridge drama ▸ Loop RWAs and compound yield Alpha tip: rotate borrows/supplies for L pts, tap Tria cards for off-chain spend, route with Velora when moving size, and pin Rayls for the UniFi thesis

。。swap by swap, agent by agent, the stack starts to click。。 ➥ Here’s the flow I’ve been stress‑testing ↓ ▸ @VeloraDEX intent router via Delta, Portikus for atomic settlement, MEV shielding, cross‑chain routes that adapt to gas/slippage in real time. $VLR expands liquidity on BNB and aligns users with protocol revenue + governance ▸ @RaylsLabs VENs for banks, Enygma privacy preserving EVM, Ethereum trust anchors. $RLS live with fixed 10B supply, utility across validator staking, private chain gas, governance; Drex pilot + hybrid tokenization show real throughput ▸ @useTria BestPath AVS + TriAI orchestrate gasless, cross‑chain execution. Agent‑oriented framework, payment layer, task market, all in one UX ▸ @LayerBankFi unified, omni‑chain lending. lTokens accrue, loops simplified, RWA collateral adds stability to multi‑network liquidity Playbook I run: Velora swap on Avalanche → deposit lTokens on LayerBank → pay or route gasless via Tria → institutions settle inside a Rayls VEN. One pipeline, fewer seams. @cookiedotfun Which piece do you anchor first? A) Velora execution B) LayerBank liquidity C) Tria UX D) Rayls infra Reply A/B/C/D and tell me why; I’ll quote the sharpest takes

➥ the cross-chain stack that actually clicks rn ▸ @VeloraDEX intent-based execution with gasless, MEV-shielded flows, CCTP live for native USDC settlement, 7+ chains wired and Arbitrum’s native bridge baked in. Cross-chain limit orders that feel instant, minus the wrapped-token mess. Powered by $VLR ▸ @RaylsLabs the institutional rails: hybrid public/private EVM subnets, Enygma’s quantum-safe privacy, auditor view-keys, CBDC-ready. Drex pilot in Brazil proves the design; compliance without killing composability ▸ @useTria self-custodial neo-bank UX on Arbitrum. BestPath AVS routes liquidity across chains, abstracts gas/bridging, and connects to card rails in 150+ countries. Spend, earn, and move value without juggling wallets ▸ @LayerBankFi omni-chain money markets across 17+ networks, audited, with Rootstock mBTC looping live and BTC-denominated yield. Deposit once, mobilize across ecosystems. $ULAB keeps the flywheel aligned how i chain it: 1) execute cross-chain with native USDC on Velora 2) park collateral on LayerBank, borrow where needed 3) route payouts and spend via Tria’s account-based UX 4) when institutions join the flow, Rayls handles privacy + settlement controls unified intents, native settlement, real privacy, portable liquidity. that’s the playbook i’m running while others chase tickers. who else stacking these rails #DeFi

➥ The on-chain money loop I’m watching right now ▸ @VeloraDEX intent-based DEX aggregator with Delta v2.5 routing, gas abstraction, MEV resistance, and multi-chain limit orders. Cross-chain swaps feel like one market. $VLR aligns routing + rewards, and the Polygon native bridge upgrade tightened speed and cost ▸ @useTria self-custodial neo-bank. Swap on Arbitrum, earn on Solana, tap the Tria Card globally. BestPath routes payments for minimum cost and clear settlement. $TRIA points + spend data create a real utility flywheel ▸ @LayerBankFi cross-chain lending and leverage looping across 17+ networks, including BTC and RWA vaults with e-Mode risk controls. $ULAB drives governance, boosts, fee discounts, and buyback dynamics ▸ @RaylsLabs KYC-verified public chain with private bank nodes, ZK-backed stablecoin proofs, and Reg D clarity for institution-grade rails. $RLS coordinates validators, builders, and capital Flow I like: loop yield on LayerBank → route execution via Velora → spend through Tria → settle where compliance meets transparency on Rayls Alpha from the field: - set cross-chain limit orders on Velora - loop stables/BTC in LayerBank’s vaults before $ULAB TGE - use the Tria Card and stack $TRIA rewards - read Rayls Litepaper and watch the public sale cadence #DeFi #CrossChain #RWA

➥ Infra that actually composes, quietly loading alpha for the next cycle ▸ @VeloraDEX intent-based swaps, gasless, MEV-shielded; Base Polygon BestPath with agents + RFQ for clean fills; staker rewards still underrated vs $VLR supply cap ▸ @RaylsLabs dual-chain rails for banks; private subnets + KYC-enabled public; EVM + quantum-safe privacy; Drex pilot, $38M raised; $RLS validators anchoring programmable finance ▸ @useTria chain abstraction with social login; BestPath spend across 150+ countries; physical + virtual Visa; gasless tx + yield on every swipe; live on Play Store ▸ @LayerBankFi omni-chain money market across 17+ nets; mBTC loops on Rootstock up to 135% BTC-denom yield; RWAs in automated vaults; $ULAB revenue share, TVL >55M ✦ Flow Map Tria spend → Velora trade → LayerBank loop → Rayls settle ✦ Moves • Stake $VLR for routing economics • Delegate to $RLS validators • Use Tria card for everyday yield • Loop BTC/LSTs with Efficiency Mode on LayerBank Usability, compliance, and composable credit win when the next wave lands

➥ The programmable liquidity stack that actually ships ▸ @VeloraDEX for execution Intent-based routing across 100+ sources on 10 chains, gasless swaps, MEV-resistance, CCTP for native USDC, Base bridge, and yoVaults for deeper fills. $110B+ routed and migration rewards live for seVLR via Sablier. Stack $VLR where flow lives ▸ @useTria as the money OS Self-custodial balance that spends/trades/earns. BestPath AVS on Arbitrum hunts the cheapest route per payment, with Visa live in 150+ countries and 250K+ users. Built for humans and agents, so intent turns into settlement fast ▸ @LayerBankFi for credit and yield Omnichain markets across 17+ networks, zero bad debt so far, RWA yields peaking 76% and Rootstock BTC vaults hitting 135%. Final L.Points season before $ULAB veTokenomics + TGE Q4 2025 ▸ @RaylsLabs as compliant rails Hybrid infra with privacy-preserving subnets + public EVM liquidity, ZK-first design, pilots from Drex to Onyx. $RLS ties staking, fees, governance to real institutional flow Alpha playbook: → Route with Tria → Execute on Velora, settle native USDC → Park on LayerBank, borrow where needed → Bridge corridors with Rayls for instant, compliant scale $VLR $ULAB $RLS #DeFi

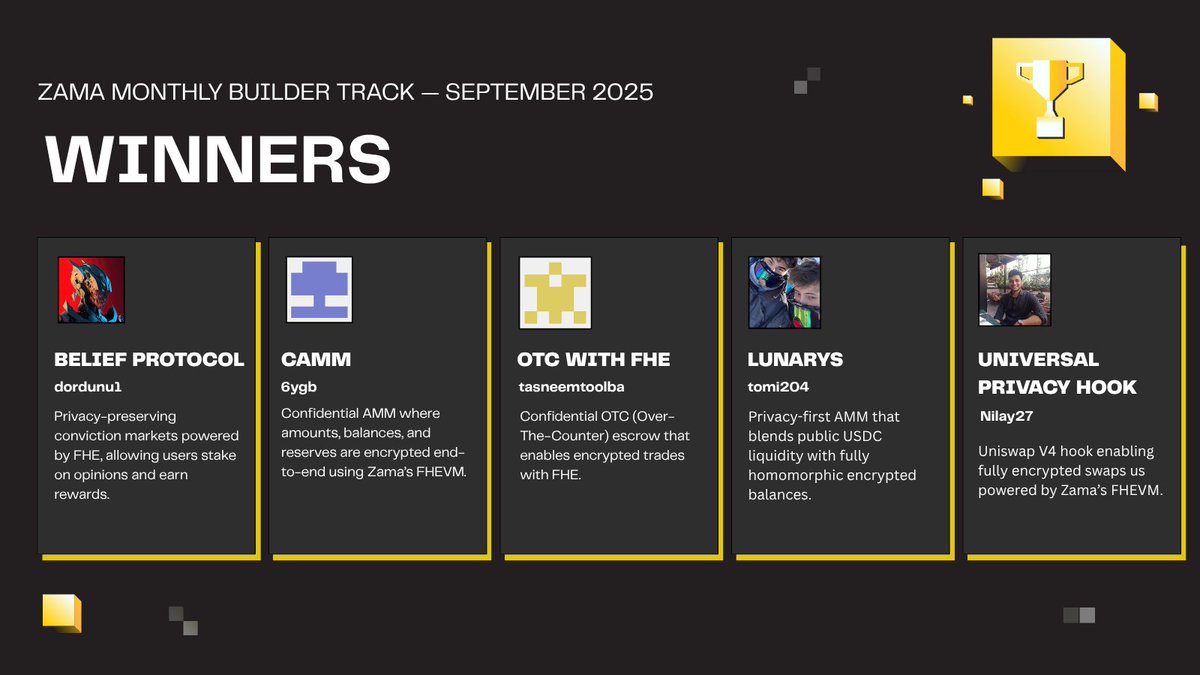

newbie alert: what if $ETH confidentiality drops q4, but adoption stays stuck at testnet vibes? nah, zama's got 5k devs grinding fhEVM already, 1k wallets live on quests q4 mainnet flips that to 50k easy, circle's id rails pulling in the suits risking my stack on the surge, who's with me @zama_fhe #FHE

➥ Agents x payments x social liquidity are converging fast and the edge shows up when you connect @EdgenTech’s x402 analytics with @River4fun’s contribution flywheel From the Edgen vantage: • x402 rails enable machine‑native micropayments for AI agents across Base, Solana, and more pay per call, settle instantly, move liquidity before the feed catches up • Momentum receipts are loud: $VPAY up thousands of percent in 30D, $PAYAI ripping triple digits in 7D, x402 printing strong 24h lifts with on‑chain liquidity confirming the move • Catalysts stack: AI‑payments narrative, multi‑chain dev growth, and rising institutional attention. Trading Mindshare maps the difference between flow that sticks vs flow that screams • Toolkit that matters now: 360° Reports, Themes Beta, Pivot Alerts, and exchange flow panels. Apple login reset Nov 3, Insight Showdown thru Nov 10. Portfolio‑native agents are the cheat code when narratives flip From the River vantage: • 50M River Pts sold out in 2.5 hours via Dutch auction 2,908 BNB subscribed, uniform final price, claim window scheduled. Demand found the clearing price at scale • Dynamic Airdrop Conversion turns time into value early claims get less, patience compounds over a 180‑day curve into more $RIVER per point • satUSD underpins flow across chains without bridges; vaults and upcoming satUSD+ boost yield mechanics. Staking and voting add multipliers, Season 2 leaderboards and Rising Star push mindshare to creators • The social graph converts to collateral‑like gravity when points, rank, and governance loop back into economic rewards How to run the two‑track play: ✧ Research track with Edgen ▸ Pull a 360° on $PAYAI, $VPAY, $RIVER. Save grades, set Pivot Alerts, and watch Mindshare vs perp OI funding ▸ Track the x402 theme in Themes Beta; compression + positive slope on EMA stacks = ignition signals ▸ Use price forecasts to frame if/then routes; require closes, not intrabar noise. Let agent consensus filter chatter ✧ Earn track with River ▸ Stake satUSD or $RIVER, farm River Pts, and stack multipliers; vote in Rising Star to capture shared pools ▸ Treat the 180‑day conversion like an options curve time premium belongs to the patient ▸ Rotate Pts between staking and governance to defend rank, then time conversions into liquid windows Risk doctrine: • Cap risk per idea, trail into strength, and avoid averaging into losers • Social spikes without flow get faded; flow without social often precedes trend confirmation • Seasonality matters: Nov 3 resets and snapshots, Nov 10 outcomes, December agent marketplace for Edgen time boxes create volatility pockets My read: Mindshare > TVL at narrative birth, then liquidity ratifies. x402 gives agents a spending primitive, River turns community action into priced reputation. When payments compress to milliseconds and social proof becomes measurable, the next leg allocates to those who route both Tag your cockpit and your contribution layer: @EdgenTech for intent‑driven execution, @River4fun for proof‑of‑content and yield. Track #X402, watch $RIVER order books, and let agents surface routes while your patience compounds on the curve #EdgenTech #River4FUN #DeFi #Web3 #AIPayments

➥ Cross‑chain finance, cleaned up for humans: a Q4 stack that actually ships ✧ Trading layer @VeloraDEX ▸ Intent-based routing + Arbitrum One means MEV pressure drops while fills speed up ▸ Aggregates 100+ liquidity sources across 10 chains, limit/OTC/cross‑chain in one flow ▸ Tapping Arb’s 900+ apps with L2 fees, right as DEX volume cleared $200B+ in Q3 2025 $VLR ✧ Money rails @RaylsLabs ▸ KYC’d public chain + Privacy Nodes for institutions that need auditability without leaking state ▸ Managed on‑chain rails: tokenized cash, compliant flows, EVM connectivity, Elsa‑style prompts for ops $RLS ✧ Consumer bank @useTria ▸ Self‑custody neobank with gasless BestPath routing and chain abstraction ▸ USDC yield streams straight to Tria Visa so spend comes from earnings, not principal $TRIA ✧ Credit/yield @LayerBankFi ▸ E‑Mode, isolated markets, leverage looping vaults, omni‑chain liquidity ▸ rBTC on Rootstock brings BTC yield into DeFi without sketchy wrappers $ULAB Smart flow ▸ Route with Velora → custody/spend on Tria → park idle in LayerBank loops → settle RWAs or enterprise flows on Rayls Alpha lies in composition, not hot takes Size for risk, measure slippage/health factors, let intents abstract the noise while you compound the signal #DeFi

➥ Stacking Aura on @EdgenTech while farming RiverPts on @River4fun feels like unlocking dual radars for this cycle's wild rotations Edgen's multi-agent swarm flags zkEVM upticks before wallets pile in, cross-asset ratings stitch BTC dips to NVDA hedges, mindshare heatmaps catch DeFi/RWA shifts early Playbook there: scan convergence scores on on-chain infra, long tokens with rising TVL, pair with supplier plays when OI resets $EDGEN rerate incoming if agent marketplace drops mobile hooks, TVL climbing 45% APY, aura grinding rep into compounding alpha Flip to River: omni-CDP mints satUSD across 12 chains no bridge tax, stake into Smart Vaults for 40%+ yields, split PT/YT on Pendle for asymmetric chases Social Pool weights originals over noise, 2 posts 4x/day sustainable, stake points 180/270d for conversion boosts, LP satUSD/USDC at 25x Signals popping: $700M TVL, 300M+ outstanding, Dual Pools flipping liquidity wars, Base collab deepening RIVER/USDC volume Korean fam owning top ranks, K-creators storming leaderboards, next AI storytelling challenge Oct 17 could 10x bags for yappers Why pair 'em? Edgen debates signals into actionable reads, River routes yields cross-chain without slippage eating edges Early grinders convert mindshare to measurable flows, turning infra noise into clean $RIVER/$EDGEN syncs Who's routing L2 bridges into satUSD vaults first, or fading the zk proving grounds? Alpha hides in the overlap Wen TGE snapshots align for both

solid lanes indeed @Kris_thang2k dropping the blueprint on @MindoAI Arena turning scrolls into stacks while the rest chase ghosts that Rubic KOL push? 30k USDT feels like low-hanging fruit with deadlines this tight, Oct 16 cutoff means no room for laggards then $MND seasonal hits different, 100k total pool carving out 33k monthly bites second payout Oct 17, final Nov 17, steady grind pays climbing tips hit home: sharp angles over fluff, 24h sustain beats burst spam, linking swaps/routes/tutorials to real moves? that's the moat Rubic timing screams entry: Blum/BestWallet integrations routing liquidity seamless, MetaMask Snap flow ghosts the friction cross-chain finally moves like butter leaderboards daily refresh, comp light af, plant flag on @CryptoRubic lane now or watch it fill who's scripting that end-to-end swap demo to lock top spots?

➥ Privacy meta exploding, but half the space still treats data like it's free candy The real alpha? Building where confidentiality actually scales without the slowdowns. That's where @zama_fhe flips the script → FHE that runs encrypted ops at chain speeds, no decryption detours. ▸ fhEVM drops private Solidity straight on EVM chains, letting DeFi stay anonymous while crunching numbers ▸ TFHE-rs cranks boolean + integer math on ciphertexts, powering confidential AI that never peeks at your inputs ▸ Concrete ML lets models train and infer on locked datasets, unlocking healthcare + finance without the leaks Zama's open-source stack isn't lab vibes → it's production-ready, hitting 20 TPS now and eyeing 1K+ with HPU accel by next year. I rate this as the missing middleware for Web3's trust layer, where encrypted states compose across chains without exposing a byte. No more ZK tradeoffs or TEE risks → just verifiable privacy that devs can audit and build on today. If LayerZero wires the bridges, Zama encrypts the payloads end-to-end. Pivot here before confidential dApps become the default flex #ZamaCreatorProgram

➥ quantum threat got everyone sweating over their keys, but @zama_fhe just flipped the script with lattice-based FHE that laughs at shor's algorithm picture this: your wallet balance encrypted, deFi strategies running blind to the numbers, ai models crunching patient scans without a single leak that's the flex - computations on locked data, no decrypt first, no exposure ever now layer in the hpu hardware acceleration, and suddenly confidential contracts hit speeds that make zk look sluggish devs dropping fhEVM builds left and right, gateways syncing encrypted requests like clockwork opportunities stacking: ▸ deFi protocols auditing positions without wallet peeks, compliance baked in from jump ▸ ai x web3 collabs where datasets stay sealed, gdpr headaches vanish overnight ▸ institutional onramps - banks testing encrypted txns on eth/sol without the transparency tax ▸ post-quantum armor: while ecc crumbles, zama's lattices hold, harvest now decrypt later? good luck ngl, this isn't hype, it's the infra upgrade web3's been begging for since eth gen1 zama's litepaper spells it out - build private dapps that verify without revealing, scale without sacrificing dive in, stack that knowledge before the quantum wave hits what's your first confidential build gonna be? #ZamaCreatorProgram

diving deeper into @SentientAGI's stack after that thread it's not just hype, it's the verifiable mesh we've been waiting for in AGI land that ROMA meta-agent crushing Seal-0 at 45.6%? doubles Gemini, leaves Kimi in dust, straight builder energy on the leaderboard and the trust layer TEE + PoR + ZKR for privacy? flips AI accountability on its head, no more black box outputs economics hit different too: onchain rewards, $SENT staking on artifacts you vibe with, TGE whispers for Q4 why i'm hooked: agents learning horizontal, outputs chained to truth end-to-end receipts that actually hold up tracking those GRID split/merge latencies next, plus PoR audits who's dropping live tests on chain already? builders, plug in, stake what you believe, let's see those receipts stack #SentientAGI

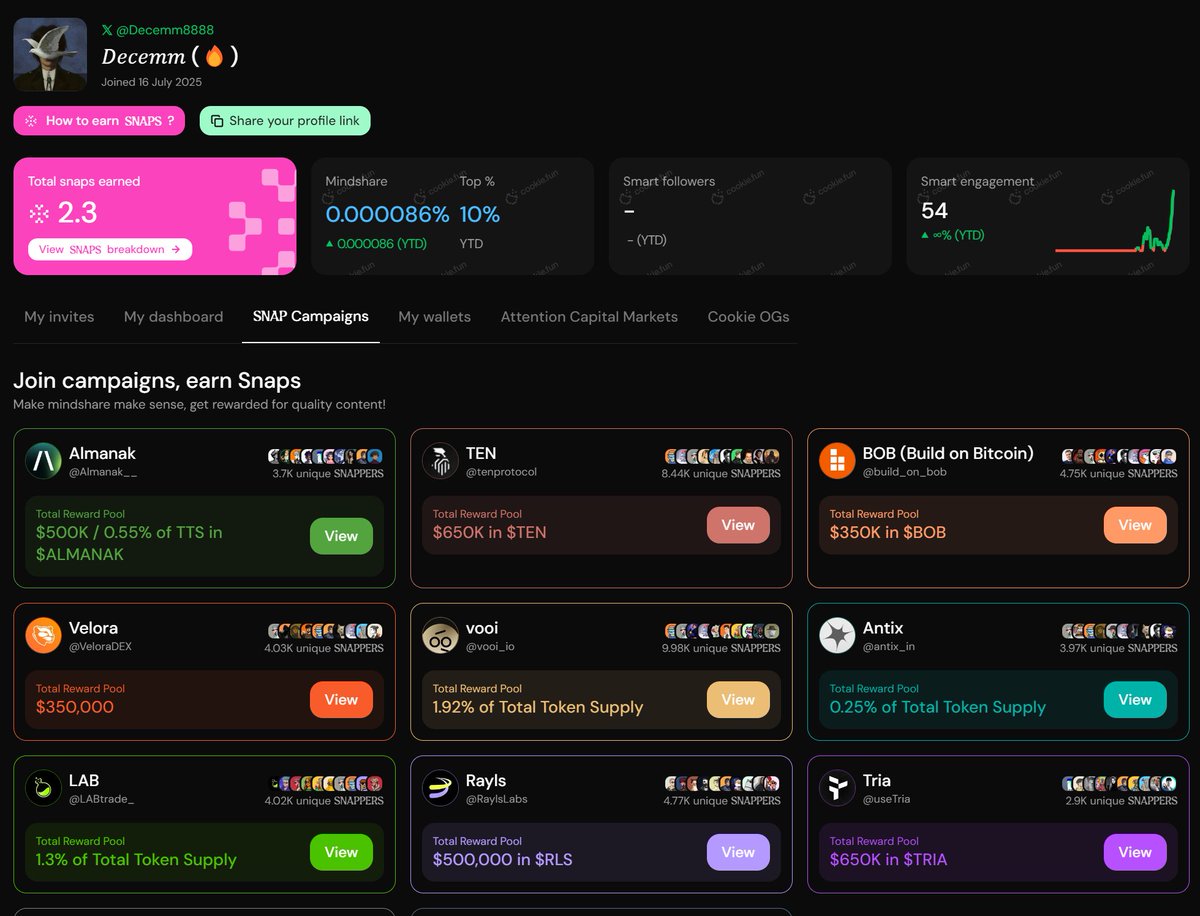

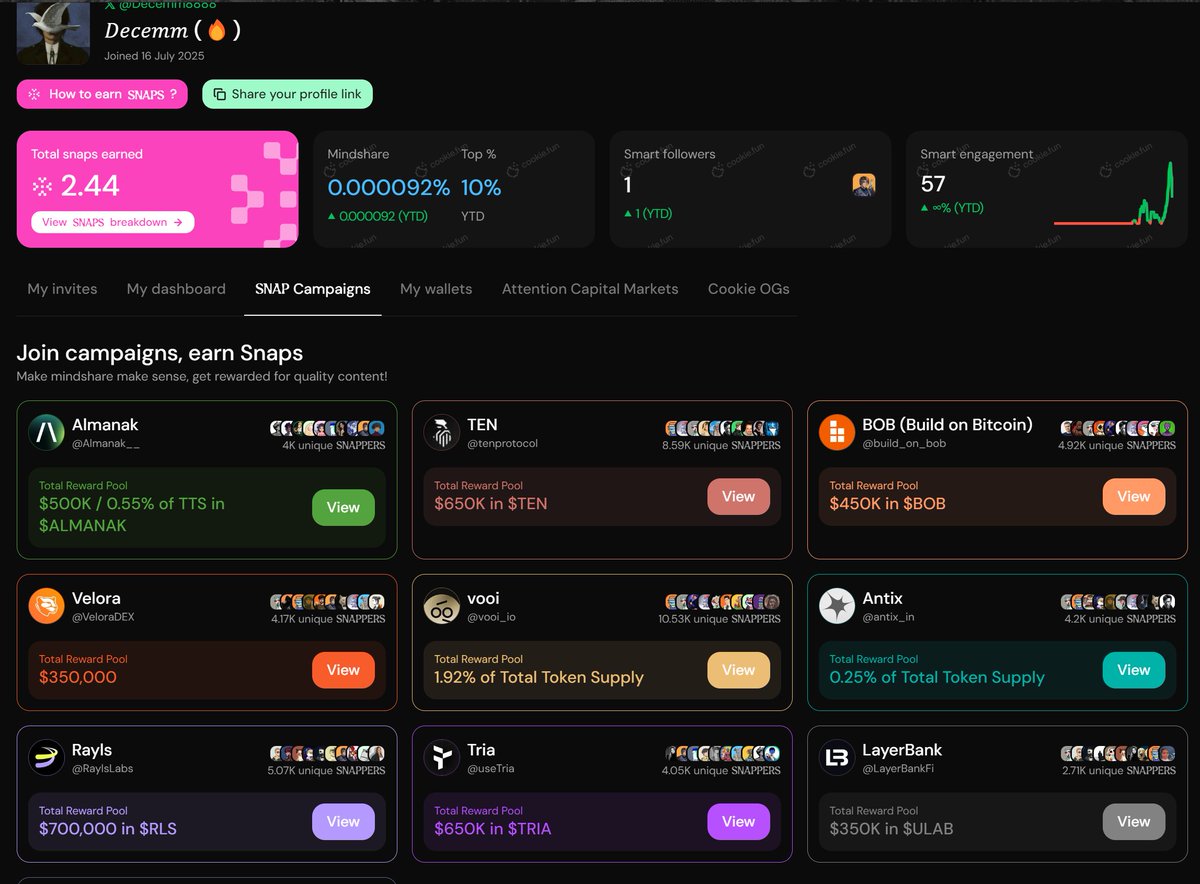

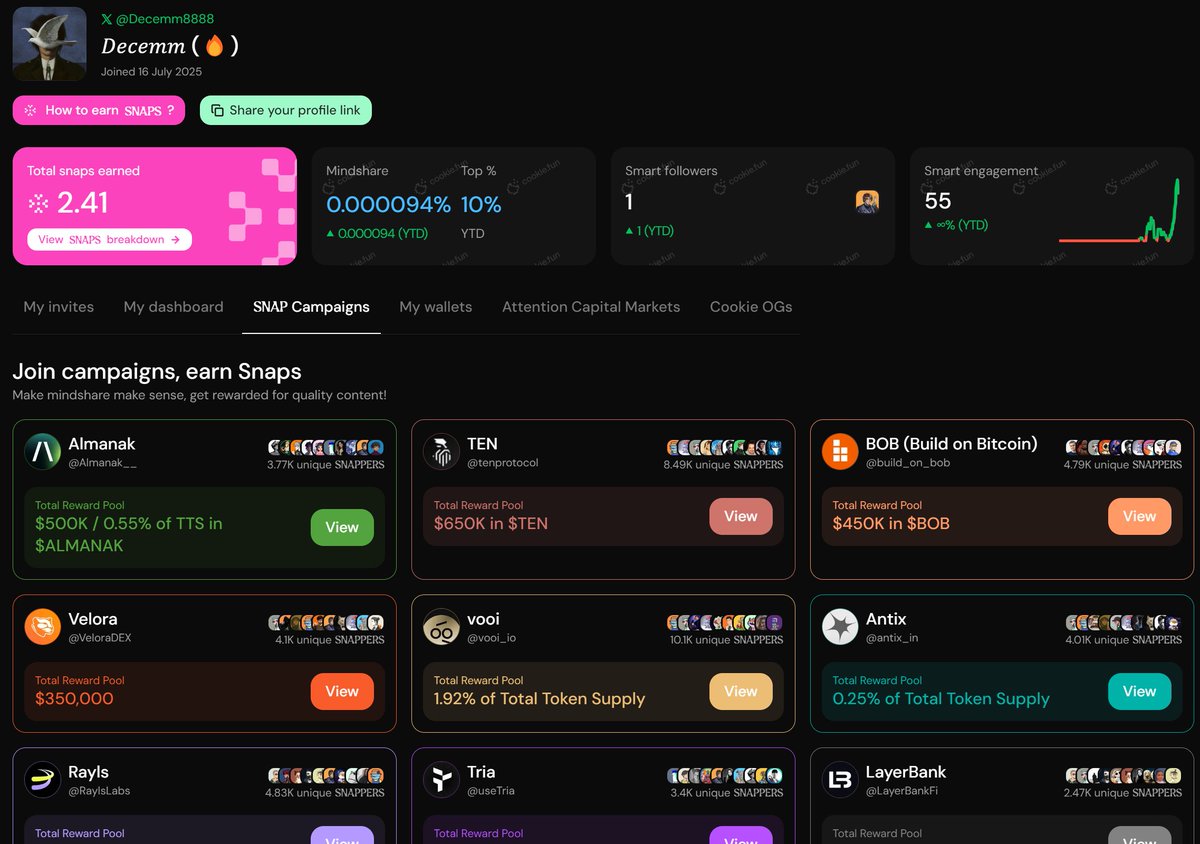

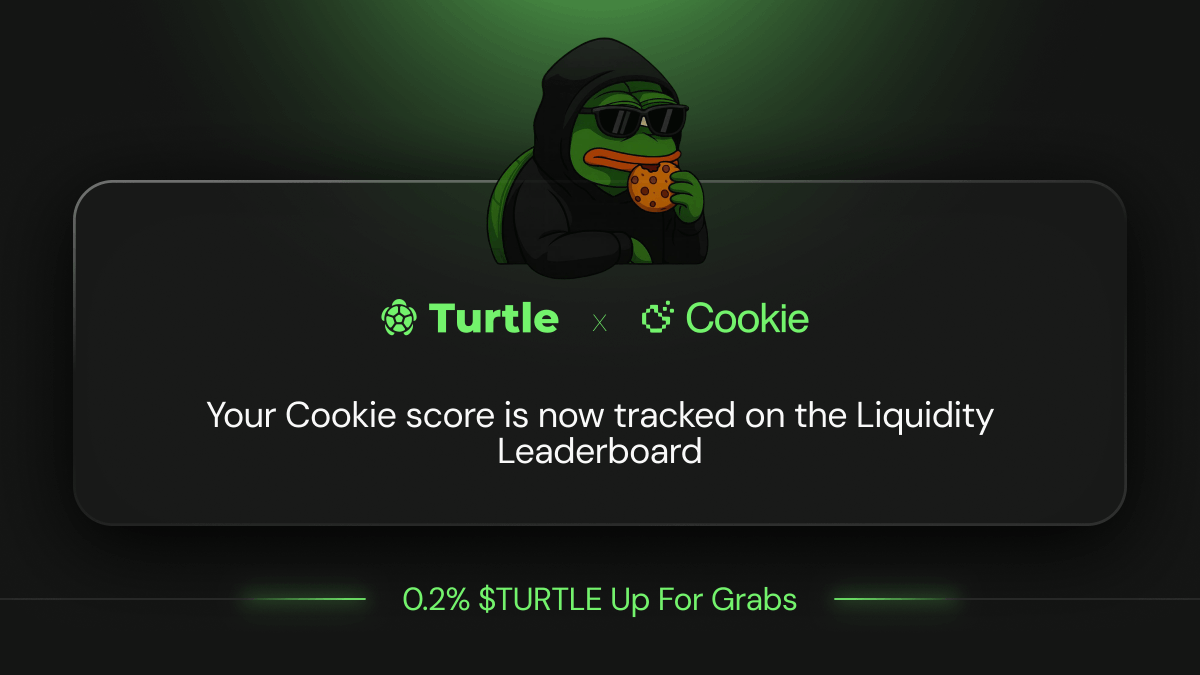

➥ Q4 bags are stacking, but only if you pivot to flywheels that actually compound. While noise chases ghosts, these four are printing real alpha: meme energy on rails, yield loops with social boosts, AI that predicts the meta, and yap that turns talk into tokens. ▸ @Hyperpiexyz_io flips meme chaos into liquidity gold. Bonding curves launch fair, no snipers. Stake $HYPE for mHYPE at 23% APR, fees split 60% to holders. Cap at $40M? If flows consolidate, this DEX-staking engine hits escape velocity. Study the pause button safety in speed. ▸ @turtledotxyz resets DeFi with Turtle vaults on Katana. Bridge USDC, lock Samurai's Call for 40% APY + $KAT drops + $TURTLE airdrop. 15K users, but only 4.7K farmed $1+. Snapshot soon position LP for leaderboard treasures, whales swim first. ▸ @AlloraNetwork blends ML models into onchain foresight. Forge pits data scientists against BTC/USD logs, accuracy compounds live. No single AI overlord, just collective sharpening. TGE whispers? Backers like Polychain signal verifiable intel that outruns the curve. ▸ @kaito turns mindshare into uncapped yaps. Leaderboards for Brevis, Theo post smart, rank up, claim % supply. Diversify from testnets: 0.05% $THEO for THBULLs, monthly $THBILL to top creators. Low comp on new LBs means early yappers eat 1B $MYR slices. Quiet phase favors builders. Farm these loops now meme + yield + AI + infofi = your cycle edge. Who's locking first?

Most engaged tweets of 𝐷𝑒𝑐𝑒𝑚𝑚 (🔥)

➥ Infra cycle alignment is where the real compounding hides and the current stack on @cookiedotfun is printing signals all over my screen @VeloraDEX → gasless omnichain aggregation with MEV shields, leading Base txns since migration, now routing Polygon Portal intents natively. $VLR at 0.01 still feels like a mismatch vs utility @RaylsLabs → VENs for private bank rails synced to public chains, Enygma zk+encryption flipping privacy/compliance headaches into automated flows. RWA corridors + LayerZero comms already live @useTria → BestPath AVS auto-routes swaps across chains for lowest slippage, 0.05% fee siphoned into buybacks, Visa card bridge normalizing Web3 spend in 150+ countries @LayerBankFi → omni-chain lending over 17 networks, leverage loops keep TVL compounding even in chop, $ULAB governance shaping liquidity routing and yield parameters SNAPS meta keeps top grinders stacking extra rewards while infra plays quietly lock in the rails for next cycle capital flow. Align early, track LB climbs, let the layers do the heavy lifting

。。swap by swap, agent by agent, the stack starts to click。。 ➥ Here’s the flow I’ve been stress‑testing ↓ ▸ @VeloraDEX intent router via Delta, Portikus for atomic settlement, MEV shielding, cross‑chain routes that adapt to gas/slippage in real time. $VLR expands liquidity on BNB and aligns users with protocol revenue + governance ▸ @RaylsLabs VENs for banks, Enygma privacy preserving EVM, Ethereum trust anchors. $RLS live with fixed 10B supply, utility across validator staking, private chain gas, governance; Drex pilot + hybrid tokenization show real throughput ▸ @useTria BestPath AVS + TriAI orchestrate gasless, cross‑chain execution. Agent‑oriented framework, payment layer, task market, all in one UX ▸ @LayerBankFi unified, omni‑chain lending. lTokens accrue, loops simplified, RWA collateral adds stability to multi‑network liquidity Playbook I run: Velora swap on Avalanche → deposit lTokens on LayerBank → pay or route gasless via Tria → institutions settle inside a Rayls VEN. One pipeline, fewer seams. @cookiedotfun Which piece do you anchor first? A) Velora execution B) LayerBank liquidity C) Tria UX D) Rayls infra Reply A/B/C/D and tell me why; I’ll quote the sharpest takes

➥ Intent-native stack I’m rotating into ✧ Trades: @VeloraDEX programmable routing + MEV-aware intents across 10 chains, 100+ sources. Delta on Arbitrum routes natively; cancel/speed-up txs; direct Polygon portal → $POL PoS. ParaSwap evolution powered by $VLR ✧ Finance rails: @RaylsLabs bank-centric network on Arbitrum Orbit. Tokenized deposits, RWA/CBDC ready, T+0 settlement, private/public subnets with KYC baked for 6B users. $RLS for staking + governance #ProgrammableFinance ✧ Spend layer: @useTria one app to trade/earn/spend. BestPath AVS unifies EVM/SVM/Cosmos, gas handled in-app. VISA from virtual to metal; Japan already got the premium drop ✧ Yield engine: @LayerBankFi cross-chain money market, isolated risk. Leverage Looping Vaults on Plume, 150+ markets/17+ chains, Ozean mainnet users flowing in. Stake $ULAB for rev share, 3x boosts, governance Why this combo ▸ Define intent → agents auction best path ▸ Wrap idle balances into T+0 rails ▸ Execute + pay without bridge drama ▸ Loop RWAs and compound yield Alpha tip: rotate borrows/supplies for L pts, tap Tria cards for off-chain spend, route with Velora when moving size, and pin Rayls for the UniFi thesis

➥ the cross-chain stack that actually clicks rn ▸ @VeloraDEX intent-based execution with gasless, MEV-shielded flows, CCTP live for native USDC settlement, 7+ chains wired and Arbitrum’s native bridge baked in. Cross-chain limit orders that feel instant, minus the wrapped-token mess. Powered by $VLR ▸ @RaylsLabs the institutional rails: hybrid public/private EVM subnets, Enygma’s quantum-safe privacy, auditor view-keys, CBDC-ready. Drex pilot in Brazil proves the design; compliance without killing composability ▸ @useTria self-custodial neo-bank UX on Arbitrum. BestPath AVS routes liquidity across chains, abstracts gas/bridging, and connects to card rails in 150+ countries. Spend, earn, and move value without juggling wallets ▸ @LayerBankFi omni-chain money markets across 17+ networks, audited, with Rootstock mBTC looping live and BTC-denominated yield. Deposit once, mobilize across ecosystems. $ULAB keeps the flywheel aligned how i chain it: 1) execute cross-chain with native USDC on Velora 2) park collateral on LayerBank, borrow where needed 3) route payouts and spend via Tria’s account-based UX 4) when institutions join the flow, Rayls handles privacy + settlement controls unified intents, native settlement, real privacy, portable liquidity. that’s the playbook i’m running while others chase tickers. who else stacking these rails #DeFi

➥ Infra that actually composes, quietly loading alpha for the next cycle ▸ @VeloraDEX intent-based swaps, gasless, MEV-shielded; Base Polygon BestPath with agents + RFQ for clean fills; staker rewards still underrated vs $VLR supply cap ▸ @RaylsLabs dual-chain rails for banks; private subnets + KYC-enabled public; EVM + quantum-safe privacy; Drex pilot, $38M raised; $RLS validators anchoring programmable finance ▸ @useTria chain abstraction with social login; BestPath spend across 150+ countries; physical + virtual Visa; gasless tx + yield on every swipe; live on Play Store ▸ @LayerBankFi omni-chain money market across 17+ nets; mBTC loops on Rootstock up to 135% BTC-denom yield; RWAs in automated vaults; $ULAB revenue share, TVL >55M ✦ Flow Map Tria spend → Velora trade → LayerBank loop → Rayls settle ✦ Moves • Stake $VLR for routing economics • Delegate to $RLS validators • Use Tria card for everyday yield • Loop BTC/LSTs with Efficiency Mode on LayerBank Usability, compliance, and composable credit win when the next wave lands

➥ The on-chain money loop I’m watching right now ▸ @VeloraDEX intent-based DEX aggregator with Delta v2.5 routing, gas abstraction, MEV resistance, and multi-chain limit orders. Cross-chain swaps feel like one market. $VLR aligns routing + rewards, and the Polygon native bridge upgrade tightened speed and cost ▸ @useTria self-custodial neo-bank. Swap on Arbitrum, earn on Solana, tap the Tria Card globally. BestPath routes payments for minimum cost and clear settlement. $TRIA points + spend data create a real utility flywheel ▸ @LayerBankFi cross-chain lending and leverage looping across 17+ networks, including BTC and RWA vaults with e-Mode risk controls. $ULAB drives governance, boosts, fee discounts, and buyback dynamics ▸ @RaylsLabs KYC-verified public chain with private bank nodes, ZK-backed stablecoin proofs, and Reg D clarity for institution-grade rails. $RLS coordinates validators, builders, and capital Flow I like: loop yield on LayerBank → route execution via Velora → spend through Tria → settle where compliance meets transparency on Rayls Alpha from the field: - set cross-chain limit orders on Velora - loop stables/BTC in LayerBank’s vaults before $ULAB TGE - use the Tria Card and stack $TRIA rewards - read Rayls Litepaper and watch the public sale cadence #DeFi #CrossChain #RWA

➥ The programmable liquidity stack that actually ships ▸ @VeloraDEX for execution Intent-based routing across 100+ sources on 10 chains, gasless swaps, MEV-resistance, CCTP for native USDC, Base bridge, and yoVaults for deeper fills. $110B+ routed and migration rewards live for seVLR via Sablier. Stack $VLR where flow lives ▸ @useTria as the money OS Self-custodial balance that spends/trades/earns. BestPath AVS on Arbitrum hunts the cheapest route per payment, with Visa live in 150+ countries and 250K+ users. Built for humans and agents, so intent turns into settlement fast ▸ @LayerBankFi for credit and yield Omnichain markets across 17+ networks, zero bad debt so far, RWA yields peaking 76% and Rootstock BTC vaults hitting 135%. Final L.Points season before $ULAB veTokenomics + TGE Q4 2025 ▸ @RaylsLabs as compliant rails Hybrid infra with privacy-preserving subnets + public EVM liquidity, ZK-first design, pilots from Drex to Onyx. $RLS ties staking, fees, governance to real institutional flow Alpha playbook: → Route with Tria → Execute on Velora, settle native USDC → Park on LayerBank, borrow where needed → Bridge corridors with Rayls for instant, compliant scale $VLR $ULAB $RLS #DeFi

newbie alert: what if $ETH confidentiality drops q4, but adoption stays stuck at testnet vibes? nah, zama's got 5k devs grinding fhEVM already, 1k wallets live on quests q4 mainnet flips that to 50k easy, circle's id rails pulling in the suits risking my stack on the surge, who's with me @zama_fhe #FHE

➥ Cross‑chain finance, cleaned up for humans: a Q4 stack that actually ships ✧ Trading layer @VeloraDEX ▸ Intent-based routing + Arbitrum One means MEV pressure drops while fills speed up ▸ Aggregates 100+ liquidity sources across 10 chains, limit/OTC/cross‑chain in one flow ▸ Tapping Arb’s 900+ apps with L2 fees, right as DEX volume cleared $200B+ in Q3 2025 $VLR ✧ Money rails @RaylsLabs ▸ KYC’d public chain + Privacy Nodes for institutions that need auditability without leaking state ▸ Managed on‑chain rails: tokenized cash, compliant flows, EVM connectivity, Elsa‑style prompts for ops $RLS ✧ Consumer bank @useTria ▸ Self‑custody neobank with gasless BestPath routing and chain abstraction ▸ USDC yield streams straight to Tria Visa so spend comes from earnings, not principal $TRIA ✧ Credit/yield @LayerBankFi ▸ E‑Mode, isolated markets, leverage looping vaults, omni‑chain liquidity ▸ rBTC on Rootstock brings BTC yield into DeFi without sketchy wrappers $ULAB Smart flow ▸ Route with Velora → custody/spend on Tria → park idle in LayerBank loops → settle RWAs or enterprise flows on Rayls Alpha lies in composition, not hot takes Size for risk, measure slippage/health factors, let intents abstract the noise while you compound the signal #DeFi

➥ Stacking Aura on @EdgenTech while farming RiverPts on @River4fun feels like unlocking dual radars for this cycle's wild rotations Edgen's multi-agent swarm flags zkEVM upticks before wallets pile in, cross-asset ratings stitch BTC dips to NVDA hedges, mindshare heatmaps catch DeFi/RWA shifts early Playbook there: scan convergence scores on on-chain infra, long tokens with rising TVL, pair with supplier plays when OI resets $EDGEN rerate incoming if agent marketplace drops mobile hooks, TVL climbing 45% APY, aura grinding rep into compounding alpha Flip to River: omni-CDP mints satUSD across 12 chains no bridge tax, stake into Smart Vaults for 40%+ yields, split PT/YT on Pendle for asymmetric chases Social Pool weights originals over noise, 2 posts 4x/day sustainable, stake points 180/270d for conversion boosts, LP satUSD/USDC at 25x Signals popping: $700M TVL, 300M+ outstanding, Dual Pools flipping liquidity wars, Base collab deepening RIVER/USDC volume Korean fam owning top ranks, K-creators storming leaderboards, next AI storytelling challenge Oct 17 could 10x bags for yappers Why pair 'em? Edgen debates signals into actionable reads, River routes yields cross-chain without slippage eating edges Early grinders convert mindshare to measurable flows, turning infra noise into clean $RIVER/$EDGEN syncs Who's routing L2 bridges into satUSD vaults first, or fading the zk proving grounds? Alpha hides in the overlap Wen TGE snapshots align for both

➥ Privacy meta exploding, but half the space still treats data like it's free candy The real alpha? Building where confidentiality actually scales without the slowdowns. That's where @zama_fhe flips the script → FHE that runs encrypted ops at chain speeds, no decryption detours. ▸ fhEVM drops private Solidity straight on EVM chains, letting DeFi stay anonymous while crunching numbers ▸ TFHE-rs cranks boolean + integer math on ciphertexts, powering confidential AI that never peeks at your inputs ▸ Concrete ML lets models train and infer on locked datasets, unlocking healthcare + finance without the leaks Zama's open-source stack isn't lab vibes → it's production-ready, hitting 20 TPS now and eyeing 1K+ with HPU accel by next year. I rate this as the missing middleware for Web3's trust layer, where encrypted states compose across chains without exposing a byte. No more ZK tradeoffs or TEE risks → just verifiable privacy that devs can audit and build on today. If LayerZero wires the bridges, Zama encrypts the payloads end-to-end. Pivot here before confidential dApps become the default flex #ZamaCreatorProgram

➥ Agents x payments x social liquidity are converging fast and the edge shows up when you connect @EdgenTech’s x402 analytics with @River4fun’s contribution flywheel From the Edgen vantage: • x402 rails enable machine‑native micropayments for AI agents across Base, Solana, and more pay per call, settle instantly, move liquidity before the feed catches up • Momentum receipts are loud: $VPAY up thousands of percent in 30D, $PAYAI ripping triple digits in 7D, x402 printing strong 24h lifts with on‑chain liquidity confirming the move • Catalysts stack: AI‑payments narrative, multi‑chain dev growth, and rising institutional attention. Trading Mindshare maps the difference between flow that sticks vs flow that screams • Toolkit that matters now: 360° Reports, Themes Beta, Pivot Alerts, and exchange flow panels. Apple login reset Nov 3, Insight Showdown thru Nov 10. Portfolio‑native agents are the cheat code when narratives flip From the River vantage: • 50M River Pts sold out in 2.5 hours via Dutch auction 2,908 BNB subscribed, uniform final price, claim window scheduled. Demand found the clearing price at scale • Dynamic Airdrop Conversion turns time into value early claims get less, patience compounds over a 180‑day curve into more $RIVER per point • satUSD underpins flow across chains without bridges; vaults and upcoming satUSD+ boost yield mechanics. Staking and voting add multipliers, Season 2 leaderboards and Rising Star push mindshare to creators • The social graph converts to collateral‑like gravity when points, rank, and governance loop back into economic rewards How to run the two‑track play: ✧ Research track with Edgen ▸ Pull a 360° on $PAYAI, $VPAY, $RIVER. Save grades, set Pivot Alerts, and watch Mindshare vs perp OI funding ▸ Track the x402 theme in Themes Beta; compression + positive slope on EMA stacks = ignition signals ▸ Use price forecasts to frame if/then routes; require closes, not intrabar noise. Let agent consensus filter chatter ✧ Earn track with River ▸ Stake satUSD or $RIVER, farm River Pts, and stack multipliers; vote in Rising Star to capture shared pools ▸ Treat the 180‑day conversion like an options curve time premium belongs to the patient ▸ Rotate Pts between staking and governance to defend rank, then time conversions into liquid windows Risk doctrine: • Cap risk per idea, trail into strength, and avoid averaging into losers • Social spikes without flow get faded; flow without social often precedes trend confirmation • Seasonality matters: Nov 3 resets and snapshots, Nov 10 outcomes, December agent marketplace for Edgen time boxes create volatility pockets My read: Mindshare > TVL at narrative birth, then liquidity ratifies. x402 gives agents a spending primitive, River turns community action into priced reputation. When payments compress to milliseconds and social proof becomes measurable, the next leg allocates to those who route both Tag your cockpit and your contribution layer: @EdgenTech for intent‑driven execution, @River4fun for proof‑of‑content and yield. Track #X402, watch $RIVER order books, and let agents surface routes while your patience compounds on the curve #EdgenTech #River4FUN #DeFi #Web3 #AIPayments

➥ quantum threat got everyone sweating over their keys, but @zama_fhe just flipped the script with lattice-based FHE that laughs at shor's algorithm picture this: your wallet balance encrypted, deFi strategies running blind to the numbers, ai models crunching patient scans without a single leak that's the flex - computations on locked data, no decrypt first, no exposure ever now layer in the hpu hardware acceleration, and suddenly confidential contracts hit speeds that make zk look sluggish devs dropping fhEVM builds left and right, gateways syncing encrypted requests like clockwork opportunities stacking: ▸ deFi protocols auditing positions without wallet peeks, compliance baked in from jump ▸ ai x web3 collabs where datasets stay sealed, gdpr headaches vanish overnight ▸ institutional onramps - banks testing encrypted txns on eth/sol without the transparency tax ▸ post-quantum armor: while ecc crumbles, zama's lattices hold, harvest now decrypt later? good luck ngl, this isn't hype, it's the infra upgrade web3's been begging for since eth gen1 zama's litepaper spells it out - build private dapps that verify without revealing, scale without sacrificing dive in, stack that knowledge before the quantum wave hits what's your first confidential build gonna be? #ZamaCreatorProgram

solid lanes indeed @Kris_thang2k dropping the blueprint on @MindoAI Arena turning scrolls into stacks while the rest chase ghosts that Rubic KOL push? 30k USDT feels like low-hanging fruit with deadlines this tight, Oct 16 cutoff means no room for laggards then $MND seasonal hits different, 100k total pool carving out 33k monthly bites second payout Oct 17, final Nov 17, steady grind pays climbing tips hit home: sharp angles over fluff, 24h sustain beats burst spam, linking swaps/routes/tutorials to real moves? that's the moat Rubic timing screams entry: Blum/BestWallet integrations routing liquidity seamless, MetaMask Snap flow ghosts the friction cross-chain finally moves like butter leaderboards daily refresh, comp light af, plant flag on @CryptoRubic lane now or watch it fill who's scripting that end-to-end swap demo to lock top spots?

➥ FHE season is igniting why @zama_fhe has my attention ▸ fhEVM → confidential smart contracts on EVM using encrypted types (euint, ebool, eaddress) with standard Solidity ops on ciphertext ▸ Works across Ethereum, Arbitrum, Polygon, Optimism a confidentiality layer over the stack ▸ Programmable privacy → choose what stays hidden, what’s shared, and under what conditions it decrypts Hardware acceleration matters: ▸ HPU on FPGA (e.g. Xilinx V80) → ~13K bootstraps/sec, pushing FHE toward practical throughput for onchain + ML Open source stack you can build with today: ▸ Concrete / Concrete ML ▸ TFHE-rs for high‑performance FHE Use cases that finally make sense: ▸ DeFi dark pools, sealed-bid auctions, private lending ▸ Verifiable private voting ▸ Encrypted ML inference Alpha for creators: ▸ First 1,000 → Zama OG 003 NFT ▸ $50,000 to top 100 by score ▸ Monthly: $3,000 x6 for written + $3,000 x6 for video My take: ZK = proof, FHE = privacy. Together you get verifiable encrypted compute the path to compliant, confidential apps at scale #ZamaCreatorProgram

➥ Q4 bags are stacking, but only if you pivot to flywheels that actually compound. While noise chases ghosts, these four are printing real alpha: meme energy on rails, yield loops with social boosts, AI that predicts the meta, and yap that turns talk into tokens. ▸ @Hyperpiexyz_io flips meme chaos into liquidity gold. Bonding curves launch fair, no snipers. Stake $HYPE for mHYPE at 23% APR, fees split 60% to holders. Cap at $40M? If flows consolidate, this DEX-staking engine hits escape velocity. Study the pause button safety in speed. ▸ @turtledotxyz resets DeFi with Turtle vaults on Katana. Bridge USDC, lock Samurai's Call for 40% APY + $KAT drops + $TURTLE airdrop. 15K users, but only 4.7K farmed $1+. Snapshot soon position LP for leaderboard treasures, whales swim first. ▸ @AlloraNetwork blends ML models into onchain foresight. Forge pits data scientists against BTC/USD logs, accuracy compounds live. No single AI overlord, just collective sharpening. TGE whispers? Backers like Polychain signal verifiable intel that outruns the curve. ▸ @kaito turns mindshare into uncapped yaps. Leaderboards for Brevis, Theo post smart, rank up, claim % supply. Diversify from testnets: 0.05% $THEO for THBULLs, monthly $THBILL to top creators. Low comp on new LBs means early yappers eat 1B $MYR slices. Quiet phase favors builders. Farm these loops now meme + yield + AI + infofi = your cycle edge. Who's locking first?

People with Creator archetype

Software Engineer @Microsoft · Code Artist · Works on C++/C#/Web/Win32/Linux/DevOps

独立游戏喵呜小镇开发中,目前在 ZEROBASE 打工。

Microsoft AI Team - Support Esc. Engineer | AI lover | Sharing my own AI interests and looking forward to see yours | Vibe coder | Gaming Lover | ハゲマント

I don’t create content. I create what’s next. Creator | Gaming | Ambassador life:edgen.tech/aura/NoonLue92…

Logo & Brand Identity Designer DM open for collab & freelance work: designernazmulhossan@gmail.com or WhatsApp: +8801978857454

I turn emails & static ads from “meh” to money-makers 💰 | Design that solves problems + drives clicks | Clients: Coushy, Tavo, Nootri, & more @forstdigital

Visual & Web Designer | Framer Expert Taking On New Projects for November. DM for collab!

♱ Product Director @NEXARTIS_ @aimusicvideo ♱ ♱ Music Artist with 33 albums 'Pastor Fussycat' on all sites ♱ ♱ Click Highlights for music videos, 4K on my YT ♱

💡Fresh ideas about someething unique ✨, life hack & tutorial 🎉, and everyday creativity 🌟. Always fun, always different! 😎🎨”

Front End Developer | Mobile App Developer | Wix Expert | I help individuals and businesses to create Websites | send email to - me@toluijiola.com

Logo & Brand Identity Designer #Logo #logodesign #brandidentity #branding fiverr.com/s/VYXKvpx

This is my #AIart account. My other account is @Ryuk_devi.I'm an enthusiastic AI art creator and hope you like what you see. You can find more on my Patreon 😊

Explore Related Archetypes

If you enjoy the creator profiles, you might also like these personality types: