Get live statistics and analysis of ◮加密之星◮'s profile on X / Twitter

Web3猎手

The Connector

◮加密之星◮ is a dynamic Web3 hunter who thrives on bridging disparate players in the decentralized finance ecosystem. With relentless activity and insightful updates, they keep their network informed of groundbreaking advancements and high-yield opportunities. Their tweets are a hub for crypto enthusiasts looking to stay ahead in the fast-evolving blockchain space.

Top users who interacted with ◮加密之星◮ over the last 14 days

With 29,656 tweets but no visible followers, ◮加密之星◮ might just be practicing their blockchain soliloquies to a very exclusive, invisible audience—proof that in crypto, even your tweets might need staking to gain traction.

Successfully positioned themselves as a key information relay in the Web3 community, consistently breaking down complex DeFi events and launches with sharp precision and real-time updates, gaining trust among crypto insiders.

To connect builders, quants, and investors by spreading cutting-edge Web3 intelligence that empowers collective financial innovation and adoption.

They believe in the power of decentralized networks, transparency through shared data, and that the future of finance lies in collaborative technological evolution rather than isolated efforts.

Exceptional networking prowess combined with deep expertise in DeFi and blockchain, enabling them to deliver timely, high-value information to a broad and diverse audience.

High tweet volume without a visible follower count might dilute perceived influence, and an over-reliance on technical jargon could alienate less tech-savvy users.

To grow on X, focus on interactive content like AMAs, polls, or simplified explainers for newcomers, and leverage strategic collaborations with influencers for broader reach. Highlight success stories of wallet users and DeFi participants to build social proof and attract followers beyond core crypto experts.

Fun fact: Despite not having a public follower count, ◮加密之星◮ interacts with thousands through nearly 30,000 tweets, showing an extraordinary commitment to engagement and information sharing in the crypto community.

Top tweets of ◮加密之星◮

Decentralized AI bottlenecks are crumbling fast. @AlloraNetwork coordinates 288K+ models across 55 domains, spitting out 692M inferences with 10x accuracy gains over solo setups. Even pre-staking, hit 14% yield in 4 months real edge, no fluff. August testnet crushed it: - 53.22% directional accuracy on BTC calls - 0.09 correlation coefficient - 1273% equiv APY from 10k+ forecasts Self-improving loop? Workers predict, Reputers score, network evolves onchain collective brain that sharpens daily. Backed by Polychain, Framework, CoinFund at $35M, ties to Alibaba, Mantle, gumi. Q4 mainnet drops $ALLO, PWYW fees, dev kit for DeFi agents and gaming. This wires intel straight into onchain decisions. Quants and builders, plug in now. Infinite alpha ahead

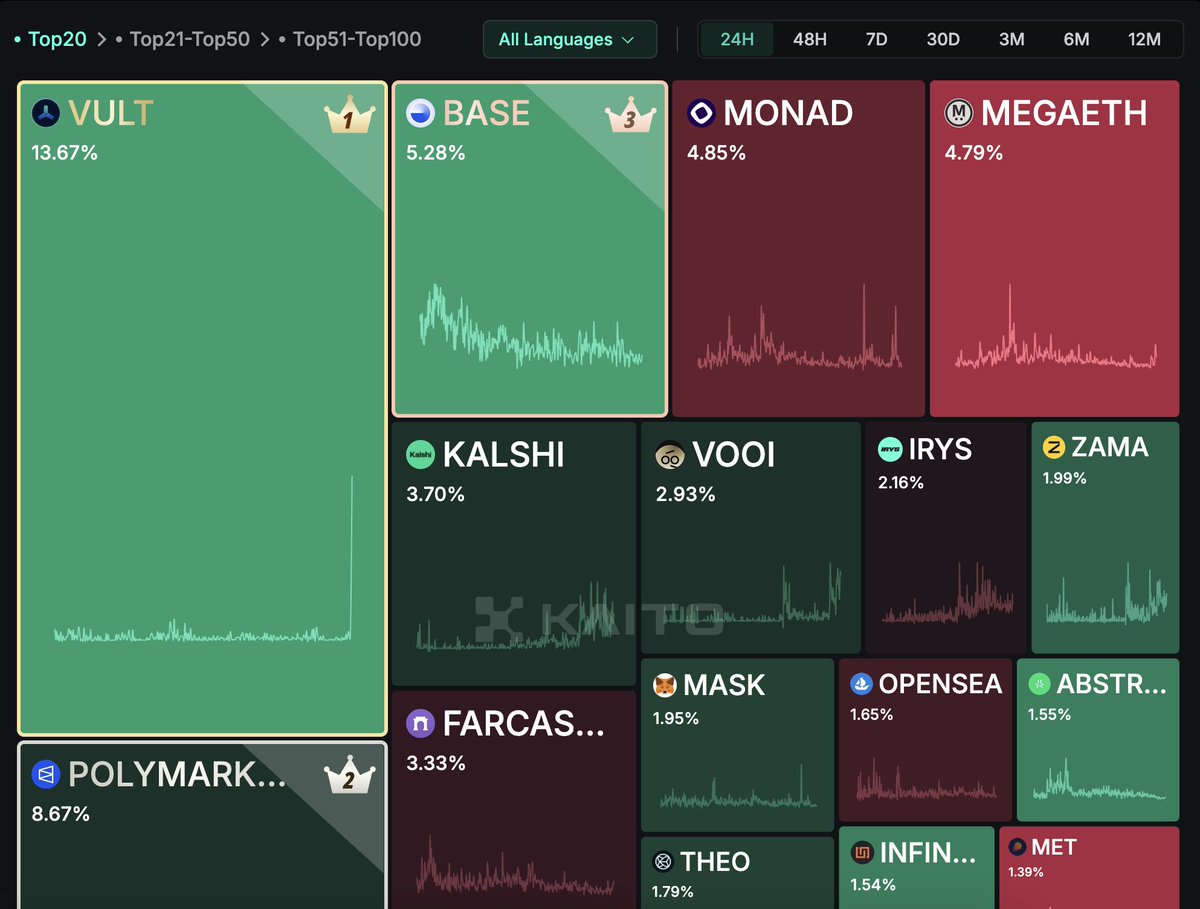

Infinit Labs Founder Talk AMA drops today at Binance Square, 3PM GMT+8 Tascha Panpan unpacks agentic finance roadmap after that 280M-user Binance Wallet integration Expect deep dives on one-click yield loops, multi-chain execution, and $IN staking APYs hitting 25% 1,500+ RSVPs already tune in for Q4 catalysts like Berachain rollout @Infinit_Labs #AgenticDeFi

Proving Grounds Strategy: @brevis_zk Phase 1 wraps Nov 2 lock in social tasks for base Sparks, then Phase 2 drops Nov 3 with on-chain multipliers via PancakeSwap v3 pools and MetaMask lending Top play: Stack verified DeFi volume (e.g., slisBNB stakes) for 2x boosts, ties direct to TGE allocation $4B TVL enabled already, this unlocks continuous rewards over one-offs Your move? proving-grounds.brevis.network

kindred waitlist hits 3m users pre-tge, that's 1m added since september alone. 40% ecosystem allocation means airdrops could seed 120m $kin to early holders at $100m fdv projection. sei's 10k tps handles agent txns without hiccups, turning emotional chats into revenue shares via 20% staking yields. institutions like cmc labs already locked in retail chases ips, but kindred captures the $16b companionship market first. @kindred_ai leading the ip x ai pump #KindredAI

$VULT TGE in 2 days. @vultisig nailed the seedless shift: TSS splits keys across your devices, no single hack point, multi-chain swaps baked in. Whitelist top 300? Straight $3M FDV entry on Uniswap V3 first hour caps at $1k buys to kill snipers. Kraken follows. Momentum's real. Who's vaulting up?

Sui's DeFi TVL just crossed $2B, and @MMTFinance is capturing over 50% of that with $550M locked in organic growth from $23B cumulative volume, no emissions gimmicks. The ve(3,3) flywheel here routes fees straight to LPs and voters, turning speculation into sustainable yields that could pull in $1B+ more from BTCFi cross-chain flows via Wormhole. Meanwhile @buidlpad's HODL staking has already stacked $222M for $MMT priority, filtering real users with wallet binds and KYC before the Oct 27 contrib window. This setup undervalues the liquidity engine at $250M Tier 1 FDV imagine compounding xSUI stakes into automated vaults while grabbing 100% unlocked tokens at TGE. Early squads in the UGC challenge are locking $150+ allocations by Oct 22; if you're stacking LP for that snapshot, what's your target APR on SUI-USDC pools?

Momentum Finance just crossed $23B in swap volume with $550M TVL locked in, turning Sui into a liquidity beast that outpaces most chains twice its age. @MMTFinance built the playbook first: CLMM depth, xSUI staking yields, vaults automating the grind, all feeding a flywheel that hits $368K daily fees from actual trades, not farm spam. Now the $MMT community round drops on @buidlpad October 27-28: $4.5M raise, 100% unlock at TGE, no VC cuts, tiers at $250M/$350M FDV for HODL stakers vs public. Snapshot locks tomorrow stake $3K+ LP in SUI-USDC or xSUI pairs via HODL for Tier 1 caps up to $20K, or UGC your way to 30% creator pool. Backed by Jump, Coinbase, OKX, this isn't hype chasing, it's infra compounding. Sui DeFi flips the script when liquidity sticks. By EOY expect $MMT mirroring Aerodrome's run but with cross-chain Wormhole juice and RWA tokenization rails MMT X bridges TradFi assets on-chain, compliance baked in. Early apes who bind wallets, KYC by 25th, and contribute BNB/SUI/USD1 stand to 5x from here as TVL doubles on TGL launches. The alignment screams melt-up: easing Fed, fiscal juice, and Sui's parallel tx speed making DeFi feel like CEX without the suits. Who stacks LP before snapshot?

Momentum's ve(3,3) flywheel just unlocked a new layer of alignment on Sui LPs, traders, and voters all compounding in sync without the usual friction. $550M+ TVL anchoring $23B cumulative volume, xSUI liquid staking pulling in 2.1M users, CLMM pools squeezing slippage on everything from $SUI pairs to RWAs. Now the @buidlpad community offering flips the script: $4.5M raise at $250-350M FDV, 100% TGE unlock, no VC cliffs just retail and creators stacking early. Tier 1 snapshot hits Oct 25 for $3K+ HODLers, UGC squads locking $150+ priority by Oct 22. Metrics scream infrastructure play, not hype cycle. Post-launch? Expect veMMT votes to bootstrap emissions into high-usage pools, bridging Wormhole inflows for that next liquidity surge. Sui's DeFi OS scaling to trillions positioned or watching? $MMT t.co/Z18nZcIp3B

I have extremely strong intuition that self‑improving intelligence layers are about to become the default for onchain agents @AlloraNetwork is days from mainnet and the design clicks: inference for signals, Reputers paid to benchmark truth, regret feedback tightening the loop so models adapt in real time Practical win: AI‑powered swap aggregation + routing that responds to fees, slippage, liquidity across DEXs. Static models die; markets move; adaptive prediction wins AMA Sunday with @nick_emmons 5 AM CET / 12:00 pm KST. Snapshot + $ALLO timing could drop Side note: @cysic_xyz pushing ComputeFi will matter here Which layer gets your vote: Inference, Reputers, or Regret feedback

Brevis ZK Overview: > ZK coprocessor unlocking historical on-chain data for any smart contract, all via trustless proofs that verify both facts and math > Hybrid model flips the script: full proofs on challenge, slashing gas costs while keeping everything auditable across chains > Live hooks into Kwenta derivatives, JoJo exchange, Trusta labs turning raw history into programmable truth for DeFi yields and compliance layers > Cross-chain headers via zkFabric mean no more silos; queries pull verified states from Ethereum to Solana without leaking a byte Seasonality favors ZK stacks as scaling narratives heat up, macro tailwinds from ETF inflows pushing risk into verifiable compute plays. Bullish on @brevis_zk bridging data to on-chain intelligence expect integrations to spike with Q4 protocol upgrades. Invalidation below recent proof throughput dips, but momentum holds above coprocessor adoption thresholds. Weak hands get shaken; the verifiable future solidifies without them

Monad card holders flipping for $40k-$60k OTC while premarket $MON dumps from 40B to 14B FDV. FOMO baked in, sure, but let's unpack this. Discord roles, Kaito leaderboard spots, testnet badges those were the easy multipliers pre-hype. Now? Nominated alts getting shut out, full access stimmy feels like a lottery ticket on Arbitrum rails. Top KOLs cashing early screams doubt on airdrop convexity, yet community raids keep loading 98% claims. @monad built parallel EVM with 10k TPS, sub-second finals tek that crushes Solana's outage roulette without the VC theater. If TGE hits with real liquidity, $MON could 3x off lows, flipping that 14B into moon math. But watch the burn: ineligible wallets turning water, gMonad drops as eligibility hacks. Positioned heavy on cards? You're betting on appreciation tokens turning into alpha hunts. Missed? Farm the ecosystem MadLads whispers, SHIBAI last calls. This isn't retail noise, it's the signal for L1 wars heating up. Bullish on execution over memes, but $8k-$10k card floor holds if claims drop clean tomorrow. What's your play hodl the nad or flip the script?

Frax's frxUSD isn't messing around fully collateralized with T-Bills and cash equivs, it's engineered for institutions craving that GENIUS-level stability in wild markets. Pair it with sfrxUSD for auto-compounding yields blending DeFi alpha and treasury safety, turning your stack into a passive powerhouse. FraxNet drops soon, unlocking seamless mint/redeem across 20+ chains expect transfer volumes to explode past ATHs. This is stablecoin evolution at warp speed @fraxfinance $frxUSD

River's vaults hitting $716M TVL already, with that 49% APR on staked Pts compounding like a beast while $RIVER grinds ATHs and perps light up on Binance. Love the dynamic airdrop hold: 180 days turns points into rocket fuel, slashing sell pressure and stacking yields. Tactical add: if you're voting in Rising Star, pair it with Omni-CDP across those 8+ chains satUSD LPs are printing when spreads widen post-tweak. Non-stakers snagging free votes? Game-changer for first-timers chasing that 3M pool. Spend your X scrolls stacking #RiverPts, not scrolling @River4FUN's playbook is printing real alpha @DucHoan07242344

In the last quarter alone, @brevis_zk has minted over 43M verifiable proofs for cross-chain DeFi apps outpacing rivals like Succinct by 3.4x in cost-efficient performance on everyday RTX GPUs. As a dev grinding on scalable ZK stacks, I've seen the bottlenecks: bloated oracles, chain silos, endless custom integrations that kill velocity. Brevis flips it with modular coprocessing pull historical data from ETH, Solana, or IBC, compute off-chain, attest on-chain without the overhead. No more wrestling centralized feeds or proof silos; it's a shared layer where computations compose across protocols like @usualmoney or @noble_xyz. Cautiously, this isn't hype it's the quiet shift to trustless interoperability that devs have begged for. Bold call: By mid-2026, 70% of new dApps will lean on Brevis for data proofs, unlocking $10B in untapped yield flows. Devs, what's your next build waiting on? Fork their SDK and prove me right this week.

regen claims + ethereum intents? this could be the coordination layer we've been waiting for onchain regen verification syncing with intent solvers think verifiable carbon credits executed via anoma-style arch without the trust assumptions from the post: bridging giveth's claims engine to eth, enabling purpose-driven txns that actually stick 1. core play: users express regen intents (e.g., offset via verified claims), solvers match/execute on eth L1/L2s. no more offchain promises 2. upside: boosts regen tvl by tying it to eth liquidity. imagine auto-routing yields to climate vaults post-execution. lfg for real impact 3. risks: solver centralization if not diversified (anoma mitigates but early). oracle dependency for claims data watch for disputes shoutout @gregory_landua for surfacing this. if you're building in regen space, test the bridge asap @Regen_Network this unlocks composability we need. what's the first intent primitive dropping?

Most engaged tweets of ◮加密之星◮

Infinit Labs Founder Talk AMA drops today at Binance Square, 3PM GMT+8 Tascha Panpan unpacks agentic finance roadmap after that 280M-user Binance Wallet integration Expect deep dives on one-click yield loops, multi-chain execution, and $IN staking APYs hitting 25% 1,500+ RSVPs already tune in for Q4 catalysts like Berachain rollout @Infinit_Labs #AgenticDeFi

Decentralized AI bottlenecks are crumbling fast. @AlloraNetwork coordinates 288K+ models across 55 domains, spitting out 692M inferences with 10x accuracy gains over solo setups. Even pre-staking, hit 14% yield in 4 months real edge, no fluff. August testnet crushed it: - 53.22% directional accuracy on BTC calls - 0.09 correlation coefficient - 1273% equiv APY from 10k+ forecasts Self-improving loop? Workers predict, Reputers score, network evolves onchain collective brain that sharpens daily. Backed by Polychain, Framework, CoinFund at $35M, ties to Alibaba, Mantle, gumi. Q4 mainnet drops $ALLO, PWYW fees, dev kit for DeFi agents and gaming. This wires intel straight into onchain decisions. Quants and builders, plug in now. Infinite alpha ahead

Proving Grounds Strategy: @brevis_zk Phase 1 wraps Nov 2 lock in social tasks for base Sparks, then Phase 2 drops Nov 3 with on-chain multipliers via PancakeSwap v3 pools and MetaMask lending Top play: Stack verified DeFi volume (e.g., slisBNB stakes) for 2x boosts, ties direct to TGE allocation $4B TVL enabled already, this unlocks continuous rewards over one-offs Your move? proving-grounds.brevis.network

kindred waitlist hits 3m users pre-tge, that's 1m added since september alone. 40% ecosystem allocation means airdrops could seed 120m $kin to early holders at $100m fdv projection. sei's 10k tps handles agent txns without hiccups, turning emotional chats into revenue shares via 20% staking yields. institutions like cmc labs already locked in retail chases ips, but kindred captures the $16b companionship market first. @kindred_ai leading the ip x ai pump #KindredAI

Sui's DeFi TVL just crossed $2B, and @MMTFinance is capturing over 50% of that with $550M locked in organic growth from $23B cumulative volume, no emissions gimmicks. The ve(3,3) flywheel here routes fees straight to LPs and voters, turning speculation into sustainable yields that could pull in $1B+ more from BTCFi cross-chain flows via Wormhole. Meanwhile @buidlpad's HODL staking has already stacked $222M for $MMT priority, filtering real users with wallet binds and KYC before the Oct 27 contrib window. This setup undervalues the liquidity engine at $250M Tier 1 FDV imagine compounding xSUI stakes into automated vaults while grabbing 100% unlocked tokens at TGE. Early squads in the UGC challenge are locking $150+ allocations by Oct 22; if you're stacking LP for that snapshot, what's your target APR on SUI-USDC pools?

Momentum Finance just crossed $23B in swap volume with $550M TVL locked in, turning Sui into a liquidity beast that outpaces most chains twice its age. @MMTFinance built the playbook first: CLMM depth, xSUI staking yields, vaults automating the grind, all feeding a flywheel that hits $368K daily fees from actual trades, not farm spam. Now the $MMT community round drops on @buidlpad October 27-28: $4.5M raise, 100% unlock at TGE, no VC cuts, tiers at $250M/$350M FDV for HODL stakers vs public. Snapshot locks tomorrow stake $3K+ LP in SUI-USDC or xSUI pairs via HODL for Tier 1 caps up to $20K, or UGC your way to 30% creator pool. Backed by Jump, Coinbase, OKX, this isn't hype chasing, it's infra compounding. Sui DeFi flips the script when liquidity sticks. By EOY expect $MMT mirroring Aerodrome's run but with cross-chain Wormhole juice and RWA tokenization rails MMT X bridges TradFi assets on-chain, compliance baked in. Early apes who bind wallets, KYC by 25th, and contribute BNB/SUI/USD1 stand to 5x from here as TVL doubles on TGL launches. The alignment screams melt-up: easing Fed, fiscal juice, and Sui's parallel tx speed making DeFi feel like CEX without the suits. Who stacks LP before snapshot?

I have extremely strong intuition that self‑improving intelligence layers are about to become the default for onchain agents @AlloraNetwork is days from mainnet and the design clicks: inference for signals, Reputers paid to benchmark truth, regret feedback tightening the loop so models adapt in real time Practical win: AI‑powered swap aggregation + routing that responds to fees, slippage, liquidity across DEXs. Static models die; markets move; adaptive prediction wins AMA Sunday with @nick_emmons 5 AM CET / 12:00 pm KST. Snapshot + $ALLO timing could drop Side note: @cysic_xyz pushing ComputeFi will matter here Which layer gets your vote: Inference, Reputers, or Regret feedback

Momentum's ve(3,3) flywheel just unlocked a new layer of alignment on Sui LPs, traders, and voters all compounding in sync without the usual friction. $550M+ TVL anchoring $23B cumulative volume, xSUI liquid staking pulling in 2.1M users, CLMM pools squeezing slippage on everything from $SUI pairs to RWAs. Now the @buidlpad community offering flips the script: $4.5M raise at $250-350M FDV, 100% TGE unlock, no VC cliffs just retail and creators stacking early. Tier 1 snapshot hits Oct 25 for $3K+ HODLers, UGC squads locking $150+ priority by Oct 22. Metrics scream infrastructure play, not hype cycle. Post-launch? Expect veMMT votes to bootstrap emissions into high-usage pools, bridging Wormhole inflows for that next liquidity surge. Sui's DeFi OS scaling to trillions positioned or watching? $MMT t.co/Z18nZcIp3B

$VULT TGE in 2 days. @vultisig nailed the seedless shift: TSS splits keys across your devices, no single hack point, multi-chain swaps baked in. Whitelist top 300? Straight $3M FDV entry on Uniswap V3 first hour caps at $1k buys to kill snipers. Kraken follows. Momentum's real. Who's vaulting up?

Brevis ZK Overview: > ZK coprocessor unlocking historical on-chain data for any smart contract, all via trustless proofs that verify both facts and math > Hybrid model flips the script: full proofs on challenge, slashing gas costs while keeping everything auditable across chains > Live hooks into Kwenta derivatives, JoJo exchange, Trusta labs turning raw history into programmable truth for DeFi yields and compliance layers > Cross-chain headers via zkFabric mean no more silos; queries pull verified states from Ethereum to Solana without leaking a byte Seasonality favors ZK stacks as scaling narratives heat up, macro tailwinds from ETF inflows pushing risk into verifiable compute plays. Bullish on @brevis_zk bridging data to on-chain intelligence expect integrations to spike with Q4 protocol upgrades. Invalidation below recent proof throughput dips, but momentum holds above coprocessor adoption thresholds. Weak hands get shaken; the verifiable future solidifies without them

Frax's frxUSD isn't messing around fully collateralized with T-Bills and cash equivs, it's engineered for institutions craving that GENIUS-level stability in wild markets. Pair it with sfrxUSD for auto-compounding yields blending DeFi alpha and treasury safety, turning your stack into a passive powerhouse. FraxNet drops soon, unlocking seamless mint/redeem across 20+ chains expect transfer volumes to explode past ATHs. This is stablecoin evolution at warp speed @fraxfinance $frxUSD

Monad card holders flipping for $40k-$60k OTC while premarket $MON dumps from 40B to 14B FDV. FOMO baked in, sure, but let's unpack this. Discord roles, Kaito leaderboard spots, testnet badges those were the easy multipliers pre-hype. Now? Nominated alts getting shut out, full access stimmy feels like a lottery ticket on Arbitrum rails. Top KOLs cashing early screams doubt on airdrop convexity, yet community raids keep loading 98% claims. @monad built parallel EVM with 10k TPS, sub-second finals tek that crushes Solana's outage roulette without the VC theater. If TGE hits with real liquidity, $MON could 3x off lows, flipping that 14B into moon math. But watch the burn: ineligible wallets turning water, gMonad drops as eligibility hacks. Positioned heavy on cards? You're betting on appreciation tokens turning into alpha hunts. Missed? Farm the ecosystem MadLads whispers, SHIBAI last calls. This isn't retail noise, it's the signal for L1 wars heating up. Bullish on execution over memes, but $8k-$10k card floor holds if claims drop clean tomorrow. What's your play hodl the nad or flip the script?

River's vaults hitting $716M TVL already, with that 49% APR on staked Pts compounding like a beast while $RIVER grinds ATHs and perps light up on Binance. Love the dynamic airdrop hold: 180 days turns points into rocket fuel, slashing sell pressure and stacking yields. Tactical add: if you're voting in Rising Star, pair it with Omni-CDP across those 8+ chains satUSD LPs are printing when spreads widen post-tweak. Non-stakers snagging free votes? Game-changer for first-timers chasing that 3M pool. Spend your X scrolls stacking #RiverPts, not scrolling @River4FUN's playbook is printing real alpha @DucHoan07242344

In the last quarter alone, @brevis_zk has minted over 43M verifiable proofs for cross-chain DeFi apps outpacing rivals like Succinct by 3.4x in cost-efficient performance on everyday RTX GPUs. As a dev grinding on scalable ZK stacks, I've seen the bottlenecks: bloated oracles, chain silos, endless custom integrations that kill velocity. Brevis flips it with modular coprocessing pull historical data from ETH, Solana, or IBC, compute off-chain, attest on-chain without the overhead. No more wrestling centralized feeds or proof silos; it's a shared layer where computations compose across protocols like @usualmoney or @noble_xyz. Cautiously, this isn't hype it's the quiet shift to trustless interoperability that devs have begged for. Bold call: By mid-2026, 70% of new dApps will lean on Brevis for data proofs, unlocking $10B in untapped yield flows. Devs, what's your next build waiting on? Fork their SDK and prove me right this week.

yo @Hughie_X, edgen's ai cockpit sounds slick for ditching tab hell on $SNX perps and $ZEC zk spikes, but as an investor grinding portfolios, does it actually shave hours off without the multi-agent lag feeling like a dex jam? poked around beta signals crisp, grades spot-on for buffett bags, just needs mobile polish before oct 30 aura lock. worth the stake? @EdgenTech

People with Connector archetype

NFT〽️Man. Builder 🧢creator of NFT’s.🛠️Former Knight of the Round Table. ⚜️. 5+ years in Crypto.🌙

Defi || Web3 Jobs || You can never out trench me! || Legend || Think and Work it to Existence! $

BOY ON A MISSON🥷

Learning by doing in web3 | I actually love to write about the stuff I hear around me. @Somnia_Network all the way.

Angel Investor Inner Circle Founder @DrAlphaweb3 | @ordinalcarrots | Ambassador | Advisor discord.gg | t.me/nftsturk Bitmap 🐳 | OMB

Company Secretary (CS),Viral Zomato Girl. Contact for Company incorporation,FDI,FEMA,Trademarks, Patents,FSSAI, IPO related work! csnehamoolchandani@zohomail.in

Always keep Your Smile..😃

⚜️💶 Introduce your project . advertise and spread the project . Airdrop and hold crypto . send me request. DM📥.

Growth 🌱

DeFying the AI inevitability • Turning my creativity & copywriting into valuable Web 3.0 content • Head Of Community @synternet_com

$pepecoins🐸🧠 $brett $UFD🦄💨✨##GoodAttractsGOOD #JoinTheHERD Veteran USN

I'm The White Whale's Army , and I devoted my self to him. "no question asked"

Explore Related Archetypes

If you enjoy the connector profiles, you might also like these personality types: